Reports

Reports

Hydrogen peroxide is a transparent, odorless, colorless liquid, a strong oxidant and disinfectant that is known to possess a number of useful properties. The end-use applications include pulp & paper, textiles, water treatment, healthcare, electronics, food processing. Its fundamental applications encompass bleaching, sterilizing, oxidizing, and controlling pollution since it decomposes to water and oxygen and does not produce any toxic remnants.

Hydrogen peroxide can come in various concentration levels and grades including industrial, food, and pharmaceutical. Hydrogen peroxide can be produced in the other concentration levels and grades inclusive of industrial, food and pharmaceutical. The most popular uses pertain to paper pulp, textile bleaching, waste water treatment, and as an antiseptic or disinfectant in the medical industry

The growing popularity of environmentally-friendly chemicals is boosting the use of hydrogen peroxide in place of chlorine-containing chemicals as bleaching and disinfecting agents.

Also, water and wastewater treatment is expanding due to rapid industrialization and regulations laid down to waste release. Hydrogen peroxide is a powerful oxidizing agent, thus being suitable for the treatment of organic pollution in municipal and industrial effluents. The market also tends to move to on-site hydrogen peroxide producing technologies combined with the advanced oxidation processes (AOPs) to achieve superior treatment efficiency.

Hydrogen peroxide is a green chemical widely used as a bleaching agent, oxidizer, and antiseptic agent. It finds application in pulp and paper sector, textile bleaching, chemical sector, etc., but these days the greener property of hydrogen peroxide is used at an industrial scale, especially in green propulsion industry.

The latest application of hydrogen peroxide is usage in electronic and semiconductor industry and green propulsion and aerospace industry. Another application is medical device sterilization that utilizes the vaporized hydrogen peroxide (VHP) systems for cold sterilization of delicate equipment like endoscopes.

| Attributes | Details |

|---|---|

| Hydrogen Peroxide Market Drivers |

|

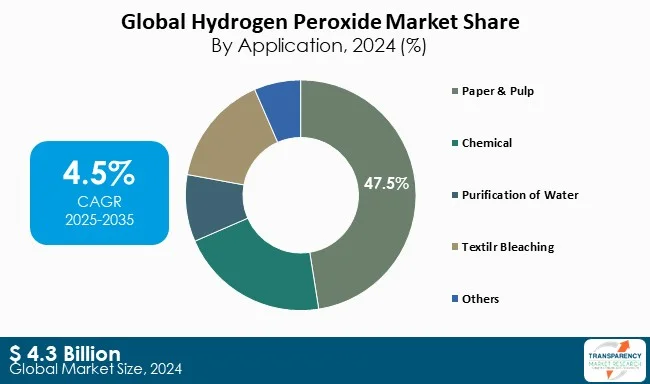

The paper and pulp industry leads the end-use segment as it uses hydrogen peroxide owing to its green properties. Hydrogen peroxide is devoid of toxic by-products like dioxins as seen in conventional chlorine-based bleaches and this renders it a good option in both - ECF and TCF bleaching processes. This adheres to the ever stricter environmental standards and sustainability objectives across world paper mills. Apart from its greener qualities, hydrogen peroxide provides a higher level of brightness than conventional bleaching chemicals.

In addition, the fact that recycled paper processing is not complete without hydrogen peroxide for de-inking and re-brightening papers can’t be ignored. The rapid expansion of e-Commerce has increased the need of high durable, quality, and eco-friendly packaging materials like paperboard and corrugated boxes. This has further increased the demand from paper and pulp industry.

The fact that hydrogen peroxide has green oxidation properties makes it widely utilized in most of the end-use industries in contrast with the other well-known bleaching agents including chlorine gas, chlorine dioxide, sodium hypochlorite, potassium permanganate, ozone, and peracetic acid that have been utilized in such processes for obtaining bleaching, disinfecting, or oxidation features.

Hydrogen peroxide provides a more viable option in oxidation owing to being clean, safe, and sustainable since it breaks down into water and oxygen without any hazardous or pervasive contaminants. Coupled with its flexibility and effectiveness in most industrial processes, this environmental benefit is seen to cause a similar trend of deterioration in the use of traditional oxidants in favor of hydrogen peroxide-based solutions. Its use is gaining momentum in industries like wastewater treatment, electronics factories, pulp, and paper companies to bleach pulp and food companies to sterilize their food.

With industries increasingly facing demands to meet circular economy objectives, climate change mitigation, and green chemistry principles, hydrogen peroxide is turning out to be the oxidant of preference all through an extensive set of industrial and commercial processes.

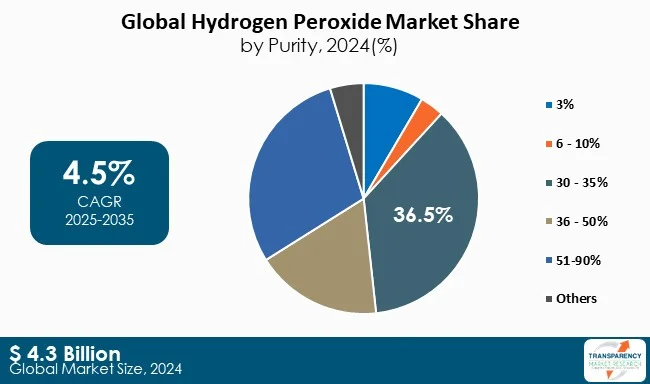

The major industries that use hydrogen peroxide are paper and pulp, textile, chemical, etc. In each of these industries 30 – 35% purity of hydrogen peroxide is used. This concentration provides an excellent compromise between efficiency and safety. It can thus be used in high volume applications in the pulp & paper industry in bleaching, in textile processing, chemical synthesis and wastewater treatment. It is also recommended in many disinfection and sterilization uses in healthcare and food factories.

Another attribute is the ease of transport and safety in handling. The 30-35% grade is widely accessible and reasonably priced for large-scale industrial applications. It may be diluted on-site for specific process needs, thereby allowing versatility across applications such as textile bleaching, wastewater treatment, and sterilization. With most of the industries moving toward the eco-friendly and higher performance oxidizing agents it is likely that the 30-35% purity grade of hydrogen peroxide will continue to dominate the market as it is highly compatible and dependable in such crucial functions.

The paper and pulp sector has been controlling the business as it has large production and consumption with greener and chlorine free reagents in the bleaching process. Packaging, printing, hygiene, and office supplies are some of the major users of paper. Hydrogen peroxide is also used in pulp and paper industry in high quantities due to the increased demand for recyclable/biodegradable products from the packaging vertical.

The traditional bleaching agents such as chlorine gas, chlorine dioxide, sodium hypochlorite, potassium permanganate, ozone, and peracetic acid will bring issues such as emission of some toxic gases and by-products (dioxins, furans and chlorinated organics) that are harmful to the human health and the environment. Also, the increasing needs in packaging and sustainable paper products supported by e-Commerce and environmentally-friendly consumer attitude encourage the increase in pulp production in the world.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific |

The growing demand for packaging, tissue paper, and recycled paper fuels large-scale consumption of hydrogen peroxide for bleaching and de-inking processes. The region offers low production costs, abundant raw materials, and government support for chemical and industrial manufacturing. The growth of the other end-use industries like textile, Electronics & Semiconductors is also promoting the dominance.

Hydrogen Peroxide Market: Key Players

The worldwide hydrogen peroxide market is a dynamic and moderately fragmented market with various major players competing regionally with varying levels of specialization and technological capability.

Evonik Industries, Solvay S.A, BASF SE, Arkema Inc., and Mitsubishi Gas Chemicals dominate the market with a diverse portfolio of different grades of hydrogen peroxide. The players like Nouryon, Gujarat Alkalies & Chemicals Limited, Kingboard Chemical Holdings Ltd., and Kemira Oyj are also contributing to the growth of hydrogen peroxide market.

| Attribute | Details |

| Market Size Value in 2024 | US$ 4.3 Bn |

| Market Forecast Value in 2035 | US$ 7.0 Bn |

| Growth Rate (CAGR) | 4.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Tons For Volume and US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Purity

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 4.3 Bn in 2024.

The market is expected to grow at a CAGR of 4.5% from 2025 to 2035.

Rising demand from paper & pulp industry & shift toward eco‑friendly oxidants.

Paper and pulp held the largest share under application segment in 2024.

Asia Pacific was the most lucrative region of the Hydrogen Peroxide market in 2024.

Evonik Industries, Solvay S.A., Arkema Inc., Nouryon, Gujarat Alkalies & Chemicals Limited , Kingboard Chemical Holdings Ltd., Mitsubishi Gas Chemical, BASF SE, Kemira Oyj, Chemplast Sanmar, and Hawkins, Inc.

Table 1 Global Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 2 Global Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 3 Global Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 4 Global Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 5 Global Hydrogen Peroxide Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 6 Global Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 7 North America Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 8 North America Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 9 North America Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 10 North America Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 11 North America Hydrogen Peroxide Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 12 North America Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 13 USA Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 14 USA Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 15 USA Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 16 USA Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 17 Canada Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 18 Canada Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 19 Canada Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 20 Canada Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 Europe Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 22 Europe Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 23 Europe Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 24 Europe Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 25 Europe Hydrogen Peroxide Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 26 Europe Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 27 Germany Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 28 Germany Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 29 Germany Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 30 Germany Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 31 France Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 32 France Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 33 France Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 34 France Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 35 UK Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 36 UK Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 37 UK Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 38 UK Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 39 Italy Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 40 Italy Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 41 Italy Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 42 Italy Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 Spain Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 44 Spain Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 45 Spain Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 46 Spain Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 47 Russia & CIS Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 48 Russia & CIS Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 49 Russia & CIS Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 50 Russia & CIS Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 51 Rest of Europe Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 52 Rest of Europe Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 53 Rest of Europe Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 54 Rest of Europe Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 55 Rest of Europe Hydrogen Peroxide Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 56 Rest of Europe Hydrogen Peroxide Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 57 Asia Pacific Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 58 Asia Pacific Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 59 Asia Pacific Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 60 Asia Pacific Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 61 Asia Pacific Hydrogen Peroxide Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 62 Asia Pacific Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 63 China Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 64 China Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity 2020 to 2035

Table 65 China Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 66 China Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 67 Japan Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 68 Japan Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 69 Japan Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 70 Japan Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 71 India Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 72 India Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 73 India Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 74 India Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 75 ASEAN Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 76 ASEAN Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 77 ASEAN Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 78 ASEAN Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 79 Rest of Asia Pacific Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 80 Rest of Asia Pacific Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 81 Rest of Asia Pacific Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 82 Rest of Asia Pacific Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 83 Latin America Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 84 Latin America Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 85 Latin America Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 86 Latin America Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 87 Latin America Hydrogen Peroxide Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 88 Latin America Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 89 Brazil Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 90 Brazil Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 91 Brazil Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 92 Brazil Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93 Mexico Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 94 Mexico Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 95 Mexico Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 96 Mexico Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 97 Rest of Latin America Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 98 Rest of Latin America Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 99 Rest of Latin America Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 100 Rest of Latin America Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 101 Middle East & Africa Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 102 Middle East & Africa Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 103 Middle East & Africa Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 104 Middle East & Africa Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105 Middle East & Africa Hydrogen Peroxide Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 106 Middle East & Africa Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 107 GCC Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 108 GCC Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 109 GCC Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 110 GCC Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 111 South Africa Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 112 South Africa Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 113 South Africa Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 114 South Africa Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 115 Rest of Middle East & Africa Hydrogen Peroxide Market Volume (Tons) Forecast, by Purity, 2020 to 2035

Table 116 Rest of Middle East & Africa Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Purity, 2020 to 2035

Table 117 Rest of Middle East & Africa Hydrogen Peroxide Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 118 Rest of Middle East & Africa Hydrogen Peroxide Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Figure 1 Global Hydrogen Peroxide Market Volume Share Analysis, by Purity, 2024, 2027, and 2035

Figure 2 Global Hydrogen Peroxide Market Attractiveness, by Purity

Figure 3 Global Hydrogen Peroxide Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 4 Global Hydrogen Peroxide Market Attractiveness, by Application

Figure 5 Global Hydrogen Peroxide Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 6 Global Hydrogen Peroxide Market Attractiveness, by Region

Figure 7 North America Hydrogen Peroxide Market Volume Share Analysis, by Purity, 2024, 2027, and 2035

Figure 8 North America Hydrogen Peroxide Market Attractiveness, by Purity

Figure 9 North America Hydrogen Peroxide Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 10 North America Hydrogen Peroxide Market Attractiveness, by Application

Figure 11 North America Hydrogen Peroxide Market Attractiveness, by Country and Sub-region

Figure 12 Europe Hydrogen Peroxide Market Volume Share Analysis, by Purity, 2024, 2027, and 2035

Figure 13 Europe Hydrogen Peroxide Market Attractiveness, by Purity

Figure 14 Europe Hydrogen Peroxide Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 15 Europe Hydrogen Peroxide Market Attractiveness, by Application

Figure 16 Europe Hydrogen Peroxide Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 17 Europe Hydrogen Peroxide Market Attractiveness, by Country and Sub-region

Figure 18 Asia Pacific Hydrogen Peroxide Market Volume Share Analysis, by Purity, 2024, 2027, and 2035

Figure 19 Asia Pacific Hydrogen Peroxide Market Attractiveness, by Purity

Figure 20 Asia Pacific Hydrogen Peroxide Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 21 Asia Pacific Hydrogen Peroxide Market Attractiveness, by Application

Figure 22 Asia Pacific Hydrogen Peroxide Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 23 Asia Pacific Hydrogen Peroxide Market Attractiveness, by Country and Sub-region

Figure 24 Latin America Hydrogen Peroxide Market Volume Share Analysis, by Purity, 2024, 2027, and 2035

Figure 25 Latin America Hydrogen Peroxide Market Attractiveness, by Purity

Figure 26 Latin America Hydrogen Peroxide Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 27 Latin America Hydrogen Peroxide Market Attractiveness, by Application

Figure 28 Latin America Hydrogen Peroxide Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 29 Latin America Hydrogen Peroxide Market Attractiveness, by Country and Sub-region

Figure 30 Middle East & Africa Hydrogen Peroxide Market Volume Share Analysis, by Purity, 2024, 2027, and 2035

Figure 31 Middle East & Africa Hydrogen Peroxide Market Attractiveness, by Purity

Figure 32 Middle East & Africa Hydrogen Peroxide Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 33 Middle East & Africa Hydrogen Peroxide Market Attractiveness, by Application

Figure 34 Middle East & Africa Hydrogen Peroxide Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 35 Middle East & Africa Hydrogen Peroxide Market Attractiveness, by Country and Sub-region