Reports

Reports

The sodium cocoyl glycinate market is witnessing steadiness with rising consumer demand for natural, mild, and sustainable personal care ingredients. Growing awareness regarding clean-label formulations and the prevailing shift toward sulfate-free formulations help natural alternatives like sodium cocoyl glycinate to gain prominence and growth.

Overall, the market will benefit from both consumers led demand for natural alternatives and initiated routes to market against cleaner, safer, and environmentally responsible personal care ingredients from the industry.

The sodium cocoyl glycinate is a mild, amino acid-based surfactant obtained from glycine and coconut fatty acids. Sodium cocoyl glycinate exhibits exceptional mild cleansing ability, foaming properties, and moisturizing benefits, thereby making it an ideal alternative to harsh surfactants in personal care formulations.

Sodium cocoyl glycinate is broadly utilized in skin and hair care formulations (e.g., facial cleansers, body washes, shampoos, and baby care) as it preserves skin moisture, produces creamy and stable foams, and minimizes irritation, especially in applications for sensitive skin.

| Attribute | Detail |

|---|---|

| Sodium Cocoyl Glycinate Market Drivers |

|

The sodium cocoyl glycinate market is largely driven by the rising consumer preference for sulfate-free personal care products, which is currently re-shaping the global hygiene and beauty sector. Growing consumer awareness regarding the potential harsh effects that conventional surfactants like sodium laureth sulfate (SLES) and sodium lauryl sulfate (SLS) have on the skin, such as skin irritation and dryness or stripping the skin of its natural oils, have both - consumers and formulators searching for milder personal care alternatives.

Sodium cocoyl glycinate is a mild surfactant that is skin-friendly and able to offer consumers an alternative. This surfactant can produce rich creamy foam while not disrupting the skin’s moisture balance, which renders it an attractive substitute ingredient in facial cleansers, body washes, shampoos, and baby care products where ease of irritation is a concern.

Sulfate-free claims are one way that cosmetic brands are approaching the functional need, and this has become a significant path for differentiation. Marketing strategies related to sulfur-free activity, in which leading manufacturers are building portfolios around sulfate-free as well as clean-label and dermatologist-tested products, position sodium cocoyl glycinate as eminent ingredient.

Factors such as e-Commerce, social media influence, and the rise of beauty bloggers create a perfect storm by speeding up awareness around ingredient safety while pushing for more transparency in ingredient labeling.

The global sodium cocoyl glycinate market is experiencing speedy growth as demand for mild, natural, and sustainable surfactants grow within the personal care industry. As consumers develop awareness regarding ingredients and their effects on the environment, conventional surfactants made from petrochemicals are being replaced with bio-based solutions that offer better performance, quality, and sustainability in formulation.

With consumer demand for eco surfactants, global regulatory frameworks are serving as a change driver. Regulatory frameworks in various regions such as Europe, North America, and parts of Asia now place new demands to limit synthetic and environmentally persistent chemicals in cosmetics and personal care products. Sodium cocoyl glycinate has the benefits of meeting safety and environmentally preferred chemical standards that supports its position in the market.

Large companies are investing significantly in sustainable procurement, green chemistry, and process innovations that will enhance the quality, costs, and scale of production of amino acid-based surfactants.

As the beauty and personal care industry evolves toward cleaner and greener formulations, this surfactant is expected to continue to be a surfactant of choice for eco-conscious brands looking to relatively balance performance and mildness with environmental sustainability.

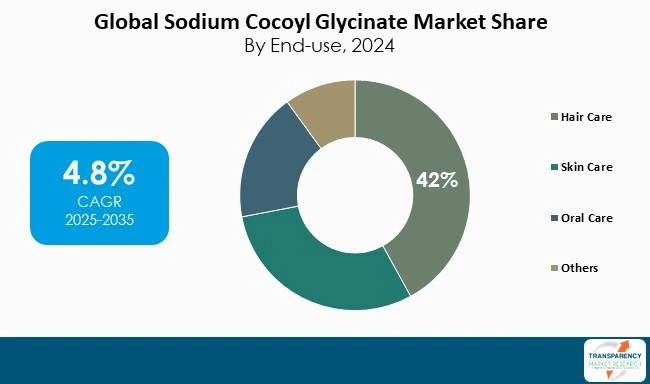

Hair care has a higher share of sodium cocoyl glycinate due to the growing demand for sulfate-free, gentle, and conditioning shampoos that help in maintaining scalp health and natural oils. Consumers have also been moving away from conventional surfactants or cleaning agents as they cause excessive dryness, irritation, or hair damage. There is also a growing shift toward premium natural hair care products. The use of sodium cocoyl glycinate in anti-dandruff products, due to its gentle and effective cleansing ability, will continue to drive high volume growth in this industry.

| Attribute | Detail |

|---|---|

| Leading Region |

|

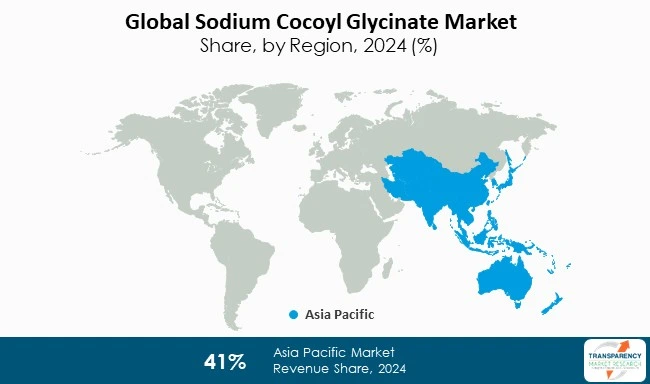

Asia Pacific is the leading market for Sodium Cocoyl Glycinate, having represented over 41% of global demand in 2024 propelled by a high pace of growth in personal care and cosmetic categories. There is growing consumer preference for mild, bio-based surfactants, which has driven adoption in shampoos, cleansing facial washes, and body washes in countries such as China, Japan, South Korea, and India. In addition to a growing middle class, consumer awareness of sustainable ingredients would create opportunities for growth within the Asia Pacific market, solidifying the Asia Pacific's dominance for growth in the global Sodium Cocoyl Glycinate market.

Sino Lion, Ajinomoto Co., Inc., Clariant AG, and Solvay S.A. have custom sodium cocoyl glycinate surfactants marketed for premium skincare, haircare, and personal wash products. They have portfolios rich in sulfate-free, mild, and eco-friendly cleansing options with high emphasis on natural ingredient sourcing, foaming, and dermatologist tested formulations that are aligned with the worldwide clean beauty movement.

Additionally, Wilmar International Ltd, Surface Chemical Industry Co. Ltd, STARCHEEM ENTERPRISES LTD, and Hebei Qida Biotech Co., Ltd play a major role in the consolidated sodium cocoyl glycinate market, with a competitive landscape governed by innovation and productivity.

| Attribute | Detail |

|---|---|

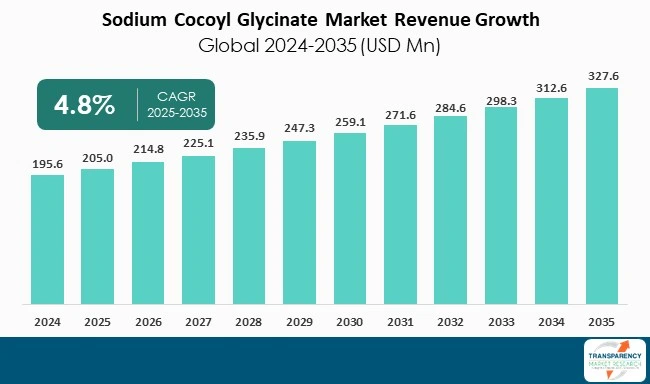

| Market Size Value in 2024 | US$ 195.6 Mn |

| Market Forecast Value in 2035 | US$ 327.6 Mn |

| Growth Rate (CAGR) | 4.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | Tons For Volume and US$ Mn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Form

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The sodium cocoyl glycinate market stood at US$ 195.6 Mn in 2024

The market is expected to grow at a CAGR of 4.8% from 2025 to 2035

Rising consumer preference for sulfate-free personal care products and increasing demand for natural, mild, and eco-friendly surfactants

Hair care held the largest share under end-use segment in 2024

Asia Pacific was the most lucrative region for the sodium cocoyl glycinate market in 2024

Wilmar International Ltd, Clariant, Innospec, ZXCHEM, Surface Chemical Industry Co. Ltd, STARCHEEM ENTERPRISES LTD., Hebei Qida Biotech Co., Ltd, Solvay, Galaxy, Sino Lion USA, Shoka Koreo Co., Ltd., and Ataman Kimya A.S.

Table 1 Global Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 2 Global Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 3 Global Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 4 Global Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 5 Global Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 6 Global Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 7 Global Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 8 Global Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 9 North America Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 10 North America Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 11 North America Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 12 North America Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 13 North America Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 14 North America Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 15 North America Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 16 North America Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 17 USA Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 18 USA Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 19 USA Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 20 USA Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 21 USA Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 22 USA Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 23 Canada Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 24 Canada Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 25 Canada Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 26 Canada Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 27 Canada Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 Canada Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 29 Europe Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 30 Europe Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 31 Europe Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 32 Europe Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 33 Europe Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 34 Europe Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 35 Europe Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 36 Europe Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 37 Germany Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 38 Germany Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 39 Germany Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 40 Germany Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 41 Germany Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 42 Germany Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 43 France Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 44 France Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 45 France Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 46 France Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 47 France Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 48 France Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 49 UK Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 50 UK Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 51 UK Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 UK Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 53 UK Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 UK Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 55 Italy Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 56 Italy Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 57 Italy Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 58 Italy Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 59 Italy Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 60 Italy Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 61 Spain Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 62 Spain Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 63 Spain Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 64 Spain Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 65 Spain Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 66 Spain Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 67 Russia & CIS Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 68 Russia & CIS Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 69 Russia & CIS Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 70 Russia & CIS Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 71 Russia & CIS Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 72 Russia & CIS Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 73 Rest of Europe Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 74 Rest of Europe Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 75 Rest of Europe Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 76 Rest of Europe Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 77 Rest of Europe Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Rest of Europe Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 79 Asia Pacific Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 80 Asia Pacific Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 81 Asia Pacific Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 82 Asia Pacific Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 83 Asia Pacific Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 84 Asia Pacific Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 85 Asia Pacific Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 86 Asia Pacific Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 87 China Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 88 China Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form 2020 to 2035

Table 89 China Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 90 China Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 91 China Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 92 China Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 93 Japan Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 94 Japan Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 95 Japan Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 96 Japan Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 97 Japan Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 98 Japan Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 99 India Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 100 India Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 101 India Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 102 India Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 103 India Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 104 India Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 105 India Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 106 India Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 107 ASEAN Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 108 ASEAN Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 109 ASEAN Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 110 ASEAN Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 111 ASEAN Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 112 ASEAN Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 113 Rest of Asia Pacific Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 114 Rest of Asia Pacific Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 115 Rest of Asia Pacific Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 116 Rest of Asia Pacific Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 117 Rest of Asia Pacific Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 118 Rest of Asia Pacific Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 119 Latin America Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 120 Latin America Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 121 Latin America Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 122 Latin America Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 123 Latin America Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 124 Latin America Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 125 Latin America Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 126 Latin America Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 127 Brazil Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 128 Brazil Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 129 Brazil Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 130 Brazil Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 131 Brazil Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 132 Brazil Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 133 Mexico Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 134 Mexico Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 135 Mexico Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 136 Mexico Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 137 Mexico Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 138 Mexico Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 139 Rest of Latin America Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 140 Rest of Latin America Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 141 Rest of Latin America Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 142 Rest of Latin America Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 143 Rest of Latin America Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 Rest of Latin America Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 145 Middle East & Africa Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 146 Middle East & Africa Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 147 Middle East & Africa Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 148 Middle East & Africa Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 149 Middle East & Africa Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 150 Middle East & Africa Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 151 Middle East & Africa Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 152 Middle East & Africa Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 153 GCC Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 154 GCC Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 155 GCC Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 156 GCC Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 157 GCC Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 158 GCC Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 159 South Africa Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 160 South Africa Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 161 South Africa Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 162 South Africa Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 163 South Africa Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 164 South Africa Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 165 Rest of Middle East & Africa Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 166 Rest of Middle East & Africa Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 167 Rest of Middle East & Africa Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 168 Rest of Middle East & Africa Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 169 Rest of Middle East & Africa Sodium Cocoyl Glycinate Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Rest of Middle East & Africa Sodium Cocoyl Glycinate Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Figure 1 Global Sodium Cocoyl Glycinate Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 2 Global Sodium Cocoyl Glycinate Market Attractiveness, by Form

Figure 3 Global Sodium Cocoyl Glycinate Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 4 Global Sodium Cocoyl Glycinate Market Attractiveness, by Application

Figure 5 Global Sodium Cocoyl Glycinate Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 6 Global Sodium Cocoyl Glycinate Market Attractiveness, by End-use

Figure 7 Global Sodium Cocoyl Glycinate Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 8 Global Sodium Cocoyl Glycinate Market Attractiveness, by Region

Figure 9 North America Sodium Cocoyl Glycinate Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 10 North America Sodium Cocoyl Glycinate Market Attractiveness, by Form

Figure 11 North America Sodium Cocoyl Glycinate Market Attractiveness, by Form

Figure 12 North America Sodium Cocoyl Glycinate Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 13 North America Sodium Cocoyl Glycinate Market Attractiveness, by Application

Figure 14 North America Sodium Cocoyl Glycinate Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 15 North America Sodium Cocoyl Glycinate Market Attractiveness, by End-use

Figure 16 North America Sodium Cocoyl Glycinate Market Attractiveness, by Country and Sub-region

Figure 17 Europe Sodium Cocoyl Glycinate Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 18 Europe Sodium Cocoyl Glycinate Market Attractiveness, by Form

Figure 19 Europe Sodium Cocoyl Glycinate Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 20 Europe Sodium Cocoyl Glycinate Market Attractiveness, by Application

Figure 21 Europe Sodium Cocoyl Glycinate Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 22 Europe Sodium Cocoyl Glycinate Market Attractiveness, by End-use

Figure 23 Europe Sodium Cocoyl Glycinate Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 24 Europe Sodium Cocoyl Glycinate Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Sodium Cocoyl Glycinate Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 26 Asia Pacific Sodium Cocoyl Glycinate Market Attractiveness, by Form

Figure 27 Asia Pacific Sodium Cocoyl Glycinate Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 28 Asia Pacific Sodium Cocoyl Glycinate Market Attractiveness, by Application

Figure 29 Asia Pacific Sodium Cocoyl Glycinate Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 30 Asia Pacific Sodium Cocoyl Glycinate Market Attractiveness, by End-use

Figure 31 Asia Pacific Sodium Cocoyl Glycinate Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 32 Asia Pacific Sodium Cocoyl Glycinate Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Sodium Cocoyl Glycinate Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 34 Latin America Sodium Cocoyl Glycinate Market Attractiveness, by Form

Figure 35 Latin America Sodium Cocoyl Glycinate Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 36 Latin America Sodium Cocoyl Glycinate Market Attractiveness, by Application

Figure 37 Latin America Sodium Cocoyl Glycinate Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 38 Latin America Sodium Cocoyl Glycinate Market Attractiveness, by End-use

Figure 39 Latin America Sodium Cocoyl Glycinate Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 40 Latin America Sodium Cocoyl Glycinate Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Sodium Cocoyl Glycinate Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 42 Middle East & Africa Sodium Cocoyl Glycinate Market Attractiveness, by Form

Figure 43 Middle East & Africa Sodium Cocoyl Glycinate Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 44 Middle East & Africa Sodium Cocoyl Glycinate Market Attractiveness, by Application

Figure 45 Middle East & Africa Sodium Cocoyl Glycinate Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 46 Middle East & Africa Sodium Cocoyl Glycinate Market Attractiveness, by End-use

Figure 47 Middle East & Africa Sodium Cocoyl Glycinate Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 48 Middle East & Africa Sodium Cocoyl Glycinate Market Attractiveness, by Country and Sub-region