Reports

Reports

Analysts’ Viewpoint on Geophysical Services Market Scenario

Geophysical services entail investigation studies carried out in the air, water, or land with the aim of ascertaining surface or subsurface details. Geophysical methods are gaining prominence due to their success in resolving majority of geological issues. Geophysical surveys help achieve considerable time and financial savings as compared to other conventional methods such as borehole logging and soil testing. These surveys can accurately measure the natural resources deposited underground, which helps governments or companies in proper planning of the utilization of resources. Key players of the geophysical services market are capitalizing on revenue opportunities post the peak of the COVID-19 pandemic due to the reopening of country borders, which is supporting aerial, land, and marine-based survey activities.

Geophysical services play a vital role in systematic compilation of geophysical data. Various methods can be used in a geophysical survey for data acquisition. A detailed geophysical survey helps extract detailed information about the topography and subsurface of the earth. The geophysical services market is projected to grow significantly in the near future owing to the surge in activities such as mining and oil & gas exploration. Companies offering geophysical services are currently planning a transition from traditional oil & gas exploration services due to their high volatility to new renewable and allied services.

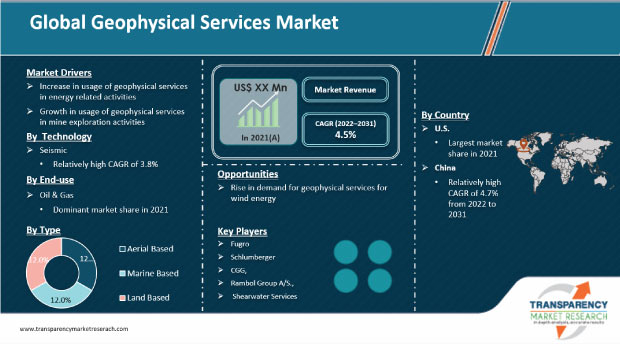

The global geophysical services market is projected to reach US$ 30.0 Bn by 2031, growing at a CAGR of 4.5% during the forecast period, owing to its technical application in oil & gas exploration. Companies operating in the geophysical services market are increasing their data library, which can be used by multiple clients. Oil & gas and mining companies are investing significantly in procurement of geophysical data in order to help discover new natural resources and cater to the ever-increasing demand of the growing urbanization trends. Developments and innovations in the geophysical services market include advancements in 2D/3D land seismic technology. This technology is being used to discover deposits of titanium and molybdenum.

According to the International Energy Agency, global demand for energy is expected to increase by 2.2% in 2022. Petroleum and gas are likely to remain the most used natural resources till 2050. Crude oil production in the U.S. touched a record high in 2021, while natural gas production is increasingly being driven by natural gas exports. This trend has been observed all over the world.

Increase in commodity prices and rise in demand for oil & gas have prompted oil & gas companies to invest more in exploration activities for underground hydrocarbon deposits. In May 2022, ONGC, an India-based oil & gas company, announced a US$ 16 Bn investment in oil & gas exploration for the next three years. This is expected to boost the geophysical services market.

Geophysical services are increasingly being used in site investigations of offshore wind farms. Construction of commercial-scale wind farms (especially off-shore) requires knowledge of the shape of the earth (morphology) and geologic makeup of the earth. These factors play a critical role in planning the foundation for turbines, magnitude of ground disturbance, and geoengineering that would be required to set that foundation. Companies are increasingly investing in R&D to analyze the presence of hazards for construction/maintenance activities and assess the specific layout of the field.

In terms of application, the wind energy segment of the geophysical services market grew at a CAGR of 13.61% from 2015 to 2021, and is expected to advance at a CAGR of 17.5% till 2030. Geophysical services are projected to gain traction due to their usage in exploration and planning activities for the installation of wind energy turbines. Thus, increase in the usage of geophysical services in the energy industry is expected to boost the geophysical services market in the near future.

Rapid increase in urbanization and industrialization is expected to boost the demand for metals and minerals across the globe. Many of the largest, highest grade and closest to surface mineral deposits have been depleted or are currently under production. There exists a need to explore new mines to cater to the rising demand for metals and minerals.

Geophysical services provide technological support to mineral and mining sectors. Geophysics plays an important role in reducing geological uncertainty in mining. Small mining companies are realizing the financial benefits of using geophysical services in mining activities. This has boosted the adoption of geophysical services for site assessment, thereby propelling the geophysical services market.

In terms of technology, the global geophysical services market has been classified into seismic, magnetic, electromagnetic, gravity, LiDAR, and others.

Seismic is the most commonly used technology in geophysical surveys in oil & gas exploration due to its reliability and low cost. Seismic surveys help locate groundwater and check foundations for roads and buildings. They also help locate potentially recoverable mineral & hydrocarbon resources. The seismic technology segment accounted for significant share of 43.4% of the global market in 2021. The segment is estimated to grow at a CAGR of 3.8% during the forecast period. Detailed information about topography and subsurface of the earth can be acquired using the seismic technology.

Based on type, the geophysical services market can be split into aerial-based survey, marine-based survey, and land-based survey. Rise in usage of aerial-based geophysical surveys is propelling the market. Drone mapping, imagery survey, and aerial inspection services are important applications of aerial surveying services. Service providers are increasing the availability of land-based survey services and aerial-based survey services to broaden their revenue streams.

The marine-based survey segment accounted for a relatively large share of 49.3% of the global market in 2021. The segment is estimated to grow at a CAGR of 3.5% during the forecast period. Marine-based survey is primarily conducted for offshore oil & gas exploration and offshore wind farm subsurface investigation. Marine-based geophysical survey can also be used for environmental impact assessment or critical habitat monitoring.

The aerial-based survey segment is estimated to grow at a CAGR of more than 6% during the forecast period. Aerial-based survey can cover a large area in limited time. These surveys are increasingly used for metal, mining, and infrastructure development. Technological advancements in drones and UAVs (Unmanned Aerial Vehicles) have opened up new avenues for geophysical survey methods. Thus, the aerial-based survey segment is expected to expand significantly during the forecast year.

Based on end-use, the oil & gas segment dominated the global geophysical services market with 47.1% share in 2021. The segment is also expected to register a notable CAGR of 3.2% during the forecast period. According to the International Energy Agency, the oil & gas segment accounted for 56.8% share of the total global energy consumption in 2021. Demand for energy is anticipated to increase exponentially due to population growth and high rate of industrialization. This is likely to lead to a rise in exploration activities for oil and gas. In April 2022, the U.K Government announced an extra 25% tax on the profit of oil & gas energy companies; however, companies that reinvest their profits in oil and gas exploration in the U.K. can claim up to 90% off the new tax in relief. Such government measures are likely to drive the geophysical services market.

Investment in renewable energy sources has increased significantly over the last few years. Countries are adhering to the Paris Agreement to limit global warming to well below 2⁰C. Wind energy is gaining popularity in the renewable energy segment, as it is far more efficient than others. Several countries are considering the installation of offshore wind turbines. Geophysical services help plan the type of foundation for turbines, magnitude of ground disturbance, and many other activities. Thus, the usage of geophysical services in wind energy is expected to rise in the near future.

In terms of value, North America held 34.3% share of the global geophysical services market in 2021. It is expected to be a highly attractive region of the global market during the forecast period. Increase in demand for geophysical services in North America can be ascribed to the rise in investments by governments and companies in exploration of hydrocarbons and metals & mining in the region.

In terms of value, Asia Pacific and Europe are also prominent regions of the geophysical services market. These regions held 20.3% & 19.4% share, respectively, of the global geophysical services market in 2021. The market in Asia Pacific and Europe is estimated to grow at a CAGR of 4.4% and 3.8%, respectively, during the forecast period.

The global geophysical services market comprises several small and large-scale service providers who control majority of the share. Most of the firms are adopting new technologies and strategies with comprehensive research & development, primarily to develop their geophysical data, which can be acquired by multiple clients. Diversification of product portfolios and mergers & acquisitions are important strategies adopted by key players. Fugro, Schlumberger, CGG, SGS Sa, Rambol Group A/S., Shearwater Services, and EON Geosciences are the prominent entities operating in the market.

Each of these players has been profiled in the geophysical services market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 19.4 Bn |

|

Market Forecast Value in 2031 |

US$ 30.0 Bn |

|

Growth Rate (CAGR) |

4.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood at US$ 19.4 Bn in 2021

The market is expected to grow at a CAGR of 4.5% from 2022 to 2031

Increase in use of geophysical services in energy-related activities and mine exploration activities

Seismic was the largest technology segment that held 43.4% share in 2021

North America was the most lucrative region of the geophysical services market in 2021

Fugro, Schlumberger, CGG, SGS SA, Rambol Group A/S., Shearwater Services, and EON Geosciences

1. Executive Summary

1.1. Geophysical Services Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Service Providers

2.6.2. List of Potential Customers

3. COVID-19 Impact Analysis

4. Global Geophysical Services Market Analysis and Forecast, by Technology, 2020–2031

4.1. Introduction and Definitions

4.2. Global Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

4.2.1. Seismic

4.2.2. Magnetic

4.2.3. Electromagnetic

4.2.4. Gravity

4.2.5. LIDAR

4.2.6. Others

4.3. Global Geophysical Services Market Attractiveness, by Technology

5. Global Geophysical Services Market Analysis and Forecast, by Type, 2020–2031

5.1. Introduction and Definitions

5.2. Global Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

5.2.1. Aerial-based Survey

5.2.1.1. Drone Based

5.2.1.2. Other Conventional

5.2.2. Marine-based Survey

5.2.3. Land-based Survey

5.3. Global Geophysical Services Market Attractiveness, by Type

6. Global Geophysical Services Market Analysis and Forecast, by End-use, 2020–2031

6.1. Introduction and Definitions

6.2. Global Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

6.2.1. Minerals & Mining

6.2.2. Oil & Gas

6.2.3. Infrastructure

6.2.4. Wind Energy

6.2.5. Water Exploration

6.2.6. Archaeological Research

6.2.7. Others

6.3. Global Geophysical Services Market Attractiveness, by End-use

7. Global Geophysical Services Market Analysis and Forecast, by Region, 2020–2031

7.1. Key Findings

7.2. Global Geophysical Services Market Value (US$ Bn) Forecast, by Region, 2020–2031

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Global Geophysical Services Market Attractiveness, by Region

8. North America Geophysical Services Market Analysis and Forecast, 2020–2031

8.1. Key Findings

8.2. North America Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

8.3. North America Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

8.4. North America Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

8.5. North America Geophysical Services Market Value (US$ Bn) Forecast, by Country, 2020–2031

8.5.1. U.S. Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

8.5.2. U.S. Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

8.5.3. U.S. Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

8.5.4. Canada Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

8.5.5. Canada Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

8.5.6. Canada Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

8.6. North America Geophysical Services Market Attractiveness Analysis

9. Europe Geophysical Services Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. Europe Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

9.3. Europe Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

9.4. Europe Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

9.5. Europe Geophysical Services Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

9.5.1. Germany Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

9.5.2. Germany Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

9.5.3. Germany Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

9.5.4. France Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

9.5.5. France Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

9.5.6. France Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

9.5.7. U.K. Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

9.5.8. U.K. Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

9.5.9. U.K. Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

9.5.10. Italy Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

9.5.11. Italy. Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

9.5.12. Italy Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

9.5.13. Russia & CIS Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

9.5.14. Russia & CIS Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

9.5.15. Russia & CIS Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

9.5.16. Rest of Europe Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

9.5.17. Rest of Europe Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

9.5.18. Rest of Europe Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

9.6. Europe Geophysical Services Market Attractiveness Analysis

10. Asia Pacific Geophysical Services Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020-2031

10.3. Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

10.4. Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

10.5. Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

10.5.1. China Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

10.5.2. China Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

10.5.3. China Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

10.5.4. Japan Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

10.5.5. Japan Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

10.5.6. Japan Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

10.5.7. India Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

10.5.8. India Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

10.5.9. India Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

10.5.10. ASEAN Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

10.5.11. ASEAN Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

10.5.12. ASEAN Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

10.5.13. Rest of Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

10.5.14. Rest of Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

10.5.15. Rest of Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

10.6. Asia Pacific Geophysical Services Market Attractiveness Analysis

11. Latin America Geophysical Services Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Latin America Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

11.3. Latin America Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

11.4. Latin America Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

11.5. Latin America Geophysical Services Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

11.5.1. Brazil Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

11.5.2. Brazil Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

11.5.3. Brazil Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

11.5.4. Mexico Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

11.5.5. Mexico Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

11.5.6. Mexico Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

11.5.7. Rest of Latin America Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

11.5.8. Rest of Latin America Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

11.5.9. Rest of Latin America Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

11.6. Latin America Geophysical Services Market Attractiveness Analysis

12. Middle East & Africa Geophysical Services Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

12.3. Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

12.4. Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

12.5. Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

12.5.1. GCC Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

12.5.2. GCC Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

12.5.3. GCC Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

12.5.4. South Africa Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

12.5.5. South Africa Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

12.5.6. South Africa Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

12.5.7. Rest of Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

12.5.8. Rest of Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

12.5.9. Rest of Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

12.6. Middle East & Africa Geophysical Services Market Attractiveness Analysis

13. Global Geophysical Services Company Market Share Analysis, 2021

13.1. Competition Matrix

13.2. Market Footprint Analysis

13.2.1. By Technology

13.2.2. By Type

13.2.3. By End-use

13.3. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

13.3.1. Schlumberger

13.3.1.1. Company Description

13.3.1.2. Business Overview

13.3.1.3. Financial Details

13.3.1.4. Strategic Overview

13.3.2. CGG

13.3.2.1. Company Description

13.3.2.2. Business Overview

13.3.2.3. Financial Details

13.3.2.4. Strategic Overview

13.3.3. Petroleum Geo-service

13.3.3.1. Company Description

13.3.3.2. Business Overview

13.3.3.3. Financial Details

13.3.3.4. Strategic Overview

13.3.4. TGS

13.3.4.1. Company Description

13.3.4.2. Business Overview

13.3.4.3. Financial Details

13.3.4.4. Strategic Overview

13.3.5. Shearwater Services

13.3.5.1. Company Description

13.3.5.2. Business Overview

13.3.5.3. Financial Details

13.3.5.4. Strategic Overview

13.3.6. Dawson Geophysical Company

13.3.6.1. Company Description

13.3.6.2. Business Overview

13.3.6.3. Financial Details

13.3.6.4. Strategic Overview

13.3.7. CGG

13.3.7.1. Company Description

13.3.7.2. Business Overview

13.3.7.3. Financial Details

13.3.7.4. Strategic Overview

13.3.8. Fugro

13.3.8.1. Company Description

13.3.8.2. Business Overview

13.3.8.3. Financial Details

13.3.8.4. Strategic Overview

13.3.9. SGS SA

13.3.9.1. Company Description

13.3.9.2. Business Overview

13.3.9.3. Financial Details

13.3.9.4. Strategic Overview

13.3.10. EON Geosciences

13.3.10.1. Company Description

13.3.10.2. Business Overview

13.3.10.3. Financial Details

13.3.10.4. Strategic Overview

13.3.11. Ramboll Group A/S

13.3.11.1. Company Description

13.3.11.2. Business Overview

13.3.11.3. Financial Details

13.3.11.4. Strategic Overview

13.3.12. Getech

13.3.12.1. Company Description

13.3.12.2. Business Overview

13.3.12.3. Financial Details

13.3.12.4. Strategic Overview

13.3.13. NUVIA Dynamics Inc.

13.3.13.1. Company Description

13.3.13.2. Business Overview

13.3.13.3. Financial Details

13.3.13.4. Strategic Overview

13.3.14. Abitibi Geophysics

13.3.14.1. Company Description

13.3.14.2. Business Overview

13.3.14.3. Financial Details

13.3.14.4. Strategic Overview

13.3.15. Xcalibur Multiphysics

13.3.15.1. Company Description

13.3.15.2. Business Overview

13.3.15.3. Financial Details

13.3.15.4. Strategic Overview

14. Primary Research: Key Insights

15. Appendix

List of Tables

Table 1: Global Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 2: Global Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 3: Global Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 4: Global Geophysical Services Market Value (US$ Bn) Forecast, by Region, 2020–2031

Table 5: North America Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 6: North America Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 7: North America Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 8: North America Geophysical Services Market Value (US$ Bn) Forecast, by Country, 2020–2031

Table 9: U.S. Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 10: U.S. Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 11: U.S. Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 12: Canada Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 13: Canada Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 14: Canada Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 15: Europe Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 16: Europe Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 17: Europe Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 18: Europe Geophysical Services Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 19: Germany Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 20: Germany Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 21: Germany Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 22: France Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 23: France Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 24: France Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 25: U.K. Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 26: U.K. Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 27: U.K. Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 28: Italy Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 29: Italy Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 30: Italy Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 31: Spain Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 32: Spain Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 33: Spain Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 34: Russia & CIS Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 35: Russia & CIS Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 36: Russia & CIS Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 37: Rest of Europe Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 38: Rest of Europe Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 39: Rest of Europe Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 40: Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 41: Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 42: Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 43: Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 44: China Geophysical Services Market Value (US$ Bn) Forecast, by Technology 2020–2031

Table 45: China Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 46: China Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 47: Japan Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 48: Japan Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 49: Japan Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 50: India Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 51: India Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 52: India Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 54: ASEAN Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 55: ASEAN Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 56: ASEAN Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 57: Rest of Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 58: Rest of Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 59: Rest of Asia Pacific Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 60: Latin America Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 61: Latin America Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 62: Latin America Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 63: Latin America Geophysical Services Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 64: Brazil Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 65: Brazil Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 66: Brazil Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 67: Mexico Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 68: Mexico Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 69: Mexico Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 70: Rest of Latin America Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 71: Rest of Latin America Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 72: Rest of Latin America Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 73: Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 74: Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 75: Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 76: Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 77: GCC Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 78: GCC Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 79: GCC Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 80: South Africa Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 81: South Africa Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 82: South Africa Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 83: Rest of Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by Technology, 2020–2031

Table 84: Rest of Middle East & Africa Geophysical Services Market Value (US$ Bn) Forecast, by Type, 2020–2031

Table 85: Rest of Middle East and Africa Geophysical Services Market Value (US$ Bn) Forecast, by End-use, 2020–2031

List of Figures

Figure 1: Global Geophysical Services Market Attractiveness, by Technology

Figure 2: Global Geophysical Services Market Attractiveness, by Type

Figure 3: Global Geophysical Services Market Attractiveness, by End-use

Figure 4: Global Geophysical Services Market Attractiveness, by Region

Figure 5: North America Geophysical Services Market Attractiveness, by Technology

Figure 6: North America Geophysical Services Market Attractiveness, by Type

Figure 7: North America Geophysical Services Market Attractiveness, by End-use

Figure 8: North America Geophysical Services Market Attractiveness, by Country

Figure 9: Europe Geophysical Services Market Attractiveness, by Technology

Figure 10: Europe Geophysical Services Market Attractiveness, by Type

Figure 11: Europe Geophysical Services Market Attractiveness, by End-use

Figure 12: Europe Geophysical Services Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Geophysical Services Market Attractiveness, by Technology

Figure 14: Asia Pacific Geophysical Services Market Attractiveness, by Type

Figure 15: Asia Pacific Geophysical Services Market Attractiveness, by End-use

Figure 16: Asia Pacific Geophysical Services Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Geophysical Services Market Attractiveness, by Technology

Figure 18: Latin America Geophysical Services Market Attractiveness, by Type

Figure 19: Latin America Geophysical Services Market Attractiveness, by End-use

Figure 20: Latin America Geophysical Services Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Geophysical Services Market Attractiveness, by Technology

Figure 22: Middle East & Africa Geophysical Services Market Attractiveness, by Type

Figure 23: Middle East & Africa Geophysical Services Market Attractiveness, by End-use

Figure 24: Middle East & Africa Geophysical Services Market Attractiveness, by Country and Sub-region