Reports

Reports

Thanks to the rising demand for highly efficient insecticides containing natural ingredients, the U.K. market for insect repellents is expected to witness substantial growth over the next few years. Manufacturers of these repellants are prompted to increase their research activities to develop innovative products, which are highly effective yet cost competent.

Insect repellent on skin products are sold through different distribution channels such as supermarkets, online stores, and convenience stores. The increase in the availability of products in convenience stores, supermarkets and online stores are promoting growth of the insect repellent market in the U.K. Manufacturers also sell these products through their websites. Moreover, many companies enter into joint venture agreements with different online stores in order to sell insect repellent on skin products through their websites. The impact of this driver is medium at present, but is expected to become high in the near future.

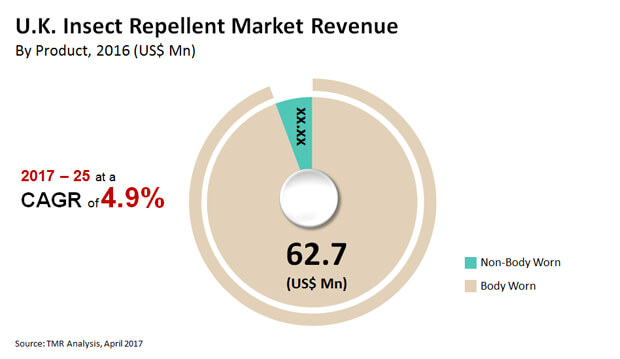

The U.K. market for insect repellents, which stood at US$ 66.4 mn in 2016, is anticipated to increase at a healthy CAGR of 4.90% during the period from 2017 to 2025, expanding the opportunity in this market to US$100.0 mn by the end of 2024.

Predominantly, insect repellents are of two types, body worn and non-body worn. The demand for non-body worn insect repellent is much higher than their body worn counterparts. Coils, mats and sheets, electric/liquid vaporizers, and aerosol sprays are the most preferred insecticides among consumers in the U.K. Among these, the demand for aerosol is significantly higher. Aerosol cans are used to kill or repel different insects including mosquitoes, and cockroaches among others. These sprays are not meant for direct application on the skin unlike body worn aerosol sprays. Aerosol cans are tightly sealed and do not leak or spill.

Currently, all aerosol containers are tamper-evident and tamper resistant. Moreover, these products are manufactured in such a way that they home in on the target without much effort. Aerosol cans control the pattern of the spray, the size of the particle, the volume released per second, and the concentration of the spray for maximum effect. Hermetic sealed package protects and extends the life of the product. Therefore, the product can be stored for longer time without the risk of getting evaporated. Thus, owing to these factors, aerosol sprays accounted for the major market share in 2016 and is expected to lead the market throughout.

Malathion- and Pyrethrin-based Repellents Report High Adoption

On the basis of composition, the U.K. market for insect repellants is segregated into malathion, carbaryl, and pyrethrin (non-body worn) and deet, picaridin, oil of lemon eucalyptus/p-menthane-3, 8-diol, IR 3535, and plant oil (body worn). The demand for malathion-based and pyrethrin-based mosquito repellents is remarkably high in this country. Plant oil-based repellants and oil of lemon eucalyptus/p-menthane-3, 8-diol are also quite popular among consumers.

With a number of established participants, the U.K. insect repellent market displays a compartive structure. At the forefront of this market are Avon Products Inc., BASF SE, E. I. Du Pont de Nemours and Co., 3M Corp., and S. C. Johnson & Son, Inc.

Major key players in the UK insect repellent market are Avon Products Inc., BASF SE, DuPont, and S. C. Johnson & Son.

UK Insect Repellent Market will expand at a 4.90% CAGR between 2017 and 2025

UK insect repellent market size is estimated to worth US$100.0 MN by 2025.

UK Insect Repellent Market forecast period would be from 2017 to 2025.

The increase in the availability of products in convenience stores, supermarkets and online stores are promoting growth of the insect repellent market in the U.K.

Chapter 1 Preface

1.1 Research Scope

1.2 Market Segmentation

1.3 Research Highlights

Chapter 2 Assumptions and Research Methodology

2.1 Report Assumptions

2.2 Acronyms Used

2.3 Research Methodology

Chapter 3 Executive Summary

3.1 Product Overview

3.2 Key Trends

Chapter 4 Market Dynamics

4.1 Market Introduction

4.2 Key Trend Analysis

4.3 Drivers and Restraints Snapshot Analysis

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.4 U.K. Insect Repellent Analysis, and Forecasts, 2016 – 2025

4.5 U.K. Insect Repellent Market Attractiveness Analysis (2016) by Product

Chapter 5 U.K. Insect Repellent Market Analysis By Product

5.1 Introduction

5.2 U.K. Insect Repellent Market Revenue Share Analysis, by Product, 2016 & 2025

5.3 U.K. Insect Repellent Market Revenue Analysis By Product

Chapter 6 U.K. Insect Repellent Market Analysis By Non-Body Worn Products

6.1 Introduction

6.2 U.K. Insect Repellent Market Revenue Share Analysis, by Non-Body Worn Products, 2016 & 2025

6.3 U.K. Insect Repellent Market Revenue Analysis By Non-Body Worn Products

Chapter 7 U.K. Insect Repellent Market Analysis By Body Worn Products

7.1 Introduction

7.2 U.K. Insect Repellent Market Revenue Share Analysis, by Body Worn Products, 2016 & 2025

7.3 U.K. Insect Repellent Market Revenue Analysis By Body Worn Products

Chapter 8 U.K. Insect Repellent Market Analysis By Non-Body Worn Composition

8.1 Introduction

8.2 U.K. Insect Repellent Market Revenue Share Analysis, by Non-Body Worn Composition, 2016 & 2025

8.3 U.K. Insect Repellent Market Revenue Analysis By Non-Body Worn Composition

Chapter 9 U.K. Insect Repellent Market Analysis By Body Worn Composition

9.1 Introduction

9.2 U.K. Insect Repellent Market Revenue Share Analysis, by Body Worn Composition, 2016 & 2025

9.3 U.K. Insect Repellent Market Revenue Analysis By Body Worn Composition

Chapter 10 Company Profiles

10.1 Insect Repellent Market: Market Share Analysis, by Company, 2016 (%)

10.2 Avon Products Inc.

10.2.1 Company Details (HQ, Foundation Year, Employee Strength)

10.2.2 Market Presence, By Segment and Geography

10.2.3 SWOT Analysis

10.2.4 Strategic Overview

10.2.5 Revenue and YoY (%)

10.3 BASF SE

10.3.1 Company Details (HQ, Foundation Year, Employee Strength)

10.3.2 Market Presence, By Segment and Geography

10.3.3 SWOT Analysis

10.3.4 Strategic Overview

10.3.5 Revenue and YoY (%)

10.4 E. I. du Pont de Nemours and Company

10.4.1 Company Details (HQ, Foundation Year, Employee Strength)

10.4.2 Market Presence, By Segment and Geography

10.4.3 SWOT Analysis

10.4.4 Strategic Overview

10.4.5 Revenue and YoY (%)

10.5 3M Corporation

10.5.1 Company Details (HQ, Foundation Year, Employee Strength)

10.5.2 Market Presence, By Segment and Geography

10.5.3 SWOT Analysis

10.5.4 Strategic Overview

10.5.5 Revenue and YoY (%)

10.6 S. C. Johnson & Son, Inc.

10.6.1 Company Details (HQ, Foundation Year, Employee Strength)

10.6.2 Market Presence, By Segment and Geography

10.6.3 SWOT Analysis

10.6.4 Strategic Overview

10.6.5 Revenue and YoY (%)

List of Figures

1 U.K. Insect Repellent Analysis, and Forecasts, 2016 – 2025

2 U.K. Insect Repellent Market Attractiveness Analysis (2016) by Product

3 U.K. Insect Repellent Market Revenue Share Analysis, by Product, 2016 & 2025

4 U.K. Non-Body Worn Insect Repellent Market Revenue (US$ Mn), 2016– 2025

5 U.K. Body Worn Insect Repellent Market Revenue (US$ Mn), 2016 – 2025

6 U.K. Insect Repellent Market Revenue Share Analysis, by Non-Body Worn Products, 2016 & 2025

7 U.K. Coil, Mat and Sheet Market Revenue (US$ Mn), 2016– 2025

8 U.K. Electric/Liquid Vaporizers Market Revenue (US$ Mn), 2016 – 2025

9 U.K. Aerosol Sprays Market Revenue (US$ Mn), 2016– 2025

10 U.K. Insect Repellent Market Revenue Share Analysis, by Body Worn Products, 2016 & 2025

11 U.K. Oils and Creams Market Revenue (US$ Mn), 2016– 2025

12 U.K. Stickers and Patches Market Revenue (US$ Mn), 2016 – 2025

13 U.K. Apparels Market Revenue (US$ Mn), 2016– 2025

14 U.K. Aerosol Market Revenue (US$ Mn), 2016 – 2025

15 U.K. Insect Repellent Market Revenue Share Analysis, by Non-Body Worn Composition, 2016 & 2025

16 U.K. Malathion Market Revenue (US$ Mn), 2016– 2025

17 U.K. Carbaryl Market Revenue (US$ Mn), 2016 – 2025

18 U.K. Pyrethrin Market Revenue (US$ Mn), 2016– 2025

19 U.K. Others Market Revenue (US$ Mn), 2016 – 2025

20 U.K. Insect Repellent Market Revenue Share Analysis, by Body Worn Composition, 2016 & 2025

21 U.K. Deet Market Revenue (US$ Mn), 2016– 2025

22 U.K. Picaridin Market Revenue (US$ Mn), 2016 – 2025

23 U.K. Oil of Lemon Eucalyptus/ p-Menthane-3,8-diol Market Revenue (US$ Mn), 2016– 2025

24 U.K. IR 3535 Market Revenue (US$ Mn), 2016 – 2025

25 U.K. Plant Oil Market Revenue (US$ Mn), 2016– 2025

26 U.K. Others Market Revenue (US$ Mn), 2016 – 2025

27 U.K. Insect Repellent Market Share Analysis: By Company (2016)