Reports

Reports

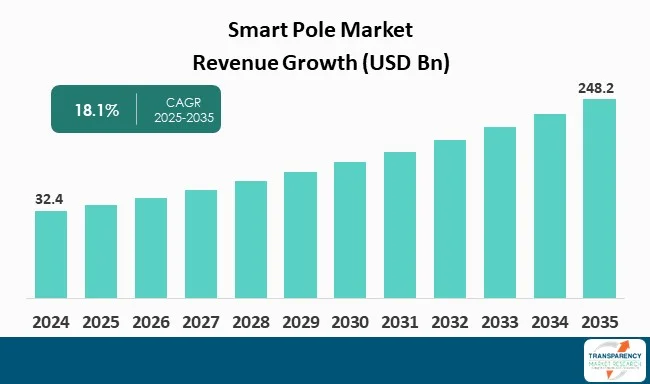

The global smart pole market size was valued at US$ 32.4 Bn in 2024 and is projected to reach US$ 248.2 Bn by 2035, expanding at a CAGR of 18.1% from 2025 to 2035. The market growth is driven by increased public safety and surveillance needs; and government regulations and support for smart infrastructure.

The smart pole market is growing at a rapid pace due to the increasing demand for energy-efficient and sustainable infrastructure in urban areas. The world is witnessing population explosion, which is increasing the consumption of energy and creating needs for public services solutions, thereby limiting the power usage. Smart poles are providing solutions for urban areas to save on electricity costs and lessen carbon footprints with LED lighting and adaptive control systems.

The ongoing trends in the smart pole market showcase innovation and sustainability. These days, smart poles are manufactured with modular components, which helps it to upgrade and customize particular urban requirements. Cities are moving toward sustainable and renewable energy to reduce the operational cost. Artificial intelligence (AI) and machine learning technologies are being used in the sensors and cameras, which analyze and process the data to make smarter decisions and improve quality of maintenance.

Companies in the smart pole industry are making investments in research and development activities to improve product functions. Many are entering into partnerships with telecommunications operators, city governments, and technology providers to enable cities to implement smart poles at scale and integrate them into existing infrastructure.

A smart pole is a multi-functional street light pole that integrates technologies like LED lighting, Wi-Fi hotspots, CCTV cameras, environmental sensors, electric vehicle (EV) charging stations, communication devices, etc. These poles help to increase management of the city, public safety, and connectivity. Smart poles can be categorized based on their functions that includes lighting smart poles that give energy-efficient LED lightning with some controls.

Smart poles are utilized across many different industries. They are primarily used by urban governments to help manage streets and keep people safe. Telecom companies will use smart poles to provide a better wireless network and implement their 5G technology. Transportation departments, including traffic departments, use smart poles to monitor traffic and improve traffic flow.

Energy and utility companies incorporate smart poles into their systems to monitor energy use and improve street lighting. Retailers and businesses use smart poles to provide better internet access and facilitate digital advertising. Environmental monitoring groups will use smart poles to measure pollution and other environmental measures.

Smart poles have many different applications: adaptive street lighting with all the benefits of energy savings; public safety through features such as video surveillance, and emergency communications; wireless network access points improving connectivity; traffic management using built-in sensors and/or cameras; and the collection of valuable real-time environmental data for air and noise pollution. Additionally, smart poles can support effective digital signage and smart advertising platforms. Smart poles are now becoming an integral part of smart cities.

| Attribute | Detail |

|---|---|

| Smart Pole Market Drivers |

|

Growth in the smart pole market can be attributed to the increasing need for managed public safety as well as enhancements in public safety activities and surveillance in metropolitan areas around the world. As cities become more crowded and complex, city officials and administrators need to deploy advanced technologies to simultaneously monitor more public and public areas such as parks, sidewalks, and parking lots.

Smart poles are designed with high-definition CCTV cameras, motion sensors, and emergency communication devices, which support real-time monitoring. With the situational awareness in-place, law enforcement and emergency personnel can use their personnel to deter crime, reinforce local traffic laws at moment of the incident, assess the current situation, and appropriately respond to car accidents and public disturbances more rapidly than if the emergency first responders had to rely on existing systems to inform them of an occurrence.

Furthermore, smart poles can leverage IoT devices such as facial recognition systems, autonomy plate readers, and automatic alerts to be used alone or in concert with the other monitored public safety devices that can support user mobility or high-resolution capabilities to figure out crime and public safety conditions and enhancements on an exigent basis for the urban observer or citizen.

Government support and regulatory initiatives are also important contributors to drive the smart pole market. Many national and local governments have introduced various policies and funding schemes to promote smart infrastructure development in the context of their wider smart cities strategies. This is often done through financial incentives, public-private partnerships, and government-funded programs promoting smart city missions, all of which help to provide better opportunities for the adoption and use of smart technologies within urban planning.

Regulations require energy-efficient lighting, environmental monitoring, and connectivity, which can also help drive the uptake of smart poles. The role of governments in developing technical standards, mandating legislation on data privacy, and developing infrastructure standards and guidelines also shapes the partnerships that can be developed and the way smart pole solutions are conceived and delivered by cities.

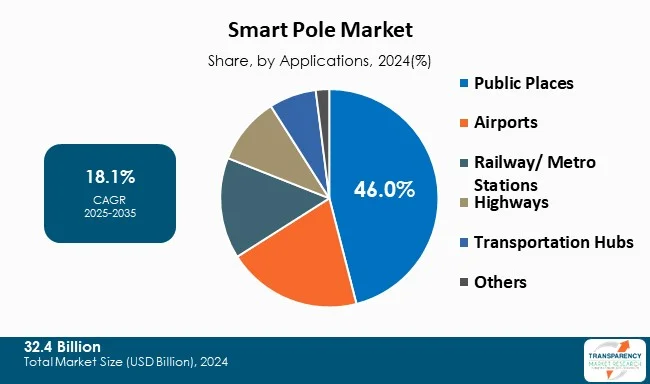

The public places segment is leading the global smart pole market with 46.0% due to the need for smart infrastructure in crowded urban spaces like city centers, parks, squares, and recreational spaces, when these areas will have large gatherings and constant pedestrian traffic. Smart poles in a public place are crucial for public officials to be able to implement public safety measures, working lights, connectivity, and surveillance measures in regards to the areas that are likely to be congested.

Concerned cities will purchase smart poles in public places to incorporate adaptive LED lighting, real time video surveillance, emergency communications, environmental sensors, and free public Wi-Fi. Cities have a vested interest to locate smart poles in public places to provide a better experience for their citizens in relation to public safety, even greater saving in energy consumption, and the overall citizen experience.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific is leading region for global smart pole market with 31.2%, due to growing urbanization and government support across the economies like China, India, Japan, and South Korea. Government of these countries are investing in infrastructure to meet ongoing population growth, traffic congestion, and energy efficiency aspects within the context of modern demands from sophisticated metropolitan areas.

The recent launch of 5G in the Asia Pacific through global players has further increased demand for smart poles as communication convergent multi-use solutions. Additionally, APAC has a greater presence of key technology facilitators and lower installation rates than the other global markets, which contributes to their overall leadership position.

Companies are investing in R&D for enhancing smart pole technologies and partnering with telecom operators and cities for large-scale deployments. They focus on sustainability, modular designs, and integrated smart city solutions combining lighting, surveillance, and communication.

Hapco, Signify Holding, Delta Electronics, Inc., Siteco GmbH, OMNIFLOW, Kesslec, Wipro Lighting, Telensa, Huawei Technologies Co., Ltd., Leica Geosystems AG, Sunna Design, Ubicquia, Inc., Sansi LED, Norsk Hydro ASA, and Digi International Inc. are the key players in global market.

Each of these players has been profiled in the smart pole market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 32.4 Bn |

| Forecast Value in 2035 | US$ 248.2 Bn |

| CAGR | 18.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentations | Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The smart pole market was valued at US$ 32.4 Bn in 2024

The smart pole market is projected to reach at US$ 248.2 Bn by the end of 2035

Increased public safety & surveillance needs, and government regulations & support for smart infrastructure are few factors driving the market

The CAGR is anticipated to be 18.1% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

Hapco, Signify Holding, Delta Electronics, Inc., Siteco GmbH, OMNIFLOW, Kesslec, Wipro Lighting, Telensa, Huawei Technologies Co., Ltd., Leica Geosystems AG, Sunna Design, Ubicquia, Inc., Sansi LED, Norsk Hydro ASA, Digi International Inc., and others

Table 01: Global Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 02: Global Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 03: Global Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 04: Global Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 05: Global Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 06: Global Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 07: Global Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 08: Global Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 09: Global Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 10: Global Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 11: Global Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 12: Global Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 13: Global Smart Pole Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 14: Global Smart Pole Market Volume (Units) Forecast, by Region, 2020 to 2035

Table 15: North America Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 16: North America Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 17: North America Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 18: North America Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 19: North America Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 20: North America Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 21: North America Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 22: North America Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 23: North America Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 24: North America Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 25: North America Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 26: North America Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 27: North America Smart Pole Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 28: North America Smart Pole Market Volume (Units) Forecast, by Country, 2020 to 2035

Table 29: U.S. Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 30: U.S. Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 31: U.S. Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 32: U.S. Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 33: U.S. Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 34: U.S. Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 35: U.S. Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 36: U.S. Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 37: U.S. Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 38: U.S. Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 39: U.S. Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 40: U.S. Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 41: Canada Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 42: Canada Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 43: Canada Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 44: Canada Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 45: Canada Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 46: Canada Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 47: Canada Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 48: Canada Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 49: Canada Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 50: Canada Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 51: Canada Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 52: Canada Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 53: Europe Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 54: Europe Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 55: Europe Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 56: Europe Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 57: Europe Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 58: Europe Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 59: Europe Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 60: Europe Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 61: Europe Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 62: Europe Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 63: Europe Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 64: Europe Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 65: Europe Smart Pole Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 66: Europe Smart Pole Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 67: Germany Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 68: Germany Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 69: Germany Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 70: Germany Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 71: Germany Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 72: Germany Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 73: Germany Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 74: Germany Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 75: Germany Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 76: Germany Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 77: Germany Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 78: Germany Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 79: U.K. Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 80: U.K. Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 81: U.K. Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 82: U.K. Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 83: U.K. Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 84: U.K. Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 85: U.K. Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 86: U.K. Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 87: U.K. Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 88: U.K. Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 89: U.K. Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 90: U.K. Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 91: France Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 92: France Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 93: France Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 94: France Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 95: France Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 96: France Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 97: France Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 98: France Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 99: France Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 100: France Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 101: France Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 102: France Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 103: Italy Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 104: Italy Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 105: Italy Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 106: Italy Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 107: Italy Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 108: Italy Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 109: Italy Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 110: Italy Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 111: Italy Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 112: Italy Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 113: Italy Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 114: Italy Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 115: Spain Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 116: Spain Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 117: Spain Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 118: Spain Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 119: Spain Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 120: Spain Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 121: Spain Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 122: Spain Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 123: Spain Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 124: Spain Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 125: Spain Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 126: Spain Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 127: Switzerland Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 128: Switzerland Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 129: Switzerland Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 130: Switzerland Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 131: Switzerland Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 132: Switzerland Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 133: Switzerland Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 134: Switzerland Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 135: Switzerland Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 136: Switzerland Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 137: Switzerland Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 138: Switzerland Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 139: The Netherlands Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 140: The Netherlands Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 141: The Netherlands Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 142: The Netherlands Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 143: The Netherlands Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 144: The Netherlands Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 145: The Netherlands Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 146: The Netherlands Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 147: The Netherlands Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 148: The Netherlands Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 149: The Netherlands Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 150: The Netherlands Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 151: Rest of Europe Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 152: Rest of Europe Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 153: Rest of Europe Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 154: Rest of Europe Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 155: Rest of Europe Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 156: Rest of Europe Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 157: Rest of Europe Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 158: Rest of Europe Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 159: Rest of Europe Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 160: Rest of Europe Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 161: Rest of Europe Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 162: Rest of Europe Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 163: Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 164: Asia Pacific Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 165: Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 166: Asia Pacific Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 167: Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 168: Asia Pacific Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 169: Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 170: Asia Pacific Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 171: Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 172: Asia Pacific Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 173: Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 174: Asia Pacific Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 175: Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 176: Asia Pacific Smart Pole Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 177: China Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 178: China Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 179: China Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 180: China Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 181: China Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 182: China Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 183: China Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 184: China Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 185: China Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 186: China Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 187: China Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 188: China Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 189: Japan Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 190: Japan Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 191: Japan Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 192: Japan Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 193: Japan Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 194: Japan Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 195: Japan Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 196: Japan Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 197: Japan Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 198: Japan Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 199: Japan Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 200: Japan Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 201: India Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 202: India Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 203: India Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 204: India Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 205: India Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 206: India Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 207: India Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 208: India Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 209: India Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 210: India Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 211: India Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 212: India Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 213: South Korea Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 214: South Korea Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 215: South Korea Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 216: South Korea Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 217: South Korea Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 218: South Korea Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 219: South Korea Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 220: South Korea Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 221: South Korea Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 222: South Korea Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 223: South Korea Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 224: South Korea Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 225: Australia and New Zealand Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 226: Australia and New Zealand Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 227: Australia and New Zealand Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 228: Australia and New Zealand Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 229: Australia and New Zealand Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 230: Australia and New Zealand Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 231: Australia and New Zealand Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 232: Australia and New Zealand Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 233: Australia and New Zealand Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 234: Australia and New Zealand Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 235: Australia and New Zealand Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 236: Australia and New Zealand Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 237: Rest of Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 238: Rest of Asia Pacific Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 239: Rest of Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 240: Rest of Asia Pacific Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 241: Rest of Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 242: Rest of Asia Pacific Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 243: Rest of Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 244: Rest of Asia Pacific Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 245: Rest of Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 246: Rest of Asia Pacific Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 247: Rest of Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 248: Rest of Asia Pacific Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 249: Latin America Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 250: Latin America Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 251: Latin America Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 252: Latin America Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 253: Latin America Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 254: Latin America Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 255: Latin America Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 256: Latin America Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 257: Latin America Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 258: Latin America Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 259: Latin America Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 260: Latin America Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 261: Latin America Smart Pole Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 262: Latin America Smart Pole Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 263: Brazil Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 264: Brazil Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 265: Brazil Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 266: Brazil Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 267: Brazil Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 268: Brazil Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 269: Brazil Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 270: Brazil Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 271: Brazil Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 272: Brazil Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 273: Brazil Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 274: Brazil Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 275: Mexico Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 276: Mexico Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 277: Mexico Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 278: Mexico Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 279: Mexico Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 280: Mexico Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 281: Mexico Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 282: Mexico Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 283: Mexico Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 284: Mexico Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 285: Mexico Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 286: Mexico Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 287: Argentina Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 288: Argentina Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 289: Argentina Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 290: Argentina Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 291: Argentina Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 292: Argentina Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 293: Argentina Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 294: Argentina Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 295: Argentina Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 296: Argentina Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 297: Argentina Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 298: Argentina Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 299: Rest of Latin America Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 300: Rest of Latin America Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 301: Rest of Latin America Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 302: Rest of Latin America Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 303: Rest of Latin America Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 304: Rest of Latin America Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 305: Rest of Latin America Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 306: Rest of Latin America Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 307: Rest of Latin America Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 308: Rest of Latin America Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 309: Rest of Latin America Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 310: Rest of Latin America Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 311: Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 312: Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 313: Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 314: Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 315: Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 316: Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 317: Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 318: Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 319: Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 320: Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 321: Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 322: Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 323: Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 324: Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 325: GCC Countries Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 326: GCC Countries Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 327: GCC Countries Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 328: GCC Countries Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 329: GCC Countries Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 330: GCC Countries Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 331: GCC Countries Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 332: GCC Countries Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 333: GCC Countries Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 334: GCC Countries Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 335: GCC Countries Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 336: GCC Countries Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 337: South Africa Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 338: South Africa Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 339: South Africa Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 340: South Africa Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 341: South Africa Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 342: South Africa Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 343: South Africa Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 344: South Africa Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 345: South Africa Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 346: South Africa Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 347: South Africa Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 348: South Africa Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Table 349: Rest of Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 350: Rest of Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 351: Rest of Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Hardware, 2020 to 2035

Table 352: Rest of Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Hardware, 2020 to 2035

Table 353: Rest of Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Software, 2020 to 2035

Table 354: Rest of Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Software, 2020 to 2035

Table 355: Rest of Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Installation Type, 2020 to 2035

Table 356: Rest of Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Installation Type, 2020 to 2035

Table 357: Rest of Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Connectivity, 2020 to 2035

Table 358: Rest of Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Connectivity, 2020 to 2035

Table 359: Rest of Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, by Applications, 2020 to 2035

Table 360: Rest of Middle East and Africa Smart Pole Market Volume (Units) Forecast, by Applications, 2020 to 2035

Figure 01: Global Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 03: Global Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 04: Global Smart Pole Market Revenue (US$ Mn), by Hardware, 2020 to 2035

Figure 05: Global Smart Pole Market Revenue (US$ Mn), by Software, 2020 to 2035

Figure 06: Global Smart Pole Market Revenue (US$ Mn), by Services, 2020 to 2035

Figure 07: Global Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 08: Global Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 09: Global Smart Pole Market Revenue (US$ Mn), by New Installation, 2020 to 2035

Figure 10: Global Smart Pole Market Revenue (US$ Mn), by Retrofit Installation, 2020 to 2035

Figure 11: Global Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 12: Global Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 13: Global Smart Pole Market Revenue (US$ Mn), by Cellular Access Connectivity (3G, 4G, 5G), 2020 to 2035

Figure 14: Global Smart Pole Market Revenue (US$ Mn), by WiFi Connectivity, 2020 to 2035

Figure 15: Global Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 16: Global Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 17: Global Smart Pole Market Revenue (US$ Mn), by Public Places, 2020 to 2035

Figure 18: Global Smart Pole Market Revenue (US$ Mn), by Airports, 2020 to 2035

Figure 19: Global Smart Pole Market Revenue (US$ Mn), by Railway/ Metro Stations, 2020 to 2035

Figure 20: Global Smart Pole Market Revenue (US$ Mn), by Highways, 2020 to 2035

Figure 21: Global Smart Pole Market Revenue (US$ Mn), by Transportation Hubs, 2020 to 2035

Figure 22: Global Smart Pole Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 23: Global Smart Pole Market Value Share Analysis, by Region, 2024 and 2035

Figure 24: Global Smart Pole Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 25: North America Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 26: North America Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 27: North America Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 28: North America Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 29: North America Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 30: North America Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 31: North America Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 32: North America Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 33: North America Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 34: North America Smart Pole Market Value Share Analysis, by Country, 2024 and 2035

Figure 35: North America Smart Pole Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 36: U.S. Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 37: U.S. Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 38: U.S. Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 39: U.S. Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 40: U.S. Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 41: U.S. Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 42: U.S. Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 43: U.S. Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 44: U.S. Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 45: Canada Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 46: Canada Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 47: Canada Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 48: Canada Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 49: Canada Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 50: Canada Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 51: Canada Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 52: Canada Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 53: Canada Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 54: Europe Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 55: Europe Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 56: Europe Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 57: Europe Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 58: Europe Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 59: Europe Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 60: Europe Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 61: Europe Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 62: Europe Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 63: Europe Smart Pole Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 64: Europe Smart Pole Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 65: Germany Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 66: Germany Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 67: Germany Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 68: Germany Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 69: Germany Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 70: Germany Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 71: Germany Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 72: Germany Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 73: Germany Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 74: U.K. Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 75: U.K. Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 76: U.K. Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 77: U.K. Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 78: U.K. Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 79: U.K. Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 80: U.K. Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 81: U.K. Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 82: U.K. Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 83: France Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 84: France Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 85: France Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 86: France Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 87: France Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 88: France Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 89: France Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 90: France Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 91: France Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 92: Italy Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 93: Italy Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 94: Italy Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 95: Italy Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 96: Italy Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 97: Italy Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 98: Italy Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 99: Italy Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 100: Italy Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 101: Spain Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 102: Spain Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 103: Spain Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 104: Spain Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 105: Spain Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 106: Spain Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 107: Spain Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 108: Spain Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 109: Spain Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 110: Switzerland Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 111: Switzerland Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 112: Switzerland Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 113: Switzerland Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 114: Switzerland Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 115: Switzerland Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 116: Switzerland Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 117: Switzerland Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 118: Switzerland Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 119: The Netherlands Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 120: The Netherlands Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 121: The Netherlands Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 122: The Netherlands Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 123: The Netherlands Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 124: The Netherlands Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 125: The Netherlands Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 126: The Netherlands Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 127: The Netherlands Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 128: Rest of Europe Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 129: Rest of Europe Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 130: Rest of Europe Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 131: Rest of Europe Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 132: Rest of Europe Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 133: Rest of Europe Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 134: Rest of Europe Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 135: Rest of Europe Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 136: Rest of Europe Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 137: Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 138: Asia Pacific Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 139: Asia Pacific Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 140: Asia Pacific Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 141: Asia Pacific Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 142: Asia Pacific Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 143: Asia Pacific Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 144: Asia Pacific Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 145: Asia Pacific Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 146: Asia Pacific Smart Pole Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 147: Asia Pacific Smart Pole Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 148: China Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 149: China Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 150: China Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 151: China Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 152: China Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 153: China Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 154: China Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 155: China Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 156: China Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 157: Japan Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 158: Japan Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 159: Japan Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 160: Japan Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 161: Japan Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 162: Japan Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 163: Japan Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 164: Japan Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 165: Japan Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 166: India Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 167: India Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 168: India Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 169: India Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 170: India Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 171: India Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 172: India Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 173: India Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 174: India Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 175: South Korea Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 176: South Korea Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 177: South Korea Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 178: South Korea Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 179: South Korea Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 180: South Korea Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 181: South Korea Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 182: South Korea Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 183: South Korea Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 184: Australia and New Zealand Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 185: Australia and New Zealand Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 186: Australia and New Zealand Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 187: Australia and New Zealand Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 188: Australia and New Zealand Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 189: Australia and New Zealand Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 190: Australia and New Zealand Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 191: Australia and New Zealand Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 192: Australia and New Zealand Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 193: Rest of Asia Pacific Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 194: Rest of Asia Pacific Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 195: Rest of Asia Pacific Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 196: Rest of Asia Pacific Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 197: Rest of Asia Pacific Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 198: Rest of Asia Pacific Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 199: Rest of Asia Pacific Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 200: Rest of Asia Pacific Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 201: Rest of Asia Pacific Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 202: Latin America Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 203: Latin America Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 204: Latin America Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 205: Latin America Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 206: Latin America Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 207: Latin America Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 208: Latin America Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 209: Latin America Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 210: Latin America Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 211: Latin America Smart Pole Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 212: Latin America Smart Pole Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 213: Brazil Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 214: Brazil Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 215: Brazil Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 216: Brazil Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 217: Brazil Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 218: Brazil Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 219: Brazil Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 220: Brazil Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 221: Brazil Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 222: Mexico Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 223: Mexico Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 224: Mexico Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 225: Mexico Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 226: Mexico Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 227: Mexico Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 228: Mexico Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 229: Mexico Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 230: Mexico Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 231: Argentina Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 232: Argentina Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 233: Argentina Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 234: Argentina Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 235: Argentina Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 236: Argentina Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 237: Argentina Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 238: Argentina Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 239: Argentina Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 240: Rest of Latin America Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 241: Rest of Latin America Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 242: Rest of Latin America Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 243: Rest of Latin America Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 244: Rest of Latin America Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 245: Rest of Latin America Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 246: Rest of Latin America Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 247: Rest of Latin America Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 248: Rest of Latin America Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 249: Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 250: Middle East and Africa Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 251: Middle East and Africa Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 252: Middle East and Africa Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 253: Middle East and Africa Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 254: Middle East and Africa Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 255: Middle East and Africa Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 256: Middle East and Africa Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 257: Middle East and Africa Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 258: Middle East and Africa Smart Pole Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 259: Middle East and Africa Smart Pole Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 260: GCC Countries Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 261: GCC Countries Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 262: GCC Countries Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 263: GCC Countries Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 264: GCC Countries Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 265: GCC Countries Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 266: GCC Countries Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 267: GCC Countries Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 268: GCC Countries Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 269: South Africa Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 270: South Africa Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 271: South Africa Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 272: South Africa Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 273: South Africa Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 274: South Africa Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 275: South Africa Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 276: South Africa Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 277: South Africa Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035

Figure 278: Rest of Middle East and Africa Smart Pole Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 279: Rest of Middle East and Africa Smart Pole Market Value Share Analysis, by Component, 2024 and 2035

Figure 280: Rest of Middle East and Africa Smart Pole Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 281: Rest of Middle East and Africa Smart Pole Market Value Share Analysis, by Installation Type, 2024 and 2035

Figure 282: Rest of Middle East and Africa Smart Pole Market Attractiveness Analysis, by Installation Type, 2025 to 2035

Figure 283: Rest of Middle East and Africa Smart Pole Market Value Share Analysis, by Connectivity, 2024 and 2035

Figure 284: Rest of Middle East and Africa Smart Pole Market Attractiveness Analysis, by Connectivity, 2025 to 2035

Figure 285: Rest of Middle East and Africa Smart Pole Market Value Share Analysis, by Applications, 2024 and 2035

Figure 286: Rest of Middle East and Africa Smart Pole Market Attractiveness Analysis, by Applications, 2025 to 2035