Reports

Reports

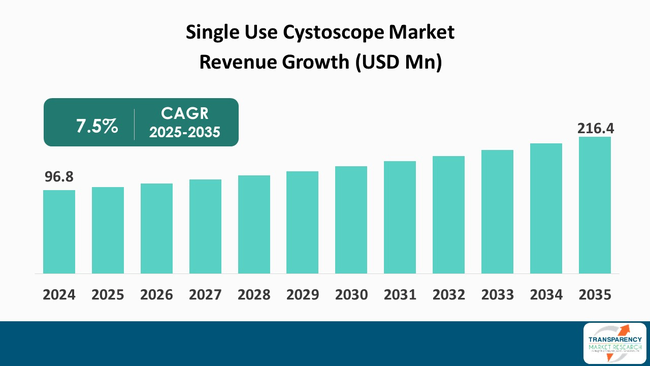

The global single use cystoscope market size was valued at US$ 96.8 Mn in 2024 and is projected to reach US$ 216.4 Mn by 2035, expanding at a CAGR of 7.5% from 2025 to 2035. The market growth is driven by increasing demand for rapid infectious disease screening and technological advancements improving sensitivity and multiplexing.

The single-use cystoscope market is developing rapidly as clinicians, hospitals, and ambulatory centers respond to increased emphasis on infection control, workflow efficiencies, and more flexible point of care opportunities. Growth is driven by improved visualization optics, connections to portable visualization platforms, and the expansion of manufacturers’ portfolios that de-emphasize expensive reprocessing infrastructure. Manufacturers are shaping clinical practice through regulatory approvals, limited commercial launches, and investing in manufacturing scale. Product launches and distribution strategies are promoting uptake in hospitals and increasing competitive pressure on pricing and service models.

Payers and health systems think about total cost of care instead of straight device price, which favors a single-use approach in settings that involve high-value reprocessing work, and/or contamination risks. Clinically, the simplicity of single use devices reduces delays scheduling procedures and time between procedures. Moreover, hospital epidemiology departments are highlighting decreased cross-contamination risks.

Recent approvals of single-use cystoscope and commercial introductions by single-use companies or specialist manufacturers have turned clinical feasibility into actual procurement decisions, thereby consolidating the migration of reusable products to single-use products in some care pathways.

Single use cystoscope market growth is driven by considerations of clinical safety, operational efficiency, and technological maturity rather than a single commercial driver. Hospitals responding to scrutiny of endoscopic reprocessing or any contagion from endoscope use are rethinking of the capital and labor costs associated with reusable services by eliminating reprocessing steps and any oversight quality control of reprocessing cycles. Single use sets aside those issues.

In parallel to repurposing endoscopy space and staff capacity, the decentralized procedural space—moving diagnostic cystoscopy from operating rooms into clinic and bedside—requires a compact self-contained visualization system that can operate without an endoscopy suite.

Sensor miniaturization spatial dimensions, integrated lights, and tablet-based displays have narrowed the performance gap to reusable devices, thereby making it more clinically acceptable for disposables to gain market acceptance for more traditional indications. Supply-chain and procurement teams are increasingly modeling lifecycle cost and staff time-savings when selecting devices. Environmentally and device/consumption lifecycle considerations continue to be relevant market constraints. However, packaging and material development is beginning to address sustainability, while retaining client safety and operational benefits of disposables.

| Attribute | Detail |

|---|---|

| Single Use Cystoscope Market Drivers |

|

Infection control continues to be a main impetus for single-use cystoscopes, which are now available from several manufacturers. A single-use device avoids the complexities involved with reusable endoscopes, which need to go through challenging reprocessing steps that can break down and lead to cross-contamination.

Single-use endoscopes avoid any variability manual and automated reprocessing creates: infection can only be involved in a single and clearly defined reuse step of cystoscopy. This alone reduces the odds of healthcare-acquired infections linked to cystoscopy. This rationale extends to purchasing and procurement decisions that are growing in both - acute care and ambulatory care spaces where the metrics of infection prevention ultimately impact accreditation, reimbursement and institutional reputation.

The move of diagnostic and minor therapeutic cystoscopy from centralized endoscopy suites to office, clinic and bedside venues is a major driver to single-use cystoscopes. Decentralized settings value devices are ready-to-use, with minimal capital infrastructure and turnover speed between patients.

Single-use cystoscopes meet these operational needs by completely eliminating downtime for processing and allowing same-day procedures without having to work around sterilization cycles.

Modification reports on single-use cystoscopes from providers have revealed that clinicians experience shorter room turnover time and easier logistics associated with disposables, which ultimately translates into increased capacity in high-volume practices. In fact, the introduction of single-use flexible instruments by Karl Storz and the subsequent clinical assessments in 2024 showed how manufacturers are concentrating on disposables to assist outpatient workflows; reports from providers verify and support early shortening of set up times and clinical time that satisfied efficient practice managers.

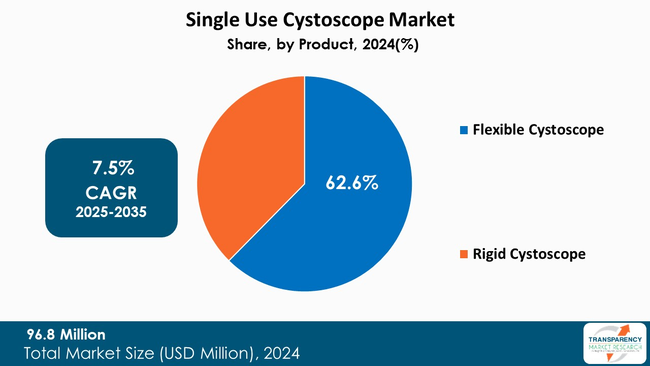

Flexible single-use cystoscopes have become the most popular product type, as they provide patient comfort, increased clinical utility, and the flexibility to provide diagnostic visualization and perform minor interventions. Flexibility allows for better access to the bladder and lower ureter while providing less discomfort to the patient than rigid instruments, which facilitate outpatient cystoscopy and ambulatory treatment.

Flexible disposables are also available with digital imaging and accessory channels to provide for biopsy, stent removal, or stone management where appropriate, thereby increasing the procedural options and eliminating the need for numerous reusable instruments. For example, Oxidative Technology Unit (OTU) Medical’s WiScope HD single-use flexible cystoscope, which has received regional approvals and is generating attention in urology across meetings since spring 2025, is an example of how high-resolution flexible disposables are being brought to market to meet clinician demands for image quality and in-office functionality, further solidifying the preeminent adoption of the flexible category.

| Attribute | Detail |

|---|---|

| Leading Region |

|

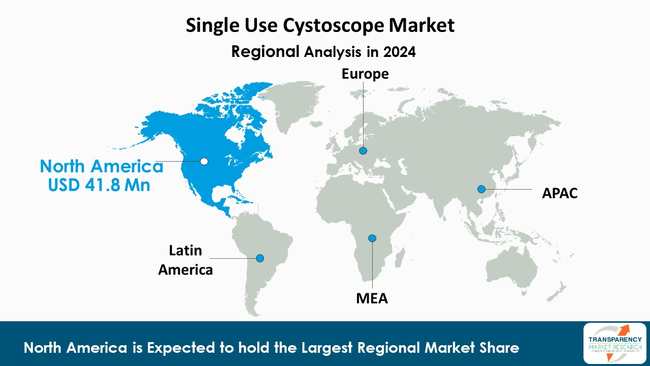

North America accounted for approximately 42.3% share of the global single-use cystoscope market in 2024, reflecting its leadership in early adoption and technological integration. This demonstrates its role as the early adopter and technology developer. North America's continuing leadership adheres to the established regulatory frameworks, a clear consideration of the purchasing power of integrated health networks, and a high degree of institutional awareness about infection control.

The U.S. has continued to be a major impact player with high-frequency approvals by the FDA 510(k) process and introduction of new products that support the safety and efficacy of disposable cystoscopy platforms.

The U.S. hospitals and ambulatory surgical centers are beginning to embrace infection prevention and workflow efficiency by sourcing these single-use cystoscopes in order to mitigate the risk of cross-contamination and to avoid reprocessing delays. For example, an FDA clearance in 2025 for a new generation single-use cystoscope platform has enabled the use of several U.S. healthcare systems, which indicates the momentum building among clinicians and procurement pathways.

Furthermore, game-changing strategic investments by manufacturers to support regional distribution pathways, clinician training, and customer service supports the continuity of North America’s leadership position in this developing global evolution.

Companies operating in the single use cystoscope market focus on forging strategic collaborations, innovating their products, and validating the performance of their products across various clinical settings. These firms invest significantly in R&D pertaining to cutting-edge microfluidic and non-invasive techniques, broaden their distribution channels, and provide integrated service solutions to have a strong market presence and a high customer loyalty.

Coloplast Group, NeoScope Inc., Asieris Pharmaceuticals, Stryker, Ambu, Olympus Medical Corporation, PENTAX Medical, Richard Wolf GmBH, Cogentix Medical, Karl Storz, Henke-Sass Wolf, Advanced Health Care Resources, UroViu Corporation, Boston Scientific Corporation, NeoScope, Inc. and Others, are some of the leading players operating in the global market.

Each of these players has been profiled in the single use cystoscope industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 96.8 Mn |

| Forecast Value in 2035 | US$ 216.4 Mn |

| CAGR | 7.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn |

| Single Use Cystoscope Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global single use cystoscope market was valued at US$ 96.8 Mn in 2024

The global single use cystoscope industry is projected to reach more than US$ 216.4 Mn by the end of 2035

Infection control and patient safety and Procedural decentralization and workflow efficiency

The CAGR is anticipated to be 7.5% from 2025 to 2035

Coloplast Group, NeoScope Inc., Asieris Pharmaceuticals, Stryker, Ambu, Olympus Medical Corporation, PENTAX Medical, Richard Wolf GmBH, Cogentix Medical, Karl Storz, Henke-Sass Wolf, Advanced Health Care Resources, UroViu Corporation, Boston Scientific Corporation, NeoScope, Inc., and Others

Table 01: Global Single Use Cystoscope Market Value (US$ Mn) Forecast, by Product, 2020 to 2035

Table 02: Global Single Use Cystoscope Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 03: Global Single Use Cystoscope Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 04: North America Single Use Cystoscope Market Value (US$ Mn) Forecast, by Product, 2020 to 2035

Table 05: North America Single Use Cystoscope Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 06: North America Single Use Cystoscope Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 07: Europe Single Use Cystoscope Market Value (US$ Mn) Forecast, by Product, 2020 to 2035

Table 08: Europe Single Use Cystoscope Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 09: Europe Single Use Cystoscope Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 10: Asia Pacific Single Use Cystoscope Market Value (US$ Mn) Forecast, by Product, 2020 to 2035

Table 11: Asia Pacific Single Use Cystoscope Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 12: Asia Pacific Single Use Cystoscope Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 13: Latin America Single Use Cystoscope Market Value (US$ Mn) Forecast, by Product, 2020 to 2035

Table 14: Latin America Single Use Cystoscope Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 15: Latin America Single Use Cystoscope Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 16: Middle East and Africa Single Use Cystoscope Market Value (US$ Mn) Forecast, by Product, 2020 to 2035

Table 17: Middle East and Africa Single Use Cystoscope Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 18: Middle East and Africa Single Use Cystoscope Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Figure 01: Global Single Use Cystoscope Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global Single Use Cystoscope Market Value Share Analysis, by Product, 2024 and 2035

Figure 03: Global Single Use Cystoscope Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 04: Global Single Use Cystoscope Market Revenue (US$ Mn), by Flexible Cystoscope, 2020 to 2035

Figure 05: Global Single Use Cystoscope Market Revenue (US$ Mn), by Rigid Cystoscope, 2020 to 2035

Figure 06: Global Single Use Cystoscope Market Value Share Analysis, by End-user, 2024 and 2035

Figure 07: Global Single Use Cystoscope Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 08: Global Single Use Cystoscope Market Revenue (US$ Mn), by Hospitals & Clinics, 2020 to 2035

Figure 09: Global Single Use Cystoscope Market Revenue (US$ Mn), by Diagnostic Centers, 2020 to 2035

Figure 10: Global Single Use Cystoscope Market Revenue (US$ Mn), by Others (Research Institutes etc.), 2020 to 2035

Figure 11: Global Single Use Cystoscope Market Value Share Analysis, by Region, 2024 and 2035

Figure 12: Global Single Use Cystoscope Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 13: North America Single Use Cystoscope Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 14: North America Single Use Cystoscope Market Value Share Analysis, by Product, 2024 and 2035

Figure 15: North America Single Use Cystoscope Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 16: North America Single Use Cystoscope Market Value Share Analysis, by End-user, 2024 and 2035

Figure 17: North America Single Use Cystoscope Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 18: North America Single Use Cystoscope Market Value Share Analysis, by Region, 2024 and 2035

Figure 19: North America Single Use Cystoscope Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 20: Europe Single Use Cystoscope Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 21: Europe Single Use Cystoscope Market Value Share Analysis, by Product, 2024 and 2035

Figure 22: Europe Single Use Cystoscope Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 23: Europe Single Use Cystoscope Market Value Share Analysis, by End-user, 2024 and 2035

Figure 24: Europe Single Use Cystoscope Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 25: Europe Single Use Cystoscope Market Value Share Analysis, by Region, 2024 and 2035

Figure 26: Europe Single Use Cystoscope Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 27: Asia Pacific Single Use Cystoscope Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 28: Asia Pacific Single Use Cystoscope Market Value Share Analysis, by Product, 2024 and 2035

Figure 29: Asia Pacific Single Use Cystoscope Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 30: Asia Pacific Single Use Cystoscope Market Value Share Analysis, by End-user, 2024 and 2035

Figure 31: Asia Pacific Single Use Cystoscope Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 32: Asia Pacific Single Use Cystoscope Market Value Share Analysis, by Region, 2024 and 2035

Figure 33: Asia Pacific Single Use Cystoscope Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 34: Latin America Single Use Cystoscope Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 35: Latin America Single Use Cystoscope Market Value Share Analysis, by Product, 2024 and 2035

Figure 36: Latin America Single Use Cystoscope Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 37: Latin America Single Use Cystoscope Market Value Share Analysis, by End-user, 2024 and 2035

Figure 38: Latin America Single Use Cystoscope Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 39: Latin America Single Use Cystoscope Market Value Share Analysis, by Region, 2024 and 2035

Figure 40: Latin America Single Use Cystoscope Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 41: Middle East and Africa Single Use Cystoscope Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 42: Middle East and Africa Single Use Cystoscope Market Value Share Analysis, by Product, 2024 and 2035

Figure 43: Middle East and Africa Single Use Cystoscope Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 44: Middle East and Africa Single Use Cystoscope Market Value Share Analysis, by End-user, 2024 and 2035

Figure 45: Middle East and Africa Single Use Cystoscope Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 46: Middle East and Africa Single Use Cystoscope Market Value Share Analysis, by Region, 2024 and 2035

Figure 47: Middle East and Africa Single Use Cystoscope Market Attractiveness Analysis, by Region, 2025 to 2035