Reports

Reports

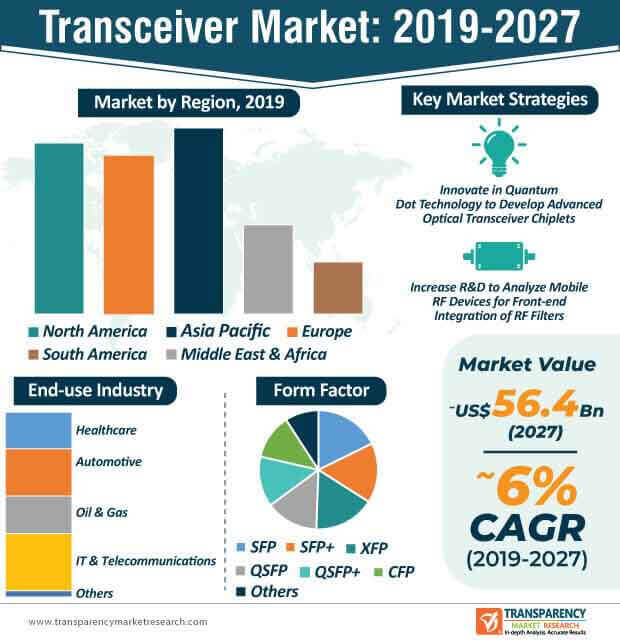

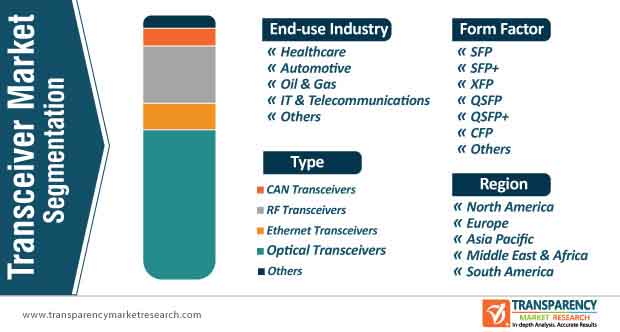

The implementation of 5G wireless is anticipated to deliver new services in high-speed optical networks such as augmented reality and industrial IoT. As such, optical transceivers are projected to dominate the transceiver market with the highest revenue, estimated at a record ~US$ 36.8 billion by the end of 2027. Hence, manufacturers in the transceiver market are tapping into opportunities in machine learning, and the development of advanced drones and self-driving vehicles. The growing demand for 5G is catalyzing the demand for high-speed optical connectivity in cloud data centers.

On the other hand, manufacturers are innovating in new optical transceiver chiplets to integrate lasers with electro-photonic silicon chips. For instance, in September 2019, ADVA - a telecommunications company, announced the developing of novel optical transceiver chiplets to cater to the increasing demand for bandwidth in data center interconnect networks.

Companies in the transceiver market are adopting quantum dot technology to create compact-size devices. They are increasing focus on developing miniaturized optical transceivers that are cost-effective and support transmitter-receiver optical sub-assemblies for inter-data center applications.

The transceiver market is estimated to witness growth in electronic warfare and other applications. There is growing demand for transceivers that offer flexibility in electronic warfare (EW) systems. Companies in the transceiver market are introducing new wideband microwave transceivers that offer immediate-frequency bandwidth in RF (radio frequency) modules. Innovations in wideband microwave transceivers are benefitting stakeholders in the defense landscape by helping them deploy spectrum monitoring and beamforming in EW systems.

Companies are increasing research efforts to maximize system flexibility by developing transceivers that integrate with multiple interfaces. They are increasing R&D to analyze mobile RF front-end architectures of smartphones to support global LTE (long term evolution) standards in the IT and telecommunications landscape. As such, IT and telecommunications accounts for the highest sale of transceivers, and is estimated to reach a value of ~US$ 12.7 billion by 2022, in the transceiver market.

Manufacturers are onboarding the best researchers to develop transceivers that offer quality communications and cost-efficient scalability. They are increasing production capacities to develop advanced transceivers that transform 5G wireless equipment, such as smartphones and tablets, and are being increasingly used in IoT applications. Companies are introducing new frequency bands in transceivers that support 5G applications.

There is growing demand for tunable devices in the rapidly expanding networking technology landscape. Manufacturers are innovating cutting-edge technology that provides on-site wavelength adjustment in tunable transceivers. Static transceivers require multiple backups to reduce downtime in the DWDM (dense wavelength division multiplexing) space. Hence, tunable transceivers are an efficient alternative to their static counterparts, since the former offer more flexibility in optical networking.

The burgeoning growth of networking technology is triggering the sales of tunable transceivers in the global transceiver market. However, tunable transceivers cost more than static transceivers. Tunable transceiver technology also presents a challenge for operators attempting to interface tunable transceivers with legacy equipment. To win over these limitations, companies are introducing transceiver management modules, AKA tuning boxes, to host tunable transceivers in various DWDM environments. The efficacy of tuning boxes is leveraged with the help of tuning software to reinforce on-the-go tuning through proprietary mobile tuning applications.

The automotive industry accounts for the second-highest revenue amongst all end-use industries in the transceiver market that require technologically-advanced transceivers. Companies in the landscape are developing new Ethernet PHY (physical layer) transceivers that are standard-complaint and interoperable in automotive technology. These efforts are being made to offer sleep and wake-up-forwarding functionality in vehicles.

Ethernet PHY transceivers are helping automotive manufacturers reach their end goal of high efficiency in future electric vehicle architectures. Besides car brands such as BMW, JLR, and VW, automotive manufacturers are augmenting the application of Ethernet in infotainment, telematics, and ADAS (advanced driver-assistance systems) for other automobile companies. The trend of connected cars is further catalyzing market growth.

Analysts’ Viewpoint

Analysts of the transceiver market opine that, optical transceivers are gaining far-reaching applications in networking and IT applications. SFP+ transceivers are predicted to account for the highest revenue amongst all form factors in the market landscape. Hence, manufacturers are innovating in new interfaces of tunable transceiver technology that complement well with tunable SFP+ transceivers.

However, challenges of base station receiver design pose a hurdle to manufacturers. Hence, they should develop novel integrated transceivers that offer desired sensitivity under specific conditions in base station receiver designs. Manufacturers should capitalize on the trend of 5G wireless to develop built-in gain phase calibration that minimizes radiation and boosts signal strength in devices.

Global Transceiver Market: Overview

Rapid Expansion of Data Centers: A Key Transceiver Market Driver

Rising Demand of Optical Transceivers: Latest Trend in Transceiver Market

Testing of Transceivers: Major Challenge for Global Transceiver Market

Global Transceiver Market: Competition Landscape

Global Transceiver Market: Key Developments

In the report on the global transceiver market, we have discussed individual strategies, followed by company profiles of providers of transceivers. The ‘Competition Landscape’ section of the global transceiver market has been included in the report to provide readers with a dashboard view and market share analysis of key players operating in the global transceiver market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Transceiver Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Trends Analysis

4.4. Global Transceiver Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projection (US$ Mn)

4.4.2. Market Volume Projection (Million Units)

4.5. Porter’s Five Forces Analysis - Global Transceiver Market

4.6. Value Chain Analysis - Global Transceiver Market

4.7. Market Outlook

5. Global Transceiver Market Analysis and Forecast, by Type

5.1. Overview & Definitions

5.2. Global Transceiver Market Size (US$ Mn and Units) Forecast, by Type, 2017–2027

5.2.1. RF Transceivers

5.2.2. Optical Transceivers

5.2.3. Ethernet Transceivers

5.2.4. CAN Transceivers

5.2.5. Others

5.3. Type Comparison Matrix

5.4. Global Transceiver Market Attractiveness, by Type

6. Global Transceiver Market Analysis and Forecast, by Form Factor

6.1. Overview & Definition

6.2. Global Transceiver Market Revenue (US$ Mn) Forecast, by Form Factor, 2017–2027

6.2.1. SFP

6.2.2. SFP+

6.2.3. XFP

6.2.4. QSFP

6.2.5. QSFP+

6.2.6. CFP

6.2.7. Others

6.3. Form Factor Comparison Matrix

6.4. Global Transceiver Market Attractiveness, by Form Factor

7. Global Transceiver Market Analysis and Forecast, by End-use Industry

7.1. Overview & Definitions

7.2. Global Transceiver Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

7.2.1. Healthcare

7.2.2. Automotive

7.2.3. Retail

7.2.4. IT & Telecommunication

7.2.5. Others

7.3. End-use Industry Comparison Matrix

7.4. Global Transceiver Market Attractiveness, by End-use Industry

8. Global Transceiver Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Regulations and Policies

8.3. Global Transceiver Market Revenue (US$ Mn) Forecast, by Region, 2017–2027

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Middle East & Africa

8.3.5. South America

8.4. Global Transceiver Market Attractiveness, by Region

9. North America Transceiver Market Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. North America Transceiver Market Size (US$ Mn and Units) Forecast, by Type, 2017–2027

9.3.1. RF Transceivers

9.3.2. Optical Transceivers

9.3.3. Ethernet Transceivers

9.3.4. CAN Transceivers

9.3.5. Others

9.4. North America Transceiver Market Revenue (US$ Mn) Forecast, by Form Factor, 2017–2027

9.4.1. SFP

9.4.2. SFP+

9.4.3. XFP

9.4.4. QSFP

9.4.5. QSFP+

9.4.6. CFP

9.4.7. Others

9.5. North America Transceiver Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

9.5.1. Healthcare

9.5.2. Automotive

9.5.3. Retail

9.5.4. IT & Telecommunication

9.5.5. Others

9.6. North America Transceiver Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. North America Transceiver Market Attractiveness Analysis

9.7.1. By Type

9.7.2. By Form Factor

9.7.3. By End-use Industry

9.7.4. By Country/Sub-region

10. Europe Transceiver Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Europe Transceiver Market Size (US$ Mn and Units) Forecast, by Type, 2017–2027

10.3.1. RF Transceivers

10.3.2. Optical Transceivers

10.3.3. Ethernet Transceivers

10.3.4. CAN Transceivers

10.3.5. Others

10.4. Europe Transceiver Market Revenue (US$ Mn) Forecast, by Form Factor, 2017–2027

10.4.1. SFP

10.4.2. SFP+

10.4.3. XFP

10.4.4. QSFP

10.4.5. QSFP+

10.4.6. CFP

10.4.7. Others

10.5. Europe Transceiver Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

10.5.1. Healthcare

10.5.2. Automotive

10.5.3. Retail

10.5.4. IT & Telecommunication

10.5.5. Others

10.6. Europe Transceiver Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

10.6.1. Germany

10.6.2. U.K.

10.6.3. France

10.6.4. Rest of Europe

10.7. Europe Transceiver Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By End-use Industry

10.7.3. By Form Factor

10.7.4. By Country/Sub-region

11. Asia Pacific Transceiver Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Asia Pacific Transceiver Market Size (US$ Mn and Units) Forecast, by Type, 2017–2027

11.3.1. RF Transceivers

11.3.2. Optical Transceivers

11.3.3. Ethernet Transceivers

11.3.4. CAN Transceivers

11.3.5. Others

11.4. Asia Pacific Transceiver Market Revenue (US$ Mn) Forecast, by Form Factor, 2017–2027

11.4.1. SFP

11.4.2. SFP+

11.4.3. XFP

11.4.4. QSFP

11.4.5. QSFP+

11.4.6. CFP

11.4.7. Others

11.5. Asia Pacific Transceiver Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

11.5.1. Healthcare

11.5.2. Automotive

11.5.3. Retail

11.5.4. IT & Telecommunication

11.5.5. Others

11.6. Asia Pacific Transceiver Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. Rest of Asia Pacific

11.7. Asia Pacific Transceiver Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Form Factor

11.7.3. By End-use Industry

11.7.4. By Country/Sub-region

12. Middle East & Africa Transceiver Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Middle East & Africa Transceiver Market Size (US$ Mn and Units) Forecast, by Type, 2017–2027

12.3.1. RF Transceivers

12.3.2. Optical Transceivers

12.3.3. Ethernet Transceivers

12.3.4. CAN Transceivers

12.3.5. Others

12.4. Middle East & Africa Transceiver Market Revenue (US$ Mn) Forecast, by Form Factor, 2017–2027

12.4.1. SFP

12.4.2. SFP+

12.4.3. XFP

12.4.4. QSFP

12.4.5. QSFP+

12.4.6. CFP

12.4.7. Others

12.5. Middle East & Africa Transceiver Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

12.5.1. Healthcare

12.5.2. Automotive

12.5.3. Retail

12.5.4. IT & Telecommunication

12.5.5. Others

12.6. Middle East & Africa Transceiver Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Middle East & Africa Transceiver Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Form Factor

12.7.3. By End-use Industry

12.7.4. By Country/Sub-region

13. South America Transceiver Market Analysis and Forecast

13.1. Key Findings

13.2. Key Trends

13.3. South America Transceiver Market Size (US$ Mn and Units) Forecast, by Type, 2017–2027

13.3.1. RF Transceivers

13.3.2. Optical Transceivers

13.3.3. Ethernet Transceivers

13.3.4. CAN Transceivers

13.3.5. Others

13.4. South America Transceiver Market Revenue (US$ Mn) Forecast, by Form Factor, 2017–2027

13.4.1. SFP

13.4.2. SFP+

13.4.3. XFP

13.4.4. QSFP

13.4.5. QSFP+

13.4.6. CFP

13.4.7. Others

13.5. South America Transceiver Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

13.5.1. Healthcare

13.5.2. Automotive

13.5.3. Retail

13.5.4. IT & Telecommunication

13.5.5. Others

13.6. South America Transceiver Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

13.6.1. Brazil

13.6.2. Rest of South America

13.7. South America Transceiver Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Form Factor

13.7.3. By End-use Industry

13.7.4. By Country/Sub-region

14. Competition Landscape

14.1. Market Players – Competition Matrix

14.2. Global Transceiver Market Share Analysis, by Company (2018)

14.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Recent Developments, Strategy)

14.3.1. Texas Instruments Incorporated

14.3.1.1. Overview

14.3.1.2. Financials

14.3.1.3. SWOT Analysis

14.3.1.4. Recent Developments

14.3.1.5. Strategy

14.3.2. Finisar Corporation

14.3.2.1. Overview

14.3.2.2. Financials

14.3.2.3. SWOT Analysis

14.3.2.4. Recent Developments

14.3.2.5. Strategy

14.3.3. Microchip Technology Inc.

14.3.3.1. Overview

14.3.3.2. Financials

14.3.3.3. SWOT Analysis

14.3.3.4. Recent Developments

14.3.3.5. Strategy

14.3.4. ROHM SEMICONDUCTOR

14.3.4.1. Overview

14.3.4.2. Financials

14.3.4.3. SWOT Analysis

14.3.4.4. Recent Developments

14.3.4.5. Strategy

14.3.5. Analog Devices, Inc.

14.3.5.1. Overview

14.3.5.2. Financials

14.3.5.3. SWOT Analysis

14.3.5.4. Recent Developments

14.3.5.5. Strategy

14.3.6. ATOP Corporation

14.3.6.1. Overview

14.3.6.2. Financials

14.3.6.3. SWOT Analysis

14.3.6.4. Recent Developments

14.3.6.5. Strategy

14.3.7. NXP Semiconductors

14.3.7.1. Overview

14.3.7.2. Financials

14.3.7.3. SWOT Analysis

14.3.7.4. Recent Developments

14.3.7.5. Strategy

14.3.8. ON Semiconductor Corporation

14.3.8.1. Overview

14.3.8.2. Financials

14.3.8.3. SWOT Analysis

14.3.8.4. Recent Developments

14.3.8.5. Strategy

14.3.9. MAXIM INTEGRATED PRODUCTS, INC.

14.3.9.1. Overview

14.3.9.2. Financials

14.3.9.3. SWOT Analysis

14.3.9.4. Recent Developments

14.3.9.5. Strategy

14.3.10. Broadcom Inc.

14.3.10.1. Overview

14.3.10.2. Financials

14.3.10.3. SWOT Analysis

14.3.10.4. Recent Developments

14.3.10.5. Strategy

14.3.11. Infineon Technologies AG

14.3.11.1. Overview

14.3.11.2. Financials

14.3.11.3. SWOT Analysis

14.3.11.4. Recent Developments

14.3.11.5. Strategy

14.3.12. Lumentum Operations LLC

14.3.12.1. Overview

14.3.12.2. Financials

14.3.12.3. SWOT Analysis

14.3.12.4. Recent Developments

14.3.12.5. Strategy

14.3.13. InnoLight Technology (Suzhou) Ltd.

14.3.13.1. Overview

14.3.13.2. Financials

14.3.13.3. SWOT Analysis

14.3.13.4. Recent Developments

14.3.13.5. Strategy

15. Key Takeaways

List of Tables

Table 01: Global Transceiver Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

Table 02: Global Transceiver Market Revenue (Million Units) Forecast, by Type, 2017–2027

Table 03: Global Transceiver Market Revenue (US$ Mn) Forecast, by Form Factor, 2017–2027

Table 04: Global Transceiver Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 05: Global Transceiver Market Revenue (US$ Mn) Forecast, by Region, 2017–2027

Table 06: Global Transceiver Market Revenue (Million Units) Forecast, by Region, 2017–2027

Table 07: North America Transceiver Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

Table 08: North America Transceiver Market Revenue (Million Units) Forecast, by Type, 2017–2027

Table 09: North America Transceiver Market Revenue (US$ Mn) Forecast, by Form Factor, 2017–2027

Table 10: North America Transceiver Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 11: North America Transceiver Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 12: North America Transceiver Market Size (Million Units) Forecast, by Country/Sub-region, 2017–2027

Table 13: Europe Transceiver Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

Table 14: Europe Transceiver Market Revenue (Million Units) Forecast, by Type, 2017–2027

Table 15: Europe Transceiver Market Revenue (US$ Mn) Forecast, by Form Factor, 2017–2027

Table 16: Europe Transceiver Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 17: Europe Transceiver Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 18: Europe Transceiver Market Size (Million Units) Forecast, by Country/Sub-region, 2017–2027

Table 19: Asia Pacific Transceiver Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

Table 20: Asia Pacific Transceiver Market Revenue (Million Units) Forecast, by Type, 2017–2027

Table 21: Asia Pacific Transceiver Market Revenue (US$ Mn) Forecast, by Form Factor, 2017–2027

Table 22: Asia Pacific Transceiver Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 23: Asia Pacific Transceiver Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 24: Asia Pacific Transceiver Market Size (Million Units) Forecast, by Country/Sub-region, 2017–2027

Table 25: Middle East & Africa Transceiver Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

Table 26: Middle East & Africa Transceiver Market Revenue (Million Units) Forecast, by Type, 2017–2027

Table 27: Middle East & Africa Transceiver Market Revenue (US$ Mn) Forecast, by Form Factor, 2017–2027

Table 28: Middle East & Africa Transceiver Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 29: Middle East & Africa Transceiver Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 30: Middle East & Africa Transceiver Market Size (Million Units) Forecast, by Country/Sub-region, 2017–2027

Table 31: South America Transceiver Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

Table 32: South America Transceiver Market Revenue (Million Units) Forecast, by Type, 2017–2027

Table 33: South America Transceiver Market Revenue (US$ Mn) Forecast, by Form Factor, 2017–2027

Table 34: South America Transceiver Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 35: South America Transceiver Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 36: South America Transceiver Market Size (Million Units) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Figure 01: Global Transceiver Market Revenue (US$ Mn) Y-o-Y Forecast, 2019–2027

Figure 02: Global Transceiver Market Volume (Million Units) Y-o-Y Forecast, 2019–2027

Figure 03: Global Transceiver Market, by Optical Transceiver

Figure 04: Global Transceiver Market, by Ethernet Transceiver

Figure 05: Global Transceiver Market, by RF Transceiver

Figure 06: Global Transceiver Market, by CAN Transceiver

Figure 07: Global Transceiver Market, by Others

Figure 08: Global Transceiver Market Comparison Matrix, by Type

Figure 09: Global Transceiver Market Attractiveness Analysis, by Type

Figure 10: Global Transceiver Market, by SFP (Small Form-factor Pluggable)

Figure 11: Global Transceiver Market, by SFP+ (Small Form-factor Pluggable Plus)

Figure 12: Global Transceiver Market, by XFP (10 Gigabit Small Form-factor Pluggable)

Figure 13: Global Transceiver Market, by QSFP (Quad Small Form-factor Pluggable)

Figure 14: Global Transceiver Market, by QSFP+ (Quad Small Form-factor Pluggable Plus)

Figure 15: Global Transceiver Market, by CFP (C Form-factor Pluggable)

Figure 16: Global Transceiver Market, by Others

Figure 17: Global Transceiver Market Comparison Matrix, by Form Factor

Figure 18: Global Transceiver Market Attractiveness Analysis, by Form Factor

Figure 19: Global Transceiver Market, by Healthcare

Figure 20: Global Transceiver Market, by Automotive

Figure 21: Global Transceiver Market, by Oil & Gas

Figure 22: Global Transceiver Market, by IT & Telecommunication

Figure 23: Global Transceiver Market, by Others

Figure 24: Global Transceiver Market Comparison Matrix, by End-use Industry

Figure 25: Global Transceiver Market Attractiveness Analysis, by End-use Industry

Figure 26: Global Transceiver Market Value Share Analysis, by Region (2019E)

Figure 27: Global Transceiver Market Value Share Analysis, by Region (2027F)

Figure 28: Global Transceiver Market Attractiveness Analysis, by Region

Figure 29: North America Transceiver Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 30: North America Transceiver Market Size Y-o-Y Growth Projection, 2017–2027

Figure 31: North America Transceiver Market Value Share Analysis, by Type, 2019 and 2027

Figure 32: North America Transceiver Market Value Share Analysis, by Form Factor, 2019 and 2027

Figure 33: North America Transceiver Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 34: North America Transceiver Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 35: North America Transceiver Market Attractiveness Analysis, by Type

Figure 36: North America Transceiver Market Attractiveness Analysis, by Form Factor

Figure 37: North America Transceiver Market Attractiveness Analysis, by End-use Industry

Figure 38: North America Transceiver Market Attractiveness Analysis, by Country/Sub-region

Figure 39: Europe Transceiver Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 40: Europe Transceiver Market Size Y-o-Y Growth Projection, 2017–2027

Figure 41: Europe Transceiver Market Value Share Analysis, by Type, 2019 and 2027

Figure 42: Europe Transceiver Market Value Share Analysis, by Form Factor, 2019 and 2027

Figure 43: Europe Transceiver Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 44: Europe Transceiver Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 45: Europe Transceiver Market Attractiveness Analysis, by Type

Figure 46: Europe Transceiver Market Attractiveness Analysis, by Form Factor

Figure 47: Europe Transceiver Market Attractiveness Analysis, by End-use Industry

Figure 48: Europe Transceiver Market Attractiveness Analysis, by Country/Sub-region

Figure 49: Asia Pacific Transceiver Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 50: Asia Pacific Transceiver Market Size Y-o-Y Growth Projection, 2017–2027

Figure 51: Asia Pacific Transceiver Market Value Share Analysis, by Type, 2019 and 2027

Figure 52: Asia Pacific Transceiver Market Value Share Analysis, by Form Factor, 2019 and 2027

Figure 53: Asia Pacific Transceiver Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 54: Asia Pacific Transceiver Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 55: Asia Pacific Transceiver Market Attractiveness Analysis, by Type

Figure 56: Asia Pacific Transceiver Market Attractiveness Analysis, by Form Factor

Figure 57: Asia Pacific Transceiver Market Attractiveness Analysis, by End-use Industry

Figure 58: Asia Pacific Transceiver Market Attractiveness Analysis, by Country/Sub-region

Figure 59: Middle East & Africa Transceiver Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 60: Middle East & Africa Transceiver Market Size Y-o-Y Growth Projection, 2017–2027

Figure 61: Middle East & Africa Transceiver Market Value Share Analysis, by Type, 2019 and 2027

Figure 62: Middle East & Africa Transceiver Market Value Share Analysis, by Form Factor, 2019 and 2027

Figure 63: Middle East & Africa Transceiver Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 64: Middle East & Africa Transceiver Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 65: Middle East & Africa Transceiver Market Attractiveness Analysis, by Type

Figure 66: Middle East & Africa Transceiver Market Attractiveness Analysis, by Form Factor

Figure 67: Middle East & Africa Transceiver Market Attractiveness Analysis, by End-use Industry

Figure 68: Middle East & Africa Transceiver Market Attractiveness Analysis, by Country/Sub-region

Figure 69: South America Transceiver Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 70: South America Transceiver Market Size Y-o-Y Growth Projection, 2017–2027

Figure 71: South America Transceiver Market Value Share Analysis, by Type, 2019 and 2027

Figure 72: South America Transceiver Market Value Share Analysis, by Form Factor, 2019 and 2027

Figure 73: South America Transceiver Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 74: South America Transceiver Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 75: South America Transceiver Market Attractiveness Analysis, by Type

Figure 76: South America Transceiver Market Attractiveness Analysis, by Form Factor

Figure 77: South America Transceiver Market Attractiveness Analysis, by End-use Industry

Figure 78: South America Transceiver Market Attractiveness Analysis, by Country/Sub-region