Reports

Reports

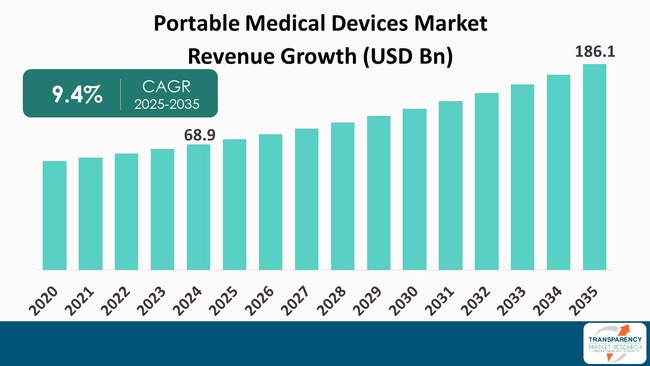

The market for global portable medical devices industry is expected to witness massive growth during the forecast period. Among the other factors leading this growth, the most significant ones are the increasing need for home healthcare, remote patient monitoring, and the growing occurrence of chronic diseases. Furthermore, consumer awareness is one of the factors responsible for expansion of patient-centric healthcare market, not only from the clinical settings but also from the preventive healthcare and fitness segments.

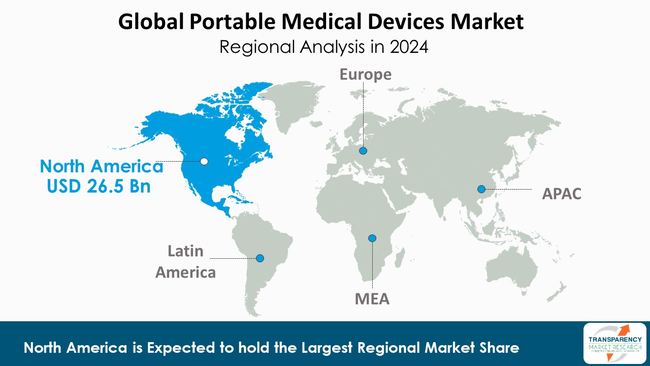

One of the major factors that contribute to the improvement of a smart gadget is the integration of Al and the parallel developments in wireless connection and wearable technologies. The largest market share is still held by North America where the infrastructure is strong and reimbursement policies are favorable.

Moreover, the Asia-Pacific region is anticipated to be the fastest-growing market with the rising healthcare spending and huge patient base. Despite a number of challenges including regulatory barriers, worries about data security, and the high cost of emerging regions, the global mood remains bright, with on-the-go medical gadgets being looked upon as an important element of the healthcare system of the future.

The portable medical devices market includes a variety of small, lightweight, and easy-to-use healthcare devices that can be used outside of the usual clinical setting, such as at the patient's residence or while traveling. Some examples of these devices are diagnostic tools, treatment devices, monitoring systems, as well as health or sport wearables, which make it possible to track the vital parameters and health status of the patient in real time.

The rise of the occurrence of chronic diseases, the aging of the population, and the growing need for healthcare solutions that can be carried out at home are some of the major reasons for the market, attracting so much attention. Some technological advantages in wireless connectivity, miniaturization, and AI integration have also allowed device features as well as patient comfort to extend to greater lengths.

Moreover, the portable medical devices market is becoming a vital part of the healthcare system all over the world as the provision of healthcare is moving more to preventive care and remote monitoring. The FDA supports the production of new, safe, and efficient medical devices, among which are the ones that use Al as a tool. The Al-enabled medical device List is a helpful resource to recognize those Al-powered medical devices, which have been given clearance to be sold in the U.S.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Health technology in the form of wearables, basically smartwatches and fitness trackers, has brought about a major change in the way people take care of their health as it provides easy and continuous monitoring of vital signs such as heart rate, oxygen levels, blood pressure, and physical activity. For instance, in June 2025, the U.S. Health Secretary made a public announcement that the Department of Health and Human Services is preparing a big public campaign for promoting the use of wearable devices in the American population. The campaign aims to include devices that measure pulse, glucose levels, and likewise. The campaign ties into his policy agenda “Making America Healthy Again” (MAHA).

These devices allow users to access their health data in the moment and make informed decisions about their own well-being, in addition to giving doctors important information for faster diagnosis and treatment.

Wearable health technologies make a significant contribution to the improvement of the relationship between lifestyle management and clinical healthcare by facilitating early recognition of diseases and preventive care. Growing trends in their popularity symbolize the movement of healthcare to a patient-centric model that is characterized by the above-mentioned features as the keys to better health.

For instance, The MHRA (Medicines and Healthcare Products Regulatory Agency) of the United Kingdom (UK) has published proposals to improve patient access to advance medical devices and simplify the authorizations' procedures. Among the planned alterations are to facilitate additional means for utilizing foreign clinical data to achieve quicker approvals and to simplify the handling of UKCA marking after the implementation of a device identification system.

One of the main factors that lead to the implementation of portable medical devices is the growing number of elderly people at the global scale. Aged people are more vulnerable to long-term illnesses such as diabetes, heart diseases, and limited mobility, which eventually become the main causes of pressure ulcers, venous leg ulcers, and slow wound healing. According to World Health Organization, the number of people aged 60 years and above was estimated 1 billion in 2020. The number of people aged 60 and above is projected to double with 2.1 billion in 2050.

Diagnostic and monitoring tools that fall in the category of portable devices are capable of assisting the elderly in tracking their health without being in a hospital, which is a great saving for the healthcare system. The devices help the elderly with routine activities with the same comfort and independence.

Given trend highlights the necessity to create more user-friendly designs with easy-to-use interfaces for senior patients.

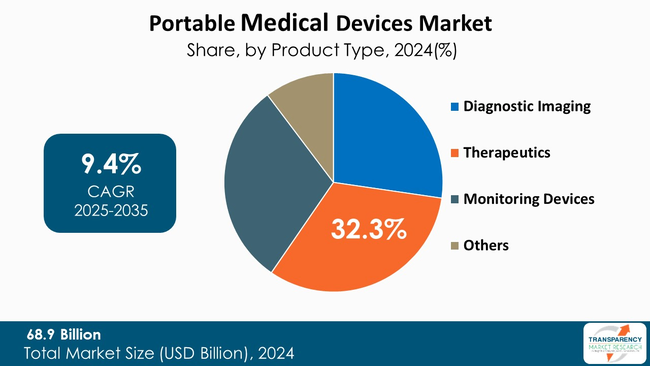

The therapeutics segment is taking a lead over the other categories in the portable medical devices market with share of 32.3%, along with increasing demand for highly effective treatment solutions that are re-usable in less controlled environments. Patients with chronic conditions are turning to the use of portable therapeutic devices such as insulin delivery systems, respiratory therapy equipment, and pain management devices, which are being used majorly to maintain their regular, long-term care.

Their capacity to deliver treatment on continuous basis and at the patient's convenience definitely enhances compliance among patients. Additionally, it becomes less stressful for the hospitals and the other healthcare institutions. The growing prevalence of lifestyle-related diseases together with the technological advancements in the miniaturization and connectivity of medical devices is leading the therapeutics sector to top the global market by volume.

As an illustration, China's National Medical Products Administration (NMPA) has revealed 10 novel regulatory steps (Announcement No. 63 of 2025) to promote innovation in high-end medical devices. The policy provides support for AI diagnostics, surgical robotics, and shorter approval times with the aim of raising international competitiveness.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America dominate with 38.5% of the market share. This is mainly due to the region's well-developed healthcare infrastructure, rapid uptake of innovative technologies, and considerable number of leading medical device manufacturers.

The region benefits by good reimbursement policies, general recognition of preventive healthcare, and the increasing need for monitoring at home, especially by the elderly population making up considerable proportion of the region. Furthermore, steady commitment to research and development, quick adoption of AI and IoT in medical devices, and a solid regulatory framework also go a long way in consolidating the leadership position of North America in this market.

For instance, the Food and Drug Administration (FDA), in November, 2025, did announce that its Digital Health Advisory Committee will convene to assess AI-powered digital mental health devices. The assessment will concentrate on the device's safety and efficacy and assist in forming supervision policies for digital treatment, patient monitoring from a distance, and software-driven medical devices.

GE HealthCare, 3M, Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd, Medtronic, Abbott, OMRON Healthcare, Inc., Johnson & Johnson, Baxter, McKesson Corporation, Medline Industries, SCHILLER AG, Siemens Healthcare Private Limited, Dexcom, Inc., AliveCor, Inc. and others are some of the leading manufacturers operating in the global portable medical devices market.

Each of these companies has been profiled in the portable medical devices market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 68.9 Bn |

| Forecast Value in 2035 | US$ 186.1 Bn |

| CAGR | 9.4 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global portable medical devices market was valued at US$ 68.9 Bn in 2024

The global portable medical devices industry is projected to reach more than US$ 186.1 Bn by the end of 2035

Rising wearable technology drives growth & geriatric population growth are some of the factors driving the expansion of portable medical devices market.

The CAGR is anticipated to be 9.4% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

GE HealthCare, 3M, Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd, Medtronic, Abbott, OMRON Healthcare, Inc., Johnson & Johnson, Baxter, McKesson Corporation, Medline Industries, LP., SCHILLER AG, Siemens Healthcare Private Limited, Dexcom, Inc., AliveCor, Inc. and other prominent players.

Table 01: Global Portable Medical Devicess Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 02: Global Portable Medical Devicess Market Value (US$ Bn), by Diagnostic Imaging, 2020 to 2035

Table 03: Global Portable Medical Devicess Market Value (US$ Bn), by Therapeutics, 2020 to 2035

Table 04: Global Portable Medical Devicess Market Value (US$ Bn), by Monitoring Devices, 2020 to 2035

Table 05: Global Portable Medical Devicess Market Value (US$ Bn), by Others, 2020 to 2035

Table 06: Global Portable Medical Devicess Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 07: Global Portable Medical Devicess Market Value (US$ Bn) Forecast, By End User, 2020 to 2035

Table 08: Global Portable Medical Devicess Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 09: North America Portable Medical Devicess Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 10: North America Portable Medical Devicess Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 11: North America Portable Medical Devicess Market Value (US$ Bn), by Diagnostic Imaging, 2020 to 2035

Table 12: North America Portable Medical Devicess Market Value (US$ Bn), by Therapeutics, 2020 to 2035

Table 13: North America Portable Medical Devicess Market Value (US$ Bn), by Monitoring Devices, 2020 to 2035

Table 14: North America Portable Medical Devicess Market Value (US$ Bn), by Others, 2020 to 2035

Table 15: North America Portable Medical Devicess Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 16: North America Portable Medical Devicess Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 17: Europe Portable Medical Devicess Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 18: Europe Portable Medical Devicess Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 19: Europe Portable Medical Devicess Market Value (US$ Bn), by Diagnostic Imaging, 2020 to 2035

Table 20: Europe Portable Medical Devicess Market Value (US$ Bn), by Therapeutics, 2020 to 2035

Table 21: Europe Portable Medical Devicess Market Value (US$ Bn), by Monitoring Devices, 2020 to 2035

Table 22: Europe Portable Medical Devicess Market Value (US$ Bn), by Others, 2020 to 2035

Table 23: Europe Portable Medical Devicess Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 24: Europe Portable Medical Devicess Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 25: Asia Pacific Portable Medical Devicess Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 26: Asia Pacific Portable Medical Devicess Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 27: Asia Pacific Portable Medical Devicess Market Value (US$ Bn), by Diagnostic Imaging, 2020 to 2035

Table 28: Asia Pacific Portable Medical Devicess Market Value (US$ Bn), by Therapeutics, 2020 to 2035

Table 29: Asia Pacific Portable Medical Devicess Market Value (US$ Bn), by Monitoring Devices, 2020 to 2035

Table 30: Asia Pacific Portable Medical Devicess Market Value (US$ Bn), by Others, 2020 to 2035

Table 31: Asia Pacific Portable Medical Devicess Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 32: Asia Pacific Portable Medical Devicess Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 33: Latin America Portable Medical Devicess Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 34: Latin America Portable Medical Devicess Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 35: Latin America Portable Medical Devicess Market Value (US$ Bn), by Diagnostic Imaging, 2020 to 2035

Table 36: Latin America Portable Medical Devicess Market Value (US$ Bn), by Therapeutics, 2020 to 2035

Table 37: Latin America Portable Medical Devicess Market Value (US$ Bn), by Monitoring Devices, 2020 to 2035

Table 38: Latin America Portable Medical Devicess Market Value (US$ Bn), by Others, 2020 to 2035

Table 39: Latin America Portable Medical Devicess Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 40: Latin America Portable Medical Devicess Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 41: Middle East and Africa Portable Medical Devicess Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 42: Middle East and Africa Portable Medical Devicess Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 43: Middle East and Africa Portable Medical Devicess Market Value (US$ Bn), by Diagnostic Imaging, 2020 to 2035

Table 44: Middle East and Africa Portable Medical Devicess Market Value (US$ Bn), by Therapeutics, 2020 to 2035

Table 45: Middle East and Africa Portable Medical Devicess Market Value (US$ Bn), by Monitoring Devices, 2020 to 2035

Table 46: Middle East and Africa Portable Medical Devicess Market Value (US$ Bn), by Others, 2020 to 2035

Table 47: Middle East and Africa Portable Medical Devicess Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 48: Middle East and Africa Portable Medical Devicess Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Figure 01: Global Portable Medical Devicess Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 02: Global Portable Medical Devicess Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 03: Global Portable Medical Devicess Market Revenue (US$ Bn), by Diagnostic Imaging, 2020 to 2035

Figure 04: Global Portable Medical Devicess Market Revenue (US$ Bn), by Therapeutics, 2020 to 2035

Figure 05: Global Portable Medical Devicess Market Revenue (US$ Bn), by Monitoring Devices, 2020 to 2035

Figure 06: Global Portable Medical Devicess Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 07: Global Portable Medical Devicess Market Value Share Analysis, by Application, 2024 and 2035

Figure 08: Global Portable Medical Devicess Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 09: Global Portable Medical Devicess Market Revenue (US$ Bn), by Gynecology, 2020 to 2035

Figure 10: Global Portable Medical Devicess Market Revenue (US$ Bn), by Cardiology, 2020 to 2035

Figure 11: Global Portable Medical Devicess Market Revenue (US$ Bn), by Gastrointestinal, 2020 to 2035

Figure 12: Global Portable Medical Devicess Market Revenue (US$ Bn), by Urology, 2020 to 2035

Figure 13: Global Portable Medical Devicess Market Revenue (US$ Bn), by Neurology, 2020 to 2035

Figure 14: Global Portable Medical Devicess Market Revenue (US$ Bn), by Respiratory, 2020 to 2035

Figure 15: Global Portable Medical Devicess Market Revenue (US$ Bn), by Orthopedics, 2020 to 2035

Figure 16: Global Portable Medical Devicess Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 17: Global Portable Medical Devicess Market Value Share Analysis, by End User, 2024 and 2035

Figure 18: Global Portable Medical Devicess Market Attractiveness Analysis, by End User, 2024 and 2035

Figure 19: Global Portable Medical Devicess Market Revenue (US$ Bn), by Hospitals, 2025 to 2035

Figure 20: Global Portable Medical Devicess Market Revenue (US$ Bn), by Clinics, 2020 to 2035

Figure 21: Global Portable Medical Devicess Market Revenue (US$ Bn), by Ambulatory surgical centers, 2020 to 2035

Figure 22: Global Portable Medical Devicess Market Revenue (US$ Bn), by Homecare settings, 2020 to 2035

Figure 23: Global Portable Medical Devicess Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 24: Global Portable Medical Devicess Market Value Share Analysis, By Region, 2024 and 2035

Figure 25: Global Portable Medical Devicess Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 26: North America Portable Medical Devicess Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: North America Portable Medical Devicess Market Value Share Analysis, by Country, 2024 and 2035

Figure 28: North America Portable Medical Devicess Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 29: North America Portable Medical Devicess Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 30: North America Portable Medical Devicess Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 31: North America Portable Medical Devicess Market Value Share Analysis, by Application, 2024 and 2035

Figure 32: North America Portable Medical Devicess Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 33: North America Portable Medical Devicess Market Value Share Analysis, by End User, 2024 and 2035

Figure 34: North America Portable Medical Devicess Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 35: Europe Portable Medical Devicess Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 36: Europe Portable Medical Devicess Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 37: Europe Portable Medical Devicess Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 38: Europe Portable Medical Devicess Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 39: Europe Portable Medical Devicess Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 40: Europe Portable Medical Devicess Market Value Share Analysis, By Application, 2024 and 2035

Figure 41: Europe Portable Medical Devicess Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 42: Europe Portable Medical Devicess Market Value Share Analysis, by End User, 2024 and 2035

Figure 43: Europe Portable Medical Devicess Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 44: Asia Pacific Portable Medical Devicess Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Asia Pacific Portable Medical Devicess Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 46: Asia Pacific Portable Medical Devicess Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 47: Asia Pacific Portable Medical Devicess Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 48: Asia Pacific Portable Medical Devicess Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 49: Asia Pacific Portable Medical Devicess Market Value Share Analysis, By Application, 2024 and 2035

Figure 50: Asia Pacific Portable Medical Devicess Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 51: Asia Pacific Portable Medical Devicess Market Value Share Analysis, by End User, 2024 and 2035

Figure 52: Asia Pacific Portable Medical Devicess Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 53: Latin America Portable Medical Devicess Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 54: Latin America Portable Medical Devicess Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 55: Latin America Portable Medical Devicess Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 56: Latin America Portable Medical Devicess Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 57: Latin America Portable Medical Devicess Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 58: Latin America Portable Medical Devicess Market Value Share Analysis, By Application, 2024 and 2035

Figure 59: Latin America Portable Medical Devicess Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 60: Latin America Portable Medical Devicess Market Value Share Analysis, by End User, 2024 and 2035

Figure 61: Latin America Portable Medical Devicess Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 62: Middle East and Africa Portable Medical Devicess Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 63: Middle East and Africa Portable Medical Devicess Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 64: Middle East and Africa Portable Medical Devicess Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 65: Middle East and Africa Portable Medical Devicess Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 66: Middle East and Africa Portable Medical Devicess Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 67: Middle East and Africa Portable Medical Devicess Market Value Share Analysis, by Application, 2024 and 2035

Figure 68: Middle East and Africa Portable Medical Devicess Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 69: Middle East and Africa Portable Medical Devicess Market Value Share Analysis, by End User, 2024 and 2035

Figure 70: Middle East and Africa Portable Medical Devicess Market Attractiveness Analysis, by End User, 2025 to 2035