Reports

Reports

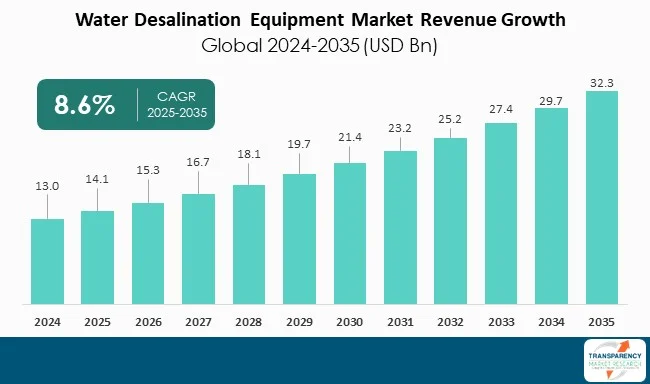

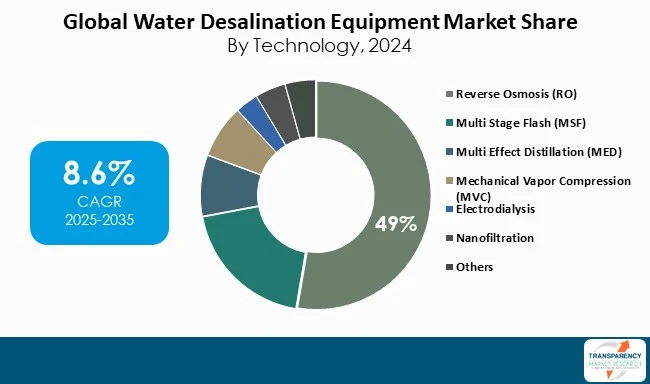

The global water desalination equipment market is witnessing steadiness at a CAGR of 8.6% as water scarcity is becoming a growing concern due to surging climate changes, urbanization, and industrialization. Reverse Osmosis (RO) is the leading technology segment accounting for approximately half of global revenues, as it uses less energy, can be scaled, and operates on municipal and industrial levels.

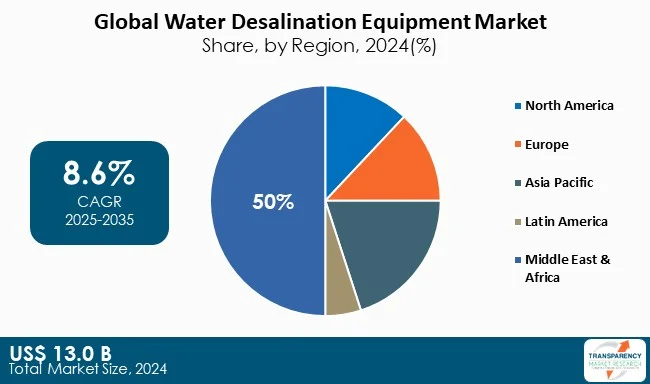

Thermal practices such as Multi-Stage Flash (MSF) and Multi-Effect Distillation (MED) will still be used in large scale power-water integration projects, predominantly in the Middle East. Regionally speaking, the Middle East & Africa are the top contributors to the desalination equipment sector, with almost 50% share, largely due to mega-projects happening currently in Saudi Arabia and the UAE. North America and Asia Pacific are catching up with investments into the segment quickly, as the U.S. water markets in California and Texas aim to reduce droughts; while countries like China, India, and Australia invest in desalination techniques to secure not only urban water but agricultural water as well.

Technological advancements like energy recovery devices, next-generation membranes, and hybrid systems are making desalination much more efficient, resulting in desalination becoming a feasible solution for long-term water security and alternative income for many around the world.

Water desalination equipment are defined as the technical systems and components that convert saline or brackish water into drinking and industrial grade freshwater. Desalination equipment are an important component of product delivery, often relied upon in arid regions to help mitigate chronic water shortages, augment municipal supply, fulfill industrial demand, and support agricultural needs. The most widely adopted technology is Reverse Osmosis (RO), which continues to be a prominent processing option due to the flexibility of the units, the energy required to create freshwater, and the ability to employ seawater and brackish water. A RO system uses semi-permeable membranes in conjunction with established high-pressure pumps.

Multi-Stage Flash (MSF) and Multi-Effect Distillation (MED) use heat strategies to evaporate and condense water and are generally installed in dedicated cogeneration power-water types of plants within the Gulf region. A maintained facet of MVC is its flexibility with smaller driven facilities where energy recapturing is always a consideration. An electrodialysis (ED) and Nanofiltration (NF) equipment offer the unique and selective removals of ions and membranes and are refunded for brackish water or industrial applications.

Continuous improvement in membranes, energy recovering devices, reciprocal energy, and hybrid re-applications are increasing efficiency and mitigating costs while combined with pre-treatment is creating new types of adaptive desalination equipment that will fulfill the essential select to ensure people living in water-stressed areas have reliable access to freshwater.

| Attribute | Detail |

|---|---|

| Water Desalination Equipment Market Drivers |

|

One of the key factors propelling the growth of the global water desalination equipment market is the increasing concern regarding global water scarcity. The United Nations states that more than 2.3 billion people live in countries that are water stressed, and project that global water demand will outstrip supply by 40% by 2030. As this gap between supply and demand continues to grow, it is enhancing the necessity of investments by governments and industries in desalination infrastructure, which will positively impact equipment demand.

In the Middle East and Africa, with available renewable water resources being very limited, desalination process supplies more than 70% of municipal water supply in countries such as Saudi Arabia, the UAE, and Kuwait. The Saline Water Conversion Corporation (SWCC) in Saudi Arabia, for example, produces more than 7.5 million cubic meters per day, which are largely dependent on an array of reverse osmosis (RO) and thermal desalination equipment.

Similarly, as urbanization expands in India, coastal cities for example like Chennai, are increasingly relying on desalination plants, which, as a whole in India, have cumulative capacity of over 750 million liters per day (MLD). As water scarcity will continue to rise due to climate change and population explosion, membranes, pumps, energy recovery devices and thermal units used in desalination equipment will continue to play a key role in providing careful water security, stimulating global demand.

The power sector is responsible for greater than 10% of total water withdrawals (some 4,000 km3), with thermal and nuclear power generation relying on a steady input in areas experiencing water stress.

Industrial applications such as those from the oil & gas industry have rapidly invested in seawater treatment in the region for enhanced oil recovery (EOR), using RO and multi-stage flash (MSF) equipment to manage thousands of barrels of injection water per day. The municipal sector has increasingly matched oil & gas industrial investments with large city projects indicating that the major urban sectors have taken note of water stress even with the added pressures of rapid urbanization and resilient water supply infrastructure development.

In 2023, the International Desalination Association (IDA) had estimated that the total global installed desalination capacity would surpass 115 million cubic meters per day (before 90 million cubic meters per day in 2017), with nearly 60% of this demand being attributed to municipal applications. Cities like San Diego (United States) and Barcelona (Spain) have opened large RO plants to deal with water supply issues during drought.

Reverse Osmosis (RO) is the leading technology segment in the global water desalination equipment market due to its energy efficiency, modularity, and application diversity Reverse osmosis is the leading technology segment in the global market. RO is technically different from the thermal processes as it cleanses salts and impurities under high-pressure pumps membrane processes, which is a lower-cost operating process and smaller environmental footprint. RO contributed more than US$ 365 Bn (49%) of total water desalination equipment revenue globally in 2024.

RO is witnessing acceptance in municipal, and industrial projects at a large scale. For example, encompassing plant with RO desalination processes, the Sorek desalination facility in Israel was constructed to produce 624,000 cubic meters per day of freshwater, which does make it the largest RO facility in the world.

Alternatively, in the U.S., the Carlsbad plant in San Diego, California, produces a collective unit of 50 million gallons per day to help manage drought. In the Middle East, the First Hybrid Complex began at Ras Al Khair, Saudi Arabia, using a combination of RO and thermal processes. Currently, with the advancements regarding membranes and energy recovery, RO will be the leading growth engine of the global water desalination equipment market.

| Attribute | Detail |

| Leading Region | Middle East & Africa is the leading region in the Water Desalination Equipment market |

At present, the global water desalination equipment market is dominated by Middle East & Africa (MEA), which holds nearly 50% of the global share due to consistently experiencing water scarcity and large scale government investments in water desalination programs.

The reliance on desalination in the MEA region can be seen at the UAE's Jebel Ali complex, which is producing 2.1 million cubic meters per day, as well as Qatar's Ras Abu Fontas, which has become part of the municipal water supply system. The Asia Pacific (APAC) region takes the second place due to the continued growth of coastal populations and rapid industrial development.

North America and Europe also play significant roles in the growth of the global water desalination market. The Rosarito plant in Mexico and the Torrevieja facility in Spain, each produce hundreds of thousands of cubic meters of water every day, and this usage signals the wider regional acceptance of desalination technology as well as the demand for water desalination equipment.

The projects include plants throughout the Middle East, Africa and North America; including high capacity reverse osmosis plants to cover short term water needs.

Alfa Laval, Aquatech International, Danfoss, Doosan Enerbility, Guangzhou KangYang Seawater Desalination Equipment Co., Ltd., IDE Technologies, LG Chem, Suez Water Technologies & Solutions, Toray Industries, Inc., Veolia Water Technologies, Wärtsilä, and Xylem are the major companies in the global water desalination equipment market. Each of these players has been profiled in the Industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 13.0 Bn |

| Market Forecast Value in 2035 | US$ 32.3 Bn |

| Growth Rate (CAGR) | 8.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Water Desalination Equipment market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Technology

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The water desalination equipment market was valued at US$ 13.0 Bn in 2024

The water desalination equipment industry is expected to grow at a CAGR of 8.6% from 2025 to 2035

Escalating global water scarcity and rising demand for freshwater and expanding industrial and municipal applications of desalinated water

Reverse osmosis was the largest technology segment in the water desalination equipment market.

Middle East was the most lucrative region in 2024

Alfa Laval, Aquatech International, Danfoss, Doosan Enerbility, Guangzhou KangYang Seawater Desalination Equipment Co., Ltd., IDE Technologies, LG Chem, Suez Water Technologies & Solutions, Toray Industries, Inc., Veolia Water Technologies, Wärtsilä, and Xylem are the major companies in the global water desalination equipment market.

Table 1 Global Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 2 Global Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 3 Global Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 4 Global Water Desalination Equipment Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 5 North America Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 6 North America Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 7 North America Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 8 North America Water Desalination Equipment Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 9 U.S. Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 10 U.S. Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 11 U.S. Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 12 Canada Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 13 Canada Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 14 Canada Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 15 Europe Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 16 Europe Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 17 Europe Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 18 Europe Water Desalination Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 19 Germany Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 20 Germany Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 21 Germany Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 22 France Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 23 France Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 24 France Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 25 U.K. Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 26 U.K. Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 27 U.K. Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 28 Italy Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 29 Italy Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 30 Italy Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 31 Spain Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 32 Spain Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 33 Spain Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 34 Russia & CIS Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 35 Russia & CIS Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 36 Russia & CIS Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 37 Rest of Europe Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 38 Rest of Europe Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 39 Rest of Europe Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 40 Asia Pacific Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 41 Asia Pacific Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 42 Asia Pacific Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 43 Asia Pacific Water Desalination Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 44 China Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 45 China Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 46 China Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 47 Japan Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 48 Japan Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 49 Japan Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 50 India Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 51 India Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 52 India Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 53 India Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 54 ASEAN Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 55 ASEAN Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 56 ASEAN Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 57 Rest of Asia Pacific Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 58 Rest of Asia Pacific Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 59 Rest of Asia Pacific Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 60 Latin America Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 61 Latin America Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 62 Latin America Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 63 Latin America Water Desalination Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 64 Brazil Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 65 Brazil Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 66 Brazil Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 67 Mexico Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 68 Mexico Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 69 Mexico Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 70 Rest of Latin America Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 71 Rest of Latin America Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 72 Rest of Latin America Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 73 Middle East & Africa Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 74 Middle East & Africa Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 75 Middle East & Africa Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 76 Middle East & Africa Water Desalination Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 77 GCC Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 78 GCC Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 79 GCC Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 80 South Africa Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 81 South Africa Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 82 South Africa Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 83 Rest of Middle East & Africa Water Desalination Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 84 Rest of Middle East & Africa Water Desalination Equipment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 85 Rest of Middle East & Africa Water Desalination Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Figure 1 Global Water Desalination Equipment Market Value Share Analysis, by Technology, 2024, 2028, and 2035

Figure 2 Global Water Desalination Equipment Market Attractiveness, by Technology,

Figure 3 Global Water Desalination Equipment Market Value Share Analysis, by Source, 2024, 2028, and 2035

Figure 4 Global Water Desalination Equipment Market Attractiveness, by Source

Figure 5 Global Water Desalination Equipment Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 6 Global Water Desalination Equipment Market Attractiveness, by Application

Figure 7 Global Water Desalination Equipment Market Value Share Analysis, by Region, 2024, 2028, and 2035

Figure 8 Global Water Desalination Equipment Market Attractiveness, by Region

Figure 9 North America Water Desalination Equipment Market Value Share Analysis, by Technology, 2024, 2028, and 2035

Figure 10 North America Water Desalination Equipment Market Attractiveness, by Technology,

Figure 11 North America Water Desalination Equipment Market Value Share Analysis, by Source, 2024, 2028, and 2035

Figure 12 North America Water Desalination Equipment Market Attractiveness, by Source

Figure 13 North America Water Desalination Equipment Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 14 North America Water Desalination Equipment Market Attractiveness, by Application

Figure 15 North America Water Desalination Equipment Market Attractiveness, by Country and Sub-region

Figure 16 Europe Water Desalination Equipment Market Value Share Analysis, by Technology, 2024, 2028, and 2035

Figure 17 Europe Water Desalination Equipment Market Attractiveness, by Technology,

Figure 18 Europe Water Desalination Equipment Market Value Share Analysis, by Source, 2024, 2028, and 2035

Figure 19 Europe Water Desalination Equipment Market Attractiveness, by Source

Figure 20 Europe Water Desalination Equipment Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 21 Europe Water Desalination Equipment Market Attractiveness, by Application

Figure 22 Europe Water Desalination Equipment Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 23 Europe Water Desalination Equipment Market Attractiveness, by Country and Sub-region

Figure 24 Asia Pacific Water Desalination Equipment Market Value Share Analysis, by Technology, 2024, 2028, and 2035

Figure 25 Asia Pacific Water Desalination Equipment Market Attractiveness, by Technology,

Figure 26 Asia Pacific Water Desalination Equipment Market Value Share Analysis, by Source, 2024, 2028, and 2035

Figure 27 Asia Pacific Water Desalination Equipment Market Attractiveness, by Source

Figure 28 Asia Pacific Water Desalination Equipment Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 29 Asia Pacific Water Desalination Equipment Market Attractiveness, by Application

Figure 30 Asia Pacific Water Desalination Equipment Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 31 Asia Pacific Water Desalination Equipment Market Attractiveness, by Country and Sub-region

Figure 32 Latin America Water Desalination Equipment Market Value Share Analysis, by Technology, 2024, 2028, and 2035

Figure 33 Latin America Water Desalination Equipment Market Attractiveness, by Technology,

Figure 34 Latin America Water Desalination Equipment Market Value Share Analysis, by Source, 2024, 2028, and 2035

Figure 35 Latin America Water Desalination Equipment Market Attractiveness, by Source

Figure 36 Latin America Water Desalination Equipment Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 37 Latin America Water Desalination Equipment Market Attractiveness, by Application

Figure 38 Latin America Water Desalination Equipment Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 39 Latin America Water Desalination Equipment Market Attractiveness, by Country and Sub-region

Figure 40 Middle East & Africa Water Desalination Equipment Market Value Share Analysis, by Technology, 2024, 2028, and 2035

Figure 41 Middle East & Africa Water Desalination Equipment Market Attractiveness, by Technology,

Figure 42 Middle East & Africa Water Desalination Equipment Market Value Share Analysis, by Source, 2024, 2028, and 2035

Figure 43 Middle East & Africa Water Desalination Equipment Market Attractiveness, by Source

Figure 44 Middle East & Africa Water Desalination Equipment Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 45 Middle East & Africa Water Desalination Equipment Market Attractiveness, by Application

Figure 46 Middle East & Africa Water Desalination Equipment Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 47 Middle East & Africa Water Desalination Equipment Market Attractiveness, by Country and Sub-region