Reports

Reports

The global topical pharmaceutical market is witnessing consistent growth owing to the increasing incidence rate of skin disorders, an aging population, and developments in drug delivery systems.

Topical products in the form of creams, ointments, gels, and lotions provide localized therapy with fewer systemic side effects and are hence in high demand in diseases like eczema, psoriasis, acne, and infections.

In line with current topical pharmaceuticals market trends, key players are investing in R&D, advancing drug delivery technologies, and developing combination therapies. Collaborations with biotech firms and regulatory support for novel formulations are accelerating growth, while expanding OTC portfolios cater to increasing demand for non-invasive, self-care treatment options.

Topical pharmaceuticals are medications applied directly to the skin or mucous membranes to treat localized conditions or deliver active ingredients systemically. These drugs can be creams, ointments, gels, lotions, sprays, or patches prepared for dermatologic, analgesic, ophthalmic, and other therapeutic applications.

The topical route offers targeted treatment with reduced systemic side effects, making it ideal for chronic skin conditions like eczema, psoriasis, and acne, as well as localized pain and infections.

The global market is driven by rising incidences of skin disorders, increasing demand for non-invasive treatments, and advancements in drug delivery technologies.

Pharmaceutical companies are investing in innovative formulations and combination therapies to enhance absorption, efficacy, and patient compliance, fueling growth in the topical pharmaceuticals segment.

| Attribute | Details |

|---|---|

| Market Drivers |

|

The rising prevalence of dermatological disorders like eczema, psoriasis, acne, and fungal infections is a key growth driver boosting topical pharmaceuticals market share. Skin diseases afflict nearly 900 million individuals globally, according to the Global Burden of Disease Study, and are thus among the most prevalent health issues.

Topical drugs-like corticosteroids, antifungals, and retinoids-are usually the first choice of treatment because of their direct application, localized action, and few systemic side effects. For example, atopic dermatitis (AD) prevails in 10-20% of children and 1-3% of adults across the world. Increased environmental pollution, lifestyle alterations, and augmented exposure to allergens are strong factors in causing such conditions, leading to its surge.

Its increased demand has led to the innovations, of which one great example is Incyte's Opzelura (ruxolitinib cream) launch as the first ever topical JAK inhibitor for treating atopic dermatitis and vitiligo.

These innovations reveal pharmaceutical companies' efforts towards discovering targeted, safe, and efficacious topical treatment. Additionally, with an aging population-who are more susceptible to skin conditions due to reduced skin regeneration-demand for dermatological treatments is projected to continue rising.

The prevalence of chronic skin wounds such as diabetic ulcers and pressure sores also adds to this demand, further expanding the need for effective topical pharmaceuticals.

The growing shift in healthcare towards non-invasive treatment options significantly the expansion of the topical pharmaceuticals market. Unlike oral or injectable drugs, topical applications allow for localized drug delivery, reducing systemic absorption and associated side effects.

This approach is particularly beneficial for treating conditions that require targets action, such as psoriasis, acne, or localized pain.

Patients often prefer creams, gels, ointments, or patches for ease of application, convenience, and comfort. For instance, diclofenac gel, widely used for osteoarthritis and musculoskeletal pain, offers targeted relief without the gastrointestinal effects associated with oral NSAIDs.

This preference for non-invasive administration has led to increased patient compliance, particularly among elderly or pediatric populations where injections may be impractical or feared.

Moreover, advancements in drug formulation technologies-such as liposomal delivery, nanocarriers, and microemulsions-have enhanced the skin penetration and efficacy of topical drugs.

Companies are increasingly investing in R&D to improve absorption rates and bioavailability of topical formulations. For example, Bayer’s Canesten (clotrimazole), a common antifungal topical, is continually reformulated for faster action and better skin adherence.

This growing preference also aligns with trends in self-medication, where over-the-counter (OTC) topical treatments are popular for common ailments like fungal infections or dermatitis. Thus, non-invasive drug delivery is not just a convenience but a strategic clinical and commercial choice driving market expansion.

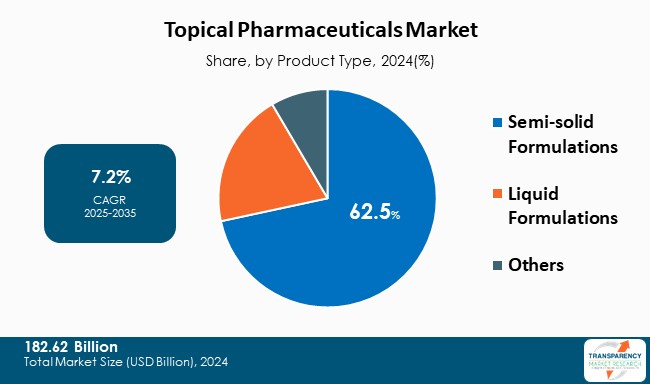

Semi-solid formulations represent a key segment in the topical pharmaceuticals market, encompassing creams, ointments, gels, and pastes. These are applied to the skin or mucoperiosteal membranes to exert the therapeutic effects locally, offering the advantages of targeted action, fewer systemic side effects, and convenient dosage accessibility.

The growing prevalence of dermatological conditions-such as eczema, psoriasis, acne, and fungal infections-along with increasing awareness of personal appearance and skincare, is driving the demand for semi-solid dosage forms.

Ointments, typically water-in-oil emulsions, are suitable for dry or scaly skin due to their occlusive properties. In contrast, creams, as oil-in-water emulsions, are more widely used across different skin types.

Gels, which are generally aqueous-based, are preferred for their fast absorption and non-greasy nature, making them ideal for oily or sensitive skin. Advances in drug delivery technologies have improved the performance, stability, and patient acceptance of these formulations.

Pharmaceutical companies are increasingly focusing on the development of combination therapies and delivery systems - such as microspheres and liposomes-within semi-solid formulations to enhance therapeutic efficacy.

Additionally, the availability of over-the-counter (OTC) topical medications, supported by government health initiatives, is contributing to market growth. Overall, the semi-solid segment plays a vital role in managing a wide range of skin disorders and continues to evolve alongside advancements in dermatological treatment.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

According to the latest topical pharmaceuticals market analysis, North America held the largest share in 2024. This regional dominance is a result of increased spending on healthcare, advanced dermatological facilities, and increasing prevalence of skin ailments such as acne, dermatitis, and fungal infections.

The region is also blessed with intensive research and development (R&D) activity, early take-up of new drug delivery systems, and existence of major pharmaceutical and biotechnology companies.

The United States dominates the North American market due to its well-established regulatory framework, rising demand for both prescription and over-the-counter (OTC) topical treatments, and a growing aging population prone to chronic skin diseases.

High consumer awareness regarding skincare and the availability of a wide range of products-from steroid creams and anti-infective ointments to cosmetic dermatology solutions-further support market expansion.

Key players operating in the global topical pharmaceuticals industry are investing through innovation, technological advancements, and strategic partnerships. Their efforts are focused on improving test accuracy, expanding product offerings, and strengthening their market presence to maintain a competitive edge in the evolving healthcare industry.

Bayer AG, Cipla, GSK plc, Johnson & Johnson Services, Inc., Novartis AG, Bausch Health Companies Inc., Hisamitsu Pharmaceuticals Co., Inc., Merck KGaA, Glenmark Pharmaceuticals LTD., MedPharm Ltd., Galderma, Teva Pharmaceuticals, Boehringer Ingelheim International GmBH, Pfizer Inc., Bristol Myers Squibb and others and others are some of the leading key players.

Each of these players has been profiled in the topical pharmaceuticals market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Details |

|---|---|

| Size in 2024 | US$ 182.62 Bn |

| Forecast Value in 2035 | US$ 396.30 Bn |

| CAGR | 7.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Topical Pharmaceuticals Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 182.62 Bn in 2024.

The topical pharmaceuticals market is projected to cross US$ 396.30 Bn by the end of 2035.

Rising prevalence of skin disorders and preference for non-invasive drug delivery.

It is anticipated to grow at a CAGR of 7.2% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Bayer AG, Cipla, GSK plc, Johnson & Johnson Services, Inc., Novartis AG, Bausch Health Companies Inc., Hisamitsu Pharmaceuticals Co., Inc., Merck KGaA, Glenmark Pharmaceuticals LTD., MedPharm Ltd., Galderma, Teva Pharmaceuticals, Boehringer Ingelheim International GmBH, Pfizer Inc., Bristol Myers Squibb and Others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Topical Pharmaceuticals Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Topical Pharmaceuticals Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industry Events

5.2. PESTEL Analysis

5.3. PORTER's Five Forces Analysis

5.4. Reimbursement Scenario by Key Countries/Regions

5.5. Pipeline Analysis

5.6. Unmet Needs of the Market

5.7. Government Initiatives

6. Global Topical Pharmaceuticals Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2020 to 2035

6.3.1. Semi-Solid Formulations

6.3.1.1. Creams

6.3.1.2. Ointments & Pastes

6.3.1.3. Lotions

6.3.1.4. Gel

6.3.2. Liquid Formulations

6.3.2.1. Suspensions

6.3.2.2. Solutions

6.3.3. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global Topical Pharmaceuticals Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2020 to 2035

7.3.1. Dermatological Treatments

7.3.2. Wound Healing

7.3.3. Anti-inflammatory Studies

7.3.4. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Topical Pharmaceuticals Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Distribution Channel, 2020 to 2035

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Topical Pharmaceuticals Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2020 to 2035

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Topical Pharmaceuticals Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2020 to 2035

10.2.1. Semi-Solid Formulations

10.2.1.1. Creams

10.2.1.2. Ointments & Pastes

10.2.1.3. Lotions

10.2.1.4. Gel

10.2.2. Liquid Formulations

10.2.2.1. Suspensions

10.2.2.2. Solutions

10.2.3. Others

10.3. Market Value Forecast, by Application, 2020 to 2035

10.3.1. Dermatological Treatments

10.3.2. Wound Healing

10.3.3. Anti-inflammatory Studies

10.3.4. Others

10.4. Market Value Forecast, by Distribution Channel, 2020 to 2035

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Topical Pharmaceuticals Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2020 to 2035

11.2.1. Semi-Solid Formulations

11.2.1.1. Creams

11.2.1.2. Ointments & Pastes

11.2.1.3. Lotions

11.2.1.4. Gel

11.2.2. Liquid Formulations

11.2.2.1. Suspensions

11.2.2.2. Solutions

11.2.3. Others

11.3. Market Value Forecast, by Application, 2020 to 2035

11.3.1. Dermatological Treatments

11.3.2. Wound Healing

11.3.3. Anti-inflammatory Studies

11.3.4. Others

11.4. Market Value Forecast, by Distribution Channel, 2020 to 2035

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. UK

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Topical Pharmaceuticals Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2020 to 2035

12.2.1. Semi-Solid Formulations

12.2.1.1. Creams

12.2.1.2. Ointments & Pastes

12.2.1.3. Lotions

12.2.1.4. Gel

12.2.2. Liquid Formulations

12.2.2.1. Suspensions

12.2.2.2. Solutions

12.2.3. Others

12.3. Market Value Forecast, by Application, 2020 to 2035

12.3.1. Dermatological Treatments

12.3.2. Wound Healing

12.3.3. Anti-inflammatory Studies

12.3.4. Others

12.4. Market Value Forecast, by Distribution Channel, 2020 to 2035

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Topical Pharmaceuticals Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2020 to 2035

13.2.1. Semi-Solid Formulations

13.2.1.1. Creams

13.2.1.2. Ointments & Pastes

13.2.1.3. Lotions

13.2.1.4. Gel

13.2.2. Liquid Formulations

13.2.2.1. Suspensions

13.2.2.2. Solutions

13.2.3. Others

13.3. Market Value Forecast, by Application, 2020 to 2035

13.3.1. Dermatological Treatments

13.3.2. Wound Healing

13.3.3. Anti-inflammatory Studies

13.3.4. Others

13.4. Market Value Forecast, by Distribution Channel, 2020 to 2035

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Topical Pharmaceuticals Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2020 to 2035

14.2.1. Semi-Solid Formulations

14.2.1.1. Creams

14.2.1.2. Ointments & Pastes

14.2.1.3. Lotions

14.2.1.4. Gel

14.2.2. Liquid Formulations

14.2.2.1. Suspensions

14.2.2.2. Solutions

14.2.3. Others

14.3. Market Value Forecast, by Application, 2020 to 2035

14.3.1. Dermatological Treatments

14.3.2. Wound Healing

14.3.3. Anti-inflammatory Studies

14.3.4. Others

14.4. Market Value Forecast, by Distribution Channel, 2020 to 2035

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis, by Company (2024)

15.3. Company Profiles

15.3.1. Bayer AG

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Cipla

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. GSK plc

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Johnson & Johnson Services, Inc.

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Novartis AG

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Bausch Health Companies Inc.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Hisamitsu Pharmaceuticals Co., Inc.

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Merck KGaA

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Glenmark Pharmaceuticals LTD.

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. MedPharm Ltd.

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Galderma

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. Teva Pharmaceuticals

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. Boehringer Ingelheim International GmBH

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Product Portfolio

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. Pfizer Inc.

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Product Portfolio

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

List of Tables

Table 01: Global Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Semi-Solid Formulations, 2020 to 2035

Table 03: Global Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Liquid Formulations, 2020 to 2035

Table 04: Global Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 05: Global Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 06: Global Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 08: North America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 09: North America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Semi-Solid Formulations, 2020 to 2035

Table 10: North America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Liquid Formulations, 2020 to 2035

Table 11: North America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: North America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 13: Europe Topical Pharmaceuticals Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 14: Europe Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 15: Europe Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Semi-Solid Formulations, 2020 to 2035

Table 16: Europe Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Liquid Formulations, 2020 to 2035

Table 17: Europe Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 18: Europe Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 19: Asia Pacific Topical Pharmaceuticals Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 20: Asia Pacific Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 21: Asia Pacific Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Semi-Solid Formulations, 2020 to 2035

Table 22: Asia Pacific Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Liquid Formulations, 2020 to 2035

Table 23: Asia Pacific Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Asia Pacific Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 25: Latin America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 26: Latin America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 27: Latin America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Semi-Solid Formulations, 2020 to 2035

Table 28: Latin America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Liquid Formulations, 2020 to 2035

Table 29: Latin America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Latin America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 31: Middle East & Africa Topical Pharmaceuticals Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 32: Middle East and Africa Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 33: Middle East and Africa Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Semi-Solid Formulations, 2020 to 2035

Table 34: Middle East and Africa Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Liquid Formulations, 2020 to 2035

Table 35: Middle East and Africa Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 36: Middle East and Africa Topical Pharmaceuticals Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

List of Figures

Figure 01: Global Topical Pharmaceuticals Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Topical Pharmaceuticals Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Topical Pharmaceuticals Market Revenue (US$ Bn), by Semi-Solid Formulations, 2020 to 2035

Figure 04: Global Topical Pharmaceuticals Market Revenue (US$ Bn), by Liquid Formulations, 2020 to 2035

Figure 05: Global Topical Pharmaceuticals Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 06: Global Topical Pharmaceuticals Market Value Share Analysis, By Application, 2024 and 2035

Figure 07: Global Topical Pharmaceuticals Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 08: Global Topical Pharmaceuticals Market Revenue (US$ Bn), by Dermatological Treatments, 2020 to 2035

Figure 09: Global Topical Pharmaceuticals Market Revenue (US$ Bn), by Wound Healing, 2020 to 2035

Figure 10: Global Topical Pharmaceuticals Market Revenue (US$ Bn), by Anti-inflammatory Studies, 2020 to 2035

Figure 11: Global Topical Pharmaceuticals Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 12: Global Topical Pharmaceuticals Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 13: Global Topical Pharmaceuticals Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 14: Global Topical Pharmaceuticals Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 15: Global Topical Pharmaceuticals Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 16: Global Topical Pharmaceuticals Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 17: Global Topical Pharmaceuticals Market Value Share Analysis, By Region, 2024 and 2035

Figure 18: Global Topical Pharmaceuticals Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 19: North America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 20: North America Topical Pharmaceuticals Market Value Share Analysis, by Country, 2024 and 2035

Figure 21: North America Topical Pharmaceuticals Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 22: North America Topical Pharmaceuticals Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 23: North America Topical Pharmaceuticals Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 24: North America Topical Pharmaceuticals Market Value Share Analysis, By Application, 2024 and 2035

Figure 25: North America Topical Pharmaceuticals Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 26: North America Topical Pharmaceuticals Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 27: North America Topical Pharmaceuticals Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 28: Europe Topical Pharmaceuticals Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 29: Europe Topical Pharmaceuticals Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 30: Europe Topical Pharmaceuticals Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 31: Europe Topical Pharmaceuticals Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 32: Europe Topical Pharmaceuticals Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 33: Europe Topical Pharmaceuticals Market Value Share Analysis, By Application, 2024 and 2035

Figure 34: Europe Topical Pharmaceuticals Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 35: Europe Topical Pharmaceuticals Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 36: Europe Topical Pharmaceuticals Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 37: Asia Pacific Topical Pharmaceuticals Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 38: Asia Pacific Topical Pharmaceuticals Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 39: Asia Pacific Topical Pharmaceuticals Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 40: Asia Pacific Topical Pharmaceuticals Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 41: Asia Pacific Topical Pharmaceuticals Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 42: Asia Pacific Topical Pharmaceuticals Market Value Share Analysis, By Application, 2024 and 2035

Figure 43: Asia Pacific Topical Pharmaceuticals Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 44: Asia Pacific Topical Pharmaceuticals Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 45: Asia Pacific Topical Pharmaceuticals Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 46: Latin America Topical Pharmaceuticals Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 47: Latin America Topical Pharmaceuticals Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 48: Latin America Topical Pharmaceuticals Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 49: Latin America Topical Pharmaceuticals Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 50: Latin America Topical Pharmaceuticals Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 51: Latin America Topical Pharmaceuticals Market Value Share Analysis, By Application, 2024 and 2035

Figure 52: Latin America Topical Pharmaceuticals Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 53: Latin America Topical Pharmaceuticals Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 54: Latin America Topical Pharmaceuticals Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 55: Middle East & Africa Topical Pharmaceuticals Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Middle East & Africa Topical Pharmaceuticals Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 57: Middle East & Africa Topical Pharmaceuticals Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 58: Middle East and Africa Topical Pharmaceuticals Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 59: Middle East and Africa Topical Pharmaceuticals Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 60: Middle East and Africa Topical Pharmaceuticals Market Value Share Analysis, By Application, 2024 and 2035

Figure 61: Middle East and Africa Topical Pharmaceuticals Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 62: Middle East and Africa Topical Pharmaceuticals Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 63: Middle East and Africa Topical Pharmaceuticals Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035