Reports

Reports

Increase in incidences of traumatic injuries and growth in investments in research and development activities are fueling the wound healing market size. The wound healing process repairs damaged tissues in chronic injuries, thereby being highly adopted in minimally invasive surgeries. Growth in geriatric population and rise prevalence of diabetic foot ulcers are fostering market expansion.

.webp)

Leading players focus on research and development to introduce innovative products for addressing consumer demands. Moreover, emergence of biomaterials and regenerative medicine offers lucrative healing market opportunities to the companies operating in this sector. They are launching advanced wound care products to increase recovery rates and enhance their product portfolio.

Healing of wounds is a physiological process whereby injured tissue is repaired. The process is undertaken in stages such as hemostasis, inflammation, proliferation, and remodeling. Catalyzing the healing process and efficiency of healing wounds are proper wound care, nutritional state, and general health. In addition, some of the innovative technologies of wound care such as topical therapy, dressings, and treatments can be utilized to enhance and speed up healing in difficult conditions.

Primary Intention, where neat, closely approximated wounds heal with little tissue loss and secondary Intention in the form of open, larger wounds with tissue loss healing by granulation and contraction are two significant types of wound healing. Reduction of risk of infection, minimized scarring, and restoration of function of the tissue are significant benefits of wound healing. It speeds up recovery to normal, reduces pain, and enhances overall comfort of the patient. Wound healing is observed in trauma injury as well as chronic wounds.

| Attribute | Detail |

|---|---|

| Wound Healing Market Drivers |

|

Traumatic injury is caused by sudden and forceful occurrences leading to physical damage. Some examples of traumatic injuries include fractures, concussions, cuts, and burns. Treatment from a medical practitioner should be sought immediately after the trauma to facilitate proper diagnosis, management, and recovery. Motor vehicle accidents are the major causes of traumatic injury in adolescents and children.

Lack of awareness regarding road safety and increase in traffic congestion are fueling the accident rates across the globe. Thus, increase in cases of traumatic injuries is augmenting the wound healing market development. According to the World Health Organization (WHO) report published in June 2022, around 1.3 million people die every year as a result of road traffic accidents.

Rise in demand for minimally invasive surgeries is propelling the wound healing market value. Minimally invasive surgeries involve fewer incisions leading to minor wounds. These wounds require proper healing to avoid severe infections. According to the report published by the National Institutes of Health, in January 2023, around 0.5% to 3% of patients undergoing surgery may experience surgical site infection, thereby driving the demand for effective wound healing.

Advanced biomaterials, regenerative medicine, and tissue repair procedures play a crucial role in wound healing. Healthcare organizations are heavily investing in research and development activities to introduce advanced wound healing. Technological advancements and adoption of regenerative tissue solutions are the major wound healing market drivers.

Increase in prevalence of chronic diseases among the geriatric population is boosting the market dynamics. Diabetes is one of the leading causes of chronic injuries among the elderly population. According to the National Center for Biotechnology Information, incidence of diabetic foot ulcers globally was between 9.1 million and 26.1 million. In addition, around 15% to 25% of patients with diabetes may develop a diabetic foot ulcer during their lifetime.

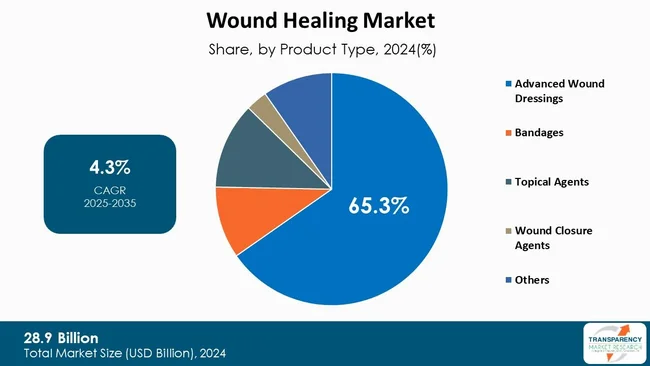

Advanced Wound Dressings are driving the wound healing market globally by product type due to improved healing results over traditional dressings, especially in the management of chronic, complex, or difficult-to-heal wounds such as diabetic foot ulcers, pressure ulcers, and surgical wounds.

The advanced dressings create a moist wound environment that has been reported to speed up healing, reduce the risk of infection, and avoid scarring. They can also incorporate antimicrobial agents (silver or iodine), foam, hydrocolloids, alginates, and hydrogels, which not only aid in tissue regeneration but also lower the frequency of dressing changes, enhancing patient comfort and compliance.

Apart from this, the increasing incidence of chronic diseases, aging, and high surgical rates worldwide have contributed to the surging demand for advanced wound care products. Healthcare professionals more and more utilize sophisticated dressings due to their clinical effectiveness and economic value in the long run, although they are more expensive in the beginning.

As innovation increases regarding wound care devices and drug delivery systems, advanced wound dressings have become the preferred treatment in hospital and home environments, further solidifying their leadership role in the market for wound healing.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is leading the overall wound healing market on account of high disease burden coupled with developed healthcare infrastructure and aggressive adoption of new-age wound care technologies. The region, and the United States in general, is undergoing a significant population suffering from chronic wounds caused by diseases such as diabetes, obesity, and cardiovascular diseases. It results in sustained demand for efficient and advanced therapies for wound healing.

Moreover, North America has a sophisticated medical infrastructure with increased accessibility of wound care professionals, reimbursement systems, and clinical pathways in support of the utilization of innovative wound products. The presence of key players like 3M, Smith & Nephew, and Johnson & Johnson also encourages innovation and readiness of novel therapies in the region.

Furthermore, heavy healthcare expenditure, strong distribution networks, and growing patient and physician awareness help in the quicker uptake of devices like bioactive dressings, NPWT, and growth factor therapies. Combined, they propel North America's size and pull the market, making it the global market leader in the wound healing industry.

Leading companies are partnering with hospitals, specialty clinics, and research institutes to expand inorganically. 3M Company, Braun Melsungen, Noventure, ConvaTec, Medline Industries, Smith & Nephew, Integra Lifesciences, Molnlycke Health Care, Paul Hartmann, Baxter, Coloplast A/S, Johnson & Johnson Services, Inc., Hydrofera, Cardinal Health, and Essity are the prominent market players.

Each of these players has been have been profiled in the Wound Healing market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 28.9 Bn |

| Forecast Value in 2035 | US$ 45.5 Bn |

| CAGR | 4.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global wound healing market was valued at US$ 28.9 Bn in 2024.

Wound Healing business is projected to cross US$ 45.5 Bn by the end of 2035.

Increase in cases of traumatic injuries and rising investments in research and development activities.

The CAGR is anticipated to be 4.3% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

3M Company, Braun Melsungen, Noventure, ConvaTec, Medline Industries, Smith & Nephew, Integra Lifesciences, Molnlycke Health Care, Paul Hartmann, Baxter, Coloplast A/S, Johnson & Johnson Services, Inc., Hydrofera, Cardinal Health, and Essity are the prominent wound healing market players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Wound Healing Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Wound Healing Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Key Industry Events

5.2. Epidemiology by Key Countries/Regions

5.3. Supply Chain Analysis

5.4. Technological advancements

5.5. Regulatory Scenario by Key Countries/Regions

5.6. Go-to Market Strategy

5.7. End-user Preference

5.8. Reimbursement Scenario by Key Countries

5.9. Top 10 Players Operating In the Market Space- Global

5.10. Key Product/Brand Analysis

5.11. Porter’s Five Forces Analysis

5.12. PESTLE Analysis

5.13. Benchmarking of Products offered by Competitors

6. Global Wound Healing Market Analysis and Forecasts, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product Type, 2020 to 2035

6.3.1. Advanced Wound Dressings

6.3.1.1. Foam Dressings

6.3.1.2. Hydrocolloid Dressings

6.3.1.3. Hydrogel Dressings

6.3.1.4. Alginate Dressings

6.3.1.5. Collagen Dressings

6.3.1.6. Others

6.3.2. Bandages

6.3.2.1. Elastic Bandages

6.3.2.2. Adhesive Bandages

6.3.2.3. Liquid Bandages

6.3.2.4. Others

6.3.3. Topical Agents

6.3.3.1. Hemostatic Agents

6.3.3.2. Antimicrobial

6.3.3.3. Others

6.3.4. Wound Closure Agents

6.3.4.1. Sutures

6.3.4.1.1. Absorbable

6.3.4.1.2. Non-absorbable

6.3.4.2. Adhesives & Sealants

6.3.4.3. Staplers

6.3.4.4. Others

6.3.5. Therapy Devices

6.3.5.1. Negative Pressure Wound Therapy Devices

6.3.5.2. Oxygen Therapy Devices

6.3.5.3. Others

6.3.6. Others

6.4. Market Attractiveness By Product Type

7. Global Wound Healing Market Analysis and Forecasts, By Wound Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Wound Type, 2020 to 2035

7.3.1. Acute Wound

7.3.1.1. Surgical & Traumatic Wounds

7.3.1.2. Burns

7.3.2. Chronic Wound

7.3.2.1. Infectious Wounds & Other Ischemic Wounds

7.3.2.2. Ulcers

7.3.2.2.1. Pressure Ulcers

7.3.2.2.2. Diabetic Foot Ulcers

7.3.2.2.3. Arterial & Venous Ulcers

7.3.2.2.4. Others

7.4. Market Attractiveness By Wound Type

8. Global Wound Healing Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2020 to 2035

8.3.1. Hospitals

8.3.2. Clinics

8.3.3. Ambulatory Surgical Centers

8.3.4. Home Healthcare

8.3.5. Others

8.4. Market Attractiveness By End-user

9. Global Wound Healing Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Region

10. North America Wound Healing Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Product Type, 2020 to 2035

10.2.1. Advanced Wound Dressings

10.2.1.1. Foam Dressings

10.2.1.2. Hydrocolloid Dressings

10.2.1.3. Hydrogel Dressings

10.2.1.4. Alginate Dressings

10.2.1.5. Collagen Dressings

10.2.1.6. Others

10.2.2. Bandages

10.2.2.1. Elastic Bandages

10.2.2.2. Adhesive Bandages

10.2.2.3. Liquid Bandages

10.2.2.4. Others

10.2.3. Topical Agents

10.2.3.1. Hemostatic Agents

10.2.3.2. Antimicrobial

10.2.3.3. Others

10.2.4. Wound Closure Agents

10.2.4.1. Sutures

10.2.4.1.1. Absorbable

10.2.4.1.2. Non-absorbable

10.2.4.2. Adhesives & Sealants

10.2.4.3. Staplers

10.2.4.4. Others

10.2.5. Therapy Devices

10.2.5.1. Negative Pressure Wound Therapy Devices

10.2.5.2. Oxygen Therapy Devices

10.2.5.3. Others

10.2.6. Others

10.3. Market Value Forecast By Wound Type, 2020 to 2035

10.3.1. Acute Wound

10.3.1.1. Surgical & Traumatic Wounds

10.3.1.2. Burns

10.3.2. Chronic Wound

10.3.2.1. Infectious Wounds & Other Ischemic Wounds

10.3.2.2. Ulcers

10.3.2.2.1. Pressure Ulcers

10.3.2.2.2. Diabetic Foot Ulcers

10.3.2.2.3. Arterial & Venous Ulcers

10.3.2.2.4. Others

10.4. Market Value Forecast By End-user, 2020 to 2035

10.4.1. Hospitals

10.4.2. Clinics

10.4.3. Ambulatory Surgical Centers

10.4.4. Home Healthcare

10.4.5. Others

10.5. Market Value Forecast By Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Wound Type

10.6.3. By End-user

10.6.4. By Country

11. Europe Wound Healing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product Type, 2020 to 2035

11.2.1. Advanced Wound Dressings

11.2.1.1. Foam Dressings

11.2.1.2. Hydrocolloid Dressings

11.2.1.3. Hydrogel Dressings

11.2.1.4. Alginate Dressings

11.2.1.5. Collagen Dressings

11.2.1.6. Others

11.2.2. Bandages

11.2.2.1. Elastic Bandages

11.2.2.2. Adhesive Bandages

11.2.2.3. Liquid Bandages

11.2.2.4. Others

11.2.3. Topical Agents

11.2.3.1. Hemostatic Agents

11.2.3.2. Antimicrobial

11.2.3.3. Others

11.2.4. Wound Closure Agents

11.2.4.1. Sutures

11.2.4.1.1. Absorbable

11.2.4.1.2. Non-absorbable

11.2.4.2. Adhesives & Sealants

11.2.4.3. Staplers

11.2.4.4. Others

11.2.5. Therapy Devices

11.2.5.1. Negative Pressure Wound Therapy Devices

11.2.5.2. Oxygen Therapy Devices

11.2.5.3. Others

11.2.6. Others

11.3. Market Value Forecast By Wound Type, 2020 to 2035

11.3.1. Acute Wound

11.3.1.1. Surgical & Traumatic Wounds

11.3.1.2. Burns

11.3.2. Chronic Wound

11.3.2.1. Infectious Wounds & Other Ischemic Wounds

11.3.2.2. Ulcers

11.3.2.2.1. Pressure Ulcers

11.3.2.2.2. Diabetic Foot Ulcers

11.3.2.2.3. Arterial & Venous Ulcers

11.3.2.2.4. Others

11.4. Market Value Forecast By End-user, 2020 to 2035

11.4.1. Hospitals

11.4.2. Clinics

11.4.3. Ambulatory Surgical Centers

11.4.4. Home Healthcare

11.4.5. Others

11.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Wound Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Wound Healing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product Type, 2020 to 2035

12.2.1. Advanced Wound Dressings

12.2.1.1. Foam Dressings

12.2.1.2. Hydrocolloid Dressings

12.2.1.3. Hydrogel Dressings

12.2.1.4. Alginate Dressings

12.2.1.5. Collagen Dressings

12.2.1.6. Others

12.2.2. Bandages

12.2.2.1. Elastic Bandages

12.2.2.2. Adhesive Bandages

12.2.2.3. Liquid Bandages

12.2.2.4. Others

12.2.3. Topical Agents

12.2.3.1. Hemostatic Agents

12.2.3.2. Antimicrobial

12.2.3.3. Others

12.2.4. Wound Closure Agents

12.2.4.1. Sutures

12.2.4.1.1. Absorbable

12.2.4.1.2. Non-absorbable

12.2.4.2. Adhesives & Sealants

12.2.4.3. Staplers

12.2.4.4. Others

12.2.5. Therapy Devices

12.2.5.1. Negative Pressure Wound Therapy Devices

12.2.5.2. Oxygen Therapy Devices

12.2.5.3. Others

12.2.6. Others

12.3. Market Value Forecast By Wound Type, 2020 to 2035

12.3.1. Acute Wound

12.3.1.1. Surgical & Traumatic Wounds

12.3.1.2. Burns

12.3.2. Chronic Wound

12.3.2.1. Infectious Wounds & Other Ischemic Wounds

12.3.2.2. Ulcers

12.3.2.2.1. Pressure Ulcers

12.3.2.2.2. Diabetic Foot Ulcers

12.3.2.2.3. Arterial & Venous Ulcers

12.3.2.2.4. Others

12.4. Market Value Forecast By End-user, 2020 to 2035

12.4.1. Hospitals

12.4.2. Clinics

12.4.3. Ambulatory Surgical Centers

12.4.4. Home Healthcare

12.4.5. Others

12.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. South Korea

12.5.5. Australia & New Zealand

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Wound Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Wound Healing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product Type, 2020 to 2035

13.2.1. Advanced Wound Dressings

13.2.1.1. Foam Dressings

13.2.1.2. Hydrocolloid Dressings

13.2.1.3. Hydrogel Dressings

13.2.1.4. Alginate Dressings

13.2.1.5. Collagen Dressings

13.2.1.6. Others

13.2.2. Bandages

13.2.2.1. Elastic Bandages

13.2.2.2. Adhesive Bandages

13.2.2.3. Liquid Bandages

13.2.2.4. Others

13.2.3. Topical Agents

13.2.3.1. Hemostatic Agents

13.2.3.2. Antimicrobial

13.2.3.3. Others

13.2.4. Wound Closure Agents

13.2.4.1. Sutures

13.2.4.1.1. Absorbable

13.2.4.1.2. Non-absorbable

13.2.4.2. Adhesives & Sealants

13.2.4.3. Staplers

13.2.4.4. Others

13.2.5. Therapy Devices

13.2.5.1. Negative Pressure Wound Therapy Devices

13.2.5.2. Oxygen Therapy Devices

13.2.5.3. Others

13.2.6. Others

13.3. Market Value Forecast By Wound Type, 2020 to 2035

13.3.1. Acute Wound

13.3.1.1. Surgical & Traumatic Wounds

13.3.1.2. Burns

13.3.2. Chronic Wound

13.3.2.1. Infectious Wounds & Other Ischemic Wounds

13.3.2.2. Ulcers

13.3.2.2.1. Pressure Ulcers

13.3.2.2.2. Diabetic Foot Ulcers

13.3.2.2.3. Arterial & Venous Ulcers

13.3.2.2.4. Others

13.4. Market Value Forecast By End-user, 2020 to 2035

13.4.1. Hospitals

13.4.2. Clinics

13.4.3. Ambulatory Surgical Centers

13.4.4. Home Healthcare

13.4.5. Others

13.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Wound Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Wound Healing Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product Type, 2020 to 2035

14.2.1. Advanced Wound Dressings

14.2.1.1. Foam Dressings

14.2.1.2. Hydrocolloid Dressings

14.2.1.3. Hydrogel Dressings

14.2.1.4. Alginate Dressings

14.2.1.5. Collagen Dressings

14.2.1.6. Others

14.2.2. Bandages

14.2.2.1. Elastic Bandages

14.2.2.2. Adhesive Bandages

14.2.2.3. Liquid Bandages

14.2.2.4. Others

14.2.3. Topical Agents

14.2.3.1. Hemostatic Agents

14.2.3.2. Antimicrobial

14.2.3.3. Others

14.2.4. Wound Closure Agents

14.2.4.1. Sutures

14.2.4.1.1. Absorbable

14.2.4.1.2. Non-absorbable

14.2.4.2. Adhesives & Sealants

14.2.4.3. Staplers

14.2.4.4. Others

14.2.5. Therapy Devices

14.2.5.1. Negative Pressure Wound Therapy Devices

14.2.5.2. Oxygen Therapy Devices

14.2.5.3. Others

14.2.6. Others

14.3. Market Value Forecast By Wound Type, 2020 to 2035

14.3.1. Acute Wound

14.3.1.1. Surgical & Traumatic Wounds

14.3.1.2. Burns

14.3.2. Chronic Wound

14.3.2.1. Infectious Wounds & Other Ischemic Wounds

14.3.2.2. Ulcers

14.3.2.2.1. Pressure Ulcers

14.3.2.2.2. Diabetic Foot Ulcers

14.3.2.2.3. Arterial & Venous Ulcers

14.3.2.2.4. Others

14.4. Market Value Forecast By End-user, 2020 to 2035

14.4.1. Hospitals

14.4.2. Clinics

14.4.3. Ambulatory Surgical Centers

14.4.4. Home Healthcare

14.4.5. Others

14.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Wound Type

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2024)

15.3. Company Profiles

15.3.1. 3M Company

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Financial Overview

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Braun Melsungen

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Financial Overview

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Noventure

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Financial Overview

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. ConvaTec

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Financial Overview

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Medline Industries

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Financial Overview

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Smith & Nephew

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Financial Overview

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Integra Lifesciences

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Financial Overview

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Molnlycke Health Care

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Financial Overview

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Paul Hartmann

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Financial Overview

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Baxter

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Financial Overview

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Coloplast A/S

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Financial Overview

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. Johnson & Johnson Services, Inc.

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Financial Overview

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. Hydrofera

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Financial Overview

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. Cardinal Health

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Financial Overview

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

15.3.15. Essity

15.3.15.1. Company Overview

15.3.15.2. Financial Overview

15.3.15.3. Financial Overview

15.3.15.4. Business Strategies

15.3.15.5. Recent Developments

List of Tables

Table 01: Global Wound Healing Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Wound Healing Market Value (US$ Bn) Forecast, By Wound Type, 2020 to 2035

Table 03: Global Wound Healing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 04: Global Wound Healing Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America Wound Healing Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 06: North America Wound Healing Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 07: North America Wound Healing Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 08: North America Wound Healing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 09: Europe Wound Healing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 10: Europe Wound Healing Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 11: Europe Wound Healing Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 12: Europe Wound Healing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Asia Pacific Wound Healing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 14: Asia Pacific Wound Healing Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 15: Asia Pacific Wound Healing Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 16: Asia Pacific Wound Healing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 17: Latin America Wound Healing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 18: Latin America Wound Healing Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 19: Latin America Wound Healing Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 20: Latin America Wound Healing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Middle East & Africa Wound Healing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 22: Middle East & Africa Wound Healing Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 23: Middle East & Africa Wound Healing Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 24: Middle East & Africa Wound Healing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Wound Healing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Wound Healing Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 03: Global Wound Healing Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 04: Global Wound Healing Market Revenue (US$ Bn), by Advanced Wound Dressings, 2020 to 2035

Figure 05: Global Wound Healing Market Revenue (US$ Bn), by Bandages, 2020 to 2035

Figure 06: Global Wound Healing Market Revenue (US$ Bn), by Topical Agents, 2020 to 2035

Figure 07: Global Wound Healing Market Revenue (US$ Bn), by Wound Closure Agents, 2020 to 2035

Figure 08: Global Wound Healing Market Revenue (US$ Bn), by Therapy Devices, 2020 to 2035

Figure 09: Global Wound Healing Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 10: Global Wound Healing Market Value Share Analysis, By Wound Type, 2024 and 2035

Figure 11: Global Wound Healing Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 12: Global Wound Healing Market Revenue (US$ Bn), by Acute Wound, 2020 to 2035

Figure 13: Global Wound Healing Market Revenue (US$ Bn), by Chronic Wound, 2020 to 2035

Figure 14: Global Wound Healing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 15: Global Wound Healing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 16: Global Wound Healing Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 17: Global Wound Healing Market Revenue (US$ Bn), by Clinics, 2020 to 2035

Figure 18: Global Wound Healing Market Revenue (US$ Bn), by Ambulatory Surgical Center, 2020 to 2035

Figure 19: Global Wound Healing Market Revenue (US$ Bn), by Home Healthcare, 2020 to 2035

Figure 20: Global Wound Healing Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 21: Global Wound Healing Market Value Share Analysis, By Region, 2024 and 2035

Figure 22: Global Wound Healing Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 23: North America Wound Healing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 24: North America Wound Healing Market Value Share Analysis, by Country, 2024 and 2035

Figure 25: North America Wound Healing Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 26: North America Wound Healing Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 27: North America Wound Healing Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 28: North America Wound Healing Market Value Share Analysis, By Wound Type, 2024 and 2035

Figure 29: North America Wound Healing Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 30: North America Wound Healing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 31: North America Wound Healing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 32: Europe Wound Healing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 33: Europe Wound Healing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 34: Europe Wound Healing Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 35: Europe Wound Healing Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 36: Europe Wound Healing Market Value Share Analysis, By Wound Type, 2024 and 2035

Figure 37: Europe Wound Healing Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 38: Europe Wound Healing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 39: Europe Wound Healing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 40: Asia Pacific Wound Healing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 41: Asia Pacific Wound Healing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 42: Asia Pacific Wound Healing Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 43: Asia Pacific Wound Healing Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 44: Asia Pacific Wound Healing Market Value Share Analysis, By Wound Type, 2024 and 2035

Figure 45: Asia Pacific Wound Healing Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 46: Asia Pacific Wound Healing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 47: Asia Pacific Wound Healing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 48: Latin America Wound Healing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 49: Latin America Wound Healing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 50: Latin America Wound Healing Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 51: Latin America Wound Healing Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 52: Latin America Wound Healing Market Value Share Analysis, By Wound Type, 2024 and 2035

Figure 53: Latin America Wound Healing Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 54: Latin America Wound Healing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 55: Latin America Wound Healing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 56: Middle East & Africa Wound Healing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 57: Middle East & Africa Wound Healing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 58: Middle East & Africa Wound Healing Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 59: Middle East & Africa Wound Healing Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 60: Middle East & Africa Wound Healing Market Value Share Analysis, By Wound Type, 2024 and 2035

Figure 61: Middle East & Africa Wound Healing Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 62: Middle East & Africa Wound Healing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 63: Middle East & Africa Wound Healing Market Attractiveness Analysis, By End-user, 2025 to 2035