Reports

Reports

The ophthalmic drug market is currently witnessing robust growth because of increased prevalence of eye diseases, advancements in pharmaceutical technology, and enhanced global awareness of the importance of eye care. One of the major reasons for this market expansion is rise in the prevalence of eye disorders.

Glaucoma, diabetic retinopathy, and cataracts are mainly being driven by aging population and lifestyle changes. As the global population is gradually moving toward older demographics, there is an increased need for treatment modalities to treat these conditions effectively.

.webp)

Moreover, the speed at which drug delivery systems and drug formulations are improving, along with the ongoing investigations into advanced treatments like gene therapy and controlled-release drug delivery systems widening the treatment options window for patients. Not only do these advances improve the efficacy of drugs, but also the compliance of patients to follow the treatment regimen.

Furthermore, increased investment by the pharmaceutical industry into research and development activities is also resulting in an increased manufacturing of new and innovative ophthalmic pharmaceuticals. The business climate also increases with partnerships involving biopharmaceutical companies and university in an effort to develop new therapeutic modalities.

The ophthalmic drugs industry is also experiencing new developments through telemedicine and online health platforms with remote diagnosis and monitoring, thereby allowing for earlier treatments and more effective management of disease.

Additionally, one of the most critical driving forces is the increasing recognition of the need for eye care due to campaigns and publicity programmes that have raised public awareness. More evolved consumers with respect to threats to their eye care drive preventive treatment and care, which increases the demand for ophthalmic products.

Additionally, an increase in penetration of ophthalmic drugs in traditional as well as online pharmacies provides enhanced patient access and thus drives market expansion. The rise in threat perception toward eye health, along with higher defensive and precautionary measures taken by customers, leads to higher demand for ophthalmic products. In addition, the higher availability of ophthalmic drugs through retail pharmacies as well as online pharmacies raises patient accessibility, thereby driving market growth.

Ophthalmic medications are unique drugs developed for the diagnosis, treatment, and prevention of a multitude of conditions and diseases related to the eye. They are formulated and designed to be administered to the eye directly to limit side-effects and allow for action by sufficiently applying drug to the site of action. The uses of ophthalmic medications are diverse and come in a variety of classes of therapy.

Ophthalmic medications come in many formulations and can be classified in many different ways, including anti-inflammatory medications, antibiotics, antifungals, antivirals, and local anesthetics. For example, corticosteroids are used to diminish inflammation following surgery or trauma to the eye, while antibiotics are necessary for treating awful bacterial infection such as conjunctivitis. Prostaglandin analogues and beta-blockers also play an important role in treating intraocular pressure in patients with glaucoma and hence avoiding blindness.

Recent advances in drug design have allowed the creation of new drug delivery systems like sustained-release implants and nanotechnology products, which are more effective and of longer therapeutic duration. These ease the dosing regimens and therefore enhance patient compliance with therapy.

Additionally, ophthalmic medication availability can be categorized into two major groups: prescription medication and over-the-counter drugs. Prescription ophthalmic medication is typically applied in more severe eye problems that need to be clinically diagnosed and treated. These involve glaucoma medication, infection, inflammatory medication, and some chronic eye diseases.

Prescription medication generally carries strong active ingredients that must be strictly monitored by physicians to be safe and effective. For example, drugs like glaucoma prostaglandin analogs or corticosteroids to reduce inflammation require cautious dosing and monitoring to avoid any side effects.

In contrast, over-the-counter ophthalmic medication is readily available to the ordinary consumer without prescription. These are typically applied for the management of milder eye conditions such as dry eyes, allergies, and minor irritations. Best-selling over-the-counter ophthalmic medication includes artificial tears, antihistamine drops, and redness reducers. Their availability allows patients to manage minor symptoms simply and effectively without going to the physician.

| Attribute | Detail |

|---|---|

| Ophthalmic Drugs Market Drivers |

|

The increasing prevalence of eye diseases is a key driver to the market for ophthalmic pharmaceuticals, a significant public health issue and emerging business opportunity for the pharmaceutical sector. With rise in aging population worldwide, the incidences of most eye diseases have increased, thereby posing a pressing requirement for effective treatment. Age-related macular degeneration (AMD), glaucoma, diabetic retinopathy, and cataracts are among the most common disorders affecting vision, especially in older adults.

According to the World Health Organization, it is estimated that 2.2 billion individuals are currently living with near or distance visual impairment. Of these, at least 1 billion cases could have been avoided or remain to be treated. Blindness and vision impairment also have a colossal economic impact at the international level, and the overall yearly cost of productivity has been estimated to be US$ 411.0 Bn.

One of the most causative drivers to increasing cases of eye diseases is the ongoing trend of an aging demographic. Since there is improved life expectancy, more individuals live with ocular ailments. For example, conditions like glaucoma, which, if left untreated, lead to irreversible blindness, are prevalent among elderly individuals. Also, diabetic retinopathy is one of the causes of visual disability in the working age population, and hence management prefers to keep it under control.

Additionally, lifestyle variables like extended screen use, bad eating habits, and physical inactivity have contributed to the onset of eye diseases. The technology era has added a further disease burden in the form of digital eye fatigue, which occurs with symptoms of dryness, blurred vision, and irritation. Increasingly, this disorder is being acknowledged, and this has led to demand for over-the-counter drugs like lubricating eye drops, which are the prime ingredients of ophthalmic drugs market.

The increasing need for telemedicine and digital health solutions is a paradigm shift in the ophthalmic drugs market, which is transforming delivery paradigms of eye care and patient treatment. Telemedicine has witnessed explosive growth over the last few years, and particularly due to the COVID-19 pandemic requiring remote consultations and treatments. The technology has enabled the patients to be diagnosed and treated for their eye ailments in time without having to report alone, thereby enhancing the ophthalmic service accessibility.

The most significant benefit of telemedicine in ophthalmology is that it can extend to underserved populations, such as rural or remote communities where access to specialty eye care may be lacking. Through digital technology healthcare professionals can perform virtual visits, thereby allowing patients to report symptoms, receive preliminary diagnoses, and obtain prescriptions for eye medications from home. This increased access not only allows for earlier diagnosis and treatment of eye disease but also prompts patients who may otherwise be reluctant to report for treatment due to logistical reasons to report for timely treatment.

Electronic health platforms like wearable devices and mobile health applications further advance this setting by providing patients with the authority of proactiveness in their own eye care. For example, mobile applications may remind patients to comply with medication, allow tracking of symptoms, and even remotely monitor intraocular pressure in glaucoma patients.

All these equipment encourage increase patient compliance and cooperation that are vital to the effective management of chronic eye disease.

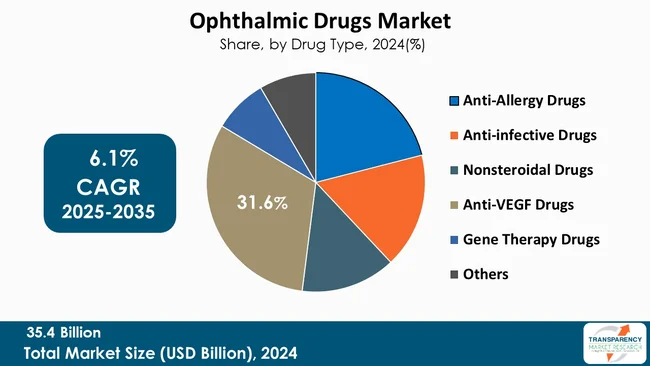

Anti-VEGF (Vascular Endothelial Growth Factor) Drugs segment leads the global ophthalmic drugs market. This can be attributed to the use of such medications in treating prevalent eye conditions such as age-related macular degeneration (AMD), diabetic retinopathy, and retinal vein occlusion, which are the leading causes of vision impairment globally.

Pegaptanib (Macugen), an aptamer targeting VEGF-A165, was the first intravitreal drug approved for treating wet AMD. In recent years, VEGF inhibitors such as bevacizumab (Avastin), ranibizumab (Lucentis), and aflibercept (Eylea) have been commonly used in clinical practice.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

As per the latest ophthalmic drugs market analysis, North America dominated the market in 2024. The region is equipped with a well-established healthcare system, advanced diagnostic and treatment facilities. The center facilitates timely access to eye care services, encouraging the use of innovative treatments and medicines.

Further, high incidence of eye diseases like age-related macular degeneration, diabetic retinopathy, and glaucoma contributes to the demand for ophthalmic drugs. Demand is further fueled by the aging U.S. and Canadian population since these conditions are more prevalent in older people.

North America houses huge pharmaceutical R&D, with the majority of top companies and R&D facilities spending heavily on ophthalmic drug developments. The high concentration of R&D allows new treatments to enter the market, advancing the treatment for individuals.

Some of the important initiatives undertaken by companies in the ophthalmic drugs market are significant investment in R&D for the development of anti-VEGF therapy, gene therapy, and new drug delivery systems for enhanced efficacy and patient compliance. The major pharmaceutical companies are conducting high-scale clinical trials to evaluate the safety and efficacy of drugs.

Alcon Inc., Novartis AG, Bausch + Lomb., Merck & Co., Inc., Regeneron Pharmaceuticals Inc., Coherus BioSciences, Inc., Pfizer Inc., AbbVie, RIBOMIC, Santen Pharmaceutical Co., Ltd., Cipla Limited, Lupin Pharmaceuticals, Inc., Ocular Therapeutix, Inc., Novaliq GmbH, ZEXUS PHARMA, and Grevis Pharmaceuticals Pvt. Ltd. are some of the leading players operating in the global ophthalmic drugs market.

Each of these players has been profiled in the ophthalmic drugs market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 35.4 Bn |

| Forecast Value in 2035 | US$ 67.9 Bn |

| CAGR | 6.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Biotechnology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global ophthalmic drugs market was valued at US$ 35.4 Bn in 2024.

The global ophthalmic drugs market is projected to reach more than US$ 67.9 Bn by the end of 2035.

Increasing prevalence of eye disorders, growing global geriatric population, advancements in drug formulations, delivery systems, and surgical technologies, and increased awareness of eye health are the factors driving the expansion of ophthalmic drugs market.

The CAGR is anticipated to be 6.1% from 2025 to 2035.

Alcon Inc., Novartis AG, Bausch + Lomb., Merck & Co., Inc., Regeneron Pharmaceuticals Inc., Coherus BioSciences, Inc., Pfizer Inc., AbbVie, RIBOMIC, Santen Pharmaceutical Co., Ltd., Cipla Limited, Lupin Pharmaceuticals, Inc., Ocular Therapeutix, Inc., Novaliq GmbH, ZEXUS PHARMA, and Grevis Pharmaceuticals Pvt. Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Ophthalmic Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Ophthalmic Drugs Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Healthcare Expenditure across Key Regions / Countries

5.2. Recent Advancements in Ophthalmic Medications

5.3. Epidemiology of Ophthalmic Disorders across Key Regions / Countries

5.4. Pricing Trends for Ophthalmic Drugs

5.5. Regulatory Scenario across Key Regions / Countries

5.6. PORTER’s Five Forces Analysis

5.7. PESTEL Analysis

5.8. Value Chain Analysis

5.9. Key Purchase Metrics for End-users

5.10. Go-to-Market Strategy for New Market Entrants

5.11. Key Industry Events (Partnerships, Collaborations, Product approvals, mergers & acquisitions)

5.12. Benchmarking of Key Products Offered by the Leading Competitors

6. Global Ophthalmic Drugs Market Analysis and Forecasts, By Drug Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Drug Type, 2020 to 2035

6.3.1. Anti-Allergy Drugs

6.3.2. Anti-infective Drugs

6.3.3. Nonsteroidal Drugs

6.3.4. Anti-VEGF Drugs

6.3.4.1. Aptamer

6.3.4.2. Antibodies (mAb & Bispecific Antibody)

6.3.4.3. Fusion Protein

6.3.5. Gene Therapy Drugs

6.3.6. Others

6.4. Market Attractiveness By Drug Type

7. Global Ophthalmic Drugs Market Analysis and Forecasts, By Route of Administration

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Route of Administration, 2020 to 2035

7.3.1. Topical

7.3.2. Intraocular

7.3.3. Others

7.4. Market Attractiveness By Route of Administration

8. Global Ophthalmic Drugs Market Analysis and Forecasts, By Dosage Form

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Dosage Form, 2020 to 2035

8.3.1. Gel

8.3.2. Drop

8.3.3. Ointment

8.3.4. Suspension & Solutions

8.3.5. Others

8.4. Market Attractiveness By Dosage Form

9. Global Ophthalmic Drugs Market Analysis and Forecasts, By Product Type

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By Product Type, 2020 to 2035

9.3.1. Prescription Drugs

9.3.2. Over-the-Counter

9.4. Market Attractiveness By Product Type

10. Global Ophthalmic Drugs Market Analysis and Forecasts, By Indication

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast By Indication, 2020 to 2035

10.3.1. Glaucoma

10.3.2. Dry Eye Disease

10.3.3. Age-Related Macular Degeneration

10.3.4. Diabetic Retinopathy

10.3.5. Pink Eye

10.3.6. Cataracts

10.3.7. Retinal Detachment

10.3.8. Others

10.4. Market Attractiveness By Indication

11. Global Ophthalmic Drugs Market Analysis and Forecasts, By Distribution Channel

11.1. Introduction & Definition

11.2. Key Findings / Developments

11.3. Market Value Forecast By Distribution Channel, 2020 to 2035

11.3.1. Hospital Pharmacies

11.3.2. Retail Pharmacies

11.3.3. Online Pharmacies

11.4. Market Attractiveness By Distribution Channel

12. Global Ophthalmic Drugs Market Analysis and Forecasts, By Region

12.1. Key Findings

12.2. Market Value Forecast By Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Latin America

12.2.5. Middle East & Africa

12.3. Market Attractiveness By Region

13. North America Ophthalmic Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Drug Type, 2020 to 2035

13.2.1. Anti-Allergy Drugs

13.2.2. Anti-infective Drugs

13.2.3. Nonsteroidal Drugs

13.2.4. Anti-VEGF Drugs

13.2.4.1. Aptamer

13.2.4.2. Antibodies (mAb & Bispecific Antibody)

13.2.4.3. Fusion Protein

13.2.5. Gene Therapy Drugs

13.2.6. Others

13.3. Market Value Forecast By Route of Administration, 2020 to 2035

13.3.1. Topical

13.3.2. Intraocular

13.3.3. Others

13.4. Market Value Forecast By Dosage Form, 2020 to 2035

13.4.1. Gel

13.4.2. Drop

13.4.3. Ointment

13.4.4. Suspension & Solutions

13.4.5. Others

13.5. Market Value Forecast By Product Type, 2020 to 2035

13.5.1. Prescription Drugs

13.5.2. Over-the-Counter

13.6. Market Value Forecast By Indication, 2020 to 2035

13.6.1. Glaucoma

13.6.2. Dry Eye Disease

13.6.3. Age-Related Macular Degeneration

13.6.4. Diabetic Retinopathy

13.6.5. Pink Eye

13.6.6. Cataracts

13.6.7. Retinal Detachment

13.6.8. Others

13.7. Market Value Forecast By Distribution Channel, 2020 to 2035

13.7.1. Hospital Pharmacies

13.7.2. Retail Pharmacies

13.7.3. Online Pharmacies

13.8. Market Value Forecast By Country , 2020 to 2035

13.8.1. U.S.

13.8.2. Canada

13.9. Market Attractiveness Analysis

13.9.1. By Drug Type

13.9.2. By Route of Administration

13.9.3. By Dosage Form

13.9.4. By Product Type

13.9.5. By Indication

13.9.6. By Distribution Channel

13.9.7. By Country

14. Europe Ophthalmic Drugs Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Drug Type, 2020 to 2035

14.2.1. Anti-Allergy Drugs

14.2.2. Anti-infective Drugs

14.2.3. Nonsteroidal Drugs

14.2.4. Anti-VEGF Drugs

14.2.4.1. Aptamer

14.2.4.2. Antibodies (mAb & Bispecific Antibody)

14.2.4.3. Fusion Protein

14.2.5. Gene Therapy Drugs

14.2.6. Others

14.3. Market Value Forecast By Route of Administration, 2020 to 2035

14.3.1. Topical

14.3.2. Intraocular

14.3.3. Others

14.4. Market Value Forecast By Dosage Form, 2020 to 2035

14.4.1. Gel

14.4.2. Drop

14.4.3. Ointment

14.4.4. Suspension & Solutions

14.4.5. Others

14.5. Market Value Forecast By Product Type, 2020 to 2035

14.5.1. Prescription Drugs

14.5.2. Over-the-Counter

14.6. Market Value Forecast By Indication, 2020 to 2035

14.6.1. Glaucoma

14.6.2. Dry Eye Disease

14.6.3. Age-Related Macular Degeneration

14.6.4. Diabetic Retinopathy

14.6.5. Pink Eye

14.6.6. Cataracts

14.6.7. Retinal Detachment

14.6.8. Others

14.7. Market Value Forecast By Distribution Channel, 2020 to 2035

14.7.1. Hospital Pharmacies

14.7.2. Retail Pharmacies

14.7.3. Online Pharmacies

14.8. Market Value Forecast By Country / Sub-region , 2020 to 2035

14.8.1. Germany

14.8.2. UK

14.8.3. France

14.8.4. Italy

14.8.5. Spain

14.8.6. Switzerland

14.8.7. The Netherlands

14.8.8. Rest of Europe

14.9. Market Attractiveness Analysis

14.9.1. By Drug Type

14.9.2. By Route of Administration

14.9.3. By Dosage Form

14.9.4. By Product Type

14.9.5. By Indication

14.9.6. By Distribution Channel

14.9.7. By Country / Sub-region

15. Asia Pacific Ophthalmic Drugs Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast By Drug Type, 2020 to 2035

15.2.1. Anti-Allergy Drugs

15.2.2. Anti-infective Drugs

15.2.3. Nonsteroidal Drugs

15.2.4. Anti-VEGF Drugs

15.2.4.1. Aptamer

15.2.4.2. Antibodies (mAb & Bispecific Antibody)

15.2.4.3. Fusion Protein

15.2.5. Gene Therapy Drugs

15.2.6. Others

15.3. Market Value Forecast By Route of Administration, 2020 to 2035

15.3.1. Topical

15.3.2. Intraocular

15.3.3. Others

15.4. Market Value Forecast By Dosage Form, 2020 to 2035

15.4.1. Gel

15.4.2. Drop

15.4.3. Ointment

15.4.4. Suspension & Solutions

15.4.5. Others

15.5. Market Value Forecast By Product Type, 2020 to 2035

15.5.1. Prescription Drugs

15.5.2. Over-the-Counter

15.6. Market Value Forecast By Indication, 2020 to 2035

15.6.1. Glaucoma

15.6.2. Dry Eye Disease

15.6.3. Age-Related Macular Degeneration

15.6.4. Diabetic Retinopathy

15.6.5. Pink Eye

15.6.6. Cataracts

15.6.7. Retinal Detachment

15.6.8. Others

15.7. Market Value Forecast By Distribution Channel, 2020 to 2035

15.7.1. Hospital Pharmacies

15.7.2. Retail Pharmacies

15.7.3. Online Pharmacies

15.8. Market Value Forecast By Country / Sub-region , 2020 to 2035

15.8.1. China

15.8.2. India

15.8.3. Japan

15.8.4. South Korea

15.8.5. Australia & New Zealand

15.8.6. Rest of Asia Pacific

15.9. Market Attractiveness Analysis

15.9.1. By Drug Type

15.9.2. By Route of Administration

15.9.3. By Dosage Form

15.9.4. By Product Type

15.9.5. By Indication

15.9.6. By Distribution Channel

15.9.7. By Country / Sub-region

16. Latin America Ophthalmic Drugs Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast By Drug Type, 2020 to 2035

16.2.1. Anti-Allergy Drugs

16.2.2. Anti-infective Drugs

16.2.3. Nonsteroidal Drugs

16.2.4. Anti-VEGF Drugs

16.2.4.1. Aptamer

16.2.4.2. Antibodies (mAb & Bispecific Antibody)

16.2.4.3. Fusion Protein

16.2.5. Gene Therapy Drugs

16.2.6. Others

16.3. Market Value Forecast By Route of Administration, 2020 to 2035

16.3.1. Topical

16.3.2. Intraocular

16.3.3. Others

16.4. Market Value Forecast By Dosage Form, 2020 to 2035

16.4.1. Gel

16.4.2. Drop

16.4.3. Ointment

16.4.4. Suspension & Solutions

16.4.5. Others

16.5. Market Value Forecast By Product Type, 2020 to 2035

16.5.1. Prescription Drugs

16.5.2. Over-the-Counter

16.6. Market Value Forecast By Indication, 2020 to 2035

16.6.1. Glaucoma

16.6.2. Dry Eye Disease

16.6.3. Age-Related Macular Degeneration

16.6.4. Diabetic Retinopathy

16.6.5. Pink Eye

16.6.6. Cataracts

16.6.7. Retinal Detachment

16.6.8. Others

16.7. Market Value Forecast By Distribution Channel, 2020 to 2035

16.7.1. Hospital Pharmacies

16.7.2. Retail Pharmacies

16.7.3. Online Pharmacies

16.8. Market Value Forecast By Country / Sub-region , 2020 to 2035

16.8.1. Brazil

16.8.2. Mexico

16.8.3. Argentina

16.8.4. Rest of Latin America

16.9. Market Attractiveness Analysis

16.9.1. By Drug Type

16.9.2. By Route of Administration

16.9.3. By Dosage Form

16.9.4. By Product Type

16.9.5. By Indication

16.9.6. By Distribution Channel

16.9.7. By Country / Sub-region

17. Middle East & Africa Ophthalmic Drugs Market Analysis and Forecast

17.1. Introduction

17.1.1. Key Findings

17.2. Market Value Forecast By Drug Type, 2020 to 2035

17.2.1. Anti-Allergy Drugs

17.2.2. Anti-infective Drugs

17.2.3. Nonsteroidal Drugs

17.2.4. Anti-VEGF Drugs

17.2.4.1. Aptamer

17.2.4.2. Antibodies (mAb & Bispecific Antibody)

17.2.4.3. Fusion Protein

17.2.5. Gene Therapy Drugs

17.2.6. Others

17.3. Market Value Forecast By Route of Administration, 2020 to 2035

17.3.1. Topical

17.3.2. Intraocular

17.3.3. Others

17.4. Market Value Forecast By Dosage Form, 2020 to 2035

17.4.1. Gel

17.4.2. Drop

17.4.3. Ointment

17.4.4. Suspension & Solutions

17.4.5. Others

17.5. Market Value Forecast By Product Type, 2020 to 2035

17.5.1. Prescription Drugs

17.5.2. Over-the-Counter

17.6. Market Value Forecast By Indication, 2020 to 2035

17.6.1. Glaucoma

17.6.2. Dry Eye Disease

17.6.3. Age-Related Macular Degeneration

17.6.4. Diabetic Retinopathy

17.6.5. Pink Eye

17.6.6. Cataracts

17.6.7. Retinal Detachment

17.6.8. Others

17.7. Market Value Forecast By Distribution Channel, 2020 to 2035

17.7.1. Hospital Pharmacies

17.7.2. Retail Pharmacies

17.7.3. Online Pharmacies

17.8. Market Value Forecast By Country / Sub-region , 2020 to 2035

17.8.1. GCC Countries

17.8.2. South Africa

17.8.3. Rest of Middle East & Africa

17.9. Market Attractiveness Analysis

17.9.1. By Drug Type

17.9.2. By Route of Administration

17.9.3. By Dosage Form

17.9.4. By Product Type

17.9.5. By Indication

17.9.6. By Distribution Channel

17.9.7. By Country / Sub-region

18. Competition Landscape

18.1. Market Player – Competition Matrix (By Tier and Size of companies)

18.2. Market Share Analysis By Company (2024)

18.3. Company Profiles

18.3.1. Alcon Inc.

18.3.1.1. Company Overview

18.3.1.2. Financial Overview

18.3.1.3. Product Portfolio

18.3.1.4. Business Strategies

18.3.1.5. Recent Developments

18.3.2. Novartis AG

18.3.2.1. Company Overview

18.3.2.2. Financial Overview

18.3.2.3. Product Portfolio

18.3.2.4. Business Strategies

18.3.2.5. Recent Developments

18.3.3. Bausch + Lomb.

18.3.3.1. Company Overview

18.3.3.2. Financial Overview

18.3.3.3. Product Portfolio

18.3.3.4. Business Strategies

18.3.3.5. Recent Developments

18.3.4. Merck & Co., Inc.

18.3.4.1. Company Overview

18.3.4.2. Financial Overview

18.3.4.3. Product Portfolio

18.3.4.4. Business Strategies

18.3.4.5. Recent Developments

18.3.5. Regeneron Pharmaceuticals Inc.

18.3.5.1. Company Overview

18.3.5.2. Financial Overview

18.3.5.3. Product Portfolio

18.3.5.4. Business Strategies

18.3.5.5. Recent Developments

18.3.6. Coherus BioSciences, Inc.

18.3.6.1. Company Overview

18.3.6.2. Financial Overview

18.3.6.3. Product Portfolio

18.3.6.4. Business Strategies

18.3.6.5. Recent Developments

18.3.7. Pfizer Inc.

18.3.7.1. Company Overview

18.3.7.2. Financial Overview

18.3.7.3. Product Portfolio

18.3.7.4. Business Strategies

18.3.7.5. Recent Developments

18.3.8. AbbVie

18.3.8.1. Company Overview

18.3.8.2. Financial Overview

18.3.8.3. Product Portfolio

18.3.8.4. Business Strategies

18.3.8.5. Recent Developments

18.3.9. RIBOMIC

18.3.9.1. Company Overview

18.3.9.2. Financial Overview

18.3.9.3. Product Portfolio

18.3.9.4. Business Strategies

18.3.9.5. Recent Developments

18.3.10. Santen Pharmaceutical Co., Ltd.

18.3.10.1. Company Overview

18.3.10.2. Financial Overview

18.3.10.3. Product Portfolio

18.3.10.4. Business Strategies

18.3.10.5. Recent Developments

18.3.11. Cipla Limited

18.3.11.1. Company Overview

18.3.11.2. Financial Overview

18.3.11.3. Product Portfolio

18.3.11.4. Business Strategies

18.3.11.5. Recent Developments

18.3.12. Lupin Pharmaceuticals, Inc.

18.3.12.1. Company Overview

18.3.12.2. Financial Overview

18.3.12.3. Product Portfolio

18.3.12.4. Business Strategies

18.3.12.5. Recent Developments

18.3.13. Ocular Therapeutix, Inc.

18.3.13.1. Company Overview

18.3.13.2. Financial Overview

18.3.13.3. Product Portfolio

18.3.13.4. Business Strategies

18.3.13.5. Recent Developments

18.3.14. Novaliq GmbH

18.3.14.1. Company Overview

18.3.14.2. Financial Overview

18.3.14.3. Product Portfolio

18.3.14.4. Business Strategies

18.3.14.5. Recent Developments

18.3.15. ZEXUS PHARMA

18.3.15.1. Company Overview

18.3.15.2. Financial Overview

18.3.15.3. Product Portfolio

18.3.15.4. Business Strategies

18.3.15.5. Recent Developments

18.3.16. Grevis Pharmaceuticals Pvt. Ltd.

18.3.16.1. Company Overview

18.3.16.2. Financial Overview

18.3.16.3. Product Portfolio

18.3.16.4. Business Strategies

18.3.16.5. Recent Developments

List of Tables

Table 01: Global Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 02: Global Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Anti-VEGF Drugs, 2020 to 2035

Table 03: Global Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 04: Global Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Dosage Form, 2020 to 2035

Table 05: Global Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 06: Global Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 07: Global Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 08: Global Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 09: North America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 10: North America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 11: North America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Anti-VEGF Drugs, 2020 to 2035

Table 12: North America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 13: North America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Dosage Form, 2020 to 2035

Table 14: North America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 15: North America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 16: North America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 17: Europe - Ophthalmic Drugs Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 18: Europe - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 19: Europe - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Anti-VEGF Drugs, 2020 to 2035

Table 20: Europe - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 21: Europe - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Dosage Form, 2020 to 2035

Table 22: Europe - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 23: Europe - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 24: Europe - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 25: Asia Pacific - Ophthalmic Drugs Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 26: Asia Pacific - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 27: Asia Pacific - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Anti-VEGF Drugs, 2020 to 2035

Table 28: Asia Pacific - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 29: Asia Pacific - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Dosage Form, 2020 to 2035

Table 30: Asia Pacific - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 31: Asia Pacific - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 32: Asia Pacific - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 33: Latin America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 34: Latin America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 35: Latin America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Anti-VEGF Drugs, 2020 to 2035

Table 36: Latin America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 37: Latin America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Dosage Form, 2020 to 2035

Table 38: Latin America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 39: Latin America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 40: Latin America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 41: Middle East & Africa - Ophthalmic Drugs Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 42: Middle East & Africa - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 43: Middle East & Africa - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Anti-VEGF Drugs, 2020 to 2035

Table 44: Middle East & Africa - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 45: Middle East & Africa - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Dosage Form, 2020 to 2035

Table 46: Middle East & Africa - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 47: Middle East & Africa - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 48: Middle East & Africa - Ophthalmic Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

List of Figures

Figure 01: Global Ophthalmic Drugs Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 02: Global Ophthalmic Drugs Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 03: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Anti-Allergy Drugs, 2020 to 2035

Figure 04: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Anti-infective Drugs, 2020 to 2035

Figure 05: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Nonsteroidal Drugs, 2020 to 2035

Figure 06: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Anti-VEGF Drugs, 2020 to 2035

Figure 07: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Gene Therapy Drugs, 2020 to 2035

Figure 08: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 09: Global Ophthalmic Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 10: Global Ophthalmic Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 11: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Topical, 2020 to 2035

Figure 12: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Intraocular, 2020 to 2035

Figure 13: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 14: Global Ophthalmic Drugs Market Value Share Analysis, By Dosage Form, 2024 and 2035

Figure 15: Global Ophthalmic Drugs Market Attractiveness Analysis, By Dosage Form, 2025 to 2035

Figure 16: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Gel, 2020 to 2035

Figure 17: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Drop, 2020 to 2035

Figure 18: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Ointment, 2020 to 2035

Figure 19: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Suspension & Solutions, 2020 to 2035

Figure 20: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 21: Global Ophthalmic Drugs Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 22: Global Ophthalmic Drugs Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 23: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Prescription Drugs, 2020 to 2035

Figure 24: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Over-the-Counter Drugs, 2020 to 2035

Figure 25: Global Ophthalmic Drugs Market Value Share Analysis, By Indication, 2024 and 2035

Figure 26: Global Ophthalmic Drugs Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 27: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Glaucoma, 2020 to 2035

Figure 28: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Dry Eye Disease, 2020 to 2035

Figure 29: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Age-Related Macular Degeneration, 2020 to 2035

Figure 30: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Diabetic Retinopathy, 2020 to 2035

Figure 31: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Pink Eye, 2020 to 2035

Figure 32: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Cataracts, 2020 to 2035

Figure 33: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Retinal Detachment, 2020 to 2035

Figure 34: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 35: Global Ophthalmic Drugs Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 36: Global Ophthalmic Drugs Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 37: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 38: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 39: Global Ophthalmic Drugs Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 40: Global Ophthalmic Drugs Market Value Share Analysis, By Region, 2024 and 2035

Figure 41: Global Ophthalmic Drugs Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 42: North America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 43: North America - Ophthalmic Drugs Market Value Share Analysis, by Country, 2024 and 2035

Figure 44: North America - Ophthalmic Drugs Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 45: North America - Ophthalmic Drugs Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 46: North America - Ophthalmic Drugs Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 47: North America - Ophthalmic Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 48: North America - Ophthalmic Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 49: North America - Ophthalmic Drugs Market Value Share Analysis, By Dosage Form, 2024 and 2035

Figure 50: North America - Ophthalmic Drugs Market Attractiveness Analysis, By Dosage Form, 2025 to 2035

Figure 51: North America - Ophthalmic Drugs Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 52: North America - Ophthalmic Drugs Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 53: North America - Ophthalmic Drugs Market Value Share Analysis, By Indication, 2024 and 2035

Figure 54: North America - Ophthalmic Drugs Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 55: North America - Ophthalmic Drugs Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 56: North America - Ophthalmic Drugs Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 60: Europe - Ophthalmic Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 61: Europe - Ophthalmic Drugs Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 62: Europe - Ophthalmic Drugs Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 63: Europe - Ophthalmic Drugs Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 64: Europe - Ophthalmic Drugs Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 65: Europe - Ophthalmic Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 66: Europe - Ophthalmic Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 67: Europe - Ophthalmic Drugs Market Value Share Analysis, By Dosage Form, 2024 and 2035

Figure 68: Europe - Ophthalmic Drugs Market Attractiveness Analysis, By Dosage Form, 2025 to 2035

Figure 69: Europe - Ophthalmic Drugs Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 70: Europe - Ophthalmic Drugs Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 72: Europe - Ophthalmic Drugs Market Value Share Analysis, By Indication, 2024 and 2035

Figure 73: Europe - Ophthalmic Drugs Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 74: Europe - Ophthalmic Drugs Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 75: Europe - Ophthalmic Drugs Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 76: Asia Pacific - Ophthalmic Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 77: Asia Pacific - Ophthalmic Drugs Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 78: Asia Pacific - Ophthalmic Drugs Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 79: Asia Pacific - Ophthalmic Drugs Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 80: Asia Pacific - Ophthalmic Drugs Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 81: Asia Pacific - Ophthalmic Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 82: Asia Pacific - Ophthalmic Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 83: Asia Pacific - Ophthalmic Drugs Market Value Share Analysis, By Dosage Form, 2024 and 2035

Figure 84: Asia Pacific - Ophthalmic Drugs Market Attractiveness Analysis, By Dosage Form, 2025 to 2035

Figure 85: Asia Pacific - Ophthalmic Drugs Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 86: Asia Pacific - Ophthalmic Drugs Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 87: Asia Pacific - Ophthalmic Drugs Market Value Share Analysis, By Indication, 2024 and 2035

Figure 88: Asia Pacific - Ophthalmic Drugs Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 89: Asia Pacific - Ophthalmic Drugs Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 90: Asia Pacific - Ophthalmic Drugs Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 91: Latin America - Ophthalmic Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 92: Latin America - Ophthalmic Drugs Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 93: Latin America - Ophthalmic Drugs Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 94: Latin America - Ophthalmic Drugs Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 95: Latin America - Ophthalmic Drugs Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 96: Latin America - Ophthalmic Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 97: Latin America - Ophthalmic Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 98: Latin America - Ophthalmic Drugs Market Value Share Analysis, By Dosage Form, 2024 and 2035

Figure 99: Latin America - Ophthalmic Drugs Market Attractiveness Analysis, By Dosage Form, 2025 to 2035

Figure 100: Latin America - Ophthalmic Drugs Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 101: Latin America - Ophthalmic Drugs Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 102: Latin America - Ophthalmic Drugs Market Value Share Analysis, By Indication, 2024 and 2035

Figure 103: Latin America - Ophthalmic Drugs Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 104: Latin America - Ophthalmic Drugs Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 105: Latin America - Ophthalmic Drugs Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 106: Middle East & Africa - Ophthalmic Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 107: Middle East & Africa - Ophthalmic Drugs Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 108: Middle East & Africa - Ophthalmic Drugs Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 109: Middle East & Africa - Ophthalmic Drugs Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 110: Middle East & Africa - Ophthalmic Drugs Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 111: Middle East & Africa - Ophthalmic Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 112: Middle East & Africa - Ophthalmic Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 113: Middle East & Africa - Ophthalmic Drugs Market Value Share Analysis, By Dosage Form, 2024 and 2035

Figure 114: Middle East & Africa - Ophthalmic Drugs Market Attractiveness Analysis, By Dosage Form, 2025 to 2035

Figure 115: Middle East & Africa - Ophthalmic Drugs Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 116: Middle East & Africa - Ophthalmic Drugs Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 117: Middle East & Africa - Ophthalmic Drugs Market Value Share Analysis, By Indication, 2024 and 2035

Figure 118: Middle East & Africa - Ophthalmic Drugs Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 119: Middle East & Africa - Ophthalmic Drugs Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 120: Middle East & Africa - Ophthalmic Drugs Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035