Reports

Reports

Analysts’ Viewpoint on Seismic Survey Equipment Market Scenario

Companies in the seismic survey equipment market are focusing on high-growth end-use industries such as oil & gas and metal & mining to keep their businesses growing post the COVID-19 pandemic. As such, the market is estimated to witness growth, owing to the rising demand from the oil & gas industry. Rapid depleting sources of oil & gas is fueling the need to finding new sources for oil, gas, metals, minerals, etc. The demand for geophysical services is expected to increase in the oil & gas industry, which is likely to affect a major change to the global market for seismic survey equipment. Seismic surveys are conducted by adopting an array of energy sources and sensors or receivers in an area of interest. Manufacturers should tap into incremental opportunities in seismic survey technology to broaden their revenue streams.

Seismic survey is a method of exploring subterranean structure related to exploration for petroleum, natural gas, and mineral deposits. The procedure is based on determining the time interval that elapses between the initiation of a seismic wave at a selected shot point (the location where an explosion generates seismic waves) and the arrival of reflected or refracted impulses at one or more seismic detectors. Seismic equipment offers detailed images of the sub-surface and enables detection of both lateral and depth variations, which drives the global seismic survey equipment market.

Consistent rise in oil & gas exploration activities across the globe by using seismic survey technology, which enhances the search and drives the overall search progression at the higher end, is estimated to boost the global seismic survey equipment market during the forecast period.

Seismic surveying is one of the most effective ways to explore rock and subsoil. It is ideal for finding groundwater, oil, and useful minerals. Common applications of seismic surveys are depth to bedrock, site investigation, geotechnical properties, groundwater exploration, and hydrocarbon and coal exploration.

A seismic survey for the subsurface study is responsible for induced seismicity and emission to the environment. In shale gas exploration, initially, a small quantity of water is used for drilling a bore well, and later a measured amount is used. The seismic survey equipment used during the hydraulic fracturing for the study of environment propels the demand for the global seismic survey equipment.

Moreover, road infrastructure is used for the transportation of water and heavy equipment. In fracking fluid, chemicals are added, and the flow back water is highly contaminated. There is a need to measure hazard in gas exploration, which in turn is expected to boost the demand for seismic survey equipment.

Earthquake is one of the major hazards during hydraulic fracturing. Monitoring of induced seismicity is necessary during hydraulic fracturing, and a proper logbook should be maintained by the operator. Monitoring is also necessary while injecting flow backwater into deep wells. These are two major hazards for induced seismicity, which in turn propel the global seismic survey equipment market.

Miniaturization of electronics, such as seismic sensors, is estimated to offer lucrative opportunities for the seismic survey equipment market during the forecast period. However, stringent government rules and regulations and the high cost of the seismic survey equipment may hamper the seismic survey equipment market.

The demand for seismic survey equipment is expected to rise substantially, owing to the rising adoption of seismic surveys technologies such as 3D imaging and data acquisitions, among others, in the brownfield projects where the development work is carried out in the place where prior work has been done and the field is in rebuilt, modify mode. Development and deployment of such a technology are expected to offer lucrative opportunities for the global seismic survey equipment market.

Quick progressions and redevelopment in the Brownfield project site, which has been used previously but is lying vacant or unused now propels the demand for the global seismic survey equipment market. Such Brownfield project sites are found mostly in Western countries and have been used for oil refineries, railroads, gas stations, or heavy manufacturing plants. In such redevelopment sites, seismic survey equipment provides detailed images of the sub-surface, which offers detection of both lateral and depth variations, and direct detection of hydrocarbon and delineates stratigraphically. These factors are projected to propel the seismic survey equipment market during the forecast period.

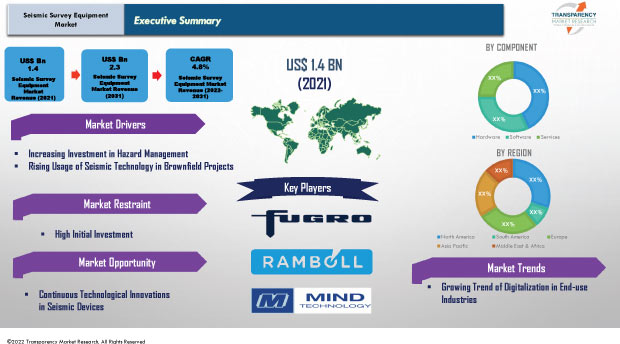

In terms of component, the global seismic survey equipment market has been segregated into hardware, software, and services. Hardware segment held the highest share in the market in 2021, owing to growing technological advancements in equipment and rising oil & gas exploration activities across the globe. Seismic survey equipment include various detectors such as hydrophones, geophones, and various seismic sources such as Vibroseis, air gun, and dynamite to generate the seismic waves.

Moreover, software is one of the fastest emerging segments in the seismic survey equipment market, owing to growing digitalization in the industry and adoption of innovative solution from end-use industries. Furthermore, some of the major market participants also provide solution in the market and contribute to the market growth such as Sercel and Kappa Offshore Solutions jointly launch PIKSEL in March 2021. PIKSEL draws on the low noise operation of its hydrophone design as well as an upgrading rigging and handling system that reduced vibration. For highest broadband imaging, PIKSEL used for to ensure the most accurate and noise-free signal possible.

In terms of application, the global seismic survey equipment has been classified into land, marine, and air-borne. Marine is expected to be the fastest growing application segment over the forecast period. For marine surveys, the instrumentation is generally a towed transmitter, and an array of geophones are commonly used, along with various equipment, including water guns, air gun, sparkers, boomers, and chirp systems.

Seismic surveys use reflected sound waves to generate a “CAT scan” of the Earth's subsurface. This survey is carried out to locate ground water, investigate area for landfills, and characterize how an area will shake during an earthquake; however, they are majorly used for oil & gas exploration.

The seismic survey equipment market in North America is expected to expand during the forecast period, owing to the presence of key market players, technological advancements, and countries, such as the U.S., Canada, and Mexico who are offering lucrative opportunities to manufacturers on a long-term basis in the region. North America held a prominent market share due to increasing government initiatives and rising demand, especially from aerospace & defense, oil & gas, building, and construction industries.

Additionally, the Government of Mexico has offered several blocks for exploration over the past few years, as the liberalization of the upstream sector led to the entry of 70 oil & gas vendors in the country after several biddings for blocks, which in turn is boosting the regional market and driving the global seismic survey equipment market. The U.S. accounted for a prominent share, in terms of value, among all countries.

Asia Pacific held the second-largest share of the global market, as Asia Pacific offers lucrative opportunities due to increasing investments of various governments in smart city projects, which, in turn, is driving the seismic survey equipment market.

Middle East & Africa is a larger seismic survey equipment market as compared to Latin America; however, the market in Latin America is estimated to grow at a rapid pace as compared to the market in Middle East & Africa.

The global seismic survey equipment market is consolidated with a small number of large-scale vendors controlling the majority of the market share. Key firms are spending significantly on comprehensive research and development, and new product development. Expansion of product portfolios and mergers & acquisitions are major strategies adopted by the key players. China National Petroleum Corporation, Fugro N.V., INTERNATIONAL LEADING TECHNOLOGIES TRANSFER COMPANY LIMITED, Mitcham Industries, Inc., Petroleum Geo-Services (PGS), Ramboll Group A/S, Schlumberger Limited, Seismic Survey Equipment, Sercel, and Wireless Seismic, Inc. are the prominent entities operating in this market.

Each of these players has been profiled in the Seismic Survey Equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.4 Bn |

|

Market Forecast Value in 2031 |

US$ 2.3 Bn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The revenue of seismic survey equipment stood over US$ 1.4 Bn in 2021

The seismic survey equipment market is expected to grow at a CAGR of 4.8% by 2031

The market size for seismic survey equipment market will be more than US$ 2.3 Bn in 2031

Prominent players operating in the seismic survey equipment market include China National Petroleum Corporation, Fugro N.V., INTERNATIONAL LEADING TECHNOLOGIES TRANSFER COMPANY LIMITED, Mitcham Industries, Inc., Petroleum Geo-Services (PGS), Ramboll Group A/S, Schlumberger Limited, Seismic Survey Equipment, Sercel, and Wireless Seismic, Inc.

In 2021, the U.S. catered approximately 17% of share of the seismic survey equipment market

Based on component, hardware segment is estimated to hold around 43% of market share in 2021

Growing digitalization in industries is the prominent trend in the seismic survey equipment market

North America region is more lucrative in seismic survey equipment market

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Seismic Survey Equipment Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Seismic Equipment Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Seismic Survey Equipment Market Analysis, by Component

5.1. Seismic Survey Equipment Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

5.1.1. Hardware

5.1.2. Software

5.1.3. Services

5.2. Market Attractiveness Analysis, by Component

6. Seismic Survey Equipment Market Analysis, by Application

6.1. Seismic Survey Equipment Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

6.1.1. Land

6.1.2. Marine

6.1.3. Air-Borne

6.2. Market Attractiveness Analysis, by Application

7. Seismic Survey Equipment Market Analysis, by End-use Industry

7.1. Seismic Survey Equipment Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

7.1.1. Aerospace & Defense

7.1.2. Oil and Gas

7.1.3. Metal & Mining

7.1.4. Building & Construction

7.1.5. Others (Energy & Power, Water and Wastewater, etc.)

7.2. Market Attractiveness Analysis, by End-use Industry

8. Seismic Survey Equipment Market Analysis and Forecast, by Region

8.1. Seismic Survey Equipment Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Seismic Survey Equipment Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Seismic Survey Equipment Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

9.3.1. Hardware

9.3.2. Software

9.3.3. Services

9.4. Seismic Survey Equipment Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

9.4.1. Land

9.4.2. Marine

9.4.3. Air-Borne

9.5. Seismic Survey Equipment Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

9.5.1. Aerospace & Defense

9.5.2. Oil and Gas

9.5.3. Metal & Mining

9.5.4. Building & Construction

9.5.5. Others (Energy & Power, Water and Wastewater, etc.)

9.6. Seismic Survey Equipment Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Component

9.7.2. By Application

9.7.3. By End-use Industry

9.7.4. By Country/Sub-region

10. Europe Seismic Survey Equipment Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Seismic Survey Equipment Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

10.3.1. Hardware

10.3.2. Software

10.3.3. Services

10.4. Seismic Survey Equipment Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

10.4.1. Land

10.4.2. Marine

10.4.3. Air-Borne

10.5. Seismic Survey Equipment Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

10.5.1. Aerospace & Defense

10.5.2. Oil and Gas

10.5.3. Metal & Mining

10.5.4. Building & Construction

10.5.5. Others (Energy & Power, Water and Wastewater, etc.)

10.6. Seismic Survey Equipment Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.6.1. The U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Italy

10.6.5. Russia

10.6.6. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Component

10.7.2. By Application

10.7.3. By End-use Industry

10.7.4. By Country/Sub-region

11. Asia Pacific Seismic Survey Equipment Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Seismic Survey Equipment Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

11.3.1. Hardware

11.3.2. Software

11.3.3. Services

11.4. Seismic Survey Equipment Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

11.4.1. Land

11.4.2. Marine

11.4.3. Air-Borne

11.5. Seismic Survey Equipment Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

11.5.1. Aerospace & Defense

11.5.2. Oil and Gas

11.5.3. Metal & Mining

11.5.4. Building & Construction

11.5.5. Others (Energy & Power, Water and Wastewater, etc.)

11.6. Seismic Survey Equipment Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Component

11.7.2. By Application

11.7.3. By End-use Industry

11.7.4. By Country/Sub-region

12. Middle East & Africa Seismic Survey Equipment Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Seismic Survey Equipment Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

12.3.1. Hardware

12.3.2. Software

12.3.3. Services

12.4. Seismic Survey Equipment Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

12.4.1. Land

12.4.2. Marine

12.4.3. Air-Borne

12.5. Seismic Survey Equipment Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

12.5.1. Aerospace & Defense

12.5.2. Oil and Gas

12.5.3. Metal & Mining

12.5.4. Building & Construction

12.5.5. Others (Energy & Power, Water and Wastewater, etc.)

12.6. Seismic Survey Equipment Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. North Africa

12.6.4. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Component

12.7.2. By Application

12.7.3. By End-use Industry

12.7.4. By Country/Sub-region

13. South America Seismic Survey Equipment Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Seismic Survey Equipment Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

13.3.1. Hardware

13.3.2. Software

13.3.3. Services

13.4. Seismic Survey Equipment Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

13.4.1. Land

13.4.2. Marine

13.4.3. Air-Borne

13.5. Seismic Survey Equipment Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

13.5.1. Aerospace & Defense

13.5.2. Oil and Gas

13.5.3. Metal & Mining

13.5.4. Building & Construction

13.5.5. Others (Energy & Power, Water and Wastewater, etc.)

13.6. Seismic Survey Equipment Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Component

13.7.2. By Application

13.7.3. By End-use Industry

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Seismic Survey Equipment Market Competition Matrix - a Dashboard View

14.1.1. Global Seismic Survey Equipment Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. China National Petroleum Corporation

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Fugro N.V.

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. INTERNATIONAL LEADING TECHNOLOGIES TRANSFER COMPANY LIMITED

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Mitcham Industries, Inc.

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Petroleum Geo-Services (PGS)

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Ramboll Group A/S

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Schlumberger Limited

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Seismic Survey Equipment

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Sercel

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Wireless Seismic, Inc.

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Component

16.1.2. By Application

16.1.3. By End-use Industry

16.1.4. By Region

List of Tables

Table 01: Global Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Component 2017‒2031

Table 02: Global Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Application 2017‒2031

Table 03: Global Seismic Survey Equipment Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 04: Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 05: North America Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 06: North America Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 07: North America Seismic Survey Equipment Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 08: North America Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 09: Europe Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 10: Europe Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 11: Europe Seismic Survey Equipment Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 12: Europe Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

Table 13: Asia Pacific Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 14: Asia Pacific Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 15: Asia Pacific Seismic Survey Equipment Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 16: Asia Pacific Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

Table 17: Middle East & Africa Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 18: Middle East & Africa Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 19: Middle East & Africa Seismic Survey Equipment Market Value (US$ Mn) Forecast, by End-use Industry 2017‒2031

Table 20: Middle East & Africa Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

Table 21: South America Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 22: South America Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 23: South America Seismic Survey Equipment Market Value (US$ Mn) Forecast, by End-use Industry,2017‒2031

Table 24: South America Seismic Survey Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

List of Figures

Figure 01: Global Seismic Survey Equipment Market Component & Forecast, Value (US$ Mn), 2017‒2031

Figure 02: Global Seismic Survey Equipment Market Component & Forecast, Volume (Million Units), 2017‒2031

Figure 03: Global Seismic Survey Equipment Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 04: Global Seismic Survey Equipment Market, Incremental Opportunity, by Component, 2021‒2031

Figure 05: Global Seismic Survey Equipment Market Share Analysis, by Component, 2021 and 2031

Figure 06: Global Seismic Survey Equipment Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 07: Global Seismic Survey Equipment Market, Incremental Opportunity, by Application, 2021‒2031

Figure 08: Global Seismic Survey Equipment Market Share Analysis, by Application, 2021 and 2031

Figure 09: Global Seismic Survey Equipment Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 10: Global Seismic Survey Equipment Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 11: Global Seismic Survey Equipment Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 12: Global Seismic Survey Equipment Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 13: Global Seismic Survey Equipment Market, Incremental Opportunity, by Region, 2021‒2031

Figure 14: Global Seismic Survey Equipment Market Share Analysis, by Region, 2021 and 2031

Figure 15: North America Seismic Survey Equipment Market Component & Forecast, Value (US$ Mn), 2017‒2031

Figure 16: North America Seismic Survey Equipment Market Component & Forecast, Volume (Million Units), 2017‒2031

Figure 17: North America Seismic Survey Equipment Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 18: North America Seismic Survey Equipment Market, Incremental Opportunity, by Component, 2021‒2031

Figure 19: North America Seismic Survey Equipment Market Share Analysis, by Component, 2021 and 2031

Figure 20: North America Seismic Survey Equipment Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 21: North America Seismic Survey Equipment Market, Incremental Opportunity, by Application, 2021‒2031

Figure 22: North America Seismic Survey Equipment Market Share Analysis, by Application, 2021 and 2031

Figure 23: North America Seismic Survey Equipment Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 24: North America Seismic Survey Equipment Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 25: North America Seismic Survey Equipment Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 26: North America Seismic Survey Equipment Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 27: North America Seismic Survey Equipment Market, Incremental Opportunity, by Country & Sub-region, 2021‒2031

Figure 28: North America Seismic Survey Equipment Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 29: Europe Seismic Survey Equipment Market Component & Forecast, Value (US$ Mn), 2017‒2031

Figure 30: Europe Seismic Survey Equipment Market Component & Forecast, Volume (Million Units), 2017‒2031

Figure 31: Europe Seismic Survey Equipment Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 32: Europe Seismic Survey Equipment Market, Incremental Opportunity, by Component, 2021‒2031

Figure 33: Europe Seismic Survey Equipment Market Share Analysis, by Component, 2021 and 2031

Figure 34: Europe Seismic Survey Equipment Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 35: Europe Seismic Survey Equipment Market, Incremental Opportunity, by Application, 2021‒2031

Figure 36: Europe Seismic Survey Equipment Market Share Analysis, by Application, 2021 and 2031

Figure 37: Europe Seismic Survey Equipment Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 38: Europe Seismic Survey Equipment Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 39: Europe Seismic Survey Equipment Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 40: Europe Seismic Survey Equipment Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 41: Europe Seismic Survey Equipment Market, Incremental Opportunity, by Country & Sub-region, 2021‒2031

Figure 42: Europe Seismic Survey Equipment Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 43: Asia Pacific Seismic Survey Equipment Market Component & Forecast, Value (US$ Mn), 2017‒2031

Figure 44: Asia Pacific Seismic Survey Equipment Market Component & Forecast, Volume (Million Units), 2017‒2031

Figure 45: Asia Pacific Seismic Survey Equipment Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 46: Asia Pacific Seismic Survey Equipment Market, Incremental Opportunity, by Component, 2021‒2031

Figure 47: Asia Pacific Seismic Survey Equipment Market Share Analysis, by Component, 2021 and 2031

Figure 48: Asia Pacific Seismic Survey Equipment Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 49: Asia Pacific Seismic Survey Equipment Market, Incremental Opportunity, by Application, 2021‒2031

Figure 50: Asia Pacific Seismic Survey Equipment Market Share Analysis, by Application, 2021 and 2031

Figure 51: Asia Pacific Seismic Survey Equipment Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 52: Asia Pacific Seismic Survey Equipment Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 53: Asia Pacific Seismic Survey Equipment Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 54: Asia Pacific Seismic Survey Equipment Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 55: Asia Pacific Seismic Survey Equipment Market, Incremental Opportunity, by Country & Sub-region, 2021‒2031

Figure 56: Asia Pacific Seismic Survey Equipment Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 57: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market Component & Forecast, Value (US$ Mn), 2017‒2031

Figure 58: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market Component & Forecast, Volume (Million Units), 2017‒2031

Figure 59: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 60: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market, Incremental Opportunity, by Component, 2021‒2031

Figure 61: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market Share Analysis, by Component, 2021 and 2031

Figure 62: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 63: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market, Incremental Opportunity, by Application, 2021‒2031

Figure 64: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market Share Analysis, by Application, 2021 and 2031

Figure 65: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 66: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 67: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 68: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 69: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market, Incremental Opportunity, by Country & Sub-region, 2021‒2031

Figure 70: MIDDLE EAST AND AFRICA Seismic Survey Equipment Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 71: South America Seismic Survey Equipment Market Component & Forecast, Value (US$ Mn), 2017‒2031

Figure 72: South America Seismic Survey Equipment Market Component & Forecast, Volume (Million Units), 2017‒2031

Figure 73: South America Seismic Survey Equipment Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 74: South America Seismic Survey Equipment Market, Incremental Opportunity, by Component, 2021‒2031

Figure 75: South America Seismic Survey Equipment Market Share Analysis, by Component, 2021 and 2031

Figure 76: South America Seismic Survey Equipment Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 77: South America Seismic Survey Equipment Market, Incremental Opportunity, by Application, 2021‒2031

Figure 78: South America Seismic Survey Equipment Market Share Analysis, by Application, 2021 and 2031

Figure 79: South America Seismic Survey Equipment Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 80: South America Seismic Survey Equipment Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 81: South America Seismic Survey Equipment Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 82: South America Seismic Survey Equipment Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 83: South America Seismic Survey Equipment Market, Incremental Opportunity, by Country & Sub-region, 2021‒2031

Figure 84: South America Seismic Survey Equipment Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 85: Seismic Survey Equipment Market Company Share Analysis