Reports

Reports

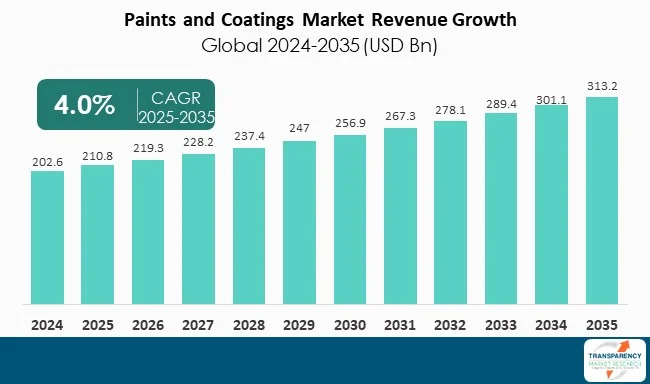

The paints and coatings market is anticipated to grow at a CAGR of 4.0% during the forecast period due to rapid urbanization followed by advancements in infrastructure around the world. In populous countries there are significant investments witnessed in the housing projects to provide homes to poor people.

Speedy urbanization is prevalent in the developing countries in Africa and Asia Pacific regions. As part of urbanization there are hordes of housing projects undertaken in cities and sub-urban areas of many countries to cater to the needs to the aspiring middle class. Governments in various countries are handsomely investing in infrastructure development in tandem with the economic growth of their countries.

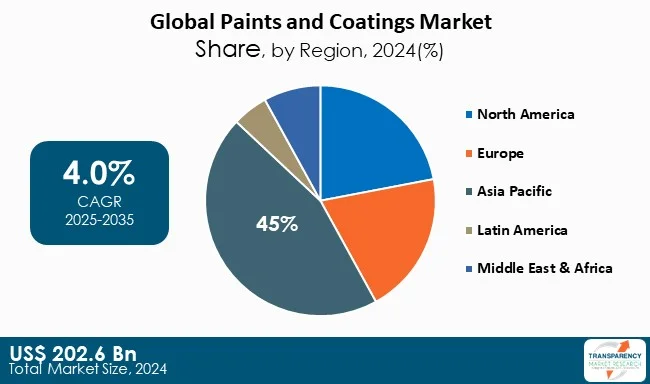

Many countries are working toward long-term projects. These generate the demand for paints and coatings across the globe. As part of reducing VOC emissions from the paints and coatings and sustainability goals, the major companies are introducing bio-based paints and coatings products. Asia Pacific is the leading region in the global paints and coatings market due to increasing consumption of paints and coatings in populous nations such as India, Indonesia, and China, and industrial nations such as Japan, South Korea, and Vietnam.

Paints and coatings are used for both functional and aesthetic purposes. Paints and coatings are a liquid or powder material that is formulated to create a protective or decorative coating to the item on which it is applied. Paints and coatings are basically made up of binders, pigments, solvents, and additives. Each of these components are designed to provide the performance characteristics like durability, color retention, resistance to corrosion, and ease of application.

In construction and infrastructure, paints and coatings provide weather resistance, prevent the deterioration of structural material, and add aesthetics to residential, commercial, and public buildings. In the automotive and transportation industries, coatings keep vehicles and transport aircraft free from corrosion, UV deterioration, and wear, while providing attractive finishes.

| Attribute | Detail |

|---|---|

| Paints and Coatings Market Drivers |

|

The fast urbanization followed by development in infrastructure around the world is a crucial driver to the paints and coatings market. As cities grow and housing demands accelerate, coatings in construction are often the prerequisite for not only protection but also embellishment. The United Nations has projected that two-thirds of the world population will reside in urban municipalities by 2050 as compared to 56% in 2020.

Migrating to urban areas has created significant construction, especially in Asia and Africa. China alone continues to build urban housing at a massive scale, with more than 15 million new housing units built every year, and each new housing unit requiring decorative and protective coatings for various laying applications. In India, the Smart Cities Mission investment budget was over US$ 13 Bn from the Government of India, and more than 100 cities are benefiting from an updated infrastructure offering substantial market demand for architectural coatings.

In the U.S., billions of dollars are likely to be allocated to renew infrastructure for bridges, roads, public buildings, and the other facilities through the recent US$ 1.2 Tn Infrastructure Investment and Jobs Act, all of which will need protective coatings to maximize lifespan and reduce future maintenance costs. In Africa, Nigeria’s and Kenya's urban housing developments will continue to drive demand for coatings across the spectrum of paint and coatings consumption. In the Middle East, Saudi Arabia's US$ 130 Bn Vision 2030 infrastructure pipeline, including the NEOM city and other mega projects across the Kingdom, will aggressively lead the demand for decorative and advanced protective coatings. The spotlight of global focus and investment in both - real estate, transport, and public utilities clearly underscores the architectural, construction, and citizen demand for coatings. The underpinning of urban assignment and infrastructure is thus a principle growth engine for the paints and coatings industry.

The increasing focus on sustainability and minimizing environmental compliance is yet another powerful influence reshaping the paints and coatings sector. In Europe, the EU’s Directive 2004/42/EC regulates the amount of VOCs that can be present in any paint, in turn driving the industry toward waterborne or low-solvent technologies, particularly in the decorative paint industry - with decorative waterborne coatings accounting for over 75% of the decorative paint sector in Western Europe.

In the U.S., the Environmental Protection Agency (EPA) and states implementing government policies that regulate VOCs such as stringent rules from California's South Coast Air Quality Management District (SCAQMD) and an aging infrastructure of buildings are impacting an increased demand for low-VOC and zero-VOC coatings.

In Asia, China requires a mandatory VOC emission reference standard for industrial and decorative paint since 2020, which has forced transition to powder and waterborne coatings. This momentum for regulation has led to consumers' increased preference for sustainable living and eco-label certification for residential and commercial projects. For example, LEED in North America or GRIHA in India. As a result, manufacturers have responded with development of high performing green alternatives.

Bio-based coatings have been brought to the market by AkzoNobel and Nippon Paint. They claim to have reduced overall carbon footprints by as much as 30% as compared to traditional products. In addition, OEMs in the automotive sector are increasingly requiring sustainable and eco-friendly coatings.

Production lines for OEMs such as Tesla and BMW are almost exclusively reliant on waterborne basecoats. No longer a 'niche offering', the combination of regulatory requirements, corporate sustainability promises, and increased raw information and consumer expectations are changing eco-friendly life-cycle coatings into a legitimate economic growth driver.

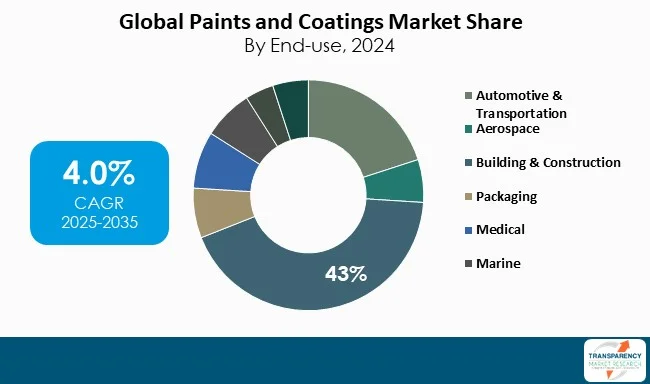

The most prominent end-use segment in the global paints and coatings market is the Building & Construction segment with almost 43% of total world-wide demand as the Building and Construction Sector has both - the protective performance and aesthetic value for residential and non-residential building projects. Paints and coatings safeguard against weathering, corrosion, and UV exposure while offering decorative finishes that enhance the value of a structure for market and consumer purposes.

As the world’s largest construction market, China invests over US$ 1 Tn each year in infrastructure and housing, generating a constant rise in architectural coatings demand. In India, there are numerous government-supported programs - the US$ 13 Bn Smart Cities Mission - driving increased consumption of decorative and protective coatings in urban housing and public infrastructure.

In the U.S., investment worth US$ 1.2 Tn as per the Infrastructure Investment and Jobs Act is already increasing coatings’ consumption over bridges and highways and public buildings. Europe, where architectural coatings account for a sizeable percentage of decorative paint sales in Western markets, also continues to witness solid growth, driven by urban and public renovations and energy-efficiency regulations.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific is the leading region in the Paints and Coatings market |

The Asia-Pacific leads the global paints and coatings market, with nearly 45% of global volume consumption. This is primarily due to the rapidly advancing industrialization as well enormous capital deployment for infrastructure development. Indonesia has spent over US$ 400 Bn dollars for infrastructure development post-2020 with a significant demand for construction and building coatings in anticipation of their infrastructure development.

Demand is also created from the increasing demand for decorative coatings in the real estate boom in Vietnam. Vietnam's housing sector receives foreign direct investment of over US$ 3 Bn annually. Beyond construction, Asia-Pacific is also the largest region for automotive coatings where Japan and South Korea produce over 12 million vehicles annually and each vehicle is given a finishing touch with multiple layers of paint/coating for protection and aesthetics.

In addition, there is a unique marine and shipping industry in China where more than 40% of the new ships built in the world are constructed. In North America, there is renovation of infrastructure to support the production of automotives at over 10 million vehicles annually and this region has benefitted PPG Industries and Sherwin-Williams as the leading manufacturers of paints and coatings in the world. This region is also seeing acceptance of low-VOC or sustainable coatings shapes regional demand.

The Sherwin-Williams Company is the leader in the paints and coatings industry with a comprehensive range of industrial and agricultural products. With annual revenue of more than US$ 23.0 Bn, the company benefits from a wide distribution network of over 4,600 stores across North America and operations in over 120 countries. Sherwin-Williams’ innovative focus on sustainable coatings, and its retail strength reinforce its position as a competitive leader in the global coatings market.

PPG Industries, Inc., the second largest player in the global paints and coatings industry, produces over US$ 18 Bn annually and operates across a variety of end-use peculiarities including automotive, aerospace, industrial, and packaging coatings. The company operates across over 70 countries. PPG aspires to reinforce its global position and maintain sustainable growth in the coatings market using a variety of advanced technologies including eco-friendly alternative coating formulations and color-matching digital systems.

BASF SE, AkzoNobel N.V., Axalta, RPM International Inc., KCC Corporation, Berger Paints India Limited, Nippon Paint Holdings Co., Ltd., Hempel A/S, Asian Paints Limited, Kansai Paint Co., Ltd, Baril Coatings, Teknos B.V., Haymes, Keim Mineral Paints, Omega Industries, Wallmaster Paint, Masco, NOROO Paint & Coatings, Jotun, and Jazeera Paints are some other major companies in the global paints and coatings market.

Each of these players has been profiled in the paints and coatings market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 202.6 Bn |

| Market Forecast Value in 2035 | US$ 313.2 Bn |

| Growth Rate (CAGR) | 4.0% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Paints and Coatings market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Coating Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The paints and coatings market was valued at US$ 202.6 Bn in 2024

The paints and coatings industry is expected to grow at a CAGR of 4.0% from 2025 to 2035

Rising infrastructure development and urbanization worldwide, and transition toward eco-friendly and sustainable coatings.

Building & construction was the largest end-use segment in the paints and coatings market.

Asia Pacific was the most lucrative region in 2024

The Sherwin-Williams Company and PPG Industries Inc, BASF SE, AkzoNobel N.V., Axalta, RPM International Inc., KCC Corporation, Berger Paints India Limited, Nippon Paint Holdings Co., Ltd., Hempel A/S, Asian Paints Limited, Kansai Paint Co., Ltd, Baril Coatings, Teknos B.V., Haymes, Keim Mineral Paints, Omega Industries, Wallmaster Paint, Masco, NOROO Paint & Coatings, Jotun, and Jazeera Paints are the major companies in the global paints and coatings market.

Table 1 Global Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 2 Global Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 3 Global Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 4 Global Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 5 Global Paints and Coatings Market Volume (Tons) Forecast, by Technology 2020 to 2035

Table 6 Global Paints and Coatings Market Value (US$ Bn) Forecast, by Technology 2020 to 2035

Table 7 Global Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 8 Global Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 9 Global Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 10 Global Paints and Coatings Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 11 Global Paints and Coatings Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 12 Global Paints and Coatings Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 13 North America Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 14 North America Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 15 North America Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 16 North America Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 17 North America Paints and Coatings Market Volume (Tons) Forecast, by Technology 2020 to 2035

Table 18 North America Paints and Coatings Market Value (US$ Bn) Forecast, by Technology 2020 to 2035

Table 19 North America Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 20 North America Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 North America Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 22 North America Paints and Coatings Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23 North America Paints and Coatings Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 24 North America Paints and Coatings Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 25 U.S. Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 26 U.S. Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 27 U.S. Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 28 U.S. Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 29 U.S. Paints and Coatings Market Volume (Tons) Forecast, by Technology 2020 to 2035

Table 30 U.S. Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 31 U.S. Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 32 U.S. Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 33 U.S. Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 34 U.S. Paints and Coatings Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 35 Canada Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 36 Canada Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 37 Canada Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 38 Canada Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 39 Canada Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 40 Canada Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 41 Canada Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 42 Canada Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 Canada Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 44 Canada Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 45 Europe Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 46 Europe Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 47 Europe Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 48 Europe Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 49 Europe Paints and Coatings Market Volume (Tons) Forecast, by Technology 2020 to 2035

Table 50 Europe Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 51 Europe Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 Europe Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 Europe Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 Europe Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 55 Europe Paints and Coatings Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 56 Europe Paints and Coatings Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 57 Germany Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 58 Germany Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 59 Germany Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 60 Germany Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 61 Germany Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 62 Germany Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 63 Germany Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 64 Germany Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65 Germany Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 66 Germany Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 67 France Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 68 France Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 69 France Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 70 France Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 71 France Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 72 France Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 73 France Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 74 France Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 75 France Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 76 France Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 77 U.K. Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 78 U.K. Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 79 U.K. Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 80 U.K. Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 81 U.K. Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 82 U.K. Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 83 U.K. Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 84 U.K. Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 85 U.K. Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 86 U.K. Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 87 Italy Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 88 Italy Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 89 Italy Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 90 Italy Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 91 Italy Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 92 Italy Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 93 Italy Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 94 Italy Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 95 Italy Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 96 Italy Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 97 Spain Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 98 Spain Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 99 Spain Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 100 Spain Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 101 Spain Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 102 Spain Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 103 Spain Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 104 Spain Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105 Spain Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 106 Spain Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 Russia & CIS Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 108 Russia & CIS Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 109 Russia & CIS Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 110 Russia & CIS Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 111 Russia & CIS Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 112 Russia & CIS Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 113 Russia & CIS Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 114 Russia & CIS Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 115 Russia & CIS Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 116 Russia & CIS Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 117 Rest of Europe Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 118 Rest of Europe Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 119 Rest of Europe Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 120 Rest of Europe Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 121 Rest of Europe Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 122 Rest of Europe Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 123 Rest of Europe Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 124 Rest of Europe Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 125 Rest of Europe Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 126 Rest of Europe Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 127 Asia Pacific Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 128 Asia Pacific Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 129 Asia Pacific Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 130 Asia Pacific Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 131 Asia Pacific Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 132 Asia Pacific Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 133 Asia Pacific Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 134 Asia Pacific Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 135 Asia Pacific Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 136 Asia Pacific Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 137 Asia Pacific Paints and Coatings Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 138 Asia Pacific Paints and Coatings Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 139 China Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 140 China Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type 2020 to 2035

Table 141 China Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 142 China Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 143 China Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 144 China Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 145 China Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 146 China Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 147 China Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 148 China Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 149 Japan Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 150 Japan Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 151 Japan Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 152 Japan Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 153 Japan Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 154 Japan Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 155 Japan Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 156 Japan Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 157 Japan Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 158 Japan Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 159 India Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 160 India Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 161 India Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 162 India Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 163 India Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 164 India Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 165 India Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 166 India Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 167 India Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 168 India Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 169 ASEAN Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 170 ASEAN Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 171 ASEAN Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 172 ASEAN Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 173 ASEAN Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 174 ASEAN Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 175 ASEAN Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 176 ASEAN Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 177 ASEAN Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 178 ASEAN Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 179 Rest of Asia Pacific Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 180 Rest of Asia Pacific Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 181 Rest of Asia Pacific Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 182 Rest of Asia Pacific Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 183 Rest of Asia Pacific Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 184 Rest of Asia Pacific Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 185 Rest of Asia Pacific Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 186 Rest of Asia Pacific Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 187 Rest of Asia Pacific Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 188 Rest of Asia Pacific Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 189 Latin America Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 190 Latin America Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 191 Latin America Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 192 Latin America Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 193 Latin America Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 194 Latin America Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 195 Latin America Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 196 Latin America Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 197 Latin America Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 198 Latin America Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 199 Latin America Paints and Coatings Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 200 Latin America Paints and Coatings Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 201 Brazil Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 202 Brazil Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 203 Brazil Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 204 Brazil Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 205 Brazil Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 206 Brazil Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 207 Brazil Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 208 Brazil Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 209 Brazil Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 210 Brazil Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 211 Mexico Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 212 Mexico Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 213 Mexico Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 214 Mexico Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 215 Mexico Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 216 Mexico Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 217 Mexico Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 218 Mexico Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 219 Mexico Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 220 Mexico Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 221 Rest of Latin America Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 222 Rest of Latin America Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 223 Rest of Latin America Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 224 Rest of Latin America Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 225 Rest of Latin America Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 226 Rest of Latin America Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 227 Rest of Latin America Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 228 Rest of Latin America Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 229 Rest of Latin America Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 230 Rest of Latin America Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 231 Middle East & Africa Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 232 Middle East & Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 233 Middle East & Africa Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 234 Middle East & Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 235 Middle East & Africa Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 236 Middle East & Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 237 Middle East & Africa Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 238 Middle East & Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 239 Middle East & Africa Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 240 Middle East & Africa Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 241 Middle East & Africa Paints and Coatings Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 242 Middle East & Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 243 GCC Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 244 GCC Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 245 GCC Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 246 GCC Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 247 GCC Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 248 GCC Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 249 GCC Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 250 GCC Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 251 GCC Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 252 GCC Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 253 South Africa Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 254 South Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 255 South Africa Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 256 South Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 257 South Africa Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 258 South Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 259 South Africa Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 260 South Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 261 South Africa Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 262 South Africa Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 263 Rest of Middle East & Africa Paints and Coatings Market Volume (Tons) Forecast, by Coating Type, 2020 to 2035

Table 264 Rest of Middle East & Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Coating Type, 2020 to 2035

Table 265 Rest of Middle East & Africa Paints and Coatings Market Volume (Tons) Forecast, by Resin, 2020 to 2035

Table 266 Rest of Middle East & Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Resin, 2020 to 2035

Table 267 Rest of Middle East & Africa Paints and Coatings Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 268 Rest of Middle East & Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 269 Rest of Middle East & Africa Paints and Coatings Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 270 Rest of Middle East & Africa Paints and Coatings Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 271 Rest of Middle East & Africa Paints and Coatings Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 272 Rest of Middle East & Africa Paints and Coatings Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1 Global Paints and Coatings Market Volume Share Analysis, by Coating Type, 2024, 2028, and 2035

Figure 2 Global Paints and Coatings Market Attractiveness, by Coating Type

Figure 3 Global Paints and Coatings Market Volume Share Analysis, by Resin, 2024, 2028, and 2035

Figure 4 Global Paints and Coatings Market Attractiveness, by Resin

Figure 5 Global Paints and Coatings Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 6 Global Paints and Coatings Market Attractiveness, by Technology

Figure 7 Global Paints and Coatings Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 8 Global Paints and Coatings Market Attractiveness, by Application

Figure 9 Global Paints and Coatings Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 10 Global Paints and Coatings Market Attractiveness, by End-use

Figure 11 Global Paints and Coatings Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 12 Global Paints and Coatings Market Attractiveness, by Region

Figure 13 North America Paints and Coatings Market Volume Share Analysis, by Coating Type, 2024, 2028, and 2035

Figure 14 North America Paints and Coatings Market Attractiveness, by Coating Type

Figure 15 North America Paints and Coatings Market Attractiveness, by Coating Type

Figure 16 North America Paints and Coatings Market Volume Share Analysis, by Resin, 2024, 2028, and 2035

Figure 17 North America Paints and Coatings Market Attractiveness, by Resin

Figure 18 North America Paints and Coatings Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 19 North America Paints and Coatings Market Attractiveness, by Technology

Figure 20 North America Paints and Coatings Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 21 North America Paints and Coatings Market Attractiveness, by Application

Figure 22 North America Paints and Coatings Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 23 North America Paints and Coatings Market Attractiveness, by End-use

Figure 24 North America Paints and Coatings Market Attractiveness, by Country and Sub-region

Figure 25 Europe Paints and Coatings Market Volume Share Analysis, by Coating Type, 2024, 2028, and 2035

Figure 26 Europe Paints and Coatings Market Attractiveness, by Coating Type

Figure 27 Europe Paints and Coatings Market Volume Share Analysis, by Resin, 2024, 2028, and 2035

Figure 28 Europe Paints and Coatings Market Attractiveness, by Resin

Figure 29 Europe Paints and Coatings Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 30 Europe Paints and Coatings Market Attractiveness, by Technology

Figure 31 Europe Paints and Coatings Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 32 Europe Paints and Coatings Market Attractiveness, by Application

Figure 33 Europe Paints and Coatings Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 34 Europe Paints and Coatings Market Attractiveness, by End-use

Figure 35 Europe Paints and Coatings Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 36 Europe Paints and Coatings Market Attractiveness, by Country and Sub-region

Figure 37 Asia Pacific Paints and Coatings Market Volume Share Analysis, by Coating Type, 2024, 2028, and 2035

Figure 38 Asia Pacific Paints and Coatings Market Attractiveness, by Coating Type

Figure 39 Asia Pacific Paints and Coatings Market Volume Share Analysis, by Resin, 2024, 2028, and 2035

Figure 40 Asia Pacific Paints and Coatings Market Attractiveness, by Resin

Figure 41 Asia Pacific Paints and Coatings Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 42 Asia Pacific Paints and Coatings Market Attractiveness, by Technology

Figure 43 Asia Pacific Paints and Coatings Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 44 Asia Pacific Paints and Coatings Market Attractiveness, by Application

Figure 45 Asia Pacific Paints and Coatings Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 46 Asia Pacific Paints and Coatings Market Attractiveness, by End-use

Figure 47 Asia Pacific Paints and Coatings Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 48 Asia Pacific Paints and Coatings Market Attractiveness, by Country and Sub-region

Figure 49 Latin America Paints and Coatings Market Volume Share Analysis, by Coating Type, 2024, 2028, and 2035

Figure 50 Latin America Paints and Coatings Market Attractiveness, by Coating Type

Figure 51 Latin America Paints and Coatings Market Volume Share Analysis, by Resin, 2024, 2028, and 2035

Figure 52 Latin America Paints and Coatings Market Attractiveness, by Resin

Figure 53 Latin America Paints and Coatings Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 54 Latin America Paints and Coatings Market Attractiveness, by Technology

Figure 55 Latin America Paints and Coatings Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 56 Latin America Paints and Coatings Market Attractiveness, by Application

Figure 57 Latin America Paints and Coatings Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 58 Latin America Paints and Coatings Market Attractiveness, by End-use

Figure 59 Latin America Paints and Coatings Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 60 Latin America Paints and Coatings Market Attractiveness, by Country and Sub-region

Figure 61 Middle East & Africa Paints and Coatings Market Volume Share Analysis, by Coating Type, 2024, 2028, and 2035

Figure 62 Middle East & Africa Paints and Coatings Market Attractiveness, by Coating Type

Figure 63 Middle East & Africa Paints and Coatings Market Volume Share Analysis, by Resin, 2024, 2028, and 2035

Figure 64 Middle East & Africa Paints and Coatings Market Attractiveness, by Resin

Figure 65 Middle East & Africa Paints and Coatings Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 66 Middle East & Africa Paints and Coatings Market Attractiveness, by Technology

Figure 67 Middle East & Africa Paints and Coatings Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 68 Middle East & Africa Paints and Coatings Market Attractiveness, by Application

Figure 69 Middle East & Africa Paints and Coatings Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 70 Middle East & Africa Paints and Coatings Market Attractiveness, by End-use

Figure 71 Middle East & Africa Paints and Coatings Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 72 Middle East & Africa Paints and Coatings Market Attractiveness, by Country and Sub-region