Reports

Reports

Analyst Viewpoint

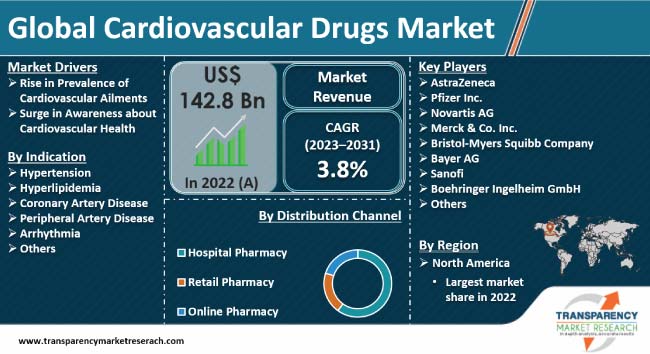

Changing dietary patterns and sedentary lifestyles have driven the incidence of cardiovascular diseases worldwide. Consequently, key cardiovascular drugs manufacturers are focusing on the development of various drugs with enhanced efficacy and lesser side-effects to enable timely treatment of cardiovascular diseases. This is estimated to drive the cardiovascular drugs market growth during the forecast period.

Rise in aging population, greater understanding about heart disease, and increase in R&D on the introduction of novel therapeutics are also fueling market progress. Moreover, rise in awareness programs about prevention and treatment of cardiovascular ailments is expected to propel the market in the next few years. However, stringent regulations on drug approval and entry are projected to hamper the future prospects of cardiovascular drugs market growth.

Significant rise in the number of patients with cardiovascular diseases is a matter of global concern. Various types of cardiovascular drugs are prescribed to treat conditions related to the cardiovascular system, which includes the heart and blood vessels. In December 2022, the American College of Cardiology stated that cardiovascular diseases accounted for 185 million disability-adjusted life years (DALYs) in 2021. Therefore, rise in need to combat cardiovascular ailments is expected to drive the cardiovascular drugs market during the forecast period.

Hypertension, if left undetected or untreated, significantly increases the risk of developing cardiovascular disease. High blood pressure accounts for about half of all heart disease- and stroke-related deaths worldwide. The WHO has set a goal to reduce prevalence of hypertension by 30%, globally, by the year 2030. Increase in research on the development of high efficacy blood pressure medications is expected to fuel the cardiovascular drugs market size in the coming years.

Frequent cardiovascular drug recalls are likely to hamper the cardiovascular drugs market outlook during the forecast period. For instance, in September 2022, the US FDA announced that Golden State Medical Supply (GSMS) would be recalling two common cardiovascular medications due to mixed-up labeling. They were atenolol to treat hypertension and clopidogrel to reduce risk of acute myocardial infarction (AMI).

Increase in availability of substitute treatments and products restrains the demand for cardiovascular pharmaceuticals. Moreover, high cost of treatment and medication is also anticipated to hamper the demand for heart strengthening medication.

As per the World Health Organization (WHO), 17.9 million individuals succumb to cardiovascular diseases every single year. It further states that 33% of these deaths are witnessed prematurely in those aged below 70. Consequently, companies in cardiovascular drugs are engaging in excessive research to introduce effective cardiovascular drugs, followed by frequent approvals by regulating authorities, which in turn is likely to positively influence the cardiovascular drugs market forecast in the next few years.

In August 2021, the US FDA approved Jardiance (empagliflozin) 10 mg for reducing risk of cardiovascular death. It is also prescribed for adults suffering from reduced ejection fraction (HFrEF). Additionally, in May 2022, Zydus Worldwide DMCC received a tentative approval from the US FDA for marketing Selexipag tablets used for treating pulmonary arterial hypertension (PAH) in adults. In February 2022, the US FDA approved Norliqva (amlodipine) oral solution to treat hypertension in adults and those aged 6 and above for lowering blood pressure. These blood pressure medications are expected to fuel the demand for heart disease medications in the next few years.

The need for these medications could be gauged from data released by the American College of Cardiology in December 2022, stating that almost 2,770 DALYs per 100K persons worldwide pertaining to cardiovascular diseases were an outcome of high blood pressure.

Heart strengthening medication encompasses intake of various advanced drugs to address diverse needs regarding treatment of cardiovascular diseases. Lipitor is amongst the highest-selling cardiovascular drugs. However, presently, awareness about this drug is low in developing countries till date. In June 2023, the Asia Pacific Cardiovascular Disease Alliance (APAC CVD Alliance) was formed with the objective of raising awareness about cardiovascular health at domestic as well as regional forums in Asia Pacific.

At the global level, The National Heart, Lung, and Blood Institute (NHLBI) organized a campaign, ‘The Heart Truth’, to boost awareness about heart disease and related risk factors amongst women worldwide. Therefore, surge in number of awareness campaigns is expected to drive cardiovascular drugs industry during the forecast period.

According to the latest cardiovascular drugs market analysis, North America accounted for the largest share of demand for cardiovascular drugs due to growing incidences of cardiovascular diseases in the U.S. According to the National Center for Biotechnology Information, 7.9 million and 9 million individuals in the U.S. have suffered from heart attacks and angina pectoris, respectively, till date, and the figure is expected to increase at a notable pace during the forecast period.

Various research & development activities are being by undertaken prominent pharmaceutical players to develop effective cardiovascular drugs. One such drug is Leqvio, developed by Novartis. It is the first and sole small interfering RNA (siRNA) therapy devised for lowering low-density lipoprotein cholesterol (LDL) with two doses/year after initial doses for the first three months. Such innovations in cardiovascular drug therapies are expected to boost North America’s cardiovascular drug market share during the forecast period.

As per the European Society of Cardiology, cardiovascular diseases account for 3.9 million fatalities in Europe every year. Measures to prevent these deaths and cure existing patients on time are expected to drive cardiovascular drugs market value in Europe during the forecast period. These measures include extensive research about pharmaceuticals related to cardiovascular ailments and upgrade of existing heart disease medications.

As per the National Institute of Health, cardiovascular diseases accounted for 35% of total fatalities in Asia in 2019. Increase in incidence of cardiovascular diseases in Asia Pacific due to rise in adoption of unhealthy lifestyle behaviors and surge in awareness campaigns about cardiac medication across developing economies in the region are anticipated to considerably boost the Asia Pacific cardiovascular drugs market in 2023.

As per the latest cardiovascular drugs market analysis, leading companies are following the latest market trends and focusing on the launch of generic drugs for heart failure, especially after expiry of patents of well-known drugs. Furthermore, key manufacturers are engaging in partnerships with research institutions to develop novel treatments and consolidate their position in the global market.

AstraZeneca, Pfizer Inc., Novartis AG, Merck & Co. Inc., Bristol-Myers Squibb Company, Bayer AG, Sanofi, Boehringer Ingelheim GmbH, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Gilead Sciences, Inc., Johnson & Johnson, Astellas Pharma, Inc., Eli Lilly and Company, Otsuka Holdings Co., Ltd., and Takeda Pharmaceuticals Company Ltd are a few prominent cardiovascular drugs market manufacturers operating across the globe.

Key players in the cardiovascular drugs market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 142.8 Bn |

| Forecast (Value) in 2031 | US$ 195.6 Bn |

| Growth Rate (CAGR) | 3.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Cardiovascular Drugs Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available Upon Request |

| Pricing | Available Upon Request |

The global market was valued at US$ 142.8 Bn in 2022

It is projected to expand at a CAGR of 3.8% from 2023 to 2031

Rise in prevalence of cardiovascular ailments and surge in awareness about cardiovascular health

In terms of distribution, the hospital pharmacy segment held largest share in 2022

North America is estimated to dominate in the next few years

AstraZeneca, Pfizer Inc., Novartis AG, Merck & Co. Inc., Bristol-Myers Squibb Company, Bayer AG, Sanofi, Boehringer Ingelheim GmbH, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Gilead Sciences, Inc., Johnson & Johnson, Astellas Pharma, Inc., Eli Lilly and Company, Otsuka Holdings Co., Ltd., and Takeda Pharmaceuticals Company Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cardiovascular Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cardiovascular Drugs Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Cardiovascular Drugs Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Drug Class, 2017–2031

6.3.1. Renin-Angiotensin System Blockers

6.3.1.1. ACE Inhibitors

6.3.1.2. Angiotensin Receptor Blockers

6.3.2. Beta Blockers

6.3.3. Diuretics

6.3.4. Anti-Clotting Agents

6.3.4.1. Anti-Coagulants

6.3.4.2. Platelet Aggregation Inhibitors

6.3.5. Antihyperlipidemics

6.3.6. Other Antihypertensive

6.3.7. Calcium Channel Blockers

6.3.8. Others

6.4. Market Attractiveness Analysis, by Drug Class

7. Global Cardiovascular Drugs Market Analysis and Forecast, by Indication

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Indication, 2017–2031

7.3.1. Hypertension

7.3.2. Hyperlipidemia

7.3.3. Coronary Artery Disease

7.3.4. Peripheral Artery Disease

7.3.5. Arrhythmia

7.3.6. Others

7.4. Market Attractiveness Analysis, by Indication

8. Global Cardiovascular Drugs Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Hospital Pharmacy

8.3.2. Retail Pharmacy

8.3.3. Online Pharmacy

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Cardiovascular Drugs Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Cardiovascular Drugs Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Drug Class, 2017–2031

10.3.1. Renin-Angiotensin System Blockers

10.3.1.1. ACE Inhibitors

10.3.1.2. Angiotensin Receptor Blockers

10.3.2. Beta Blockers

10.3.3. Diuretics

10.3.4. Anti-Clotting Agents

10.3.4.1. Anti-Coagulants

10.3.4.2. Platelet Aggregation Inhibitors

10.3.5. Antihyperlipidemics

10.3.6. Other Antihypertensive

10.3.7. Calcium Channel Blockers

10.3.8. Others

10.4. Market Value Forecast, by Indication, 2017–2031

10.4.1. Hypertension

10.4.2. Hyperlipidemia

10.4.3. Coronary Artery Disease

10.4.4. Peripheral Artery Disease

10.4.5. Arrhythmia

10.4.6. Others

10.5. Market Value Forecast, by Distribution Channel, 2017–2031

10.5.1. Hospital Pharmacy

10.5.2. Retail Pharmacy

10.5.3. Online Pharmacy

10.6. Market Value Forecast, by Country, 2017–2031

10.6.1. U.S.

10.6.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. By Drug Class

10.7.2. By Indication

10.7.3. By Distribution Channel

10.7.4. By Country

11. Europe Cardiovascular Drugs Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Drug Class, 2017–2031

11.3.1. Renin-Angiotensin System Blockers

11.3.1.1. ACE Inhibitors

11.3.1.2. Angiotensin Receptor Blockers

11.3.2. Beta Blockers

11.3.3. Diuretics

11.3.4. Anti-Clotting Agents

11.3.4.1. Anti-Coagulants

11.3.4.2. Platelet Aggregation Inhibitors

11.3.5. Antihyperlipidemics

11.3.6. Other Antihypertensive

11.3.7. Calcium Channel Blockers

11.3.8. Others

11.4. Market Value Forecast, by Indication, 2017–2031

11.4.1. Hypertension

11.4.2. Hyperlipidemia

11.4.3. Coronary Artery Disease

11.4.4. Peripheral Artery Disease

11.4.5. Arrhythmia

11.4.6. Others

11.5. Market Value Forecast, by Distribution Channel, 2017–2031

11.5.1. Hospital Pharmacy

11.5.2. Retail Pharmacy

11.5.3. Online Pharmacy

11.6. Market Value Forecast, by Country/Sub-region, 2017–2031

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Drug Class

11.7.2. By Indication

11.7.3. By Distribution Channel

11.7.4. By Country/Sub-region

12. Asia Pacific Cardiovascular Drugs Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Drug Class, 2017–2031

12.3.1. Renin-Angiotensin System Blockers

12.3.1.1. ACE Inhibitors

12.3.1.2. Angiotensin Receptor Blockers

12.3.2. Beta Blockers

12.3.3. Diuretics

12.3.4. Anti-Clotting Agents

12.3.4.1. Anti-Coagulants

12.3.4.2. Platelet Aggregation Inhibitors

12.3.5. Antihyperlipidemics

12.3.6. Other Antihypertensive

12.3.7. Calcium Channel Blockers

12.3.8. Others

12.4. Market Value Forecast, by Indication, 2017–2031

12.4.1. Hypertension

12.4.2. Hyperlipidemia

12.4.3. Coronary Artery Disease

12.4.4. Peripheral Artery Disease

12.4.5. Arrhythmia

12.4.6. Others

12.5. Market Value Forecast, by Distribution Channel, 2017–2031

12.5.1. Hospital Pharmacy

12.5.2. Retail Pharmacy

12.5.3. Online Pharmacy

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Drug Class

12.7.2. By Indication

12.7.3. By Distribution Channel

12.7.4. By Country/Sub-region

13. Latin America Cardiovascular Drugs Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Drug Class, 2017–2031

13.3.1. Renin-Angiotensin System Blockers

13.3.1.1. ACE Inhibitors

13.3.1.2. Angiotensin Receptor Blockers

13.3.2. Beta Blockers

13.3.3. Diuretics

13.3.4. Anti-Clotting Agents

13.3.4.1. Anti-Coagulants

13.3.4.2. Platelet Aggregation Inhibitors

13.3.5. Antihyperlipidemics

13.3.6. Other Antihypertensive

13.3.7. Calcium Channel Blockers

13.3.8. Others

13.4. Market Value Forecast, by Indication, 2017–2031

13.4.1.1. Hypertension

13.4.1.2. Hyperlipidemia

13.4.1.3. Coronary Artery Disease

13.4.1.4. Peripheral Artery Disease

13.4.1.5. Arrhythmia

13.4.1.6. Others

13.5. Market Value Forecast, by Distribution Channel, 2017–2031

13.5.1. Hospital Pharmacy

13.5.2. Retail Pharmacy

13.5.3. Online Pharmacy

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Drug Class

13.7.2. By Indication

13.7.3. By Distribution Channel

13.7.4. By Country/Sub-region

14. Middle East & Africa Cardiovascular Drugs Market Analysis and Forecast

14.1. Introduction

14.2. Key Findings

14.3. Market Value Forecast, by Drug Class, 2017–2031

14.3.1. Renin-Angiotensin System Blockers

14.3.1.1. ACE Inhibitors

14.3.1.2. Angiotensin Receptor Blockers

14.3.2. Beta Blockers

14.3.3. Diuretics

14.3.4. Anti-Clotting Agents

14.3.4.1. Anti-Coagulants

14.3.4.2. Platelet Aggregation Inhibitors

14.3.5. Antihyperlipidemics

14.3.6. Other Antihypertensive

14.3.7. Calcium Channel Blockers

14.3.8. Others

14.4. Market Value Forecast, by Indication, 2017–2031

14.4.1. Hypertension

14.4.2. Hyperlipidemia

14.4.3. Coronary Artery Disease

14.4.4. Peripheral Artery Disease

14.4.5. Arrhythmia

14.4.6. Others

14.5. Market Value Forecast, by Distribution Channel, 2017–2031

14.5.1. Hospital Pharmacy

14.5.2. Retail Pharmacy

14.5.3. Online Pharmacy

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. By Drug Class

14.7.2. By Indication

14.7.3. By Distribution Channel

14.7.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. AstraZeneca

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Pfizer Inc.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Novartis AG

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Merck & Co. Inc.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Bristol-Myers Squibb Company

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Bayer AG

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Sanofi

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Boehringer Ingelheim GmbH

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. F. Hoffmann-La Roche Ltd.

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Abbott Laboratories

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

15.3.11. Gilead Sciences, Inc.

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Financial Overview

15.3.11.5. Strategic Overview

15.3.12. Johnson & Johnson

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Financial Overview

15.3.12.5. Strategic Overview

15.3.13. Astellas Pharma, Inc.

15.3.13.1. Company Overview

15.3.13.2. Product Portfolio

15.3.13.3. SWOT Analysis

15.3.13.4. Financial Overview

15.3.13.5. Strategic Overview

15.3.14. Eli Lilly and Company

15.3.14.1. Company Overview

15.3.14.2. Product Portfolio

15.3.14.3. SWOT Analysis

15.3.14.4. Financial Overview

15.3.14.5. Strategic Overview

15.3.15. Otsuka Holdings Co., Ltd.

15.3.15.1. Company Overview

15.3.15.2. Product Portfolio

15.3.15.3. SWOT Analysis

15.3.15.4. Financial Overview

15.3.15.5. Strategic Overview

15.3.16. Takeda Pharmaceuticals Company Ltd.

15.3.16.1. Company Overview

15.3.16.2. Product Portfolio

15.3.16.3. SWOT Analysis

15.3.16.4. Financial Overview

15.3.16.5. Strategic Overview

List of Tables

Table 01: Global Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 02: Global Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 03: Global Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 07: North America Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 08: North America Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 11: Europe Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 12: Europe Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Asia Pacific Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 15: Asia Pacific Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 16: Asia Pacific Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 17: Latin America Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 19: Latin America Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 20: Latin America Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Middle East & Africa Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 23: Middle East & Africa Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Indication, 2017–2031

Table 24: Middle East & Africa Cardiovascular Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Cardiovascular Drugs Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Cardiovascular Drugs Market Revenue (US$ Mn), by Drug Class, 2022

Figure 03: Global Cardiovascular Drugs Market Value Share, by Drug Class, 2022

Figure 04: Global Cardiovascular Drugs Market Revenue (US$ Mn), by Indication, 2022

Figure 05: Global Cardiovascular Drugs Market Value Share, by Indication, 2022

Figure 06: Global Cardiovascular Drugs Market Revenue (US$ Mn), by Distribution Channel, 2022

Figure 07: Global Cardiovascular Drugs Market Value Share, by Distribution Channel, 2022

Figure 08: Global Cardiovascular Drugs Market Value Share, by Region, 2022

Figure 09: Global Cardiovascular Drugs Market Value (US$ Mn) Forecast, 2023–2031

Figure 10: Global Cardiovascular Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 11: Global Cardiovascular Drugs Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 12: Global Cardiovascular Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 13: Global Cardiovascular Drugs Market Attractiveness Analysis, by Indication, 2023-2031

Figure 14: Global Cardiovascular Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 15: Global Cardiovascular Drugs Market Attractiveness Analysis, by Distribution Channel, 2022-2031

Figure 16: Global Cardiovascular Drugs Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Cardiovascular Drugs Market Attractiveness Analysis, by Region, 2022-2031

Figure 18: North America Cardiovascular Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Cardiovascular Drugs Market Attractiveness Analysis, by Country, 2023–2031

Figure 20: North America Cardiovascular Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 21: North America Cardiovascular Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 22: North America Cardiovascular Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 23: North America Cardiovascular Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 24: North America Cardiovascular Drugs Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 25: North America Cardiovascular Drugs Market Attractiveness Analysis, by Indication, 2023–2031

Figure 26: North America Cardiovascular Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 27: Europe Cardiovascular Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Cardiovascular Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Europe Cardiovascular Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 30: Europe Cardiovascular Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 31: Europe Cardiovascular Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 32: Europe Cardiovascular Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 33: Europe Cardiovascular Drugs Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 34: Europe Cardiovascular Drugs Market Attractiveness Analysis, by Indication, 2023–2031

Figure 35: Europe Cardiovascular Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 36: Asia Pacific Cardiovascular Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Cardiovascular Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Asia Pacific Cardiovascular Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 39: Asia Pacific Cardiovascular Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 40: Asia Pacific Cardiovascular Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 41: Asia Pacific Cardiovascular Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 42: Asia Pacific Cardiovascular Drugs Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 43: Asia Pacific Cardiovascular Drugs Market Attractiveness Analysis, by Indication, 2023–2031

Figure 44: Asia Pacific Cardiovascular Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 45: Latin America Cardiovascular Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Cardiovascular Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 47: Latin America Cardiovascular Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Latin America Cardiovascular Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 49: Latin America Cardiovascular Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 50: Latin America Cardiovascular Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 51: Latin America Cardiovascular Drugs Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 52: Latin America Cardiovascular Drugs Market Attractiveness Analysis, by Indication, 2023–2031

Figure 53: Latin America Cardiovascular Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 54: Middle East & Africa Cardiovascular Drugs Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Cardiovascular Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 56: Middle East & Africa Cardiovascular Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 57: Middle East & Africa Cardiovascular Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 58: Middle East & Africa Cardiovascular Drugs Market Value Share Analysis, by Indication, 2022 and 2031

Figure 59: Middle East & Africa Cardiovascular Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 60: Middle East & Africa Cardiovascular Drugs Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 61: Middle East & Africa Cardiovascular Drugs Market Attractiveness Analysis, by Indication, 2023–2031

Figure 62: Middle East & Africa Cardiovascular Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031