Reports

Reports

Analyst Viewpoint

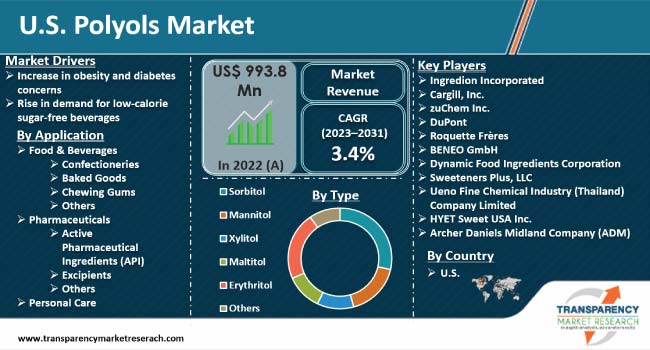

Increase in obesity and diabetes concerns and rise in demand for low-calorie sugar-free beverages are augmenting the U.S. polyols market size. Furthermore, surge in usage of polyols in pharmaceuticals and bakery products is bolstering the market trajectory. Polyols help retain moisture and increase the shelf life of products. This enables manufacturers to increase sustainability and durability of products.

Polyols are extensively employed as sugar substitutes in several food and beverage products. Sorbitol polyol sugar substitute is used extensively in bakery and confectionery products. It helps maintain dental health. Health benefits of polyols encourage people to consume sugar-free and low-calorie foods. Companies operating in the sector are following the latest U.S. polyols market trends and introducing new and innovative products to strengthen their industry position.

Polyols are formed using organic compounds containing multiple hydroxyl groups. They are alcohols with more than one hydroxyl group. Polyols containing two, three, and four hydroxyl groups are diols, triols, and tetrols.

Polyols are naturally found in some fruits and vegetables. They are also added artificially to sweeten sugar-free food products. Sorbitol and mannitol are two major types of polyols that are employed in the food & beverages sector.

Polyols have low energy content; hence, they are often used as artificial sweeteners in products such as confectioneries, chewing gums, and mints.

Polyols are considered a better alternative to sugar, as they help control calorie consumption; however, they should be consumed moderately. Companies in the food & beverages sector use polyols as low-calorie sweeteners to manufacture sugar-free beverages.

Diabetes is one of the key health concerns among the population in the U.S. Lack of physical activity, aging, obesity, and sedentary lifestyle are some of the key reasons for diabetes. Adoption of sedentary lifestyle is leading to obesity among the people in the U.S. Obesity or over weight causes resistance to insulin. Thus, rise in incidence of type 2 diabetes in the U.S. is fueling market expansion.

According to the Center for Disease Control National Diabetes Statistics Report 2022, 37.3 million people suffer from diabetes in the U.S. Of these, 28.7 people have been diagnosed with the disease, while the rest remain undiagnosed. Diabetes can lead to severe health complications such as stroke, kidney failure, heart disease, and blindness.

Polyols have low insulin levels for metabolism and are non-cariogenic in nature. Thus, they require less energy for digestion. Polyols are key ingredients in low-calorie foods, as they ensure easy digestion and improve gut health.

Polyols control crystal formation and retain moisture in packaged food products, which helps increase the shelf life of products. These aspects are augmenting market progress in the U.S.

Polyols are primarily used as sugar substitutes, as they contain half of the calories of sugar. Polyols possess the same texture and consistency as sugar and are stable against chemicals, enzymatic degradation, and acids.

Polyols act as sugar-free low-calorie sweeteners and are widely used in beverages, food, and pharmaceuticals. These crucial properties of polyols are propelling market development.

Increase in consumer demand for low-calorie and sugar-free beverages in the U.S is driving the usage of polyols in the food & beverages sector. Polyols are utilized in chewing gums, ice creams, and fruit spread. High consumption of fruit spread and ice creams among children is increasing the U.S. polyols market share.

Similarly, rise in usage of polyols in pharmaceuticals and bakery products is bolstering the U.S. polyols market growth. Sorbitol polyol is employed in bakery products and is naturally found in pears, apricots, apples, and peaches. The sorbitol market is driven by the growth in demand for bakery products during occasions such as Halloween, Thanksgiving, and Christmas in the U.S.

According to the U.S. polyols market segmentation, the sorbitol type segment accounted for the leading share in 2022. Sorbitol polyol, a sweetener containing less sugar, offers several health benefits.

It helps avoid cavities and maintain dental health due to its less sugar content. Rise in consumption of low-calorie desserts in the U.S. is steering market dynamics.

Rapid growth in obesity among the people in the U.S. is fueling the polyols business in the country. Increase in adoption of a sedentary lifestyle is one of the foremost reasons causing obesity and various health issues among the population.

Limiting the intake of sugar can help reduce calorie count in the diet. Polyols are ideal alternatives to sugar in high-calorie food products; hence, they are primarily used by large number of manufacturers in the food & beverage sector. Increase in consumer demand for low-calorie and sugar-free food is fueling the polyols business in the country.

Leading players in the U.S. polyols landscape, especially in the food & beverages sector, are focusing on expanding their product portfolio. They are striving to introduce new and innovative products to meet the rising demand for sweet food and beverages among the people in the U.S.

Companies operating in pharmaceuticals and personal care sectors are adopting growth strategies such as mergers and acquisitions and expansion of production facilities to increase their market share.

Prominent players operating in the U.S. polyols market are Ingredion Incorporated, Cargill, Inc., zuChem Inc., DuPont, Roquette Frères, BENEO GmbH, Dynamic Food Ingredients Corporation, Sweeteners Plus, LLC, Ueno Fine Chemical Industry (Thailand) Company Limited, HYET Sweet USA Inc., and Archer Daniels Midland Company (ADM).

These companies have been profiled in the U.S. polyols market report on the basis of different parameters such as business strategies, recent developments, business segments, company overview, financial overview, and product portfolio.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 993.8 Mn |

| Market Forecast Value in 2031 | US$ 1.3 Bn |

| Growth Rate (CAGR) | 3.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2022 |

| Quantitative Units | US$ Mn/Bn for Value and Kilo Tons for Volume |

| Market Analysis | It includes segment analysis as well as country level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 993.8 Mn in 2022

It is anticipated to grow at a CAGR of 3.4% from 2023 to 2031

It is projected to reach US$ 1.3 Bn by the end of 2031

Increase in incidence of obesity and diabetes, and rise in demand for low-calorie sugar-free beverages

The sorbitol type segment accounted for significant share in 2022

Ingredion Incorporated, Cargill, Inc., zuChem, Inc., DuPont, Roquette Frères, BENEO GmbH, Dynamic Food Ingredients Corporation, Sweeteners Plus, LLC, Ueno Fine Chemical Industry (Thailand) Company Limited, HYET Sweet USA Inc., and Archer Daniels Midland Company (ADM)

1. Executive Summary

1.1. Country Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. U.S. Polyols Market Analysis and Forecast, 2023-2031

2.6.1. U.S. Polyols Market Volume (Kilo Tons)

2.6.2. U.S. Polyols Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Polyols

3.2. Impact on Demand for Polyols – Pre & Post Crisis

4. Production Output Analysis (Kilo Tons), 2022

4.1. U.S.

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis by Type

6.2. Price Trend Analysis by Country

7. U.S. Polyols Market Analysis and Forecast, by Type, 2023–2031

7.1. Introduction and Definitions

7.2. U.S. Polyols Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

7.2.1. Sorbitol

7.2.2. Mannitol

7.2.3. Xylitol

7.2.4. Maltitol

7.2.5. Erythritol

7.2.6. Others

7.3. U.S. Polyols Market Attractiveness, by Type

8. U.S. Polyols Market Analysis and Forecast, by Application, 2023–2031

8.1. Introduction and Definitions

8.2. U.S. Polyols Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

8.2.1. Food & Beverages

8.2.1.1. Confectioneries

8.2.1.2. Baked Goods

8.2.1.3. Chewing Gums

8.2.1.4. Others

8.2.2. Pharmaceuticals

8.2.2.1. Active Pharmaceutical Ingredients (API)

8.2.2.2. Excipients

8.2.2.3. Others (including Gel Caps and Medicated Candies)

8.2.3. Personal Care

8.3. U.S. Polyols Market Attractiveness, by Application

9. U.S. Polyols Market Analysis and Forecast, by Country, 2023–2031

9.1. Key Findings

9.2. U.S. Polyols Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2023–2031

9.2.1. U.S.

9.2.1.1. U.S. Polyols Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

9.2.1.2. U.S. Polyols Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.3. U.S. Polyols Market Attractiveness, by Country

10. Competition Landscape

10.1. U.S. Polyols Market Share Analysis, 2022

10.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

10.2.1. Ingredion Incorporated

10.2.1.1. Company Revenue

10.2.1.2. Business Overview

10.2.1.3. Product Segments

10.2.1.4. Geographic Footprint

10.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

10.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

10.2.2. Cargill, Inc.

10.2.2.1. Company Revenue

10.2.2.2. Business Overview

10.2.2.3. Product Segments

10.2.2.4. Geographic Footprint

10.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

10.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

10.2.3. zuChem, Inc.

10.2.3.1. Company Revenue

10.2.3.2. Business Overview

10.2.3.3. Product Segments

10.2.3.4. Geographic Footprint

10.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

10.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

10.2.4. DuPont

10.2.4.1. Company Revenue

10.2.4.2. Business Overview

10.2.4.3. Product Segments

10.2.4.4. Geographic Footprint

10.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

10.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

10.2.5. Roquette Frères

10.2.5.1. Company Revenue

10.2.5.2. Business Overview

10.2.5.3. Product Segments

10.2.5.4. Geographic Footprint

10.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

10.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

10.2.6. BENEO GmbH

10.2.6.1. Company Revenue

10.2.6.2. Business Overview

10.2.6.3. Product Segments

10.2.6.4. Geographic Footprint

10.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

10.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

10.2.7. Dynamic Food Ingredients Corporation

10.2.7.1. Company Revenue

10.2.7.2. Business Overview

10.2.7.3. Product Segments

10.2.7.4. Geographic Footprint

10.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

10.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

10.2.8. Sweeteners Plus, LLC.

10.2.8.1. Company Revenue

10.2.8.2. Business Overview

10.2.8.3. Product Segments

10.2.8.4. Geographic Footprint

10.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

10.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

10.2.9. Ueno Fine Chemical Industry (Thailand) Company Limited

10.2.9.1. Company Revenue

10.2.9.2. Business Overview

10.2.9.3. Product Segments

10.2.9.4. Geographic Footprint

10.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

10.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

10.2.10. HYET Sweet USA, Inc.

10.2.10.1. Company Revenue

10.2.10.2. Business Overview

10.2.10.3. Product Segments

10.2.10.4. Geographic Footprint

10.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

10.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

10.2.11. Archer Daniels Midland Company (ADM)

10.2.11.1. Company Revenue

10.2.11.2. Business Overview

10.2.11.3. Product Segments

10.2.11.4. Geographic Footprint

10.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

10.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

11. Primary Research: Key Insights

12. Appendix

List of Tables

Table 1: U.S. Polyols Market Volume (Kilo Tons) Forecast, by Type, 2023–2031

Table 2: U.S. Polyols Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 3: U.S. Polyols Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 4: U.S. Polyols Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 5: U.S. Polyols Market Volume (Kilo Tons) Forecast, by Country, 2023–2031

Table 6: U.S. Polyols Market Value (US$ Mn) Forecast, by Country, 2023–2031

List of Figures

Figure 1: U.S. Polyols Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 2: U.S. Polyols Market Attractiveness, by Type

Figure 3: U.S. Polyols Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 4: U.S. Polyols Market Attractiveness, by Application

Figure 5: U.S. Polyols Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 6: U.S. Polyols Market Attractiveness, by Country