Reports

Reports

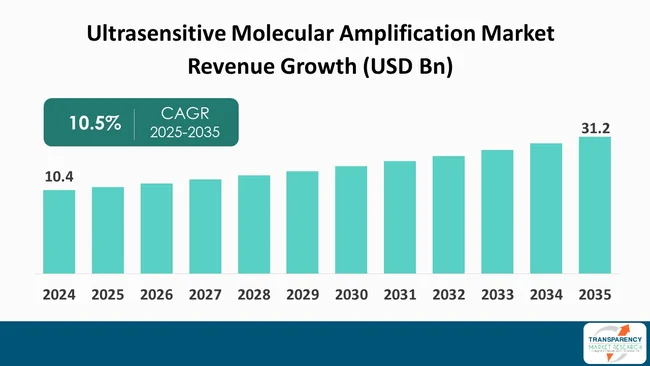

The global ultrasensitive molecular amplification market size was valued at US$ 10.4 Billion in 2024 and is projected to reach US$ 31.2 Billion by 2035, expanding at a CAGR of 10.5% from 2025 to 2035. The market growth is driven by increasing prevalence of chronic diseases and rising applications in point-of-care testing (POCT).

The ultrasensitive molecular amplification market is growing substantially due to the technological advancements in biotechnology and the high demand for accurate diagnostic tools. The market in question refers to the low molecular amplification technologies that enable the detection of low-abundance biomolecules, which are very important for early disease diagnosis and monitoring. The biggest applications to count on are oncology, infectious diseases, and personalized medicine, where biomarker detection accuracy could be the key to a better treatment outcome.

The demand for more sensitive diagnostic methods is an outcome of the rise of chronic diseases and the geriatric population. Besides, integrating next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies in diagnostic workflows do increase specificity and sensitivity. The key players in this market are putting their money in research and development activities to come up with new amplification methods that will give them a competitive advantage.

The demand for point-of-care testing (POCT) is also changing the molecular diagnostic market, making it more accessible. However, the market faces such challenges as high costs and the need for specialized training for healthcare professionals, which can slow down the growth of the market. In general, the Ultrasensitive Molecular Amplification market is a massive playground with the emergence of new technologies and an increasing focus on personalized healthcare solutions being the driving forces behind it.

Ultrasensitive Molecular Amplification is a broad term for a range of sophisticated techniques that aim to detect specific biomolecules that are present in minuscule amounts. Such methods have become essential in many different areas of application such as diagnostics, research, and therapeutic monitoring. The main goal of ultrasensitive amplification is to offer precise and reliable detection of biomarkers, which is the very first step essential for early disease diagnosis, e.g., infectious diseases and cancer.

This field is largely dependent on the use of different technologies such as loop-mediated isothermal amplification (LAMP), polymerase chain reaction (PCR), and next-generation sequencing (NGS). These tools aim at nucleic acid amplification to be able to detect the target molecules even if only a few are present. The achieved sensitivity level is vital for personalized medicine, treatment being dependent on the correct identification of biomarkers.

The desire for fast and precise diagnostic methods is the main reason for the continuous improvements of Ultrasensitive Molecular Amplifications. As healthcare keeps moving in the direction of patient-centered approaches, the progress of these technologies should be even faster. Nevertheless, problems such as high cost, device complexity, and necessity of specialized training are still present.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The Ultrasensitive Molecular Amplification market is heavily influenced by a major factor, namely the rise of chronic diseases. As these conditions, with examples like diabetes, cancer, respiratory disorders, and cardiovascular diseases are spreading worldwide, the necessity for their early and precise diagnosis is becoming pressing. Chronic diseases usually demand constant monitoring and management.

Ultrasensitive Molecular Amplification methodologies offer the chance of locating biomolecules in a few quantities, which is the primary factor for the diseases' diagnosis in their first stages. For example, in cancer, monitoring circulating tumor DNA (ctDNA) is a way to get a diagnosis sooner and a better treatment stratification. The elderly population, which is more prone to chronic diseases, makes the demand for such exact diagnostic tools even higher.

Medical care systems are gradually becoming aware of the necessity for early detection as a main factor in patient recovery and in lessening the overall healthcare costs. Therefore, investments in molecular diagnostics, especially in ultrasensitive amplification technologies, for the purpose of improving disease management, are increasing. This movement sustains not only the market growth but also the creative spirit of the companies as they compete to develop more efficacious amplification methods that meet the intricacies of chronic disease diagnostics.

The growing point-of-care testing (POCT) applications are amongst the main factors that power the Ultrasensitive Molecular Amplification market. POCT is a medical diagnostic test that can be conducted at or near a patient's care site, thus providing results quickly and allowing for immediate clinical decision-making. The shift toward decentralized care is mainly due to the demand for diagnostics that are timely, especially in case of emergencies, or in locations that are hard to reach where laboratories are not easily accessible.

As such, Ultrasensitive Molecular Amplification technologies like loop-mediated isothermal amplification (LAMP) and rapid PCR methods are progressively being employed in POCT devices to facilitate the quick detection of pathogens and biomarkers. As they can show the results right away, they are very useful in patient management, which is especially the case in infectious diseases, where intervention at an early stage is necessary.

Furthermore, the safety and speed that come with POCT help lessen the load of the healthcare facilities and in making the patients happy. As the need for decentralized healthcare solutions increases, the demand for diagnostic tools that are sensitive and accurate also rises, thereby leading to investments in ultrasensitive amplification technologies.

The trend is supported by the development in microfluidics and portable diagnostic devices, which make it possible to carry out complicated tests in different locations. In general, the use of Ultrasensitive Molecular Amplification in POCT is not only changing the way healthcare is delivered, but it is also opening up new market opportunities.

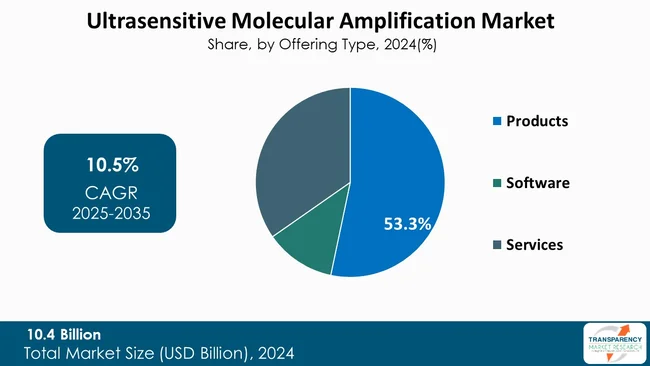

The products segment comprising instruments, reagents, and kits is one of the major contributors to the growth of the Ultrasensitive Molecular Amplification market. The segment's rise is mainly a result of the increasing demand for the diagnostic tools that are efficient and accurate and can be used in both - clinical and research settings. Advanced PCR machines and portable amplification devices enable the rapid testing to meet the pressing need for timely results in disease diagnosis and monitoring.

Reagents and kits make the testing process easy by offering ready-to-use solutions that provide the reliability and reproducibility of results. These products are necessary for laboratories and healthcare facilities that want to streamline their workflows while at the same time maintain high sensitivity and specificity in detection. Furthermore, the availability of user-friendly kits facilitates the adoption process among smaller clinics and point-of-care settings, thus, expanding the market reach.

Additionally, perpetual innovation in product offerings such as the birth of multiplex assays that can detect multiple targets simultaneously is a major factor in the product's appeal. As healthcare becomes more personalized with emphasis laid on early detection, the demand for instruments and reagents of high quality will be never-ending. The prolonged expansion of the products segment is the main driver behind the overall growth of the market, thereby making it a decisive factor in the future of diagnostics.

| Attribute | Detail |

|---|---|

| Leading Region |

|

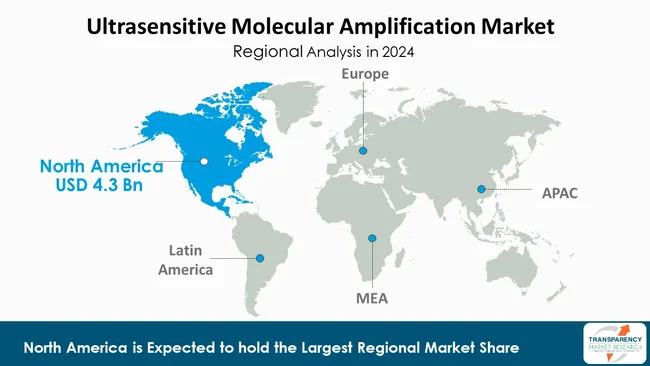

North America is the major contributor to the Ultrasensitive Molecular Amplification industry, holding the largest revenue share of 41.1%. The top technological healthcare infrastructure and a highly dense area of the world's leading biotechnology and pharmaceutical companies are some key factors to attract research and development (R&D) in such an environment. This development leads to the fast-advancement of molecular amplification technologies, and, in turn, to better diagnostic solutions.

Furthermore, the area has a strong regulatory framework that sponsors the approval and commercialization of new diagnostic products. Regulatory bodies such as the FDA are instrumental to the process of making available in the market the innovative technologies after safety and effectiveness check. This offers a high level of trust to healthcare providers and patients. Additionally, the demand for sensitive diagnostic tools to provide timely and accurate results is further fueled by an increasing trend of chronic and infectious diseases in the region.

Also, personalized medicine and preventive healthcare, as initiatives, have a deep impact on North America's demand for accurate biomarker detection. Besides, the region's already established reimbursement policies for advanced diagnostic testing facilitate and encourage investment in molecular amplification technologies.

Finally, the aforesaid point-of-care testing trend, which is supported by consumer demand for speedy and easily accessible healthcare solutions, where North America is leading, is another reason for the rise of the Ultrasensitive Molecular Amplification market in this region. Thus, these factors have a synergistic effect, which drives the growth of the market in the region.

Axxin, PCR Biosystems, Ultrassay BioTech Co., Ltd., Thermo Fisher Scientific Inc., Stilla, Rarity Bioscience, Hologic, Inc., Abbott, Bio-Rad Laboratories, Inc., BD (Becton, Dickinson and Company), Roche Diagnostics, bioMérieux, GRIP Molecular are the key players governing the global Ultrasensitive Molecular Amplification market.

Each of these players has been profiled in the Ultrasensitive Molecular Amplification industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 10.4 Bn |

| Forecast Value in 2035 | More than US$ 31.2 Bn |

| CAGR | 10.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Offering Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 10.4 Bn in 2024

It is projected to cross US$ 31.2 Bn by the end of 2035

Increasing prevalence of chronic diseases and rising applications in point-of-care testing (POCT)

It is anticipated to grow at a CAGR of 10.5% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Axxin, PCR Biosystems, Ultrassay BioTech Co., Ltd., Thermo Fisher Scientific Inc., Stilla, Rarity Bioscience, Hologic, Inc., Abbott, Bio-Rad Laboratories, Inc., BD (Becton, Dickinson and Company), Roche Diagnostics, bioMérieux, GRIP Molecular and others

Table 01: Global Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Offering Type, 2020 to 2035

Table 02: Global Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Products, 2020 to 2035

Table 03: Global Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 04: Global Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 05: Global Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Clinical Diagnostics, 2020 to 2035

Table 06: Global Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Test Location, 2020 to 2035

Table 07: Global Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America - Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 09: North America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Offering Type, 2020 to 2035

Table 10: North America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Products, 2020 to 2035

Table 11: North America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 12: North America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 13: North America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Clinical Diagnostics, 2020 to 2035

Table 14: North America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Test Location, 2020 to 2035

Table 15: Europe - Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 16: Europe Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Offering Type, 2020 to 2035

Table 17: Europe Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Products, 2020 to 2035

Table 18: Europe Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 19: Europe Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Europe Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Clinical Diagnostics, 2020 to 2035

Table 21: Europe Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Test Location, 2020 to 2035

Table 22: Asia Pacific - Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 23: Asia Pacific Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Offering Type, 2020 to 2035

Table 24: Asia Pacific Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Products, 2020 to 2035

Table 25: Asia Pacific Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 26: Asia Pacific Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 27: Asia Pacific Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Clinical Diagnostics, 2020 to 2035

Table 28: Asia Pacific Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Test Location, 2020 to 2035

Table 29: Latin America - Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 30: Latin America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Offering Type, 2020 to 2035

Table 31: Latin America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Products, 2020 to 2035

Table 32: Latin America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 33: Latin America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 34: Latin America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Clinical Diagnostics, 2020 to 2035

Table 35: Latin America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Test Location, 2020 to 2035

Table 36: Middle East & Africa - Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 37: Middle East & Africa Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Offering Type, 2020 to 2035

Table 38: Middle East & Africa Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Products, 2020 to 2035

Table 39: Middle East & Africa Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 40: Middle East & Africa Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 41: Middle East & Africa Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Clinical Diagnostics, 2020 to 2035

Table 42: Middle East & Africa Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, By Test Location, 2020 to 2035

Figure 01: Global Ultrasensitive Molecular Amplification Market Value Share Analysis, By Offering Type, 2024 and 2035

Figure 02: Global Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Offering Type, 2025 to 2035

Figure 03: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Products, 2020 to 2035

Figure 04: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 05: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 06: Global Ultrasensitive Molecular Amplification Market Value Share Analysis, By Technology, 2024 and 2035

Figure 07: Global Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 08: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Polymerase Chain Reaction (PCR), 2020 to 2035

Figure 09: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Loop-mediated Isothermal Amplification (LAMP), 2020 to 2035

Figure 10: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Transcription-Mediated Amplification (TMA), 2020 to 2035

Figure 11: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Non-thermal Nucleic Acid Amplification (NTA), 2020 to 2035

Figure 12: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 13: Global Ultrasensitive Molecular Amplification Market Value Share Analysis, By Application, 2024 and 2035

Figure 14: Global Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 15: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Clinical Diagnostics, 2020 to 2035

Figure 16: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Genetic Testing, 2020 to 2035

Figure 17: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Pharmacogenomic Testing, 2020 to 2035

Figure 18: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 19: Global Ultrasensitive Molecular Amplification Market Value Share Analysis, By Test Location, 2024 and 2035

Figure 20: Global Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Test Location, 2025 to 2035

Figure 21: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Point of Care Testing (PoC), 2020 to 2035

Figure 22: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by Diagnostic Laboratories, 2020 to 2035

Figure 23: Global Ultrasensitive Molecular Amplification Market Revenue (US$ Bn), by At-home Testing, 2020 to 2035

Figure 24: Global Ultrasensitive Molecular Amplification Market Value Share Analysis, By Region, 2024 and 2035

Figure 25: Global Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 26: North America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: North America Ultrasensitive Molecular Amplification Market Value Share Analysis, by Country, 2024 and 2035

Figure 28: North America Ultrasensitive Molecular Amplification Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 29: North America Ultrasensitive Molecular Amplification Market Value Share Analysis, By Offering Type, 2024 and 2035

Figure 30: North America Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Offering Type, 2025 to 2035

Figure 31: North America Ultrasensitive Molecular Amplification Market Value Share Analysis, By Technology, 2024 and 2035

Figure 32: North America Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 33: North America Ultrasensitive Molecular Amplification Market Value Share Analysis, By Application, 2024 and 2035

Figure 34: North America Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 35: North America Ultrasensitive Molecular Amplification Market Value Share Analysis, By Test Location, 2024 and 2035

Figure 36: North America Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Test Location, 2025 to 2035

Figure 37: Europe Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 38: Europe Ultrasensitive Molecular Amplification Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 39: Europe Ultrasensitive Molecular Amplification Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 40: Europe Ultrasensitive Molecular Amplification Market Value Share Analysis, By Offering Type, 2024 and 2035

Figure 41: Europe Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Offering Type, 2025 to 2035

Figure 42: Europe Ultrasensitive Molecular Amplification Market Value Share Analysis, By Technology, 2024 and 2035

Figure 43: Europe Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 44: Europe Ultrasensitive Molecular Amplification Market Value Share Analysis, By Application, 2024 and 2035

Figure 45: Europe Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 46: Europe Ultrasensitive Molecular Amplification Market Value Share Analysis, By Test Location, 2024 and 2035

Figure 47: Europe Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Test Location, 2025 to 2035

Figure 48: Asia Pacific Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 49: Asia Pacific Ultrasensitive Molecular Amplification Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 50: Asia Pacific Ultrasensitive Molecular Amplification Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 51: Asia Pacific Ultrasensitive Molecular Amplification Market Value Share Analysis, By Offering Type, 2024 and 2035

Figure 52: Asia Pacific Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Offering Type, 2025 to 2035

Figure 53: Asia Pacific Ultrasensitive Molecular Amplification Market Value Share Analysis, By Technology, 2024 and 2035

Figure 54: Asia Pacific Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 55: Asia Pacific Ultrasensitive Molecular Amplification Market Value Share Analysis, By Application, 2024 and 2035

Figure 56: Asia Pacific Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 57: Asia Pacific Ultrasensitive Molecular Amplification Market Value Share Analysis, By Test Location, 2024 and 2035

Figure 58: Asia Pacific Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Test Location, 2025 to 2035

Figure 59: Latin America Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 60: Latin America Ultrasensitive Molecular Amplification Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 61: Latin America Ultrasensitive Molecular Amplification Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 62: Latin America Ultrasensitive Molecular Amplification Market Value Share Analysis, By Offering Type, 2024 and 2035

Figure 63: Latin America Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Offering Type, 2025 to 2035

Figure 64: Latin America Ultrasensitive Molecular Amplification Market Value Share Analysis, By Technology, 2024 and 2035

Figure 65: Latin America Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 66: Latin America Ultrasensitive Molecular Amplification Market Value Share Analysis, By Application, 2024 and 2035

Figure 67: Latin America Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 68: Latin America Ultrasensitive Molecular Amplification Market Value Share Analysis, By Test Location, 2024 and 2035

Figure 69: Latin America Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Test Location, 2025 to 2035

Figure 70: Middle East & Africa Ultrasensitive Molecular Amplification Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 71: Middle East & Africa Ultrasensitive Molecular Amplification Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 72: Middle East & Africa Ultrasensitive Molecular Amplification Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 73: Middle East & Africa Ultrasensitive Molecular Amplification Market Value Share Analysis, By Offering Type, 2024 and 2035

Figure 74: Middle East & Africa Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Offering Type, 2025 to 2035

Figure 75: Middle East & Africa Ultrasensitive Molecular Amplification Market Value Share Analysis, By Technology, 2024 and 2035

Figure 76: Middle East & Africa Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 77: Middle East & Africa Ultrasensitive Molecular Amplification Market Value Share Analysis, By Application, 2024 and 2035

Figure 78: Middle East & Africa Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 79: Middle East & Africa Ultrasensitive Molecular Amplification Market Value Share Analysis, By Test Location, 2024 and 2035

Figure 80: Middle East & Africa Ultrasensitive Molecular Amplification Market Attractiveness Analysis, By Test Location, 2025 to 2035