Reports

Reports

Pharmaceutical intermediates are drugs used as raw materials in the production of bulk drugs. Moreover, they are widely used to refer to a material created during the synthesis of an active pharmaceutical ingredient (API) before the processing of becoming an API. Pharmaceutical intermediates are usually formed using high-grade raw materials. These intermediates are widely used in the pharmaceutical and cosmetic industries. The rising demand in these industries is expanding the global pharmaceutical intermediates market. Pharmaceutical intermediates are popularly used for research and development in the pharmaceutical industry. The pharmaceutical intermediates are increasingly being produced using raw materials such as coal tar or petroleum to manufacture pesticides, pharmaceuticals, resins, additives, plasticizers, etc. However, several intermediates can be produced in organic synthesis, and be used in creating various drugs and products. The increasing demand for research and development across the world is propelling the global pharmaceutical intermediates market during the forecast period.

Intermediates can be defined as semi-finished products that are intermediate products of certain products. In simpler words, to produce a product, it can be produced from intermediates to save costs. Pharmaceutical production needs a large number of specific chemicals that were originally produced by the pharmaceutical industry. However, with the expansion of social labor division and the evolution of production technology, the pharmaceutical industry can transfer the production of required pharmaceutical intermediates to chemical enterprises. Pharmaceutical intermediates are exquisite chemical products. The production of pharmaceutical intermediates has grown vastly in the international chemical industry. The growing chemical industry is driving demand for pharmaceutical intermediates across the world. The pharmaceutical intermediates are produced on demand for bulk and custom productions.

The outbreak of the novel COVID-19 disease led to a global pandemic that poses a serious risk to the macro economy through the halt in production activities, interruptions of people's movement, and disruption in supply chains. The crisis has had critical effects on the global healthcare industry and the pharmaceutical sector, which are expected to last long. The pharmaceutical industry will be needing appropriate planning to reduce its socio-economic burden in the upcoming future. As the virus began to spread worldwide in 2020, the pharmaceutical industry supported governments to help provide with the rising demand. Pharmaceutical ingredients raised in demand for research and development of the cure. On the other hand, pharmaceutical sectors struggled to maintain natural market flow, as the pandemic affected the access to essential medicines due to increased consumer storage. With the evaluation of the pharmaceutical system challenges at the global level, the report displays the situation analysis of the pharmaceutical intermediates market in developing countries with emerging pharmaceutical markets.

The spread of the virus has resulted in increased hospitalization with COVID-19 patients that led to a shortage of medicinal storage. Globally, many government authorities announced shortages for several medicines, including the potential treatments for COVID-19. The pandemic can be associated with various short and long-term impacts on the pharmaceutical intermediates market, mainly due to restrictions in the global supply chain resulting in a lack of raw materials. Recognizing these impacts may guide businesses in evidence-informed preparation and decision-making to fight associated difficulties. Various other industries had critical losses with the restrictions in manufacturing and selling. Several end users of pharmaceutical intermediates suffered from shutdowns, project delays, insufficient raw materials, and workforce, etc. Nevertheless, with markets being restored in many countries, and pandemic near its end, end-use industries in the pharmaceutical intermediates market, including CMOs and CROs, are anticipating rise in demand post-COVID-19 pandemic.

The pharmaceutical industry is constantly unfolding and reshaping itself. Various pharmaceutical organizations and major market players are adapting modifications in pharmaceutical intermediate businesses with their rising demand. As pharmaceutical and chemical activities stretch around the globe, innovations are the key focus of manufacturers, and the demand for pharmaceutical intermediates companies is on the rise. Due to the implementation of standardized pharmaceutical activities, good manufacturing practices (GMP) in pharmaceutical corporations, the global pharmaceutical intermediates market is expected to grow in the upcoming future. Major chemical and pharmaceutical manufacturers compete to capture the positions in the pharmaceutical intermediates market. Fulfilling consumer demand for speed, innovation, low cost, and quality amid rising competition and unpredictable market are focus points. However, the onset of new players is making it difficult to shine, which drives the need for outsourcing chemical services at all points, along the drug development pipeline.

With growing pharmaceutical manufacturers and consumers in the U.S. and Canada, North America is projected to hold a major share of the pharmaceutical intermediate market. In addition, the rising prevalence of several contagious and chronic diseases has raised the demand for pharmaceuticals, which is most likely to promote the growth of the pharmaceutical intermediates market over the projected period. Moreover, the presence of major market players in North America is also contributing to the expansion of the pharmaceutical intermediates market in North America. Furthermore, rise in R&D activities and increase in investments in these activities from governments and major players in Europe are likely to drive the market in North America. Additionally, the improved demand for advanced pharmaceutical products is expected to boost the pharmaceutical intermediates market during the forecast period.

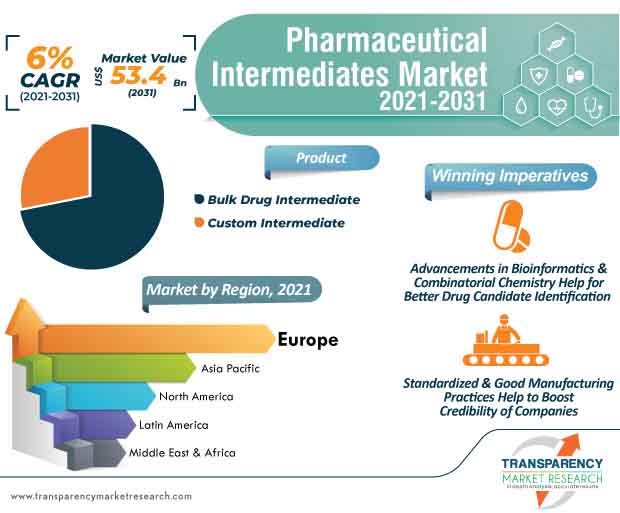

The world is witnessing an increasing number of diseases and a rising number of patients every year. In addition, the number of physician visits for infectious and parasitic diseases has rapidly raised in millions, creating the demand for numerous pharmaceutical products. High spending on R&D and advancements in innovative therapies are anticipated to improve the growth rate of the pharmaceutical intermediates market in the near future. However, strict regulatory policies for manufacturers for product quality will slow down the growth rate. Nevertheless, with increase in healthcare expenditure and rise in manufacturer focus on research & development, the global pharmaceutical intermediates market is projected to expand at a CAGR of ~6% from 2021 to 2031.

Analysts' Viewpoint

The demand for pharmaceutical intermediates majorly depends on the rise in the demand for essential drugs to treat chronic diseases. The growing prevalence of contagious diseases, principally in Southeast Asia, is likely to fuel the demand for APIs in the following years, ultimately propelling the pharmaceutical intermediates market. Moreover, advancements in technologies such as high throughput, bioinformatics, and combinatorial chemistry for better drug candidate identification are increasing the demand for pharmaceutical intermediates for research purposes. Hence, owing to rising production and research exercises in the pharmaceutical industry, the usage of pharmaceutical intermediates is expected to witness a constant growth during the projected period.

Pharmaceutical intermediates market to reach valuation of US$ 53.4 Bn by 2031

Pharmaceutical intermediates market is projected to expand at a CAGR of ~6% from 2021 to 2031

Pharmaceutical intermediates market is driven by rise in healthcare expenditure and focus on research & development

North America is expected to account for a significant share of the global pharmaceutical intermediates market during the forecast period

Key players in the global pharmaceutical intermediates market include BASF SE, Lonza Group, Evonik Industries AG, Cambrex Corporation, DSM, Aceto

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Pharmaceutical Intermediates Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Global Pharmaceutical Intermediates Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

5.2. Key Industry Events (mergers and acquisitions, new product development, etc.)

5.3. Pharmaceutical Intermediates Products/Brands List

6. Global Pharmaceutical Intermediates Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.1.1. Key Findings / Developments

6.2. Global Pharmaceutical Intermediates Market Value Forecast, by Product, 2017–2031

6.2.1. Bulk Drug Intermediate

6.2.1.1. Chiral Intermediate

6.2.1.2. Achiral Intermediate

6.2.2. Custom Intermediate

6.3. Global Pharmaceutical Intermediates Market Attractiveness Analysis, by Product

7. Global Pharmaceutical Intermediates Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.1.1. Key Findings / Developments

7.2. Global Pharmaceutical Intermediates Market Value Forecast, by Application, 2017–2031

7.2.1. Cardiology

7.2.2. Oncology

7.2.3. Endocrinology

7.2.4. Infectious Diseases

7.2.5. Orthopedics

7.2.6. Neurology

7.2.7. Gastroenterology

7.2.8. Dermatology

7.2.9. Inflammatory & Pain Management

7.2.10. Ophthalmology

7.2.11. Others

7.3. Global Pharmaceutical Intermediates Market Attractiveness Analysis, by Application

8. Global Pharmaceutical Intermediates Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.1.1. Key Findings / Developments

8.2. Global Pharmaceutical Intermediates Market Value Forecast, by End-user, 2017–2031

8.2.1. Pharmaceutical & Biotechnology Companies

8.2.2. CROs & CMOs

8.3. Global Pharmaceutical Intermediates Market Attractiveness Analysis, by End-user

9. Global Pharmaceutical Intermediates Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Pharmaceutical Intermediates Market Value Forecast by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Pharmaceutical Intermediates Market Attractiveness Analysis, by Country/Region

10. North America Pharmaceutical Intermediates Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. North America Pharmaceutical Intermediates Market Value Forecast, by Product, 2017–2031

10.2.1. Bulk Drug Intermediate

10.2.1.1. Chiral Intermediate

10.2.1.2. Achiral Intermediate

10.2.2. Custom Intermediate

10.3. North America Pharmaceutical Intermediates Market Value Forecast, by Application, 2017–2031

10.3.1. Cardiology

10.3.2. Oncology

10.3.3. Endocrinology

10.3.4. Infectious Diseases

10.3.5. Orthopedics

10.3.6. Neurology

10.3.7. Gastroenterology

10.3.8. Dermatology

10.3.9. Inflammatory & Pain Management

10.3.10. Ophthalmology

10.3.11. Others

10.4. North America Pharmaceutical Intermediates Market Value Forecast, by End-user, 2017–2031

10.4.1. Pharmaceutical & Biotechnology Companies

10.4.2. CROs & CMOs

10.5. North America Pharmaceutical Intermediates Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. North America Pharmaceutical Intermediates Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Pharmaceutical Intermediates Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Europe Pharmaceutical Intermediates Market Value Forecast, by Product, 2017–2031

11.2.1. Bulk Drug Intermediate

11.2.1.1. Chiral Intermediate

11.2.1.2. Achiral Intermediate

11.2.2. Custom Intermediate

11.3. Europe Pharmaceutical Intermediates Market Value Forecast, by Application, 2017–2031

11.3.1. Cardiology

11.3.2. Oncology

11.3.3. Endocrinology

11.3.4. Infectious Diseases

11.3.5. Orthopedics

11.3.6. Neurology

11.3.7. Gastroenterology

11.3.8. Dermatology

11.3.9. Inflammatory & Pain Management

11.3.10. Ophthalmology

11.3.11. Others

11.4. Europe Pharmaceutical Intermediates Market Value Forecast, by End-user, 2017–2031

11.4.1. Pharmaceutical & Biotechnology Companies

11.4.2. CROs & CMOs

11.5. Europe Pharmaceutical Intermediates Market Value Forecast by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Europe Pharmaceutical Intermediates Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Pharmaceutical Intermediates Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Asia Pacific Pharmaceutical Intermediates Market Value Forecast, by Product, 2017–2031

12.2.1. Bulk Drug Intermediate

12.2.1.1. Chiral Intermediate

12.2.1.2. Achiral Intermediate

12.2.2. Custom Intermediate

12.3. Asia Pacific Pharmaceutical Intermediates Market Value Forecast, by Application, 2017–2031

12.3.1. Cardiology

12.3.2. Oncology

12.3.3. Endocrinology

12.3.4. Infectious Diseases

12.3.5. Orthopedics

12.3.6. Neurology

12.3.7. Gastroenterology

12.3.8. Dermatology

12.3.9. Inflammatory & Pain Management

12.3.10. Ophthalmology

12.3.11. Others

12.4. Asia Pacific Pharmaceutical Intermediates Market Value Forecast, by End-user, 2017–2031

12.4.1. Pharmaceutical & Biotechnology Companies

12.4.2. CROs & CMOs

12.5. Asia Pacific Pharmaceutical Intermediates Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific Pharmaceutical Intermediates Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Pharmaceutical Intermediates Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Latin America Pharmaceutical Intermediates Market Value Forecast, by Product, 2017–2031

13.2.1. Bulk Drug Intermediate

13.2.1.1. Chiral Intermediate

13.2.1.2. Achiral Intermediate

13.2.2. Custom Intermediate

13.3. Latin America Pharmaceutical Intermediates Market Value Forecast, by Application, 2017–2031

13.3.1. Cardiology

13.3.2. Oncology

13.3.3. Endocrinology

13.3.4. Infectious Diseases

13.3.5. Orthopedics

13.3.6. Neurology

13.3.7. Gastroenterology

13.3.8. Dermatology

13.3.9. Inflammatory & Pain Management

13.3.10. Ophthalmology

13.3.11. Others

13.4. Latin America Pharmaceutical Intermediates Market Value Forecast, by End-user, 2017–2031

13.4.1. Pharmaceutical & Biotechnology Companies

13.4.2. CROs & CMOs

13.5. Latin America Pharmaceutical Intermediates Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Latin America Pharmaceutical Intermediates Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Pharmaceutical Intermediates Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Middle East & Africa Pharmaceutical Intermediates Market Value Forecast, by Product, 2017–2031

14.2.1. Bulk Drug Intermediate

14.2.1.1. Chiral Intermediate

14.2.1.2. Achiral Intermediate

14.2.2. Custom Intermediate

14.3. Middle East & Africa Pharmaceutical Intermediates Market Value Forecast, by Application, 2017–2031

14.3.1. Cardiology

14.3.2. Oncology

14.3.3. Endocrinology

14.3.4. Infectious Diseases

14.3.5. Orthopedics

14.3.6. Neurology

14.3.7. Gastroenterology

14.3.8. Dermatology

14.3.9. Inflammatory & Pain Management

14.3.10. Ophthalmology

14.3.11. Others

14.4. Middle East & Africa Pharmaceutical Intermediates Market Value Forecast, by End-user, 2017–2031

14.4.1. Pharmaceutical & Biotechnology Companies

14.4.2. CROs & CMOs

14.5. Middle East & Africa Pharmaceutical Intermediates Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa Pharmaceutical Intermediates Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis/Ranking, by Company, 2020

15.3. Company Profiles

15.3.1. BASF SE

15.3.1.1. Company Description

15.3.1.2. Business Overview

15.3.1.3. Strategic Overview

15.3.1.4. SWOT Analysis

15.3.2. Lonza Group

15.3.2.1. Company Description

15.3.2.2. Business Overview

15.3.2.3. Strategic Overview

15.3.2.4. SWOT Analysis

15.3.3. Evonik Industries AG

15.3.3.1. Company Description

15.3.3.2. Business Overview

15.3.3.3. Strategic Overview

15.3.3.4. SWOT Analysis

15.3.4. Cambrex Corporation

15.3.4.1. Company Description

15.3.4.2. Business Overview

15.3.4.3. Strategic Overview

15.3.4.4. SWOT Analysis

15.3.5. DSM

15.3.5.1. Company Description

15.3.5.2. Business Overview

15.3.5.3. Strategic Overview

15.3.5.4. SWOT Analysis

15.3.6. Aceto

15.3.6.1. Company Description

15.3.6.2. Business Overview

15.3.6.3. Strategic Overview

15.3.6.4. SWOT Analysis

15.3.7. Albemarle Corporation

15.3.7.1. Company Description

15.3.7.2. Business Overview

15.3.7.3. Strategic Overview

15.3.7.4. SWOT Analysis

15.3.8. Vertellus

15.3.8.1. Company Description

15.3.8.2. Business Overview

15.3.8.3. Strategic Overview

15.3.8.4. SWOT Analysis

15.3.9. Chemcon Speciality Chemicals Ltd.

15.3.9.1. Company Description

15.3.9.2. Business Overview

15.3.9.3. Strategic Overview

15.3.9.4. SWOT Analysis

15.3.10. chiracon GmbH

15.3.10.1. Company Description

15.3.10.2. Business Overview

15.3.10.3. Strategic Overview

15.3.10.4. SWOT Analysis

15.3.11. A. R. Life Sciences Private Limited

15.3.11.1. Company Description

15.3.11.2. Business Overview

15.3.11.3. Strategic Overview

15.3.11.4. SWOT Analysis

List of Tables

Table 01: Global Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Bulk Drug Intermediate, 2017–2031

Table 03: Global Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 05: Global Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 08: North America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 09: North America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Bulk Drug Intermediate, 2017–2031

Table 10: North America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 11: North America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 12: North America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Europe Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Europe Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Europe Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Bulk Drug Intermediate, 2017–2031

Table 16: Europe Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 17: Europe Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 18: Europe Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 19: Asia Pacific Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 20: Asia Pacific Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 21: Asia Pacific Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Bulk Drug Intermediate, 2017–2031

Table 22: Asia Pacific Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 23: Asia Pacific Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Asia Pacific Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 25: Latin America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 26: Latin America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 27: Latin America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Bulk Drug Intermediate, 2017–2031

Table 28: Latin America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 29: Latin America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 30: Latin America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 31: Middle East & Africa Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 32: Middle East & Africa Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 33: Middle East & Africa Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Bulk Drug Intermediate, 2017–2031

Table 34: Middle East & Africa Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 35: Middle East & Africa Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 36: Middle East & Africa Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Pharmaceutical Intermediates Market Value Share, by Product, 2020

Figure 03: Global Pharmaceutical Intermediates Market Value Share, by Application, 2020

Figure 04: Global Pharmaceutical Intermediates Market Value Share, by End-user, 2020

Figure 05: Global Pharmaceutical Intermediates Market Value Share, by Region, 2020

Figure 06: Global Pharmaceutical Intermediates Market Value Share Analysis, by Product, 2020 and 2031

Figure 07: Global Pharmaceutical Intermediates Market Attractiveness Analysis, by Product, 2021–2031

Figure 08: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by Bulk Drug Intermediate, 2017–2031

Figure 09: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by Custom Intermediate, 2017–2031

Figure 10: Global Pharmaceutical Intermediates Market Value Share Analysis, by Application, 2020 and 2031

Figure 11: Global Pharmaceutical Intermediates Market Attractiveness Analysis, by Application, 2021–2031

Figure 12: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by Cardiology, 2017–2031

Figure 13: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by Oncology, 2017–2031

Figure 14: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by Endocrinology, 2017–2031

Figure 15: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by Infectious Diseases, 2017–2031

Figure 16: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by Orthopedics, 2017–2031

Figure 17: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by Neurology, 2017–2031

Figure 18: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by Gastroenterology, 2017–2031

Figure 19: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by Dermatology, 2017–2031

Figure 20: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by Others, 2017–2031

Figure 21: Global Pharmaceutical Intermediates Market Value Share Analysis, by End-user, 2020 and 2031

Figure 22: Global Pharmaceutical Intermediates Market Attractiveness Analysis, by End-user, 2021–2031

Figure 23: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by Pharmaceutical & Biotechnology Companies, 2017–2031

Figure 24: Global Pharmaceutical Intermediates Market Revenue (US$ Mn), by CROs & CMOs, 2017–2031

Figure 25: Global Pharmaceutical Intermediates Market Value Share Analysis, by Region, 2020 and 2031

Figure 26: Global Pharmaceutical Intermediates Market Attractiveness Analysis, by Region, 2021–2031

Figure 27: North America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, 2017–2031

Figure 28: North America Pharmaceutical Intermediates Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 29: North America Pharmaceutical Intermediates Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 30: North America Pharmaceutical Intermediates Market Value Share Analysis, by Product, 2020 and 2031

Figure 31: North America Pharmaceutical Intermediates Market Attractiveness Analysis, by Product, 2021–2031

Figure 32: North America Pharmaceutical Intermediates Market Value Share Analysis, by Application, 2020 and 2031

Figure 33: North America Pharmaceutical Intermediates Market Attractiveness Analysis, by Application, 2021–2031

Figure 34: North America Pharmaceutical Intermediates Market Value Share Analysis, by End-user, 2020 and 2031

Figure 35: North America Pharmaceutical Intermediates Market Attractiveness Analysis, by End-user, 2021–2031

Figure 36: Europe Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Europe Pharmaceutical Intermediates Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 38: Europe Pharmaceutical Intermediates Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 39: Europe Pharmaceutical Intermediates Market Value Share Analysis, by Product, 2020 and 2031

Figure 40: Europe Pharmaceutical Intermediates Market Attractiveness Analysis, by Product, 2021–2031

Figure 41: Europe Pharmaceutical Intermediates Market Value Share Analysis, by Application, 2020 and 2031

Figure 42: Europe Pharmaceutical Intermediates Market Attractiveness Analysis, by Application, 2021–2031

Figure 43: Europe Pharmaceutical Intermediates Market Value Share Analysis, by End-user, 2020 and 2031

Figure 44: Europe Pharmaceutical Intermediates Market Attractiveness Analysis, by End-user, 2021–2031

Figure 45: Asia Pacific Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Asia Pacific Pharmaceutical Intermediates Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 47: Asia Pacific Pharmaceutical Intermediates Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 48: Asia Pacific Pharmaceutical Intermediates Market Value Share Analysis, by Product, 2020 and 2031

Figure 49: Asia Pacific Pharmaceutical Intermediates Market Attractiveness Analysis, by Product, 2021–2031

Figure 50: Asia Pacific Pharmaceutical Intermediates Market Value Share Analysis, by Application, 2020 and 2031

Figure 51: Asia Pacific Pharmaceutical Intermediates Market Attractiveness Analysis, by Application, 2021–2031

Figure 52: Asia Pacific Pharmaceutical Intermediates Market Value Share Analysis, by End-user, 2020 and 2031

Figure 53: Asia Pacific Pharmaceutical Intermediates Market Attractiveness Analysis, by End-user, 2021–2031

Figure 54: Latin America Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, 2017–2031

Figure 55: Latin America Pharmaceutical Intermediates Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 56: Latin America Pharmaceutical Intermediates Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 57: Latin America Pharmaceutical Intermediates Market Value Share Analysis, by Product, 2020 and 2031

Figure 58: Latin America Pharmaceutical Intermediates Market Attractiveness Analysis, by Product, 2021–2031

Figure 59: Latin America Pharmaceutical Intermediates Market Value Share Analysis, by Application, 2020 and 2031

Figure 60: Latin America Pharmaceutical Intermediates Market Attractiveness Analysis, by Application, 2021–2031

Figure 61: Latin America Pharmaceutical Intermediates Market Value Share Analysis, by End-user, 2020 and 2031

Figure 62: Latin America Pharmaceutical Intermediates Market Attractiveness Analysis, by End-user, 2021–2031

Figure 63: Middle East & Africa Pharmaceutical Intermediates Market Value (US$ Mn) Forecast, 2017–2031

Figure 64: Middle East & Africa Pharmaceutical Intermediates Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 65: Middle East & Africa Pharmaceutical Intermediates Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 66: Middle East & Africa Pharmaceutical Intermediates Market Value Share Analysis, by Product, 2020 and 2031

Figure 67: Middle East & Africa Pharmaceutical Intermediates Market Attractiveness Analysis, by Product, 2021–2031

Figure 68: Middle East & Africa Pharmaceutical Intermediates Market Value Share Analysis, by Application, 2020 and 2031

Figure 69: Middle East & Africa Pharmaceutical Intermediates Market Attractiveness Analysis, by Application, 2021–2031

Figure 70: Middle East & Africa Pharmaceutical Intermediates Market Value Share Analysis, by End-user, 2020 and 2031

Figure 71: Middle East & Africa Pharmaceutical Intermediates Market Attractiveness Analysis, by End-user, 2021–2031