Reports

Reports

Analysts’ Viewpoint on Market Scenario

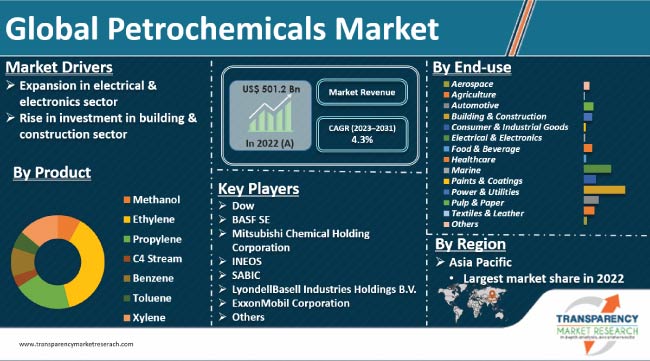

Expansion in the electrical & electronics sector is expected to fuel the petrochemicals market size in the near future. Petrochemicals are chemicals derived from petroleum or natural gas. They play a vital role in everyday life with a wide range of applications including plastics, synthetic fibers, rubber, solvents, fertilizers, and detergents. Surge in demand for goods, such as clothing, footwear, electronics, and packaging products is also augmenting market expansion.

Petrochemical manufacturers are investing substantially in capacity expansion to meet the growth in demand for various products. This involves building new plants or expanding existing ones to increase production capacity. Several vendors are engaging in mergers and acquisitions to expand their customer base and increase the petrochemicals market share.

Petrochemicals are chemical compounds derived from petroleum or natural gas that are used as feedstock in the production of a wide range of products, including plastics, rubber, fibers, solvents, detergents, and adhesives.

Petrochemicals are produced by refining crude oil or natural gas liquids, which are then further processed through a complex chemical process.

Chemicals produced by the petrochemical sector include ethylene oxide, propylene oxide, vinyl chloride, and acrylonitrile. These chemicals are employed in the manufacture of a wide range of products, such as plastics, synthetic fibers, and resins.

The electrical & electronics sector is highly dependent on petrochemical products for the manufacture of various products such as CD players, telephones, radios, computers, and TVs. Petrochemical products ensure better electrical insulation and safety, safer design, data storage, ease of assembly, and a great capacity for miniaturization.

Microchips, the primary component of computers, are made of petrochemical products. Thus, expansion in the electrical & electronics sector is projected to spur the petrochemicals market growth in the next few years.

Petrochemicals are used in the manufacture of various products with diverse applications in the building & construction sector. Petrochemical products are extensively employed to manufacture materials such as paints, coatings, adhesives, and thermal insulation. Increase in investment in the building & construction sector is fueling the petrochemicals market value.

High-performance petrochemicals are used in construction applications that directly impact energy efficiency, comfort, and durability of houses. Paints and coatings that help protect buildings and insulation products that make buildings more energy-efficient are made from various types of petrochemical products.

Durable materials made from petrochemicals aid in boosting the sustainability of buildings. Other applications of petrochemicals in the building & construction sector include piping, window frames, and interior design.

According to the latest petrochemicals industry trends, the ethylene product segment is expected to dominate the industry during the forecast period. Ethylene is a highly versatile petrochemical that can be used to produce a wide range of products, including plastics, synthetic fibers, and elastomers.

Ethylene is a basic building block for several other chemicals such as ethylene oxide, ethylene glycol, and polyethylene, which are employed in various applications such as packaging, construction, automotive, and textiles.

Ethylene is used in various industries and applications due to its unique properties such as flexibility, strength, and resistance to heat and chemicals. It is employed in the production of products such as pipes, films, packaging materials, synthetic rubber, and insulation materials.

Technological advancements have made it possible to produce ethylene more efficiently and cost-effectively, thereby increasing its production and availability. This has made it possible to meet the growth in demand for ethylene-based products, while reducing production costs.

According to the latest petrochemicals market trends, Asia Pacific is projected to hold the largest share from 2023 to 2031. Rapid industrialization and increase in demand for petrochemical-based products are fueling market dynamics of the region.

Rapid industrialization in countries such as China, India, and Vietnam is boosting the demand for various petrochemical products such as plastics, synthetic fibers, and packaging materials. Petrochemicals play a critical role in industries such as building & construction, automotive, and electrical & electronics.

Rapid urbanization is also driving market statistics in Asia Pacific. Urban areas require extensive infrastructure, housing, transportation systems, and consumer goods; all of these rely on petrochemicals. Several countries in the region are implementing policies to promote industrial growth and attract foreign investments. These policies have created a favorable environment for petrochemical manufacturers, encouraging them to expand their operations in Asia Pacific.

The global landscape consists of several small to medium-sized petrochemical manufacturers that compete with each other and large enterprises. Most of the businesses are investing significantly in R&D activities to expand their product portfolio.

Dow, BASF SE, Mitsubishi Chemical Holding Corporation, INEOS, SABIC, LyondellBasell Industries Holdings B.V., ExxonMobil Corporation, TotalEnergies, Reliance Industries Ltd., Sumitomo Seika Chemicals Co., Ltd, Chevron Phillips Chemical Company LLC, China National Petroleum Corporation, Idemitsu Kosan Co., Ltd., Shell Plc, and Indian Oil Corporation Ltd. are key entities operating in this industry.

Each of these players has been profiled in the petrochemicals market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 501.2 Bn |

| Market Forecast Value in 2031 | US$ 721.1 Bn |

| Growth Rate (CAGR) | 4.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 501.2 Bn in 2022

It is projected to grow at a CAGR of 4.3% from 2023 to 2031

Expansion in the electrical & electronics sector and rise in investment in the building & construction sector

Ethylene was the largest product segment in 2022

Asia Pacific recorded the highest demand for petrochemicals in 2022

Dow, BASF SE, Mitsubishi Chemical Holding Corporation, INEOS, SABIC, LyondellBasell Industries Holdings B.V., ExxonMobil Corporation, TotalEnergies, Reliance Industries Ltd., Sumitomo Seika Chemicals Co., Ltd, Chevron Phillips Chemical Company LLC, China National Petroleum Corporation, Idemitsu Kosan Co., Ltd., Shell Plc, and Indian Oil Corporation Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Petrochemicals Market Analysis and Forecast, 2023-2031

2.6.1. Global Petrochemicals Market Volume (Tons)

2.6.2. Global Petrochemicals Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Production Overview

2.11. Product Specification Analysis

2.11.1. Cost Structure Analysis

3. Economic Recovery Post COVID-19

3.1. Impact on Supply Chain of Petrochemicals

3.2. Impact on Demand for Petrochemicals- Pre & Post Crisis

4. Impact of Current Geopolitical Scenario

5. Production Output Analysis, 2022

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Region

7. Global Petrochemicals Market Analysis and Forecast, by Product, 2023-2031

7.1. Introduction and Definitions

7.2. Global Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

7.3. Methanol

7.3.1. Formaldehyde

7.3.2. Methyl Methacrylate (MMA)

7.3.3. Methyl Tert-butyl Ether (MTBE)

7.3.4. Others

7.4. Ethylene

7.4.1. Polyethylene

7.4.2. Ethylene Oxide

7.4.3. Ethanolamine

7.4.4. Ethyl Alcohol

7.4.5. Acetaldehyde

7.4.6. Others

7.5. Propylene

7.5.1. Polypropylene

7.5.2. Propylene Oxide

7.5.3. Acrylonitrile

7.5.4. Acrylic Acid

7.5.5. Others

7.6. C4 Stream

7.6.1. Butadiene

7.6.2. Isobutylene

7.6.3. Others

7.7. Benzene

7.7.1. Ethylbenzene

7.7.2. Cumene

7.7.3. Cyclohexane

7.7.4. Others

7.8. Toluene

7.9. Xylene

7.10. Global Petrochemicals Market Attractiveness, by Product

8. Global Petrochemicals Market Analysis and Forecast, by End-use, 2023-2031

8.1. Introduction and Definitions

8.2. Global Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

8.2.1. Automotive

8.2.2. Aerospace

8.2.3. Marine

8.2.4. Healthcare

8.2.5. Power & Utilities

8.2.6. Building & Construction

8.2.7. Agriculture

8.2.8. Consumer & Industrial Goods

8.2.9. Electrical & Electronics

8.2.10. Food & Beverage

8.2.11. Pulp & Paper

8.2.12. Textiles & Leather

8.2.13. Paints & Coatings

8.2.14. Others

8.3. Global Petrochemicals Market Attractiveness, by End-use

9. Global Petrochemicals Market Analysis and Forecast, by Region, 2023-2031

9.1. Key Findings

9.2. Global Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2023-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Petrochemicals Market Attractiveness, by Region

10. North America Petrochemicals Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. North America Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

10.3. North America Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

10.4. North America Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

10.4.1. U.S. Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

10.4.2. U.S. Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

10.4.3. Canada Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

10.4.4. Canada Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

10.5. North America Petrochemicals Market Attractiveness Analysis

11. Europe Petrochemicals Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Europe Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

11.3. Europe Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

11.4. Europe Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Country/Sub-region, 2022-2031

11.4.1. Germany Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

11.4.2. Germany Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

11.4.3. France Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

11.4.4. France Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

11.4.5. U.K. Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

11.4.6. U.K. Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

11.4.7. Italy Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

11.4.8. Italy Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

11.4.9. Russia & CIS Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

11.4.10. Russia & CIS Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

11.4.11. Rest of Europe Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

11.4.12. Rest of Europe Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

11.5. Europe Petrochemicals Market Attractiveness Analysis

12. Asia Pacific Petrochemicals Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Asia Pacific Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product

12.3. Asia Pacific Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

12.4. Asia Pacific Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Country/Sub-region, 2022-2031

12.4.1. China Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

12.4.2. China Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

12.4.3. Japan Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

12.4.4. Japan Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

12.4.5. India Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

12.4.6. India Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

12.4.7. ASEAN Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

12.4.8. ASEAN Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

12.4.9. Rest of Asia Pacific Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

12.4.10. Rest of Asia Pacific Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

12.5. Asia Pacific Petrochemicals Market Attractiveness Analysis

13. Latin America Petrochemicals Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Latin America Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

13.3. Latin America Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

13.4. Latin America Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Country/Sub-region, 2022-2031

13.4.1. Brazil Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

13.4.2. Brazil Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

13.4.3. Mexico Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

13.4.4. Mexico Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

13.4.5. Rest of Latin America Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

13.4.6. Rest of Latin America Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

13.5. Latin America Petrochemicals Market Attractiveness Analysis

14. Middle East & Africa Petrochemicals Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Middle East & Africa Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

14.3. Middle East & Africa Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

14.4. Middle East & Africa Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Country/Sub-region, 2022-2031

14.4.1. GCC Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

14.4.2. GCC Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

14.4.3. South Africa Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

14.4.4. South Africa Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

14.4.5. Rest of Middle East & Africa Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2023-2031

14.4.6. Rest of Middle East & Africa Petrochemicals Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

14.5. Middle East & Africa Petrochemicals Market Attractiveness Analysis

15. Competition Landscape

15.1. Market Players - Competition Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, 2022

15.3. Market Footprint Analysis

15.3.1. By Application

15.3.2. By End-use

15.4. Company Profiles (Details - Overview, Financials, Recent Developments, and Strategy)

15.4.1. Dow

15.4.1.1. Company Revenue

15.4.1.2. Business Overview

15.4.1.3. Product Segments

15.4.1.4. Geographic Footprint

15.4.1.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.2. BASF SE

15.4.2.1. Company Revenue

15.4.2.2. Business Overview

15.4.2.3. Product Segments

15.4.2.4. Geographic Footprint

15.4.2.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.3. Mitsubishi Chemical Holding Corporation

15.4.3.1. Company Revenue

15.4.3.2. Business Overview

15.4.3.3. Product Segments

15.4.3.4. Geographic Footprint

15.4.3.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.4. INEOS

15.4.4.1. Company Revenue

15.4.4.2. Business Overview

15.4.4.3. Product Segments

15.4.4.4. Geographic Footprint

15.4.4.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.5. SABIC

15.4.5.1. Company Revenue

15.4.5.2. Business Overview

15.4.5.3. Product Segments

15.4.5.4. Geographic Footprint

15.4.5.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.6. LyondellBasell Industries Holdings B.V.

15.4.6.1. Company Revenue

15.4.6.2. Business Overview

15.4.6.3. Product Segments

15.4.6.4. Geographic Footprint

15.4.6.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.7. Exxon Mobil Corporation

15.4.7.1. Company Revenue

15.4.7.2. Business Overview

15.4.7.3. Product Segments

15.4.7.4. Geographic Footprint

15.4.7.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.8. TotalEnergies

15.4.8.1. Company Revenue

15.4.8.2. Business Overview

15.4.8.3. Product Segments

15.4.8.4. Geographic Footprint

15.4.8.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.9. Reliance Industries Ltd.

15.4.9.1. Company Revenue

15.4.9.2. Business Overview

15.4.9.3. Product Segments

15.4.9.4. Geographic Footprint

15.4.9.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.10. Sumitomo Seika Chemicals Co., Ltd.

15.4.10.1. Company Revenue

15.4.10.2. Business Overview

15.4.10.3. Product Segments

15.4.10.4. Geographic Footprint

15.4.10.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.11. Chevron Phillips Chemical Company LLC

15.4.11.1. Company Revenue

15.4.11.2. Business Overview

15.4.11.3. Product Segments

15.4.11.4. Geographic Footprint

15.4.11.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.12. China National Petroleum Corporation

15.4.12.1. Company Revenue

15.4.12.2. Business Overview

15.4.12.3. Product Segments

15.4.12.4. Geographic Footprint

15.4.12.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.13. Idemitsu Kosan Co., Ltd.

15.4.13.1. Company Revenue

15.4.13.2. Business Overview

15.4.13.3. Product Segments

15.4.13.4. Geographic Footprint

15.4.13.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.14. Shell Companies

15.4.14.1. Company Revenue

15.4.14.2. Business Overview

15.4.14.3. Product Segments

15.4.14.4. Geographic Footprint

15.4.14.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.14.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.4.15. Indian Oil Corporation Ltd.

15.4.15.1. Company Revenue

15.4.15.2. Business Overview

15.4.15.3. Product Segments

15.4.15.4. Geographic Footprint

15.4.15.5. Production Form/Plant Details, etc. (*As Applicable)

15.4.15.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 2: Global Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 3: Global Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 4: Global Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 5: Global Petrochemicals Market Volume (Tons) Forecast, by Region, 2023-2031

Table 6: Global Petrochemicals Market Value (US$ Mn) Forecast, by Region, 2023-2031

Table 7: North America Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 8: North America Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 9: North America Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 10: North America Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 11: North America Petrochemicals Market Volume (Tons) Forecast, by Country/Sub-region, 2023-2031

Table 12: North America Petrochemicals Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 13: U.S. Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 14: U.S. Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 15: U.S. Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 16: U.S. Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 17: Canada Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 18: Canada Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 19: Canada Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 20: Canada Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 21: Europe Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 22: Europe Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 23: Europe Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 24: Europe Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 25: Europe Petrochemicals Market Volume (Tons) Forecast, by Country/Sub-region, 2023-2031

Table 26: Europe Petrochemicals Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 27: Germany Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 28: Germany Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 29: Germany Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 30: Germany Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 31: France Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 32: France Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 33: France Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 34: France Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 35: U.K. Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 36: U.K. Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 37: U.K. Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 38: U.K. Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 39: Italy Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 40: Italy Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 41: Italy Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 42: Italy Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 43: Spain Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 44: Spain Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 45: Spain Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 46: Spain Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 47: Russia & CIS Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 48: Russia & CIS Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 49: Russia & CIS Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 50: Russia & CIS Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 51: Rest of Europe Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 52: Rest of Europe Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 53: Rest of Europe Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 54: Rest of Europe Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 55: Asia Pacific Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 56: Asia Pacific Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 57: Asia Pacific Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 58: Asia Pacific Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 59: Asia Pacific Petrochemicals Market Volume (Tons) Forecast, by Country/Sub-region, 2023-2031

Table 60: Asia Pacific Petrochemicals Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 61: China Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 62: China Petrochemicals Market Value (US$ Mn) Forecast, by Product 2023-2031

Table 63: China Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 64: China Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 65: Japan Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 66: Japan Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 67: Japan Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 68: Japan Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 69: India Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 70: India Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 71: India Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 72: India Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 73: India Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 74: India Petrochemicals Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 75: ASEAN Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 76: ASEAN Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 77: ASEAN Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 78: ASEAN Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 79: Rest of Asia Pacific Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 80: Rest of Asia Pacific Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 81: Rest of Asia Pacific Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 82: Rest of Asia Pacific Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 83: Latin America Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 84: Latin America Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 85: Latin America Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 86: Latin America Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 87: Latin America Petrochemicals Market Volume (Tons) Forecast, by Country/Sub-region, 2023-2031

Table 88: Latin America Petrochemicals Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 89: Brazil Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 90: Brazil Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 91: Brazil Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 92: Brazil Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 93: Mexico Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 94: Mexico Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 95: Mexico Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 96: Mexico Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 97: Rest of Latin America Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 98: Rest of Latin America Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 99: Rest of Latin America Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 100: Rest of Latin America Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 101: Middle East & Africa Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 102: Middle East & Africa Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 103: Middle East & Africa Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 104: Middle East & Africa Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 105: Middle East & Africa Petrochemicals Market Volume (Tons) Forecast, by Country/Sub-region, 2023-2031

Table 106: Middle East & Africa Petrochemicals Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 107: GCC Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 108: GCC Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 109: GCC Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 110: GCC Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 111: South Africa Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 112: South Africa Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 113: South Africa Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 114: South Africa Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 115: Rest of Middle East & Africa Petrochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 116: Rest of Middle East & Africa Petrochemicals Market Value (US$ Mn) Forecast, by Product, 2023-2031

Table 117: Rest of Middle East & Africa Petrochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 118: Rest of Middle East & Africa Petrochemicals Market Value (US$ Mn) Forecast, by End-use, 2023-2031

List of Figures

Figure 1: Global Petrochemicals Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 2: Global Petrochemicals Market Attractiveness, by Product

Figure 3: Global Petrochemicals Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 4: Global Petrochemicals Market Attractiveness, by End-use

Figure 5: Global Petrochemicals Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Petrochemicals Market Attractiveness, by Region

Figure 7: North America Petrochemicals Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 8: North America Petrochemicals Market Attractiveness, by Product

Figure 9: North America Petrochemicals Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 10: North America Petrochemicals Market Attractiveness, by End-use

Figure 11: North America Petrochemicals Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 12: North America Petrochemicals Market Attractiveness, by Country/Sub-region

Figure 13: Europe Petrochemicals Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 14: Europe Petrochemicals Market Attractiveness, by Product

Figure 15: Europe Petrochemicals Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 16: Europe Petrochemicals Market Attractiveness, by End-use

Figure 17: Europe Petrochemicals Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 18: Europe Petrochemicals Market Attractiveness, by Country/Sub-region

Figure 19: Asia Pacific Petrochemicals Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 20: Asia Pacific Petrochemicals Market Attractiveness, by Product

Figure 21: Asia Pacific Petrochemicals Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 22: Asia Pacific Petrochemicals Market Attractiveness, by End-use

Figure 23: Asia Pacific Petrochemicals Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Petrochemicals Market Attractiveness, by Country/Sub-region

Figure 25: Latin America Petrochemicals Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 26: Latin America Petrochemicals Market Attractiveness, by Product

Figure 27: Latin America Petrochemicals Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 28: Latin America Petrochemicals Market Attractiveness, by End-use

Figure 29: Latin America Petrochemicals Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Petrochemicals Market Attractiveness, by Country/Sub-region

Figure 31: Middle East & Africa Petrochemicals Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 32: Middle East & Africa Petrochemicals Market Attractiveness, by Product

Figure 33: Middle East & Africa Petrochemicals Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 34: Middle East & Africa Petrochemicals Market Attractiveness, by End-use

Figure 35: Middle East & Africa Petrochemicals Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Petrochemicals Market Attractiveness, by Country/Sub-region