Reports

Reports

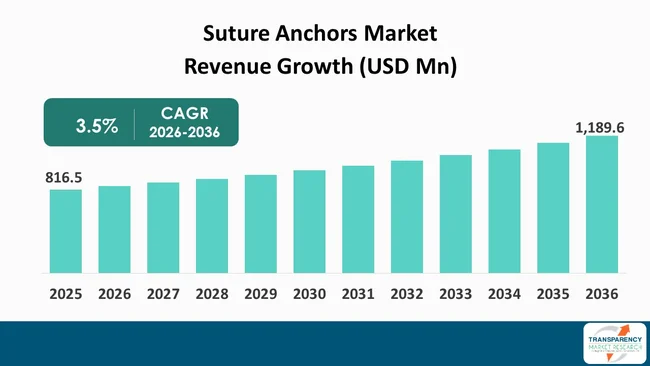

The global suture anchors market size was valued at US$ 816.5 Mn in 2025 and is projected to reach US$ 1,189.6 Mn by 2036, expanding at a CAGR of 3.5% from 2026 to 2036. The market growth is driven by rising incidence of sports injuries and orthopedic disorders, growing adoption of minimally invasive and arthroscopic procedures, and technological advancements in anchor materials.

Some of the major factors driving the growth of the suture anchors market include increasing incidences of sports injuries, rotator cuff tears, and the other soft-tissue disorders, which demand surgical repair; growing preference for minimally-invasive and arthroscopic procedures; and advanced anchor systems that offer quicker recovery with reduced postoperative complications.

Technological advancements are making these materials more effective clinically and widening their use in various orthopedic situations. Apart from these innovations, factors like the rising number of elderly people worldwide, development of ambulatory surgical centers, and better access to orthopedic care in the less developed regions are increasing the number of procedures.

Over the last few years, there has been a major change in the preference for surgeons for bio-absorbable, biocomposite, and PEEK-based suture anchors as they look for implants that cause less hardware-related complications in the long run and give better imaging results.

The use of knotless anchor configurations is also gaining popularity as they can shorten the time of the operation and decrease the possibility of the soft tissues being irritated. As more ambulatory surgical facilities are using suture anchors, this is indicative of an increase in minimally-invasive arthroscopic treatment. A further development in the evolution of suture anchors is the increase in the use of all-suture anchors as they require smaller drilled holes as compared to conventional anchor designs and provide flexibility in their use, thereby allowing for repairs of difficult-to-access/delicate anatomically constrained sites.

Suture anchors imply small medical devices that attach soft tissues such as ligaments or tendons to bones during surgical repairs. The device typically comprises an anchor inserted into the sutures that secure the tissue in place. They offer strong, stable fixation, enable precise tissue positioning, and promote effective healing. Suture anchors make surgery more effective by increasing the strength of the repair and lowering the re-injury risk. They are indispensable instruments in the orthopedic and sports medicine surgeries.

However, metal anchors typically obscure some imaging techniques. By contrast, PEEK anchors are both - radiolucent and biocompatible while also having sufficient strength to provide adequate fixation and allow for clear postoperative imaging. Ultra-high molecular weight polyethylene (UHMWPE) suture anchors provide excellent flexibility, high tensile strength, and minimal bone removal, thereby allowing safe fixation in small or limited anatomical areas.

| Attribute | Detail |

|---|---|

| Suture Anchors Market Drivers |

|

The major driver leading to the growth of the suture anchors market is the rising awareness and acceptance of minimally-invasive procedures and arthroscopy. Arthroscopic procedures, unlike open surgeries, involve only small skin incisions and specially designed instruments with cameras, enabling a surgeon to visualize and fix joint structures with minimal disturbance of the surrounding tissues. Essentially this movement toward more conservative methods is a result of the demands from patients, who want the post-operative pain to be minimal, the hospital stay to be short, the rehabilitation to be rapid and the return to their usual activities or sports to be quick.

Suture anchors play a key role in the success of surgical interventions where it is necessary to connect soft tissues like tendon, ligament, and joint capsule to bone, as these tissues are the most common ones to become loose with time. The design of a suture anchor allows for the challenges associated with performing surgery arthroscopically, and has therefore enabled surgeons' ability to provide reliable, durable fixation for soft tissue to bone while allowing for precise approximation of soft tissue to bone. Accuracy is essential to successful repair of joint function and optimal healing, particularly when performing complex repairs, such as rotator cuff, labral and ligament reconstruction.

Moreover, innovations in anchor substances—like bioabsorbable polymers, PEEK, and all-suture configurations—are helping to make the instruments more compatible with less invasive operations by lessening the chances of the hardware-causing complications and giving the possibility of better imaging after the intervention. The wide range of modern suture anchors and their enhanced biomechanical properties are the main reasons for their up to now more frequent applications in different orthopedics fields.

Technological advancements in anchor materials have now turned out to be a key driver to the growth of the suture anchors market. Over these years, significant innovation has transformed these devices from to sophisticated anchors from simple metallic implants made from advanced biomaterials, improving surgical outcomes and expanding their clinical applications.

Furthermore, the introduction of PEEK (polyether ether ketone) as a new type of arthroscopic anchor offers strength, non-toxicity, and poor visibility in radiographs, allowing for clear images post-surgery. The mechanical properties of PEEK are superior to those of traditional anchors, creating a secure attachment point even in the most complex orthopedic procedures, thereby increasing patient safety and confidence in the surgeon’s ability to successfully complete the procedure.

In addition, these material changes extend the fusion of the anchor with living tissues.Thus, the healing becomes faster, and the instances of failure are lowered. To meet the needs of surgeons who are looking for devices that offer simplicity, trustworthiness, and patient satisfaction, the need for the latest material-based anchors is increasing progressively. In general, the innovations in the field of the technology of the anchor material have a positive impact on the performance of the procedures; hence, the suture anchors market is experiencing a sustained growth.

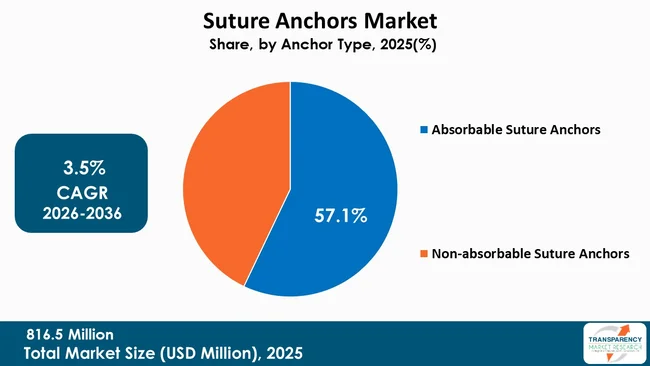

Non-absorbable suture anchors dominate the market share of the suture anchors owing to long-term strength, durability, and reliable fixation in orthopedic procedures. Non-absorbable anchors, as opposed to absorbable ones, can offer permanent support, which makes them the most suitable for high-load applications, e.g., the repair of rotator cuff, ligament, and tendon, where the stability over the long term is of great importance.

Their reliable performance in clinical settings, the ability to be used with different types of sutures, and the lowered probability of failure at the initial stage are the reasons bolstering its adoption.

Moreover, metal, PEEK, and high-strength polymer versions of non-absorbable anchors are generally available, thus providing versatility for different surgical techniques. Their longevity, dependability, and flexibility of use across various procedures are factors contributing to the segment’s continued success.

| Attribute | Detail |

|---|---|

| Leading Region |

|

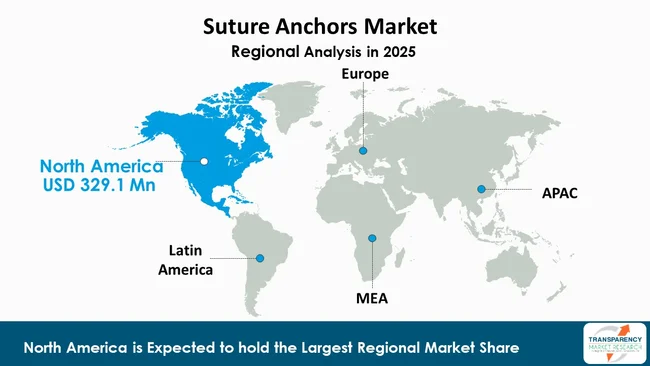

A new suture anchors market outlook says North America represented around 40.3% of the total market share in 2025. Most of the market share is held by North America as a result of the region's advanced healthcare system, high number of orthopedic-related diseases, and the quick adoption of innovative surgical techniques.

The area is backed by a fully integrated hospital system, outpatient surgical centers, and specialized orthopedic clinics, hence making arthroscopic and minimally-invasive procedures, which are the major applications of suture anchors, easily accessible to patients. Moreover, the rising cases of sports injuries, age-related musculoskeletal pathologies, and rotator cuff tears, both - in athletes and the elderly, are the factors that lead to an increase in the need for the latest fixation devices.

Firms in the suture anchors market are emphasizing on innovation by introducing state-of-the-art bioabsorbable, PEEK, and all-suture anchors, extending their product lines, and upgrading the compatibility of minimally-invasive surgeries. Additionally, they are engaging in partnerships, acquisitions, and geographic expansion to boost their market share, strengthen their distribution network, and meet the increasing demand worldwide.

Arthrex, Inc., Stryker, CONMED Corporation, Smith+Nephew, DePuy Synthes (Johnson & Johnson), Zimmer Biomet, Osteocare Medical Pvt Ltd., Cook Medical, OSSIO, Double Medical Technology Inc., Medhold Group (Pty) Ltd., Fuse Medical, Inc., Normmed Medical, Hib Surgicals, and Zealmax Innovations Pvt. Ltd. are some of the leading players operating in the global suture anchors market.

Each of these players has been profiled in the suture anchors industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$ 816.5 Mn |

| Forecast Value in 2036 | US$ 1,189.6 Mn |

| CAGR | 3.5% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2024 |

| Quantitative Units | US$ Mn |

| Suture Anchors Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Anchor Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global suture anchors market was valued at US$ 816.5 Mn in 2025

The global suture anchors industry is projected to reach more than US$ 1,189.6 Mn by the end of 2036

Rising incidence of sports injuries and orthopedic disorders, growing adoption of minimally invasive and arthroscopic procedures, technological advancements in anchor materials, and expansion of ambulatory surgical centers, are some of the factors driving the expansion of suture anchors market.

The CAGR is anticipated to be 3.5% from 2026 to 2036

Arthrex, Inc., Stryker, CONMED Corporation, Smith+Nephew, DePuy Synthes (Johnson & Johnson), Zimmer Biomet, Osteocare Medical Pvt Ltd., Cook Medical, OSSIO, Double Medical Technology Inc., Medhold Group (Pty) Ltd., Fuse Medical, Inc., Normmed Medical, Hib Surgicals, and Zealmax Innovations Pvt. Ltd.

Table 01: Global Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 02: Global Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 03: Global Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 04: Global Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 05: Global Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 06: Global Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 07: Global Suture Anchors Market Value (US$ Mn) Forecast, By Region, 2021 to 2036

Table 08: North America Suture Anchors Market Value (US$ Mn) Forecast, by Country, 2021-2036

Table 09: North America Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 10: North America Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 11: North America Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 12: North America Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 13: North America Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 14: North America Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 15: U.S. Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 16: U.S. Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 17: U.S. Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 18: U.S. Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 19: U.S. Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 20: U.S. Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 21: Canada Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 22: Canada Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 23: Canada Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 24: Canada Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 25: Canada Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 26: Canada Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 27: Europe Suture Anchors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2021-2036

Table 28: Europe Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 29: Europe Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 30: Europe Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 31: Europe Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 32: Europe Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 33: Europe Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 34: Germany Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 35: Germany Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 36: Germany Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 37: Germany Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 38: Germany Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 39: Germany Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 40: U.K. Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 41: U.K. Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 42: U.K. Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 43: U.K. Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 44: U.K. Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 45: U.K. Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 46: France Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 47: France Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 48: France Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 49: France Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 50: France Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 51: France Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 52: Italy Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 53: Italy Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 54: Italy Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 55: Italy Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 56: Italy Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 57: Italy Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 58: Spain Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 59: Spain Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 60: Spain Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 61: Spain Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 62: Spain Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 63: Spain Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 64: The Netherlands Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 65: The Netherlands Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 66: The Netherlands Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 67: The Netherlands Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 68: The Netherlands Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 69: The Netherlands Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 70: Rest of Europe Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 71: Rest of Europe Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 72: Rest of Europe Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 73: Rest of Europe Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 74: Rest of Europe Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 75: Rest of Europe Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 76: Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2021-2036

Table 77: Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 78: Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 79: Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 80: Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 81: Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 82: Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 83: China Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 84: China Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 85: China Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 86: China Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 87: China Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 88: China Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 89: India Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 90: India Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 91: India Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 92: India Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 93: India Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 94: India Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 95: Japan Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 96: Japan Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 97: Japan Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 98: Japan Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 99: Japan Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 100: Japan Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 101: South Korea Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 102: South Korea Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 103: South Korea Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 104: South Korea Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 105: South Korea Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 106: South Korea Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 107: Australia & New Zealand Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 108: Australia & New Zealand Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 109: Australia & New Zealand Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 110: Australia & New Zealand Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 111: Australia & New Zealand Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 112: Australia & New Zealand Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 113: ASEAN Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 114: ASEAN Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 115: ASEAN Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 116: ASEAN Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 117: ASEAN Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 118: ASEAN Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 119: Rest of Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 120: Rest of Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 121: Rest of Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 122: Rest of Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 123: Rest of Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 124: Rest of Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 125: Latin America Suture Anchors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2021-2036

Table 126: Latin America Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 127: Latin America Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 128: Latin America Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 129: Latin America Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 130: Latin America Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 131: Latin America Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 132: Brazil Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 133: Brazil Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 134: Brazil Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 135: Brazil Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 136: Brazil Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 137: Brazil Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 138: Argentina Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 139: Argentina Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 140: Argentina Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 141: Argentina Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 142: Argentina Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 143: Argentina Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 144: Mexico Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 145: Mexico Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 146: Mexico Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 147: Mexico Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 148: Mexico Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 149: Mexico Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 150: Rest of Latin America Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 151: Rest of Latin America Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 152: Rest of Latin America Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 153: Rest of Latin America Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 154: Rest of Latin America Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 155: Rest of Latin America Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 156: Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2021-2036

Table 157: Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 158: Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 159: Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 160: Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 161: Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 162: Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 163: GCC Countries Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 164: GCC Countries Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 165: GCC Countries Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 166: GCC Countries Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 167: GCC Countries Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 168: GCC Countries Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 169: South Africa Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 170: South Africa Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 171: South Africa Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 172: South Africa Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 173: South Africa Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 174: South Africa Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 175: Rest of Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, By Anchor Type, 2021 to 2036

Table 176: Rest of Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, By Material, 2021 to 2036

Table 177: Rest of Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, By Tying System, 2021 to 2036

Table 178: Rest of Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, By Anchoring System, 2021 to 2036

Table 179: Rest of Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, By Application, 2021 to 2036

Table 180: Rest of Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Figure 01: Global Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 02: Global Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 03: Global Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 04: Global Suture Anchors Market Revenue (US$ Mn), by Absorbable Suture Anchors, 2021 to 2036

Figure 05: Global Suture Anchors Market Revenue (US$ Mn), by Non-absorbable Suture Anchors, 2021 to 2036

Figure 06: Global Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 07: Global Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 08: Global Suture Anchors Market Revenue (US$ Mn), by Metallic Anchors, 2021 to 2036

Figure 09: Global Suture Anchors Market Revenue (US$ Mn), by PEEK (Polyether ether ketone) Anchors, 2021 to 2036

Figure 10: Global Suture Anchors Market Revenue (US$ Mn), by Biodegradable Polymer Anchors, 2021 to 2036

Figure 11: Global Suture Anchors Market Revenue (US$ Mn), by Others, 2021 to 2036

Figure 12: Global Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 13: Global Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 14: Global Suture Anchors Market Revenue (US$ Mn), by Knotless Suture Anchors, 2021 to 2036

Figure 15: Global Suture Anchors Market Revenue (US$ Mn), by Knotted Suture Anchors, 2021 to 2036

Figure 16: Global Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 17: Global Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 18: Global Suture Anchors Market Revenue (US$ Mn), by Barbed Anchor, 2021 to 2036

Figure 19: Global Suture Anchors Market Revenue (US$ Mn), by Screw Fit Anchor, 2021 to 2036

Figure 20: Global Suture Anchors Market Revenue (US$ Mn), by Others, 2021 to 2036

Figure 21: Global Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 22: Global Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 23: Global Suture Anchors Market Revenue (US$ Mn), by Shoulder Surgeries, 2021 to 2036

Figure 24: Global Suture Anchors Market Revenue (US$ Mn), by Knee Procedures, 2021 to 2036

Figure 25: Global Suture Anchors Market Revenue (US$ Mn), by Foot & Ankle Surgeries, 2021 to 2036

Figure 26: Global Suture Anchors Market Revenue (US$ Mn), by Hip Procedures, 2021 to 2036

Figure 27: Global Suture Anchors Market Revenue (US$ Mn), by Elbow and Wrist Repair, 2021 to 2036

Figure 28: Global Suture Anchors Market Revenue (US$ Mn), by Other Joint and Soft Tissue Repairs, 2021 to 2036

Figure 29: Global Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 30: Global Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 31: Global Suture Anchors Market Revenue (US$ Mn), by Hospitals, 2021 to 2036

Figure 32: Global Suture Anchors Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2021 to 2036

Figure 33: Global Suture Anchors Market Revenue (US$ Mn), by Orthopedic Clinics, 2021 to 2036

Figure 34: Global Suture Anchors Market Revenue (US$ Mn), by Others, 2021 to 2036

Figure 35: Global Suture Anchors Market Value Share Analysis, by Region, 2025 and 2036

Figure 36: Global Suture Anchors Market Attractiveness Analysis, by Region, 2026 to 2036

Figure 37: North America Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 38: North America Suture Anchors Market Value Share Analysis, by Country, 2025 and 2036

Figure 39: North America Suture Anchors Market Attractiveness Analysis, by Country, 2026 to 2036

Figure 40: North America Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 41: North America Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 42: North America Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 43: North America Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 44: North America Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 45: North America Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 46: North America Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 47: North America Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 48: North America Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 49: North America Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 50: North America Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 51: North America Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 52: U.S. Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 53: U.S. Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 54: U.S. Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 55: U.S. Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 56: U.S. Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 57: U.S. Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 58: U.S. Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 59: U.S. Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 60: U.S. Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 61: U.S. Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 62: U.S. Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 63: U.S. Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 64: U.S. Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 65: Canada Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 66: Canada Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 67: Canada Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 68: Canada Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 69: Canada Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 70: Canada Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 71: Canada Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 72: Canada Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 73: Canada Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 74: Canada Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 75: Canada Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 76: Canada Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 77: Canada Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 78: Europe Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 79: Europe Suture Anchors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 80: Europe Suture Anchors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 81: Europe Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 82: Europe Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 83: Europe Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 84: Europe Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 85: Europe Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 86: Europe Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 87: Europe Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 88: Europe Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 89: Europe Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 90: Europe Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 91: Europe Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 92: Europe Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 93: Germany Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 94: Germany Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 95: Germany Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 96: Germany Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 97: Germany Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 98: Germany Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 99: Germany Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 100: Germany Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 101: Germany Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 102: Germany Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 103: Germany Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 104: Germany Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 105: Germany Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 106: U.K. Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 107: U.K. Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 108: U.K. Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 109: U.K. Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 110: U.K. Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 111: U.K. Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 112: U.K. Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 113: U.K. Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 114: U.K. Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 115: U.K. Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 116: U.K. Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 117: U.K. Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 118: U.K. Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 119: France Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 120: France Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 121: France Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 122: France Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 123: France Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 124: France Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 125: France Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 126: France Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 127: France Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 128: France Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 129: France Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 130: France Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 131: France Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 132: Italy Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 133: Italy Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 134: Italy Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 135: Italy Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 136: Italy Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 137: Italy Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 138: Italy Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 139: Italy Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 140: Italy Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 141: Italy Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 142: Italy Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 143: Italy Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 144: Italy Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 145: Spain Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 146: Spain Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 147: Spain Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 148: Spain Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 149: Spain Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 150: Spain Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 151: Spain Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 152: Spain Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 153: Spain Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 154: Spain Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 155: Spain Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 156: Spain Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 157: Spain Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 158: The Netherlands Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 159: The Netherlands Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 160: The Netherlands Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 161: The Netherlands Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 162: The Netherlands Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 163: The Netherlands Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 164: The Netherlands Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 165: The Netherlands Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 166: The Netherlands Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 167: The Netherlands Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 168: The Netherlands Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 169: The Netherlands Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 170: The Netherlands Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 171: Rest of Europe Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 172: Rest of Europe Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 173: Rest of Europe Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 174: Rest of Europe Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 175: Rest of Europe Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 176: Rest of Europe Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 177: Rest of Europe Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 178: Rest of Europe Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 179: Rest of Europe Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 180: Rest of Europe Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 181: Rest of Europe Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 182: Rest of Europe Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 183: Rest of Europe Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 184: Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 185: Asia Pacific Suture Anchors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 186: Asia Pacific Suture Anchors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 187: Asia Pacific Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 188: Asia Pacific Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 189: Asia Pacific Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 190: Asia Pacific Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 191: Asia Pacific Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 192: Asia Pacific Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 193: Asia Pacific Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 194: Asia Pacific Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 195: Asia Pacific Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 196: Asia Pacific Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 197: Asia Pacific Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 198: Asia Pacific Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 199: China Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 200: China Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 201: China Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 202: China Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 203: China Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 204: China Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 205: China Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 206: China Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 207: China Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 208: China Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 209: China Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 210: China Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 211: China Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 212: India Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 213: India Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 214: India Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 215: India Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 216: India Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 217: India Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 218: India Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 219: India Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 220: India Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 221: India Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 222: India Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 223: India Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 224: India Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 225: Japan Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 226: Japan Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 227: Japan Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 228: Japan Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 229: Japan Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 230: Japan Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 231: Japan Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 232: Japan Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 233: Japan Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 234: Japan Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 235: Japan Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 236: Japan Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 237: Japan Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 238: South Korea Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 239: South Korea Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 240: South Korea Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 241: South Korea Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 242: South Korea Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 243: South Korea Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 244: South Korea Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 245: South Korea Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 246: South Korea Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 247: South Korea Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 248: South Korea Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 249: South Korea Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 250: South Korea Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 251: Australia & New Zealand Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 252: Australia & New Zealand Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 253: Australia & New Zealand Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 254: Australia & New Zealand Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 255: Australia & New Zealand Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 256: Australia & New Zealand Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 257: Australia & New Zealand Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 258: Australia & New Zealand Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 259: Australia & New Zealand Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 260: Australia & New Zealand Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 261: Australia & New Zealand Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 262: Australia & New Zealand Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 263: Australia & New Zealand Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 264: ASEAN Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 265: ASEAN Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 266: ASEAN Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 267: ASEAN Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 268: ASEAN Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 269: ASEAN Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 270: ASEAN Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 271: ASEAN Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 272: ASEAN Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 273: ASEAN Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 274: ASEAN Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 275: ASEAN Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 276: ASEAN Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 277: Rest of Asia Pacific Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 278: Rest of Asia Pacific Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 279: Rest of Asia Pacific Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 280: Rest of Asia Pacific Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 281: Rest of Asia Pacific Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 282: Rest of Asia Pacific Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 283: Rest of Asia Pacific Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 284: Rest of Asia Pacific Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 285: Rest of Asia Pacific Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 286: Rest of Asia Pacific Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 287: Rest of Asia Pacific Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 288: Rest of Asia Pacific Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 289: Rest of Asia Pacific Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 290: Latin America Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 291: Latin America Suture Anchors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 292: Latin America Suture Anchors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 293: Latin America Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 294: Latin America Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 295: Latin America Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 296: Latin America Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 297: Latin America Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 298: Latin America Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 299: Latin America Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 300: Latin America Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 301: Latin America Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 302: Latin America Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 303: Latin America Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 304: Latin America Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 305: Brazil Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 306: Brazil Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 307: Brazil Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 308: Brazil Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 309: Brazil Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 310: Brazil Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 311: Brazil Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 312: Brazil Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 313: Brazil Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 314: Brazil Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 315: Brazil Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 316: Brazil Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 317: Brazil Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 318: Argentina Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 319: Argentina Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 320: Argentina Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 321: Argentina Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 322: Argentina Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 323: Argentina Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 324: Argentina Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 325: Argentina Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 326: Argentina Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 327: Argentina Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 328: Argentina Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 329: Argentina Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 330: Argentina Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 331: Mexico Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 332: Mexico Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 333: Mexico Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 334: Mexico Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 335: Mexico Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 336: Mexico Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 337: Mexico Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 338: Mexico Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 339: Mexico Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 340: Mexico Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 341: Mexico Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 342: Mexico Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 343: Mexico Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 344: Rest of Latin America Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 345: Rest of Latin America Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 346: Rest of Latin America Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 347: Rest of Latin America Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 348: Rest of Latin America Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 349: Rest of Latin America Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 350: Rest of Latin America Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 351: Rest of Latin America Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 352: Rest of Latin America Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 353: Rest of Latin America Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 354: Rest of Latin America Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 355: Rest of Latin America Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 356: Rest of Latin America Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 357: Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 358: Middle East & Africa Suture Anchors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 359: Middle East & Africa Suture Anchors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 360: Middle East & Africa Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 361: Middle East & Africa Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 362: Middle East & Africa Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 363: Middle East & Africa Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 364: Middle East & Africa Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 365: Middle East & Africa Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 366: Middle East & Africa Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 367: Middle East & Africa Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 368: Middle East & Africa Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 369: Middle East & Africa Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 370: Middle East & Africa Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 371: Middle East & Africa Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 372: GCC Countries Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 373: GCC Countries Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 374: GCC Countries Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 375: GCC Countries Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 376: GCC Countries Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 377: GCC Countries Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 378: GCC Countries Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 379: GCC Countries Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 380: GCC Countries Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 381: GCC Countries Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 382: GCC Countries Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 383: GCC Countries Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 384: GCC Countries Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 385: South Africa Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 386: South Africa Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 387: South Africa Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 388: South Africa Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 389: South Africa Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 390: South Africa Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 391: South Africa Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 392: South Africa Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 393: South Africa Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 394: South Africa Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 395: South Africa Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 396: South Africa Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 397: South Africa Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 398: Rest of Middle East & Africa Suture Anchors Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 399: Rest of Middle East & Africa Suture Anchors Market Value Share Analysis, by Anchor Type, 2025 and 2036

Figure 400: Rest of Middle East & Africa Suture Anchors Market Attractiveness Analysis, by Anchor Type, 2026 to 2036

Figure 401: Rest of Middle East & Africa Suture Anchors Market Value Share Analysis, by Material, 2025 and 2036

Figure 402: Rest of Middle East & Africa Suture Anchors Market Attractiveness Analysis, by Material, 2026 to 2036

Figure 403: Rest of Middle East & Africa Suture Anchors Market Value Share Analysis, by Tying System, 2025 and 2036

Figure 404: Rest of Middle East & Africa Suture Anchors Market Attractiveness Analysis, by Tying System, 2026 to 2036

Figure 405: Rest of Middle East & Africa Suture Anchors Market Value Share Analysis, by Anchoring System, 2025 and 2036

Figure 406: Rest of Middle East & Africa Suture Anchors Market Attractiveness Analysis, by Anchoring System, 2026 to 2036

Figure 407: Rest of Middle East & Africa Suture Anchors Market Value Share Analysis, by Application, 2025 and 2036

Figure 408: Rest of Middle East & Africa Suture Anchors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 409: Rest of Middle East & Africa Suture Anchors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 410: Rest of Middle East & Africa Suture Anchors Market Attractiveness Analysis, by End-user, 2026 to 2036