Reports

Reports

Analyst Viewpoint

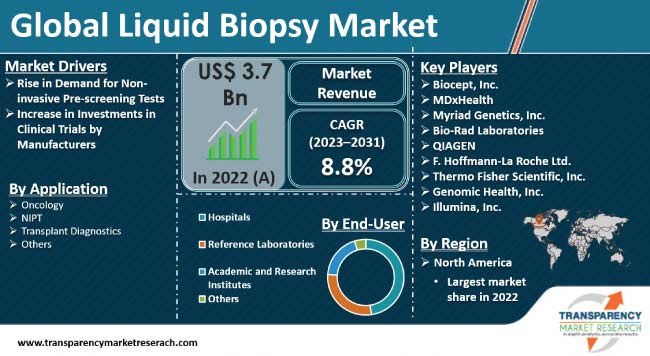

Rise in prevalence of cancer, increase in applications of liquid biopsy and growing research on enhancing efficacy of liquid biopsy over other diagnostic tests are estimated to propel the market in 2023. Furthermore, increase in demand for early cancer detection through non-invasive procedures is also likely to fuel the liquid biopsy market demand in the next few years.

Leading companies in liquid biopsy field are collaborating to establish industry-wide standards and comply with stringent regulatory requirements. Moreover, advancements in multi-omics analysis, expansion of liquid biopsy applications to other diseases, and the integration of artificial intelligence for data interpretation are expected to boost the liquid biopsy industry in the next few years.

Liquid biopsies can improve or resolve several inherent issues with current cancer treatment, enabling early cancer detection, mutation detection, tumor monitoring during treatment. They have the potential to detect cancer before tumor formation, assess multiple mutations within the tumor.

Governments are taking initiatives regarding public screening tests to reduce the further spread of chronic disorders. Non-invasive screening tests help in detection of signs of cancerous tumors inclusive of cell free DNAs, circulating biomarkers, and circulating tumor DNAs (ctDNAs) in cancer patients at recurrent or screening stages. Growing frequency of US FDA-approved advanced tests is expected to drive liquid biopsy market revenue in the next few years.

The ability of liquid biopsies to capture tumor heterogeneity and dynamics, detect MRD at an early stage, assess real-time treatment response, biomarker discovery, and non-invasive nature make liquid biopsy test an invaluable tool in formulating personalized treatment strategies. Liquid biopsy for cancer test also allows for easier accessibility, especially when obtaining tissue biopsies may be challenging or impractical. Therefore, rise in demand for non-invasive diagnostic approaches is anticipated to offer significant liquid biopsy market opportunities in the near future.

The non-invasive nature of liquid biopsies eliminates the need for traditional tissue biopsies, reducing patient discomfort and the risk of complications. This makes liquid biopsies particularly appealing for patients who may be reluctant or unable to undergo surgical procedures. Ongoing research is focused on boosting the application of liquid biopsies to population-wide cancer screening programs. The potential for early detection of cancer in asymptomatic individuals could significantly impact cancer mortality rates.

Demand for non-invasive prenatal testing is considerably high due to an increase in number of congenital and genetic abnormalities in the fetus. According to an article published by the UN group, in Arch 2022, nearly 3000 to 5000 children are born with Down syndrome annually. In May 2021, Yourgene announced the launch of IONA care – a NIPT service offering.

This solution provides an extended advantage to measure the probability that a pregnant woman is carrying fetus with autosomal aneuploidies (AA2) and sex chromosome aneuploidies (SCA1) apart from screening for trisomies 13, 18 and 21 and fetal sex determination. Thus, growing awareness about the importance of prenatal testing is expected to fuel the liquid biopsy market development in the next few years.

Currently, technology advancements in liquid biopsies are driving the frequency of therapeutic selection, cancer screening, recurrence monitoring, and drug trial optimization. Several government agencies, in collaboration with key players, are emphasizing investment in R&D to conduct clinical studies on liquid biopsy for offering precision medicine for patients.

In November 2021, BioMark Diagnostics, Inc. received funding close to US$ 135,640 from National Research Council of Canada Industrial Research Assistance Program (NRCIRAP). The basic purpose of this funding was to extend support to R&D of liquid biopsy assay to screen and detect lung cancer at early stages.

In November 2022, Thermo Fisher Scientific tabled digital PCR liquid-biopsy assays for Applied Biosystems absolute Q dPCR system and custom design tool for simplifying cancer research in clinical research and academic institutes.

Investments in liquid biopsy testing for early cancer detection have been rising for the last few years, as it provides valuable insights into the molecular characteristics of tumors, enabling the tailoring of cancer treatments based on individual genetic profiles. This personalized approach holds promise for more effective and targeted therapies and is consequently expected to bolster the global liquid biopsy market development during the forecast period.

North America accounted for the largest liquid biopsy market share in 2022 due to growing incidence of cancer and rapid advancements in screening technology in the region. As per the American Cancer Society, 1.9 million cancer cases with 609,360 fatalities were recorded in the U.S in 2022. Several organizations such as the American Society of Clinical Oncology (ASCO) are working on creating awareness campaigns regarding utilization of various types of liquid biopsy tests for early cancer detection.

According to the latest market analysis, growing awareness about prenatal screening and early cancer detection among the population is estimated to positively impact the liquid biopsy market outlook in Europe in the next few years.

Governments across Europe are taking initiatives to boost cancer screening along with various other pathology tests. In March 2022, the U.K. National health Service offered liquid biopsy tests to some cancer patients for complementing anatomic pathology testing with an effort of diagnosing 75% of all kinds of cancer at stage I or stage II by 2028. Moreover, as per the data by published by MDPI in 2022, close to 6,560 patients benefit from liquid biopsy tests every year.

Leading companies are following the latest liquid biopsy market trends and focusing on research and development initiatives, strategic collaborations, and the commercialization of advanced liquid biopsy technologies. Key players are engaged in organic as well as inorganic modes of expansion to strengthen their global presence. Biocept, Inc., MDxHealth, Myriad Genetics, Inc., Bio-Rad Laboratories, QIAGEN, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Inc., Genomic Health, Inc., and Illumina, Inc. are a few prominent entities operating in the global market.

Key players in the liquid biopsy market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 3.7 Bn |

| Forecast (Value) in 2031 | US$ 7.7 Bn |

| Growth Rate (CAGR) | 8.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available Upon Request |

| Pricing | Available Upon Request |

The global market was valued at US$ 3.7 Bn in 2022

It is projected to grow at a CAGR of 8.8% from 2023 to 2031

Rise in demand for non-invasive pre-natal tests and increase in investments in clinical trials

In terms of end-user, the hospitals segment held largest share in 2022

North America is estimated to dominate in the next few years

Biocept, Inc., MDxHealth, Myriad Genetics, Inc., Bio-Rad Laboratories, QIAGEN, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Inc., Genomic Health, Inc., and Illumina, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Technological Overview Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Regulatory Framework

5.10. Global Liquid Biopsy Market Analysis and Forecast, - 2017–2031

5.10.1. Market Value Projections (US$ Mn)

6. Global Liquid Biopsy Market Analysis and Forecast, by Application

6.1. Liquid Biopsy Market Size (US$ Mn) Forecast, by Application, 2017–2031

6.1.1. Oncology

6.1.2. NIPT

6.1.3. Transplant Diagnostics

6.1.4. Others

6.2. Incremental Opportunity, by Application

7. Global Liquid Biopsy Market Analysis and Forecast, by Circulating Biomarker

7.1. Liquid Biopsy Market Size (US$ Mn) Forecast, by Circulating Biomarker, 2017–2031

7.1.1. Circulating Tumor Cells (CTC)

7.1.2. Free Nucleic Acid

7.1.3. Exracellular Vesicles/Exosomes

7.2. Incremental Opportunity, by Circulating Biomarker

8. Global Liquid Biopsy Market Analysis and Forecast, by End-user

8.1. Liquid Biopsy Market Size (US$ Mn) Forecast, End-user, 2017–2031

8.1.1. Hospitals

8.1.2. Reference Laboratories

8.1.3. Academic and Research Institutes

8.1.4. Others

8.2. Incremental Opportunity, by End-user

9. Global Liquid Biopsy Market Analysis and Forecast, by Region

9.1. Liquid Biopsy Market Size (US$ Mn) Forecast, by Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Liquid Biopsy Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Brand Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Price

10.4. Key Trends Analysis

10.4.1. Demand Side

10.4.2. Supplier Side

10.5. Liquid Biopsy Market Size (US$ Mn) Forecast, by Application, 2017–2031

10.5.1. Oncology

10.5.2. NIPT

10.5.3. Transplant Diagnostics

10.5.4. Others

10.6. Liquid Biopsy Market Size (US$ Mn) Forecast, by Circulating Biomarker, 2017–2031

10.6.1. Circulating Tumor Cells (CTC)

10.6.2. Free Nucleic Acid

10.6.3. Exracellular Vesicles/Exosomes

10.7. Liquid Biopsy Market Size (US$ Mn) Forecast, End-user - 2017–2031

10.7.1. Hospitals

10.7.2. Reference Laboratories

10.7.3. Academic and Research Institutes

10.7.4. Others

10.8. Liquid Biopsy Market Size (US$ Mn) Forecast, by Country - 2017–2031

10.8.1. U.S.

10.8.2. Canada

10.8.3. Rest of North America

10.9. Incremental Opportunity Analysis

11. Europe Liquid Biopsy Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Brand Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supplier Side

11.5. Liquid Biopsy Market Size (US$ Mn) Forecast, by Application, 2017–2031

11.5.1. Oncology

11.5.2. NIPT

11.5.3. Transplant Diagnostics

11.5.4. Others

11.6. Liquid Biopsy Market Size (US$ Mn) Forecast, by Circulating Biomarker, 2017–2031

11.6.1. Circulating Tumor Cells (CTC)

11.6.2. Free Nucleic Acid

11.6.3. Exracellular Vesicles/Exosomes

11.7. Liquid Biopsy Market Size (US$ Mn) Forecast, End-user, 2017–2031

11.7.1. Hospitals

11.7.2. Reference Laboratories

11.7.3. Academic and Research Institutes

11.7.4. Others

11.8. Liquid Biopsy Market Size (US$ Mn) Forecast, by Country, 2017–2031

11.8.1. U.K.

11.8.2. Germany

11.8.3. France

11.8.4. Rest of Europe

11.9. Incremental Opportunity Analysis

12. Asia Pacific Liquid Biopsy Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supplier Side

12.5. Liquid Biopsy Market Size (US$ Mn) Forecast, by Application, 2017–2031

12.5.1. Oncology

12.5.2. NIPT

12.5.3. Transplant Diagnostics

12.5.4. Others

12.6. Liquid Biopsy Market Size (US$ Mn) Forecast, by Circulating Biomarker, 2017–2031

12.6.1. Circulating Tumor Cells (CTC)

12.6.2. Free Nucleic Acid

12.6.3. Exracellular Vesicles/Exosomes

12.7. Liquid Biopsy Market Size (US$ Mn) Forecast, End-user, 2017–2031

12.7.1. Hospitals

12.7.2. Reference Laboratories

12.7.3. Academic and Research Institutes

12.7.4. Others

12.8. Liquid Biopsy Market Size (US$ Mn) Forecast, by Country, 2017–2031

12.8.1. India

12.8.2. China

12.8.3. Japan

12.8.4. Rest of Asia Pacific

12.9. Incremental Opportunity Analysis

13. Middle East & South Africa Liquid Biopsy Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supplier Side

13.5. Liquid Biopsy Market Size (US$ Mn) Forecast, by Application, 2017–2031

13.5.1. Oncology

13.5.2. NIPT

13.5.3. Transplant Diagnostics

13.5.4. Others

13.6. Liquid Biopsy Market Size (US$ Mn) Forecast, by Circulating Biomarker, 2017–2031

13.6.1. Circulating Tumor Cells (CTC)

13.6.2. Free Nucleic Acid

13.6.3. Exracellular Vesicles/Exosomes

13.7. Liquid Biopsy Market Size (US$ Mn) Forecast, End-user, 2017–2031

13.7.1. Hospitals

13.7.2. Reference Laboratories

13.7.3. Academic and Research Institutes

13.7.4. Others

13.8. Liquid Biopsy Market Size (US$ Mn) Forecast, by Country, 2017–2031

13.8.1. GCC

13.8.2. Rest of Middle East & Africa

13.9. Incremental Opportunity Analysis

14. South America Liquid Biopsy Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supplier Side

14.5. Liquid Biopsy Market Size (US$ Mn) Forecast, by Application, 2017–2031

14.5.1. Oncology

14.5.2. NIPT

14.5.3. Transplant Diagnostics

14.5.4. Others

14.6. Liquid Biopsy Market Size (US$ Mn) Forecast, by Circulating Biomarker, 2017–2031

14.6.1. Circulating Tumor Cells (CTC)

14.6.2. Free Nucleic Acid

14.6.3. Exracellular Vesicles/Exosomes

14.7. Liquid Biopsy Market Size (US$ Mn) Forecast, End-user, 2017–2031

14.7.1. Hospitals

14.7.2. Reference Laboratories

14.7.3. Academic and Research Institutes

14.7.4. Others

14.8. Liquid Biopsy Market Size (US$ Mn) Forecast, by Country, 2017–2031

14.8.1. Brazil

14.8.2. Rest of South America

14.9. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player - Competition Dashboard

15.2. Market Share Analysis (%), by Company, (2022)

15.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

15.3.1. Biocept, Inc.

15.3.1.1. Company Overview

15.3.1.2. Sales Area

15.3.1.3. Geographical Presence

15.3.1.4. Revenue

15.3.1.5. Strategy & Business Overview

15.3.2. MDxHealth

15.3.2.1. Company Overview

15.3.2.2. Sales Area

15.3.2.3. Geographical Presence

15.3.2.4. Revenue

15.3.2.5. Strategy & Business Overview

15.3.3. Myriad Genetics, Inc.

15.3.3.1. Company Overview

15.3.3.2. Sales Area

15.3.3.3. Geographical Presence

15.3.3.4. Revenue

15.3.3.5. Strategy & Business Overview

15.3.4. Bio-Rad Laboratories

15.3.4.1. Company Overview

15.3.4.2. Sales Area

15.3.4.3. Geographical Presence

15.3.4.4. Revenue

15.3.4.5. Strategy & Business Overview

15.3.5. QIAGEN

15.3.5.1. Company Overview

15.3.5.2. Sales Area

15.3.5.3. Geographical Presence

15.3.5.4. Revenue

15.3.5.5. Strategy & Business Overview

15.3.6. F. Hoffmann-La Roche Ltd.

15.3.6.1. Company Overview

15.3.6.2. Sales Area

15.3.6.3. Geographical Presence

15.3.6.4. Revenue

15.3.6.5. Strategy & Business Overview

15.3.7. Thermo Fisher Scientific, Inc.

15.3.7.1. Company Overview

15.3.7.2. Sales Area

15.3.7.3. Geographical Presence

15.3.7.4. Revenue

15.3.7.5. Strategy & Business Overview

15.3.8. Genomic Health, Inc.

15.3.8.1. Company Overview

15.3.8.2. Sales Area

15.3.8.3. Geographical Presence

15.3.8.4. Revenue

15.3.8.5. Strategy & Business Overview

15.3.9. Illumina, Inc.

15.3.9.1. Company Overview

15.3.9.2. Sales Area

15.3.9.3. Geographical Presence

15.3.9.4. Revenue

15.3.9.5. Strategy & Business Overview

15.3.10. Other Key Players

15.3.10.1. Company Overview

15.3.10.2. Sales Area

15.3.10.3. Geographical Presence

15.3.10.4. Revenue

15.3.10.5. Strategy & Business Overview

16. Go to Market Strategy

17. Identification of Potential Market Spaces

18. Prevailing Market Risks

19. Understanding Buying Process of Customers

20. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Liquid Biopsy Market Value (US$ Mn), by Application, 2017-2031

Table 2: Global Liquid Biopsy Market Value (US$ Mn), by Circulating Biomarker, 2017-2031

Table 3: Global Liquid Biopsy Market Value (US$ Mn), by End-user, 2017-2031

Table 4: Global Liquid Biopsy Market Value (US$ Mn), by Region, 2017-2031

Table 5: North America Liquid Biopsy Market Value (US$ Mn), by Application, 2017-2031

Table 6: North America Liquid Biopsy Market Value (US$ Mn), by Circulating Biomarker, 2017-2031

Table 7: North America Liquid Biopsy Market Value (US$ Mn), by End-user, 2017-2031

Table 8: North America Liquid Biopsy Market Value (US$ Mn), by Region, 2017-2031

Table 9: Europe Liquid Biopsy Market Value (US$ Mn), by Application, 2017-2031

Table 10: Europe Liquid Biopsy Market Value (US$ Mn), by Circulating Biomarker, 2017-2031

Table 11: Europe Liquid Biopsy Market Value (US$ Mn), by End-user, 2017-2031

Table 12: Europe Liquid Biopsy Market Value (US$ Mn), by Region, 2017-2031

Table 13: Asia Pacific Liquid Biopsy Market Value (US$ Mn), by Application, 2017-2031

Table 14: Asia Pacific Liquid Biopsy Market Value (US$ Mn), by Circulating Biomarker, 2017-2031

Table 15: Asia Pacific Liquid Biopsy Market Value (US$ Mn), by End-user, 2017-2031

Table 16: Asia Pacific Liquid Biopsy Market Value (US$ Mn), by Region, 2017-2031

Table 17: Middle East & Africa Liquid Biopsy Market Value (US$ Mn), by Application, 2017-2031

Table 18: Middle East & Africa Liquid Biopsy Market Value (US$ Mn), by Circulating Biomarker, 2017-2031

Table 19: Middle East & Africa Liquid Biopsy Market Value (US$ Mn), by End-user, 2017-2031

Table 20: Middle East & Africa Liquid Biopsy Market Value (US$ Mn), by Region, 2017-2031

Table 21: South America Liquid Biopsy Market Value (US$ Mn), by Application, 2017-2031

Table 22: South America Liquid Biopsy Market Value (US$ Mn), by Circulating Biomarker, 2017-2031

Table 23: South America Liquid Biopsy Market Value (US$ Mn), by End-user, 2017-2031

Table 24: South America Liquid Biopsy Market Value (US$ Mn), by Region, 2017-2031

List of Figures

Figure 1: Global Liquid Biopsy Market Value (US$ Mn), by Application, 2017-2031

Figure 2: Global Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 3: Global Liquid Biopsy Market Value (US$ Mn), by Circulating Biomarker, 2017-2031

Figure 4: Global Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Circulating Biomarker, 2023-2031

Figure 5: Global Liquid Biopsy Market Value (US$ Mn), by End-user, 2017-2031

Figure 6: Global Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2023-2031

Figure 7: Global Liquid Biopsy Market Value (US$ Mn), by Region, 2017-2031

Figure 8: Global Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 9: North America Liquid Biopsy Market Value (US$ Mn), by Application, 2017-2031

Figure 10: North America Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 11: North America Liquid Biopsy Market Value (US$ Mn), by Circulating Biomarker, 2017-2031

Figure 12: North America Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Circulating Biomarker, 2023-2031

Figure 13: North America Liquid Biopsy Market Value (US$ Mn), by End-user, 2017-2031

Figure 14: North America Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2023-2031

Figure 15: North America Liquid Biopsy Market Value (US$ Mn), by Region, 2017-2031

Figure 16: North America Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 17: Europe Liquid Biopsy Market Value (US$ Mn), by Application, 2017-2031

Figure 18: Europe Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 19: Europe Liquid Biopsy Market Value (US$ Mn), by Circulating Biomarker, 2017-2031

Figure 20: Europe Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Circulating Biomarker, 2023-2031

Figure 21: Europe Liquid Biopsy Market Value (US$ Mn), by End-user, 2017-2031

Figure 22: Europe Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2023-2031

Figure 23: Europe Liquid Biopsy Market Value (US$ Mn), by Region, 2017-2031

Figure 24: Europe Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 25: Asia Pacific Liquid Biopsy Market Value (US$ Mn), by Application, 2017-2031

Figure 26: Asia Pacific Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 27: Asia Pacific Liquid Biopsy Market Value (US$ Mn), by Circulating Biomarker, 2017-2031

Figure 28: Asia Pacific Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Circulating Biomarker, 2023-2031

Figure 29: Asia Pacific Liquid Biopsy Market Value (US$ Mn), by End-user, 2017-2031

Figure 30: Asia Pacific Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2023-2031

Figure 31: Asia Pacific Liquid Biopsy Market Value (US$ Mn), by Region, 2017-2031

Figure 32: Asia Pacific Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 33: Middle East & Africa Liquid Biopsy Market Value (US$ Mn), by Application, 2017-2031

Figure 34: Middle East & Africa Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 35: Middle East & Africa Liquid Biopsy Market Value (US$ Mn), by Circulating Biomarker, 2017-2031

Figure 36: Middle East & Africa Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Circulating Biomarker, 2023-2031

Figure 37: Middle East & Africa Liquid Biopsy Market Value (US$ Mn), by End-user, 2017-2031

Figure 38: Middle East & Africa Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2023-2031

Figure 39: Middle East & Africa Liquid Biopsy Market Value (US$ Mn), by Region, 2017-2031

Figure 40: Middle East & Africa Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 41: South America Liquid Biopsy Market Value (US$ Mn), by Application, 2017-2031

Figure 42: South America Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 43: South America Liquid Biopsy Market Value (US$ Mn), by Circulating Biomarker, 2017-2031

Figure 44: South America Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Circulating Biomarker, 2023-2031

Figure 45: South America Liquid Biopsy Market Value (US$ Mn), by End-user, 2017-2031

Figure 46: South America Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2023-2031

Figure 47: South America Liquid Biopsy Market Value (US$ Mn), by Region, 2017-2031

Figure 48: South America Liquid Biopsy Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031