Reports

Reports

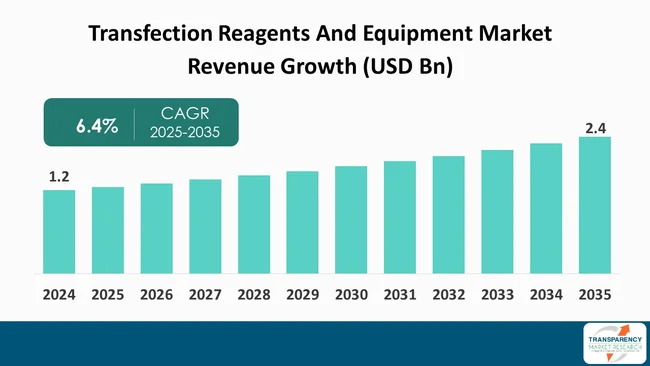

The global transfection reagents and equipment market size was valued at US$ 1.2 Bn in 2024 and is projected to reach US$ 2.4 Bn by 2035, expanding at a CAGR of 6.4 % from 2025 to 2035. The major factors leading to the expansion of the transfection reagents and equipment industry are the major adoption of advanced gene-editing technologies such as CRISPR, the inflow of capital to cell and gene therapy research, and the uptrend in the utilization of transfection instruments in drug discovery and biomedical research.

The global transfection reagents and equipment market is witnessing steadiness. This growth is mainly influenced by the demand for cell- and gene-based research, progress in gene-editing technologies like CRISPR, and the rising concentration of therapeutic applications in the pharmaceutical and biotechnology industries.

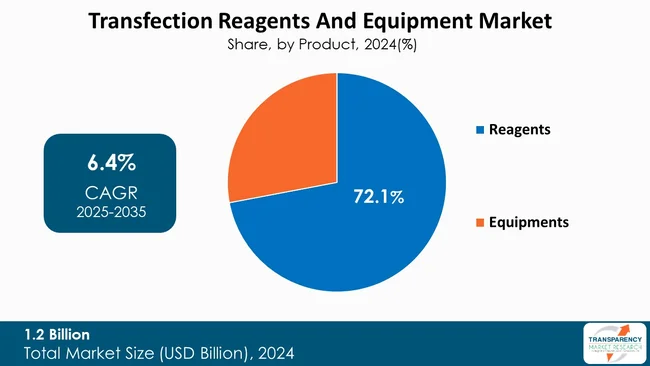

The increased use of transfection tools in research and clinical labs has been largely influenced by the rising investments in proteomics, genomics, and drug discovery. Additionally, the analysts have pointed out that the reagents segment, which is mainly responsible for the consumables in experiments, is still leading the market, whereas the equipment segment is experiencing significant changes to meet the requirements of higher efficiency, automation, and scalability.

While a few challenges have been identified in the market such as the increased prices, the technologically complex nature of the processes and the difficulties of passing through the regulations, the forecast of the market has been positive overall and a number of opportunities opened up in the underdeveloped regions and in the expanding sector of personalized medicine.

One of the primary technologies in basic molecular biology and life sciences is the market for transfection reagents and equipment. This market provides essential tools that enable researchers to insert nucleic acids such as DNA and RNA into eukaryotic cells, , for both - research and therapeutic use. Consequently, transfection represents the central operation in the investigation of gene expression, new drug development, and the production of refined therapies such as gene- and cell-based treatment.

The market covers a diverse array of reagents - for instance, lipid-based, polymer-based, and calcium phosphate - along with devices such as electroporators and microinjection systems aimed at increasing both - the efficiency and the accuracy of transfection. The market has been expanding all over the world due to the increasing focus on genetic research, development of gene-editing tools such as CRISPR, and the demand for targeted therapies.

Transfection technologies have become essential tools to both - academic and industrial laboratories, as research in genomics and proteomics continues to evolve rapidly. The market is forecast to experience steadiness over the next few years, which will be facilitated by increasing R&D investments and transfection application extension in drug development and regenerative medicine.

For instance, the National Institutes of Health (NIH), the Food and Drug Administration (FDA), and 15 private organizations collectively initiated the Bespoke Gene Therapy Consortium, a programme aimed at making the development of gene therapies less time-consuming and more efficient (most of these therapies are based on nucleic acid delivery and cell transfection) for rare diseases.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The advancements in genetics research heavily depend on the rapid pace of new concepts in various areas such as recombinant DNA technology, proteomics, and advanced gene-editing tools like CRISPR. These innovations have, in fact, altered the entire understanding and working with genetic material, which forms the basis of life sciences.

With integration of these technologies, scientists have been able to understand diseases more rapidly, produce new drugs, and tailor medicine to individual needs. In April 2024, the NIH released its revised "Guidelines for Research Involving Recombinant or Synthetic Nucleic Acid Molecules" to the public. The guidelines specify that if an experiment (e.g., a study conducted in a foreign country) results in the creation of recombinant/synthetic nucleic acid molecules and is funded by the NIH, the experiment must be in accordance with the institutional oversight and biosafety requirements set forth in the guidelines.

Personalized medicine is evolving rapidly and reshaping the health-care system by focusing on treatments that are dependent on a patient's genetic makeup, way of life, and nature of the disease. Consequently, there is a huge need for sophisticated instruments that are capable of accurate gene manipulation in human cells for therapy.

These are looked upon as revolution therapies that utilize the most advanced technologies: gene editing, RNAi, and transfection in order to develop the next generation of drugs that will cure the root causes of diseases rather than treating the symptoms. The Medicines and Healthcare Products Regulatory Agency (MHRA) in the UK declared that the new regulations, which came into effect on July 2025, create the possibility for personalized treatments and gene therapies to be produced locally or close to the place of care (e.g., in hospitals or clinics) in place of necessitating centralized production at a considerable distance.

Reagents account for the largest share of the global transfection reagents and equipment market by product type with 72.1% market share. The major factor for this dominance is that reagents are essential and regularly used in a diverse set of gene and cell-based research applications such as protein production, gene expression studies, and therapeutic development.

Reagents are essentially consumables that are needed for several experimental cycles, and thus, there is a consistent demand for them from universities, biotech companies, and pharma companies. While, the equipment segment, which includes devices such as electroporation systems, microinjection instruments, and the other delivery apparatus, is increasingly expanding at a steady pace due to innovations and the growing requirement for automation and high-throughput transfection techniques. For instance, the China National Medical Products Administration (NMPA) and various industry observers have indicated that Chinese pharmaceutical and R&D companies are progressively purchasing laboratory reagents from local suppliers rather than importing them. This change in sourcing is a result of higher import tariffs and worries about the stability of the supply chain.

| Attribute | Detail |

|---|---|

| Leading Region |

|

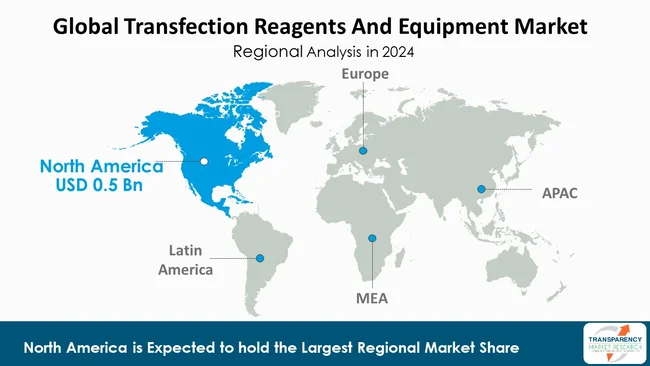

North America dominates the global transfection reagents and equipment market with 41.1% market share and is mainly sustained by its matured biotech and pharma industries, leading research facilities, and substantial government financing for genetic and cell studies. The region also has advantage due to presence of key industry players, vigorous R&D activities in gene therapy and drug discovery, and a rapid uptake of advanced technologies such as CRISPR and high-throughput screening.

For instance, the National Institutes of Health (NIH) and the National Institute of Mental Health (NIMH), among others, are supporting with investments in big-scale projects that combine genomics, neuroimaging, and data analytics to psychiatric care. Moreover, the region is becoming dominant due to the presence of top biotech companies, advanced data ecosystems, and a well-concerted regulatory framework for digital and precision medicine.

Moreover, the market expansion in the region is being continuously supported by enabling regulatory structures and substantial government programs that are mainly directed towards advancing genomic and cell-based research. The growing focus on personalized medicine along with the huge investments in biotechnology are pushing North America to be the global center of innovation in transfection technology.

Thermo Fisher Scientific Inc., Promega Corporation, Lonza Group Ltd, QIAGEN, F. Hoffmann-La Roche AG, Merck KGaA, OriGene Technologies, Inc, MaxCyte, Polyplus, Mirus Bio LLC, Bio-Rad Laboratories, Inc., Amerigo Scientific, Aldevron LLC, Agilent Technologies, Inc., Cytiva and others are some of the leading manufacturers operating in the global transfection reagents and equipment market.

Each of these companies has been profiled in the transfection reagents and equipment Industry report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.2 Bn |

| Forecast Value in 2035 | More than US$ 2.4 Bn |

| CAGR | 6.4 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global transfection reagents and equipment market was valued at US$ 1.2 Bn in 2024

The global transfection reagents and equipment industry is projected to reach more than US$ 2.4 Bn by the end of 2035

Advancements in genetic research and growth of personalized medicine are some of the factors driving the expansion of transfection reagents and equipment market.

The CAGR is anticipated to be 6.4% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Thermo Fisher Scientific Inc., Promega Corporation, Lonza Group Ltd, QIAGEN, F. Hoffmann-La Roche AG, Merck KGaA, OriGene Technologies, Inc, MaxCyte, Polyplus, Mirus Bio LLC, Bio-Rad Laboratories, Inc., Amerigo Scientific, Aldevron LLC, Agilent Technologies, Inc., Cytiva, and other prominent players.

Table 01: Global Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 02: Global Transfection Reagents and Equipment Market Value (US$ Bn), by Reagents, 2020 to 2035

Table 03: Global Transfection Reagents and Equipment Market Value (US$ Bn), by Equipment, 2020 to 2035

Table 04: Global Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, By Method, 2020 to 2035

Table 05: Global Transfection Reagents and Equipment Market Value (US$ Bn), By Biochemical Methods, 2020 to 2035

Table 06: Global Transfection Reagents and Equipment Market Value (US$ Bn), By Physical Methods, 2020 to 2035

Table 07: Global Transfection Reagents and Equipment Market Value (US$ Bn), By Viral Methods, 2020 to 2035

Table 08: Global Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 09: Global Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, By Cell Type, 2020 to 2035

Table 10: Global Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Global Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 12: North America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 13: North America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 14: North America Transfection Reagents and Equipment Market Value (US$ Bn), by Reagents, 2020 to 2035

Table 15: North America Transfection Reagents and Equipment Market Value (US$ Bn), by Equipment, 2020 to 2035

Table 16: North America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 17: North America Transfection Reagents and Equipment Market Value (US$ Bn), By Biochemical Methods, 2020 to 2035

Table 18: North America Transfection Reagents and Equipment Market Value (US$ Bn), By Physical Methods, 2020 to 2035

Table 19: North America Transfection Reagents and Equipment Market Value (US$ Bn), By Viral Methods, 2020 to 2035

Table 20: North America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21: North America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Cell Type, 2020 to 2035

Table 22: North America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 23: Europe Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Country/Sub Region, 2020-2035

Table 24: Europe Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 25: Europe Transfection Reagents and Equipment Market Value (US$ Bn), by Reagents, 2020 to 2035

Table 26: Europe Transfection Reagents and Equipment Market Value (US$ Bn), by Equipment, 2020 to 2035

Table 27: Europe Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 28: Europe Transfection Reagents and Equipment Market Value (US$ Bn), By Biochemical Methods, 2020 to 2035

Table 29: Europe Transfection Reagents and Equipment Market Value (US$ Bn), By Physical Methods, 2020 to 2035

Table 30: Europe Transfection Reagents and Equipment Market Value (US$ Bn), By Viral Methods, 2020 to 2035

Table 31: Europe Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 32: Europe Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Cell Type, 2020 to 2035

Table 33: Europe Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 34: Asia Pacific Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Country/Sub Region, 2020-2035

Table 35: Asia Pacific Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 36: Asia Pacific Transfection Reagents and Equipment Market Value (US$ Bn), by Reagents, 2020 to 2035

Table 37: Asia Pacific Transfection Reagents and Equipment Market Value (US$ Bn), by Equipment, 2020 to 2035

Table 38: Asia Pacific Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 39: Asia Pacific Transfection Reagents and Equipment Market Value (US$ Bn), By Biochemical Methods, 2020 to 2035

Table 40: Asia Pacific Transfection Reagents and Equipment Market Value (US$ Bn), By Physical Methods, 2020 to 2035

Table 41: Asia Pacific Transfection Reagents and Equipment Market Value (US$ Bn), By Viral Methods, 2020 to 2035

Table 42: Asia Pacific Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43: Asia Pacific Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Cell Type, 2020 to 2035

Table 44: Asia Pacific Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 45: Latin America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Country/Sub Region, 2020-2035

Table 46: Latin America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 47: Latin America Transfection Reagents and Equipment Market Value (US$ Bn), by Reagents, 2020 to 2035

Table 48: Latin America Transfection Reagents and Equipment Market Value (US$ Bn), by Equipment, 2020 to 2035

Table 49: Latin America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 50: Latin America Transfection Reagents and Equipment Market Value (US$ Bn), By Biochemical Methods, 2020 to 2035

Table 51: Latin America Transfection Reagents and Equipment Market Value (US$ Bn), By Physical Methods, 2020 to 2035

Table 52: Latin America Transfection Reagents and Equipment Market Value (US$ Bn), By Viral Methods, 2020 to 2035

Table 53: Latin America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 54: Latin America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Cell Type, 2020 to 2035

Table 55: Latin America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 56: Middle East & Africa Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Country/Sub Region, 2020-2035

Table 57: Middle East & Africa Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 58: Middle East & Africa Transfection Reagents and Equipment Market Value (US$ Bn), by Reagents, 2020 to 2035

Table 59: Middle East & Africa Transfection Reagents and Equipment Market Value (US$ Bn), by Equipment, 2020 to 2035

Table 60: Middle East & Africa Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 61: Middle East & Africa Transfection Reagents and Equipment Market Value (US$ Bn), By Biochemical Methods, 2020 to 2035

Table 62: Middle East & Africa Transfection Reagents and Equipment Market Value (US$ Bn), By Physical Methods, 2020 to 2035

Table 63: Middle East & Africa Transfection Reagents and Equipment Market Value (US$ Bn), By Viral Methods, 2020 to 2035

Table 64: Middle East & Africa Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65: Middle East & Africa Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by Cell Type, 2020 to 2035

Table 66: Middle East & Africa Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Transfection Reagents and Equipment Market Value Share Analysis, by Product, 2024 and 2035

Figure 02: Global Transfection Reagents and Equipment Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 03: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Reagents, 2020 to 2035

Figure 04: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Equipment, 2020 to 2035

Figure 05: Global Transfection Reagents and Equipment Market Value Share Analysis, by Method, 2024 and 2035

Figure 06: Global Transfection Reagents and Equipment Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 07: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Biochemical Methods, 2020 to 2035

Figure 08: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Physical Methods, 2020 to 2035

Figure 09: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Viral Methods, 2020 to 2035

Figure 10: Global Transfection Reagents and Equipment Market Value Share Analysis, by Application, 2024 and 2035

Figure 11: Global Transfection Reagents and Equipment Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 12: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Gene & mRNA Expression Studies, 2020 to 2035

Figure 13: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Protein Production, 2020 to 2035

Figure 14: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Cell & Gene Therapy Manufacturing, 2020 to 2035

Figure 15: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Drug Delivery & Screening, 2020 to 2035

Figure 16: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Cancer Research, 2020 to 2035

Figure 17: Global Transfection Reagents and Equipment Market Value Share Analysis, by Cell Type, 2024 and 2035

Figure 18: Global Transfection Reagents and Equipment Market Attractiveness Analysis, by Cell Type, 2025 to 2035

Figure 19: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Mammalian Cells, 2020 to 2035

Figure 20: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Bacterial Cells, 2020 to 2035

Figure 21: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Yeast & Fungi, 2020 to 2035

Figure 22: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Insect Cells, 2020 to 2035

Figure 23: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Plant Cells, 2020 to 2035

Figure 24: Global Transfection Reagents and Equipment Market Value Share Analysis, by End-user, 2024 and 2035

Figure 25: Global Transfection Reagents and Equipment Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 26: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Academic and Research Institutes, 2025 to 2035

Figure 27: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by Pharmaceutical & Biotechnology Companies, 2020 to 2035

Figure 28: Global Transfection Reagents and Equipment Market Revenue (US$ Bn), by CROs & CMOs, 2020 to 2035

Figure 29: Global Transfection Reagents and Equipment Market Value Share Analysis, By Region, 2024 and 2035

Figure 30: Global Transfection Reagents and Equipment Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 31: North America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 32: North America Transfection Reagents and Equipment Market Value Share Analysis, by Country, 2024 and 2035

Figure 33: North America Transfection Reagents and Equipment Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 34: North America Transfection Reagents and Equipment Market Value Share Analysis, by Product, 2024 and 2035

Figure 35: North America Transfection Reagents and Equipment Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 36: North America Transfection Reagents and Equipment Value Share Analysis, by Method, 2025 to 2035

Figure 37: North America Transfection Reagents and Equipment Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 38: North America Transfection Reagents and Equipment Market Value Share Analysis, by Application, 2025 to 2035

Figure 39: North America Transfection Reagents and Equipment Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 40: North America Transfection Reagents and Equipment Market Value Share Analysis, by Cell Type, 2024 and 2035

Figure 41: North America Transfection Reagents and Equipment Market Attractiveness Analysis, by Cell Type, 2025 to 2035

Figure 42: North America Transfection Reagents and Equipment Market Value Share Analysis, by End-user, 2024 and 2035

Figure 43: North America Transfection Reagents and Equipment Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 44: Europe Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Europe Transfection Reagents and Equipment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 46: Europe Transfection Reagents and Equipment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 47: Europe Transfection Reagents and Equipment Market Value Share Analysis, by Product, 2024 and 2035

Figure 48: Europe Transfection Reagents and Equipment Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 49: Europe Transfection Reagents and Equipment Market Value Share Analysis, by Method, 2024 and 2035

Figure 50: Europe Transfection Reagents and Equipment Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 51: Europe Transfection Reagents and Equipment Market Value Share Analysis, by Application, 2025 to 2035

Figure 52: Europe Transfection Reagents and Equipment Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 53: Europe Transfection Reagents and Equipment Market Value Share Analysis, By Cell Type, 2024 and 2035

Figure 54: Europe Transfection Reagents and Equipment Market Attractiveness Analysis, By Cell Type, 2025 to 2035

Figure 55: Europe Transfection Reagents and Equipment Market Value Share Analysis, by End-user, 2024 and 2035

Figure 56: Europe Transfection Reagents and Equipment Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 57: Asia Pacific Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 58: Asia Pacific Transfection Reagents and Equipment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 59: Asia Pacific Transfection Reagents and Equipment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 60: Asia Pacific Transfection Reagents and Equipment Market Value Share Analysis, by Product, 2024 and 2035

Figure 61: Asia Pacific Transfection Reagents and Equipment Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 62: Asia Pacific Transfection Reagents and Equipment Market Value Share Analysis, by Method, 2024 and 2035

Figure 63: Asia Pacific Transfection Reagents and Equipment Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 64: Asia Pacific Transfection Reagents and Equipment Market Value Share Analysis, by Application, 2025 to 2035

Figure 65: Asia Pacific Transfection Reagents and Equipment Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 66: Asia Pacific Transfection Reagents and Equipment Market Value Share Analysis, By Cell Type, 2024 and 2035

Figure 67: Asia Pacific Transfection Reagents and Equipment Market Attractiveness Analysis, By Cell Type, 2025 to 2035

Figure 68: Asia Pacific Transfection Reagents and Equipment Market Value Share Analysis, by End-user, 2024 and 2035

Figure 69: Asia Pacific Transfection Reagents and Equipment Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 70: Latin America Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 71: Latin America Transfection Reagents and Equipment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 72: Latin America Transfection Reagents and Equipment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 73: Latin America Transfection Reagents and Equipment Market Value Share Analysis, by Product, 2024 and 2035

Figure 74: Latin America Transfection Reagents and Equipment Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 75: Latin America Transfection Reagents and Equipment Market Value Share Analysis, by Method, 2024 and 2035

Figure 76: Latin America Transfection Reagents and Equipment Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 77: Latin America Transfection Reagents and Equipment Market Value Share Analysis, by Application, 2025 to 2035

Figure 78: Latin America Transfection Reagents and Equipment Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 79: Latin America Transfection Reagents and Equipment Market Value Share Analysis, By Cell Type, 2024 and 2035

Figure 80: Latin America Transfection Reagents and Equipment Market Attractiveness Analysis, By Cell Type, 2025 to 2035

Figure 81: Latin America Transfection Reagents and Equipment Market Value Share Analysis, by End-user, 2024 and 2035

Figure 82: Latin America Transfection Reagents and Equipment Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 83: Middle East and Africa Transfection Reagents and Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 84: Middle East and Africa Transfection Reagents and Equipment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 85: Middle East and Africa Transfection Reagents and Equipment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 86: Middle East and Africa Transfection Reagents and Equipment Market Value Share Analysis, by Product, 2024 and 2035

Figure 87: Middle East and Africa Transfection Reagents and Equipment Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 88: Middle East and Africa Transfection Reagents and Equipment Market Value Share Analysis, by Method, 2024 and 2035

Figure 89: Middle East and Africa Transfection Reagents and Equipment Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 90: Middle East and Africa Transfection Reagents and Equipment Market Value Share Analysis, by Application, 2025 to 2035

Figure 91: Middle East and Africa Transfection Reagents and Equipment Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 92: Middle East and Africa Transfection Reagents and Equipment Market Value Share Analysis, by Cell Type, 2024 and 2035

Figure 93: Middle East and Africa Transfection Reagents and Equipment Market Attractiveness Analysis, By Cell Type, 2025 to 2035

Figure 94: Middle East and Africa Transfection Reagents and Equipment Market Value Share Analysis, by End-user, 2024 and 2035

Figure 95: Middle East and Africa Transfection Reagents and Equipment Market Attractiveness Analysis, by End-user, 2025 to 2035