Reports

Reports

Analysts’ Viewpoint

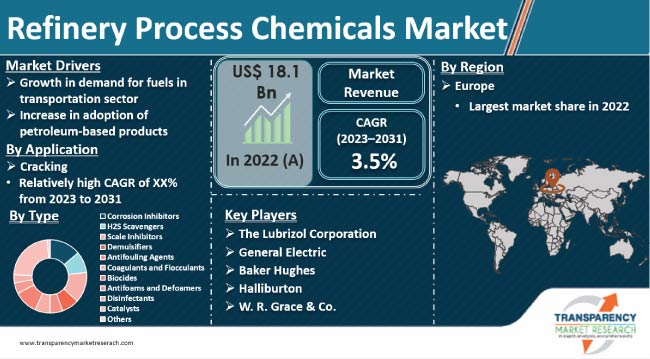

Growth in demand for fuels in the transportation sector is expected to boost the refinery process chemicals market size in the near future. Refinery process chemicals are primarily used in oil refineries. These chemicals help increase the productivity and efficiency of refineries. Refinery process chemicals also minimize foul smell, corrosion, and contamination of crude oil. Furthermore, they help regulate pH levels and can be used in the treatment of boiling and cold water.

Expansion in the oil & gas sector is also likely to boost market progress in the next few years. Refinery process chemicals are used in various processes such as distillation, cracking, and reforming. Regional and international refinery process chemicals manufacturers are investing significantly in R&D of new products to broaden their customer base.

Refinery process chemicals are widely employed in crude oil refineries. These chemicals include corrosion inhibitors, H2S scavengers, scale inhibitors, demulsifiers, antifouling agents, coagulants and flocculants, biocides, antifoams and defoamers, disinfectants, and catalysts.

Corrosion inhibitors help reduce the rate of corrosion in metal equipment and pipelines. Antifouling agents aid in reducing the accumulation of fouling or deposits on equipment, while catalysts accelerate the chemical reaction and improve efficiency and product quality.

Refinery process chemicals are primarily used in cracking, a process used to break down large hydrocarbon molecules into smaller, more valuable molecules through the application of heat and pressure. This process is a critical step in oil refining.

The transportation sector is one of the largest end-users of fuels. It accounts for approximately 50.0% share of the total global oil consumption. Demand for fuels is expected to increase in the near future, driven by population growth, urbanization, and economic development.

Refineries must produce more fuel to meet the rising demand. However, efficient and cost-effective fuel production requires the usage of specialized chemicals and processes. Thus, surge in demand for fuels in the transportation sector is augmenting the refinery process chemicals market development.

Refinery process chemicals are employed to improve the efficiency and productivity of refining processes, reduce the environmental impact of refining, and produce higher-quality fuels. The production of cleaner-burning fuels, such as low-sulfur diesel, requires the usage of catalysts and other additives that help remove sulfur and other impurities from crude oil.

Production of high-performance fuels, such as jet fuel, requires the usage of advanced refining processes that can produce fuels with specific characteristics, such as high energy density and low freezing points. Hence, rise in production of high-performance fuels is projected to spur refinery process chemicals market growth in the near future.

Petroleum-based products are used in a wide range of industries, including plastics, chemicals, textiles, and pharmaceuticals. As the global population continues to grow, so does the demand for these products. This is expected to drive the adoption of refined petroleum products.

Specialized chemicals and processes are required for efficient and cost-effective production of these petroleum-based products. Refinery process chemicals are employed to improve the efficiency and productivity of refining processes, reduce the environmental impact of refining, and produce higher-quality products. Thus, rise in usage of petroleum-based products is augmenting the refinery process chemicals market value.

Production of petrochemicals, such as ethylene and propylene, requires the use of advanced refining processes and catalysts. These chemicals are used to produce a wide range of products, including plastics, synthetic fibers, and pharmaceuticals.

Refinery process chemicals are also employed in the production of lubricating oils, waxes, and asphalt, which play a key role in construction and automotive industries.

According to the latest refinery process chemicals market trends, the catalysts type segment is expected to account for the largest share from 2023 to 2031. The segment dominated the industry with 22.9% share in 2022. It is anticipated to constitute 23.9% share by the end of 2031, with a CAGR of 4.1% during the forecast period.

Catalysts are substances that accelerate or promote chemical reactions in oil & gas refining processes. They are primarily used in the cracking process, a process where complex organic molecules are broken down into smaller molecules.

According to the latest refinery process chemicals industry analysis, the cracking application segment dominated the business with 28.4% share in 2022. The segment is projected to constitute 25.4% share by 2031 with a CAGR of 2.3% during the forecast period.

Cracking is used to break down large hydrocarbon molecules into smaller molecules. Oil refineries employ this technique to extract marketable byproducts from crude oil. Some types of oil, such as light sweet crude, need a small amount of refining before they can be sold. The relative value of commodities such as heating oil and petrol can fluctuate over time depending on factors such as production rate of various petroleum byproducts. This provides opportunities for speculation or hedging for commodity dealers.

According to the latest refinery process chemicals market forecast, Europe is estimated to hold the largest share from 2023 to 2031. The region dominated the global landscape with 31.6% share in 2022.

Europe is projected to account for 31.3% share by 2031 with a CAGR of 3.3% during the forecast period. Expansion in the oil & gas sector in Russia & CIS, Rest of Europe, and Germany is fueling market dynamics of the region.

The global landscape is dominated by a few players that cumulatively accounted for more than 45.0% to 55.0% share in 2022. Vendors are focusing on technological innovations, business expansion through acquisitions, and financial restructuring and investments to increase their refinery process chemical market share.

BASF SE, Baker Hughes Company, The Lubrizol Corporation, Dorf Ketal, General Electric, Halliburton, W. R. Grace & Co., Buckman, Berryman Chemical, Akzo Nobel, Clariant, Johnson Matthey, Chemiphase, Nelson Brothers Incorporated, Ecolab, and Canadian Energy Services are prominent entities operating in this industry.

Each of these players has been profiled in the refinery process chemicals market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 18.1 Bn |

|

Market Forecast Value in 2031 |

US$ 24.5 Bn |

|

Growth Rate (CAGR) |

3.5% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2021 |

|

Quantitative Units |

US$ Bn For Value and Kilo Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 18.1 Bn in 2022

It is projected to grow at a CAGR of 3.5% from 2023 to 2031

Growth in demand for fuels in the transportation sector and increase in adoption of petroleum-based products

Cracking was the largest application segment with 28.4% share in 2022

Europe recorded the highest demand in 2022

BASF SE, Baker Hughes Company, The Lubrizol Corporation, Dorf Ketal, General Electric, Halliburton, W. R. Grace & Co., Buckman, Berryman Chemical, Akzo Nobel, Clariant, Johnson Matthey, Chemiphase, Nelson Brothers Incorporated, Ecolab, and Canadian Energy Services

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Refinery Process Chemicals Market Analysis and Forecast, 2020-2031

2.6.1. Global Refinery Process Chemicals Market Volume (Kilo Tons)

2.6.2. Global Refinery Process Chemicals Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Refinery Process Chemicals

3.2. Impact on Demand for Refinery Process Chemicals- Pre & Post Crisis

4. Production Output Analysis (Kilo Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2020-2031

6.1. Price Trend Analysis by Type

6.2. Price Trend Analysis by Region

7. Global Refinery Process Chemicals Market Analysis and Forecast, by Type, 2023-2031

7.1. Introduction and Definitions

7.2. Global Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

7.2.1. Corrosion Inhibitors

7.2.2. H2S Scavengers

7.2.3. Scale Inhibitors

7.2.4. Demulsifiers

7.2.5. Antifouling Agents

7.2.6. Coagulants and Flocculants

7.2.7. Biocides

7.2.8. Antifoams and Defoamers

7.2.9. Disinfectants

7.2.10. Catalysts

7.2.11. Others

7.3. Global Refinery Process Chemicals Market Attractiveness, by Type

8. Global Refinery Process Chemicals Market Analysis and Forecast, by Application, 2023-2031

8.1. Introduction and Definitions

8.2. Global Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

8.2.1. Treatment

8.2.1.1. Boiler Water Treatment

8.2.1.2. Cooling Water Treatment

8.2.1.3. Steam/Condensate Treatment

8.2.1.4. Desalination Plant

8.2.1.5. Others

8.2.2. Distillation

8.2.3. Cracking

8.2.4. Reforming

8.2.5. Others

8.3. Global Refinery Process Chemicals Market Attractiveness, by Application

9. Global Refinery Process Chemicals Market Analysis and Forecast, by Region, 2023-2031

9.1. Key Findings

9.2. Global Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2023-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Refinery Process Chemicals Market Attractiveness, by Region

10. North America Refinery Process Chemicals Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. North America Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

10.3. North America Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

10.4. North America Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2023-2031

10.4.1. U.S. Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

10.4.2. U.S. Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

10.4.3. Canada Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

10.4.4. Canada Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

10.5. North America Refinery Process Chemicals Market Attractiveness Analysis

11. Europe Refinery Process Chemicals Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Europe Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.3. Europe Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

11.4. Europe Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

11.4.1. Germany Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.4.2. Germany. Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

11.4.3. France Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.4.4. France Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

11.4.5. U.K. Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.4.6. U.K. Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

11.4.7. Italy Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.4.8. Italy Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

11.4.9. Russia & CIS Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.4.10. Russia & CIS Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

11.4.11. Rest of Europe Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.4.12. Rest of Europe Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

11.5. Europe Refinery Process Chemicals Market Attractiveness Analysis

12. Asia Pacific Refinery Process Chemicals Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Asia Pacific Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type

12.3. Asia Pacific Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.4. Asia Pacific Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

12.4.1. China Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.4.2. China Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

12.4.3. Japan Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.4.4. Japan Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

12.4.5. India Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.4.6. India Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

12.4.7. ASEAN Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.4.8. ASEAN Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

12.4.9. Rest of Asia Pacific Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.4.10. Rest of Asia Pacific Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

12.5. Asia Pacific Refinery Process Chemicals Market Attractiveness Analysis

13. Latin America Refinery Process Chemicals Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Latin America Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.3. Latin America Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.4. Latin America Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

13.4.1. Brazil Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.4.2. Brazil Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

13.4.3. Mexico Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.4.4. Mexico Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

13.4.5. Rest of Latin America Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.4.6. Rest of Latin America Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

13.5. Latin America Refinery Process Chemicals Market Attractiveness Analysis

14. Middle East & Africa Refinery Process Chemicals Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Middle East & Africa Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.3. Middle East & Africa Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.4. Middle East & Africa Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

14.4.1. GCC Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.4.2. GCC Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

14.4.3. South Africa Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.4.4. South Africa Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

14.4.5. Rest of Middle East & Africa Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.4.6. Rest of Middle East & Africa Refinery Process Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

14.5. Middle East & Africa Refinery Process Chemicals Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Refinery Process Chemicals Market Company Share Analysis, 2022

15.2. Company Profiles (Details - Overview, Financials, Recent Developments, and Strategy)

15.2.1. BASF SE

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.2. Baker Hughes Company

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.3. The Lubrizol Corporation

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.4. Dorf Ketal

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.5. General Electric

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.6. Halliburton

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.7. W. R. Grace & Co.

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.8. Buckman

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.9. Berryman Chemical

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.10. Akzo Nobel

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.11. Clariant

15.2.11.1. Company Revenue

15.2.11.2. Business Overview

15.2.11.3. Product Segments

15.2.11.4. Geographic Footprint

15.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.12. Johnson Matthey

15.2.12.1. Company Revenue

15.2.12.2. Business Overview

15.2.12.3. Product Segments

15.2.12.4. Geographic Footprint

15.2.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.13. Chemiphase

15.2.13.1. Company Revenue

15.2.13.2. Business Overview

15.2.13.3. Product Segments

15.2.13.4. Geographic Footprint

15.2.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.14. Nelson Brothers Incorporated

15.2.14.1. Company Revenue

15.2.14.2. Business Overview

15.2.14.3. Product Segments

15.2.14.4. Geographic Footprint

15.2.14.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.14.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.15. Ecolab

15.2.15.1. Company Revenue

15.2.15.2. Business Overview

15.2.15.3. Product Segments

15.2.15.4. Geographic Footprint

15.2.15.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.15.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.16. Canadian Energy Services

15.2.16.1. Company Revenue

15.2.16.2. Business Overview

15.2.16.3. Product Segments

15.2.16.4. Geographic Footprint

15.2.16.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.16.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 2: Global Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 3: Global Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 4: Global Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 5: Global Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Region, 2023-2031

Table 6: Global Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Region, 2023-2031

Table 7: North America Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 8: North America Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 9: North America Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 10: North America Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 11: North America Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Country, 2023-2031

Table 12: North America Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Country, 2023-2031

Table 13: U.S. Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 14: U.S. Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 15: U.S. Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 16: U.S. Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 17: Canada Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 18: Canada Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 19: Canada Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 20: Canada Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 21: Europe Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 22: Europe Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 23: Europe Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 24: Europe Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 25: Europe Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 26: Europe Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 27: Germany Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 28: Germany Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 29: Germany Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 30: Germany Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 31: France Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 32: France Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 33: France Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 34: France Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 35: U.K. Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 36: U.K. Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 37: U.K. Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 38: U.K. Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 39: Italy Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 40: Italy Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 41: Italy Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 42: Italy Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 43: Spain Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 44: Spain Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 45: Spain Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 46: Spain Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 47: Russia & CIS Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 48: Russia & CIS Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 49: Russia & CIS Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 50: Russia & CIS Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 51: Rest of Europe Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 52: Rest of Europe Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 53: Rest of Europe Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 54: Rest of Europe Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 55: Asia Pacific Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 56: Asia Pacific Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 57: Asia Pacific Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 58: Asia Pacific Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 59: Asia Pacific Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 60: Asia Pacific Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 61: China Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 62: China Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type 2023-2031

Table 63: China Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 64: China Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 65: Japan Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 66: Japan Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 67: Japan Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 68: Japan Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 69: India Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 70: India Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 71: India Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 72: India Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 73: ASEAN Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 74: ASEAN Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 75: ASEAN Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 76: ASEAN Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 77: Rest of Asia Pacific Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 78: Rest of Asia Pacific Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 79: Rest of Asia Pacific Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 80: Rest of Asia Pacific Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 81: Latin America Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 82: Latin America Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 83: Latin America Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 84: Latin America Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 85: Latin America Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 86: Latin America Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 87: Brazil Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 88: Brazil Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 89: Brazil Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 90: Brazil Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 91: Mexico Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 92: Mexico Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 93: Mexico Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 94: Mexico Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 95: Rest of Latin America Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 96: Rest of Latin America Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 97: Rest of Latin America Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 98: Rest of Latin America Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 99: Middle East & Africa Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 100: Middle East & Africa Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 101: Middle East & Africa Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 102: Middle East & Africa Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 103: Middle East & Africa Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 104: Middle East & Africa Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 105: GCC Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 106: GCC Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 107: GCC Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 108: GCC Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 109: South Africa Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 110: South Africa Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 111: South Africa Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 112: South Africa Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 113: Rest of Middle East & Africa Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 114: Rest of Middle East & Africa Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 115: Rest of Middle East & Africa Refinery Process Chemicals Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 116: Rest of Middle East & Africa Refinery Process Chemicals Market Value (US$ Mn) Forecast, by Application 2023-2031

List of Figures

Figure 1: Global Refinery Process Chemicals Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 2: Global Refinery Process Chemicals Market Attractiveness, by Type

Figure 3: Global Refinery Process Chemicals Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 4: Global Refinery Process Chemicals Market Attractiveness, by Application

Figure 5: Global Refinery Process Chemicals Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Refinery Process Chemicals Market Attractiveness, by Region

Figure 7: North America Refinery Process Chemicals Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 8: North America Refinery Process Chemicals Market Attractiveness, by Type

Figure 9: North America Refinery Process Chemicals Market Attractiveness, by Type

Figure 10: North America Refinery Process Chemicals Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 11: North America Refinery Process Chemicals Market Attractiveness, by Application

Figure 12: North America Refinery Process Chemicals Market Attractiveness, by Country and Sub-region

Figure 13: Europe Refinery Process Chemicals Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 14: Europe Refinery Process Chemicals Market Attractiveness, by Type

Figure 15: Europe Refinery Process Chemicals Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 16: Europe Refinery Process Chemicals Market Attractiveness, by Application

Figure 17: Europe Refinery Process Chemicals Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Refinery Process Chemicals Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Refinery Process Chemicals Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 20: Asia Pacific Refinery Process Chemicals Market Attractiveness, by Type

Figure 21: Asia Pacific Refinery Process Chemicals Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Asia Pacific Refinery Process Chemicals Market Attractiveness, by Application

Figure 23: Asia Pacific Refinery Process Chemicals Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Refinery Process Chemicals Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Refinery Process Chemicals Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 26: Latin America Refinery Process Chemicals Market Attractiveness, by Type

Figure 27: Latin America Refinery Process Chemicals Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 28: Latin America Refinery Process Chemicals Market Attractiveness, by Application

Figure 29: Latin America Refinery Process Chemicals Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Refinery Process Chemicals Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Refinery Process Chemicals Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 32: Middle East & Africa Refinery Process Chemicals Market Attractiveness, by Type

Figure 33: Middle East & Africa Refinery Process Chemicals Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 34: Middle East & Africa Refinery Process Chemicals Market Attractiveness, by Application

Figure 35: Middle East & Africa Refinery Process Chemicals Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Refinery Process Chemicals Market Attractiveness, by Country and Sub-region