Reports

Reports

Surgical instruments market is experiencing high growth due to advancements in technology, increasing frequency of surgical procedures, and rise in incidence of chronic illnesses. With the development of healthcare systems, there comes a growing and more aggressive demand for advanced surgical tools that help surgeons with conducting more efficient and precise surgeries. Among the top drivers are ongoing developments in minimally invasive treatments that not only speed up recovery but also decrease complications, hence becoming popular with providers and patients alike.

Apart from that, the aging population at the global level is also adding to the increasing number of diseases being operated on, such as cardiovascular and orthopedic diseases. The demographic shift will be driving surgery upward, thus making an increasing demand for surgical equipment. Robotic surgery and intelligent surgical instruments are also changing the dynamics and enabling surgeons to perform complex surgeries with greater accuracy.

.webp)

Besides, higher healthcare expenditure by the emerging economies is making the access to advanced surgical devices more affordable. Due to the investments made by the hospitals and surgery centers in state-of-the-art technology, the surgical equipment industry will grow substantially, thus becoming a significant segment for the healthcare firms. At the global level, the trends certainly reflect the changing market landscape of the surgical equipment and its application in today's healthcare.

Surgical instruments imply equipment and machinery of medical instruments used throughout the course of surgery to ease the process and the patient as well. Surgical instruments include devices such as scalpels, forceps, clamps, and sutures, among many others, and advanced technology such as robotic systems and imaging systems. The only purpose of surgical instruments is to help surgeons perform precise and successful surgeries with less trauma to the patient and increased success in surgery.

| Attribute | Detail |

|---|---|

| Surgical Equipment Market Drivers |

|

The growth in demand for surgical devices is largely due to the increasing incidence of trauma and accident cases worldwide. With increased levels of urbanization and stressful lifestyles, accidents like road traffic accidents, falls, and sports injuries are on the rise in severity. Road traffic injury alone causes more than 1.35 million deaths every year and is considered one of the major causes of disability by the World Health Organization (WHO). This threatening trend has health care systems at its center, that is, the mechanisms that receive high-tech medical technology.

Apart from this, the geriatric segment is so much of a market driver that elderly patients are more likely to experience a fall and suffer an injury. The requirement for proper treatment of surgery to cure such trauma cases created huge investment in surgical devices and equipment technology such as minimally invasive surgery devices and imaging technology. Physicians are also discovering newer avenues to surgery more and more to enhance better patient outcome, less recovery, and avoidance of complications.

Other than this, the increasing prices of healthcare and the advancements in trauma care also increase the demand for surgical equipment. With hospitals and surgery units eager to deliver enhanced care, the implementation of new technology in surgery is the most crucial factor. As the demand for improved trauma management increases, the demand for surgical equipment increases and becomes an industry giant for manufacturers, healthcare centers, and investors as well. As injuries too are on the rise, the market for surgical equipment will increase incrementally as it mirrors the demand for quality and innovation towards safety from such an issue.

Surgical devices market is experiencing robust growth driven by rising healthcare investment globally. Private and government sectors are increasingly investing larger sums of money in developing healthcare infrastructure, enhancing patient care, and embracing new technologies. The boom in investments is heavily felt in developing nations with ever-increasing numbers of middle-class citizens seeking better quality health care. More money to hospitals leads to the purchase of advanced surgery machines, hence an increase in surgeries and treatment offered to patients.

Additionally, evolving healthcare environments have increasingly focused on minimally invasive surgery and high-tech equipment. R&D investment is necessary so that the manufacturers can produce and provide evolving healthcare needs of the providers. Not only does this emphasis on technology development enhance precision in surgery but also enables quick recovery and associated healthcare cost, which becomes a choice for both - providers and customers.

This sensitizes individuals to surgery and illness in terms of time, and governments therefore put a lot of money in the surgery sector. Rolled-out healthcare policies that favor and accelerate surgeries' entry also direct the market toward positive direction. Robotic surgery procedures and imaging machines are new technologies that get energized with such funding so that hospitals are able to provide new-generation services.

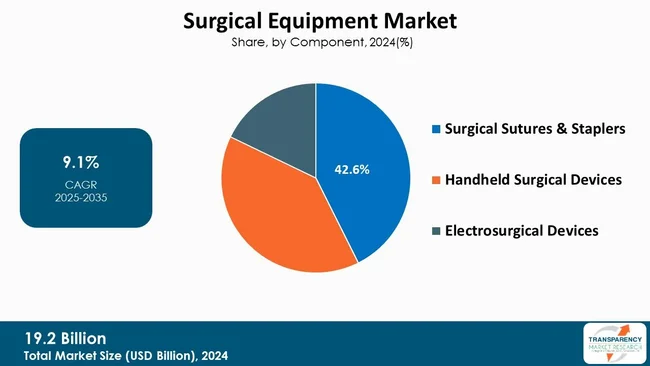

Suturing and stapling instruments are emerging as market leaders in the sector of surgical instruments due to their central role in wound closure and tissue approximation, the pillars of successful surgery. Not only do they facilitate healing, but also reduce postoperative issues and thus become integral to the majority of surgeries.

The growing interest in minimally invasive surgeries even more charges the demand for more advanced suturing patterns and staplers because these surgeries have a tendency to require specialty instruments to be used in order to provide room for precision and success.

Several drivers drive the importance of surgical staplers and sutures in the market. First, the numbers of operations, especially orthopedic, cardiac, and general surgery operations, have increased, making the need for efficient solutions to wound closure greater. Second, improvements in innovative technology have also increased the need for developing new products like absorbable sutures and automatic staplers that are more convenient and efficient to use.

Also, ever-increasing emphasis on best patient performance and minimal compromise in healing time is persuading healthcare professionals towards the usage of quality devices and suture materials. Therefore, the sutures and surgical staplers segment still remains supreme in the market as a gauge of their core positioning in modern surgery.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America dominates the surgical devices market with the establishment of advanced healthcare infrastructure, massive research, and development expenditure of high-order skills, and high rates of disease prevalence of chronic disorders that need to be treated surgically. Some of the globe's highest-ranked medical centers and hospitals are present in the region with state-of-the-art machinery and well-trained healthcare workers. These highly developed infrastructures conduct a massive number of surgeries, and this raises the need for sophisticated surgical devices.

Among the most important drivers of North America’s market growth is the higher rate of use of minimally invasive surgical techniques, which require specialized equipment and tools. While both - patients and doctors wanting faster recovery and less post-procedure complications, rise in demand for sophisticated surgical instruments like robot-assisted surgery systems and quality sutures has been observed.

Furthermore, the North America’s aging population is a driver due to the fact that older individuals are prone to falling sick from diseases that need to be treated through operations.

Plus, sound reimbursement policies and sustained efforts toward improving patient performance are also propelling the region's market ahead. With healthcare technology advancing day by day on an ongoing basis, North America's leadership in the surgical equipment market will also never be surpassed, leading to the world's future generation of surgery.

Key players in the global surgical equipment market are investing in innovation, technological advancements, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and gain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

Stryker Corporation, Medicon eG, Johnson & Johnson (Ethicon Inc.), Zimmer Biomet, B. Braun SE, Medtronic, Integra LifeSciences Holdings Corporation, Fuhrmann GmbH, ConMed Corporation, STERIS, Acheron Instruments, Hebson and others are some of the leading key players.

Each of these players has been profiled in the surgical equipment market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 19.2 Bn |

| Forecast Value in 2035 | US$ 50.1 Bn |

| CAGR | 9.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Surgical Equipment Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 19.2 Bn in 2024.

It is projected to cross US$ 50.1 Bn by the end of 2035.

Rising prevalence of trauma cases and accidents and rising healthcare investments.

It is anticipated to grow at a CAGR of 9.1% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Stryker Corporation, Medicon eG., Johnson & Johnson (Ethicon Inc.), Zimmer Biomet, B. Braun SE, Medtronic, Integra LifeSciences Holdings Corporation, Fuhrmann GmbH, ConMed Corporation, STERIS, Acheron Instruments, Hebson and Others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Surgical Equipment Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Surgical Equipment Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Technological Advancements

5.2. PORTER’s Five Forces Analysis

5.3. PESTLE Analysis

5.4. Supply Chain Analysis

5.5. Key Industry Events

5.6. Regulatory Landscape across Key Regions / Countries

5.7. Go-to-Market Strategy for New Market Entrants

6. Global Surgical Equipment Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2020 to 2035

6.3.1. Surgical Sutures & Staplers

6.3.2. Handheld Surgical Devices

6.3.2.1. Forceps & Spatulas

6.3.2.2. Retractors

6.3.2.3. Dilators

6.3.2.4. Graspers

6.3.2.5. Cutter Instruments

6.3.2.6. Others

6.3.3. Electrosurgical Devices

6.4. Market Attractiveness Analysis, by Product

7. Global Surgical Equipment Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2020 to 2035

7.3.1. Neurosurgery

7.3.2. Plastic & Reconstructive Surgery

7.3.3. Wound Closure

7.3.4. Obstetrics & Gynecology

7.3.5. Cardiovascular

7.3.6. Orthopedic

7.3.7. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Surgical Equipment Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2020 to 2035

8.3.1. Hospitals

8.3.2. Ambulatory Surgery Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Surgical Equipment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2020 to 2035

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Surgical Equipment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2020 to 2035

10.2.1. Surgical Sutures & Staplers

10.2.2. Handheld Surgical Devices

10.2.2.1. Forceps & Spatulas

10.2.2.2. Retractors

10.2.2.3. Dilators

10.2.2.4. Graspers

10.2.2.5. Cutter Instruments

10.2.2.6. Others

10.2.3. Electrosurgical Devices

10.3. Market Value Forecast, by Application, 2020 to 2035

10.3.1. Neurosurgery

10.3.2. Plastic & Reconstructive Surgery

10.3.3. Wound Closure

10.3.4. Obstetrics & Gynecology

10.3.5. Cardiovascular

10.3.6. Orthopedic

10.3.7. Others

10.4. Market Value Forecast, by End-user, 2020 to 2035

10.4.1. Hospitals

10.4.2. Ambulatory Surgery Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Surgical Equipment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2020 to 2035

11.2.1. Surgical Sutures & Staplers

11.2.2. Handheld Surgical Devices

11.2.2.1. Forceps & Spatulas

11.2.2.2. Retractors

11.2.2.3. Dilators

11.2.2.4. Graspers

11.2.2.5. Cutter Instruments

11.2.2.6. Others

11.2.3. Electrosurgical Devices

11.3. Market Value Forecast, by Application, 2020 to 2035

11.3.1. Neurosurgery

11.3.2. Plastic & Reconstructive Surgery

11.3.3. Wound Closure

11.3.4. Obstetrics & Gynecology

11.3.5. Cardiovascular

11.3.6. Orthopedic

11.3.7. Others

11.4. Market Value Forecast, by End-user, 2020 to 2035

11.4.1. Hospitals

11.4.2. Ambulatory Surgery Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. UK

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Surgical Equipment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2020 to 2035

12.2.1. Surgical Sutures & Staplers

12.2.2. Handheld Surgical Devices

12.2.2.1. Forceps & Spatulas

12.2.2.2. Retractors

12.2.2.3. Dilators

12.2.2.4. Graspers

12.2.2.5. Cutter Instruments

12.2.2.6. Others

12.2.3. Electrosurgical Devices

12.3. Market Value Forecast, by Application, 2020 to 2035

12.3.1. Neurosurgery

12.3.2. Plastic & Reconstructive Surgery

12.3.3. Wound Closure

12.3.4. Obstetrics & Gynecology

12.3.5. Cardiovascular

12.3.6. Orthopedic

12.3.7. Others

12.4. Market Value Forecast, by End-user, 2020 to 2035

12.4.1. Hospitals

12.4.2. Ambulatory Surgery Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. South Korea

12.5.5. Australia & New Zealand

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Surgical Equipment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2020 to 2035

13.2.1. Surgical Sutures & Staplers

13.2.2. Handheld Surgical Devices

13.2.2.1. Forceps & Spatulas

13.2.2.2. Retractors

13.2.2.3. Dilators

13.2.2.4. Graspers

13.2.2.5. Cutter Instruments

13.2.2.6. Others

13.2.3. Electrosurgical Devices

13.3. Market Value Forecast, by Application, 2020 to 2035

13.3.1. Neurosurgery

13.3.2. Plastic & Reconstructive Surgery

13.3.3. Wound Closure

13.3.4. Obstetrics & Gynecology

13.3.5. Cardiovascular

13.3.6. Orthopedic

13.3.7. Others

13.4. Market Value Forecast, by End-user, 2020 to 2035

13.4.1. Hospitals

13.4.2. Ambulatory Surgery Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Surgical Equipment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2020 to 2035

14.2.1. Surgical Sutures & Staplers

14.2.2. Handheld Surgical Devices

14.2.2.1. Forceps & Spatulas

14.2.2.2. Retractors

14.2.2.3. Dilators

14.2.2.4. Graspers

14.2.2.5. Cutter Instruments

14.2.2.6. Others

14.2.3. Electrosurgical Devices

14.3. Market Value Forecast, by Application, 2020 to 2035

14.3.1. Neurosurgery

14.3.2. Plastic & Reconstructive Surgery

14.3.3. Wound Closure

14.3.4. Obstetrics & Gynecology

14.3.5. Cardiovascular

14.3.6. Orthopedic

14.3.7. Others

14.4. Market Value Forecast, by End-user, 2020 to 2035

14.4.1. Hospitals

14.4.2. Ambulatory Surgery Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2024)

15.3. Company Profiles

15.3.1. Stryker Corporation

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Medicon eG.

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Johnson & Johnson (Ethicon Inc.)

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Zimmer Biomet

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. B. Braun SE

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Medtronic

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Integra LifeSciences Holdings Corporation

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Fuhrmann GmbH

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. ConMed Corporation

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. STERIS

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Acheron Instruments

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. Hebson

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

List of Tables

Table 01: Global Surgical Equipment Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 02: Global Surgical Equipment Market Value (US$ Bn) Forecast, By Handheld Surgical Devices, 2020 to 2035

Table 03: Global Surgical Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Surgical Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Surgical Equipment Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Surgical Equipment Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 07: North America Surgical Equipment Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 08: North America Surgical Equipment Market Value (US$ Bn) Forecast, By Handheld Surgical Devices, 2020 to 2035

Table 09: North America Surgical Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 10: North America Surgical Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe Surgical Equipment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 12: Europe Surgical Equipment Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 13: Europe Surgical Equipment Market Value (US$ Bn) Forecast, By Handheld Surgical Devices, 2020 to 2035

Table 14: Europe Surgical Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: Europe Surgical Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific Surgical Equipment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 17: Asia Pacific Surgical Equipment Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 18: Asia Pacific Surgical Equipment Market Value (US$ Bn) Forecast, By Handheld Surgical Devices, 2020 to 2035

Table 19: Asia Pacific Surgical Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Asia Pacific Surgical Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America Surgical Equipment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Latin America Surgical Equipment Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 23: Latin America Surgical Equipment Market Value (US$ Bn) Forecast, By Handheld Surgical Devices, 2020 to 2035

Table 24: Latin America Surgical Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 25: Latin America Surgical Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa Surgical Equipment Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 27: Middle East & Africa Surgical Equipment Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 28: Middle East & Africa Surgical Equipment Market Value (US$ Bn) Forecast, By Handheld Surgical Devices, 2020 to 2035

Table 29: Middle East & Africa Surgical Equipment Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Middle East & Africa Surgical Equipment Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Surgical Equipment Market Value Share Analysis, By Product, 2024 and 2035

Figure 02: Global Surgical Equipment Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 03: Global Surgical Equipment Market Revenue (US$ Bn), by Surgical Sutures & Staplers, 2020 to 2035

Figure 04: Global Surgical Equipment Market Revenue (US$ Bn), by Handheld Surgical Devices, 2020 to 2035

Figure 05: Global Surgical Equipment Market Revenue (US$ Bn), by Electrosurgical Devices, 2020 to 2035

Figure 06: Global Surgical Equipment Market Value Share Analysis, By Application, 2024 and 2035

Figure 07: Global Surgical Equipment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 08: Global Surgical Equipment Market Revenue (US$ Bn), by Neurosurgery, 2020 to 2035

Figure 09: Global Surgical Equipment Market Revenue (US$ Bn), by Plastic & Reconstructive Surgery, 2020 to 2035

Figure 10: Global Surgical Equipment Market Revenue (US$ Bn), by Wound Closure, 2020 to 2035

Figure 11: Global Surgical Equipment Market Revenue (US$ Bn), by Obstetrics & Gynecology, 2020 to 2035

Figure 12: Global Surgical Equipment Market Revenue (US$ Bn), by Cardiovascular, 2020 to 2035

Figure 13: Global Surgical Equipment Market Revenue (US$ Bn), by Orthopedic, 2020 to 2035

Figure 14: Global Surgical Equipment Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 15: Global Surgical Equipment Market Value Share Analysis, By End-user, 2024 and 2035

Figure 16: Global Surgical Equipment Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 17: Global Surgical Equipment Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 18: Global Surgical Equipment Market Revenue (US$ Bn), by Ambulatory Surgery Centers, 2020 to 2035

Figure 19: Global Surgical Equipment Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Surgical Equipment Market Value Share Analysis, By Region, 2024 and 2035

Figure 21: Global Surgical Equipment Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 22: North America Surgical Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 23: North America Surgical Equipment Market Value Share Analysis, by Country, 2024 and 2035

Figure 24: North America Surgical Equipment Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 25: North America Surgical Equipment Market Value Share Analysis, By Product, 2024 and 2035

Figure 26: North America Surgical Equipment Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 27: North America Surgical Equipment Market Value Share Analysis, By Application, 2024 and 2035

Figure 28: North America Surgical Equipment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 29: North America Surgical Equipment Market Value Share Analysis, By End-user, 2024 and 2035

Figure 30: North America Surgical Equipment Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 31: Europe Surgical Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 32: Europe Surgical Equipment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 33: Europe Surgical Equipment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 34: Europe Surgical Equipment Market Value Share Analysis, By Product, 2024 and 2035

Figure 35: Europe Surgical Equipment Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 36: Europe Surgical Equipment Market Value Share Analysis, By Application, 2024 and 2035

Figure 37: Europe Surgical Equipment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 38: Europe Surgical Equipment Market Value Share Analysis, By End-user, 2024 and 2035

Figure 39: Europe Surgical Equipment Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 40: Asia Pacific Surgical Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 41: Asia Pacific Surgical Equipment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 42: Asia Pacific Surgical Equipment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 43: Asia Pacific Surgical Equipment Market Value Share Analysis, By Product, 2024 and 2035

Figure 44: Asia Pacific Surgical Equipment Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 45: Asia Pacific Surgical Equipment Market Value Share Analysis, By Application, 2024 and 2035

Figure 46: Asia Pacific Surgical Equipment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 47: Asia Pacific Surgical Equipment Market Value Share Analysis, By End-user, 2024 and 2035

Figure 48: Asia Pacific Surgical Equipment Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 49: Latin America Surgical Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 50: Latin America Surgical Equipment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 51: Latin America Surgical Equipment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 52: Latin America Surgical Equipment Market Value Share Analysis, By Product, 2024 and 2035

Figure 53: Latin America Surgical Equipment Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 54: Latin America Surgical Equipment Market Value Share Analysis, By Application, 2024 and 2035

Figure 55: Latin America Surgical Equipment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 56: Latin America Surgical Equipment Market Value Share Analysis, By End-user, 2024 and 2035

Figure 57: Latin America Surgical Equipment Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 58: Middle East & Africa Surgical Equipment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Middle East & Africa Surgical Equipment Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 60: Middle East & Africa Surgical Equipment Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 61: Middle East & Africa Surgical Equipment Market Value Share Analysis, By Product, 2024 and 2035

Figure 62: Middle East & Africa Surgical Equipment Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 63: Middle East & Africa Surgical Equipment Market Value Share Analysis, By Application, 2024 and 2035

Figure 64: Middle East & Africa Surgical Equipment Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 65: Middle East & Africa Surgical Equipment Market Value Share Analysis, By End-user, 2024 and 2035

Figure 66: Middle East & Africa Surgical Equipment Market Attractiveness Analysis, By End-user, 2025 to 2035