Reports

Reports

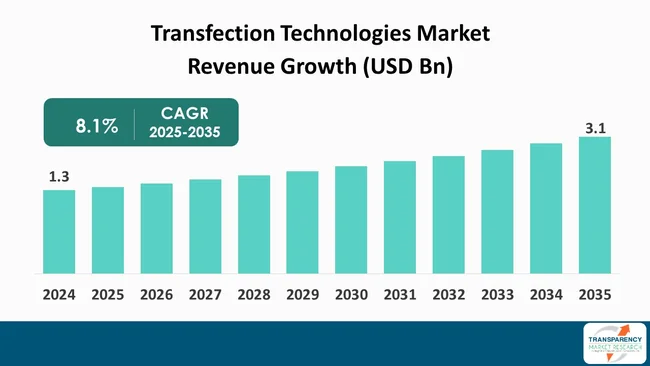

The global transfection technologies market size was valued at US$ 1.3 Bn in 2024 and is projected to reach US$ 3.1 Bn by 2035, expanding at a CAGR of 8.1 % from 2025 to 2035. The global market is projected to expand at annual growth rate (CAGR of 8.1%) during the forecast period. The primary factors that are fueling this growth include the increasing acceptance of biopharmaceuticals, imposition of stringent regulations to ensure safety and efficacy of products, and technological innovations in the bioprocessing sector.

Consistency is likely to be witnessed in the global transfection technologies market for the next few years. This is basically owing to the rising need for research pertaining to biotechnology and pharmaceutical industries for various sophisticated gene delivery methods. The increased application of transfection in personalized medicine, genetic engineering, and cell-based therapies is expected to be the main factor behind the market growth.

Moreover, innovations such as the rise in frequency of non-viral delivery methods, automation, and high-throughput platforms are enhancing transfection efficiency as well as reproducibility, which, in turn, is resulting in increased uptake in both - commercial and academic laboratories.

However, challenges like high prices for advanced systems, probable cytotoxicity concerns, and difficulties in regulations are likely to limit the expansion of the market to certain degree. Still, the continuous R&D efforts and the increasing demand for gene and cell therapy products are expected to open a wealth of opportunities for the leading companies in the global transfection technologies market.

The global transfection technologies market comprises various methods, instruments, and chemical substances employed to introduce nucleic acids such as DNA and RNA into eukaryotic cells. Transfection is a vital operation in genetic research, drug discovery, gene therapy, and biopharmaceutical production, as it facilitates the study and regulation of gene expression.

The market is diversified with the range of different methods of transfection, which are physical, chemical, and biological, and each method has distinct advantages depending on the cell type and the purpose. As a result of an increased emphasis on precision medicine, cell and gene therapy, and the invention of new biologics, transfection devices have turned out to be the most essential instruments in life sciences as well as biotechnological research.

Through a significant regulatory reorganization, China's Ministry of Science and Technology (MOST) has handed over the oversight of human genetic resources to the National Health Commission (NHC). The change is intended to facilitate the approvals and lower the number of administrative obstacles that researchers and biotech companies working with genetic materials face.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The rising investments allotted to research and development activities have been a major factor in the increased global demand for transfection technologies. As the pharmaceutical and biotechnology companies ramp up their work to find and make new drugs, transfection techniques are extensively used to decipher genes, confirm drug targets, and make recombinant proteins.

Moreover, these are the technologies that allow the scientific community to change the genetic material in an efficient manner, thus enabling high-throughput screening and making the drug discovery process faster. The increasing focus on precision medicine, genomics, and biologics is a major factor that is driving the demand for dependable and easily scalable transfection systems in research that is carried out in universities, hospitals, and industries.

Additionally, partnerships between research institutions and biotech companies are opening up new application areas for transfection technologies in the early stages of drug development. Ongoing innovation in non-viral and automated delivery systems is making experiments more efficient and reproducible. Therefore, transfection technologies are progressively being recognized as a key enabler to the development of the next generation of therapeutics and the speeding up of biomedical innovation.

For instance, the UK Research and Innovation (UKRI), in collaboration with partner research agencies, by far, presented a funding scheme to the tune of more than £55 Bn pounds to promote research and innovation in a wide variety of areas including health and life sciences, clean‐energy and digital technologies.

One of the main factors leading to the expansion of the transfection technologies market is the fast development of cell and gene therapies. These innovative treatments, which entail the alteration or substitution of faulty genes and the modification of cells to heal or avert diseases, require the use of effective gene delivery systems.

Transfection methods are essential instruments needed in the exact placing of new genes into the cells that need them, thus being the basis for the creation of medicines for cancer, hereditary diseases, and illnesses that have very few patients. This area, which is witnessing a growing count of clinical trials, regulatory green lights, and commercial introductions, is a clear indication of the fast-moving trend towards personalized and regenerative medicine.

The persistent increase of demand for high-standard performance transfection tools and reagents, which is a direct result of the worldwide healthcare systems adoption of these innovative treatments, has been the main factor for the continuous expansion of the market. and the technological progress. For instance, The Medicines and Healthcare products

Regulatory Agency (MHRA) has published a position paper "Rare therapies and UK regulatory considerations", outlining a new regulatory route for advanced gene and cell therapies for ultra-rare diseases. The paper expresses the UK ambition to be a worldwide leader in the creation, regulation and healthcare system integration of such therapies.

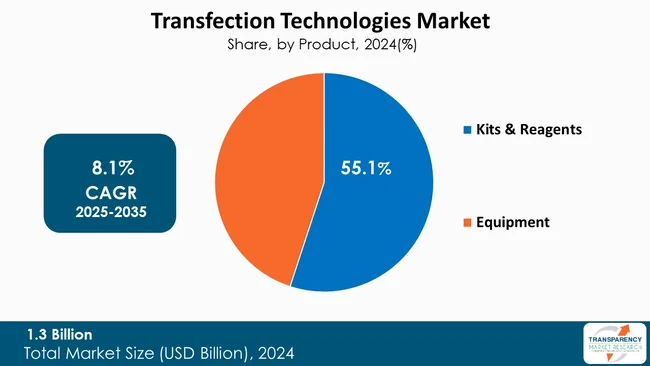

The kits and reagents are the major contributors to the global transfection technologies market which is a product segment with market share of 55.1%. It is the categories which has the biggest share of the market because it is the most direct in almost all the transfection workflows that can be given as a research in academies, production of biopharmaceuticals or clinical applications. The frequent requirements of reagents like transfection buffers, liposomes, and polymers is what makes the businesses a steady revenue generator in contrast to that of equipment which is one-time purchase.

Furthermore, nonstop innovations in reagent formulations have made transfection more efficient, lowered cytotoxicity, and increased the compatibility with a wide variety of cell types, which have, in turn, increased their market share. As a result of the increasing research activities in gene and cell therapy, drug discovery, and molecular biology, the kits and reagents segment is anticipated to keep its command, being upheld by the escalated usage in developed and emerging markets.

For instance, The Life Sciences Innovative Manufacturing Fund (LSIMF) is one of the key measures of the Department for Business, Energy & Industrial Strategy (BEIS) and the Department of Health and Social Care (DHSC). Their fund installation will provide a total of up to £520 Mn in grants for different industries' capital expenditures, such as the diagnostic sector where the production of reagents and consumables is the area of manufacturing.

Moreover, the increase in high-throughput screening and the use of automation in labs have led to a higher demand for ready-to-use transfection kits, which supply convenience and reproducibility. The continuous innovation of key producers aiming at the development of specially made reagents for complex cell lines and primary cells is, in fact, accelerating the worldwide expansion of this segment.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The global transfection technology market is mostly influenced by North America with market share of 40.5%. This is attributed to the presence of the top pharma and biotech companies, an advanced research setup, and hefty government and private sector investments in genetic and cell-based research. The U.S. is specifically responsible for the major part due to the widespread use of innovative gene delivery methods, large-scale financing for genomics and personalized medicine, and an increasing number of clinical trials for cell and gene therapies.

Moreover, the region is also benefiting from supportive regulatory frameworks, a vibrant collaboration network between the academic and industrial sectors, and a pool of talented researchers. With the unceasing innovations in biotechnology and a healthy ecosystem for R&D, the continent will be able to maintain its stronghold and lead the global transfection technologies market for the next few years.

For instance, ISED (Innovation, Science and Economic Development Canada) is putting in US$ 62 Mn for a US$ 198.5 Mn project head by Entos Pharmaceuticals to build a 103,000-square-foot facility that includes a bio manufacturing plant and R&D center. The new plant will enhance the capacity of Canada to create and make sophisticated therapeutics and vaccines locally, which is in line with Canada's contribution to the global medicine of the future.

Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., QIAGEN, Merck KGaA, Sartorius AG, Lonza Group Ltd., Agilent Technologies, Inc., MaxCyte, Revvity, Promega Corporation, DH Life Sciences, LLC, BOC Sciences, Altogen Biosystems, Synvolux, BioIVT, and others are some of the leading manufacturers operating in the global transfection technologies market.

Each of these companies has been profiled in the transfection technologies industry report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.3 Bn |

| Forecast Value in 2035 | More than US$ 3.1 Bn |

| CAGR | 8.1 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global transfection technologies market was valued at US$ 1.3 Bn in 2024

The global transfection technologies industry is projected to reach more than US$ 3.1 Bn by the end of 2035

Increased R&D and drug discovery and rise of cell and gene therapies are some of the factors driving the expansion of Transfection technologies market.

The CAGR is anticipated to be 8.1% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., QIAGEN, Merck KGaA, Sartorius AG, Lonza Group Ltd., Agilent Technologies, Inc., MaxCyte, Revvity, Promega Corporation, DH Life Sciences, LLC, BOC Sciences, Altogen Biosystems, Synvolux, BioIVT, and other prominent players

Table 01: Global Transfection Technologies Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 02: Global Transfection Technologies Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 03: Global Transfection Technologies Market Value (US$ Bn), by Physical Transfection, 2020 to 2035

Table 04: Global Transfection Technologies Market Value (US$ Bn), by Bio-Chemical Based Transfection, 2020 to 2035

Table 05: Global Transfection Technologies Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 06: Global Transfection Technologies Market Value (US$ Bn, By Therapeutic Delivery, 2020 to 2035

Table 07: Global Transfection Technologies Market Value (US$ Bn, By Biomedical Research, 2020 to 2035

Table 08: Global Transfection Technologies Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 09: Global Transfection Technologies Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 10: North America Transfection Technologies Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 11: North America Transfection Technologies Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 12: North America Transfection Technologies Market Value (US$ Bn), by Physical Transfection, 2020 to 2035

Table 13: North America Transfection Technologies Market Value (US$ Bn), by Bio-Chemical Based Transfection, 2020 to 2035

Table 14: North America Transfection Technologies Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: North America Transfection Technologies Market Value (US$ Bn, By Therapeutic Delivery, 2020 to 2035

Table 16: North America Transfection Technologies Market Value (US$ Bn, By Biomedical Research, 2020 to 2035

Table 17: North America Transfection Technologies Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 18: North America Transfection Technologies Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 19: Europe Transfection Technologies Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 20: Europe Transfection Technologies Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 21: Europe Transfection Technologies Market Value (US$ Bn), by Physical Transfection, 2020 to 2035

Table 22: Europe Transfection Technologies Market Value (US$ Bn), by Bio-Chemical Based Transfection, 2020 to 2035

Table 23: Europe Transfection Technologies Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Europe Transfection Technologies Market Value (US$ Bn, By Therapeutic Delivery, 2020 to 2035

Table 25: Europe Transfection Technologies Market Value (US$ Bn, By Biomedical Research, 2020 to 2035

Table 26: Europe Transfection Technologies Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 27: Europe Transfection Technologies Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 28: Asia Pacific Transfection Technologies Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 29: Asia Pacific Transfection Technologies Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 30: Asia Pacific Transfection Technologies Market Value (US$ Bn), by Physical Transfection, 2020 to 2035

Table 31: Asia Pacific Transfection Technologies Market Value (US$ Bn), by Bio-Chemical Based Transfection, 2020 to 2035

Table 32: Asia Pacific Transfection Technologies Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 33: Asia Pacific Transfection Technologies Market Value (US$ Bn, By Therapeutic Delivery, 2020 to 2035

Table 34: Asia Pacific Transfection Technologies Market Value (US$ Bn, By Biomedical Research, 2020 to 2035

Table 35: Asia Pacific Transfection Technologies Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 36: Asia Pacific Transfection Technologies Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 37: Latin America Transfection Technologies Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 38: Latin America Transfection Technologies Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 39: Latin America Transfection Technologies Market Value (US$ Bn), by Physical Transfection, 2020 to 2035

Table 40: Latin America Transfection Technologies Market Value (US$ Bn), by Bio-Chemical Based Transfection, 2020 to 2035

Table 41: Latin America Transfection Technologies Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 42: Latin America Transfection Technologies Market Value (US$ Bn, By Therapeutic Delivery, 2020 to 2035

Table 43: Latin America Transfection Technologies Market Value (US$ Bn, By Biomedical Research, 2020 to 2035

Table 44: Latin America Transfection Technologies Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 45: Latin America Transfection Technologies Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 46: Middle East and Africa Transfection Technologies Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 47: Middle East and Africa Transfection Technologies Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 48: Middle East and Africa Transfection Technologies Market Value (US$ Bn), by Physical Transfection, 2020 to 2035

Table 49: Middle East and Africa Transfection Technologies Market Value (US$ Bn), by Bio-Chemical Based Transfection, 2020 to 2035

Table 50: Middle East and Africa Transfection Technologies Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 51: Middle East and Africa Transfection Technologies Market Value (US$ Bn, By Therapeutic Delivery, 2020 to 2035

Table 52: Middle East and Africa Transfection Technologies Market Value (US$ Bn, By Biomedical Research, 2020 to 2035

Table 53: Middle East and Africa Transfection Technologies Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 54: Middle East and Africa Transfection Technologies Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Figure 01: Global Transfection Technologies Market Value Share Analysis, by Product, 2024 and 2035

Figure 02: Global Transfection Technologies Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 03: Global Transfection Technologies Market Revenue (US$ Bn), by Kits & Reagents, 2020 to 2035

Figure 04: Global Transfection Technologies Market Revenue (US$ Bn), by Equipment, 2020 to 2035

Figure 05: Global Transfection Technologies Market Value Share Analysis, by Method, 2024 and 2035

Figure 06: Global Transfection Technologies Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 07: Global Transfection Technologies Market Revenue (US$ Bn), by Physical Transfection, 2020 to 2035

Figure 08: Global Transfection Technologies Market Revenue (US$ Bn), by Bio-Chemical Based Transfection, 2020 to 2035

Figure 09: Global Transfection Technologies Market Revenue (US$ Bn), by Viral-Vector Based Transfection, 2020 to 2035

Figure 10: Global Transfection Technologies Market Value Share Analysis, by Application, 2024 and 2035

Figure 11: Global Transfection Technologies Market Attractiveness Analysis, by Application, 2024 and 2035

Figure 12: Global Transfection Technologies Market Revenue (US$ Bn), by Therapeutic Delivery, 2020 to 2035

Figure 13: Global Transfection Technologies Market Revenue (US$ Bn), by Biomedical Research, 2020 to 2035

Figure 14: Global Transfection Technologies Market Revenue (US$ Bn), by Protein Production, 2020 to 2035

Figure 15: Global Transfection Technologies Market Revenue (US$ Bn), by Cell Based Microarrays, 2020 to 2035

Figure 16: Global Transfection Technologies Market Value Share Analysis, by End-user, 2024 and 2035

Figure 17: Global Transfection Technologies Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 18: Global Transfection Technologies Market Revenue (US$ Bn), by Pharmaceutical & Biotechnology Companies, 2025 to 2035

Figure 19: Global Transfection Technologies Market Revenue (US$ Bn), by Contract Research & Manufacturing, 2020 to 2035

Figure 20: Global Transfection Technologies Market Revenue (US$ Bn), by Academic & Research Institutes, 2020 to 2035

Figure 21: Global Transfection Technologies Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 22: Global Transfection Technologies Market Value Share Analysis, By Region, 2024 and 2035

Figure 23: Global Transfection Technologies Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 24: North America Transfection Technologies Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 25: North America Transfection Technologies Market Value Share Analysis, by Country, 2024 and 2035

Figure 26: North America Transfection Technologies Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 27: North America Transfection Technologies Market Value Share Analysis, by Product, 2024 and 2035

Figure 28: North America Transfection Technologies Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 29: North America Transfection Technologies Market Value Share Analysis, by Method, 2024 and 2035

Figure 30: North America Transfection Technologies Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 31: North America Transfection Technologies Market Value Share Analysis, by Application, 2024 and 2035

Figure 32: North America Transfection Technologies Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 33: North America Transfection Technologies Market Value Share Analysis, by End-user, 2024 and 2035

Figure 34: North America Transfection Technologies Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 35: Europe Transfection Technologies Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 36: Europe Transfection Technologies Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 37: Europe Transfection Technologies Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 38: Europe Transfection Technologies Market Value Share Analysis, by Product, 2024 and 2035

Figure 39: Europe Transfection Technologies Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 40: Europe Transfection Technologies Market Value Share Analysis, by Method, 2024 and 2035

Figure 41: Europe Transfection Technologies Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 42: Europe Transfection Technologies Market Value Share Analysis, By Application, 2024 and 2035

Figure 43: Europe Transfection Technologies Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 44: Europe Transfection Technologies Market Value Share Analysis, by End-user, 2024 and 2035

Figure 45: Europe Transfection Technologies Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 46: Asia Pacific Transfection Technologies Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 47: Asia Pacific Transfection Technologies Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 48: Asia Pacific Transfection Technologies Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 49: Asia Pacific Transfection Technologies Market Value Share Analysis, by Product, 2024 and 2035

Figure 50: Asia Pacific Transfection Technologies Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 51: Asia Pacific Transfection Technologies Market Value Share Analysis, by Method, 2024 and 2035

Figure 52: Asia Pacific Transfection Technologies Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 53: Asia Pacific Transfection Technologies Market Value Share Analysis, By Application, 2024 and 2035

Figure 54: Asia Pacific Transfection Technologies Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 55: Asia Pacific Transfection Technologies Market Value Share Analysis, by End-user, 2024 and 2035

Figure 56: Asia Pacific Transfection Technologies Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 57: Latin America Transfection Technologies Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 58: Latin America Transfection Technologies Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 59: Latin America Transfection Technologies Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 60: Latin America Transfection Technologies Market Value Share Analysis, by Product, 2024 and 2035

Figure 61: Latin America Transfection Technologies Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 62: Latin America Transfection Technologies Market Value Share Analysis, by Method, 2024 and 2035

Figure 63: Latin America Transfection Technologies Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 64: Latin America Transfection Technologies Market Value Share Analysis, By Application, 2024 and 2035

Figure 65: Latin America Transfection Technologies Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 66: Latin America Transfection Technologies Market Value Share Analysis, by End-user, 2024 and 2035

Figure 67: Latin America Transfection Technologies Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 68: Middle East & Africa Transfection Technologies Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 69: Middle East & Africa Transfection Technologies Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 70: Middle East & Africa Transfection Technologies Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 71: Middle East & Africa Transfection Technologies Market Value Share Analysis, by Product, 2024 & 2035

Figure 72: Middle East & Africa Transfection Technologies Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 73: Middle East & Africa Transfection Technologies Market Value Share Analysis, by Method, 2024 and 2035

Figure 74: Middle East & Africa Transfection Technologies Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 75: Middle East & Africa Transfection Technologies Market Value Share Analysis, by Application, 2024 & 2035

Figure 76: Middle East & Africa Transfection Technologies Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 77: Middle East & Africa Transfection Technologies Market Value Share Analysis, by End-user, 2024 & 2035

Figure 78: Middle East & Africa Transfection Technologies Market Attractiveness Analysis, by End-user, 2025 to 2035