Reports

Reports

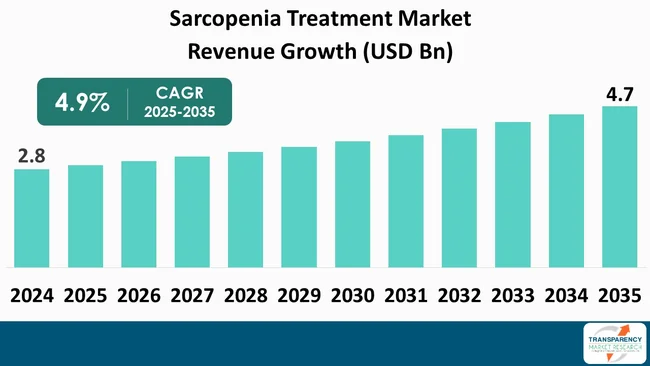

The global sarcopenia treatment market size was valued at US$ 2.8 Billion in 2024 and is projected to reach US$ 4.7 Billion by 2035, expanding at a CAGR of 4.9% from 2025 to 2035. The market is primarily driven by the rapidly increasing aging population, which significantly raises the prevalence of age-related muscle loss. Additionally, growing awareness, improved diagnostic capabilities, and rising adoption of nutritional supplements and emerging therapeutic options further accelerate market growth

The key factors driving the growth of sarcopenia treatment market are the aging global population, raised awareness of and diagnosis of sarcopenia, the ongoing influx of nutritional supplementation into mainstream, and the emergence of pharmacological therapies such as myostatin inhibitors and SARMs.

Currently, North America is leading the market based on established healthcare systems, while the Asia-Pacific is expected to be the fastest-growing region based on its rapidly aging population and growing access to healthcare.

However, widescale pharmacological treatment is limited by current disconnect between the existing guidelines relied on for reimbursement. Overall, the growth potential in the long run relies on the development and approval of drugs that can provide a significant therapeutic benefit. Emerging markets and combination therapies with beta-chain agonists and/or myostatin inhibitors, and integrated digital health will drive the opportunity but regulatory approaches and clinical evidence will limit size among emerging markets and lifestyle interventions will bring potential risks to market size.

Sarcopenia implies the age-related progressive loss of muscle strength and mass. Sarcopenia is a type of muscle atrophy basically caused by the natural aging process. Scientists believe that being physically inactive and following an unhealthy diet can contribute to the disease.

Treatment for sarcopenia typically includes lifestyle changes. Such modifications to your lifestyle behaviors can help reverse sarcopenia. The researchers are studying the possibility of using hormone supplements for increasing muscle mass. However, there aren’t any FDA-approved medications to treat sarcopenia as of now.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The anticipated market growth will be largely attributed to the growing awareness of sarcopenia followed by improved diagnosis. Healthcare professionals as well as the general population are increasingly aware of sarcopenia its effects on independence, mobility, and quality of life, leading to improved screening and earlier diagnosis.

The improved diagnostic measures of DXA (Dual-energy X-ray Absorptiometry) or bioelectrical impedance analysis let health professionals assess muscle mass and muscle function more precisely and efficiently, thereby allowing for early intervention. The provision of early identification allows the individual to implement targeted treatment strategies and therapeutic options such as nutritional supplementation and exercise regimens, and forthcoming pharmacologic therapies, thereby ultimately enhancing the need or demand for interventions. Overall recognition and management of sarcopenia will positively influence the overall treatments market due to the increased awareness from clinicians and patients to effectively treat and minimize muscle loss or maintain physical function.

The anticipated increase in nutritional supplement use will contribute substantially to the growth of the sarcopenia treatment sector. Diets high in protein, branched-chain amino acids such as leucine, vitamin D, and certain micronutrients are important for the preservation of muscle mass and strength, primarily in older adults with a pre-existing vulnerability to sarcopenia.

The general credibility of targeted nutrition is growing and consumers are increasingly adding supplements to their daily wellness or exercise program as either preventative or to slow changes in muscle consumption. Supplement use, now viewed as a mainstream wellness behavior and a clinical management approach, has improved the ease of food supplement use by offering more diverse product options and providing education in health professional care as either a standalone intervention or as part of a multi-modal approach.

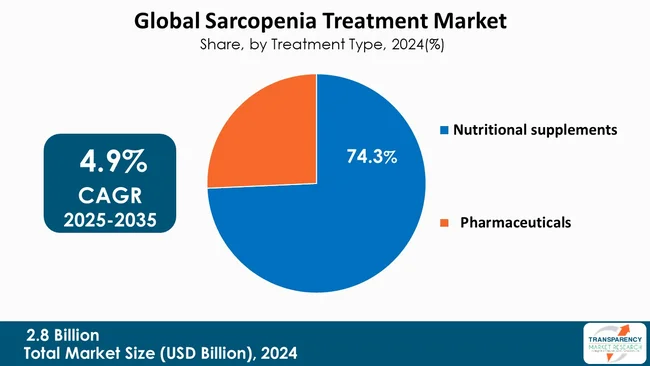

The nutritional supplements category is quickly becoming a central growth driver in the sarcopenia treatment market as they are essential for the preservation of muscle mass and function, especially in the older adults. Examples such as protein, essential amino acids like leucine, and vitamin D can slow the loss of muscle mass and strength, and enhance overall physical performance.

Growing attention to nutrition and its impact on healthy aging in the past two decades and increasing endorsement by healthcare professionals to use nutrition products in conjunction with resistance exercise are driving the increased adoption of these products. Nutritional supplements are also commonly used with exercise programs, which furthers their benefit and effectiveness as part of an overall sarcopenia treatment approach, as they are valuable tools for improving nutritional and physical function.

Research suggests that the increased engagement and adherence to physical activity as well as compliance with nutritional supplements can lead to a better outcome than either functional intervention when nutrition factors are addressed in an overall sarcopenia treatment strategy.

The low cost and easy access of nutritional supplements as compared to medications and the growing acceptance of nutritional supplementation as a preventive approach or intervention have made the nutritional supplements segment a major growth component of the overall sarcopenia treatment market that is attracting attention from investors and established and new companies investing in this market segment.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America dominated the market in 2024, holding the largest revenue share of 39.5% in 2024. Currently, North America dominates the sarcopenia treatment market due to its well-established healthcare system, general awareness of age-related muscle loss, and increased adoption of pharmacological therapies and nutritional treatments. The aging population is larger in North America than in many of the other regions, and the trend is toward a more active aging population working to maintain mobility and independence while treating sarcopenia. The presence of established diagnostic tests such as DXA scans and bioelectrical impedance analysis allows for early diagnosis as well as timely treatment and intervention.

Nestlé Health Science, Abbott Nutrition, Eli Lilly and Company, Pfizer Inc., Amgen Inc., Biophytis, TNF Pharmaceuticals, Epirium Bio, Turn biotechnologies, inc., ONCOCROSS CO., LTD, BPGbio, Inc., Lipocine, Rejuvenate Biomed NV., Animuscure Co., Ltd and Other Prominent Players are the key players governing the global sarcopenia treatment market.

Each of these players has been profiled in the sarcopenia treatment market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 2.8 Bn |

| Forecast Value in 2035 | More than US$ 4.7 Bn |

| CAGR | 4.9% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Treatment Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 2.8 Bn in 2024

It is projected to cross US$ 4.7 Bn by the end of 2035

Increased Awareness and Diagnosis, Growing Adoption of Nutritional Supplementation and Emergence of Pharmacological Therapies

It is anticipated to grow at a CAGR 4.9% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Nestlé Health Science, Abbott Nutrition, Eli Lilly and Company, Pfizer Inc., Amgen Inc., Biophytis, TNF Pharmaceuticals, Epirium Bio, Turn biotechnologies, inc., ONCOCROSS CO., LTD, BPGbio, Inc., Lipocine, Rejuvenate Biomed NV., Animuscure Co., Ltd and Other Prominent Player

Table 01: Global Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Treatment Type, 2020 to 2035

Table 02: Global Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Nutritional supplements, 2020 to 2035

Table 03: Global Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Pharmaceuticals, 2020 to 2035

Table 04: Global Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 05: Global Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 06: Global Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Sarcopenia Treatment Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 08: North America Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Treatment Type, 2020 to 2035

Table 09: North America Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Nutritional supplements, 2020 to 2035

Table 10: North America Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Pharmaceuticals, 2020 to 2035

Table 11: North America Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 12: North America Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 13: Europe Sarcopenia Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 14: Europe Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Treatment Type, 2020 to 2035

Table 15: Europe Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Nutritional supplements, 2020 to 2035

Table 16: Europe Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Pharmaceuticals, 2020 to 2035

Table 17: Europe Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 18: Europe Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 19: Asia Pacific Sarcopenia Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 20: Asia Pacific Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Treatment Type, 2020 to 2035

Table 21: Asia Pacific Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Nutritional supplements, 2020 to 2035

Table 22: Asia Pacific Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Pharmaceuticals, 2020 to 2035

Table 23: Asia Pacific Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 24: Asia Pacific Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 25: Latin America Sarcopenia Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 26: Latin America Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Treatment Type, 2020 to 2035

Table 27: Latin America Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Nutritional supplements, 2020 to 2035

Table 28: Latin America Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Pharmaceuticals, 2020 to 2035

Table 29: Latin America Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 30: Latin America Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 31: Middle East & Africa Sarcopenia Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 32: Middle East & Africa Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Treatment Type, 2020 to 2035

Table 33: Middle East & Africa Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Nutritional supplements, 2020 to 2035

Table 34: Middle East & Africa Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Pharmaceuticals, 2020 to 2035

Table 35: Middle East & Africa Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 36: Middle East & Africa Sarcopenia Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Figure 01: Global Sarcopenia Treatment Market Value Share Analysis, By Treatment Type, 2024 and 2035

Figure 02: Global Sarcopenia Treatment Market Attractiveness Analysis, By Treatment Type, 2025 to 2035

Figure 03: Global Sarcopenia Treatment Market Revenue (US$ Bn), by Nutritional supplements, 2020 to 2035

Figure 04: Global Sarcopenia Treatment Market Revenue (US$ Bn), by Pharmaceuticals, 2020 to 2035

Figure 05: Global Sarcopenia Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 06: Global Sarcopenia Treatment Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 07: Global Sarcopenia Treatment Market Revenue (US$ Bn), by Oral, 2020 to 2035

Figure 08: Global Sarcopenia Treatment Market Revenue (US$ Bn), by Parenteral, 2020 to 2035

Figure 09: Global Sarcopenia Treatment Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 10: Global Sarcopenia Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 11: Global Sarcopenia Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 12: Global Sarcopenia Treatment Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 13: Global Sarcopenia Treatment Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 14 Global Sarcopenia Treatment Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 15: Global Sarcopenia Treatment Market Value Share Analysis, By Region, 2024 and 2035

Figure 16: Global Sarcopenia Treatment Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 17: North America - Sarcopenia Treatment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 18: North America - Sarcopenia Treatment Market Value Share Analysis, by Country, 2024 and 2035

Figure 19: North America - Sarcopenia Treatment Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 20: North America Sarcopenia Treatment Market Value Share Analysis, By Treatment Type, 2024 and 2035

Figure 21: North America Sarcopenia Treatment Market Attractiveness Analysis, By Treatment Type, 2025 to 2035

Figure 22: North America Sarcopenia Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 23: North America Sarcopenia Treatment Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 24: North America Sarcopenia Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 25: North America Sarcopenia Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 26: Europe - Sarcopenia Treatment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 27: Europe - Sarcopenia Treatment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 28: Europe Sarcopenia Treatment Market Value Share Analysis, By Treatment Type, 2024 and 2035

Figure 29: Europe Sarcopenia Treatment Market Attractiveness Analysis, By Treatment Type, 2025 to 2035

Figure 30: Europe Sarcopenia Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 31: Europe Sarcopenia Treatment Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 32: Europe Sarcopenia Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 33: Europe Sarcopenia Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 34: Asia Pacific - Sarcopenia Treatment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 35: Asia Pacific - Sarcopenia Treatment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 36: Asia Pacific Sarcopenia Treatment Market Value Share Analysis, By Treatment Type, 2024 and 2035

Figure 37: Asia Pacific Sarcopenia Treatment Market Attractiveness Analysis, By Treatment Type, 2025 to 2035

Figure 38: Asia Pacific Sarcopenia Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 39: Asia Pacific Sarcopenia Treatment Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 40: Asia Pacific Sarcopenia Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 41: Asia Pacific Sarcopenia Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 42: Latin America - Sarcopenia Treatment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 43: Latin America - Sarcopenia Treatment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 44: Latin America Sarcopenia Treatment Market Value Share Analysis, By Treatment Type, 2024 and 2035

Figure 45: Latin America Sarcopenia Treatment Market Attractiveness Analysis, By Treatment Type, 2025 to 2035

Figure 46: Latin America Sarcopenia Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 47: Latin America Sarcopenia Treatment Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 48: Latin America Sarcopenia Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 49: Latin America Sarcopenia Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 50: Middle East & Africa - Sarcopenia Treatment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 51: Middle East & Africa - Sarcopenia Treatment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 52: Middle East & Africa Sarcopenia Treatment Market Value Share Analysis, By Treatment Type, 2024 and 2035

Figure 53: Middle East & Africa Sarcopenia Treatment Market Attractiveness Analysis, By Treatment Type, 2025 to 2035

Figure 54: Middle East & Africa Sarcopenia Treatment Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 55: Middle East & Africa Sarcopenia Treatment Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 56: Middle East & Africa Sarcopenia Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 57: Middle East & Africa Sarcopenia Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035