Reports

Reports

Analysts’ Viewpoint on Tablet Coatings Market Scenario

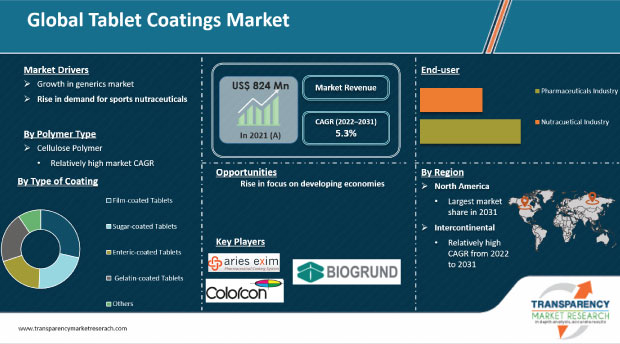

Companies in the global tablet coatings market are focusing on advanced tablet coating materials due to the rise in demand for nutraceuticals. Increase in emphasis on superior pharmaceutical products, generics, and biosimilars has led to a rise in demand for novel excipients. Formulators are focusing on the development of advanced products that can be used for sports nutraceuticals. Increase in outsourcing of operations and rise in R&D activities in pharmaceuticals in developed countries are creating lucrative opportunities for players in the tablet coatings market.

Coated tablets are smooth and colorful, and can be manufactured by enclosing a drug in a protective shell. Coated tablets are designed with an extra thin layer to control the release rate of the drug, while uncoated tablets are designed with a single layer of formulations that offers rapid disintegration in the gastric fluid of the stomach. This is the key difference between coated and uncoated tablets. Growth of the global tablet coatings market can be ascribed to the expansion of the generics market, rise in demand for sports nutraceuticals, and increase in uptake of biopharmaceuticals. However, high cost of products, unfavorable medication price control regime, and changes in trade policies in various countries are posing challenges to pharmaceutical and excipient industries.

The sports nutrition industry was one of the first to embrace dietary supplements. Sports powders, beverages, and bars are the most popular protein delivery forms, accounting for majority of sales in the sports nutrition segment. However, demand for other delivery forms is also high in a wide range of supplements. Acid-resistant HPMC capsules are ideal for acid-sensitive substances such as creatine (for energy), enzymes (for digestion and inflammation), amino acids (for endurance and muscle repair), and probiotics (for digestive health). Lipid multi-particulates (LMP) technology allows for variable release and taste masking. Increase in focus on sports nutrition is likely to drive the oral formulations market in the next few years. In turn, this is projected to propel the global tablet coatings market.

Generic medications are less expensive and possess similar therapeutic efficacy and safety characteristics as their branded counterparts. The U.S. healthcare system saved around US$ 292.6 Bn in 2018 due to increase in adoption of generic medicines. Medicaid and Medicare saved nearly US$ 90.3 Bn and US$ 46.8 Bn, respectively, in the same year. Several governments are encouraging the use of generic medications, as a large number of medications have gone off patents. According to the National Pharmaceutical Services, around 31 medications lost patents in 2018, with an additional 47 expected to lose their patents between 2019 and 2022. Novartis, Merck, and Eli Lilly are likely to lose critical pharmaceutical patent protection. Generic erosion caused significant revenue and volume losses for the branded medication segment between 2012 and 2021. Rise in healthcare affordability and expenditure in emerging markets is expected to boost the sales volume of generics during the forecast period. This is anticipated to drive the global tablet coatings market in the next few years.

Based on type of coating, the film-coated tablets segment held significant share of the global tablet coatings market in 2021. Demand for film-coated tablets is high in the pharmaceutical industry due to the benefits of shorter processing time and fairly thin coats compared to other types of coatings. Pharmaceutical applications of tablet film coatings have increased in recent times, creating value-grab opportunities for manufacturers. Sugar coating is an excellent technique for coating tablets, as it minimizes the risk of medication errors. It leverages pigments/colors for identification and improves patient compliance through esthetic appeal. The gelatin-coated tablets segment held large market share in 2021. The segment is anticipated to grow at a steady pace during the forecast period.

The cellulosic polymers segment held major share of the global market in 2021 due to the ability of these polymers to form coatings with strong properties such as good film strength, compressibility, and aqueous solubility. Global regulatory acceptance and easy availability have also increased the adoption of cellulosic polymers for tablet coating applications.

The pharmaceuticals industry segment is driven by the rise in prevalence of various diseases that need tablet-based formulations for treatment, increase in demand for pharmaceutical tablet coatings, and surge in number of drugs launched as tablet formulations. Manufacturers of pharmaceutical tablet coatings are generating incremental opportunities in the global market. Ongoing R&D activities in the pharmaceutical industry in order to improve the quality of products is positively influencing the global tablet coatings market.

North America is projected to be a highly lucrative region of the global market during the forecast period. The region accounted for more than 40% share of the global table coatings market in 2021. Development of innovative pharmaceutical products, generics, and biosimilars along with the lucrative presence of key players is expected to drive the market in North America. The market in Asia Pacific is anticipated to grow at a rapid pace during the forecast period. Increase in outsourcing of drug manufacturing to specialized contract manufacturing organizations (CMOs), rise in number of companies setting up manufacturing units in countries in the region, favorable government regulations, and low labor & manufacturing costs are projected to drive the market in Asia Pacific during the forecast period.

The tablet coatings market report concludes with the company profiles section, which includes information about key players in the global tablet coatings market. Recent trends and innovations in the pharmaceutical industry are likely to increase future business opportunities in the tablet coatings market. Leading players analyzed in the report include Invacare Corporation, Evonik Industries AG, Merck KGaA, BASF SE, Colorcon, Inc., Eastman Chemical Co., Kery Group plc, Ashland Global Holdings, Inc., Air Liquide S.A., and Roquette Freres.

Each of these players has been profiled in the tablet coatings market report based on parameters such as company overview, financial overview, business strategies, application portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 824 Mn |

|

Market Forecast Value in 2031 |

More than US$ 1,543 Mn |

|

Growth Rate |

CAGR of 5.3% from Year-to-Year |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global tablet coatings market is projected to reach more than US$ 1,543 Mn by 2031

The global tablet coatings market is anticipated to expand at a CAGR of 5.3% during the forecast period

The film-coated tablets segment constituted more than 31% share of the global tablet coatings market in 2021

North America is expected to account for major share of the global market during the forecast period.

Prominent players in the global tablet coatings market include Invacare Corporation, Evonik Industries AG, Merck KGaA, BASF SE, Colorcon, Inc., Eastman Chemical Co., Kery Group plc, Ashland Global Holdings, Inc., Air Liquide S.A., and Roquette Freres

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Tablet Coatings Market

4. Market Overview

4.1. Introduction

4.1.1. Polymer Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Tablet Coatings Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Installed Base Scenario (2019)

5.1.1. Installed Base Scenario

5.1.1.1. By Polymer Type

5.1.1.2. By Type of Coating Type

5.1.1.3. By Region

5.1.1.4. By Major Players

5.1.2. New versus Replacement Unit Shipments

5.2. Export-Import Scenario

5.2.1. Export-Import Scenario, by Region

5.3. Price Comparison Analysis (2019)

5.3.1. By Polymer Type

5.3.2. By Type of Coating Type

5.3.3. By Region

5.3.4. By Major Players

5.4. Key Potential Customers

5.4.1. Key Potential Customers by Region

5.5. Key Vendor and Distributor Analysis

5.5.1. Key Vendor Analysis by Major Players

5.5.2. Key Distributor Analysis by Major Players

5.6. Technological Advancements

5.7. Regulatory Scenario, by Region/Globally

5.8. Key Industry Events (mergers, acquisitions, partnerships, etc.)

5.9. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Tablet Coatings Market Analysis and Forecast, by Polymer Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Polymer Type, 2017–2031

6.3.1. Cellulosic Polymers

6.3.1.1. Hydroxypropyl Methylcellulose (HPMC)

6.3.1.2. Hydroxypropyl Cellulose (HPC)

6.3.1.3. Ethyl Cellulose (EC)

6.3.1.4. Methyl Cellulose

6.3.1.5. Others

6.3.2. Vinyl Derivatives

6.3.2.1. Polyvinyl Pyrrolidone

6.3.2.2. Polyvinyl Alcohol

6.3.2.3. Others

6.3.3. Acrylic Polymers

6.3.3.1. Polymethacrylate

6.3.3.2. Polymethyl Methacrylate

6.3.3.3. Others

6.3.4. Others

6.3.4.1. Polyethylene Glycol

6.3.4.2. Polydextrose

6.3.4.3. Others Slings

6.4. Market Attractiveness Analysis, by Polymer Type

7. Global Tablet Coatings Market Analysis and Forecast, by Type of Coating

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Type of Coating, 2017–2031

7.3.1. Film-coated Tablets

7.3.2. Sugar-coated Tablets

7.3.3. Enteric-coated Tablets

7.3.4. Gelatin-coated Tablets

7.4. Market Attractiveness Analysis, by Type of Coating

8. Global Tablet Coatings Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Pharmaceuticals Industry

8.3.2. Nutraceutical Industry

8.4. Market Attractiveness Analysis, by End-user

9. Global Tablet Coatings Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by /Region

10. North America Tablet Coatings Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Polymer Type, 2017–2031

10.2.1. Cellulosic Polymers

10.2.1.1. Hydroxypropyl Methylcellulose (HPMC)

10.2.1.2. Hydroxypropyl Cellulose (HPC)

10.2.1.3. Ethyl Cellulose (EC)

10.2.1.4. Methyl Cellulose

10.2.1.5. Others

10.2.2. Vinyl Derivatives

10.2.2.1. Polyvinyl Pyrrolidone

10.2.2.2. Polyvinyl Alcohol

10.2.2.3. Others

10.2.3. Acrylic Polymers

10.2.3.1. Polymethacrylate

10.2.3.2. Polymethyl Methacrylate

10.2.3.3. Others

10.2.4. Others

10.2.4.1. Polyethylene Glycol

10.2.4.2. Polydextrose

10.2.4.3. Others Slings

10.3. Market Value Forecast, by Type of Coating, 2017–2031

10.3.1. Film-coated Tablets

10.3.2. Sugar-coated Tablets

10.3.3. Enteric-coated Tablets

10.3.4. Gelatin-coated Tablets

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Pharmaceuticals Industry

10.4.2. Nutraceutical Industry

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Polymer Type

10.6.2. By Type of Coating

10.6.3. By End-user

10.6.4. By Country

11. Europe Tablet Coatings Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Polymer Type, 2017–2031

11.2.1. Cellulosic Polymers

11.2.1.1. Hydroxypropyl Methylcellulose (HPMC)

11.2.1.2. Hydroxypropyl Cellulose (HPC)

11.2.1.3. Ethyl Cellulose (EC)

11.2.1.4. Methyl Cellulose

11.2.1.5. Others

11.2.2. Vinyl Derivatives

11.2.2.1. Polyvinyl Pyrrolidone

11.2.2.2. Polyvinyl Alcohol

11.2.2.3. Others

11.2.3. Acrylic Polymers

11.2.3.1. Polymethacrylate

11.2.3.2. Polymethyl Methacrylate

11.2.3.3. Others

11.2.4. Others

11.2.4.1. Polyethylene Glycol

11.2.4.2. Polydextrose

11.2.4.3. Others Slings

11.3. Market Value Forecast, by Type of Coating, 2017–2031

11.3.1. Film-coated Tablets

11.3.2. Sugar-coated Tablets

11.3.3. Enteric-coated Tablets

11.3.4. Gelatin-coated Tablets

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Pharmaceuticals Industry

11.4.2. Nutraceutical Industry

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Polymer Type

11.6.2. By Type of Coating

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Tablet Coatings Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Polymer Type, 2017–2031

12.2.1. Cellulosic Polymers

12.2.1.1. Hydroxypropyl Methylcellulose (HPMC)

12.2.1.2. Hydroxypropyl Cellulose (HPC)

12.2.1.3. Ethyl Cellulose (EC)

12.2.1.4. Methyl Cellulose

12.2.1.5. Others

12.2.2. Vinyl Derivatives

12.2.2.1. Polyvinyl Pyrrolidone

12.2.2.2. Polyvinyl Alcohol

12.2.2.3. Others

12.2.3. Acrylic Polymers

12.2.3.1. Polymethacrylate

12.2.3.2. Polymethyl Methacrylate

12.2.3.3. Others

12.2.4. Others

12.2.4.1. Polyethylene Glycol

12.2.4.2. Polydextrose

12.2.4.3. Others Slings

12.3. Market Value Forecast, by Type of Coating, 2017–2031

12.3.1. Film-coated Tablets

12.3.2. Sugar-coated Tablets

12.3.3. Enteric-coated Tablets

12.3.4. Gelatin-coated Tablets

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Pharmaceuticals Industry

12.4.2. Nutraceutical Industry

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. Japan

12.5.2. China

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Polymer Type

12.6.2. By Type of Coating

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Tablet Coatings Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Polymer Type, 2017–2031

13.2.1. Cellulosic Polymers

13.2.1.1. Hydroxypropyl Methylcellulose (HPMC)

13.2.1.2. Hydroxypropyl Cellulose (HPC)

13.2.1.3. Ethyl Cellulose (EC)

13.2.1.4. Methyl Cellulose

13.2.1.5. Others

13.2.2. Vinyl Derivatives

13.2.2.1. Polyvinyl Pyrrolidone

13.2.2.2. Polyvinyl Alcohol

13.2.2.3. Others

13.2.3. Acrylic Polymers

13.2.3.1. Polymethacrylate

13.2.3.2. Polymethyl Methacrylate

13.2.3.3. Others

13.2.4. Others

13.2.4.1. Polyethylene Glycol

13.2.4.2. Polydextrose

13.2.4.3. Others Slings

13.3. Market Value Forecast, by Type of Coating, 2017–2031

13.3.1. Film-coated Tablets

13.3.2. Sugar-coated Tablets

13.3.3. Enteric-coated Tablets

13.3.4. Gelatin-coated Tablets

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Pharmaceuticals Industry

13.4.2. Nutraceutical Industry

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Polymer Type

13.6.2. By Type of Coating

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Tablet Coatings Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Polymer Type, 2017–2031

14.2.1. Cellulosic Polymers

14.2.1.1. Hydroxypropyl Methylcellulose (HPMC)

14.2.1.2. Hydroxypropyl Cellulose (HPC)

14.2.1.3. Ethyl Cellulose (EC)

14.2.1.4. Methyl Cellulose

14.2.1.5. Others

14.2.2. Vinyl Derivatives

14.2.2.1. Polyvinyl Pyrrolidone

14.2.2.2. Polyvinyl Alcohol

14.2.2.3. Others

14.2.3. Acrylic Polymers

14.2.3.1. Polymethacrylate

14.2.3.2. Polymethyl Methacrylate

14.2.3.3. Others

14.2.4. Others

14.2.4.1. Polyethylene Glycol

14.2.4.2. Polydextrose

14.2.4.3. Others Slings

14.3. Market Value Forecast, by Type of Coating, 2017–2031

14.3.1. Film-coated Tablets

14.3.2. Sugar-coated Tablets

14.3.3. Enteric-coated Tablets

14.3.4. Gelatin-coated Tablets

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Pharmaceuticals Industry

14.4.2. Nutraceutical Industry

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Polymer Type

14.6.2. By Type of Coating

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Market Footprint Analysis

15.3.1. By Region

15.3.2. By Polymer Type

15.4. Competitive Business Strategies

15.5. Company Profiles

15.5.1. Evonik Industries AG

15.5.1.1. Company Overview

15.5.1.2. Financial Overview

15.5.1.3. Product Portfolio

15.5.1.4. Business Strategies

15.5.2. Merck KGaA

15.5.2.1. Company Overview

15.5.2.2. Financial Overview

15.5.2.3. Product Portfolio

15.5.2.4. Business Strategies

15.5.3. BASF SE

15.5.3.1. Company Overview

15.5.3.2. Financial Overview

15.5.3.3. Product Portfolio

15.5.3.4. Business Strategies

15.5.4. Colorcon, Inc.

15.5.4.1. Company Overview

15.5.4.2. Financial Overview

15.5.4.3. Product Portfolio

15.5.4.4. Business Strategies

15.5.5. Eastman Chemical Co.

15.5.5.1. Company Overview

15.5.5.2. Financial Overview

15.5.5.3. Product Portfolio

15.5.5.4. Business Strategies

15.5.6. Kery Group plc

15.5.6.1. Company Overview

15.5.6.2. Financial Overview

15.5.6.3. Product Portfolio

15.5.6.4. Business Strategies

15.5.7. Ashland Global Holdings Inc.

15.5.7.1. Company Overview

15.5.7.2. Financial Overview

15.5.7.3. Product Portfolio

15.5.7.4. Business Strategies

15.5.8. Air Liquide S.A.

15.5.8.1. Company Overview

15.5.8.2. Financial Overview

15.5.8.3. Product Portfolio

15.5.8.4. Business Strategies

15.5.9. Eastman Chemical Company

15.5.9.1. Company Overview

15.5.9.2. Financial Overview

15.5.9.3. Product Portfolio

15.5.9.4. Business Strategies

15.5.10. Roquette Freres

15.5.10.1. Company Overview

15.5.10.2. Financial Overview

15.5.10.3. Product Portfolio

15.5.10.4. Business Strategies

List of Tables

Table 01: Global Tablet Coatings Market Value (US$ Mn) Forecast, by Polymer Type, 2017–2031

Table 02: Global Tablet Coatings Market Volume (Metric Tons) Forecast, by Polymer Type, 2017–2031

Table 03: Global Tablet Coatings Market Value (US$ Mn) Forecast, by Cellulosic Polymers, 2017–2031

Table 04: Global Tablet Coatings Market Volume (Metric Tons) Forecast, by Cellulosic Polymers, 2017–2031

Table 05: Global Tablet Coatings Market Value (US$ Mn) Forecast, by Vinyl Derivatives, 2017–2031

Table 06: Global Tablet Coatings Market Volume (Metric Tons) Forecast, by Vinyl Derivatives, 2017–2031

Table 07: Global Tablet Coatings Market Value (US$ Mn) Forecast, by Acrylic Polymers, 2017–2031

Table 08: Global Tablet Coatings Market Volume (Metric Tons) Forecast, by Acrylic Polymers, 2017–2031

Table 09: Global Tablet Coatings Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 10: Global Tablet Coatings Market Value (US$ Mn) Forecast, by Polymer Type, 2017–2031

Table 11: Global Tablet Coatings Market Volume (Metric Tons) Forecast, by Others, 2017–2031

Table 12: Global Tablet Coatings Market Value (US$ Mn) Forecast, by Type of Coating, 2017–2031

Table 13: Global Tablet Coatings Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 14: Global Tablet Coatings Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 15: North America Tablet Coatings Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 16: North America Tablet Coatings Market Value (US$ Mn) Forecast, by Polymer Type, 2017–2031

Table 17: North America Tablet Coatings Market Volume (Metric Tons) Forecast, by Polymer Type, 2017–2031

Table 18: North America Tablet Coatings Market Value (US$ Mn) Forecast, by Cellulosic Polymers, 2017–2031

Table 19: North America Tablet Coatings Market Volume (Metric Tons) Forecast, by Cellulosic Polymers, 2017–2031

Table 20: North America Tablet Coatings Market Value (US$ Mn) Forecast, by Vinyl Derivatives, 2017–2031

Table 21: North America Tablet Coatings Market Volume (Metric Tons) Forecast, by Vinyl Derivatives, 2017–2031

Table 22: North America Tablet Coatings Market Value (US$ Mn) Forecast, by Acrylic Polymers, 2017–2031

Table 23: North America Tablet Coatings Market Volume (Metric Tons) Forecast, by Acrylic Polymers, 2017–2031

Table 24: North America Tablet Coatings Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 25: North America Tablet Coatings Market Volume (Metric Tons) Forecast, by Others, 2017–2031

Table 26: North America Tablet Coatings Market Value (US$ Mn) Forecast, by Type of Coating, 2017–2031

Table 27: North America Tablet Coatings Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 28: Europe Tablet Coatings Market Analysis Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 29: Europe Tablet Coatings Market Value (US$ Mn) Forecast, by Polymer Type, 2017–2031

Table 30: Europe Tablet Coatings Market Volume (Metric Tons) Forecast, by Polymer Type, 2017–2031

Table 31: Europe Tablet Coatings Market Value (US$ Mn) Forecast, by Cellulosic Polymers, 2017–2031

Table 32: Europe Tablet Coatings Market Volume (Metric Tons) Forecast, by Cellulosic Polymers, 2017–2031

Table 33: Europe Tablet Coatings Market Value (US$ Mn) Forecast, by Vinyl Derivatives, 2017–2031

Table 34: Europe Tablet Coatings Market Volume (Metric Tons) Forecast, by Vinyl Derivatives, 2017–2031

Table 35: Europe Tablet Coatings Market Value (US$ Mn) Forecast, by Acrylic Polymers, 2017–2031

Table 36: Europe Tablet Coatings Market Volume (Metric Tons) Forecast, by Acrylic Polymers, 2017–2031

Table 37: Europe Tablet Coatings Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 38: Europe Tablet Coatings Market Volume (Metric Tons) Forecast, by Others, 2017–2031

Table 39: Europe Tablet Coatings Market Value (US$ Mn) Forecast, by Type of Coating, 2017–2031

Table 40: Europe Tablet Coatings Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 41: Asia Pacific Tablet Coatings Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 42: Asia Pacific Tablet Coatings Market Value (US$ Mn) Forecast, by Polymer Type, 2017–2031

Table 43: Asia Pacific Tablet Coatings Market Volume (Metric Tons) Forecast, by Polymer Type, 2017–2031

Table 44: Asia Pacific Tablet Coatings Market Value (US$ Mn) Forecast, by Cellulosic Polymers, 2017–2031

Table 45: Asia Pacific Tablet Coatings Market Volume (Metric Tons) Forecast, by Cellulosic Polymers, 2017–2031

Table 46: Asia Pacific Tablet Coatings Market Value (US$ Mn) Forecast, by Vinyl Derivatives, 2017–2031

Table 47: Asia Pacific Tablet Coatings Market Volume (Metric Tons) Forecast, by Vinyl Derivatives, 2017–2031

Table 48: Asia Pacific Tablet Coatings Market Value (US$ Mn) Forecast, by Acrylic Polymers, 2017–2031

Table 49: Asia Pacific Tablet Coatings Market Volume (Metric Tons) Forecast, by Acrylic Polymers, 2017–2031

Table 50: Asia Pacific Tablet Coatings Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 51: Asia Pacific Tablet Coatings Market Volume (Metric Tons) Forecast, by Others, 2017–2031

Table 52: Asia Pacific Tablet Coatings Market Value (US$ Mn) Forecast, by Type of Coating, 2017–2031

Table 53: Asia Pacific Tablet Coatings Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 54: Latin America Tablet Coatings Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 55: Latin America Tablet Coatings Market Value (US$ Mn) Forecast, by Polymer Type, 2017–2031

Table 56: Latin America Tablet Coatings Market Volume (Metric Tons) Forecast, by Polymer Type, 2017–2031

Table 57: Latin America Tablet Coatings Market Value (US$ Mn) Forecast, by Cellulosic Polymers, 2017–2031

Table 58: Latin America Tablet Coatings Market Volume (Metric Tons) Forecast, by Cellulosic Polymers, 2017–2031

Table 59: Latin America Tablet Coatings Market Value (US$ Mn) Forecast, by Vinyl Derivatives, 2017–2031

Table 60: Latin America Tablet Coatings Market Volume (Metric Tons) Forecast, by Vinyl Derivatives, 2017–2031

Table 61: Latin America Tablet Coatings Market Value (US$ Mn) Forecast, by Acrylic Polymers, 2017–2031

Table 62: Latin America Tablet Coatings Market Volume (Metric Tons) Forecast, by Acrylic Polymers, 2017–2031

Table 63: Latin America Tablet Coatings Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 64: Latin America Tablet Coatings Market Volume (Metric Tons) Forecast, by Others, 2017–2031

Table 65: Latin America Tablet Coatings Market Value (US$ Mn) Forecast, by Type of Coating, 2017–2031

Table 66: Latin America Tablet Coatings Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 67: Middle East & Africa Tablet Coatings Market Analysis Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 68: Middle East & Africa Tablet Coatings Market Value (US$ Mn) Forecast, by Polymer Type, 2017–2031

Table 69: Middle East & Africa Tablet Coatings Market Volume (Metric Tons) Forecast, by Polymer Type, 2017–2031

Table 70: Middle East & Africa Tablet Coatings Market Value (US$ Mn) Forecast, by Cellulosic Polymers, 2017–2031

Table 71: Middle East & Africa Tablet Coatings Market Volume (Metric Tons) Forecast, by Cellulosic Polymers, 2017–2031

Table 72: Middle East & Africa Tablet Coatings Market Value (US$ Mn) Forecast, by Vinyl Derivatives, 2017–2031

Table 73: Middle East & Africa Tablet Coatings Market Volume (Metric Tons) Forecast, by Vinyl Derivatives, 2017–2031

Table 74: Middle East & Africa Tablet Coatings Market Value (US$ Mn) Forecast, by Acrylic Polymers, 2017–2031

Table 75: Middle East & Africa Tablet Coatings Market Volume (Metric Tons) Forecast, by Acrylic Polymers, 2017–2031

Table 76: Middle East & Africa Tablet Coatings Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 77: Middle East & Africa Tablet Coatings Market Volume (Metric Tons) Forecast, by Others, 2017–2031

Table 78: Middle East & Africa Tablet Coatings Market Value (US$ Mn) Forecast, by Type of Coating, 2017–2031

Table 79: Middle East & Africa Tablet Coatings Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Tablet Coatings Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Tablet Coatings Market Value Share, by Polymer Type, 2021

Figure 03: Global Tablet Coatings Market Value Share, by Type of Coating, 2021

Figure 04: Global Tablet Coatings Market Value Share, by End-user, 2021

Figure 05: Global Tablet Coatings Market Value Share, by Region, 2021

Figure 06: Global Tablet Coatings Market Value Share Analysis, by Polymer Type, 2021 and 2031

Figure 07: Global Tablet Coatings Market Attractiveness Analysis, by Polymer Type, 2021–2031

Figure 08: Global Tablet Coatings Market Revenue (US$ Mn), by Cellulosic Polymers, 2017–2031

Figure 09: Global Tablet Coatings Market Revenue (US$ Mn), by Vinyl Derivatives, 2017–2031

Figure 10: Global Tablet Coatings Market Revenue (US$ Mn), by Acrylic Polymers, 2017–2031

Figure 11: Global Tablet Coatings Market Value Share and Attractiveness Analysis, by Type of Coating, 2022 and 2031

Figure 12: Global Tablet Coatings Market Value Share and Attractiveness Analysis, by Type of Coating, 2022–2031

Figure 13: Global Tablet Coatings Market Revenue (US$ Mn), by Film-coated Tablets, 2017–2031

Figure 14: Global Tablet Coatings Market Revenue (US$ Mn), by Sugar-coated Tablets, 2017–2031

Figure 15: Global Tablet Coatings Market Revenue (US$ Mn), by Enteric-coated Tablets, 2017–2031

Figure 16: Global Tablet Coatings Market Revenue (US$ Mn), by Gelatin-coated Tablets, 2017–2031

Figure 17: Global Tablet Coatings Market Revenue (US$ Mn), by Others, 2017–2031

Figure 18: Global Tablet Coatings Market Value Share Analysis, by End-user, 2022 and 2031

Figure 19: Global Tablet Coatings Market Attractiveness Analysis, by End-user, 2022–2031

Figure 20: Global Tablet Coatings Market Revenue (US$ Mn), by Pharmaceuticals Industry, 2017–2031

Figure 21: Global Tablet Coatings Market Revenue (US$ Mn), by Nutracuetical Industry, 2017–2031

Figure 22: Global Tablet Coatings Market Value Share Analysis, by Region, 2021 and 2031

Figure 23: Global Tablet Coatings Market Analysis, by Region, 2022–2031

Figure 24: North America Tablet Coatings Market Value (US$ Mn) Forecast, 2017–2031

Figure 25: North America Tablet Coatings Market Value Share, by Country/Sub-region, 2021 and 2031

Figure 26: North America Tablet Coatings Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 27: North America Tablet Coatings Market Value Share Analysis, by Polymer Type, 2021 and 2031

Figure 28: North America Tablet Coatings Market Attractiveness Analysis, by Polymer Type, 2022–2031

Figure 29: North America Tablet Coatings Market Value Share Analysis, by Type of Coating, 2021 and 2031

Figure 30: North America Tablet Coatings Market Attractiveness Analysis, by Type of Coating, 2021–2031

Figure 31: North America Tablet Coatings Market Value Share Analysis, by End-user, 2021 and 2031

Figure 32: North America Tablet Coatings Market Attractiveness Analysis, by End-user, 2022–2031

Figure 33: Europe Tablet Coatings Market Value (US$ Mn) Forecast, 2017–2031

Figure 34: Europe Tablet Coatings Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 35: Europe Tablet Coatings Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 36: Europe Tablet Coatings Market Value Share Analysis, by Polymer Type, 2021 and 2031

Figure 37: Europe Tablet Coatings Market Attractiveness Analysis, by Polymer Type, 2022–2031

Figure 38: Europe Tablet Coatings Market Value Share Analysis, by Type of Coating, 2021 and 2031

Figure 39: Europe Tablet Coatings Market Attractiveness Analysis, by Type of Coating, 2022–2031

Figure 40: Europe Tablet Coatings Market Value Share Analysis, by End-user, 2021 and 2031

Figure 41: Europe Tablet Coatings Market Attractiveness Analysis, by End-user, 2022–2031

Figure 42: Asia Pacific Tablet Coatings Market Value (US$ Mn) Forecast, 2017–2031

Figure 43: Asia Pacific Tablet Coatings Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 44: Asia Pacific Tablet Coatings Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 45: Asia Pacific Tablet Coatings Market Value Share Analysis, by Polymer Type, 2021 and 2031

Figure 46: Asia Pacific Tablet Coatings Market Attractiveness Analysis, by Polymer Type, 2022–2031

Figure 47: Asia Pacific Tablet Coatings Market Value Share Analysis, by Type of Coating, 2021 and 2031

Figure 48: Asia Pacific Tablet Coatings Market Attractiveness Analysis, by Type of Coating, 2022–2031

Figure 49: Asia Pacific Tablet Coatings Market Value Share Analysis, by End-user, 2021 and 2031

Figure 50: Asia Pacific Tablet Coatings Market Attractiveness Analysis, by End-user, 2022–2031

Figure 51: Latin America Tablet Coatings Market Value (US$ Mn) Forecast, 2017–2031

Figure 52: Latin America Tablet Coatings Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 53: Latin America Tablet Coatings Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 54: Latin America Tablet Coatings Market Value Share Analysis, by Polymer Type, 2021 and 2031

Figure 55: Latin America Tablet Coatings Market Attractiveness Analysis, by Polymer Type, 2022–2031

Figure 56: Latin America Tablet Coatings Market Value Share Analysis, by Type of Coating, 2021 and 2031

Figure 57: Latin America Tablet Coatings Market Attractiveness Analysis, by Type of Coating, 2022–2031

Figure 58: Latin America Tablet Coatings Market Value Share Analysis, by End-user, 2021 and 2031

Figure 59: Latin America Tablet Coatings Market Attractiveness Analysis, by End-user, 2022–2031

Figure 60: Middle East & Africa Tablet Coatings Market Value (US$ Mn) Forecast, 2017–2031

Figure 61: Middle East & Africa Tablet Coatings Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 62: Middle East & Africa Tablet Coatings Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 63: Middle East & Africa Tablet Coatings Market Value Share Analysis, by Polymer Type, 2021 and 2031

Figure 64: Middle East & Africa Tablet Coatings Market Attractiveness Analysis, by Polymer Type, 2021–2031

Figure 65: Middle East & Africa Tablet Coatings Market Value Share Analysis, by Type of Coating, 2021 and 2031

Figure 66: Middle East & Africa Tablet Coatings Market Attractiveness Analysis, by Type of Coating, 2022–2031

Figure 67: Middle East & Africa Tablet Coatings Market Value Share Analysis, by End-user, 2021 and 2031

Figure 68: Middle East & Africa Tablet Coatings Market Attractiveness Analysis, by End-user, 2022–2031