Reports

Reports

As governments across the world grapple with the ongoing COVID-19 (coronavirus), the India Health Fund (IHF) is inviting applications from innovators to address respiratory and airborne infections through its nation-wide search, Quest 2020. Such initiatives are encouraging effective solutions addressing respiratory disorders treatment. Thus, governments in other countries such as the U.S., Italy, and Spain can take cues from such nation-wide initiatives that can help to control COVID-19.

Since coronavirus directly affects the respiratory system of patients, governments, and laboratories have accelerated their research to minimize the severity of the virus among the affected and new patients. Ongoing R&D activities hold promising potential for innovations in the respiratory disorders treatment market. Top-tier companies in India are extending their arms to fund government initiatives in respiratory disorders treatment market. These initiatives are prioritizing the identification and diagnosis of coronavirus. There is a growing need for pre-validated solutions that can be extended for the treatment of coronavirus and other respiratory conditions.

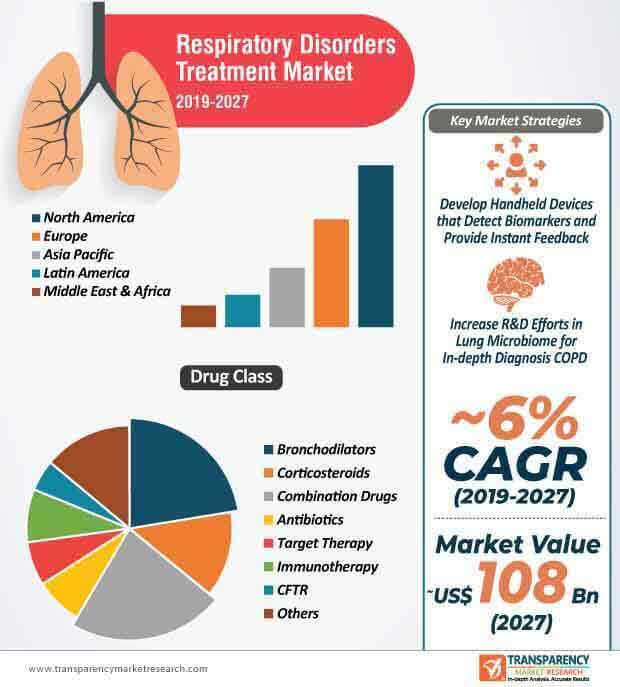

There is a growing demand for handheld devices capable of detecting biomarkers and molecules that deploy instant feedback on respiratory disorders. Hence, NOWA Innovations-a University of California, Irvine (UCI) startup, has introduced Unaresp™, a novel device that identifies inhaled medication concentrations and trains patients to correctly inhale medications. Such innovations are anticipated to boost the expansion of the respiratory disorders treatment market, where the market is expected to reach ~US$ 108 Bn by 2027.

Companies in the respiratory disorders treatment market are increasing their R&D capabilities to develop devices that deliver information about the quality of the patient’s exhalation and the probability of an inflamed airway. Thus, useful information on airway and breath quality is predicted to improve patient outcomes in the respiratory disorders treatment market. Companies in the market for respiratory disorders treatment are increasing efforts to fast-track the device’s approval with the FDA for future commercialization.

The concept of lung microbiome is acquiring popularity in the respiratory disorders treatment market. Since some of the microorganisms in lungs are uninvited gatecrashers, lung microbiome helps to provide information about the status of an individual’s disease status.

Lung microbiome is as unique as an individual’s fingerprint, thus resulting in guided individual treatment decisions that help improve patient quality of life. The novel technique also has the potential to guide companies in the respiratory disorders treatment market to develop new medicines. As such, modern laboratory techniques are being deployed to gain information about the quantity and specificity of bacteria present in the sputum samples of individuals.

Several factors such as different organisms moving into the airways as well as environmental factors determine the composition of the lung microbiome among individuals. Thus, the importance of ‘friendly’ gut bacteria is gaining widespread acceptance for respiratory disorders treatment. Healthcare providers in the market of respiratory disorders treatment can increase their efficacy in lung microbiome to identify the symptoms and perhaps decipher the slow progression of respiratory infections.

Asthma is one of the most common non-communicable disease among children, with a high prevalence worldwide. This is evident since asthma dictates the highest revenue among all diseases in the respiratory disorders treatment market, where the market estimated to progress at a healthy CAGR of ~6% during the forecast period. However, challenges concerning non-availability of equipment and medications for the treatment of asthma in low-resource settings pose as a barrier for market growth. Hence, companies in the respiratory disorders treatment market should increase their production capabilities to meet the demands of healthcare facilities in low-income countries.

Sufficient availability of equipment and necessary medications helps healthcare professionals to differentiate between common respiratory conditions such as pneumonia and asthma versus self-limiting viral infections. Apart from this, there is a growing awareness about non-pharmacological interventions that are underutilized, but can ease symptoms of patients requiring respiratory disorders treatment.

Analysts’ Viewpoint

Given the current public health exigencies amidst the COVID-19 crisis, nation-wide search programs inviting innovators to showcase pre-validated solutions are helping to control the virus. The concept of lung microbiome is acquiring widespread acceptance in the respiratory disorders treatment market to demonstrate how microbiomes are associated with other disorders such as cancer, stroke, and obesity.

Non-pharmacological interventions such as cognitive behavioral techniques are helping to improve the quality of life of chronic obstructive pulmonary disease (COPD) patients. However, there is a need to educate asthma and COPD patients on how to take their medications, which is one of the biggest issues that companies face. Hence, companies should gain expertise in devices that train patients on how to properly inhale their medications.

The global respiratory disorders treatment market was worth US$ 65 Bn and is projected to reach a value of US$ 108 Bn by the end of 2026

Respiratory disorders treatment market is anticipated to grow at a CAGR of 6% during the forecast period

North America accounted for a major share of the global respiratory disorders treatment market

Respiratory disorders treatment market is driven by increase in incidence of respiratory disorders, surge in supportive care products to meet the rise in demand for treatment of respiratory disorders and entry of new players

Key players in the global respiratory disorders treatment market include Mylan N.V, AstraZeneca plc, Boehringer Ingelheim International GmbH, F. Hoffmann-La Roche Ltd., GlaxoSmithKline plc, Merck & Co., Inc., Novartis AG, Sanofi, Sunovion Pharmaceuticals, Inc., Teva Pharmaceutical Industries, CHIESI Farmaceutici S.p.A., Cipla, Vertex Pharmaceuticals Incorporated

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Respiratory Disorders Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Route of Administration Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Respiratory Disorders Treatment Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Bn)

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Health Care Industry Overview

5.2. Health Care Industry Overview

5.3. Pipeline Analysis (asthma, lung cancer, COPD)

5.4. Disease Prevalence Rate in Key Countries

5.5. Disease Management

5.6. Key Market Events

5.7. Regulatory Scenario

5.8. Reimbursement Scenario

5.9. Technological Advancements

6. Global Respiratory Disorders Treatment Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.1.1. Key Findings / Developments

6.2. Global Respiratory Disorders Treatment Market Value Forecast, by Drug Class, 2017–2027

6.2.1. Bronchodilators

6.2.2. Corticosteroids

6.2.3. Combination Drugs

6.2.4. Antibiotics

6.2.5. Target Therapy

6.2.6. Immunotherapy

6.2.7. CFTR

6.3. Others Global Respiratory Disorders Treatment Market Attractiveness Analysis, by Drug Class

7. Global Respiratory Disorders Treatment Market Analysis and Forecast, by Disease

7.1. Introduction & Definition

7.1.1. Key Findings / Developments

7.2. Global Respiratory Disorders Treatment Market Value Forecast, by Disease, 2017–2027

7.2.1. Asthma

7.2.2. Chronic Obstructive Pulmonary Disease (COPD)

7.2.3. Lung Cancer

7.2.4. Respiratory Tract Infection

7.2.5. Allergic Rhinitis

7.2.6. Cystic Fibrosis (CF)

7.2.7. Others

7.3. Global Respiratory Disorders Treatment Market Attractiveness Analysis, by Disease

8. Global Respiratory Disorders Treatment Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.1.1. Key Findings / Developments

8.2. Global Respiratory Disorders Treatment Market Value Forecast, by Route of Administration, 2017–2027

8.2.1. Oral

8.2.2. Nasal

8.2.3. Injectable

8.3. Global Respiratory Disorders Treatment Market Attractiveness Analysis, by Route of Administration

9. Global Respiratory Disorders Treatment Market Analysis and Forecast, by Distribution Channel

9.1. Introduction & Definition

9.1.1. Key Findings / Developments

9.2. Global Respiratory Disorders Treatment Market Value Forecast, by Distribution Channel, 2017–2027

9.2.1. Hospital Pharmacies

9.2.2. Retail Pharmacies

9.2.3. Online Pharmacies

9.3. Global Respiratory Disorders Treatment Market Attractiveness Analysis, by Distribution Channel

10. Global Respiratory Disorders Treatment Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Global Respiratory Disorders Treatment Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. North America Respiratory Disorders Treatment Market Attractiveness Analysis, by Region

11. North America Respiratory Disorders Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. North America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Drug Class, 2017–2027

11.2.1. Bronchodilators

11.2.2. Corticosteroids

11.2.3. Combination Drugs

11.2.4. Antibiotics

11.2.5. Target Therapy

11.2.6. Immunotherapy

11.2.7. CFTR

11.3. North America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Disease, 2017–2027

11.3.1. Asthma

11.3.2. Chronic Obstructive Pulmonary Disease (COPD)

11.3.3. Lung Cancer

11.3.4. Respiratory Tract Infection

11.3.5. Allergic Rhinitis

11.3.6. Cystic Fibrosis (CF)

11.3.7. Others

11.4. North America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017–2027

11.4.1. Oral

11.4.2. Nasal

11.4.3. Injectable

11.5. North America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2027

11.5.1. Hospital Pharmacies

11.5.2. Retail Pharmacies

11.5.3. Online Pharmacies

11.6. North America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Country, 2017–2027

11.6.1. U.S.

11.6.2. Canada

11.7. North America Respiratory Disorders Treatment Market Attractiveness Analysis

11.7.1. By Drug Class

11.7.2. By Disease

11.7.3. By Route of Administration

11.7.4. By Distribution Channel

11.7.5. By Country

12. Europe Respiratory Disorders Treatment Market Analysis and Forecast

12.1. Europe Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Drug Class, 2017–2027

12.1.1. Bronchodilators

12.1.2. Corticosteroids

12.1.3. Combination Drugs

12.1.4. Antibiotics

12.1.5. Target Therapy

12.1.6. Immunotherapy

12.1.7. CFTR

12.2. Europe Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Disease, 2017–2027

12.2.1. Asthma

12.2.2. Chronic Obstructive Pulmonary Disease (COPD)

12.2.3. Lung Cancer

12.2.4. Respiratory Tract Infection

12.2.5. Allergic Rhinitis

12.2.6. Cystic Fibrosis (CF)

12.2.7. Others

12.3. Europe Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017–2027

12.3.1. Oral

12.3.2. Nasal

12.3.3. Injectable

12.4. Europe Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2027

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Europe Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2027

12.5.1. Germany

12.5.2. U.K.

12.5.3. France

12.5.4. Spain

12.5.5. Italy

12.5.6. Rest of Europe

12.6. Europe Respiratory Disorders Treatment Market Attractiveness Analysis

12.6.1. By Drug Class

12.6.2. By Disease

12.6.3. By Route of Administration

12.6.4. By Distribution Channel

12.6.5. By Country/Sub-region

13. Asia Pacific Respiratory Disorders Treatment Market Analysis and Forecast

13.1. Asia Pacific Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Drug Class, 2017–2027

13.1.1. Bronchodilators

13.1.2. Corticosteroids

13.1.3. Combination Drugs

13.1.4. Antibiotics

13.1.5. Target Therapy

13.1.6. Immunotherapy

13.1.7. CFTR

13.2. Asia Pacific Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Disease, 2017–2027

13.2.1. Asthma

13.2.2. Chronic Obstructive Pulmonary Disease (COPD)

13.2.3. Lung Cancer

13.2.4. Respiratory Tract Infection

13.2.5. Allergic Rhinitis

13.2.6. Cystic Fibrosis (CF)

13.2.7. Others

13.3. Asia Pacific Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017–2027

13.3.1. Oral

13.3.2. Nasal

13.3.3. Injectable

13.4. Asia Pacific Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2027

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Asia Pacific Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2027

13.5.1. China

13.5.2. Japan

13.5.3. India

13.5.4. Australia & New Zealand

13.5.5. Rest of Asia Pacific

13.6. Asia Pacific Respiratory Disorders Treatment Market Attractiveness Analysis

13.6.1. By Drug Class

13.6.2. By Disease

13.6.3. By Route of Administration

13.6.4. By Distribution Channel

13.6.5. By Country/Sub-region

14. Latin America Respiratory Disorders Treatment Market Analysis and Forecast

14.1. Latin America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Drug Class, 2017–2027

14.1.1. Bronchodilators

14.1.2. Corticosteroids

14.1.3. Combination Drugs

14.1.4. Antibiotics

14.1.5. Target Therapy

14.1.6. Immunotherapy

14.1.7. CFTR

14.2. Latin America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Disease, 2017–2027

14.2.1. Asthma

14.2.2. Chronic Obstructive Pulmonary Disease (COPD)

14.2.3. Lung Cancer

14.2.4. Respiratory Tract Infection

14.2.5. Allergic Rhinitis

14.2.6. Cystic Fibrosis (CF)

14.2.7. Others

14.3. Latin America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017–2027

14.3.1. Oral

14.3.2. Nasal

14.3.3. Injectable

14.4. Latin America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2027

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Latin America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2027

14.5.1. Brazil

14.5.2. Mexico

14.5.3. Rest of Latin America Latin America

14.6. Latin America Respiratory Disorders Treatment Market Attractiveness Analysis

14.6.1. By Drug Class

14.6.2. By Disease

14.6.3. By Route of Administration

14.6.4. By Distribution Channel

14.6.5. By Country/Sub-region

15. Middle East & Africa Respiratory Disorders Treatment Market Analysis and Forecast

15.1. Middle East & Africa Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Drug Class, 2017–2027

15.1.1. Bronchodilators

15.1.2. Corticosteroids

15.1.3. Combination Drugs

15.1.4. Antibiotics

15.1.5. Target Therapy

15.1.6. Immunotherapy

15.1.7. CFTR

15.2. Middle East & Africa Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Disease, 2017–2027

15.2.1. Asthma

15.2.2. Chronic Obstructive Pulmonary Disease (COPD)

15.2.3. Lung Cancer

15.2.4. Respiratory Tract Infection

15.2.5. Allergic Rhinitis

15.2.6. Cystic Fibrosis (CF)

15.2.7. Others

15.3. Middle East & Africa Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017–2027

15.3.1. Oral

15.3.2. Nasal

15.3.3. Injectable

15.4. Middle East & Africa Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2027

15.4.1. Hospital Pharmacies

15.4.2. Retail Pharmacies

15.4.3. Online Pharmacies

15.5. Middle East & Africa Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2027

15.5.1. GCC Countries

15.5.2. South Africa

15.5.3. Rest of Middle East & Africa

15.6. Middle East & Africa Respiratory Disorders Treatment Market Attractiveness Analysis

15.6.1. By Drug Class

15.6.2. By Disease

15.6.3. By Route of Administration

15.6.4. By Distribution Channel

15.6.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by Tier and Size of companies)

16.2. Market Share / Position Analysis, by Company, 2018

16.3. Competitive Business Strategies

16.4. Company Profiles

16.4.1. GlaxoSmithKline plc

16.4.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.1.2. Growth Strategies

16.4.1.3. SWOT Analysis

16.4.2. Merck & Co., Inc.

16.4.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.2.2. Growth Strategies

16.4.2.3. SWOT Analysis

16.4.3. AstraZeneca

16.4.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.3.2. Growth Strategies

16.4.3.3. SWOT Analysis

16.4.4. Boehringer Ingelheim International GmbH

16.4.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.4.2. Growth Strategies

16.4.4.3. SWOT Analysis

16.4.5. Novartis AG

16.4.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.5.2. Growth Strategies

16.4.5.3. SWOT Analysis

16.4.6. F. Hoffmann-La Roche Ltd.

16.4.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.6.2. Growth Strategies

16.4.6.3. SWOT Analysis

16.4.7. Teva Pharmaceutical Industries Ltd.

16.4.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.7.2. Growth Strategies

16.4.7.3. SWOT Analysis

16.4.8. Sanofi

16.4.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.8.2. Growth Strategies

16.4.8.3. SWOT Analysis

16.4.9. Cipla, Inc.

16.4.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.9.2. Growth Strategies

16.4.9.3. SWOT Analysis

16.4.10. Sun Pharmaceutical Industries Ltd.

16.4.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.10.2. Growth Strategies

16.4.10.3. SWOT Analysis

16.4.11. Mylan N.V.

16.4.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.11.2. Growth Strategies

16.4.11.3. SWOT Analysis

16.4.12. Takeda Pharmaceutical Company Limited

16.4.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.12.2. Growth Strategies

16.4.12.3. SWOT Analysis

16.4.13. CHIESI Farmaceutici S.p.A.

16.4.13.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.13.2. Growth Strategies

16.4.13.3. SWOT Analysis

16.4.14. Orion Corporation

16.4.14.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.14.2. Growth Strategies

16.4.14.3. SWOT Analysis

16.4.15. Vertex Pharmaceutical

16.4.15.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.15.2. Growth Strategies

16.4.15.3. SWOT Analysis

List of Tables

Table 01: Global Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Drug Class, 2017–2027

Table 02: Global Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Disease, 2017–2027

Table 03: Global Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017–2027

Table 04: Global Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2027

Table 05: Global Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Region, 2017–2027

Table 06: North America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Country, 2017–2027

Table 07: North America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Drug Class, 2017–2027

Table 08: North America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Disease, 2017–2027

Table 09: North America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017–2027

Table 10: North America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2027

Table 11: Europe Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2027

Table 12: Europe Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Drug Class, 2017–2027

Table 13: Europe Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Disease, 2017–2027

Table 14: Europe Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017–2027

Table 15: Europe Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2027

Table 16: Asia Pacific Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2027

Table 17: Asia Pacific Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Drug Class, 2017–2027

Table 18: Asia Pacific Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Disease, 2017–2027

Table 19: Asia Pacific Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017–2027

Table 20: Asia Pacific Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2027

Table 21: Latin America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2027

Table 22: Latin America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Drug Class, 2017–2027

Table 23: Latin America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Disease, 2017–2027

Table 24: Latin America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017–2027

Table 25: Latin America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2027

Table 26: Middle East & Africa Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2027

Table 27: Middle East & Africa Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Drug Class, 2017–2027

Table 28: Middle East & Africa Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Disease, 2017–2027

Table 29: Middle East & Africa Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017–2027

Table 30: Middle East & Africa Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2027

List of Figures

Figure 01: Global Respiratory Disorders Treatment Market Value (US$ Bn) and Distribution (%), by Region, 2018 and 2027

Figure 02: Global Respiratory Disorders Treatment Market Value (US$ Bn) Forecast, 2017–2027

Figure 03: Global Respiratory Disorders Treatment Market Value Share (%), by Drug Class, 2018

Figure 04: Global Respiratory Disorders Treatment Market Value Share (%), by Disease, 2018

Figure 05: Global Respiratory Disorders Treatment Market Value Share (%), by Route of Administration, 2018

Figure 06: Global Respiratory Disorders Treatment Market Value Share (%), by End-user, 2018

Figure 07: Global Respiratory Disorders Treatment Market Value Share (%), by Region, 2018

Figure 08: Global Respiratory Disorders Treatment Market Value Share (%), by Drug Class, 2018 and 2027

Figure 09: Global Respiratory Disorders Treatment Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 10: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Bronchodilators, 2017–2027

Figure 11: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Corticosteroids, 2017–2027

Figure 12: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Combination Drugs, 2017–2027

Figure 13: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Antibiotics, 2017–2027

Figure 14: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Target Therapy, 2017–2027

Figure 15: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Immunotherapy, 2017–2027

Figure 16: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by CFTR, 2017–2027

Figure 17: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 18: Global Respiratory Disorders Treatment Market Value Share (%) Analysis, by Disease, 2018 and 2027

Figure 19: Global Respiratory Disorders Treatment Market Attractiveness Analysis, by Disease, 2019–2027

Figure 20: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Asthma, 2017–2027

Figure 21: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Chronic Obstructive Pulmonary Disease (COPD), 2017–2027

Figure 22: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Lung Cancer, 2017–2027

Figure 23: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Respiratory Tract Infection, 2017–2027

Figure 24: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Allergic Rhinitis, 2017–2027

Figure 25: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Cystic Fibrosis (CF), 2017–2027

Figure 26: Global Respiratory Disorders Treatment Market Revenue (US$ Bn), by Others, 2017–2027

Figure 27: Global Respiratory Disorders Treatment Market Value Share (%) Analysis, by Route of Administration, 2018 and 2027

Figure 28: Global Respiratory Disorders Treatment Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 29: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Oral, 2017–2027

Figure 30: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Nasal, 2017–2027

Figure 31: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Injectable, 2017–2027

Figure 32: Global Respiratory Disorders Treatment Market Value Share (%) Analysis, by Distribution Channel, 2018 and 2027

Figure 33: Global Respiratory Disorders Treatment Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 34: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Hospital Pharmacies, 2017–2027

Figure 35: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Retail Pharmacies, 2017–2027

Figure 36: Global Respiratory Disorders Treatment Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Online Pharmacies, 2017–2027

Figure 37: Global Respiratory Disorders Treatment Market Value Share (%) Analysis, by Region, 2018 and 2027

Figure 38: Global Respiratory Disorders Treatment Market Attractiveness Analysis, by Region, 2019–2027

Figure 39: North America Respiratory Disorders Treatment Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 40: North America Respiratory Disorders Treatment Market Value Share (%) Analysis, by Country, 2018 and 2027

Figure 41: North America Respiratory Disorders Treatment Market Attractiveness Analysis, by Country, 2019–2027

Figure 42: North America Respiratory Disorders Treatment Market Value Share (%) Analysis, by Drug Class, 2018 and 2027

Figure 43: North America Respiratory Disorders Treatment Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 44: North America Respiratory Disorders Treatment Market Value Share (%) Analysis, by Disease, 2018 and 2027

Figure 45: North America Respiratory Disorders Treatment Market Attractiveness Analysis, by Disease, 2019–2027

Figure 46: North America Respiratory Disorders Treatment Market Value Share (%) Analysis, by Route of Administration, 2018 and 2027

Figure 47: North America Respiratory Disorders Treatment Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 48: North America Respiratory Disorders Treatment Market Value Share (%) Analysis, by Distribution Channel, 2018 and 2027

Figure 49: North America Respiratory Disorders Treatment Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 50: Europe Respiratory Disorders Treatment Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 51: Europe Respiratory Disorders Treatment Market Value Share (%) Analysis, by Country/Sub-Region, 2018 and 2027

Figure 52: Europe Respiratory Disorders Treatment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 53: Europe Respiratory Disorders Treatment Market Value Share (%) Analysis, by Drug Class, 2018 and 2027

Figure 54: Europe Respiratory Disorders Treatment Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 55: Europe Respiratory Disorders Treatment Market Value Share (%) Analysis, by Disease, 2018 and 2027

Figure 56: Europe Respiratory Disorders Treatment Market Attractiveness Analysis, by Disease, 2019–2027

Figure 57: Europe Respiratory Disorders Treatment Market Value Share (%) Analysis, by Route of Administration, 2018 and 2027

Figure 58: Europe Respiratory Disorders Treatment Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 59: Europe Respiratory Disorders Treatment Market Value Share (%) Analysis, by Distribution Channel, 2018 and 2027

Figure 60: Europe Respiratory Disorders Treatment Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 61: Asia Pacific Respiratory Disorders Treatment Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 62: Asia Pacific Respiratory Disorders Treatment Market Value Share (%) Analysis, by Country/Sub-region, 2018 and 2027

Figure 63: Asia Pacific Respiratory Disorders Treatment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 64: Asia Pacific Respiratory Disorders Treatment Market Value Share (%) Analysis, by Drug Class, 2018 and 2027

Figure 65: Asia Pacific Respiratory Disorders Treatment Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 66: Asia Pacific Respiratory Disorders Treatment Market Value Share (%) Analysis, by Disease, 2018 and 2027

Figure 67: Asia Pacific Respiratory Disorders Treatment Market Attractiveness Analysis, by Disease, 2019–2027

Figure 68: Asia Pacific Respiratory Disorders Treatment Market Value Share (%) Analysis, by Route of Administration, 2018 and 2027

Figure 69: Asia Pacific Respiratory Disorders Treatment Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 70: Asia Pacific Respiratory Disorders Treatment Market Value Share (%) Analysis, by Distribution Channel, 2018 and 2027

Figure 71: Asia Pacific Respiratory Disorders Treatment Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 72: Latin America Respiratory Disorders Treatment Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 73: Latin America Respiratory Disorders Treatment Market Value Share (%) Analysis, by Country/Sub-region, 2018 and 2027

Figure 74: Latin America Respiratory Disorders Treatment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 75: Latin America Respiratory Disorders Treatment Market Value Share (%) Analysis, by Drug Class, 2018 and 2027

Figure 76: Latin America Respiratory Disorders Treatment Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 77: Latin America Respiratory Disorders Treatment Market Value Share (%) Analysis, by Disease, 2018 and 2027

Figure 78: Latin America Respiratory Disorders Treatment Market Attractiveness Analysis, by Disease, 2019–2027

Figure 79: Latin America Respiratory Disorders Treatment Market Value Share (%) Analysis, by Route of Administration, 2018 and 2027

Figure 80: Latin America Respiratory Disorders Treatment Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 81: Latin America Respiratory Disorders Treatment Market Value Share (%) Analysis, by Distribution Channel, 2018 and 2027

Figure 82: Latin America Respiratory Disorders Treatment Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 83: Middle East & Africa Respiratory Disorders Treatment Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 84: Middle East & Africa Respiratory Disorders Treatment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 85: Middle East & Africa Respiratory Disorders Treatment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 86: Middle East & Africa Respiratory Disorders Treatment Market Value Share (%) Analysis, by Drug Class, 2018 and 2027

Figure 87: Middle East & Africa Respiratory Disorders Treatment Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 88: Middle East & Africa Respiratory Disorders Treatment Market Value Share (%) Analysis, by Disease, 2018 and 2027

Figure 89: Middle East & Africa Respiratory Disorders Treatment Market Attractiveness Analysis, by Disease, 2019–2027

Figure 90: Middle East & Africa Respiratory Disorders Treatment Market Value Share (%) Analysis, by Route of Administration, 2018 and 2027

Figure 91: Middle East & Africa Respiratory Disorders Treatment Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 92: Middle East & Africa Respiratory Disorders Treatment Market Value Share (%) Analysis, by Distribution Channel, 2018 and 2027

Figure 93: Middle East & Africa Respiratory Disorders Treatment Market Attractiveness Analysis, by Distribution Channel, 2019–2027