Reports

Reports

Analysts’ Viewpoint on Europe Superabsorbent Polymers Market

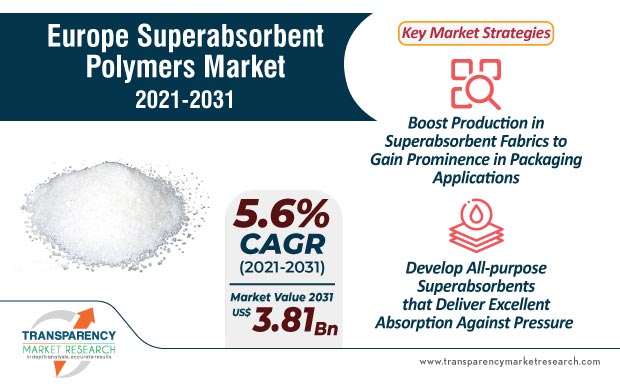

Even as global sales order has been altered due to the ongoing COVID-19 crisis, manufacturers in the Europe superabsorbent polymers market are capitalizing on revenue opportunities through eCommerce and mobile shopping apps to boost essential product sales. Since recycling of superabsorbent polymers from diapers and other feminine hygiene products is challenging, participants in the market should gain proficiency in recovering materials from used consumer products to attenuate their environmental impact. Thus, to achieve this, manufacturers should use recovered superabsorbent materials in water retention application for agriculture in drought-stricken countries. Superabsorbent fabrics on the other hand are creating revenue opportunities for manufacturers in packaging applications.

Companies in the Europe superabsorbent polymers market are making use of sodium polyacrylate to manufacture diapers. Apart from diapers, manufacturers are unlocking revenue opportunities in gardening, forestry, and landscaping as a means of conserving water. Even though superabsorbent polymers (SAPs) are gaining prominence in disposable diapers and feminine hygiene products, it is potentially challenging to recycle these materials through open- or closed-loop processes. Hence, participants in the superabsorbent polymers market are focusing on the recovery of materials rather recycling. For instance, the recovered superabsorbent polymers are being explored for enhancing the water retention properties of soil.

The COVID-19 crisis has altered manufacturing activities in the Europe superabsorbent polymers market. Manufacturers are focusing on positive or limited negative industries such as healthcare, packaging, and agriculture industries to stay financially afloat. The unprecedented demand for essential products including diapers, adult incontinence products, and sanitary products under the hygiene products list is helping manufacturers to keep their economies running.

Companies in the Europe superabsorbent polymers market are strategizing on business activities to adapt to fluctuating demand and supply trends. They are increasing efforts to minimize lead times during the entire production cycle. Participants in the market are offering on-demand products and services to ensure business continuity. Due to a sudden surge in Omicron variant cases amongst individuals, production activities are anticipated to grow at a staggered rate.

The issue of water shortages and droughts in agriculture are fueling demand for superabsorbent polymers that hold potential to retain moisture in soil and reduce irrigation water consumption. As such, natural SAPs such as cellulose, starch, and chitosan are emerging as an alternative to synthetic SAPs. However, natural SAPs are linked with issues in extraction process since this process is relatively complex and tends to cost more than using synthetic polymers. Hence, participants in the market are boosting R&D efforts to innovate in a combination of natural and synthetic SAPs to achieve reduced irrigation water consumption in agriculture.

Manufacturers are boosting output capacities for superabsorbent rolled goods, solution superabsorbents and blood superabsorbents. Superabsorbent rolled goods are gaining prominence in dental, filtration, and labeling applications. Solution superabsorbents, on the other hand, are being used for manufacturing yarns, fabrics, and nonwovens.

Manufacturers in the superabsorbent polymers market are innovating in blood superabsorbents that are being publicized for high absorption, easy to use, and low dust attributes. These superabsorbents can be used for whole blood or blood mixtures, medical waste solidification, and spill control. Manufacturers are increasing the availability of all-purpose superabsorbents that deliver excellent combination of absorption against pressure and capacity.

The growing demand for superabsorbent fabrics are translating into value-grab opportunities for manufacturers in the superabsorbent polymers market. Companies are developing a wide range of disposable and washable superabsorbent nonwoven fabrics, all containing unique super absorbent fiber technology. These absorbent fabrics are being supplied in roll format and are ideal for a wide range of consumer, industrial, and environmental applications.

Superabsorbent needlepunch fabrics are being extensively used in medical, filtration, and packaging applications. Such trends are contributing to the growth of the global superabsorbent polymers market. Technical felt-like materials offer great strength and integrity due to the nature of mechanical bonding i.e. needling, used during manufacture. Long, superabsorbent fiber grades are typically blended with other synthetic fibers to manufacture needlepunch nonwovens.

|

Attribute |

Detail |

|

Market Size Value in 2020 |

US$ 2,126 Mn |

|

Market Forecast Value in 2031 |

US$ 3,818.1 Mn |

|

Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value & Kilo Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the Europe level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

Market Share Analysis, by Company (2020) The Company Profiles section includes overview, product portfolio, sales footprint, key subsidiaries or distributors, strategy & recent developments, and key financials. |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Key Regions Covered |

Europe |

|

Key Countries Covered |

|

|

Key Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

Europe Superabsorbent Polymers Market is expected to reach US$ 3.8 Bn By 2031

Europe Superabsorbent Polymers Market is estimated to rise at a CAGR of 5.6% during forecast period

Rise in demand for baby diapers, sanitary products, and adult incontinence products made from superabsorbent polymers is expected to the drive the superabsorbent polymers market in Europe in the near future

Key players operating in the superabsorbent polymers market in Europe are BASF SE, Evonik Industries AG, LG Chem Ltd, Sumitomo Seika Chemicals Co., Ltd, KAO Corporation, SNF, Formosa Plastic Corporation, Songwon, and Nippon Shokubai Co.,Ltd.

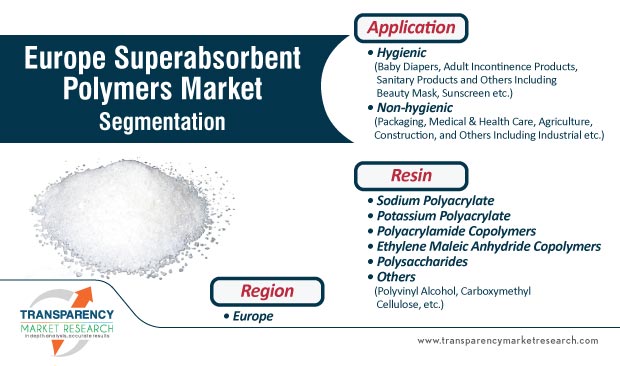

Baby Diapers, Adult Incontinence Products, Sanitary Products, Packaging, Medical & Health Care, Agriculture are the end-use segments in the Europe Superabsorbent Polymers Market

1. Executive Summary

1.1. Superabsorbent Polymers Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Resin Manufacturers

2.6.2. List of Superabsorbent Polymer Manufacturers

2.6.3. List of Potential customer

3. COVID-19 Impact Analysis

4. Superabsorbent Polymers Market Production Outlook

5. Europe Superabsorbent Polymers Market, Price Trend Analysis

6. Europe Superabsorbent Polymers Price Trend Analysis, 2020–2031

6.1. By Resin

7. Europe Superabsorbent Polymers Market Analysis and Forecast, by Resin, 2020–2031

7.1. Introduction and Definitions

7.2. Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

7.2.1. Sodium Polyacrylate

7.2.2. Potassium Polyacrylate

7.2.3. Polyacrylamide Copolymers

7.2.4. Ethylene Maleic Anhydride Copolymers

7.2.5. Polysaccharides

7.2.6. Others (including Polyvinyl Alcohol and Carboxymethyl Cellulose)

7.3. Superabsorbent Polymers Market Attractiveness, by Resin

8. Europe Superabsorbent Polymers Market Analysis and Forecast, by Application, 2020–2031

8.1. Introduction and Definitions

8.2. Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.2.1. Hygienic

8.2.1.1. Baby Diapers

8.2.1.2. Adult Incontinence Products

8.2.1.3. Sanitary Products,

8.2.1.4. Others (including Beauty Mask and Sunscreen)

8.2.2. Non-hygienic

8.2.2.1. Packaging

8.2.2.2. Medical & Health Care

8.2.2.3. Agriculture, Construction

8.2.2.4. Others (including Industrial)

8.3. Superabsorbent Polymers Market Attractiveness, by Application

9. Europe Superabsorbent Polymers Market Analysis and Forecast, by Country and Sub-region, 2020–2031

9.1. Key Findings

9.2. Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

9.3. Superabsorbent Polymers Market Attractiveness, by Country and Sub-region

10. Germany Superabsorbent Polymers Market Analysis and Forecast, 2020–2031

10.1.1. Germany Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.1.2. Germany Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.1.3. France Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.1.4. France Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.1.5. U.K. Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.1.6. U.K. Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.1.7. Italy Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.1.8. Italy Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.1.9. Spain Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.1.10. Spain Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.1.11. Russia Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.1.12. Russia Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.1.13. CIS Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.1.14. CIS Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.1.15. Poland Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.1.16. Poland Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.1.17. Hungary Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.1.18. Hungary Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.1.19. Romania Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.1.20. Romania Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.1.21. Rest of Europe Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.1.22. Rest of Europe Superabsorbent Polymers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11. Competition Landscape

11.1. Market Players - Competition Matrix (by Tier and Size of Companies)

11.2. Superabsorbent polymers Company Market Share Analysis, 2020

11.3. Competition Matrix

11.4. Market Footprint Analysis

11.4.1. By Resin

11.4.2. By Application

11.5. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

11.5.1. BASF SE

11.5.1.1. Company Description

11.5.1.2. Business Overview

11.5.1.3. Financial Details

11.5.1.4. Strategic Overview

11.5.1.5. Company Description

11.5.1.6. Business Overview

11.5.2. Evonik Industries AG

11.5.2.1. Company Description

11.5.2.2. Business Overview

11.5.2.3. Financial Details

11.5.2.4. Strategic Overview

11.5.3. LG Chem Ltd

11.5.3.1. Company Description

11.5.3.2. Business Overview

11.5.3.3. Financial Details

11.5.3.4. Strategic Overview

11.5.4. Sumitomo Seika Chemicals Co.,Ltd

11.5.4.1. Company Description

11.5.4.2. Business Overview

11.5.4.3. Financial Details

11.5.4.4. Strategic Overview

11.5.5. KAO Corporation

11.5.5.1. Company Description

11.5.5.2. Business Overview

11.5.5.3. Strategic Overview

11.5.6. SNF

11.5.6.1. Company Description

11.5.6.2. Business Overview

11.5.6.3. Strategic Overview

11.5.7. Formosa Plastics Corporation

11.5.7.1. Company Description

11.5.7.2. Business Overview

11.5.7.3. Strategic Overview

11.5.8. Songwon

11.5.8.1. Company Description

11.5.8.2. Business Overview

11.5.8.3. Strategic Overview

11.5.9. Nippon Shokubai Co.,Ltd

11.5.9.1. Company Description

11.5.9.2. Business Overview

11.5.9.3. Strategic Overview

12. Appendix

List of Tables

Table 1: Europe Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Resin, 2020–2031

Table 2: Europe Superabsorbent polymers Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 3: Europe Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Application, 2020–2031

Table 4: Europe Superabsorbent polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 5: Europe Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 6: Europe Superabsorbent polymers Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 7: Germany Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Resin, 2020–2031

Table 8: Germany Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 9: Germany Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Application, 2020–2031

Table 10: Germany Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 11: France Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Resin, 2020–2031

Table 12: France Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 13: France Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Application, 2020–2031

Table 14: France Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 15: U.K. Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Resin, 2020–2031

Table 16: U.K. Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 17: U.K. Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Application, 2020–2031

Table 18: U.K. Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 19: Spain Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Resin, 2020–2031

Table 20: Spain Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 21: Spain Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Application, 2020–2031

Table 22: Spain Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 23: Russia Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Resin, 2020–2031

Table 24: Russia Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 25: Russia Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Application, 2020–2031

Table 26: Russia Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 27: CIS Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Resin, 2020–2031

Table 28: CIS Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 29: CIS Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Application, 2020–2031

Table 30: CIS Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: Poland Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Resin, 2020–2031

Table 32: Poland Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 33: Poland Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Application, 2020–2031

Table 34: Poland Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 35: Hungary Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Resin, 2020–2031

Table 36: Hungary Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 37: Hungary Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Application, 2020–2031

Table 38: Hungary Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 39: Romania Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Resin, 2020–2031

Table 40: Romania Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 41: Romania Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Application, 2020–2031

Table 42: Romania Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: Rest of Europe Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Resin, 2020–2031

Table 44: Rest of Europe Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 45: Rest of Europe Superabsorbent Polymers Market Volume ( Kilo Tons) Forecast, by Application, 2020–2031

Table 46: Rest of Europe Superabsorbent Polymers Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Europe Superabsorbent Polymers Market Share Analysis, by Resin

Figure 2: Europe Superabsorbent Polymers Market Attractiveness Analysis, by Resin

Figure 3: Europe Superabsorbent Polymers Market Share Analysis, by Application

Figure 4: Europe Superabsorbent Polymers Market Attractiveness Analysis, by Application

Figure 5: Europe Superabsorbent Polymers Market Share Analysis, by Country and Sub-region

Figure 6: Europe Superabsorbent Polymers Market Attractiveness Analysis, by Country and Sub-region