Reports

Reports

The worldwide market for breast pumps is witnessing steadiness due to growing awareness of the advantages of breastfeeding and enhanced medical technology. Increased numbers of women returning to work after having children, especially in urban settings, are turning to breast pumps as a means to reconcile breastfeeding with work demands.

.webp)

Pressure on more efficient, unobtrusive, and portable pump systems is being stimulated by this trend. As such, the companies are rapidly developing battery-powered, electric, and wearable pumps that meet convenience and hygiene requirements. The technological advancements have fully revolutionized the market.

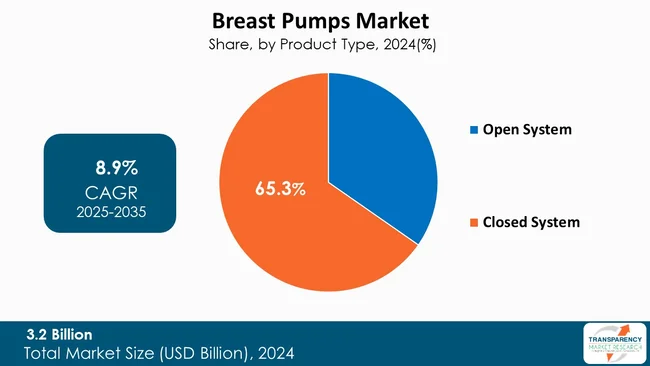

The traditional manual pumps are being replaced with more intelligent, app-based wearable pumps with features such as adjustable suction, memory feature, and whisper quiet. They are particularly appealing to tech-savvy, working mothers. Closed-system pumps that preclude milk contamination and are simpler to clean are taking market share away from open-system models. Hospital-grade pumps also remain increasingly in demand in institutional markets, particularly with greater awareness of milk donation and NICU feeding are supported.

The global breast pumps market has witnessed a considerable growth over the past decade and is anticipated to continue growing gradually in the future years. Demand is driven primarily by the growing number of working women, greater awareness of breastfeeding benefits, and greater demand for convenience feeding solutions for lactating mothers.

With increasing numbers of women resuming work soon after giving birth, demand for more convenient and hygienic breastfeeding alternatives has increased, the result being rising awareness about the importance of breast pumps as a key product in the postnatal category. The role of technology has greatly impacted market trend.

Electric and battery-powered breast pumps are now the norm, making hand pumps obsolete in terms of ease of use, efficiency, and convenience. Of late, hands-free, app-compatible wearable breast pumps have been the rage among urban mothers who value convenience and discretion.

Closed-system breast pumps with added hygiene of prevention against backflow of milk are also catching on in the home and hospital environments. For instance, in January 2025, Willow Innovations, Inc. (Willow), after achieving triple-digit growth with its line of pumping and feeding accessories, is cementing its position as a comprehensive, one-stop destination for breastfeeding mothers looking for innovative, high-quality, and seamless support.

Moreover, the FemTech pioneer, known for revolutionizing the breast pumping experience, unveils new accessories designed for optimizing the breastfeeding, pumping, and milk storage approach for new mothers.

| Attribute | Detail |

|---|---|

| Breast Pumps Market Drivers |

|

Increase in consumer awareness and supportive government initiatives are expected to fuel the breast pumps market. For instance, In June 2022, the National Department of Health, in collaboration with the WHO and UNICEF, hosted a two-day revitalisation workshop of the MBFI to address challenges and identify actions to stop the breastfeeding rate decline.

Welma Lubbe and colleagues have reported plans to introduce breastfeeding outcomes as key performance indicators at district levels. Healthcare providers have reported that they lack relevant expertise, are short staffed, and their responsibilities are unclear.

Furthermore, they find it difficult to assist new mothers who often stop breastfeeding after two or three months to return to work in cities far from their homes. Furthermore, the Baby Friendly Hospital Initiative (BFHI), which promotes evidence-based practices for breastfeeding success, has been established by the United Nations Children’s Fund (UNICEF) and the World Health Organization (WHO) to enhance breastfeeding rates and assist families in achieving their breastfeeding goals.

Increasing number of women entering and staying in the workforce after childbirth is a key growth driver to the breast pumps market. With more women leading professional lives while also playing motherhood, there has been a rising demand for efficient and convenient breastfeeding mechanism.

Breast pumps enable working mothers to continue with breastfeeding in spite of work commitments by offering the ability to express and store milk at work or away from their infants. In regions of increasing female participation in the labor market-particularly metropolitan regions of Asia-Pacific, North America, and Europe-the market for easy, convenient, and discreet breast pumps has expanded dynamically.

With more women joining the global labor force, breast pumps are becoming an integral part of postpartum care, allowing for infant feeding and maternal productivity-thus underpinning long-term market growth.

For instance, in 2024, data presented by the national survey conducted by the Indian Ministry of Statistics (IMS) states that the labor force participation rate (LFPR) for females aged 15 years and above increased from 37.0% during July 2022-2023 to 41.7% during July 2023-June 2024.

The open system category is the market leader in breast pump market share due to its affordability, broad market penetration, and lifetime of usage. Open system pumps are relatively less expensive than closed system pumps and therefore more convenient for a greater number of individuals, particularly in the markets that are price-sensitive like markets in Asia, Latin America, and Africa.

They are also widely distributed by retail establishments, internet sites, and local drugstores, partly explaining their extensive market coverage. The market system is dominant owing to the fact that open system pumps were among the earliest ones commercially available in the market, and thus they have installed consumer base and brand name.

Consumers have grown used to such systems, and where there is poor awareness for variations of hygiene between open systems and closed systems, the consumer can still stick with open system pumps due to familiarity or unawareness. Apart from that, most low-end electric and manual breast pumps come under the open system category as well, and such pumps are used by those mothers who require pumping intermittently, as opposed to frequent or extended periods.

| Attribute | Detail |

|---|---|

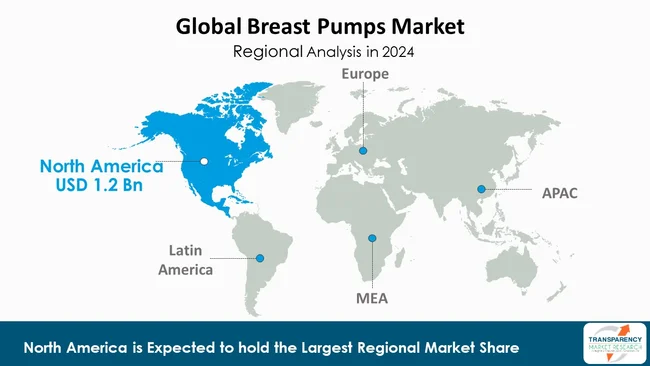

| Leading Region | North America |

North America, and the United States above all, holds majority of the breast pumps market share due to a series of healthy health policy decisions, high level of awareness, buying power, and common availability The strongest single factor is likely to be the insured coverage under the Affordable Care Act (ACA) in the United States, which mandates that insurance companies give free breastfeeding equipment, counseling, and support to mothers. This policy has greatly improved the availability of breast pumps, particularly for first-time moms living in urban and rural areas.

The area also enjoys high degrees of awareness of breastfeeding and visible support from healthcare workers, hospitals, and mother care activities that strongly recommend the use of breast pumps to support infant feeding. Additionally, North American consumers place high importance on convenience, cleanliness, and technology, and hence the market is open to high-end and innovative products like electric, wearable, and app-enabled breast pumps.

Leading companies are partnering with hospitals, specialty clinics, and research institutes to expand inorganically. Ameda (International Biomedical, Ltd.), Hygeia Health, Medela AG, Koninklijke Philips N.V., Lansinoh Laboratories, Inc. (Pigeon Corporation), Chiaro Technology Limited (Elvie), Willow Innovations, Inc., Uzin Medicare (Spectra Baby), Momcozy (Shenzhen Lute Jiacheng Network Technology Co., Ltd.), Mamapump, Tommee Tippee (Shanghai Jahwa United Co., Ltd), and Haakaa are the prominent breast pumps market players.

Each of these players has been have been profiled in the breast pumps market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 3.2 Bn |

| Forecast Value in 2035 | More than US$ 8.0 Bn |

| CAGR | 8.9% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global breast pumps market was valued at US$ 3.2 Bn in 2024.

Breast Pumps business is projected to cross US$ 8.0 Bn by the end of 2035.

Increase in the government initiatives aimed at improving consumer awareness levels and rising number of working women population.

The CAGR is anticipated to be 8.9% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Ameda (International Biomedical, Ltd.), Hygeia Health, Medela AG, Koninklijke Philips N.V., Lansinoh Laboratories, Inc. (Pigeon Corporation), Chiaro Technology Limited (Elvie), Willow Innovations, Inc., Uzin Medicare (Spectra Baby), Momcozy (Shenzhen Lute Jiacheng Network Technology Co., Ltd.), Mamapump, Tommee Tippee (Shanghai Jahwa United Co., Ltd), Haakaa, Inc. are the prominent breast pumps market players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Breast Pumps Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Breast Pumps Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Key Industry Events (Partnerships, Collaborations, Mergers, Acquisitions, etc.)

5.2. Technological Advancements

5.3. Consumer Behavior Analysis

5.4. Key Purchase Metrics for End-Users

5.5. PORTER’s Five Forces Analysis

5.6. PESTLE Analysis

5.7. Regulatory Scenario by Key Countries/Regions

5.8. Value Chain Analysis

5.9. Pricing Trends

5.10. Benchmarking of the Products Offered by the Leading Competitors

5.11. Go-to-Market Strategy for New Market Entrants

6. Global Breast Pumps Market Analysis and Forecasts, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product Type, 2020 to 2035

6.3.1. Open System

6.3.2. Closed System

6.4. Market Attractiveness By Product Type

7. Global Breast Pumps Market Analysis and Forecasts, By Technology

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Technology, 2020 to 2035

7.3.1. Powered/Electric Breast Pumps

7.3.1.1. Single Electric Breast Pump

7.3.1.2. Double Electric Breast Pump

7.3.2. Manual Breast Pump

7.4. Market Attractiveness By Technology

8. Global Breast Pumps Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2020 to 2035

8.3.1. Hospitals

8.3.2. Home Users

8.3.3. Maternity Clinics

8.4. Market Attractiveness By End-user

9. Global Breast Pumps Market Analysis and Forecasts, By Sales Channel

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By Sales Channel, 2020 to 2035

9.3.1. Online

9.3.1.1. Company-owned Websites

9.3.1.2. Third Party Aggregators

9.3.2. Offline

9.3.2.1. Pharmacies

9.3.2.2. Specialty/Maternity Stores

9.3.2.3. Others

9.4. Market Attractiveness By Sales Channel

10. Global Breast Pumps Market Analysis and Forecasts, By Region

10.1. Key Findings

10.2. Market Value Forecast By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Country/Region

11. North America Breast Pumps Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product Type, 2020 to 2035

11.2.1. Open System

11.2.2. Closed System

11.3. Market Value Forecast By Technology, 2020 to 2035

11.3.1. Powered/Electric Breast Pumps

11.3.1.1. Single Electric Breast Pump

11.3.1.2. Double Electric Breast Pump

11.3.2. Manual Breast Pump

11.4. Market Value Forecast By End-user, 2020 to 2035

11.4.1. Hospitals

11.4.2. Home Users

11.4.3. Maternity Clinics

11.5. Market Value Forecast By Sales Channel, 2020 to 2035

11.5.1. Online

11.5.1.1. Company-owned Websites

11.5.1.2. Third Party Aggregators

11.5.2. Offline

11.5.2.1. Pharmacies

11.5.2.2. Specialty/Maternity Stores

11.5.2.3. Others

11.6. Market Value Forecast By Country, 2020 to 2035

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Technology

11.7.3. By End-user

11.7.4. By Sales Channel

11.7.5. By Country

12. Europe Breast Pumps Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product Type, 2020 to 2035

12.2.1. Open System

12.2.2. Closed System

12.3. Market Value Forecast By Technology, 2020 to 2035

12.3.1. Powered/Electric Breast Pumps

12.3.1.1. Single Electric Breast Pump

12.3.1.2. Double Electric Breast Pump

12.3.2. Manual Breast Pump

12.4. Market Value Forecast By End-user, 2020 to 2035

12.4.1. Hospitals

12.4.2. Home Users

12.4.3. Maternity Clinics

12.5. Market Value Forecast By Sales Channel, 2020 to 2035

12.5.1. Online

12.5.1.1. Company-owned Websites

12.5.1.2. Third Party Aggregators

12.5.2. Offline

12.5.2.1. Pharmacies

12.5.2.2. Specialty/Maternity Stores

12.5.2.3. Others

12.6. Market Value Forecast By Country, 2020 to 2035

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Switzerland

12.6.7. The Netherlands

12.6.8. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Technology

12.7.3. By End-user

12.7.4. By Sales Channel

12.7.5. By Country

13. Asia Pacific Breast Pumps Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product Type, 2020 to 2035

13.2.1. Open System

13.2.2. Closed System

13.3. Market Value Forecast By Technology, 2020 to 2035

13.3.1. Powered/Electric Breast Pumps

13.3.1.1. Single Electric Breast Pump

13.3.1.2. Double Electric Breast Pump

13.3.2. Manual Breast Pump

13.4. Market Value Forecast By End-user, 2020 to 2035

13.4.1. Hospitals

13.4.2. Home Users

13.4.3. Maternity Clinics

13.5. Market Value Forecast By Sales Channel, 2020 to 2035

13.5.1. Online

13.5.1.1. Company-owned Websites

13.5.1.2. Third Party Aggregators

13.5.2. Offline

13.5.2.1. Pharmacies

13.5.2.2. Specialty/Maternity Stores

13.5.2.3. Others

13.6. Market Value Forecast By Country, 2020 to 2035

13.6.1. China

13.6.2. India

13.6.3. Japan

13.6.4. South Korea

13.6.5. Australia & New Zealand

13.6.6. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Technology

13.7.3. By End-user

13.7.4. By Sales Channel

13.7.5. By Country

14. Latin America Breast Pumps Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product Type, 2020 to 2035

14.2.1. Open System

14.2.2. Closed System

14.3. Market Value Forecast By Technology, 2020 to 2035

14.3.1. Powered/Electric Breast Pumps

14.3.1.1. Single Electric Breast Pump

14.3.1.2. Double Electric Breast Pump

14.3.2. Manual Breast Pump

14.4. Market Value Forecast By End-user, 2020 to 2035

14.4.1. Hospitals

14.4.2. Home Users

14.4.3. Maternity Clinics

14.5. Market Value Forecast By Sales Channel, 2020 to 2035

14.5.1. Online

14.5.1.1. Company-owned Websites

14.5.1.2. Third Party Aggregators

14.5.2. Offline

14.5.2.1. Pharmacies

14.5.2.2. Specialty/Maternity Stores

14.5.2.3. Others

14.6. Market Value Forecast By Country, 2020 to 2035

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Argentina

14.6.4. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product Type

14.7.2. By Technology

14.7.3. By End-user

14.7.4. By Sales Channel

14.7.5. By Country

15. Middle East & Africa Breast Pumps Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast By Product Type, 2020 to 2035

15.2.1. Open System

15.2.2. Closed System

15.3. Market Value Forecast By Technology, 2020 to 2035

15.3.1. Powered/Electric Breast Pumps

15.3.1.1. Single Electric Breast Pump

15.3.1.2. Double Electric Breast Pump

15.3.2. Manual Breast Pump

15.4. Market Value Forecast By End-user, 2020 to 2035

15.4.1. Hospitals

15.4.2. Home Users

15.4.3. Maternity Clinics

15.5. Market Value Forecast By Sales Channel, 2020 to 2035

15.5.1. Online

15.5.1.1. Company-owned Websites

15.5.1.2. Third Party Aggregators

15.5.2. Offline

15.5.2.1. Pharmacies

15.5.2.2. Specialty/Maternity Stores

15.5.2.3. Others

15.6. Market Value Forecast By Country, 2020 to 2035

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product Type

15.7.2. By Technology

15.7.3. By End-user

15.7.4. By Sales Channel

15.7.5. By Country

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis By Company (2024)

16.3. Company Profiles

16.3.1. Ameda (International Biomedical, Ltd.)

16.3.1.1. Company Overview

16.3.1.2. Financial Overview

16.3.1.3. Financial Overview

16.3.1.4. Business Strategies

16.3.1.5. Recent Developments

16.3.2. Hygeia Health

16.3.2.1. Company Overview

16.3.2.2. Financial Overview

16.3.2.3. Financial Overview

16.3.2.4. Business Strategies

16.3.2.5. Recent Developments

16.3.3. Medela AG

16.3.3.1. Company Overview

16.3.3.2. Financial Overview

16.3.3.3. Financial Overview

16.3.3.4. Business Strategies

16.3.3.5. Recent Developments

16.3.4. Koninklijke Philips N.V.

16.3.4.1. Company Overview

16.3.4.2. Financial Overview

16.3.4.3. Financial Overview

16.3.4.4. Business Strategies

16.3.4.5. Recent Developments

16.3.5. Lansinoh Laboratories, Inc. (Pigeon Corporation)

16.3.5.1. Company Overview

16.3.5.2. Financial Overview

16.3.5.3. Financial Overview

16.3.5.4. Business Strategies

16.3.5.5. Recent Developments

16.3.6. Chiaro Technology Limited (Elvie)

16.3.6.1. Company Overview

16.3.6.2. Financial Overview

16.3.6.3. Financial Overview

16.3.6.4. Business Strategies

16.3.6.5. Recent Developments

16.3.7. Willow Innovations, Inc.

16.3.7.1. Company Overview

16.3.7.2. Financial Overview

16.3.7.3. Financial Overview

16.3.7.4. Business Strategies

16.3.7.5. Recent Developments

16.3.8. Uzin Medicare (Spectra Baby)

16.3.8.1. Company Overview

16.3.8.2. Financial Overview

16.3.8.3. Financial Overview

16.3.8.4. Business Strategies

16.3.8.5. Recent Developments

16.3.9. Momcozy (Shenzhen Lute Jiacheng Network Technology Co., Ltd.)

16.3.9.1. Company Overview

16.3.9.2. Financial Overview

16.3.9.3. Financial Overview

16.3.9.4. Business Strategies

16.3.9.5. Recent Developments

16.3.10. Mamapump

16.3.10.1. Company Overview

16.3.10.2. Financial Overview

16.3.10.3. Financial Overview

16.3.10.4. Business Strategies

16.3.10.5. Recent Developments

16.3.11. Tommee Tippee (Shanghai Jahwa United Co., Ltd)

16.3.11.1. Company Overview

16.3.11.2. Financial Overview

16.3.11.3. Financial Overview

16.3.11.4. Business Strategies

16.3.11.5. Recent Developments

16.3.12. Haakaa

16.3.12.1. Company Overview

16.3.12.2. Financial Overview

16.3.12.3. Financial Overview

16.3.12.4. Business Strategies

16.3.12.5. Recent Developments

16.3.13. Other Prominent Players

16.3.13.1. Company Overview

16.3.13.2. Financial Overview

16.3.13.3. Financial Overview

16.3.13.4. Business Strategies

16.3.13.5. Recent Developments

List of Tables

Table 01: Global Breast Pumps Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Breast Pumps Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 03: Global Breast Pumps Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 04: Global Breast Pumps Market Value (US$ Bn) Forecast, By Sales Channel, 2020 to 2035

Table 05: Global Breast Pumps Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America - Breast Pumps Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 07: North America - Breast Pumps Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 08: North America - Breast Pumps Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 09: North America Breast Pumps Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 10: North America Breast Pumps Market Value (US$ Bn) Forecast, By Sales Channel, 2020 to 2035

Table 11: Europe - Breast Pumps Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 12: Europe - Breast Pumps Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 13: Europe - Breast Pumps Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 14: Europe Breast Pumps Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 15: Europe Breast Pumps Market Value (US$ Bn) Forecast, By Sales Channel, 2020 to 2035

Table 16: Asia Pacific - Breast Pumps Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 17: Asia Pacific - Breast Pumps Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 18: Asia Pacific - Breast Pumps Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 19: Asia Pacific Breast Pumps Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 20: Asia Pacific Breast Pumps Market Value (US$ Bn) Forecast, By Sales Channel, 2020 to 2035

Table 21: Latin America - Breast Pumps Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 22: Latin America - Breast Pumps Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 23: Latin America - Breast Pumps Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 24: Latin America Breast Pumps Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Latin America Breast Pumps Market Value (US$ Bn) Forecast, By Sales Channel, 2020 to 2035

Table 26: Middle East & Africa - Breast Pumps Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 27: Middle East & Africa - Breast Pumps Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 28: Middle East & Africa - Breast Pumps Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 29: Middle East & Africa Breast Pumps Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 30: Middle East & Africa Breast Pumps Market Value (US$ Bn) Forecast, By Sales Channel, 2020 to 2035

List of Figures

Figure 01: Global Breast Pumps Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Figure 02: Global Breast Pumps Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 03: Global Breast Pumps Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 04: Global Breast Pumps Market Revenue (US$ Bn), by Open System, 2020 to 2035

Figure 05: Global Breast Pumps Market Revenue (US$ Bn), by Closed System, 2020 to 2035

Figure 06: Global Breast Pumps Market Value Share Analysis, By Technology, 2024 and 2035

Figure 07: Global Breast Pumps Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 08: Global Breast Pumps Market Revenue (US$ Bn), by Powered/Electric Breast Pumps, 2020 to 2035

Figure 09: Global Breast Pumps Market Revenue (US$ Bn), by Manual Breast Pump, 2020 to 2035

Figure 10: Global Breast Pumps Market Value Share Analysis, By End-user, 2024 and 2035

Figure 11: Global Breast Pumps Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 12: Global Breast Pumps Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 13: Global Breast Pumps Market Revenue (US$ Bn), by Home Users, 2020 to 2035

Figure 14: Global Breast Pumps Market Revenue (US$ Bn), by Maternity Clinics, 2020 to 2035

Figure 15: Global Breast Pumps Market Value Share Analysis, By Sales Channel, 2024 and 2035

Figure 16: Global Breast Pumps Market Attractiveness Analysis, By Sales Channel, 2025 to 2035

Figure 17: Global Breast Pumps Market Revenue (US$ Bn), by Online, 2020 to 2035

Figure 18: Global Breast Pumps Market Revenue (US$ Bn), by Offline, 2020 to 2035

Figure 19: Global Breast Pumps Market Value Share Analysis, By Region, 2024 and 2035

Figure 20: Global Breast Pumps Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 21: North America - Breast Pumps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 22: North America - Breast Pumps Market Value Share Analysis, by Country, 2024 and 2035

Figure 23: North America - Breast Pumps Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 24: North America Breast Pumps Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 25: North America Breast Pumps Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 26: North America - Breast Pumps Market Value Share Analysis, By Technology, 2024 and 2035

Figure 27: North America - Breast Pumps Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 28: North America - Breast Pumps Market Value Share Analysis, By End-user, 2024 and 2035

Figure 29: North America - Breast Pumps Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 30: North America - Breast Pumps Market Value Share Analysis, By Sales Channel, 2024 and 2035

Figure 31: North America - Breast Pumps Market Attractiveness Analysis, By Sales Channel, 2025 to 2035

Figure 32: Europe - Breast Pumps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 33: Europe - Breast Pumps Market Value Share Analysis, by Country, 2024 and 2035

Figure 34: Europe - Breast Pumps Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 35: Europe Breast Pumps Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 36: Europe Breast Pumps Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 37: Europe - Breast Pumps Market Value Share Analysis, By Technology, 2024 and 2035

Figure 38: Europe - Breast Pumps Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 39: Europe - Breast Pumps Market Value Share Analysis, By End-user, 2024 and 2035

Figure 40: Europe - Breast Pumps Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 41: Europe - Breast Pumps Market Value Share Analysis, By Sales Channel, 2024 and 2035

Figure 42: Europe - Breast Pumps Market Attractiveness Analysis, By Sales Channel, 2025 to 2035

Figure 43: Asia Pacific - Breast Pumps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: Asia Pacific - Breast Pumps Market Value Share Analysis, by Country, 2024 and 2035

Figure 45: Asia Pacific - Breast Pumps Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 46: Asia Pacific Breast Pumps Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 47: Asia Pacific Breast Pumps Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 48: Asia Pacific - Breast Pumps Market Value Share Analysis, By Technology, 2024 and 2035

Figure 49: Asia Pacific - Breast Pumps Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 50: Asia Pacific - Breast Pumps Market Value Share Analysis, By End-user, 2024 and 2035

Figure 51: Asia Pacific - Breast Pumps Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 52: Asia Pacific - Breast Pumps Market Value Share Analysis, By Sales Channel, 2024 and 2035

Figure 53: Asia Pacific - Breast Pumps Market Attractiveness Analysis, By Sales Channel, 2025 to 2035

Figure 54: Latin America - Breast Pumps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 55: Latin America - Breast Pumps Market Value Share Analysis, by Country, 2024 and 2035

Figure 56: Latin America - Breast Pumps Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 57: Latin America Breast Pumps Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 58: Latin America Breast Pumps Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 59: Latin America - Breast Pumps Market Value Share Analysis, By Technology, 2024 and 2035

Figure 60: Latin America - Breast Pumps Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 61: Latin America - Breast Pumps Market Value Share Analysis, By End-user, 2024 and 2035

Figure 62: Latin America - Breast Pumps Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 63: Latin America - Breast Pumps Market Value Share Analysis, By Sales Channel, 2024 and 2035

Figure 64: Latin America - Breast Pumps Market Attractiveness Analysis, By Sales Channel, 2025 to 2035

Figure 65: Middle East & Africa - Breast Pumps Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 66: Middle East & Africa - Breast Pumps Market Value Share Analysis, by Country, 2024 and 2035

Figure 67: Middle East & Africa - Breast Pumps Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 68: Middle East & Africa Breast Pumps Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 69: Middle East & Africa Breast Pumps Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 70: Middle East & Africa - Breast Pumps Market Value Share Analysis, By Technology, 2024 and 2035

Figure 71: Middle East & Africa - Breast Pumps Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 72: Middle East & Africa - Breast Pumps Market Value Share Analysis, By End-user, 2024 and 2035

Figure 73: Middle East & Africa - Breast Pumps Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 74: Middle East & Africa - Breast Pumps Market Value Share Analysis, By Sales Channel, 2024 and 2035

Figure 75: Middle East & Africa - Breast Pumps Market Attractiveness Analysis, By Sales Channel, 2025 to 2035