Reports

Reports

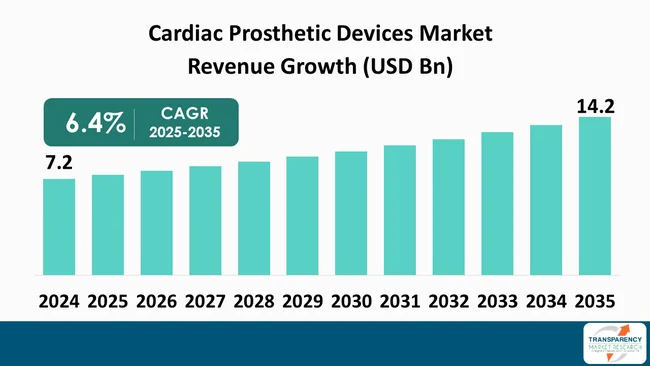

The global cardiac prosthetic devices market size was valued at US$ 7.2 Bn in 2024 and is projected to reach US$ 14.2 Bn by 2035, expanding at a CAGR of 6.4% from 2025 to 2035. The market growth is driven by increasing prevalence of cardiovascular diseases and innovations in digital health and remote monitoring.

The demand for cardiac prosthetic devices is increasing considerably towing to the rapid technological advancements that follow the increasing incidences of cardiovascular diseases across the globe. As an outcome of the increased aging population, the demand for effective treatments is rising, thereby leading to the innovations of prosthetic devices such as pacemakers, heart valves, and left ventricular assist devices (LVADs).

The major players in the market are committed to the improvement of device biocompatibility, improvement of patient outcomes, and reduction of complications by minimally invasive procedures. Besides, the adoption of digital health technologies, including remote monitoring and telehealth, is revolutionizing the management as well as follow-up of patients, which in turn, results in market growth.

In addition, the process of getting regulatory approvals along with clinical trials plays an important role in changing the market dynamics, as they provide efficacy and safety, thereby leading to a higher level of trust on the part of patients and physicians.

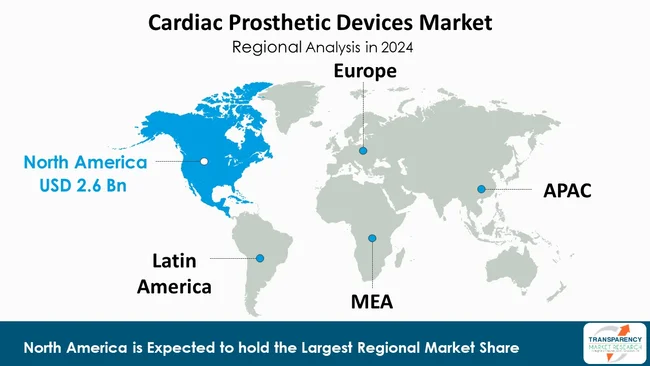

Analysis of geographical trends shows that North America has a considerable market share due to its high healthcare spending and advanced healthcare infrastructure. Asia-Pacific’s emerging markets, on the other hand, are expected to experience a visible growth due to the better access to cardiac care and growing healthcare awareness.

Cardiac prosthetic devices are medical implants that help or completely replace the heart structures that are damaged. These devices are the major key in the treatment of cardiovascular diseases. Devices include technologies like pacemakers, artificial heart valves, and left ventricular assist devices (LVADs). One of the functions of artificial heart valves is to replace the valves that are not functioning well or are dysfunctional to allow proper blood flow through the heart.

On the contrary, pacemakers are electro-medical devices that control heart rhythms, giving electrical stimulation for the maintenance of a normal heartbeat. LVADs are mechanical pumps that help the heart to circulate blood and are thus used in patients on the waiting list for heart transplants or those who are not suitable for surgery.

The improvement of cardiac prosthetic devices is driven by the use of advanced biomaterials in the field of engineering, thus resulting in better biocompatibility and lowered risk of complications. Additionally, the rising number of heart diseases as a result of factors such as aging population and lifestyle changes has increased the demand for such devices.

The use of innovation in minimally invasive surgical techniques has also made the cardiac prosthetic devices more accessible and efficient, thus enabling the patients to recover fast and have good health. The future of cardiac prosthetic devices is positive as the research activities are still going with the aim of improving the devices’ functionality and durability.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The cardiac prosthetic devices market is basically fueled by the rising incidences of cardiovascular diseases (CVDs), which are becoming a major concern. CVDs, as one of the major causes of death globally, do refer to a combination of diseases such as heart failure, coronary artery disease, and arrhythmias.

The main contributors to the diseases are unhealthy dietary habits, sedentary lifestyles, obesity, and smoking. The risk of cardiovascular problems tends to increase with age; thus, the demand for CVDs treatment options continues to soar as the population continues to age.

In most severe cases of CVDs, the use of cardiac prosthetic devices such as artificial heart valves, pacemakers, and left ventricular assist devices (LVADs) implantation becomes indispensable in managing the conditions and relieving the symptoms. Medical practitioners are increasingly using such devices as a solution not only to maximize the patient outcomes but also to elevate the standard of living of the individuals with chronic heart diseases.

Increase in community knowledge and early diagnosis of heart diseases propel the market to higher levels as well. The market for cardiac prosthetic devices is large and viable with the cardiac innovations and breakthroughs playing a critical role in satisfying the healthcare needs of the cardiovascular diseases patients as the global burden of cardiovascular diseases continues to rise.

The use of digital health innovation and remote monitoring to change the market for cardiac prosthetic device has been quite significant over time. As the integration of technology becomes pervasive in healthcare, it has become possible to create advanced monitoring systems that, in turn, improve patient management and follow-up care.

Remote monitoring devices trackers restrict heart conditions of patients in real-time and thus make timely interventions possible. This, therefore, implies that patients who have received implanted cardiac prosthetics, notably a pacemaker and left ventricular assist device (LVAD), are the most beneficiaries as they are assured of continuous device function and health monitoring.

On top of that, the innovations have the potential to influence patient outcomes positively through proactive management wherein patient engagement and adherence to treatment plans are also perfected. Patients can become recipients of alerts and notifications about their health status, thereby creating a rapport between them and their healthcare providers as they are empowered and involved in their care. Moreover, digital health solutions are always accompanied by analytics and AI features, which makes the future of personalized patient treatment based on individual data possible.

Healthcare systems looking forward to saving costs and providing efficient care are likely to increase the demand for remote monitoring solutions, which will be a plus to the cardiac prosthetic devices market. In essence, the relationship between digital health innovations and cardiac care is leading to better clinical outcomes as well as easing the healthcare journey for those suffering from cardiovascular diseases.

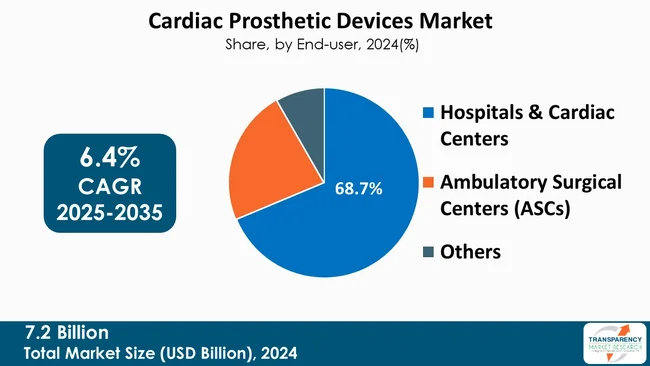

The hospitals and cardiac centers end-user segment represents the major contributor to the expansion of the market for cardiac prosthetic devices due to a number of compelling reasons. These facilities are outfitted with cutting-edge medical infrastructure and staffed with highly qualified personnel, which allows them to execute complicated cardiac operations successfully.

Being the main locations where cardiac surgeries and interventions are carried out, hospitals and cardiac centers are the highest potential customers of novel prosthetic devices such as artificial heart valves, pacemakers, and left ventricular assist devices (LVADs).

The intake of cardiovascular surgeries in these establishments, as a consequence, is the reason that the market has escalated besides the hospitals and cardiac centers. Due to the increasing rate of cardiovascular diseases, hospitals have to cope with more patients than before, which call for the deployment of advanced prosthetic devices in order to treat the illnesses effectively. Moreover, the existence of specialized cardiac care teams facilitates the adoption of innovative technologies, thereby increasing the need for state-of-the-art devices that can enhance patient recovery.

In addition, collaborations between hospitals and device manufacturers lead to an increase in research and development activities, which, in turn, result in the launching of more efficient and safer cardiac prosthetics. As healthcare systems keep on focusing on cardiovascular health, hospitals and cardiac centers will be the main sources of leveraging the implantation and expansion of cardiac prosthetic devices, thus, becoming the key players in this transitioning market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America is at the forefront of the cardiac prosthetic devices market, holding the largest revenue share of 35.6%, leading by example with an advanced healthcare system and elevated expenditure on healthcare. The region is home to ultramodern medical facilities that are well-equipped with the newest technological innovations, thus enabling the smooth implementation of novel cardiac prosthetics. What is more, the existence of top-tier manufacturers and a strong supply chain network is acting as a vehicle to increase not only the availability but also the accessibility of the devices.

In addition, the higher prevalence of cardiovascular diseases in North America, which is mainly attributed to lifestyle factors such as obesity, lack of physical activity, and the aging of the population, has resulted in a rising demand for cardiac interventions. Such an upsurge in the occurrence of cases calls for the use of state-of-the-art prosthetic devices, thus positioning the hospitals and cardiac centers at the forefront of the technology uptake.

The different regulatory frameworks in the region also contribute significantly to the flow of the market. For instance, the Food and Drug Administration has made it easier for the new devices to be approved by the regulatory agencies, thus taking a little time from the device’s innovation stage to its market launch.

Furthermore, the changing lifestyle, which has resulted in increased awareness of heart health, and the importance of early diagnosis and treatment, has made many patients to actively seek care. Thus, the demand for cardiac prosthetic devices is further elevated. All these factors combined, make North America the leading force behind the global market and with a positive prospect of growth sustained in the future.

Abbott Laboratories, Medtronic plc, Edwards Lifesciences Corporation, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, MicroPort Scientific Corporation, Lepu Medical Technology (Beijing) Co., Ltd, Shree Pacetronix Ltd., OSYPKA Medical GmbH, Medico S.p.A., Vitatron, Cook Medical, Meril are the key players governing the global Cardiac Prosthetic Devices Market.

Each of these players has been profiled in the cardiac prosthetic devices market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 7.2 Bn |

| Forecast Value in 2035 | More than US$ 14.2 Bn |

| CAGR | 6.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 7.2 Bn in 2024

It is projected to cross US$ 14.2 Bn by the end of 2035

Increasing prevalence of cardiovascular diseases and innovations in digital health and remote monitoring

It is anticipated to grow at a CAGR of 6.4% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Abbott Laboratories, Medtronic plc, Edwards Lifesciences Corporation, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, MicroPort Scientific Corporation, Lepu Medical Technology (Beijing) Co., Ltd, Shree Pacetronix Ltd., OSYPKA Medical GmbH, Medico S.p.A., Vitatron, Cook Medical, Meril, and others

Table 01: Global Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 02: Global Cardiac Prosthetic Devices Market Value (US$ Bn), by Valves, 2020 to 2035

Table 03: Global Cardiac Prosthetic Devices Market Value (US$ Bn), by Tissue Valve, 2020 to 2035

Table 04: Global Cardiac Prosthetic Devices Market Value (US$ Bn), by Pacemakers, 2020 to 2035

Table 05: Global Cardiac Prosthetic Devices Market Value (US$ Bn), by Implantable Pacemakers, 2020 to 2035

Table 06: Global Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 07: Global Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 08: North America Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 09: North America Cardiac Prosthetic Devices Market Value (US$ Bn), by Valves, 2020 to 2035

Table 10: North America Cardiac Prosthetic Devices Market Value (US$ Bn), by Tissue Valve, 2020 to 2035

Table 11: North America Cardiac Prosthetic Devices Market Value (US$ Bn), by Pacemakers, 2020 to 2035

Table 12: North America Cardiac Prosthetic Devices Market Value (US$ Bn), by Implantable Pacemakers, 2020 to 2035

Table 13: North America Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 14: North America Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 15: Europe Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 16: Europe Cardiac Prosthetic Devices Market Value (US$ Bn), by Valves, 2020 to 2035

Table 17: Europe Cardiac Prosthetic Devices Market Value (US$ Bn), by Tissue Valve, 2020 to 2035

Table 18: Europe Cardiac Prosthetic Devices Market Value (US$ Bn), by Pacemakers, 2020 to 2035

Table 19: Europe Cardiac Prosthetic Devices Market Value (US$ Bn), by Implantable Pacemakers, 2020 to 2035

Table 20: Europe Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 21: Europe Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 22: Asia Pacific Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 23: Asia Pacific Cardiac Prosthetic Devices Market Value (US$ Bn), by Valves, 2020 to 2035

Table 24: Asia Pacific Cardiac Prosthetic Devices Market Value (US$ Bn), by Tissue Valve, 2020 to 2035

Table 25: Asia Pacific Cardiac Prosthetic Devices Market Value (US$ Bn), by Pacemakers, 2020 to 2035

Table 26: Asia Pacific Cardiac Prosthetic Devices Market Value (US$ Bn), by Implantable Pacemakers, 2020 to 2035

Table 27: Asia Pacific Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 28: Asia Pacific Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 29: Latin America Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 30: Latin America Cardiac Prosthetic Devices Market Value (US$ Bn), by Valves, 2020 to 2035

Table 31: Latin America Cardiac Prosthetic Devices Market Value (US$ Bn), by Tissue Valve, 2020 to 2035

Table 32: Latin America Cardiac Prosthetic Devices Market Value (US$ Bn), by Pacemakers, 2020 to 2035

Table 33: Latin America Cardiac Prosthetic Devices Market Value (US$ Bn), by Implantable Pacemakers, 2020 to 2035

Table 34: Latin America Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 35: Latin America Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 36: Middle East and Africa Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 37: Middle East and Africa Cardiac Prosthetic Devices Market Value (US$ Bn), by Valves, 2020 to 2035

Table 38: Middle East and Africa Cardiac Prosthetic Devices Market Value (US$ Bn), by Tissue Valve, 2020 to 2035

Table 39: Middle East and Africa Cardiac Prosthetic Devices Market Value (US$ Bn), by Pacemakers, 2020 to 2035

Table 40: Middle East and Africa Cardiac Prosthetic Devices Market Value (US$ Bn), by Implantable Pacemakers, 2020 to 2035

Table 41: Middle East and Africa Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 42: Middle East and Africa Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Figure 01: Global Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Cardiac Prosthetic Devices Market Value Share Analysis, by Product , 2024 and 2035

Figure 03: Global Cardiac Prosthetic Devices Market Attractiveness Analysis, by Product , 2025 to 2035

Figure 04: Global Cardiac Prosthetic Devices Market Revenue (US$ Bn), by Valves, 2020 to 2035

Figure 05: Global Cardiac Prosthetic Devices Market Revenue (US$ Bn), by Pacemakers, 2020 to 2035

Figure 06: Global Cardiac Prosthetic Devices Market Value Share Analysis, by End-user, 2024 and 2035

Figure 07: Global Cardiac Prosthetic Devices Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 08: Global Cardiac Prosthetic Devices Market Revenue (US$ Bn), by Hospitals & Cardiac Centers, 2020 to 2035

Figure 09: Global Cardiac Prosthetic Devices Market Revenue (US$ Bn), by Ambulatory Surgical Centers (ASCs), 2020 to 2035

Figure 10: Global Cardiac Prosthetic Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 11: Global Cardiac Prosthetic Devices Market Value Share Analysis, by Region, 2024 and 2035

Figure 12: Global Cardiac Prosthetic Devices Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 13: North America Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 14: North America Cardiac Prosthetic Devices Market Value Share Analysis, by Product , 2024 and 2035

Figure 15: North America Cardiac Prosthetic Devices Market Attractiveness Analysis, by Product , 2025 to 2035

Figure 16: North America Cardiac Prosthetic Devices Market Value Share Analysis, by End-user, 2024 and 2035

Figure 17: North America Cardiac Prosthetic Devices Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 18: North America Cardiac Prosthetic Devices Market Value Share Analysis, by Region, 2024 and 2035

Figure 19: North America Cardiac Prosthetic Devices Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 20: Europe Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 21: Europe Cardiac Prosthetic Devices Market Value Share Analysis, by Product , 2024 and 2035

Figure 22: Europe Cardiac Prosthetic Devices Market Attractiveness Analysis, by Product , 2025 to 2035

Figure 23: Europe Cardiac Prosthetic Devices Market Value Share Analysis, by End-user, 2024 and 2035

Figure 24: Europe Cardiac Prosthetic Devices Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 25: Europe Cardiac Prosthetic Devices Market Value Share Analysis, by Region, 2024 and 2035

Figure 26: Europe Cardiac Prosthetic Devices Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 27: Asia Pacific Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: Asia Pacific Cardiac Prosthetic Devices Market Value Share Analysis, by Product , 2024 and 2035

Figure 29: Asia Pacific Cardiac Prosthetic Devices Market Attractiveness Analysis, by Product , 2025 to 2035

Figure 30: Asia Pacific Cardiac Prosthetic Devices Market Value Share Analysis, by End-user, 2024 and 2035

Figure 31: Asia Pacific Cardiac Prosthetic Devices Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 32: Asia Pacific Cardiac Prosthetic Devices Market Value Share Analysis, by Region, 2024 and 2035

Figure 33: Asia Pacific Cardiac Prosthetic Devices Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 34: Latin America Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 35: Latin America Cardiac Prosthetic Devices Market Value Share Analysis, by Product , 2024 and 2035

Figure 36: Latin America Cardiac Prosthetic Devices Market Attractiveness Analysis, by Product , 2025 to 2035

Figure 37: Latin America Cardiac Prosthetic Devices Market Value Share Analysis, by End-user, 2024 and 2035

Figure 38: Latin America Cardiac Prosthetic Devices Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 39: Latin America Cardiac Prosthetic Devices Market Value Share Analysis, by Region, 2024 and 2035

Figure 40: Latin America Cardiac Prosthetic Devices Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 41: Middle East and Africa Cardiac Prosthetic Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 42: Middle East and Africa Cardiac Prosthetic Devices Market Value Share Analysis, by Product , 2024 and 2035

Figure 43: Middle East and Africa Cardiac Prosthetic Devices Market Attractiveness Analysis, by Product , 2025 to 2035

Figure 44: Middle East and Africa Cardiac Prosthetic Devices Market Value Share Analysis, by End-user, 2024 and 2035

Figure 45: Middle East and Africa Cardiac Prosthetic Devices Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 46: Middle East and Africa Cardiac Prosthetic Devices Market Value Share Analysis, by Region, 2024 and 2035

Figure 47: Middle East and Africa Cardiac Prosthetic Devices Market Attractiveness Analysis, by Region, 2025 to 2035