Reports

Reports

Increasing prevalence of cancer, rising aging population, and lucrative presence of endoscopic device manufacturers are factors responsible for the rapid expansion of the global endoscopy devices market. Companies in the global market should accelerate their product development and unlock revenue opportunities to obtain competitive benefits.

Market stakeholders are extending their services arms by developing innovative and technologically advanced endoscopy devices in order to gain revenue benefits. Market contributors are focusing on the production of cost-efficient endoscopy devices.

The high cost of endoscopic devices is a factor hampering the growth of the global endoscopy devices business. Among the major drivers of this growth is the elderly world population that is at risk of chronic disease like colorectal cancer, gastrointestinal infection, and respiratory disease.

All of these are more likely to require endoscopic diagnostics as well as therapy. AI-based software platforms are also being integrated into endoscopy devices to provide automated lesion detection as well as real-time decision-making assistance.

Robotic endoscopy, in this case, is quickly becoming an emerging trend. These tools offer greater accuracy, improved control, and access in difficult-to-reach anatomical areas, but utilization continues to be confined to more affluent hospitals due to expense.

The global market for endoscopy devices is growing aggressively, driven by the rapidly increasing need for minimally invasive procedures in many medical specialties. The devices making up the core component in the diagnosis, monitoring, and treatment of gastrointestinal, respiratory, urinary, and the other internal organ diseases.

Advances in technology like high-definition imaging, 3D visualization, capsule endoscopy, and AI-based detection have revolutionized the effectiveness and accuracy of endoscopic procedures. Endoscopy has thus emerged as the foremost diagnostic and also surgical modality, with more invasive methods being replaced by it in most instances. It is being driven by the growing incidence of chronic gastrointestinal disorders, colorectal cancer, and lifestyle disorders, as well as the growing base of elderly populations across the globe.

The growth in outpatient and ambulatory surgical centers is also driving the use of portable and user-friendly endoscopy systems with decreased hospitalization costs and increased turn-around time for procedures.

| Attribute | Detail |

|---|---|

| Endoscopy Devices Market Drivers |

|

Increasing adoption of minimally invasive methods is one of the key drivers for the expansion of the endoscopy devices industry. Minimally invasive methods (MIS) offer many advantages over open surgery, including fewer incisions, less pain, less hospitalization, shorter recovery, and reduced risk of post-surgical complications.

All the above-mentioned attributes have turned MIS the surgeons' and patients' choice, and therefore it has increased the demand for advanced endoscopic tools much more. Endoscopy is a gateway to MIS as it allows visualization and intervention within the body without making big wounds. It allows doctors to diagnose and treat a majority of diseases such as gastrointestinal disease, respiratory disease, urinary disease, and cancer, more precisely and less invasively.

As concern about the advantages of minimally invasive surgical techniques rises, so does the pressure on healthcare systems to perform better. A larger number of surgery centers and hospitals are committing toward investment in robot-assisted systems, flexible scopes, and endoscopic units with high-definition imaging for promoting visualization and convenience.

Apart from this, growth of ambulatory surgery centers and outpatient procedures has spurred demand for cost-efficient, miniaturized, and high-throughput procedural capability endoscopy devices. Technologies such as AI-enhanced lesion detection, 3D imaging, NBI, and capsule endoscopy are also driving adoption by increasing diagnostic performance and procedural safety.

The technology innovations in endoscopic devices are at the forefront of the global endoscopy devices market. Over the last ten years, developments in imaging, device technology, and connectivity have all contributed to making endoscopic procedures much more precise, safe, and effective.

Endoscopy equipment today include HD and 4K imaging technology to enhance visualization of inner anatomy and resolution of the anatomy. This has enhanced diagnostic yield and facilitated pre-detection of pathology in, for example, gastrointestinal cancers, ulcers, and lesions.

The most dramatic advancement has likely been the inclusion of artificial intelligence (AI) in endoscopic equipment. Computer programs can potentially aid clinicians in real time by being able to automatically detect and mark possible abnormalities like polyps or suspicious tissue, thereby minimizing the possibility of being overlooked and augment diagnostic yields.

Additionally, newer techniques like narrow band imaging (NBI), fluorescence imaging, and chromo endoscopy enhance mucosal visibility and discrimination between dye-free or more time-consuming methods. Capsule endoscopy (another innovation) is one of the things being explored non-invasively by swallowing a pill camera with on-board ability, and patient-available convenience as opposed to conventional practice.

Gastrointestinal Endoscopy Market Segment is Dominating Global Endoscopy Devices Market by Application

The GI endoscopy segment is leading the global endoscopy devices market by application due to the high incidence of gastrointestinal disorders and the predominant position endoscopy occupies in their diagnosis and treatment. Incidences of diseases like colorectal cancer, gastroesophageal reflux disease (GERD), peptic ulcers, inflammatory bowel disease (IBD), and gastrointestinal bleeding are on the rise more in the developed as well as the developing world.

Another key factor behind the dominance of GI endoscopy is the global utilization of upper and lower GI endoscopic techniques like esophagogastroduodenoscopy (EGD) and colonoscopy for diagnosis and screening. In most nations, repeat colonoscopy screening is advised in individuals over the age of 50 years to identify colorectal cancer at an early stage, leading to an enormous number of procedures being conducted each year. This also receives a boost from the aging population across the globe, as older patients are more likely to develop chronic gastrointestinal disorders to be diagnosed and treated using endoscopy.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

The global endoscopy devices market is being dominated by North America through a blend of advanced healthcare infrastructure, procedure volumes, good reimbursement policies, and a head start in adopting new technology. The region and the United States, in general, have long been a leader in medical device development and early technology adoption and are thus a matured and attractive market for endoscopic machines.

North American hospitals and out-patient centers are adequately equipped with the most advanced endoscopic technologies such as high-definition imaging platforms, robotic platforms, capsule endoscopy, and artificial intelligence-based diagnostic equipment. Extensive use and popularity of advanced systems directly benefit by imparting improved procedural efficiency and diagnosis accuracy, thereby encouraging growth of the market.

One of the most significant forces driving North America's dominance is the widespread conditions that need to be examined endoscopically, including colorectal cancer, gastrointestinal bleeding, peptic ulcer, and inflammatory bowel disease in the Crohn's and ulcerative colitis. Screening tests are routinely recommended and carried out in the entire continent primarily through colonoscopies.

The U.S. Preventive Services Task Force, for instance, has endorsed screening for colorectal cancer at 45 years and older, resulting in millions of procedures each year. This requirement for periodic screening translates to demand for therapeutic and diagnostic endoscopy equipment. Furthermore, growing geriatric population, which is more vulnerable to gastrointestinal and urological diseases, has driven up endoscopy procedures in hospitals and ambulatory surgical centers.

Leading companies are partnering with hospitals, specialty clinics, and research institutes to expand inorganically. Ethicon Endo-Surgery, Covidien plc, Olympus Corporation, Boston Scientific Corporation, Intuitive Surgical, Inc., Stryker Corporation, Richard Wolf, FUJIFILM Holdings Corporation, KARL STORZ GmbH & Co. KG, HOYA Corporation, B. Braun Melsungen AG, Arthrex, Inc., Cook Medical, Inc. are the prominent endoscopy devices industry players. Each of these players has been profiled in the endoscopy devices market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

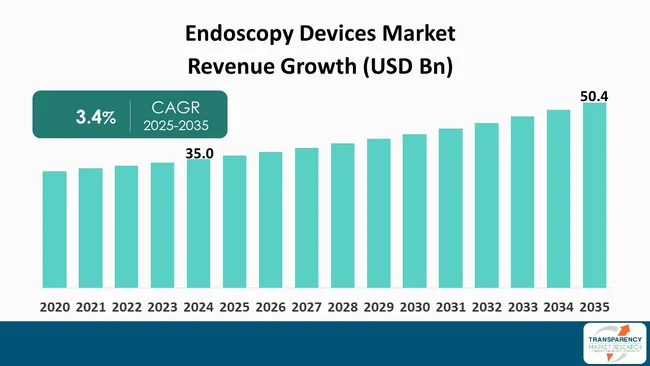

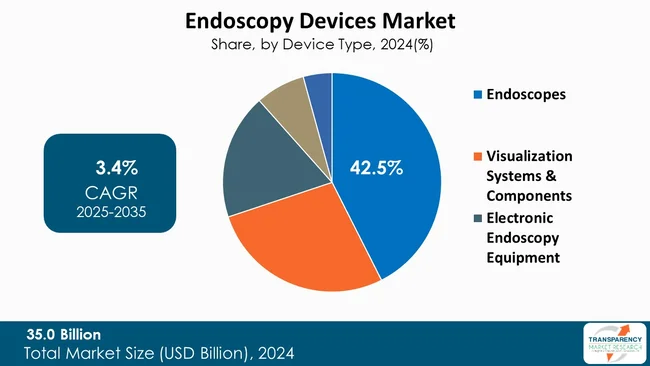

| Size in 2024 | US$ 35.0 Bn |

| Forecast Value in 2035 | More than US$ 50.8 Bn |

| CAGR | 3.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Device Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global endoscopy devices market was valued at US$ 35.0 Bn in 2024

Endoscopy devices business is projected to cross US$ 50.4 Bn by the end of 2035

Increasing adoption of minimally invasive procedures and technological advancements in endoscopic devices

The CAGR is anticipated to be 3.4% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Ethicon Endo-Surgery, Covidien plc, Olympus Corporation, Boston Scientific Corporation, Intuitive Surgical, Inc., Stryker Corporation, Richard Wolf, FUJIFILM Holdings Corporation, KARL STORZ GmbH & Co. KG, HOYA Corporation, B. Braun Melsungen AG, Arthrex, Inc., Cook Medical, Inc. and other players are the prominent Endoscopy Devices market players.

Table 01: Global Endoscopy Devices Market Value (US$ Bn) Forecast, By Device Type, 2020 to 2035

Table 02: Global Endoscopy Devices Market Value (US$ Bn) Forecast, by Endoscopes, 2020 to 2035

Table 03: Global Endoscopy Devices Market Value (US$ Bn) Forecast, by Rigid Endoscopes, 2020 to 2035

Table 04: Global Endoscopy Devices Market Value (US$ Bn) Forecast, by Flexible Endoscopes, 2020 to 2035

Table 05: Global Endoscopy Devices Market Value (US$ Bn) Forecast, by Visualization Systems & Components, 2020 to 2035

Table 06: Global Endoscopy Devices Market Value (US$ Bn) Forecast, by Camera Heads, 2020 to 2035

Table 07: Global Endoscopy Devices Market Value (US$ Bn) Forecast, by Electronic Endoscopy Equipment, 2020 to 2035

Table 08: Global Endoscopy Devices Market Value (US$ Bn) Forecast, by Mechanical Endoscopy Equipment, 2020 to 2035

Table 09: Global Endoscopy Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 10: Global Endoscopy Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Global Endoscopy Devices Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 12: North America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 13: North America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 14: North America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Endoscopes, 2020 to 2035

Table 15: North America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Rigid Endoscopes, 2020 to 2035

Table 16: North America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Flexible Endoscopes, 2020 to 2035

Table 17: North America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Visualization Systems & Components, 2020 to 2035

Table 18: North America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Camera Heads, 2020 to 2035

Table 19: North America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Electronic Endoscopy Equipment, 2020 to 2035

Table 20: North America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Mechanical Endoscopy Equipment, 2020 to 2035

Table 21: North America - Endoscopy Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 22: North America - Endoscopy Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 23: Europe - Endoscopy Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 24: Europe - Endoscopy Devices Market Value (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 25: Europe - Endoscopy Devices Market Value (US$ Bn) Forecast, by Endoscopes, 2020 to 2035

Table 26: Europe - Endoscopy Devices Market Value (US$ Bn) Forecast, by Rigid Endoscopes, 2020 to 2035

Table 27: Europe - Endoscopy Devices Market Value (US$ Bn) Forecast, by Flexible Endoscopes, 2020 to 2035

Table 28: Europe - Endoscopy Devices Market Value (US$ Bn) Forecast, by Visualization Systems & Components, 2020 to 2035

Table 29: Europe - Endoscopy Devices Market Value (US$ Bn) Forecast, by Camera Heads, 2020 to 2035

Table 30: Europe - Endoscopy Devices Market Value (US$ Bn) Forecast, by Electronic Endoscopy Equipment, 2020 to 2035

Table 31: Global Endoscopy Devices Market Value (US$ Bn) Forecast, by Mechanical Endoscopy Equipment, 2020 to 2035

Table 32: Europe - Endoscopy Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 33: Europe - Endoscopy Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 34: Asia Pacific - Endoscopy Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 35: Asia Pacific - Endoscopy Devices Market Value (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 36: Asia Pacific - Endoscopy Devices Market Value (US$ Bn) Forecast, by Endoscopes, 2020 to 2035

Table 37: Asia Pacific - Endoscopy Devices Market Value (US$ Bn) Forecast, by Rigid Endoscopes, 2020 to 2035

Table 38: Asia Pacific - Endoscopy Devices Market Value (US$ Bn) Forecast, by Flexible Endoscopes, 2020 to 2035

Table 39: Asia Pacific - Endoscopy Devices Market Value (US$ Bn) Forecast, by Visualization Systems & Components, 2020 to 2035

Table 40: Asia Pacific - Endoscopy Devices Market Value (US$ Bn) Forecast, by Camera Heads, 2020 to 2035

Table 41: Asia Pacific - Endoscopy Devices Market Value (US$ Bn) Forecast, by Electronic Endoscopy Equipment, 2020 to 2035

Table 42: Asia Pacific - Endoscopy Devices Market Value (US$ Bn) Forecast, by Mechanical Endoscopy Equipment, 2020 to 2035

Table 43: Asia Pacific - Endoscopy Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 44: Asia Pacific - Endoscopy Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 45: Latin America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 46: Latin America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 47: Latin America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Endoscopes, 2020 to 2035

Table 48: Latin America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Rigid Endoscopes, 2020 to 2035

Table 49: Latin America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Flexible Endoscopes, 2020 to 2035

Table 50: Latin America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Visualization Systems & Components, 2020 to 2035

Table 51: Latin America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Camera Heads, 2020 to 2035

Table 52: Latin America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Electronic Endoscopy Equipment, 2020 to 2035

Table 53: Latin America - Endoscopy Devices Market Value (US$ Bn) Forecast, by Mechanical Endoscopy Equipment, 2020 to 2035

Table 54: Latin America - Endoscopy Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 55: Latin America - Endoscopy Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 56: Middle East & Africa - Endoscopy Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 57: Middle East & Africa - Endoscopy Devices Market Value (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 58: Middle East & Africa - Endoscopy Devices Market Value (US$ Bn) Forecast, by Endoscopes, 2020 to 2035

Table 59: Middle East & Africa - Endoscopy Devices Market Value (US$ Bn) Forecast, by Rigid Endoscopes, 2020 to 2035

Table 60: Middle East & Africa - Endoscopy Devices Market Value (US$ Bn) Forecast, by Flexible Endoscopes, 2020 to 2035

Table 61: Middle East & Africa - Endoscopy Devices Market Value (US$ Bn) Forecast, by Visualization Systems & Components, 2020 to 2035

Table 62: Middle East & Africa - Endoscopy Devices Market Value (US$ Bn) Forecast, by Camera Heads, 2020 to 2035

Table 63: Middle East & Africa - Endoscopy Devices Market Value (US$ Bn) Forecast, by Electronic Endoscopy Equipment, 2020 to 2035

Table 64: Middle East & Africa - Endoscopy Devices Market Value (US$ Bn) Forecast, by Mechanical Endoscopy Equipment, 2020 to 2035

Table 65: Middle East & Africa - Endoscopy Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 66: Middle East & Africa - Endoscopy Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Endoscopy Devices Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Figure 02: Global Endoscopy Devices Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 03: Global Endoscopy Devices Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 04: Global Endoscopy Devices Market Revenue (US$ Bn), by Endoscopes, 2020 to 2035

Figure 05: Global Endoscopy Devices Market Revenue (US$ Bn), by Visualization Systems & Components, 2020 to 2035

Figure 06: Global Endoscopy Devices Market Revenue (US$ Bn), by Electronic Endoscopy Equipment, 2020 to 2035

Figure 07: Global Endoscopy Devices Market Revenue (US$ Bn), by Mechanical Endoscopy Equipment, 2020 to 2035

Figure 08: Global Endoscopy Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 09: Global Endoscopy Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 10: Global Endoscopy Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 11: Global Endoscopy Devices Market Revenue (US$ Bn), by Gastrointestinal Endoscopy, 2020 to 2035

Figure 12: Global Endoscopy Devices Market Revenue (US$ Bn), by Laparoscopy, 2020 to 2035

Figure 13: Global Endoscopy Devices Market Revenue (US$ Bn), by Arthroscopy, 2020 to 2035

Figure 14: Global Endoscopy Devices Market Revenue (US$ Bn), by Obstetrics Endoscopy, 2020 to 2035

Figure 15: Global Endoscopy Devices Market Revenue (US$ Bn), by Urology Endoscopy, 2020 to 2035

Figure 16: Global Endoscopy Devices Market Revenue (US$ Bn), by Bronchoscopy, 2020 to 2035

Figure 17: Global Endoscopy Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global Endoscopy Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 19: Global Endoscopy Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 20: Global Endoscopy Devices Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 21: Global Endoscopy Devices Market Revenue (US$ Bn), by Diagnostic & Ambulatory Centers, 2020 to 2035

Figure 22: Global Endoscopy Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 23: Global Endoscopy Devices Market Value Share Analysis, By Region, 2024 and 2035

Figure 24: Global Endoscopy Devices Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 25: North America - Endoscopy Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 26: North America - Endoscopy Devices Market Value Share Analysis, by Country, 2024 and 2035

Figure 27: North America - Endoscopy Devices Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 28: North America Endoscopy Devices Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 29: North America Endoscopy Devices Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 30: North America - Endoscopy Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 31: North America - Endoscopy Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 32: North America - Endoscopy Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 33: North America - Endoscopy Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 34: Europe - Endoscopy Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 35: Europe - Endoscopy Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 36: Europe - Endoscopy Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 37: Europe Endoscopy Devices Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 38: Europe Endoscopy Devices Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 39: Europe - Endoscopy Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 40: Europe - Endoscopy Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 41: Europe - Endoscopy Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 42: Europe - Endoscopy Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 43: Asia Pacific - Endoscopy Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: Asia Pacific - Endoscopy Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 45: Asia Pacific - Endoscopy Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 46: Asia Pacific Endoscopy Devices Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 47: Asia Pacific Endoscopy Devices Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 48: Asia Pacific - Endoscopy Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 49: Asia Pacific - Endoscopy Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 50: Asia Pacific - Endoscopy Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 51: Asia Pacific - Endoscopy Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 52: Latin America - Endoscopy Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 53: Latin America - Endoscopy Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 54: Latin America - Endoscopy Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 55: Latin America Endoscopy Devices Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 56: Latin America Endoscopy Devices Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 57: Latin America - Endoscopy Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 58: Latin America - Endoscopy Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 59: Latin America - Endoscopy Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 60: Latin America - Endoscopy Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 61: Middle East & Africa - Endoscopy Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Middle East & Africa - Endoscopy Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 63: Middle East & Africa - Endoscopy Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 64: Middle East & Africa Endoscopy Devices Market Value Share Analysis, By Device Type, 2024 and 2035

Figure 65: Middle East & Africa Endoscopy Devices Market Attractiveness Analysis, By Device Type, 2025 to 2035

Figure 66: Middle East & Africa - Endoscopy Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 67: Middle East & Africa - Endoscopy Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 68: Middle East & Africa - Endoscopy Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 69: Middle East & Africa - Endoscopy Devices Market Attractiveness Analysis, By End-user, 2025 to 2035