Reports

Reports

Analysts’ Viewpoint

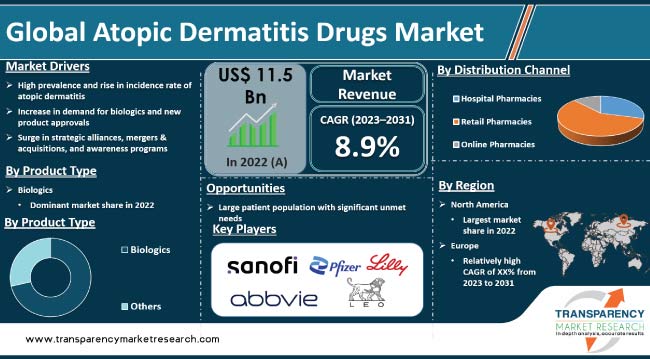

Rise in prevalence of atopic dermatitis is driving the global atopic dermatitis drugs market. Prevalence of atopic dermatitis has been increasing, with a significant rise in both adults and children. Introduction of innovative therapies and treatment options for atopic dermatitis are expected to propel market expansion. Furthermore, increase in demand for biologics, rise in new product approvals, and surge in healthcare expenditure, especially in developing countries, are likely to bolster the global atopic dermatitis drugs market size during the forecast period.

Development of effective and targeted therapies for atopic dermatitis offers lucrative opportunities to market players. Leading companies are focusing on improving access to healthcare services and providing affordable treatments such as targeted biologic therapies and topical medications in order to increase market share.

Atopic dermatitis is a skin condition that causes dry, itchy, and inflamed skin. It is most common in young children, but it could happen at any age. Atopic dermatitis is a chronic condition that flares up from time to time. It can be annoying, but it is not contagious.

Atopic dermatitis is a common disease that typically manifests itself during infancy and childhood. Several children's atopic dermatitis resolves before adolescence. Some children with atopic dermatitis may continue to have symptoms as teenagers and adults. In some cases, the disease manifests itself during adulthood.

Atopic dermatitis has shown positive response to biologic therapies. These therapies have improved the overall quality of life. Hence, demand for biologic drugs for atopic dermatitis has increased significantly, and the trend is likely to continue in the next few years.

Dermatological disorders differ across the globe based on geographic location, climatic conditions, socioeconomic status, lifestyles, age, gender, heredity, and personal habits. High prevalence of atopic dermatitis across the globe is a major factor driving the atopic dermatitis drugs market growth.

According to the World Health Organization (WHO), over 900 million people were affected with skin disease in 2017, and around 80% of the skin disorders are accounted for by the five common skin disorders. Atopic dermatitis, a common and chronic inflammatory skin disease, affects 15% to 20% of children and 1% to 3% of adults across the world.

In 2022, atopic dermatitis affected 223 million people globally, of these 43 million were children under the age of five. Atopic dermatitis can have a negative impact on children’s development and schooling.

The condition is not common everywhere. According to the 2017 Global Burden of Disease (GBD) data, Sweden, the U.K., Iceland, Finland, and Denmark had the five highest scores, while Uzbekistan, Armenia, Tajikistan, China, and Kazakhstan had the five lowest scores. Hence, rise in incidence of atopic dermatitis across the globe and increase in awareness about the disease are projected to drive the atopic dermatitis drugs market demand during the forecast period.

In terms of product type, the biologics segment accounted for the largest global atopic dermatitis drugs market share in 2022. This is ascribed to increase in the number of biologic drug approvals in the past few years. Biologics are considered to represent a breakthrough in the management of atopic dermatitis because of the improvement seen in clinical outcomes and the quality of life of patients.

Biologics work differently than other atopic dermatitis treatments. Instead of treating general inflammation all over the body, they target specific molecules and do not go through the whole system. Hence, they tend to cause fewer side effects than other treatments. This is propelling the biologics segment.

Recent approvals and launches, such as Abbvie’s Rinvoq, Pfizer’s Cibinqo, and Incyte’s Opzelura, indicate that demand for biologic drugs in the treatment of atopic dermatitis is rising across the globe, especially in the U.S. and Europe, where large populations are affected.

Based on distribution channel, the hospital pharmacies segment dominated the global atopic dermatitis drugs market in 2022. Distribution channels for atopic dermatitis, including biologics, can vary depending on the region and healthcare system.

Atopic dermatitis can be treated with a range of medications, including topical corticosteroids, immunomodulators, emollients, and biologics. These medications are largely available at hospital pharmacies. Hence, the hospital pharmacies segment dominated the global atopic dermatitis drugs market in 2022.

Atopic dermatitis is relatively common in North America, with a significant number of individuals affected by the condition. This high prevalence drives demand for effective treatments and contributes to the expansion of the market.

As per atopic dermatitis drugs market research, the U.S. is likely to dominate the industry during the forecast period owing to its large patient population and usage of biologic drugs in the affected population of patients with atopic dermatitis.

According to the National Eczema Association, around 9.6 million U.S. children under the age of 18 have atopic dermatitis, and one-third have moderate-to-severe disease. An estimated 16.5 million U.S. adults (7.3%) have atopic dermatitis, with nearly 40% affected by moderate-to-severe disease.

North America boasts a well-developed healthcare infrastructure, including hospitals, specialized dermatology clinics, research institutions, and pharmaceutical companies. This infrastructure supports the diagnosis, treatment, and development of new therapies for atopic dermatitis.

The global atopic dermatitis drugs market is consolidated, with the presence of small number of leading players. Expansion of product portfolio and mergers & acquisitions are the key strategies implemented by the leading players in the global industry.

Sanofi, Pfizer, AbbVie, Leo Pharma, Eli Lilly, Teva Pharmaceutical Industries Ltd., and Novartis AG are the prominent players in the global atopic dermatitis drugs market.

Each of these players has been profiled in the atopic dermatitis drugs market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 11.5 Bn |

| Market Forecast Value in 2031 | More than US$ 28.2 Bn |

| Growth Rate (CAGR) | 8.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 11.5 Bn in 2021

It is projected to reach more than US$ 28.2 Bn by 2031

The CAGR is anticipated to be 8.9% from 2023 to 2031

Rise in prevalence of atopic dermatitis and increase in demand for biologics and new product approvals

North America is likely to account for significant share during the forecast period

Sanofi, Pfizer, AbbVie, Leo Pharma, Eli Lilly, Teva Pharmaceutical Industries Ltd, and Novartis AG

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Atopic Dermatitis Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Atopic Dermatitis Drugs Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Disease Prevalence Assessment, by Eczema

5.3. Key Industry Events (Mergers & Acquisitions, Partnerships, Product Launches, etc.)

5.4. COVID-19 Impact Analysis

6. Global Atopic Dermatitis Drugs Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017-2031

6.3.1. Biologics

6.3.2. Others

6.4. Market Attractiveness, by Product Type

7. Global Atopic Dermatitis Drugs Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Distribution Channel, 2017-2031

7.3.1. Hospital Pharmacies

7.3.2. Retail Pharmacies

7.3.3. Online Pharmacies

7.4. Market Attractiveness, by Distribution Channel

8. Global Atopic Dermatitis Drugs Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Atopic Dermatitis Drugs Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product Type, 2017-2031

9.2.1. Biologics

9.2.2. Others

9.3. Market Value Forecast, by Distribution Channel, 2017-2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. Market Value Forecast, by Country, 2017-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By Distribution Channel

9.5.3. By Country

10. Europe Atopic Dermatitis Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017-2031

10.2.1. Biologics

10.2.2. Others

10.3. Market Value Forecast, by Distribution Channel, 2017-2031

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Pharmacies

10.4. Market Value Forecast, by Country/Sub-region, 2017-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By Distribution Channel

10.5.3. By Country/Sub-region

11. Asia Pacific Atopic Dermatitis Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017-2031

11.2.1. Biologics

11.2.2. Others

11.3. Market Value Forecast, by Distribution Channel, 2017-2031

11.3.1. Hospital Pharmacies

11.3.2. Retail Pharmacies

11.3.3. Online Pharmacies

11.4. Market Value Forecast, by Country/Sub-region, 2017-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By Distribution Channel

11.5.3. By Country/Sub-region

12. Latin America Atopic Dermatitis Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017-2031

12.2.1. Biologics

12.2.2. Others

12.3. Market Value Forecast, by Distribution Channel, 2017-2031

12.3.1. Hospital Pharmacies

12.3.2. Retail Pharmacies

12.3.3. Online Pharmacies

12.4. Market Value Forecast, by Country/Sub-region, 2017-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By Distribution Channel

12.5.3. By Country/Sub-region

13. Middle East & Africa Atopic Dermatitis Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017-2031

13.2.1. Biologics

13.2.2. Others

13.3. Market Value Forecast, by Distribution Channel, 2017-2031

13.3.1. Hospital Pharmacies

13.3.2. Retail Pharmacies

13.3.3. Online Pharmacies

13.4. Market Value Forecast, by Country/Sub-region, 2017-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product Type

13.5.2. By Distribution Channel

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competitive Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Sanofi

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. Strategic Overview

14.3.1.5. SWOT Analysis

14.3.2. Pfizer

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. Strategic Overview

14.3.2.5. SWOT Analysis

14.3.3. AbbVie

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. Strategic Overview

14.3.3.5. SWOT Analysis

14.3.4. Leo Pharma

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. Strategic Overview

14.3.4.5. SWOT Analysis

14.3.5. Eli Lilly and Company

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. Strategic Overview

14.3.5.5. SWOT Analysis

14.3.6. Novartis AG

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. Strategic Overview

14.3.6.5. SWOT Analysis

14.3.7. Teva Pharmaceutical Industries Ltd.

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. Strategic Overview

14.3.7.5. SWOT Analysis

List of Tables

Table 01: Global Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 02: Global Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 03: Global Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 04: North America Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Country, 2017-2031

Table 05: North America Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 06: North America Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 07: Europe Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 08: Europe Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 09: Europe Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 10: Asia Pacific Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 11: Asia Pacific Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 12: Asia Pacific Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 13: Latin America Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Latin America Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 15: Latin America Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 16: Middle East & Africa Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Middle East & Africa Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 18: Middle East & Africa Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2017-2031

List of Figures

Figure 01: Global Atopic Dermatitis Drugs Market Size (US$ Mn) and Distribution (%), by Region, 2017 and 2031

Figure 02: Global Atopic Dermatitis Drugs Market Revenue (US$ Mn), by Product Type, 2021

Figure 03: Global Atopic Dermatitis Drugs Market Value Share, by Product Type, 2021

Figure 04: Global Atopic Dermatitis Drugs Market Revenue (US$ Mn), by Distribution Channel, 2021

Figure 05: Global Atopic Dermatitis Drugs Market Value Share, by Distribution Channel, 2021

Figure 06: Global Atopic Dermatitis Drugs Market Value Share, by Region, 2021

Figure 07: Global Atopic Dermatitis Drugs Market Value (US$ Mn) Forecast, 2017-2031

Figure 08: Global Atopic Dermatitis Drugs Market Value Share Analysis, by Product Type, 2017 and 2031

Figure 09: Global Atopic Dermatitis Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Biologics, 2017-2031

Figure 10: Global Atopic Dermatitis Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017-2031

Figure 11: Global Atopic Dermatitis Drugs Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 12: Global Atopic Dermatitis Drugs Market Value Share Analysis, by Distribution Channel, 2017 and 2031

Figure 13: Global Atopic Dermatitis Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospital Pharmacies, 2017-2031

Figure 14: Global Atopic Dermatitis Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Retail Pharmacies, 2017-2031

Figure 15: Global Atopic Dermatitis Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Online Pharmacies, 2017-2031

Figure 16: Global Atopic Dermatitis Drugs Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017-2031

Figure 17: Global Atopic Dermatitis Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 18: Global Atopic Dermatitis Drugs Market Value Share Analysis, by Region, 2017 and 2031

Figure 19: Global Atopic Dermatitis Drugs Market Attractiveness Analysis, by Region, 2022-2031

Figure 20: North America Atopic Dermatitis Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 21: North America Atopic Dermatitis Drugs Market Attractiveness Analysis, by Country, 2017-2031

Figure 22: North America Atopic Dermatitis Drugs Market Value Share Analysis, by Country, 2017 and 2031

Figure 23: North America Atopic Dermatitis Drugs Market Value Share Analysis, by Product Type, 2017 and 2031

Figure 24: North America Atopic Dermatitis Drugs Market Value Share Analysis, by Distribution Channel, 2017 and 2031

Figure 25: North America Atopic Dermatitis Drugs Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 26: North America Atopic Dermatitis Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 27: Europe Atopic Dermatitis Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 28: Europe Atopic Dermatitis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 29: Europe Atopic Dermatitis Drugs Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 30: Europe Atopic Dermatitis Drugs Market Value Share Analysis, by Product Type, 2017 and 2031

Figure 31: Europe Atopic Dermatitis Drugs Market Value Share Analysis, by Distribution Channel, 2017 and 2031

Figure 32: Europe Atopic Dermatitis Drugs Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 33: Europe Atopic Dermatitis Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 34: Asia Pacific Atopic Dermatitis Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 35: Asia Pacific Atopic Dermatitis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 36: Asia Pacific Atopic Dermatitis Drugs Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 37: Asia Pacific Atopic Dermatitis Drugs Market Value Share Analysis, by Product Type, 2017 and 2031

Figure 38: Asia Pacific Atopic Dermatitis Drugs Market Value Share Analysis, by Distribution Channel, 2017 and 2031

Figure 39: Asia Pacific Atopic Dermatitis Drugs Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 40: Asia Pacific Atopic Dermatitis Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 41: Latin America Atopic Dermatitis Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 42: Latin America Atopic Dermatitis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 43: Latin America Atopic Dermatitis Drugs Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 44: Latin America Atopic Dermatitis Drugs Market Value Share Analysis, by Product Type, 2017 and 2031

Figure 45: Latin America Atopic Dermatitis Drugs Market Value Share Analysis, by Distribution Channel, 2017 and 2031

Figure 46: Latin America Atopic Dermatitis Drugs Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 47: Latin America Atopic Dermatitis Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 48: Middle East & Africa Atopic Dermatitis Drugs Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 49: Middle East & Africa Atopic Dermatitis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 50: Middle East & Africa Atopic Dermatitis Drugs Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 51: Middle East & Africa Atopic Dermatitis Drugs Market Value Share Analysis, by Product Type, 2017 and 2031

Figure 52: Middle East & Africa Atopic Dermatitis Drugs Market Value Share Analysis, by Distribution Channel, 2017 and 2031

Figure 53: Middle East & Africa Atopic Dermatitis Drugs Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 54: Middle East & Africa Atopic Dermatitis Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031