Reports

Reports

Degenerative retinal diseases are one of the major causes of irreversible vision loss across the world. Multiple studies pertaining to retinal disorders have revealed that diabetic retinopathy and age-related degeneration (AMD) accounts for over 80% of the reported cases of bilateral blindness worldwide. According to the National Eye Institute of the U.S., nearly 7.7 million individuals suffer from diabetic retinopathy across the U.S. and the number is estimated to reach around 11.3 million by 2030. On a global scale, nearly 36 million individuals suffer from complete vision loss and in most cases, the blindness stems from a range of retinal disorders.

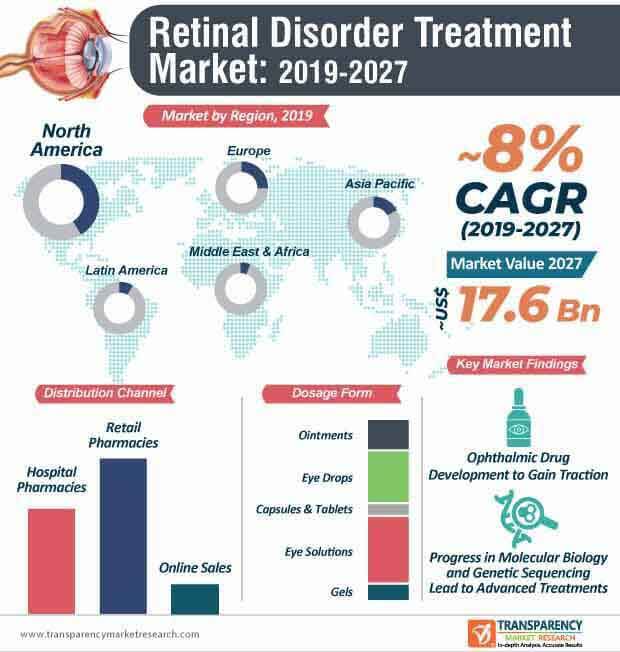

The prevalence of retinal disorders is notably higher in low to medium income countries wherein access to efficient and effective healthcare is a major issue. While developed countries, such as the U.S., Canada, Germany, and the U.K., among others, have laid down the groundwork to address retinal disorders, developing countries continue to make gradual improvements in that regard. Within the retinal disorders treatment market, research and development activities have gained significant momentum, especially over the last decade. Due to the growing demand for cutting-edge retinal disorders treatment and noteworthy investments in research, the retinal disorder treatment market is expected to reach a value of ~US$ 17.6 Bn by the end of 2027.

In recent times, the development and discovery of new ophthalmic drugs has gained significant momentum. Within the retinal disorders treatment market, drug manufacturers are shifting from traditional drug formulations toward the discovery of new and improved drugs to treat a range of retinal disorders. This factor, along with notable progress in genetic sequencing and molecular biology has paved the way for improved retinal disorders treatment.

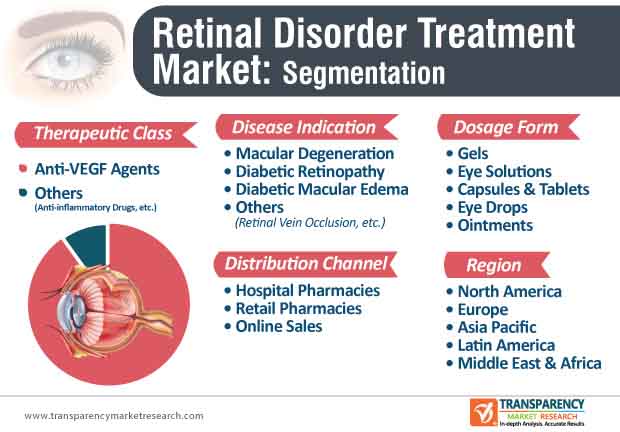

Government, as well as several nonprofit organizations, are increasingly spending on the development of new retinal disorders treatment. Within the retinal disorders treatment market, collaborations between nonprofit organizations and the government are on the rise particularly in developed regions such as North America. For instance, The Foundation Fighting Blindness, a nonprofit organization, is aiding in research pertaining to ophthalmic drug development by funding over 90 researchers around the world. The research activities are largely focusing on the development of new drugs to treat retinal disorders, including inherited retinal degenerative diseases and age-related macular degeneration diseases. Moreover, swift and cost-efficient genetic testing is likely to offer lucrative opportunities for drug developers in the retinal disorder treatment market during the forecast period. Within the retinal disorders treatment market, macular degeneration and diabetic retinopathy disease indication segments are expected to collectively account for over 85% of the total market share, in terms of value– a major factor why researches and studies pertaining to retinal disorders are largely focusing on these disease indications. The macular degeneration disease indication segment is expected to reach a market value of ~US$ 5.3 Bn by 2020 from ~US$ 5.1 Bn in 2019.

Age-related macular degeneration (AMD), diabetic retinopathy, inherited retinal dystrophies, and diabetic macular degeneration diseases are some of the major retinal disorders that require efficient, reliable, and cost-effective retinal disorder treatments. The advent of anti-vascular endothelial growth factor (VEGF) agents has redefined retinal disorder treatments, such as neovascular (wet) AMD and diabetic macular edema, among others. The adoption of anti-VEGF injections in the retinal disorder treatment market is expected to scale new heights, as these injections have, repeatedly, proved their efficacy in providing relief from a range of retinal disorders. Despite ongoing research pertaining to alternative drug delivery techniques and drugs, anti-VEGF agents therapeutic class segment is expected to account for a share of over 88% of the retinal disorder treatment market during the forecast period. Anti-VEGF agents segment is likely to reach a market value of ~9.4 Bn by 2020.

Analysts’ Viewpoint

The retinal disorder treatment market is expected to grow at an impressive CAGR of ~8% during the forecast period. Strides taken by genetic sequencing and molecular biology have paved the way for the development of a range of retinal disorders treatment in recent times. Moreover, research and development activities funded by governments as well as nonprofit organizations pertaining to the development of novel therapeutic strategies for retinal treatment will provide a significant impetus for growth of the retinal disorder treatment market during the forecast period. North America and Europe are expected to be at the helm, in terms of innovation, owing to robust healthcare systems and favorable government policies.

Retinal disorder treatment market is expected to reach a value of ~US$ 17.6 Bn by 2027

Retinal disorder treatment market is projected to expand at a CAGR of ~8% from 2019 to 2027

Retinal disorder treatment market is driven by rise in prevalence of retinal disorders due to increase in geriatric patient population

The retail pharmacies segment dominated the retinal disorder treatment market, and the trend is expected to continue during the forecast period

Key players in the retinal disorder treatment market include Santen Pharmaceutical Co., Ltd., Regeneron Pharmaceuticals, Inc., F. Hoffmann-La Roche Ltd., Pfizer, Inc., Allergan plc

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Research Methodology

3. Executive Summary

3.1. Global Retinal Disorder Treatment Market Snapshot

4. Market Overview

4.1. Product Overview

4.2. Key Industry Events

4.3. Market Dynamics

4.3.1. Drivers and Restraints Snapshot Analysis

4.3.2. Drivers

4.3.3. Restraints

4.3.4. Opportunities

4.4. Global Retinal Disorder Treatment Market Revenue Projection

4.5. Global Retinal Disorder Treatment Market Outlook

5. Market Outlook

5.1. Clinical Trial Analysis

5.2. Regulatory Scenario

5.3. Pipeline Analysis

5.4. Key Mergers & Acquisitions

5.5. Reimbursement Scenario

6. Global Retinal Disorder Treatment Market Analysis, by Disease Indication

6.1. Introduction

6.2. Global Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Disease Indication

6.3. Global Retinal Disorder Treatment Market Forecast, by Disease Indication

6.3.1. Macular Degeneration

6.3.1.1. Dry Macular Degeneration

6.3.1.2. Wet Macular Degeneration

6.3.2. Diabetic Retinopathy

6.3.3. Diabetic Macular Edema

6.3.4. Others (Retinal Vein Occlusion, etc.)

7. Global Retinal Disorder Treatment Market Analysis, by Therapeutic Class

7.1. Introduction

7.2. North America Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Therapeutic Class

7.3. North America Retinal Disorder Treatment Market Forecast, by Therapeutic Class

7.3.1. Anti-VEGF Agents

7.3.2. Others (Anti-inflammatory Drugs, etc.)

8. Global Retinal Disorder Treatment Market Analysis, by Dosage Form

8.1. Introduction

8.2. Global Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Dosage Form

8.3. Global Retinal Disorder Treatment Market Forecast, by Dosage Form

8.3.1. Gels

8.3.2. Eye Solutions

8.3.3. Capsules & Tablets

8.3.4. Eye Drops

8.3.5. Ointments

8.4. Global Retinal Disorder Treatment Market Analysis, by Dosage Form

9. Global Retinal Disorder Treatment Market Analysis, by Distribution Channel

9.1. Introduction

9.2. Global Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Distribution Channel

9.3. Global Retinal Disorder Treatment Market Forecast, by Distribution Channel

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Sales

9.4. Global Retinal Disorder Treatment Market Analysis, by Distribution Channel

10. Global Retinal Disorder Treatment Market Analysis, by Region

10.1. Global Retinal Disorder Treatment Market Scenario, by Country

10.2. Global Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Region

10.3. Global Retinal Disorder Treatment Market Forecast, by Region

10.3.1. North America

10.3.2. Europe

10.3.3. Asia Pacific

10.3.4. Latin America

10.3.5. Middle East & Africa

11. North America Retinal Disorder Treatment Market Analysis

11.1. Key Findings

11.2. North America Retinal Disorder Treatment Market Overview

11.3. North America Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Country

11.4. North America Retinal Disorder Treatment Market Forecast, by Country

11.4.1. U.S.

11.4.2. Canada

11.5. North America Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Disease Indication

11.6. North America Retinal Disorder Treatment Market Forecast, by Disease Indication

11.6.1. Macular Degeneration

11.6.1.1. Dry Macular Degeneration

11.6.1.2. Wet Macular Degeneration

11.6.2. Diabetic Retinopathy

11.6.3. Diabetic Macular Edema

11.6.4. Others (Retinal Vein Occlusion, etc.)

11.7. North America Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Therapeutic Class

11.8. North America Retinal Disorder Treatment Market Forecast, by Therapeutic Class

11.8.1. Anti-VEGF Agents

11.8.2. Others (Anti-inflammatory Drugs, etc.)

11.9. North America Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Dosage Form

11.10. North America Retinal Disorder Treatment Market Forecast, by Dosage Form

11.10.1. Gels

11.10.2. Eye Solutions

11.10.3. Capsules & Tablets

11.10.4. Eye Drops

11.10.5. Ointments

11.11. North America Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Distribution Channel

11.12. North America Retinal Disorder Treatment Market Forecast, by Distribution Channel

11.12.1. Hospital Pharmacies

11.12.2. Retail Pharmacies

11.12.3. Online Sales

12. Europe Retinal Disorder Treatment Market Analysis

12.1. Key Findings

12.2. Europe Retinal Disorder Treatment Market Overview

12.3. Europe Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Country/Sub-region

12.4. Europe Retinal Disorder Treatment Market Forecast, by Country/Sub-region

12.4.1. Germany

12.4.2. France

12.4.3. U.K.

12.4.4. Italy

12.4.5. Spain

12.4.6. Rest of Europe

12.5. Europe Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Disease Indication

12.6. Europe Retinal Disorder Treatment Market Forecast, by Disease Indication

12.6.1. Macular Degeneration

12.6.1.1. Dry Macular Degeneration

12.6.1.2. Wet Macular Degeneration

12.6.2. Diabetic Retinopathy

12.6.3. Diabetic Macular Edema

12.6.4. Others (Retinal Vein Occlusion, etc.)

12.7. Europe Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Therapeutic Class

12.8. Europe Retinal Disorder Treatment Market Forecast, by Therapeutic Class

12.8.1. Anti-VEGF Agents

12.8.2. Others (Anti-inflammatory Drugs, etc.)

12.9. Europe Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Dosage Form

12.10. Europe Retinal Disorder Treatment Market Forecast, by Dosage Form

12.10.1. Gels

12.10.2. Eye Solutions

12.10.3. Capsules & Tablets

12.10.4. Eye Drops

12.10.5. Ointments

12.11. Europe Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Distribution Channel

12.12. Europe Retinal Disorder Treatment Market Forecast, by Distribution Channel

12.12.1. Hospital Pharmacies

12.12.2. Retail Pharmacies

12.12.3. Online Sales

13. Asia Pacific Retinal Disorder Treatment Market Analysis

13.1. Key Findings

13.2. Asia Pacific Retinal Disorder Treatment Market Overview

13.3. Asia Pacific Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Country/Sub-region

13.4. Asia Pacific Retinal Disorder Treatment Market Forecast, by Country/Sub-region

13.4.1. Japan

13.4.2. China

13.4.3. India

13.4.4. Australia & New Zealand

13.4.5. Rest of Asia Pacific

13.5. Asia Pacific Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Disease Indication

13.6. Asia Pacific Retinal Disorder Treatment Market Forecast, by Disease Indication

13.6.1. Macular Degeneration

13.6.1.1. Dry Macular Degeneration

13.6.1.2. Wet Macular Degeneration

13.6.2. Diabetic Retinopathy

13.6.3. Diabetic Macular Edema

13.6.4. Others (Retinal Vein Occlusion, etc.)

13.7. Asia Pacific Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Therapeutic Class

13.8. Asia Pacific Retinal Disorder Treatment Market Forecast, by Therapeutic Class

13.8.1. Anti-VEGF Agents

13.8.2. Others (Anti-inflammatory Drugs, etc.)

13.9. Asia Pacific Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Dosage Form

13.10. Asia Pacific Retinal Disorder Treatment Market Forecast, by Dosage Form

13.10.1. Gels

13.10.2. Eye Solutions

13.10.3. Capsules & Tablets

13.10.4. Eye Drops

13.10.5. Ointments

13.11. Asia Pacific Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Distribution Channel

13.12. Asia Pacific Retinal Disorder Treatment Market Forecast, by Distribution Channel

13.12.1. Hospital Pharmacies

13.12.2. Retail Pharmacies

13.12.3. Online Sales

14. Latin America Retinal Disorder Treatment Market Analysis

14.1. Key Findings

14.2. Latin America Retinal Disorder Treatment Market Overview

14.3. Latin America Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Country/Sub-region

14.4. Latin America Retinal Disorder Treatment Market Forecast, by Country/Sub-region

14.4.1. Brazil

14.4.2. Mexico

14.4.3. Rest of Latin America

14.5. Latin America Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Disease Indication

14.6. Latin America Retinal Disorder Treatment Market Forecast, by Disease Indication

14.6.1. Macular Degeneration

14.6.1.1. Dry Macular Degeneration

14.6.1.2. Wet Macular Degeneration

14.6.2. Diabetic Retinopathy

14.6.3. Diabetic Macular Edema

14.6.4. Others (Retinal Vein Occlusion, etc.)

14.7. Latin America Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Therapeutic Class

14.8. Latin America Retinal Disorder Treatment Market Forecast, by Therapeutic Class

14.8.1. Anti-VEGF Agents

14.8.2. Others (Anti-inflammatory Drugs, etc.)

14.9. Latin America Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Dosage Form

14.10. Latin America Retinal Disorder Treatment Market Forecast, by Dosage Form

14.10.1. Gels

14.10.2. Eye Solutions

14.10.3. Capsules & Tablets

14.10.4. Eye Drops

14.10.5. Ointments

14.11. Latin America Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Distribution Channel

14.12. Latin America Retinal Disorder Treatment Market Forecast, by Distribution Channel

14.12.1. Hospital Pharmacies

14.12.2. Retail Pharmacies

14.12.3. Online Sales

15. Middle East & Africa Retinal Disorder Treatment Market Analysis

15.1. Key Findings

15.2. Middle East & Africa Retinal Disorder Treatment Market Overview

15.3. Middle East & Africa Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Country/Sub-region

15.4. Middle East & Africa Retinal Disorder Treatment Market Forecast, by Country/Sub-region

15.4.1. GCC Countries

15.4.2. South Africa

15.4.3. Rest of Middle East & Africa

15.5. Middle East & Africa Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Disease Indication

15.6. Middle East & Africa Retinal Disorder Treatment Market Forecast, by Disease Indication

15.6.1. Macular Degeneration

15.6.1.1. Dry Macular Degeneration

15.6.1.2. Wet Macular Degeneration

15.6.2. Diabetic Retinopathy

15.6.3. Diabetic Macular Edema

15.6.4. Others (Retinal Vein Occlusion, etc.)

15.7. Middle East & Africa Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Therapeutic Class

15.8. Middle East & Africa Retinal Disorder Treatment Market Forecast, by Therapeutic Class

15.8.1. Anti-VEGF Agents

15.8.2. Others (Anti-inflammatory Drugs, etc.)

15.9. Middle East & Africa Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Dosage Form

15.10. Middle East & Africa Retinal Disorder Treatment Market Forecast, by Dosage Form

15.10.1. Gels

15.10.2. Eye Solutions

15.10.3. Capsules & Tablets

15.10.4. Eye Drops

15.10.5. Ointments

15.11. Middle East & Africa Retinal Disorder Treatment Market Value Share and Attractiveness Analysis, by Distribution Channel

15.12. Middle East & Africa Retinal Disorder Treatment Market Forecast, by Distribution Channel

15.12.1. Hospital Pharmacies

15.12.2. Retail Pharmacies

15.12.3. Online Sales

16. Competition Analysis

16.1. Global Retinal Disorder Treatment Market Share Analysis, by Company

16.2. Competition Matrix

16.3. Company Profile

16.3.1. Santen Pharmaceutical Co., Ltd.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Financial Overview

16.3.1.3. Product Portfolio

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Regeneron Pharmaceuticals, Inc.

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Financial Overview

16.3.2.3. Product Portfolio

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. F. Hoffmann-La Roche Ltd.

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Financial Overview

16.3.3.3. Product Portfolio

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Pfizer, Inc.

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Financial Overview

16.3.4.3. Product Portfolio

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Allergan plc

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Financial Overview

16.3.5.3. Product Portfolio

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Shire (Takeda Pharmaceutical Company Limited)

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Financial Overview

16.3.6.3. Product Portfolio

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Bayer AG

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Financial Overview

16.3.7.3. Product Portfolio

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Graybug Vision, Inc.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Financial Overview

16.3.8.3. Product Portfolio

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Novartis AG

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Financial Overview

16.3.9.3. Product Portfolio

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Acucela Inc. (Kubota Pharmaceutical Holdings Co., Ltd.)

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Financial Overview

16.3.10.3. Product Portfolio

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

List of Tables

Table 01: Global Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2027

Table 02: Global Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Macular Degeneration, 2017–2027

Table 03: North America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Therapeutic Class, 2017–2027

Table 04: Global Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 05: Global Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 06: North America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 07: North America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2027

Table 08: North America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Macular Degeneration, 2017–2027

Table 09: North America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Therapeutic Class, 2017–2027

Table 10: North America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2027

Table 11: North America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 12: Europe Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 13: Europe Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2027

Table 14: Europe Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Macular Degeneration, 2017–2027

Table 15: Europe Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Therapeutic Class, 2017–2027

Table 16: Europe Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2027

Table 17: Europe Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 18: Asia Pacific Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 19: Asia Pacific Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2027

Table 20: Asia Pacific Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Macular Degeneration, 2017–2027

Table 21: Asia Pacific Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Therapeutic Class, 2017–2027

Table 22: Asia Pacific Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2027

Table 23: Asia Pacific Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 24: Latin America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 25: Latin America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2027

Table 26: Latin America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Macular Degeneration, 2017–2027

Table 27: Latin America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Therapeutic Class, 2017–2027

Table 28: Latin America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2027

Table 29: Latin America Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 30: Middle East & Africa Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 31: Middle East & Africa Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Disease Indication, 2017–2027

Table 32: Middle East & Africa Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Macular Degeneration, 2017–2027

Table 33: Middle East & Africa Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Therapeutic Class, 2017–2027

Table 34: Middle East & Africa Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2027

Table 35: Middle East & Africa Retinal Disorder Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

List of Figures

Figure 01: Global retinal disorder treatment Market Value (US$ Mn) and Distribution (%), by Region, 2018 and 2027

Figure 02: Global Retinal Disorder Treatment Market Value (US$ Mn) and Forecast, 2019–2027

Figure 03: Global Retinal Disorder Treatment Market Value Share (%), by Disease Indication, 2018

Figure 04: Global Retinal Disorder Treatment Market Value Share (%), by Therapeutic Class, 2018

Figure 05: Global Retinal Disorder Treatment Market Value Share (%), by Dosage Form, 2018

Figure 06: Global Retinal Disorder Treatment Market Value Share (%), by Region, 2018

Figure 07: Global Retinal Disorder Treatment Market Value Share (%), by Distribution Channel, 2018

Figure 08: Clinical Trial Analysis by Phase

Figure 09: Clinical Trial Analysis by Status

Figure 10: Clinical Trial Analysis by Completion and Termination Rate

Figure 11: Clinical Trial Analysis by Region

Figure 12: Global Retinal Disorder Treatment Market Value Share Analysis, by Disease Indication, 2018 and 2027

Figure 13: Global Retinal Disorder Treatment Market Attractiveness, by Disease Indication, 2019–2027

Figure 14: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Macular Degeneration, 2017–2027

Figure 15: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Diabetes Retinopathy, 2017–2027

Figure 16: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Diabetic Macular Edema, 2017–2027

Figure 17: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others (Retinal Vein Occlusion, etc.), 2017–2027

Figure 18: North America Retinal Disorder Treatment Market Value Share Analysis, by Therapeutic Class, 2018 and 2027

Figure 19: North America Retinal Disorder Treatment Market Attractiveness, by Therapeutic Class, 2019–2027

Figure 20: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Anti-VEGF Agents, 2017–2027

Figure 21: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others (Anti-inflammatory Drugs, etc.), 2017–2027

Figure 22: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Gels, 2017–2027

Figure 23: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Eye Solutions, 2017–2027

Figure 24: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Capsules & Tablets, 2017–2027

Figure 25: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Eye Drops, 2017–2027

Figure 26: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ointments, 2017–2027

Figure 27: Global Retinal Disorder Treatment Market Value Share, by Distribution Channel, 2018 and 2027

Figure 28: Global Retinal Disorder Treatment Market Attractiveness, by Distribution Channel, 2019–2027

Figure 29: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospital Pharmacies, 2017–2027

Figure 30: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Retail Pharmacies, 2017–2027

Figure 31: Global Retinal Disorder Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Online Sales, 2017–2027

Figure 32: Global Retinal Disorder Treatment Market Value Share, by Region, 2018 and 2027

Figure 33: Global Retinal Disorder Treatment Market Attractiveness, by Region, 2019–2027

Figure 34: North America Retinal Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 35: North America Retinal Disorder Treatment Market Value Share Analysis, by Country, 2018 and 2027

Figure 36: North America Retinal Disorder Treatment Market Attractiveness, by Country, 2019–2027

Figure 37: North America Retinal Disorder Treatment Market Value Share Analysis, by Disease Indication, 2018 and 2027

Figure 38: North America Retinal Disorder Treatment Market Attractiveness, by Disease Indication, 2019–2027

Figure 39: North America Retinal Disorder Treatment Market Value Share Analysis, by Therapeutic Class, 2018 and 2027

Figure 40: North America Retinal Disorder Treatment Market Attractiveness, by Therapeutic Class, 2019–2027

Figure 41: North America Retinal Disorder Treatment Market Value Share, by Dosage Form, 2018 and 2027

Figure 42: North America Retinal Disorder Treatment Market Attractiveness, by Dosage Form, 2019–2027

Figure 43: North America Retinal Disorder Treatment Market Value Share, by Distribution Channel, 2018 and 2027

Figure 44: North America Retinal Disorder Treatment Market Attractiveness, by Distribution Channel, 2019–2027

Figure 45: Europe Retinal Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 46: Europe Retinal Disorder Treatment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 47: Europe Retinal Disorder Treatment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 48: Europe Retinal Disorder Treatment Market Value Share Analysis, by Disease Indication, 2018 and 2027

Figure 49: Europe Retinal Disorder Treatment Market Attractiveness, by Disease Indication, 2019–2027

Figure 50: Europe Retinal Disorder Treatment Market Value Share Analysis, by Therapeutic Class, 2018 and 2027

Figure 51: Europe Retinal Disorder Treatment Market Attractiveness, by Therapeutic Class, 2019–2027

Figure 52: Europe Retinal Disorder Treatment Market Value Share, by Dosage Form, 2018 and 2027

Figure 53: Europe Retinal Disorder Treatment Market Attractiveness, by Dosage Form, 2019–2027

Figure 54: Europe Retinal Disorder Treatment Market Value Share, by Distribution Channel, 2018 and 2027

Figure 55: Europe Retinal Disorder Treatment Market Attractiveness, by Distribution Channel, 2019–2027

Figure 56: Asia Pacific Retinal Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 57: Asia Pacific Retinal Disorder Treatment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 58: Asia Pacific Retinal Disorder Treatment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 59: Asia Pacific Retinal Disorder Treatment Market Value Share Analysis, by Disease Indication, 2018 and 2027

Figure 60: Asia Pacific Retinal Disorder Treatment Market Attractiveness, by Disease Indication, 2019–2027

Figure 61: Asia Pacific Retinal Disorder Treatment Market Value Share Analysis, by Therapeutic Class, 2018 and 2027

Figure 62: Asia Pacific Retinal Disorder Treatment Market Attractiveness, by Therapeutic Class, 2019–2027

Figure 63: Asia Pacific Retinal Disorder Treatment Market Value Share, by Dosage Form, 2018 and 2027

Figure 64: Asia Pacific Retinal Disorder Treatment Market Attractiveness, by Dosage Form, 2019–2027

Figure 65: Asia Pacific Retinal Disorder Treatment Market Value Share, by Distribution Channel, 2018 and 2027

Figure 66: Asia Pacific Retinal Disorder Treatment Market Attractiveness, by Distribution Channel, 2019–2027

Figure 67: Latin America Retinal Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 68: Latin America Retinal Disorder Treatment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 69: Latin America Retinal Disorder Treatment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 70: Latin America Retinal Disorder Treatment Market Value Share Analysis, by Disease Indication, 2018 and 2027

Figure 71: Latin America Retinal Disorder Treatment Market Attractiveness, by Disease Indication, 2019–2027

Figure 72: Latin America Retinal Disorder Treatment Market Value Share Analysis, by Therapeutic Class, 2018 and 2027

Figure 73: Latin America Retinal Disorder Treatment Market Attractiveness, by Therapeutic Class, 2019–2027

Figure 74: Latin America Retinal Disorder Treatment Market Value Share, by Dosage Form, 2018 and 2027

Figure 75: Latin America Retinal Disorder Treatment Market Attractiveness, by Dosage Form, 2019–2027

Figure 76: Latin America Retinal Disorder Treatment Market Value Share, by Distribution Channel, 2018 and 2027

Figure 77: Latin America Retinal Disorder Treatment Market Attractiveness, by Distribution Channel, 2019–2027

Figure 78: Middle East & Africa Retinal Disorder Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 79: Middle East & Africa Retinal Disorder Treatment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 80: Middle East & Africa Retinal Disorder Treatment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 81: Middle East & Africa Retinal Disorder Treatment Market Value Share Analysis, by Disease Indication, 2018 and 2027

Figure 82: Middle East & Africa Retinal Disorder Treatment Market Attractiveness, by Disease Indication, 2019–2027

Figure 83: Middle East & Africa Retinal Disorder Treatment Market Value Share Analysis, by Therapeutic Class, 2018 and 2027

Figure 84: Middle East & Africa Retinal Disorder Treatment Market Attractiveness, by Therapeutic Class, 2019–2027

Figure 85: Middle East & Africa Retinal Disorder Treatment Market Value Share, by Dosage Form, 2018 and 2027

Figure 86: Middle East & Africa Retinal Disorder Treatment Market Attractiveness, by Dosage Form, 2019–2027

Figure 87: Middle East & Africa Retinal Disorder Treatment Market Value Share, by Distribution Channel, 2018 and 2027

Figure 88: Middle East & Africa Retinal Disorder Treatment Market Attractiveness, by Distribution Channel, 2019–2027