Reports

Reports

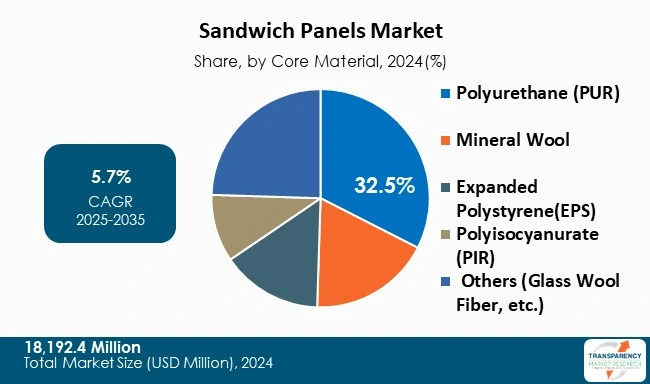

The market for sandwich panels is conditioned by the increasing demand for durable and lightweight building materials, which are thermally efficient. Constructed of two outer metal sheets and an insulating core, these panels are commonly utilized in roofing, wall veneering, and cold storage. Polyurethane (PUR) and polyisocyanurate (PIR) are some of the most popular core materials as they have good insulation and fire resistance, whereas EPS and mineral wool are also applicable in cost-sensitive or special cases.

By application, the cold storage and industrial applications are the highest ones with the food-processing sector, pharmaceutical and logistics sectors being largely dependent on a controlled environment. The business sector comes in next due to demand on the part of office, mall, and institutional building, and the residential market is slowly developing as prefabricated housing is being adopted.

Asia-Pacific is the region that gains supremacy due to strong construction, and industrial growth. Overall, the market remains multi-faceted and its applications are utilized all around in industrial, commercial, and residential project

The sandwich panels market is expanding due to the increased demand for energy-efficient, durable, and effective building solutions, which are cost-effective. Sandwich panels are constructed of two outer coverings, usually steel, aluminium or fiber-reinforced plastic that sandwich an insulating core of polyurethane (PUR), polyisocyanurate (PIR) or mineral wool. These layered composites have low thermal and sound conductivity, strength, and are increasingly lightweight - ideal for applicability in construction, cold storage, transportation and energy market.

Such panels are commonly used in walls, roofs, facade systems, truck trailers, shipping containers, temperature-control storage warehouses as they are fire-resistant, highly durable, provides sound insulation, and easy to install. They can be provided in different categories depending on the material core, e.g. PUR, PIR, and mineral wool, which would enable tailoring the range of products to suit certain performance needs.

Due to their versatility and the fact that they can save energy yet enforce structural strength, people have been relying on them - more in residential as well as commercial construction projects.

The market is evolving due to emerging sandwich panel materials, environmental-friendly solutions, and technologies that improve its efficiency, longevity, and environmental impact.

| Attribute | Detail |

|---|---|

| Sandwich Panels Market Drivers | Increasing Usage of Sandwich Panels in Cold Storage Rising Demand for Energy-efficient Buildings |

The growing need of cold storage in the food, pharmaceutical, and logistics industries is boosting the employment of sandwich panel. These panels offer superior thermal insulations, which are significant to ensure an ambiance of low temperatures in warehouses, refrigerated rooms, and transport containers.

With perishable goods, frozen food distributors, and temperature-sensitive pharmaceuticals, industries are demanding materials of construction that not only could maintain a constant temperature but remain durable and are easy to maintain. Sandwich panels satisfy this requirement by offering the advantage of being lightweight, combined with high levels of thermal insulation performance, thereby making them a suitable construction material in cold stores.

Moreover, due to the booming popularity of e-Commerce and global supply chains as well as the food delivery market, the other large-scale and consistent cold storage facilities have become even more necessary. Sandwich panels enables such facilities to be constructed quickly and modularly, while not only saving time and cutting down construction prices, but also ensuring the soundness of stored goods. They are also fire and moisture resistant, which makes them safer places for storage as risks of spoilage or destruction are reduced. Sandwich panels play a critical role in infrastructure requirements by being highly efficient and effective as the cold chain industry continues to expand all across the globe.

The need to have power-efficient structures has emerged to be amongst one of the most significant drivers in the sandwich panels market with governments, firms and consumers focusing more on sustainability and reduced energy usage. Sandwich panels, particularly polyurethane (PUR) and polyisocyanurate (PIR) cores provide effective thermal insulation characteristics that considerably lessen the necessity of synthetic cooling and heating. This is not only beneficial in reducing operational energy expenses but also in line with the global efforts to reduce carbon footprints and address climate change obligations. In many countries, building codes and regulations are stringent and require high-performance insulations to be used, which strengthens the use of sandwich panels. For example, in the European Union, the Energy Performance of Buildings Directive (EPBD) - a policy framework introduced to improve the energy efficiency of buildings, requires stricter rules for building insulation, aiming to cut energy use by 11.7% by 2030. This encourages the use of better insulating materials like sandwich panels.

Sandwich panels have outperformed conventional building materials in insulation, while also being lightweight and quick to install, making them, best suited for modern construction projects where efficiency and sustainability are top priorities. Their capability to maintain stable indoor temperatures adds to the comfort of the occupants and long term cost savings, which has become a significant factor for residential and commercial developments. With increasing awareness of energy conservation and the push towards green buildings, sandwich panels are increasingly being preferred as the material of choice in walls, roofs, and facades.

Polyurethane (PUR) prevails in the sandwich panels market due to its high thermal insulating ability, high strength-weight ratio, and cost-effectiveness. PUR panels are not as thermally conductive as Expanded Polystyrene, Polyisocyanurate (PIR) and mineral wool, so they can provide superior insulation performance using thinner panel thickness, thereby reducing material and construction costs.

Their being lightweight but tough construction makes them easier to handle and place as well as their low water absorption helps them last long in damp or cold storage conditions. PUR is the best solution for many different uses as it strikes the right mix between performance and practicality.

When compared to mineral wool that is less expensive, heavy, and bulky, the other substitutes like EPS are less durable due to their decreased moisture resistance. PIR is its close competitor but it is more expensive and is not adopted widely. However, PUR panels find a middle-ground between performance, cost, and versatility, which makes them the most commonly used solution in the construction or industrial facilities and commercial projects and thus, the hegemony in the market.

| Attribute | Detail |

|---|---|

| Leading Region | Asia- Pacific |

Asia Pacific is the key market in sandwich panels market owing to the urbanization, industrialization, and massive development in infrastructure in regions such as China, India, Japan and Southeast Asia. There is an upsurge in the construction activities in the region such as residential complexes, commercial buildings, and industrial facilities, warehouses. This rising construction demand needs materials that are durable, light, energy saving, and of low cost, and sandwich panels are ones that would be suitable.

Low costs of production and favorable policies are also the factors contributing to the supremacy of Asia Pacific. The area has an easy access to raw materials and cheap labor hence manufacturers in the region are capable of producing sandwich panels at competitive prices for both - local consumption and export. Governments are increasingly advancing the objective of energy efficiency and a more sustainable system of buildings, which further increases opportunities for sandwich panels rather than traditional material.

North America and Europe have established slow-growing construction markets that lack capacity to absorb significant quantities of sandwich panel despite the governments pressing on sustainability. The market size and the industrial base in the Middle East and Africa is less than in the Asia Pacific, though there is expansion due to infrastructure development. The high construction activity, infrastructure investment, cost-efficient production, and supportive government policies make Asia Pacific the leading region when it comes to sandwich panels in the world.

The sandwich panels market is characterized by both - domination of the large multinational companies and extensive middle and small regional enterprises. Significant players focus on the production of superior quality, energy-efficient and resilient sandwich panels to use in construction, industrial, and cold stores.

Arcelor Mittal, Areco Group, Assan Panels A.S., Avient Corporation, Balex-Metal, DANA Group of Companies, Kingspan Group, Manni Group S.p.A, Metecno Group, Nucor Corporation, Romakowski GmbH & Co. KG, Tata Steel, Rinac along with several other prominent regional and global manufacturers are the prominent entities operating in this market.

Each of these players has been profiled in the sandwich panels market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 18,192.4 Mn |

| Forecast Value in 2035 | US$ 33,678.9 Mn |

| CAGR | 5.7% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020–2023 |

| Quantitative Units | US$ Mn for Value & Million Square Metre for Volume. |

| Sandwich Panels Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Core Material

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global sandwich panels market was valued at US$ 18,192.4 Mn in 2024

The global sandwich panels industry is projected to reach at US$ 33,678.9 Mn by the end of 2035

Increasing usage of sandwich panels in cold storage, and rising demand for energy-efficient buildings are some of the factors driving the expansion of sandwich panels market.

The CAGR is anticipated to be 5.7% from 2025 to 2035

Arcelor Mittal, Areco Group, Assan Panels A.S., Avient Corporation, Balex-Metal, DANA Group of Companies, Kingspan Group, Manni Group S.p.A, Metecno Group, Nucor Corporation, Romakowski GmbH & Co. KG, Tata Steel, Rinac along with several other prominent regional and global manufacturers are the prominent entities operating in this market.

Table 1: Global Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 2: Global Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 3: Global Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 4: Global Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 5: Global Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 6: Global Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 7: Global Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 8: Global Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 9: Global Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 10: Global Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 11: Global Market Value (US$ Mn) Projection, 2020 to 2035 By Region

Table 12: Global Market Volume (Million Square Meter) Projection, 2020 to 2035 By Region

Table 13: North America Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 14: North America Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 15: North America Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 16: North America Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 17: North America Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 18: North America Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 19: North America Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 20: North America Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 21: North America Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 22: North America Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 23: North America Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 24: North America Market Volume (Million Square Meter) Projection, 2020 to 2035 By Country

Table 25: U.S. Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 26: U.S. Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 27: U.S. Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 28: U.S. Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 29: U.S. Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 30: U.S. Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 31: U.S. Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 32: U.S. Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 33: U.S. Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 34: U.S. Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 35: Canada Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 36: Canada Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 37: Canada Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 38: Canada Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 39: Canada Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 40: Canada Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 41: Canada Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 42: Canada Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 43: Canada Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 44: Canada Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 45: Europe Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 46: Europe Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 47: Europe Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 48: Europe Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 49: Europe Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 50: Europe Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 51: Europe Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 52: Europe Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 53: Europe Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 54: Europe Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 55: Europe Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 56: Europe Market Volume (Million Square Meter) Projection, 2020 to 2035 By Country

Table 57: U.K. Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 58: U.K. Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 59: U.K. Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 60: U.K. Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 61: U.K. Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 62: U.K. Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 63: U.K. Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 64: U.K. Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 65: U.K. Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 66: U.K. Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 67: Germany Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 68: Germany Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 69: Germany Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 70: Germany Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 71: Germany Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 72: Germany Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 73: Germany Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 74: Germany Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 75: Germany Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 76: Germany Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 77: France Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 78: France Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 79: France Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 80: France Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 81: France Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 82: France Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 83: France Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 84: France Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 85: France Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 86: France Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 87: Italy Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 88: Italy Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 89: Italy Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 90: Italy Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 91: Italy Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 92: Italy Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 93: Italy Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 94: Italy Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 95: Italy Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 96: Italy Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 97: Spain Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 98: Spain Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 99: Spain Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 100: Spain Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 101: Spain Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 102: Spain Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 103: Spain Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 104: Spain Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 105: Spain Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 106: Spain Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 107: The Netherlands Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 108: The Netherlands Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 109: The Netherlands Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 110: The Netherlands Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 111: The Netherlands Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 112: The Netherlands Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 113: The Netherlands Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 114: The Netherlands Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 115: The Netherlands Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 116: The Netherlands Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 117: Asia Pacific Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 118: Asia Pacific Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 119: Asia Pacific Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 120: Asia Pacific Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 121: Asia Pacific Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 122: Asia Pacific Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 123: Asia Pacific Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 124: Asia Pacific Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 125: Asia Pacific Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 126: Asia Pacific Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 127: Asia Pacific Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 128: Asia Pacific Market Volume (Million Square Meter) Projection, 2020 to 2035 By Country

Table 129: China Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 130: China Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 131: China Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 132: China Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 133: China Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 134: China Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 135: China Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 136: China Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 137: China Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 138: China Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 139: India Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 140: India Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 141: India Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 142: India Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 143: India Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 144: India Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 145: India Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 146: India Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 147: India Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 148: India Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 149: Japan Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 150: Japan Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 151: Japan Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 152: Japan Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 153: Japan Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 154: Japan Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 155: Japan Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 156: Japan Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 157: Japan Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 158: Japan Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 159: Australia Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 160: Australia Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 161: Australia Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 162: Australia Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 163: Australia Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 164: Australia Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 165: Australia Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 166: Australia Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 167: Australia Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 168: Australia Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 169: South Korea Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 170: South Korea Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 171: South Korea Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 172: South Korea Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 173: South Korea Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 174: South Korea Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 175: South Korea Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 176: South Korea Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 177: South Korea Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 178: South Korea Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 179: ASEAN Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 180: ASEAN Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 181: ASEAN Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 182: ASEAN Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 183: ASEAN Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 184: ASEAN Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 185: ASEAN Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 186: ASEAN Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 187: ASEAN Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 188: ASEAN Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 189: Middle East & Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 190: Middle East & Africa Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 191: Middle East & Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 192: Middle East & Africa Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 193: Middle East & Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 194: Middle East & Africa Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 195: Middle East & Africa Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 196: Middle East & Africa Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 197: Middle East & Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 198: Middle East & Africa Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 199: Middle East & Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 200: Middle East & Africa Market Volume (Million Square Meter) Projection, 2020 to 2035 By Country

Table 201: GCC Countries Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 202: GCC Countries Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 203: GCC Countries Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 204: GCC Countries Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 205: GCC Countries Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 206: GCC Countries Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 207: GCC Countries Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 208: GCC Countries Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 209: GCC Countries Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 210: GCC Countries Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 211: South Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 212: South Africa Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 213: South Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 214: South Africa Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 215: South Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 216: South Africa Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 217: South Africa Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 218: South Africa Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 219: South Africa Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 220: South Africa Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 221: Latin America Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 222: Latin America Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 223: Latin America Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 224: Latin America Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 225: Latin America Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 226: Latin America Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 227: Latin America Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 228: Latin America Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 229: Latin America Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 230: Latin America Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 231: Latin America Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 232: Latin America Market Volume (Million Square Meter) Projection, 2020 to 2035 By Country

Table 233: Brazil Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 234: Brazil Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 235: Brazil Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 236: Brazil Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 237: Brazil Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 238: Brazil Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 239: Brazil Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 240: Brazil Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 241: Brazil Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 242: Brazil Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 243: Argentina Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 244: Argentina Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 245: Argentina Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 246: Argentina Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 247: Argentina Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 248: Argentina Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 249: Argentina Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 250: Argentina Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 251: Argentina Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 252: Argentina Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Table 253: Mexico Market Value (US$ Mn) Projection, 2020 to 2035 By Core Material

Table 254: Mexico Market Volume (Million Square Meter) Projection, 2020 to 2035 By Core Material

Table 255: Mexico Market Value (US$ Mn) Projection, 2020 to 2035 By Thickness

Table 256: Mexico Market Volume (Million Square Meter) Projection, 2020 to 2035 By Thickness

Table 257: Mexico Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 258: Mexico Market Volume (Million Square Meter) Projection, 2020 to 2035 By Application

Table 259: Mexico Market Value (US$ Mn) Projection, 2020 to 2035 By End-use

Table 260: Mexico Market Volume (Million Square Meter) Projection, 2020 to 2035 By End-use

Table 261: Mexico Market Value (US$ Mn) Projection, 2020 to 2035 By Distribution Channel

Table 262: Mexico Market Volume (Million Square Meter) Projection, 2020 to 2035 By Distribution Channel

Figure 1: Global Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 2: Global Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 3: Global Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 4: Global Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 5: Global Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 6: Global Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 7: Global Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 8: Global Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 9: Global Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 10: Global Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 11: Global Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 12: Global Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 13: Global Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 14: Global Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 15: Global Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 16: Global Market Value (US$ Mn) Projection, By Region 2020 to 2035

Figure 17: Global Market Volume (Million Square Meter) Projection, By Region 2020 to 2035

Figure 18: Global Market Incremental Opportunities (US$ Mn) Forecast, By Region 2025 to 2035

Figure 19: North America Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 20: North America Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 21: North America Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 22: North America Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 23: North America Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 24: North America Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 25: North America Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 26: North America Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 27: North America Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 28: North America Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 29: North America Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 30: North America Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 31: North America Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 32: North America Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 33: North America Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 34: North America Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 35: North America Market Volume (Million Square Meter) Projection, By Country 2020 to 2035

Figure 36: North America Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 37: U.S. Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 38: U.S. Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 39: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 40: U.S. Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 41: U.S. Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 42: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 43: U.S. Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 44: U.S. Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 45: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 46: U.S. Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 47: U.S. Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 48: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 49: U.S. Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 50: U.S. Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 51: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 52: Canada Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 53: Canada Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 54: Canada Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 55: Canada Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 56: Canada Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 57: Canada Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 58: Canada Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 59: Canada Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 60: Canada Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 61: Canada Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 62: Canada Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 63: Canada Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 64: Canada Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Canada Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 66: Canada Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 68: Europe Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 69: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 70: Europe Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 71: Europe Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 72: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 73: Europe Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 74: Europe Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 75: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 76: Europe Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 77: Europe Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 78: Europe Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 79: Europe Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 80: Europe Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 81: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Europe Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 83: Europe Market Volume (Million Square Meter) Projection, By Country 2020 to 2035

Figure 84: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 85: U.K. Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 86: U.K. Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 87: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 88: U.K. Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 89: U.K. Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 90: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 91: U.K. Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 92: U.K. Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 93: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 94: U.K. Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 95: U.K. Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 96: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 97: U.K. Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 98: U.K. Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 99: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 100: Germany Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 101: Germany Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 102: Germany Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 103: Germany Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 104: Germany Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 105: Germany Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 106: Germany Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 107: Germany Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 108: Germany Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 109: Germany Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 110: Germany Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 111: Germany Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 112: Germany Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 113: Germany Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 114: Germany Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 115: France Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 116: France Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 117: France Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 118: France Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 119: France Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 120: France Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 121: France Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 122: France Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 123: France Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 124: France Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 125: France Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 126: France Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 127: France Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 128: France Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 129: France Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 130: Italy Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 131: Italy Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 132: Italy Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 133: Italy Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 134: Italy Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 135: Italy Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 136: Italy Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 137: Italy Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 138: Italy Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 139: Italy Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 140: Italy Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 141: Italy Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 142: Italy Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 143: Italy Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 144: Italy Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 145: Spain Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 146: Spain Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 147: Spain Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 148: Spain Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 149: Spain Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 150: Spain Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 151: Spain Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 152: Spain Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 153: Spain Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 154: Spain Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 155: Spain Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 156: Spain Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 157: Spain Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 158: Spain Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 159: Spain Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 160: The Netherlands Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 161: The Netherlands Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 162: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 163: The Netherlands Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 164: The Netherlands Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 165: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 166: The Netherlands Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 167: The Netherlands Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 168: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 169: The Netherlands Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 170: The Netherlands Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 171: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 172: The Netherlands Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 173: The Netherlands Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 174: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 175: Asia Pacific Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 176: Asia Pacific Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 177: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 178: Asia Pacific Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 179: Asia Pacific Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 180: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 181: Asia Pacific Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 182: Asia Pacific Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 183: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 184: Asia Pacific Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 185: Asia Pacific Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 186: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 187: Asia Pacific Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 188: Asia Pacific Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 189: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 190: Asia Pacific Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 191: Asia Pacific Market Volume (Million Square Meter) Projection, By Country 2020 to 2035

Figure 192: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 193: China Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 194: China Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 195: China Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 196: China Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 197: China Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 198: China Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 199: China Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 200: China Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 201: China Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 202: China Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 203: China Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 204: China Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 205: China Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 206: China Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 207: China Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 208: India Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 209: India Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 210: India Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 211: India Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 212: India Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 213: India Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 214: India Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 215: India Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 216: India Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 217: India Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 218: India Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 219: India Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 220: India Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 221: India Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 222: India Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 223: Japan Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 224: Japan Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 225: Japan Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 226: Japan Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 227: Japan Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 228: Japan Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 229: Japan Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 230: Japan Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 231: Japan Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 232: Japan Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 233: Japan Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 234: Japan Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 235: Japan Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 236: Japan Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 237: Japan Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 238: Australia Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 239: Australia Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 240: Australia Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 241: Australia Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 242: Australia Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 243: Australia Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 244: Australia Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 245: Australia Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 246: Australia Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 247: Australia Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 248: Australia Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 249: Australia Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 250: Australia Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 251: Australia Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 252: Australia Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 253: South Korea Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 254: South Korea Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 255: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 256: South Korea Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 257: South Korea Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 258: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 259: South Korea Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 260: South Korea Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 261: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 262: South Korea Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 263: South Korea Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 264: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 265: South Korea Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Korea Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 268: ASEAN Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 269: ASEAN Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 270: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 271: ASEAN Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 272: ASEAN Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 273: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 274: ASEAN Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 275: ASEAN Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 276: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 277: ASEAN Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 278: ASEAN Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 279: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 280: ASEAN Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 281: ASEAN Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 282: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 283: Middle East & Africa Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 284: Middle East & Africa Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 285: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 286: Middle East & Africa Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 287: Middle East & Africa Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 288: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 289: Middle East & Africa Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 290: Middle East & Africa Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 291: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 292: Middle East & Africa Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 293: Middle East & Africa Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 294: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 295: Middle East & Africa Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 296: Middle East & Africa Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 297: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 298: Middle East & Africa Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 299: Middle East & Africa Market Volume (Million Square Meter) Projection, By Country 2020 to 2035

Figure 300: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 301: GCC Countries Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 302: GCC Countries Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 303: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 304: GCC Countries Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 305: GCC Countries Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 306: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 307: GCC Countries Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 308: GCC Countries Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 309: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 310: GCC Countries Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 311: GCC Countries Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 312: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 313: GCC Countries Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 314: GCC Countries Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 315: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 316: South Africa Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 317: South Africa Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 318: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 319: South Africa Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 320: South Africa Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 321: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 322: South Africa Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 323: South Africa Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 324: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 325: South Africa Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 326: South Africa Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 327: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 328: South Africa Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 329: South Africa Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 330: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 331: Latin America Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 332: Latin America Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 333: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 334: Latin America Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 335: Latin America Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 336: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 337: Latin America Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 338: Latin America Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 339: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 340: Latin America Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 341: Latin America Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 342: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 343: Latin America Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 344: Latin America Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 345: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 346: Latin America Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 347: Latin America Market Volume (Million Square Meter) Projection, By Country 2020 to 2035

Figure 348: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 349: Brazil Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 350: Brazil Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 351: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 352: Brazil Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 353: Brazil Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 354: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 355: Brazil Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 356: Brazil Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 357: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 358: Brazil Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 359: Brazil Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 360: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 361: Brazil Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 362: Brazil Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 363: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 364: Argentina Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 365: Argentina Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 366: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 367: Argentina Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 368: Argentina Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 369: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 370: Argentina Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 371: Argentina Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 372: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 373: Argentina Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 374: Argentina Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 375: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 376: Argentina Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 377: Argentina Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 378: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 379: Mexico Market Value (US$ Mn) Projection, By Core Material 2020 to 2035

Figure 380: Mexico Market Volume (Million Square Meter) Projection, By Core Material 2020 to 2035

Figure 381: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By Core Material 2025 to 2035

Figure 382: Mexico Market Value (US$ Mn) Projection, By Thickness 2020 to 2035

Figure 383: Mexico Market Volume (Million Square Meter) Projection, By Thickness 2020 to 2035

Figure 384: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By Thickness 2025 to 2035

Figure 385: Mexico Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 386: Mexico Market Volume (Million Square Meter) Projection, By Application 2020 to 2035

Figure 387: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 388: Mexico Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 389: Mexico Market Volume (Million Square Meter) Projection, By End-use 2020 to 2035

Figure 390: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 391: Mexico Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 392: Mexico Market Volume (Million Square Meter) Projection, By Distribution Channel 2020 to 2035

Figure 393: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035