Reports

Reports

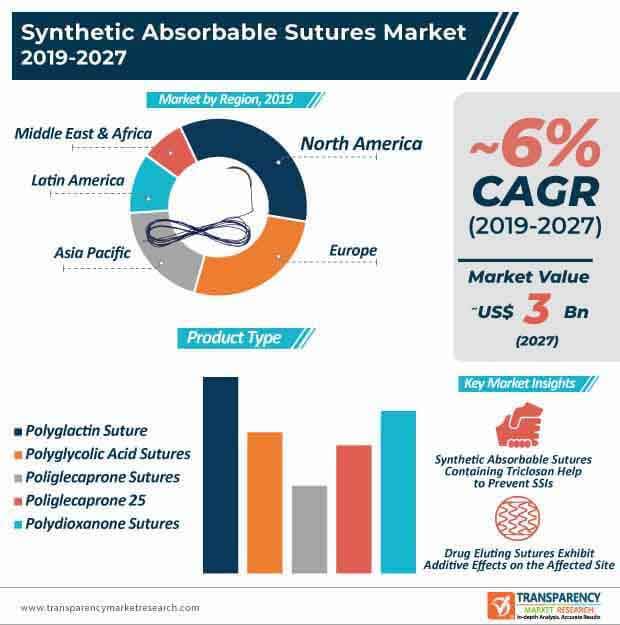

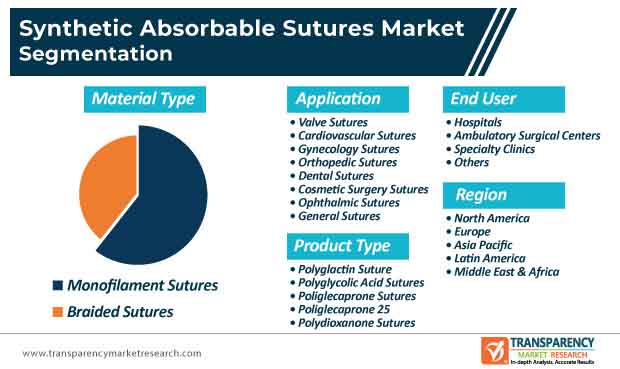

Braided and coated synthetic absorbable sutures are gaining widespread acceptance in gastrointestinal and gynecological procedures. This explains why the revenue of gynecology applications is estimated for aggressive growth in the synthetic absorbable sutures market, where the market is estimated to reach a value of ~US$ 3 Bn by the end of 2027. Hence, distributors and medtech companies are setting their collaboration wheels in motion to generate sales. For instance, Uniplex (UK) Ltd.- a specialist in the repair and servicing of surgical instruments and medical devices, has joined forces with Meril Life, a medical device manufacturer, to strengthen their distribution channels in the global synthetic absorbable sutures market.

Medtech companies are investing in capacity additions to increase the availability of braided and coated synthetic sutures that degrade via hydrolysis and ensure reliable absorption. They are increasing focus in multi-stroke technology to ensure that every suture is stitched to reduce the incidences of suture snapping.

Surgical sutures have become one of the most common implantable medical textiles in the synthetic absorbable sutures market. This trend is contributing toward the robust growth of the synthetic absorbable sutures market, which is anticipated to expand at a CAGR of ~6% during the forecast period. Due to increased popularity of sutures post surgical procedures, medtech companies are increasingly focusing on biocompatibility of textile materials to ensure predictable absorption of sutures. Likewise, porosity of synthetic absorbable sutures has become an important deciding factor that determines how fast the human tissue will heal after the surgery.

Manufacturers in the market for synthetic absorbable sutures are increasing their R&D activities to introduce sutures with small circular fibers that are better encapsulate with the human tissue, thus improving the patient quality of life. They are developing absorbable sutures that remain free from surface contamination such as from lubricants and sizing. As such, companies are increasing their production capabilities in polyglactin sutures, since the revenue of these sutures is slated for exponential growth during the assessment period.

Synthetic absorbable sutures containing triclosan are becoming more commonplace for wound closure applications among adults and children after surgical procedures. Moreover, triclosan helps to fight off microorganisms and prevent incidences of surgical sight infections (SSIs). According to the recently published medtech innovation briefing by NICE (National Institute for Health and Care Excellence), absorbable sutures are replacing traditional non-antibacterial sutures. However, synthetic absorbable sutures are more expensive than non-antibacterial sutures. As such, the relatively high cost is offset by the fact that absorbable sutures help in prevention of SSIs, thus resulting in increased sales.

Novel absorbable sutures containing triclosan as provided by Ethicon, Inc.— a subsidiary of leading medical devices company Johnson & Johnson, are being highly publicized in the Europe synthetic absorbable sutures market. This is evident since the revenue of the synthetic absorbable sutures market in Europe is projected for exponential growth. Manufacturers are increasing their production capabilities to produce both monofilament and multifilament sutures.

Recent developments of COVID-19 (coronavirus) in the U.K. have significantly disrupted supply chains in the synthetic absorbable sutures market. However, several distributors are striving to maintain 100% ‘in stock’ for synthetic absorbable sutures and other medical devices that fall under the category of regularly purchased products. Organizations are taking necessary precautions to prevent the spread of coronavirus. In order to meet any urgent patient needs, numerous companies in the synthetic absorbable sutures market have acquired special permissions from local authorities to keep certain amount of business operations functional.

Medtech companies are requesting that all non-essential visits to the office wait until the situation stabilizes in the U.K. They are resorting to virtual meetings through Skype or telephone to meet urgent client requirements. Companies have curtailed their national and international plans to prevent the spread of coronavirus.

Analysts’ Viewpoint

Distribution companies in the U.K. synthetic absorbable sutures market have put many business continuity plans of critical partners on hold in order to stabilize business operations amidst the growing COVID-19 pandemic. On the other hand, drug-eluting sutures are being highly publicized to exhibit additive effects on the affected site.

Manufacturers are experimenting with copolymers of glycolide and lactide to increase the tensile strength of sutures. However, growing incidences of sutures snapping are likely to slow down market growth. Hence, companies should gain expertise in multi-stroke technology to ensure each suture is swaged to reduce incidence of sutures snapping. Excellent knot security and smooth knot run-down are becoming the key focus points for innovations among medtech companies.

The global synthetic absorbable sutures market was worth US$ 1.5 Bn and is projected to reach a value of US$ 3 Bn by the end of 2027

Synthetic absorbable sutures market is anticipated to grow at a CAGR of 6% during the forecast period

North America accounted for a major share of the global synthetic absorbable sutures market

Synthetic absorbable sutures market is driven by increase in number of surgical procedures, rapidly increasing population, changing in lifestyle, and early adoption of treatment procedures

Key players in the global synthetic absorbable sutures market include B. Braun Melsungen AG, Medtronic plc, Teleflex Incorporated, Johnson & Johnson, Smith & Nephew plc, Acelity L.P. Inc., Boston Scientific Corporation, Zimmer Biomet Holdings, Inc., ConMed Corporation, Integra LifeSciences Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Synthetic Absorbable Sutures Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Synthetic Absorbable Sutures Market Analysis and Forecasts, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Market Outlook

5.1. Key Mergers & Acquisitions

5.2. Information of Coating Material of Sutures

5.3. Technological Advancements

6. Global Synthetic Absorbable Sutures Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2027

6.3.1. Polyglactin Suture

6.3.2. Polyglycolic Acid Sutures

6.3.3. Poliglecaprone Sutures

6.3.4. Poliglecaprone 25

6.3.5. Polydioxanone Sutures

6.4. Market Attractiveness, by Product Type

7. Global Synthetic Absorbable Sutures Market Analysis and Forecast, by Material Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Material Type, 2017–2027

7.3.1. Monofilament Sutures

7.3.2. Braided Sutures

7.4. Market Attractiveness, by Material Type

8. Global Synthetic Absorbable Sutures Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2027

8.3.1. Valve Sutures

8.3.2. Cardiovascular Sutures

8.3.3. Gynecology Sutures

8.3.4. Orthopedic Sutures

8.3.5. Dental Sutures

8.3.6. Cosmetic Surgery Sutures

8.3.7. Ophthalmic Sutures

8.3.8. General Sutures

8.4. Market Attractiveness, by Application

9. Global Synthetic Absorbable Sutures Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017–2027

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Specialty Clinics

9.3.4. Others

9.4. Market Attractiveness, by End-user

10. Global Synthetic Absorbable Sutures Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness, by Region

10.4. North America Synthetic Absorbable Sutures Market Analysis and Forecast

10.5. Introduction

10.5.1. Key Findings

10.6. Market Value Forecast, by Product Type, 2017–2027

10.6.1. Polyglactin Suture

10.6.2. Polyglycolic Acid Sutures

10.6.3. Poliglecaprone Sutures

10.6.4. Poliglecaprone 25

10.6.5. Polydioxanone Sutures

10.7. Market Value Forecast, by Material Type, 2017–2027

10.7.1. Monofilament Sutures

10.7.2. Braided Sutures

10.8. Market Value Forecast, by Application, 2017–2027

10.8.1. Valve Sutures

10.8.2. Cardiovascular Sutures

10.8.3. Gynecology Sutures

10.8.4. Orthopedic Sutures

10.8.5. Dental Sutures

10.8.6. Cosmetic Surgery Sutures

10.8.7. Ophthalmic Sutures

10.8.8. General Sutures

10.9. Market Value Forecast, by End-user, 2017–2027

10.9.1. Hospitals

10.9.2. Ambulatory Surgical Centers

10.9.3. Specialty Clinics

10.9.4. Others

10.10. Market Value Forecast, by Country, 2017–2027

10.10.1. U.S.

10.10.2. Canada

10.11. Market Attractiveness Analysis

10.11.1. By Product Type

10.11.2. By Material Type

10.11.3. By Application

10.11.4. By End-user

10.11.5. By Country

11. Europe Synthetic Absorbable Sutures Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2027

11.2.1. Polyglactin Suture

11.2.2. Polyglycolic Acid Sutures

11.2.3. Poliglecaprone Sutures

11.2.4. Poliglecaprone 25

11.2.5. Polydioxanone Sutures

11.3. Market Value Forecast, by Material Type, 2017–2027

11.3.1. Monofilament Sutures

11.3.2. Braided Sutures

11.4. Market Value Forecast, by Application, 2017–2027

11.4.1. Valve Sutures

11.4.2. Cardiovascular Sutures

11.4.3. Gynecology Sutures

11.4.4. Orthopedic Sutures

11.4.5. Dental Sutures

11.4.6. Cosmetic Surgery Sutures

11.4.7. Ophthalmic Sutures

11.4.8. General Sutures

11.5. Market Value Forecast, by End-user, 2017–2027

11.5.1. Hospitals

11.5.2. Ambulatory Surgical Centers

11.5.3. Specialty Clinics

11.5.4. Others

11.6. Market Value Forecast, by Country/Sub-Region, 2017–2027

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Material Type

11.7.3. By End-user

11.7.4. By End-user

11.7.5. By Country/Sub-Region

12. Asia Pacific Synthetic Absorbable Sutures Market Analysis and Forecast

13. Introduction

13.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2027

13.2.1. Polyglactin Suture

13.2.2. Polyglycolic Acid Sutures

13.2.3. Poliglecaprone Sutures

13.2.4. Poliglecaprone 25

13.2.5. Polydioxanone Sutures

13.3. Market Value Forecast, by Material Type, 2017–2027

13.3.1. Monofilament Sutures

13.3.2. Braided Sutures

13.4. Market Value Forecast, by Application, 2017–2027

13.4.1. Valve Sutures

13.4.2. Cardiovascular Sutures

13.4.3. Gynecology Sutures

13.4.4. Orthopedic Sutures

13.4.5. Dental Sutures

13.4.6. Cosmetic Surgery Sutures

13.4.7. Ophthalmic Sutures

13.4.8. General Sutures

13.5. Market Value Forecast, by End-user, 2017–2027

13.5.1. Hospitals

13.5.2. Ambulatory Surgical Centers

13.5.3. Specialty Clinics

13.5.4. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2027

13.6.1. Japan

13.6.2. China

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Material Type

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-Region

14. Latin America Synthetic Absorbable Sutures Market Analysis and Forecast

15. Introduction

15.1. Key Findings

15.2. Market Value Forecast, by Product Type, 2017–2027

15.2.1. Polyglactin Suture

15.2.2. Polyglycolic Acid Sutures

15.2.3. Poliglecaprone Sutures

15.2.4. Poliglecaprone 25

15.2.5. Polydioxanone Sutures

15.3. Market Value Forecast, by Material Type, 2017–2027

15.3.1. Monofilament Sutures

15.3.2. Braided Sutures

15.4. Market Value Forecast, by Application, 2017–2027

15.4.1. Valve Sutures

15.4.2. Cardiovascular Sutures

15.4.3. Gynecology Sutures

15.4.4. Orthopedic Sutures

15.4.5. Dental Sutures

15.4.6. Cosmetic Surgery Sutures

15.4.7. Ophthalmic Sutures

15.4.8. General Sutures

15.5. Market Value Forecast, by End-user, 2017–2027

15.5.1. Hospitals

15.5.2. Ambulatory Surgical Centers

15.5.3. Specialty Clinics

15.5.4. Others

15.6. Market Value Forecast, by Country/Sub-Region, 2017–2027

15.6.1. Brazil

15.6.2. Mexico

15.6.3. Rest of Latin America

15.7. Market Attractiveness Analysis

15.7.1. By Product Type

15.7.2. By Material Type

15.7.3. By End-user

15.7.4. By End-user

15.7.5. By Country/Sub-Region

16. Middle East & Africa Synthetic Absorbable Sutures Market Analysis and Forecast

17. Introduction

17.1. Key Findings

17.2. Market Value Forecast, by Product Type, 2017–2027

17.2.1. Polyglactin Suture

17.2.2. Polyglycolic Acid Sutures

17.2.3. Poliglecaprone Sutures

17.2.4. Poliglecaprone 25

17.2.5. Polydioxanone Sutures

17.3. Market Value Forecast, by Material Type, 2017–2027

17.3.1. Monofilament Sutures

17.3.2. Braided Sutures

17.4. Market Value Forecast, by Application, 2017–2027

17.4.1. Valve Sutures

17.4.2. Cardiovascular Sutures

17.4.3. Gynecology Sutures

17.4.4. Orthopedic Sutures

17.4.5. Dental Sutures

17.4.6. Cosmetic Surgery Sutures

17.4.7. Ophthalmic Sutures

17.4.8. General Sutures

17.5. Market Value Forecast, by End-user, 2017–2027

17.5.1. Hospitals

17.5.2. Ambulatory Surgical Centers

17.5.3. Specialty Clinics

17.5.4. Others

17.6. Market Value Forecast, by Country/Sub-Region, 2017–2027

17.6.1. GCC Countries

17.6.2. South Africa

17.6.3. Rest of Middle East & Africa

17.7. Market Attractiveness Analysis

17.7.1. By Product Type

17.7.2. By Material Type

17.7.3. By Application

17.7.4. By End-user

17.7.5. By Country/Sub-Region

18. Competition Landscape

18.1. Market Player – Competition Matrix (By Tier and Size of companies)

18.2. Market Share Analysis, by Company (2018)

18.3. Competitive Business Strategies

18.4. Company Profiles

18.4.1. B. Braun Melsungen AG

18.4.1.1. Company Overview (HQ, Business Segments, Employee Strength)

18.4.1.2. Financial Overview

18.4.1.3. Product Portfolio

18.4.1.4. SWOT Analysis

18.4.1.5. Strategic Overview

18.4.2. Ethicon, Inc.

18.4.2.1. Company Overview (HQ, Business Segments, Employee Strength)

18.4.2.2. Financial Overview

18.4.2.3. Product Portfolio

18.4.2.4. SWOT Analysis

18.4.2.5. Strategic Overview

18.4.3. Zimmer Biomet Holdings, Inc.

18.4.3.1. Company Overview (HQ, Business Segments, Employee Strength)

18.4.3.2. Financial Overview

18.4.3.3. Product Portfolio

18.4.3.4. SWOT Analysis

18.4.3.5. Strategic Overview

18.4.4. Medtronic Plc.

18.4.4.1. Company Overview (HQ, Business Segments, Employee Strength)

18.4.4.2. Financial Overview

18.4.4.3. Product Portfolio

18.4.4.4. SWOT Analysis

18.4.4.5. Strategic Overview

18.4.5. DemeTech Corporation

18.4.5.1. Company Overview (HQ, Business Segments, Employee Strength)

18.4.5.2. Financial Overview

18.4.5.3. Product Portfolio

18.4.5.4. SWOT Analysis

18.4.5.5. Strategic Overview

18.4.6. Smith & Nephew Plc.

18.4.6.1. Company Overview (HQ, Business Segments, Employee Strength)

18.4.6.2. Financial Overview

18.4.6.3. Product Portfolio

18.4.6.4. SWOT Analysis

18.4.6.5. Strategic Overview

18.4.7. Boston Scientific Corporation

18.4.7.1. Company Overview (HQ, Business Segments, Employee Strength)

18.4.7.2. Financial Overview

18.4.7.3. Product Portfolio

18.4.7.4. SWOT Analysis

18.4.7.5. Strategic Overview

18.4.8. LifeSciences Corporation

18.4.8.1. Company Overview (HQ, Business Segments, Employee Strength)

18.4.8.2. Financial Overview

18.4.8.3. Product Portfolio

18.4.8.4. SWOT Analysis

18.4.8.5. Strategic Overview

18.4.9. Teleflex Incorporated

18.4.9.1. Company Overview (HQ, Business Segments, Employee Strength)

18.4.9.2. Financial Overview

18.4.9.3. Product Portfolio

18.4.9.4. SWOT Analysis

18.4.9.5. Strategic Overview

18.4.10. ConMed Corporation

18.4.10.1. Company Overview (HQ, Business Segments, Employee Strength)

18.4.10.2. Financial Overview

18.4.10.3. Product Portfolio

18.4.10.4. SWOT Analysis

18.4.10.5. Strategic Overview

List of Tables

Table 01: Global Synthetic Absorbable Sutures Market Size (US$ Mn) Forecast, by Product Type, 2017–2027

Table 02: Global Synthetic Absorbable Sutures Market Size (US$ Mn) Forecast, by Material Type, 2017–2027

Table 03: Global Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 04: Global Synthetic Absorbable Sutures Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 05: Global Synthetic Absorbable Sutures Market Size (US$ Mn) Forecast, by Region, 2017–2027

Table 06: North America Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 07: North America Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 08: North America Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Material Type, 2017–2027

Table 09: North America Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 10: North America Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 11: Europe Synthetic Absorbable Sutures Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 12: Europe Synthetic Absorbable Sutures Market Size (US$ Mn) Forecast, by Product Type, 2017–2027

Table 13: Europe Synthetic Absorbable Sutures Market Size (US$ Mn) Forecast, by Material Type, 2017–2027

Table 14: Europe Synthetic Absorbable Sutures Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 15: Europe Synthetic Absorbable Sutures Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table 16: Asia Pacific Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 17: Asia Pacific Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 18: Asia Pacific Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Material Type, 2017–2027

Table 19: Asia Pacific Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 20: Asia Pacific Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 21: Latin America Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 22: Latin America Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 23: Latin America Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Material Type, 2017–2027

Table 24: Latin America Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 25: Latin America Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 26: Middle East & Africa Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 27: Middle East & Africa Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 28: Middle East & Africa Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Material Type, 2017–2027

Table 29: Middle East & Africa Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 30: Middle East & Africa Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01: Global Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, 2017–2027

Figure 02: Market Value Share, by Product Type (2018)

Figure 03: Market Value Share, by Application (2018)

Figure 04: Market Value Share, by End-user (2018)

Figure 05: Market Value Share, by Material Type (2018)

Figure 06: Global Synthetic Absorbable Sutures Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 07: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Polyglactin Sutures, 2017–2027

Figure 08: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Polyglycolic Acid Sutures, 2017–2027

Figure 09: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Poliglecaprone Sutures, 2017–2027

Figure 10: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Poliglecaprone 25, 2017–2027

Figure 11: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Polydioxanone Sutures, 2017–2027

Figure 12: Global Synthetic Absorbable Sutures Market Attractiveness Analysis, by Product Type, 2019–2027

Figure 13: Global Synthetic Absorbable Sutures Market Value Share Analysis, by Material Type, 2018 and 2027

Figure 14: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Monofilament Sutures, 2017–2027

Figure 15: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Braided Sutures, 2017–2027

Figure 16: Synthetic Absorbable Sutures Market Attractiveness Analysis, by Material Type, 2019–2027

Figure 17: Global Synthetic Absorbable Sutures Market Value Share Analysis, by Application, 2019 and 2027

Figure 18: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Valve Sutures, 2017–2027

Figure 19: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cardiovascular Sutures, 2017–2027

Figure 20: Global Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Gynecology Sutures, 2017–2027

Figure 21: Global Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Orthopedic Sutures, 2017–2027

Figure 22: Global Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Dental Sutures, 2017–2027

Figure 23: Global Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cosmetic Surgery Sutures, 2017–2027

Figure 24: Global Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ophthalmic Sutures, 2017–2027

Figure 25: Global Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by General Sutures, 2017–2027

Figure 26: Synthetic Absorbable Sutures Market Attractiveness Analysis, by Application, 2019-2027

Figure 27: Global Synthetic Absorbable Sutures Market Value Share Analysis, by End-user, 2018 and 2027

Figure 28: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2017–2027

Figure 29: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Specialty Clinics, 2017–2027

Figure 30: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ambulatory Surgical Centers, 2017–2027

Figure 31: Global Synthetic Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 32: Global Synthetic Absorbable Sutures Market Attractiveness Analysis, by End-user, 2019–2027

Figure 33: Global Synthetic Absorbable Sutures Market Value Share Analysis, by Region, 2018 and 2027

Figure 34: Global Synthetic Absorbable Sutures Market Attractiveness Analysis, by Region, 2019–2027

Figure 35: North America Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, 2017–2027

Figure 36: North America Synthetic Absorbable Sutures Market Attractiveness Analysis, by Country, 2019–2027

Figure 37: North America Synthetic Absorbable Sutures Market Value Share Analysis, by Country, 2018 and 2027

Figure 38: North America Synthetic Absorbable Sutures Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 39: North America Synthetic Absorbable Sutures Market Value Share Analysis, by Material Type, 2018 and 2027

Figure 40: North America Synthetic Absorbable Sutures Market Value Share Analysis, by Application, 2019 and 2027

Figure 41: North America Synthetic Absorbable Sutures Market Value Share Analysis, by End-user, 2019 and 2027

Figure 42: North America Synthetic Absorbable Sutures Market Attractiveness Analysis, by Product Type, 2019–2027

Figure 43: North America Synthetic Absorbable Sutures Market Attractiveness Analysis, by Material Type, 2019–2027

Figure 44: North America Synthetic Absorbable Sutures Market Attractiveness Analysis, by Application, 2019–2027

Figure 45: North America Synthetic Absorbable Sutures Market Attractiveness Analysis, by End-user, 2019–2027

Figure 46: Europe Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, 2017–2027

Figure 47: Europe Synthetic Absorbable Sutures Market Attractiveness Analysis, by Country, 2019–2027

Figure 48: Europe Synthetic Absorbable Sutures Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 49: Europe Synthetic Absorbable Sutures Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 50: Europe Synthetic Absorbable Sutures Market Value Share Analysis, by Material Type, 2018 and 2027

Figure 51: Europe Synthetic Absorbable Sutures Market Value Share Analysis, by Application, 2019 and 2027

Figure 52: Europe Synthetic Absorbable Sutures Market Value Share Analysis, by End-user, 2019 and 2027

Figure 53: Europe Synthetic Absorbable Sutures Market Attractiveness Analysis, by Product Type, 2019–2027

Figure 54: Europe Synthetic Absorbable Sutures Market Attractiveness Analysis, by Material Type, 2019–2027

Figure 55: Europe Synthetic Absorbable Sutures Market Attractiveness Analysis, by Application, 2019–2027

Figure 56: Europe Synthetic Absorbable Sutures Market Attractiveness Analysis, by End-user, 2019–2027

Figure 57: Asia Pacific Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, 2017–2027

Figure 58: Asia Pacific Synthetic Absorbable Sutures Market Attractiveness Analysis, by Country, 2019–2027

Figure 59: Asia Pacific Synthetic Absorbable Sutures Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 60: Asia Pacific Synthetic Absorbable Sutures Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 61: Asia Pacific Synthetic Absorbable Sutures Market Value Share Analysis, by Material Type, 2018 and 2027

Figure 62: Asia Pacific Synthetic Absorbable Sutures Market Value Share Analysis, by Application, 2019 and 2027

Figure 63: Asia Pacific Synthetic Absorbable Sutures Market Value Share Analysis, by End-user, 2019 and 2027

Figure 64: Asia Pacific Synthetic Absorbable Sutures Market Attractiveness Analysis, by Product Type, 2019–2027

Figure 65: Asia Pacific Synthetic Absorbable Sutures Market Attractiveness Analysis, by Material Type, 2019–2027

Figure 66: Asia Pacific Synthetic Absorbable Sutures Market Attractiveness Analysis, by Application, 2019–2027

Figure 67: Asia Pacific Synthetic Absorbable Sutures Market Attractiveness Analysis, by End-user, 2019–2027

Figure 68: Latin America Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, 2017–2027

Figure 69: Latin America Synthetic Absorbable Sutures Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 70: Latin America Synthetic Absorbable Sutures Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 71: Latin America Synthetic Absorbable Sutures Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 72: Latin America Synthetic Absorbable Sutures Market Value Share Analysis, by Material Type, 2018 and 2027

Figure 73: Latin America Synthetic Absorbable Sutures Market Value Share Analysis, by Application, 2019 and 2027

Figure 74: Latin America Synthetic Absorbable Sutures Market Value Share Analysis, by End-user, 2019 and 2027

Figure 75: Latin America Synthetic Absorbable Sutures Market Attractiveness Analysis, by Product Type, 2019–2027

Figure 76: Latin America Synthetic Absorbable Sutures Market Attractiveness Analysis, by Material Type, 2019–2027

Figure 77: Latin America Synthetic Absorbable Sutures Market Attractiveness Analysis, by Application, 2019–2027

Figure 78: Latin America Synthetic Absorbable Sutures Market Attractiveness Analysis, by End-user, 2019–2027

Figure 79: Middle East & Africa Synthetic Absorbable Sutures Market Value (US$ Mn) Forecast, 2017–2027

Figure 80: Middle East & Africa Synthetic Absorbable Sutures Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 81: Middle East & Africa Synthetic Absorbable Sutures Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 82: Middle East & Africa Synthetic Absorbable Sutures Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 83: Middle East & Africa Synthetic Absorbable Sutures Market Value Share Analysis, by Material Type, 2018 and 2027

Figure 84: Middle East & Africa Synthetic Absorbable Sutures Market Value Share Analysis, by Application, 2019 and 2027

Figure 85: Middle East & Africa Synthetic Absorbable Sutures Market Value Share Analysis, by End-user, 2019 and 2027

Figure 86: Middle East & Africa Synthetic Absorbable Sutures Market Attractiveness Analysis, by Product Type, 2019–2027

Figure 87: Middle East & Africa Synthetic Absorbable Sutures Market Attractiveness Analysis, by Material Type, 2019–2027

Figure 88: Middle East & Africa Synthetic Absorbable Sutures Market Attractiveness Analysis, by Application, 2019–2027

Figure 89: Middle East & Africa Synthetic Absorbable Sutures Market Attractiveness Analysis, by End-user, 2019–2027

Figure 90: Global Synthetic Absorbable Sutures Market Share Analysis, by Company (2018)