Reports

Reports

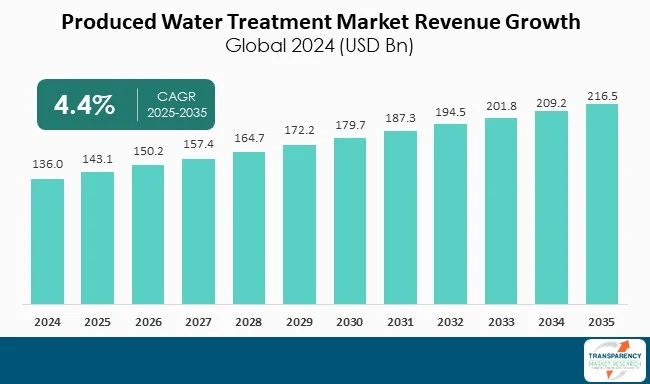

The produced water treatment market is anticipated to grow at a CAGR of 4.4% during the forecast period due to the increasing demand from oil and gas industry. Untreated produced water comprises heavy metals, high salinity, hydrocarbons, and even radioactive materials that pose risk to human health and ecosystems.

Produced water treatment is important for removing contaminants before reusing the water or discharging and in order to comply with environmental regulations. Treated produced water can be utilized in industrial processes and agricultural processes. Produced water treatment helps upstream operators in reducing the volume of liquid waste injection and optimize the field development.

The major technologies used for the treatment of produced water during oil and gas extraction include membrane processes such as reverse osmosis, nanofiltration, and ultrafiltration. For removal of oil, coalescing filters, gravity separators, and hydrocyclones are utilized. For removal of organic contaminants biological treatment and advanced oxidation processes are utilized. Middle East and Africa is the leading region in the produced water treatment market.

Produced water treatment is the process of removing contaminants from waste water generated during the extraction of oil and gas to make it suitable for reusing or disposal. Produced water treatment mainly focuses on reducing environmental impact and maximizing the utilization of resources in the oil and gas sector. Some of the benefits include maximizing water reuse opportunities, decreasing disposal costs, and recovering useful byproducts such as salts and fresh water.

Treating produced water facilitates its safe disposal, by reducing the requirement for surface discharge or deep well injection. By treating the contaminants such as suspended particles, dissolved gases, and oil, produced water treatment helps in preventing pollution of waterbodies and related ecosystems. It ensures that discharged water complies with the environmental standards.

Treated water could be re-utilized for various requirements in the oil and gas industry; like hydraulic fracking and steam generation. In regions facing water scarcity, treated water can help in supplementing water resources. With the re-utilization of treated water, oil and gas industry can reduce their overall water consumption costs and reduce the requirement for procuring expensive freshwater.

Some of the technologies used for produced water treatment are membrane filtration, thermal desalination, chemical and biological processes, and the other technologies such as hydrocyclones, API separators, membrane bioreactors, advanced oxidation processes, and electro dialysis.

|

Attribute |

Detail |

|---|---|

|

Produced Water Treatment Market Drivers |

|

Water scarcity is a serious problem worldwide, with the expanding demand for freshwater resources fueled by growing population, urbanization, and industrial activity.

Produced water contains hydrocarbons, salts, heavy metals, and other impurities. It is an important environmental problem if not controlled. However, with proper treatment technologies, it can be utilized for various secondary purposes, and the reliance on freshwater resources would be reduced to a great extent.

Treated produced water can be re-used in industrial applications, agriculture, and even aquifer recharge, thereby reducing the demand for freshwater withdrawals. Contaminant removal by advanced treatment systems ensures that the water meets certain water quality standards, allowing for safe and effective reuse.

Processes like reverse osmosis, ultrafiltration and advanced oxidation are being used more and more to produce high-quality treated water that can be used for irrigation or industrial cooling.

By treating and re-using produced water, freshwater resources are used in lesser quantities. Pressure on the local water body and groundwater aquifers is therefore eliminated, allowing these to be kept for priority use such as drinking and municipal use. The manufacturing and power sectors that utilize enormous amounts of water are hugely assisted by treated produced water, thus maintaining the flow of activities in water-stressed regions.

The water scarcity emergency fuels innovation in the market for produced water treatment, encouraging the creation of cost-effective and effective technologies. For instance, membrane-based filtration, biological treatment, and thermal distillation have evolved to address challenging water quality needs. Digital monitoring and automation integrated into treatment processes improve efficiency, optimizing resource utilization and minimizing costs of operation.

The continuous investment in oil and gas exploration greatly impacts the produced water treatment market, which propels its growth due to the demand for efficient water management solutions. Produced water is a product of hydrocarbon production, typically consisting of water from reservoirs, injected fluids, and accompanying contaminants like oil, grease, salts, heavy metals, and chemical additives. With expanding exploration operations, especially in the unconventional reservoirs such as shale, tight oil, and deep-water reservoirs, the amount of produced water produced is growing, and with it the urgency for sophisticated treatment technologies.

Heightened global energy demand, powered by industrialization and economic development, particularly in the emerging economies, is propelling investment in oil and gas exploration. This development necessitates the establishment of efficient produced water management systems to adhere to regulations as well as achieve optimal sustainable utilization of resources.

Traditional oil and gas reserve depletion have raised the need for unconventional resources such as shale gas, tight oil, and coal bed methane. These extraction processes tend to have increased water-to-hydrocarbon ratios and create greater volumes of produced water, hence the need to treat it, thus inducing the market for produced water treatment.

Technological advancements such as hydraulic fracturing and horizontal drilling have boosted the viability of tapping previously undeveloped reservoirs. Yet these methods create huge amounts of water containing sophisticated contaminants, for which sophisticated solutions like advanced filtration, membrane technology, and zero-liquid discharge systems are needed.

Investments in exploration and production (E&P) activities directly translate to enhanced demand for treatment solutions of produced water because efficient management of water is a critical factor for operational effectiveness and regulatory compliance.

With each new exploration project, especially in high-water unconventional plays, more produced water to be treated is produced. This propels the adoption of technologies such as physical separation, chemical treatment, bioprocesses, and reverse osmosis. Strict environmental laws globally require proper treatment and disposal of produced water to avoid pollution and ensure the integrity of ecosystems.

Exploration investments are focusing more on sustainable practices, as many operators adopted strategies such as water reuse and water recycling for reducing the consumption of freshwater. The trend propels the market for sophisticated treatment technologies like reverse osmosis, nanofiltration, and advanced oxidation processes that facilitate the treatment of produced water for reuse. Exploration operations are on the rise in areas such as the Middle East, Africa, and Asia-Pacific, where water scarcity and environmental issues take center stage.

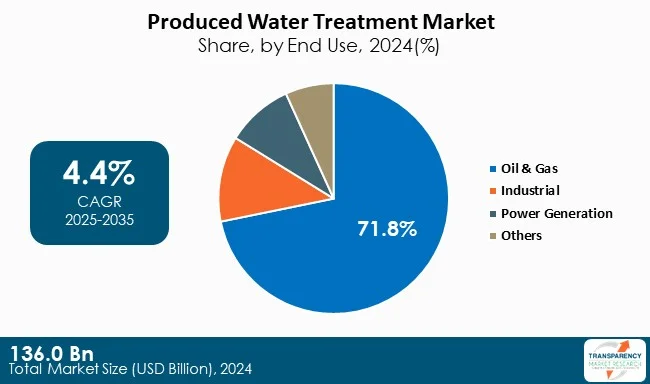

The oil and gas sector is a leading end-use application in the produced water treatment market as it involves the large quantity of water created during hydrocarbon production processes. This by-product of the oil and gas production process, not only has hydrocarbons, heavy metals, salts, and chemical additives as contaminants, but also the treatment of this water is necessary to ensure environmental compliance and operational feasibility.

As regulatory pressure to minimize the environmental impact grows, oil and gas operators are making significant investments in sophisticated treatment technologies like membrane filtration, reverse osmosis, and chemical treatment. The industry's transition toward enhanced oil recovery (EOR) methods, which frequently call for treated water for reinjection, also fuels demand.

With the global demand for energy continuing unabated and exploration efforts pushing into deeper and more hostile environments, the amount of produced water increases relentlessly, making oil and gas the principal driving force behind the produced water treatment market. This trend is likely to hold into the immediate future.

| Attribute | Detail |

|---|---|

| Leading Region | Middle East & Africa, Which Consists of 43.4% Share of Global Market |

The Middle East & Africa (MEA) region occupies a commanding 43.4% of the world's produced water treatment market share mainly because of its massive oil and gas production activities. Saudi Arabia, the UAE, Kuwait, and Nigeria are among the world's leading hydrocarbon producers, and they produce huge amounts of produced water as a byproduct.

Arid conditions and water shortages in most of the areas further require treating and re-using produced water for industrial and operational purposes. Further, stricter environmental regulations and sustainability targets are driving oil and gas operators to spend on next-generation treatment technologies. The presence of high concentrations of mature oil fields, which generate more water as they mature, also plays a major role in driving demand.

Additionally, national oil companies and governments are further putting water management and resource efficiency first, consolidating the region's market leadership. These influences combine to fuel MEA's impressive share of the global produced water treatment market.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 136.0 Bn |

| Market Forecast Value in 2035 | US$ 216.5 Bn |

| Growth Rate (CAGR) | 4.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & Million Barrels for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Produced Water Treatment market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Treatment Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The produced water treatment market was valued at US$ 136.0 Bn in 2024

The produced water treatment industry is expected to grow at a CAGR of 4.4% from 2025 to 2035

Rein in water scarcity and ongoing investment in oil & gas exploration

Oil and gas was the largest end-use segment and its value is anticipated to grow at a CAGR of 4.5% during the forecast period.

North America was the most lucrative region in 2024

Siemens Energy AG, Schlumberger Limited, CETCO Energy Services Company LLC, TechnipFMC Plc, Halliburton, Ovivo, Veolia, Enviro-Tech Systems, Produced Water solutions, Pentair Etc. are the major players in the produced water treatment market.

Table 1 Global Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 2 Global Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

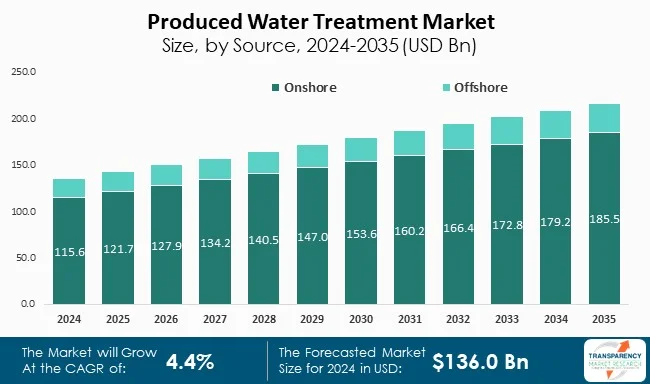

Table 3 Global Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 4 Global Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 5 Global Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 6 Global Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 7 Global Produced Water Treatment Market Volume (Million Barrels) Forecast, by Region, 2025 to 2035

Table 8 Global Produced Water Treatment Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 9 North America Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 10 North America Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 11 North America Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 12 North America Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 13 North America Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 14 North America Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 15 North America Produced Water Treatment Market Volume (Million Barrels) Forecast, by Country, 2025 to 2035

Table 16 North America Produced Water Treatment Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 17 U.S. Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 18 U.S. Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 19 U.S. Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 20 U.S. Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 21 U.S. Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 22 U.S. Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 23 Canada Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 24 Canada Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 25 Canada Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 26 Canada Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 27 Canada Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 28 Canada Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 29 Europe Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 30 Europe Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 31 Europe Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 32 Europe Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 33 Europe Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 34 Europe Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 35 Europe Produced Water Treatment Market Volume (Million Barrels) Forecast, by Country and Sub-region, 2025 to 2035

Table 36 Europe Produced Water Treatment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 37 Germany Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 38 Germany Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 39 Germany Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 40 Germany Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 41 Germany Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 42 Germany Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 43 France Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 44 France Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 45 France Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 46 France Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 47 France Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 48 France Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 49 U.K. Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 50 U.K. Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 51 U.K. Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 52 U.K. Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 53 U.K. Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 54 U.K. Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 55 Italy Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 56 Italy Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 57 Italy Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 58 Italy Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 59 Italy Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 60 Italy Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 61 Spain Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 62 Spain Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 63 Spain Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 64 Spain Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 65 Spain Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 66 Spain Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 67 Russia & CIS Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 68 Russia & CIS Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 69 Russia & CIS Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 70 Russia & CIS Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 71 Russia & CIS Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 72 Russia & CIS Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 73 Rest of Europe Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 74 Rest of Europe Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 75 Rest of Europe Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 76 Rest of Europe Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 77 Rest of Europe Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 78 Rest of Europe Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 79 Asia Pacific Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 80 Asia Pacific Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 81 Asia Pacific Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 82 Asia Pacific Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 83 Asia Pacific Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 84 Asia Pacific Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 85 Asia Pacific Produced Water Treatment Market Volume (Million Barrels) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Asia Pacific Produced Water Treatment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 China Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 88 China Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type 2025 to 2035

Table 89 China Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 90 China Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 91 China Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 92 China Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 93 Japan Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 94 Japan Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 95 Japan Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 96 Japan Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 97 Japan Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 98 Japan Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 99 India Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 100 India Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 101 India Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 102 India Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 103 India Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 104 India Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 105 India Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 106 India Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use 2025 to 2035

Table 107 ASEAN Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 108 ASEAN Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 109 ASEAN Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 110 ASEAN Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 111 ASEAN Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 112 ASEAN Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 113 Rest of Asia Pacific Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 114 Rest of Asia Pacific Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 115 Rest of Asia Pacific Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 116 Rest of Asia Pacific Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 117 Rest of Asia Pacific Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 118 Rest of Asia Pacific Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 119 Latin America Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 120 Latin America Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 121 Latin America Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 122 Latin America Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 123 Latin America Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 124 Latin America Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 125 Latin America Produced Water Treatment Market Volume (Million Barrels) Forecast, by Country and Sub-region, 2025 to 2035

Table 126 Latin America Produced Water Treatment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 127 Brazil Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 128 Brazil Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 129 Brazil Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 130 Brazil Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 131 Brazil Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 132 Brazil Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 133 Mexico Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 134 Mexico Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 135 Mexico Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 136 Mexico Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 137 Mexico Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 138 Mexico Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 139 Rest of Latin America Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 140 Rest of Latin America Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 141 Rest of Latin America Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 142 Rest of Latin America Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 143 Rest of Latin America Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 144 Rest of Latin America Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 145 Middle East & Africa Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 146 Middle East & Africa Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 147 Middle East & Africa Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 148 Middle East & Africa Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 149 Middle East & Africa Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 150 Middle East & Africa Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 151 Middle East & Africa Produced Water Treatment Market Volume (Million Barrels) Forecast, by Country and Sub-region, 2025 to 2035

Table 152 Middle East & Africa Produced Water Treatment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 153 GCC Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 154 GCC Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 155 GCC Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 156 GCC Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 157 GCC Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 158 GCC Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 159 South Africa Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 160 South Africa Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 161 South Africa Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 162 South Africa Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 163 South Africa Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 164 South Africa Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 165 Rest of Middle East & Africa Produced Water Treatment Market Volume (Million Barrels) Forecast, by Treatment Type, 2025 to 2035

Table 166 Rest of Middle East & Africa Produced Water Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2025 to 2035

Table 167 Rest of Middle East & Africa Produced Water Treatment Market Volume (Million Barrels) Forecast, by Source, 2025 to 2035

Table 168 Rest of Middle East & Africa Produced Water Treatment Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 169 Rest of Middle East & Africa Produced Water Treatment Market Volume (Million Barrels) Forecast, by End-use, 2025 to 2035

Table 170 Rest of Middle East & Africa Produced Water Treatment Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Figure 1 Global Produced Water Treatment Market Volume Share Analysis, by Treatment Type, 2023, 2027, and 2035

Figure 2 Global Produced Water Treatment Market Attractiveness, by Treatment Type

Figure 3 Global Produced Water Treatment Market Volume Share Analysis, by Source, 2023, 2027, and 2035

Figure 4 Global Produced Water Treatment Market Attractiveness, by Source

Figure 5 Global Produced Water Treatment Market Volume Share Analysis, by End-use, 2023, 2027, and 2035

Figure 6 Global Produced Water Treatment Market Attractiveness, by End-use

Figure 7 Global Produced Water Treatment Market Volume Share Analysis, by Region, 2023, 2027, and 2035

Figure 8 Global Produced Water Treatment Market Attractiveness, by Region

Figure 9 North America Produced Water Treatment Market Volume Share Analysis, by Treatment Type, 2023, 2027, and 2035

Figure 10 North America Produced Water Treatment Market Attractiveness, by Treatment Type

Figure 11 North America Produced Water Treatment Market Volume Share Analysis, by Source, 2023, 2027, and 2035

Figure 12 North America Produced Water Treatment Market Attractiveness, by Source

Figure 13 North America Produced Water Treatment Market Volume Share Analysis, by End-use, 2023, 2027, and 2035

Figure 14 North America Produced Water Treatment Market Attractiveness, by End-use

Figure 15 North America Produced Water Treatment Market Attractiveness, by Country and Sub-region

Figure 16 Europe Produced Water Treatment Market Volume Share Analysis, by Treatment Type, 2023, 2027, and 2035

Figure 17 Europe Produced Water Treatment Market Attractiveness, by Treatment Type

Figure 18 Europe Produced Water Treatment Market Volume Share Analysis, by Source, 2023, 2027, and 2035

Figure 19 Europe Produced Water Treatment Market Attractiveness, by Source

Figure 20 Europe Produced Water Treatment Market Volume Share Analysis, by End-use, 2023, 2027, and 2035

Figure 21 Europe Produced Water Treatment Market Attractiveness, by End-use

Figure 22 Europe Produced Water Treatment Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2035

Figure 23 Europe Produced Water Treatment Market Attractiveness, by Country and Sub-region

Figure 24 Asia Pacific Produced Water Treatment Market Volume Share Analysis, by Treatment Type, 2023, 2027, and 2035

Figure 25 Asia Pacific Produced Water Treatment Market Attractiveness, by Treatment Type

Figure 26 Asia Pacific Produced Water Treatment Market Volume Share Analysis, by Source, 2023, 2027, and 2035

Figure 27 Asia Pacific Produced Water Treatment Market Attractiveness, by Source

Figure 28 Asia Pacific Produced Water Treatment Market Volume Share Analysis, by End-use, 2023, 2027, and 2035

Figure 29 Asia Pacific Produced Water Treatment Market Attractiveness, by End-use

Figure 30 Asia Pacific Produced Water Treatment Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2035

Figure 31 Asia Pacific Produced Water Treatment Market Attractiveness, by Country and Sub-region

Figure 32 Latin America Produced Water Treatment Market Volume Share Analysis, by Treatment Type, 2023, 2027, and 2035

Figure 33 Latin America Produced Water Treatment Market Attractiveness, by Treatment Type

Figure 34 Latin America Produced Water Treatment Market Volume Share Analysis, by Source, 2023, 2027, and 2035

Figure 35 Latin America Produced Water Treatment Market Attractiveness, by Source

Figure 36 Latin America Produced Water Treatment Market Volume Share Analysis, by End-use, 2023, 2027, and 2035

Figure 37 Latin America Produced Water Treatment Market Attractiveness, by End-use

Figure 38 Latin America Produced Water Treatment Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2035

Figure 39 Latin America Produced Water Treatment Market Attractiveness, by Country and Sub-region

Figure 40 Middle East & Africa Produced Water Treatment Market Volume Share Analysis, by Treatment Type, 2023, 2027, and 2035

Figure 41 Middle East & Africa Produced Water Treatment Market Attractiveness, by Treatment Type

Figure 42 Middle East & Africa Produced Water Treatment Market Volume Share Analysis, by Source, 2023, 2027, and 2035

Figure 43 Middle East & Africa Produced Water Treatment Market Attractiveness, by Source

Figure 44 Middle East & Africa Produced Water Treatment Market Volume Share Analysis, by End-use, 2023, 2027, and 2035

Figure 45 Middle East & Africa Produced Water Treatment Market Attractiveness, by End-use

Figure 46 Middle East & Africa Produced Water Treatment Market Volume Share Analysis, by Country and Sub-region, 2023, 2027, and 2035

Figure 47 Middle East & Africa Produced Water Treatment Market Attractiveness, by Country and Sub-region