Reports

Reports

The global shoulder replacement market is expected to benefit from the shift from anatomic to reverse shoulder replacement surgeries by clinics for degenerative joint disorders. Manufacturers who invest in the development of advanced and customized prosthetics are likely to continue to appeal to end-users and generate significant sales opportunities.

.webp)

Governments are also playing a major role in assisting surgeons in expanding their skill sets, thereby increasing the number of expert surgeons. Growing trust among consumers about advanced surgeries such as reverse shoulder replacement surgery has encouraged manufacturers to invest in research & development activities aimed at improving patient outcomes and lowering failure rates, while investment in emerging markets could yield long-term benefits.

The global market for shoulder replacement is growing steadily, fueled primarily by increasing age, growing incidence of osteoarthritis and rotator cuff tears, and the major leaps in operating room technologies. Reverse total shoulder arthroplasties are frequently performed as they are preferred for their predictability in the management of complicated disorders of the shoulder joint, particularly when the rotator cuff fails.

Technical improvements such as innovation in modular implants, patient-specific and 3D-printed implants, and robot-assisted surgery are raising the precision quotient of surgery and treatment of patients. The hospital segment continues to be the largest end-use setting, although ambulatory surgery centers are increasingly becoming sought after with cost benefits and reduced recovery time.

Key players in the market are Zimmer Biomet, Stryker, DePuy Synthes (Johnson & Johnson), Smith+Nephew, and Arthrex, all of which are putting money into R&D to differentiate products. Even if the future of the market is rosy, a high implant and surgery cost, particularly in emerging economies, as well as the threat posed by non-surgical treatment options, are hindrances to growth.

However, ongoing advancements in surgical procedures, postoperative care, and increased accessibility of healthcare services across the globe are expected to fuel further growth of the shoulder replacement market. For instance, in January 2024, Stryker, one of the world’s leading medical technologies companies, introduced the Tornier shoulder arthroplasty portfolio in India and launched its first new Tornier product, the Perform Humeral Stem today at Shoulder Conclave in Pune.

The Tornier Perform Humeral Stem was designed with four collar diameters and is available in multiple lengths to optimize humeral fit and give surgeons the power to perform and the options to choose. The focus on smaller stem options makes it ideal for addressing smaller patient anatomies that present unique challenges.

| Attribute | Detail |

|---|---|

| Shoulder Replacement Market Drivers |

|

The rise in occurrences of shoulder injuries is one of the drivers to shoulder replacement market. This could be credited to sedentary lifestyles, occupational hazards, and increase in participation in sports.

As more number of individuals engage in activities that are physically demanding, both – professionally and recreationally, the probability of sustenance of shoulder injuries has increases on a dramatic count. Sports such as baseball, basketball, football, and activities such as weightlifting and rock climbing do expose the athletes to a greater risk of shoulder trauma. Such injuries generally result in rotator cuff tears, osteoarthritis, shoulder dislocations, which could adversely affect quality of life and mobility.

Moreover, the prevalence of shoulder injuries is not limited to athletes. It extends to the general population, particularly among older adults. As people age, degenerative changes in the shoulder joint become more common, resulting in conditions that may necessitate surgical intervention. For instance, adhesive capsulitis, also known as frozen shoulder and age-related rotator cuff tears with a more active lifestyle create a perfect storm for the rising incidences of shoulder injuries.

Occupational factors, in addition to athletic pursuits, play a crucial role. Many jobs involve repetitive overhead movements or heavy lifting, which can lead to chronic shoulder injuries over the period of time. Those serving in construction, manufacturing, and even office settings are likely to develop conditions such as tendinitis or bursitis owing to the physical demands of their roles. This occupational risk does contribute to a growing number of individuals seeking medical attention for shoulder issues.

The increasing awareness of shoulder injuries and their long-term impacts have resulted in more number of patients consulting healthcare professionals. Improved diagnostic tools and imaging technologies such as MRI and ultrasound enable more accurate identification of shoulder injuries, thereby increasing the number of diagnoses. As such conditions are recognized earlier, patients are more likely to pursue treatment options, inclusive of shoulder replacement surgery, when conservative measures fail to provide relief.

Technological advancements in implant designs and surgical techniques are basically driving the shoulder replacement market, notably improving the appeal and effectiveness of such procedures. Innovations with respect to both – advanced implant materials and minimally invasive surgical techniques have brought out transformation of the landscape of shoulder replacement surgery, thereby rendering it more efficient, safer, and yielding superlative patient outcomes.

Minimally invasive techniques have revolutionized the way shoulder surgeries are performed. Conventional open surgery often involves huge incisions and longer recovery times, which could keep patients away from opting for surgery.

However, advancements such as arthroscopy have let surgeons perform shoulder replacements through smaller incisions using specialized cameras and cameras. This approach not only minimizes tissue damage but also significantly reduces post-operative pain and accelerates recovery. Patients can often resume their daily activities much sooner as compared to conventional methods, thereby improving their overall satisfaction and willingness of undergoing surgery.

The development of advanced implant designs, in addition to surgical techniques, has played a crucial role in driving market growth. Modern shoulder implants are engineered using sophisticated materials such as polyethylene and titanium, which are known for their biocompatibility and durability. These materials reduce the risk of wear and tear over time, which is especially important in younger or more active patients who may place greater stress on their joints.

Furthermore, the design of these implants has evolved to better imitate the natural anatomy and biomechanics of the shoulder joint. For instance, reverse shoulder arthroplasty has become a well-known option for patients with complex shoulder problems, such as rotator cuff tears combined with arthritis. This design allows for improved functionality and range of motion, addressing the specific needs of various patient population.

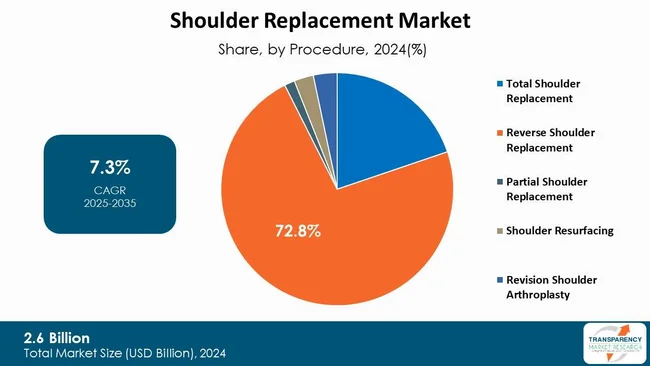

Based on procedure, the reverse shoulder replacement segment is expected to hold the maximum market share of 72.8% in 2025 due to their specificity toward a target. This could be attributed to its effectiveness in treating complex shoulder conditions, particularly in elderly patients with massive rotator cuff tears or failed conventional replacements.

This technique is increasingly preferred due to its favorable clinical outcomes, lower revision rates, and suitability for a wider patient population. Technological advancements in implant design and surgical techniques have further boosted its adoption. High procedure volumes in Europe and North America, along with growing awareness and expanded indications, have positioned reverse shoulder arthroplasty as the leading segment globally.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is expected to continue with its dominating streak in the global shoulder replacement market during the forecast period, which is driven by combination of rise in geriatric population, advanced healthcare infrastructure, and rising awareness regarding joint replacement solutions. The U.S. is witnessing higher volumes of shoulder arthroplasty procedures owing to growing occurrences of rotator cuff injuries, arthritis, and sports-related shoulder disorders.

The growing demand for outpatient surgeries, especially in ambulatory surgical centers (ASCs), is further catalyzing procedural adoption. Technological advancements such as the use of 3D-printed implants, robotics, and patient-specific surgical planning are broadly embraced across the region, thereby enhancing clinical outcomes.

In addition, the presence of leading orthopedic device companies coupled with strong reimbursement systems ascertains timely access to innovative shoulder prostheses. With continuous investments in healthcare and increasing preference for minimally invasive surgeries, North America is all set to sustain its leadership in the global shoulder replacement industry in the near future.

The United States holds the largest share of the shoulder replacement market within North America and the status quo is expected to remain the same throughout the forecast period. This dominance is primarily driven by high incidences of shoulder-related conditions such as osteoarthritis, rotator cuff tears, and fractures, particularly among the aging population.

Furthermore, the country is at the forefront of adopting innovative technologies, including customized implants, robotic-assisted surgeries, and advanced imaging for preoperative planning. The strong presence of major medical device manufacturers, combined with conducive reimbursement policies and increasing awareness of surgical options, continues to support market expansion. With focus on improved patient outcomes and procedural efficiency, the U.S. remains the primary growth engine for the global shoulder replacement market.

Leading companies are partnering with hospitals, specialty clinics, and research institutes to expand inorganically. Zimmer Biomet Holdings, Inc., Baumer, Stryker Corporation, DePuy Synthes (Johnson & Johnson), Smith+Nephew, DJO Global, Inc. (Enovis), Arthrex, Inc., Exatech Inc., Integra LifeSciences Corporation, and other players are the prominent Shoulder Replacement industry players.

Each of these players has been profiled in the Shoulder Replacement market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 2.6 Bn |

| Forecast Value in 2035 | US$ 5.7 Bn |

| CAGR | 7.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global shoulder replacement market was valued at US$ 2.6 Bn in 2024.

Shoulder replacement business is projected to cross US$ 5.7 Bn by the end of 2035.

Rising incidence of shoulder injuries and paradigm shift toward minimally invasive surgical procedures.

The CAGR is anticipated to be 7.3% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Zimmer Biomet Holdings, Inc., Baumer, Stryker Corporation, DePuy Synthes (Johnson & Johnson), Smith+Nephew, DJO Global, Inc. (Enovis), Arthrex, Inc., Exatech Inc., Integra LifeSciences Corporation, and other players are the prominent shoulder replacement market players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Shoulder Replacement Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Shoulder Replacement Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Regulatory Landscape across Key Regions / Countries

5.2. Reimbursement Scenario by Region/Globally

5.3. Porter’s Five Forces Analysis

5.4. PESTEL Analysis

5.5. Key Industry Events

5.6. Key Product/Brand Analysis

5.7. COVID-19 Pandemic Impact Analysis

6. Global Shoulder Replacement Market Analysis and Forecast, by Procedure

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Procedure, 2020 to 2035

6.3.1. Total Shoulder Replacement

6.3.2. Reverse Shoulder Replacement

6.3.3. Partial Shoulder Replacement

6.3.4. Shoulder Resurfacing

6.3.5. Revision Shoulder Arthroplasty

6.4. Market Attractiveness Analysis, by Procedure

7. Global Shoulder Replacement Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2020 to 2035

7.3.1. Hospitals

7.3.2. Ambulatory Surgical Centers

7.3.3. Orthopedic Clinics

7.4. Market Attractiveness Analysis, by End-user

8. Global Shoulder Replacement Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Shoulder Replacement Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Procedure, 2020 to 2035

9.2.1. Total Shoulder Replacement

9.2.2. Reverse Shoulder Replacement

9.2.3. Partial Shoulder Replacement

9.2.4. Shoulder Resurfacing

9.2.5. Revision Shoulder Arthroplasty

9.3. Market Value Forecast, by End-user, 2020 to 2035

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Orthopedic Clinics

9.4. Market Value Forecast, by Country, 2020 to 2035

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Procedure

9.5.2. By End-user

9.5.3. By Country

10. Europe Shoulder Replacement Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Procedure, 2020 to 2035

10.2.1. Total Shoulder Replacement

10.2.2. Reverse Shoulder Replacement

10.2.3. Partial Shoulder Replacement

10.2.4. Shoulder Resurfacing

10.2.5. Revision Shoulder Arthroplasty

10.3. Market Value Forecast, by End-user, 2020 to 2035

10.3.1. Hospitals

10.3.2. Ambulatory Surgical Centers

10.3.3. Orthopedic Clinics

10.4. Market Value Forecast, by Country/Sub-region, 2020 to 2035

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Switzerland

10.4.7. The Netherlands

10.4.8. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Procedure

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Shoulder Replacement Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Procedure, 2020 to 2035

11.2.1. Total Shoulder Replacement

11.2.2. Reverse Shoulder Replacement

11.2.3. Partial Shoulder Replacement

11.2.4. Shoulder Resurfacing

11.2.5. Revision Shoulder Arthroplasty

11.3. Market Value Forecast, by End-user, 2020 to 2035

11.3.1. Hospitals

11.3.2. Ambulatory Surgical Centers

11.3.3. Orthopedic Clinics

11.4. Market Value Forecast, by Country/Sub-region, 2020 to 2035

11.4.1. China

11.4.2. India

11.4.3. Japan

11.4.4. South Korea

11.4.5. Australia & New Zealand

11.4.6. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Procedure

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Shoulder Replacement Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Procedure, 2020 to 2035

12.2.1. Total Shoulder Replacement

12.2.2. Reverse Shoulder Replacement

12.2.3. Partial Shoulder Replacement

12.2.4. Shoulder Resurfacing

12.2.5. Revision Shoulder Arthroplasty

12.3. Market Value Forecast, by End-user, 2020 to 2035

12.3.1. Hospitals

12.3.2. Ambulatory Surgical Centers

12.3.3. Orthopedic Clinics

12.4. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Argentina

12.4.4. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Procedure

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Shoulder Replacement Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Procedure, 2020 to 2035

13.2.1. Total Shoulder Replacement

13.2.2. Reverse Shoulder Replacement

13.2.3. Partial Shoulder Replacement

13.2.4. Shoulder Resurfacing

13.2.5. Revision Shoulder Arthroplasty

13.3. Market Value Forecast, by End-user, 2020 to 2035

13.3.1. Hospitals

13.3.2. Ambulatory Surgical Centers

13.3.3. Orthopedic Clinics

13.4. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Procedure

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2024)

14.3. Company Profiles

14.3.1. Zimmer Biomet Holdings, Inc.

14.3.1.1. Company Overview

14.3.1.2. Financial Overview

14.3.1.3. Financial Overview

14.3.1.4. Business Strategies

14.3.1.5. Recent Developments

14.3.2. Baumer

14.3.2.1. Company Overview

14.3.2.2. Financial Overview

14.3.2.3. Financial Overview

14.3.2.4. Business Strategies

14.3.2.5. Recent Developments

14.3.3. Stryker Corporation

14.3.3.1. Company Overview

14.3.3.2. Financial Overview

14.3.3.3. Financial Overview

14.3.3.4. Business Strategies

14.3.3.5. Recent Developments

14.3.4. DePuy Synthes (Johnson & Johnson)

14.3.4.1. Company Overview

14.3.4.2. Financial Overview

14.3.4.3. Financial Overview

14.3.4.4. Business Strategies

14.3.4.5. Recent Developments

14.3.5. Smith+Nephew

14.3.5.1. Company Overview

14.3.5.2. Financial Overview

14.3.5.3. Financial Overview

14.3.5.4. Business Strategies

14.3.5.5. Recent Developments

14.3.6. DJO Global, Inc. (Enovis)

14.3.6.1. Company Overview

14.3.6.2. Financial Overview

14.3.6.3. Financial Overview

14.3.6.4. Business Strategies

14.3.6.5. Recent Developments

14.3.7. Arthrex, Inc.

14.3.7.1. Company Overview

14.3.7.2. Financial Overview

14.3.7.3. Financial Overview

14.3.7.4. Business Strategies

14.3.7.5. Recent Developments

14.3.8. Exatech Inc.

14.3.8.1. Company Overview

14.3.8.2. Financial Overview

14.3.8.3. Financial Overview

14.3.8.4. Business Strategies

14.3.8.5. Recent Developments

14.3.9. Integra LifeSciences Corporation

14.3.9.1. Company Overview

14.3.9.2. Financial Overview

14.3.9.3. Financial Overview

14.3.9.4. Business Strategies

14.3.9.5. Recent Developments

14.3.10. Other Prominent Players

14.3.10.1. Company Overview

14.3.10.2. Financial Overview

14.3.10.3. Financial Overview

14.3.10.4. Business Strategies

14.3.10.5. Recent Developments

List of Tables

Table 01: Global Shoulder Replacement Market Value (US$ Bn) Forecast, By Procedure, 2020 to 2035

Table 02: Global Shoulder Replacement Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 03: Global Shoulder Replacement Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 04: North America Shoulder Replacement Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 05: North America Shoulder Replacement Market Value (US$ Bn) Forecast, By Procedure, 2020 to 2035

Table 06: North America Shoulder Replacement Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 07: Europe Shoulder Replacement Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 08: Europe Shoulder Replacement Market Value (US$ Bn) Forecast, By Procedure, 2020 to 2035

Table 09: Europe Shoulder Replacement Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 10: Asia Pacific Shoulder Replacement Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 11: Asia Pacific Shoulder Replacement Market Value (US$ Bn) Forecast, By Procedure, 2020 to 2035

Table 12: Asia Pacific Shoulder Replacement Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Latin America Shoulder Replacement Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 14: Latin America Shoulder Replacement Market Value (US$ Bn) Forecast, By Procedure, 2020 to 2035

Table 15: Latin America Shoulder Replacement Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Middle East & Africa Shoulder Replacement Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 17: Middle East & Africa Shoulder Replacement Market Value (US$ Bn) Forecast, By Procedure, 2020 to 2035

Table 18: Middle East & Africa Shoulder Replacement Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Shoulder Replacement Market Value Share Analysis, By Procedure, 2024 and 2035

Figure 02: Global Shoulder Replacement Market Attractiveness Analysis, By Procedure, 2025 to 2035

Figure 03: Global Shoulder Replacement Market Revenue (US$ Bn), by Total Shoulder Replacement, 2020 to 2035

Figure 04: Global Shoulder Replacement Market Revenue (US$ Bn), by Reverse Shoulder Replacement, 2020 to 2035

Figure 05: Global Shoulder Replacement Market Revenue (US$ Bn), by Partial Shoulder Replacement, 2020 to 2035

Figure 06: Global Shoulder Replacement Market Revenue (US$ Bn), by Shoulder Resurfacing, 2020 to 2035

Figure 07: Global Shoulder Replacement Market Revenue (US$ Bn), by Revision Shoulder Arthroplasty, 2020 to 2035

Figure 08: Global Shoulder Replacement Market Value Share Analysis, By End-user, 2024 and 2035

Figure 09: Global Shoulder Replacement Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 10: Global Shoulder Replacement Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 11: Global Shoulder Replacement Market Revenue (US$ Bn), by Ambulatory Surgical Centers, 2020 to 2035

Figure 12: Global Shoulder Replacement Market Revenue (US$ Bn), by Orthopedic Clinics, 2020 to 2035

Figure 13: Global Shoulder Replacement Market Value Share Analysis, By Region, 2024 and 2035

Figure 14: Global Shoulder Replacement Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 15: North America Shoulder Replacement Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 16: North America Shoulder Replacement Market Value Share Analysis, by Country, 2024 and 2035

Figure 17: North America Shoulder Replacement Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 18: North America Shoulder Replacement Market Value Share Analysis, By Procedure, 2024 and 2035

Figure 19: North America Shoulder Replacement Market Attractiveness Analysis, By Procedure, 2025 to 2035

Figure 20: North America Shoulder Replacement Market Value Share Analysis, By End-user, 2024 and 2035

Figure 21: North America Shoulder Replacement Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 22: Europe Shoulder Replacement Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 23: Europe Shoulder Replacement Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 24: Europe Shoulder Replacement Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 25: Europe Shoulder Replacement Market Value Share Analysis, By Procedure, 2024 and 2035

Figure 26: Europe Shoulder Replacement Market Attractiveness Analysis, By Procedure, 2025 to 2035

Figure 27: Europe Shoulder Replacement Market Value Share Analysis, By End-user, 2024 and 2035

Figure 28: Europe Shoulder Replacement Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 29: Asia Pacific Shoulder Replacement Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: Asia Pacific Shoulder Replacement Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 31: Asia Pacific Shoulder Replacement Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 32: Asia Pacific Shoulder Replacement Market Value Share Analysis, By Procedure, 2024 and 2035

Figure 33: Asia Pacific Shoulder Replacement Market Attractiveness Analysis, By Procedure, 2025 to 2035

Figure 34: Asia Pacific Shoulder Replacement Market Value Share Analysis, By End-user, 2024 and 2035

Figure 35: Asia Pacific Shoulder Replacement Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 36: Latin America Shoulder Replacement Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: Latin America Shoulder Replacement Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 38: Latin America Shoulder Replacement Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 39: Latin America Shoulder Replacement Market Value Share Analysis, By Procedure, 2024 and 2035

Figure 40: Latin America Shoulder Replacement Market Attractiveness Analysis, By Procedure, 2025 to 2035

Figure 41: Latin America Shoulder Replacement Market Value Share Analysis, By End-user, 2024 and 2035

Figure 42: Latin America Shoulder Replacement Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 43: Middle East & Africa Shoulder Replacement Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: Middle East & Africa Shoulder Replacement Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 45: Middle East & Africa Shoulder Replacement Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 46: Middle East & Africa Shoulder Replacement Market Value Share Analysis, By Procedure, 2024 and 2035

Figure 47: Middle East & Africa Shoulder Replacement Market Attractiveness Analysis, By Procedure, 2025 to 2035

Figure 48: Middle East & Africa Shoulder Replacement Market Value Share Analysis, By End-user, 2024 and 2035

Figure 49: Middle East & Africa Shoulder Replacement Market Attractiveness Analysis, By End-user, 2025 to 2035