Reports

Reports

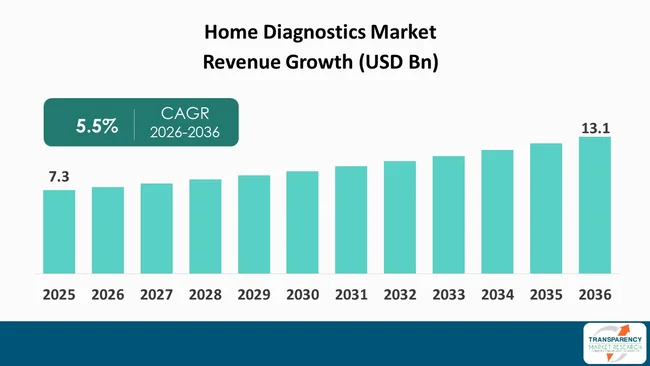

The global home diagnostics market size was valued at US$ 7.3 Bn in 2025 and is projected to reach US$ 13.1 Bn by 2036, expanding at a CAGR of 5.5% from 2026 to 2036. The market growth is driven by an increasing demand for rapid infectious disease screening and technological advancements improving sensitivity and multiplexing.

The home diagnostics market is growing as consumers and providers transition to decentralized care. Rising chronic disease rates, increased insurance acceptance of remote monitoring, and consumer demand for seamless and convenient care are leading to this growth. Established medical-device companies and nimble start-ups alike are accelerating product diversity and usability through innovative product and technology development - from continuous glucose monitors to rapid tests for infection - and advancing the market toward app-connected and integrated ecosystems.

The regulatory landscape for some point-of-care devices and clarity for reimbursement pathways in developed markets has enabled investment and new market entry, while partnership efforts between device manufacturers and telehealth platforms have increased adoption. Competitive activity - e.g. product launches, M&A, and distribution partnerships - is refining price points and channel reach, benefiting mid- and long-tail segments.

The market witnesses expansion as key market drivers emerge ranging from technological miniaturization, more precise sensors, and patient engagement through software. Reduced component costs and highly scalable mass-manufacturing have created both - single-use and low-cost multiplex tests to compete for reimbursement in the commercial market.

Health-system pressures (clinician shortages and requests to significantly reduce outpatient visits) create a consistent pull for alternatives at-home testing. Channel evolution (retail, e-commerce, pharmacy clinics) to reduce time-to-patient encounters, and ultimately allow for impulsive and prescription flows.

Data interoperability and remote monitoring platforms create continuity of care and less resistance from clinicians to accept at-home testing. Investments in user-centered design reduces errors and encourages repeat purchase behavior. Lastly, the expanded availability of at-home tests mobile phone penetration and distributed logistics in emerging markets is expanding the consumer base beyond urban and suburban communities. When all of these forces combine, diagnostic testing is evolving for episodic to continuous/periodic use cases, and enabling some recurring revenue streams along with complementary digital services.

| Attribute | Detail |

|---|---|

| Home Diagnostics Market Drivers |

|

Chronic illnesses - particularly diabetes, cardiovascular disease, and chronic respiratory disease - are the primary drivers for home diagnostics. When older people are diagnosed with diabetes, cardiovascular disease or chronic respiratory disease, their deficit of mobility increasingly demands regular and rapid measurement. Healthcare providers are usually happy to receive data para clinical visits to titrate therapy with avoidance or disasters and complications, thereby decreasing the burden of health care system visits.

In other words, testing at home empowers greater autonomy of self-testing, remote clinical supervision (e.g., a glucose meter), and ongoing assessment related to therapy. This repeated user behavior (weekly or daily testing) establishes a continuous demand for the consumables (e.g., strips, sensors).

Payers and health systems are also beginning to see the benefits of early detection combined with tighter management efforts to cause costly hospitalizations that also incentivizes programs designed to provide or reimburse for home measurement. Chronic conditions are becoming near-ubiquitous in populations over 65. Geriatric care pathways have modified recently to encourage home measurement and living at home longer therefore suggesting continued and evolving need for home diagnostics in an absence of mobility in some patients.

Technological advancements such as advanced battery life, low-cost wireless modules, smarter algorithms, and app-based user experiences have significantly reduced barriers to regular home testing. Novel UX reduces user error and instills confidence. Backend analytics provide clinical value by flagging clinical trends and provider alerts.

Additionally, distribution innovations (retailer partnerships, pharmacy point-of-sale, and direct-to-consumer e-commerce) shorten the timeline from awareness to purchase and facilitate subscription or replenishment models for consumables.

Furthermore, these improvements turn first-time purchasers into repeat buyers, and allow for bundling a service (device + coaching) thus lengthening the valued lifetime of an asset. The combination of integration of telehealth, and easier mobile onboarding, has also increased large adoption spikes with app-connected where patients can quickly share results and make the test actionable not just informational.

The end result is a faster trial-to-adoption curve realized by the company through improving retention through digital services and improved economic viability for those developing home diagnostics.

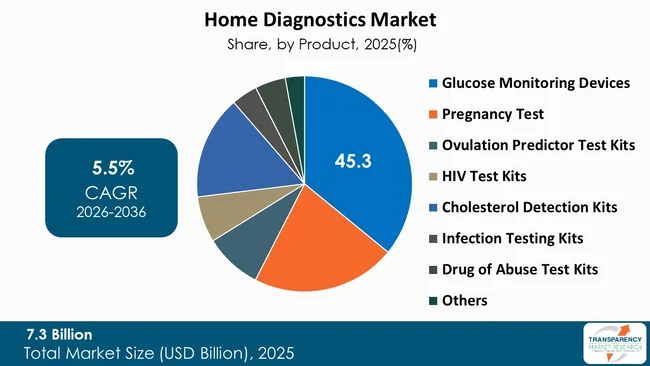

The glucose monitoring segment with 45.3% share remains the largest and most established segment of home diagnostics due to consistent, clinically needed patterns of use, and established clinical workflows. Patients with diabetes are frequently required to monitor their glucose levels to make dosing, diet, and lifestyle decisions; as a result of ongoing need for hardware (i.e. meters and continuous glucose monitors) and consumables (i.e. test strips and sensors).

From fingerstick meters to a nearly painless, continuous glucose monitor with a smartphone dashboard, device evolution has expanded consumer appeal and clinical acceptance, as well as allowing remote titration and telemedicine to be utilized in glucose monitoring.

The consumable nature of strip and sensor purchases provide consistent revenue streams to further support investment for better products and improved levels of patient support programs. For example, the introduction of continuous glucose monitoring to type-1 and insulin-treated type-2 diabetes patients has generated higher averages of device engagement per patient, and, facilitated lower clinical visits, demonstrating to payers benefits of continuous glucose monitoring for their insured populations. Strong clinical evidence, payer programs in many market, and clear utility in daily life keep glucose monitoring at the high end of the home diagnostics spectrum.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America leads the home diagnostics market, capturing an estimated 44.5% share of global activity. High healthcare spending, mature reimbursement frameworks, strong telehealth uptake and supportive regulatory environment for certain point of care technologies make North America the country where home diagnostics are most commonly used. High disease prevalence for chronic conditions is a key advantage of the U.S. market, which also has wide distribution networks through retail pharmacy chains, mail-order, and specialty suppliers, as well as rapid adoption of digital-health by consumers and providers alike.

Private payers and Medicare programs are now supporting some home-based diagnostic and remote-monitoring services, which have been increasingly integrated into clinical pathways and resulting in lower patient out-of-pocket expenses. Additionally, in the U.S, there are many device innovators and contract manufacturers who can speed up product introductions & scaling. The prevalence of diabetes in the United States, with millions of adults required for regular glucose monitoring, maintains a significant demand for glucose devices and consumables, which propels nearby category development, such as self-diagnosing of blood sugar levels and cholesterol.

The structural advantages of financing, distribution, clinician acceptance, and tech ecosystem have contributed to North America's leading position in the home diagnostics market.

Companies operating in the home diagnostics market focus on forging strategic collaborations, innovating their products, and validating the performance of their products across various clinical settings. These firms invest significantly in R&D pertaining to cutting-edge microfluidic and non-invasive techniques, widen their distribution channels, and provide integrated service solutions to have a strong market presence and a high customer loyalty.

Zeotis Inc., BTNX, Inc., Becton Dickinson & Company, ACON Laboratories, Inc., ARKRAY Inc., Roche Holding AG, Assure Tech, SA Scientific, Zeotis Inc., Bionime Corporation, Quidel Corporation, Trinity Biotech Plc, Abbott and others are some of the leading players operating in the global home diagnostics market.

Each of these players has been profiled in the home diagnostics market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$ 7.3 Bn |

| Forecast Value in 2036 | US$ 13.1 Bn |

| CAGR | 5.5% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2024 |

| Quantitative Units | US$ Bn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global home diagnostics market was valued at US$ 7.3 Bn in 2025

The global home diagnostics industry is projected to reach more than US$ 13.1 Bn by the end of 2036

Rising prevalence of chronic diseases and aging populations and advances in connectivity, UX, and distribution enabling consumer adoption

The CAGR is anticipated to be 5.5% from 2026 to 2036

Zeotis Inc., BTNX, Inc., Becton Dickinson & Company, ACON Laboratories, Inc., ARKRAY Inc., Roche Holding AG, Assure Tech, SA Scientific, Zeotis Inc., Bionime Corporation, Quidel Corporation, Trinity Biotech Plc, Abbott, and Others

Table 01: Global Home Diagnostics Market Value (US$ Bn) Forecast, by Product, 2021 to 2036

Table 02: Global Home Diagnostics Market Value (US$ Bn) Forecast, by Form, 2021 to 2036

Table 03: Global Home Diagnostics Market Value (US$ Bn) Forecast, by Distribution Channel, 2021 to 2036

Table 04: Global Home Diagnostics Market Value (US$ Bn) Forecast, by Region, 2021 to 2036

Table 05: North America Home Diagnostics Market Value (US$ Bn) Forecast, by Product, 2021 to 2036

Table 06: North America Home Diagnostics Market Value (US$ Bn) Forecast, by Form, 2021 to 2036

Table 07: North America Home Diagnostics Market Value (US$ Bn) Forecast, by Distribution Channel, 2021 to 2036

Table 08: North America Home Diagnostics Market Value (US$ Bn) Forecast, by Region, 2021 to 2036

Table 09: Europe Home Diagnostics Market Value (US$ Bn) Forecast, by Product, 2021 to 2036

Table 10: Europe Home Diagnostics Market Value (US$ Bn) Forecast, by Form, 2021 to 2036

Table 11: Europe Home Diagnostics Market Value (US$ Bn) Forecast, by Distribution Channel, 2021 to 2036

Table 12: Europe Home Diagnostics Market Value (US$ Bn) Forecast, by Region, 2021 to 2036

Table 13: Asia Pacific Home Diagnostics Market Value (US$ Bn) Forecast, by Product, 2021 to 2036

Table 14: Asia Pacific Home Diagnostics Market Value (US$ Bn) Forecast, by Form, 2021 to 2036

Table 15: Asia Pacific Home Diagnostics Market Value (US$ Bn) Forecast, by Distribution Channel, 2021 to 2036

Table 16: Asia Pacific Home Diagnostics Market Value (US$ Bn) Forecast, by Region, 2021 to 2036

Table 17: Latin America Home Diagnostics Market Value (US$ Bn) Forecast, by Product, 2021 to 2036

Table 18: Latin America Home Diagnostics Market Value (US$ Bn) Forecast, by Form, 2021 to 2036

Table 19: Latin America Home Diagnostics Market Value (US$ Bn) Forecast, by Distribution Channel, 2021 to 2036

Table 20: Latin America Home Diagnostics Market Value (US$ Bn) Forecast, by Region, 2021 to 2036

Table 21: Middle East and Africa Home Diagnostics Market Value (US$ Bn) Forecast, by Product, 2021 to 2036

Table 22: Middle East and Africa Home Diagnostics Market Value (US$ Bn) Forecast, by Form, 2021 to 2036

Table 23: Middle East and Africa Home Diagnostics Market Value (US$ Bn) Forecast, by Distribution Channel, 2021 to 2036

Table 24: Middle East and Africa Home Diagnostics Market Value (US$ Bn) Forecast, by Region, 2021 to 2036

Figure 01: Global Home Diagnostics Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 02: Global Home Diagnostics Market Value Share Analysis, by Product, 2025 and 2036

Figure 03: Global Home Diagnostics Market Attractiveness Analysis, by Product, 2026 to 2036

Figure 04: Global Home Diagnostics Market Revenue (US$ Bn), by Glucose Monitoring Devices, 2021 to 2036

Figure 05: Global Home Diagnostics Market Revenue (US$ Bn), by Pregnancy Test, 2021 to 2036

Figure 06: Global Home Diagnostics Market Revenue (US$ Bn), by Ovulation Predictor Test Kits, 2021 to 2036

Figure 07: Global Home Diagnostics Market Revenue (US$ Bn), by HIV Test Kits, 2021 to 2036

Figure 08: Global Home Diagnostics Market Revenue (US$ Bn), by Cholesterol Detection Kits, 2021 to 2036

Figure 09: Global Home Diagnostics Market Revenue (US$ Bn), by Infection Testing Kits, 2021 to 2036

Figure 10: Global Home Diagnostics Market Revenue (US$ Bn), by Drug of Abuse Test Kits, 2021 to 2036

Figure 11: Global Home Diagnostics Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 12: Global Home Diagnostics Market Value Share Analysis, by Form, 2025 and 2036

Figure 13: Global Home Diagnostics Market Attractiveness Analysis, by Form, 2026 to 2036

Figure 14: Global Home Diagnostics Market Revenue (US$ Bn), by Cassettes, 2021 to 2036

Figure 15: Global Home Diagnostics Market Revenue (US$ Bn), by Midstream, 2021 to 2036

Figure 16: Global Home Diagnostics Market Revenue (US$ Bn), by Instruments, 2021 to 2036

Figure 17: Global Home Diagnostics Market Revenue (US$ Bn), by Strips, 2021 to 2036

Figure 18: Global Home Diagnostics Market Revenue (US$ Bn), by Test, 2021 to 2036

Figure 19: Global Home Diagnostics Market Revenue (US$ Bn), by Digital Monitoring, 2021 to 2036

Figure 20: Global Home Diagnostics Market Revenue (US$ Bn), by Dip Cards, 2021 to 2036

Figure 21: Global Home Diagnostics Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 22: Global Home Diagnostics Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 23: Global Home Diagnostics Market Revenue (US$ Bn), by Hospital Pharmacies, 2021 to 2036

Figure 24: Global Home Diagnostics Market Revenue (US$ Bn), by Retail Pharmacies, 2021 to 2036

Figure 25: Global Home Diagnostics Market Revenue (US$ Bn), by Online Pharmacies, 2021 to 2036

Figure 26: Global Home Diagnostics Market Value Share Analysis, by Region, 2025 and 2036

Figure 27: Global Home Diagnostics Market Attractiveness Analysis, by Region, 2026 to 2036

Figure 28: North America Home Diagnostics Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 29: North America Home Diagnostics Market Value Share Analysis, by Product, 2025 and 2036

Figure 30: North America Home Diagnostics Market Attractiveness Analysis, by Product, 2026 to 2036

Figure 31: North America Home Diagnostics Market Value Share Analysis, by Form, 2025 and 2036

Figure 32: North America Home Diagnostics Market Attractiveness Analysis, by Form, 2026 to 2036

Figure 33: North America Home Diagnostics Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 34: North America Home Diagnostics Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 35: North America Home Diagnostics Market Value Share Analysis, by Region, 2025 and 2036

Figure 36: North America Home Diagnostics Market Attractiveness Analysis, by Region, 2026 to 2036

Figure 37: Europe Home Diagnostics Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 38: Europe Home Diagnostics Market Value Share Analysis, by Product, 2025 and 2036

Figure 39: Europe Home Diagnostics Market Attractiveness Analysis, by Product, 2026 to 2036

Figure 40: Europe Home Diagnostics Market Value Share Analysis, by Form, 2025 and 2036

Figure 41: Europe Home Diagnostics Market Attractiveness Analysis, by Form, 2026 to 2036

Figure 42: Europe Home Diagnostics Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 43: Europe Home Diagnostics Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 44: Europe Home Diagnostics Market Value Share Analysis, by Region, 2025 and 2036

Figure 45: Europe Home Diagnostics Market Attractiveness Analysis, by Region, 2026 to 2036

Figure 46: Asia Pacific Home Diagnostics Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 47: Asia Pacific Home Diagnostics Market Value Share Analysis, by Product, 2025 and 2036

Figure 48: Asia Pacific Home Diagnostics Market Attractiveness Analysis, by Product, 2026 to 2036

Figure 49: Asia Pacific Home Diagnostics Market Value Share Analysis, by Form, 2025 and 2036

Figure 50: Asia Pacific Home Diagnostics Market Attractiveness Analysis, by Form, 2026 to 2036

Figure 51: Asia Pacific Home Diagnostics Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 52: Asia Pacific Home Diagnostics Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 53: Asia Pacific Home Diagnostics Market Value Share Analysis, by Region, 2025 and 2036

Figure 54: Asia Pacific Home Diagnostics Market Attractiveness Analysis, by Region, 2026 to 2036

Figure 55: Latin America Home Diagnostics Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 56: Latin America Home Diagnostics Market Value Share Analysis, by Product, 2025 and 2036

Figure 57: Latin America Home Diagnostics Market Attractiveness Analysis, by Product, 2026 to 2036

Figure 58: Latin America Home Diagnostics Market Value Share Analysis, by Form, 2025 and 2036

Figure 59: Latin America Home Diagnostics Market Attractiveness Analysis, by Form, 2026 to 2036

Figure 60: Latin America Home Diagnostics Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 61: Latin America Home Diagnostics Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 62: Latin America Home Diagnostics Market Value Share Analysis, by Region, 2025 and 2036

Figure 63: Latin America Home Diagnostics Market Attractiveness Analysis, by Region, 2026 to 2036

Figure 64: Middle East and Africa Home Diagnostics Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 65: Middle East and Africa Home Diagnostics Market Value Share Analysis, by Product, 2025 and 2036

Figure 66: Middle East and Africa Home Diagnostics Market Attractiveness Analysis, by Product, 2026 to 2036

Figure 67: Middle East and Africa Home Diagnostics Market Value Share Analysis, by Form, 2025 and 2036

Figure 68: Middle East and Africa Home Diagnostics Market Attractiveness Analysis, by Form, 2026 to 2036

Figure 69: Middle East and Africa Home Diagnostics Market Value Share Analysis, by Distribution Channel, 2025 and 2036

Figure 70: Middle East and Africa Home Diagnostics Market Attractiveness Analysis, by Distribution Channel, 2026 to 2036

Figure 71: Middle East and Africa Home Diagnostics Market Value Share Analysis, by Region, 2025 and 2036

Figure 72: Middle East and Africa Home Diagnostics Market Attractiveness Analysis, by Region, 2026 to 2036