Reports

Reports

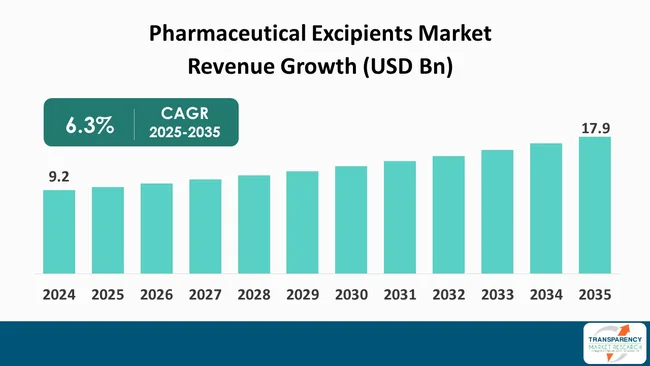

The global pharmaceutical excipients market size was valued at US$ 9.2 billion in 2024 and is projected to reach US$ 17.9 billion by 2035, expanding at a CAGR of 6.3% from 2025 to 2035. The market growth is driven by rising demand for personalized medicine, increasing prevalence of chronic diseases and stringent regulatory requirements.

Pharmaceutical excipients are an essential element in the pharmaceuticals industry as they are the inactive substances that make the delivery of active pharmaceutical ingredients (APIs) easier. The market has been growing significantly over the last few years and receiving support on various fronts. The demand for highly developed drug formulations has become one of the biggest factors for growth in this market, especially in the field of biologics and personalized medicine, where the requirement of solubilizing drug and bioavailability-enhancing excipients is increasing rapidly.

In addition, the increasing incidences of chronic diseases and the elderly population are the main sources of the necessity for drug delivery systems beyond conventional pharmaceutical research experiments.

Besides, the quality and safety of excipients, as stressed by the authorities, have made companies allocate more resources to research and development activities. The adoption of natural and plant-based excipients is also on the rise, as consumers prefer clean-label products. Besides, geographical extension, especially in the developing countries, is full of chances to grow significantly, as pharmaceutical companies are willing to tap into new consumer bases.

Pharmaceutical excipients are substances that are devoid of pharmacological effect but used in combination with active pharmaceutical ingredients (APIs) in the drug formulations. The main objective of their work is to enable the effective delivery of APIs, thus making drugs safe, stable, and efficient. Excipients can perform the functions of binders, fillers, preservatives, and substances, which make solubility easier. The selection of an appropriate excipient can have a great impact on the drug's performance, bioavailability, and the level of patient compliance.

The request for complicated drug formulations has been the main reason behind the significant growth observed in the market for excipients.

In the course of transformation of the pharmaceutical landscape, the requirement of the excipients that are advanced and offer the latest in drug delivery systems has risen. The present state of the market for excipients and challenges such as regulatory compliance and cost management notwithstanding, this market is prepared for expansion due to the continuous developments in formulation science and the patient-centered therapies focus. This indicates that the changes in technology and science are no obstacles for excipients to keep playing their indispensable role in the pharmaceutical industry.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

One of the main attributes to the expansion of the pharmaceutical excipients market is the increased incidence of chronic diseases. The onset of lifestyle-related ailments like cardiovascular diseases, diabetes, and cancer, alongside the aging of society, has led to the increased requirement of innovatively formulated drugs. It is common for chronic diseases to require continuous management and treatment; hence, the necessity for medicines that improve the quality of life of patients.

Pharmaceutical companies are stressing on the production of more advanced formulations that are capable of dealing with the complexities of chronic disease management. This implies the use of specially designed excipients that not only make the drug stable, dissolvable, and more bioavailable, but also allow the administration of the necessary effective amount over a long period.

Pharmaceutical figureheads are channelling more funds into innovative development projects and this, in turn, is the major factor that contributes to the growth of the excipients market. To come up with new and better drug formulations, most pharmaceutical companies are allocating huge sums of money to R&D endeavors. Initially, this commitment not only led to the development of new therapies but now it is also important in providing the safety needed in this very competitive healthcare landscape.

There is a strong need for the novel drug delivery systems like nanotechnologies to be developed, for example, nanoparticles, liposomes, and the other advanced formulations, which, in turn, has led to the demand for the provision of specialized excipients to meet the requirement of the market. Turning to R&D can allow companies to venture into new products and services that use different technologies or materials and lead to the creation of the desired excipients desired product that can be used in complex formulations can be used in biologics and personalized medicine.

Consequently, the pharmaceutical excipients industry is now being led by increased R&D funding, which is not only bringing new drug products to the market but also enhancing the drug efficacy and patient’s compliance, and is, therefore, considered the ultimate for healthcare transformation.

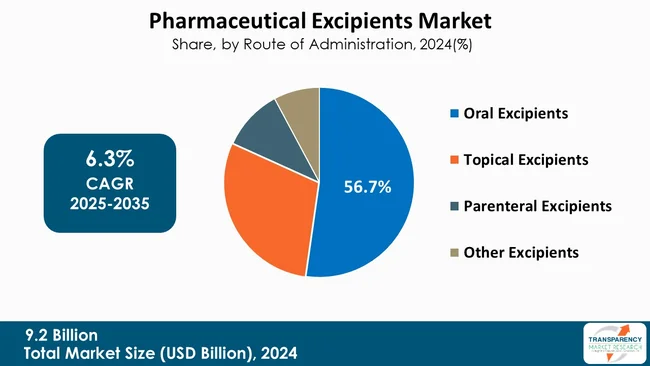

The oral excipients market, which includes the route of administration segment, is known for being one of the main sources of the market growth due to the extensive acceptance and the simplicity of the unit. Oral medications remain the primary usage of therapy and are justifiable by their easy handling, better patient compliance, and low cost. The rise in popularity of these dosage forms has consequently increased the demand for pharmaceutical excipients used in the preparation of oral dosage forms such as tablets, capsules, and powders.

The major factors include the necessity of advanced drug delivery systems to guarantee the best bioavailability and stability of the active pharmaceutical ingredients (APIs). Excipients are necessary in such formulations to provide the needed functionalities, such as binders, fillers, and disintegrates, through which matter of uniformity and therapeutic effect are ensured.

The same applies to the technological advancement in the development of excipients, which contributes to the promotion of new oral dosage forms such as controlled-release and taste-masked formulations. That greatly improves the duration and quality of treatment as well as market growth. Fabricators are thus encouraged to implant different consumer needs by making use of new technologies. Therefore, the oral excipients market continues to be a significant driver of the global pharmaceutical excipients market that reflects a wholehearted commitment to bring about advances in drug delivery that will offer safe and effective treatment to patients.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America holds the top position in the pharmaceutical excipients market, holding the largest revenue share of 38.2% and this is mainly due to the presence of a number of factors that have played a significant role in the region's growth and its overall market share in the industry. The first is the region's pharmaceutical industry, which can be described as mature and highly developed, with a very big part of its resources being allocated to research and development. Consequently, the major pharmaceutical companies and the biotech sector in the U.S. and Canada have always been very innovative which has in return led to a high demand for the pharmaceutical excipients of a quality that meets the expectations of drug formulations.

Stringent regulatory frameworks implemented by agencies such as the FDA, in which there is a requirement for excipients to meet high safety and efficacy standards, have resulted in the formation of a culture of quality assurance among producers and patients in the region. Also, the existence of cutting-edge research centers and universities has fostered partnerships between academia and the pharmaceutical industry, resulting in the creation of new excipients and the advancement of drug delivery systems.

The trend of chronic diseases in North America is one of the reasons for pharmaceutical companies to develop new drugs in the market, and in this process, they need some kind of excipients for their products. Another factor, which works in favor of this scenario, is the growing trend of personalized medicine, where the whole concept of patient-tailored formulations requiring specific pharmaceutical properties becomes a reality. All these taken together make up the North American region`s stable pharmaceutical infrastructure as the center of the current global pharmaceutical excipient market and leader in this transition.

BASF SE, Eastman Chemical Corporation, Ashland Global Holdings, Inc., Evonik Industries AG, Roquette Frères, DFE Pharma GmbH & Co. KG, Croda International Plc, Lubrizol Corporation, DuPont de Nemours, Inc., Colorcon, Inc., Merck KGaA, Kerry Group Plc, Shin-Etsu Chemical Co., Ltd., Signet Excipients Pvt. Ltd. are the key players governing the global Pharmaceutical Excipients Market.

Each of these players has been profiled in the pharmaceutical excipients market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 9.2 Bn |

| Forecast Value in 2035 | More than US$ 17.9 Bn |

| CAGR | 6.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Origin

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 9.2 Bn in 2024

It is projected to cross US$ 17.9 Bn by the end of 2035

Rising prevalence of chronic diseases and expansion of home-based and increased R&D investment

It is anticipated to grow at a CAGR of 6.3% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

BASF SE, Eastman Chemical Corporation, Ashland Global Holdings, Inc., Evonik Industries AG, Roquette Frères, DFE Pharma GmbH & Co. KG, Croda International Plc, Lubrizol Corporation, DuPont de Nemours, Inc., Colorcon, Inc., Merck KGaA, Kerry Group Plc, Shin-Etsu Chemical Co., Ltd., Signet Excipients Pvt. Ltd., and others

Table 01: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Origin, 2020 to 2035

Table 02: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Inorganic Chemicals, 2020 to 2035

Table 03: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Organic Chemicals, 2020 to 2035

Table 04: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Carbohydrates, 2020 to 2035

Table 05: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Starch, 2020 to 2035

Table 06: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Cellulose, 2020 to 2035

Table 07: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Petrochemicals, 2020 to 2035

Table 08: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Glycols, 2020 to 2035

Table 09: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Mineral Hydrocarbons, 2020 to 2035

Table 10: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Oleochemicals, 2020 to 2035

Table 11: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 12: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Functionality, 2020 to 2035

Table 13: Global Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 14: North America - Pharmaceutical Excipients Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 15: North America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Origin, 2020 to 2035

Table 16: North America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Inorganic Chemicals, 2020 to 2035

Table 17: North America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Organic Chemicals, 2020 to 2035

Table 18: North America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Carbohydrates, 2020 to 2035

Table 19: North America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Starch, 2020 to 2035

Table 20: North America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Cellulose, 2020 to 2035

Table 21: North America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Petrochemicals, 2020 to 2035

Table 22: North America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Glycols, 2020 to 2035

Table 23: North America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Mineral Hydrocarbons, 2020 to 2035

Table 24: North America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Oleochemicals, 2020 to 2035

Table 25: North America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 26: North America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Functionality, 2020 to 2035

Table 27: Europe - Pharmaceutical Excipients Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 28: Europe Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Origin, 2020 to 2035

Table 29: Europe Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Inorganic Chemicals, 2020 to 2035

Table 30: Europe Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Organic Chemicals, 2020 to 2035

Table 31: Europe Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Carbohydrates, 2020 to 2035

Table 32: Europe Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Starch, 2020 to 2035

Table 33: Europe Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Cellulose, 2020 to 2035

Table 34: Europe Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Petrochemicals, 2020 to 2035

Table 35: Europe Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Glycols, 2020 to 2035

Table 36: Europe Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Mineral Hydrocarbons, 2020 to 2035

Table 37: Europe Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Oleochemicals, 2020 to 2035

Table 38: Europe Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 39: Europe Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Functionality, 2020 to 2035

Table 40: Asia Pacific - Pharmaceutical Excipients Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 41: Asia Pacific Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Origin, 2020 to 2035

Table 42: Asia Pacific Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Inorganic Chemicals, 2020 to 2035

Table 43: Asia Pacific Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Organic Chemicals, 2020 to 2035

Table 44: Asia Pacific Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Carbohydrates, 2020 to 2035

Table 45: Asia Pacific Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Starch, 2020 to 2035

Table 46: Asia Pacific Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Cellulose, 2020 to 2035

Table 47: Asia Pacific Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Petrochemicals, 2020 to 2035

Table 48: Asia Pacific Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Glycols, 2020 to 2035

Table 49: Asia Pacific Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Mineral Hydrocarbons, 2020 to 2035

Table 50: Asia Pacific Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Oleochemicals, 2020 to 2035

Table 51: Asia Pacific Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 52: Asia Pacific Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Functionality, 2020 to 2035

Table 53: Latin America - Pharmaceutical Excipients Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 54: Latin America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Origin, 2020 to 2035

Table 55: Latin America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Inorganic Chemicals, 2020 to 2035

Table 56: Latin America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Organic Chemicals, 2020 to 2035

Table 57: Latin America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Carbohydrates, 2020 to 2035

Table 58: Latin America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Starch, 2020 to 2035

Table 59: Latin America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Cellulose, 2020 to 2035

Table 60: Latin America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Petrochemicals, 2020 to 2035

Table 61: Latin America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Glycols, 2020 to 2035

Table 62: Latin America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Mineral Hydrocarbons, 2020 to 2035

Table 63: Latin America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Oleochemicals, 2020 to 2035

Table 64: Latin America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 65: Latin America Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Functionality, 2020 to 2035

Table 66: Middle East & Africa - Pharmaceutical Excipients Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 67: Middle East & Africa Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Origin, 2020 to 2035

Table 68: Middle East & Africa Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Inorganic Chemicals, 2020 to 2035

Table 69: Middle East & Africa Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Organic Chemicals, 2020 to 2035

Table 70: Middle East & Africa Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Carbohydrates, 2020 to 2035

Table 71: Middle East & Africa Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Starch, 2020 to 2035

Table 72: Middle East & Africa Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Cellulose, 2020 to 2035

Table 73: Middle East & Africa Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Petrochemicals, 2020 to 2035

Table 74: Middle East & Africa Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Glycols, 2020 to 2035

Table 75: Middle East & Africa Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Mineral Hydrocarbons, 2020 to 2035

Table 76: Middle East & Africa Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Oleochemicals, 2020 to 2035

Table 77: Middle East & Africa Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 78: Middle East & Africa Pharmaceutical Excipients Market Value (US$ Bn) Forecast, By Functionality, 2020 to 2035

Figure 01: Global Pharmaceutical Excipients Market Value Share Analysis, By Origin, 2024 and 2035

Figure 02: Global Pharmaceutical Excipients Market Attractiveness Analysis, By Origin, 2025 to 2035

Figure 03: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Inorganic Chemicals, 2020 to 2035

Figure 04: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Organic Chemicals, 2020 to 2035

Figure 05: Global Pharmaceutical Excipients Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 06: Global Pharmaceutical Excipients Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 07: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Oral Excipients, 2020 to 2035

Figure 08: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Topical Excipients, 2020 to 2035

Figure 09: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Parenteral Excipients, 2020 to 2035

Figure 10: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Other Excipients, 2020 to 2035

Figure 11: Global Pharmaceutical Excipients Market Value Share Analysis, By Functionality, 2024 and 2035

Figure 12: Global Pharmaceutical Excipients Market Attractiveness Analysis, By Functionality, 2025 to 2035

Figure 13: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Fillers & Diluents, 2020 to 2035

Figure 14: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Binders, 2020 to 2035

Figure 15: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Suspension & Viscosity Agents, 2020 to 2035

Figure 16: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Coatings, 2020 to 2035

Figure 17: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Flavoring Agents, 2020 to 2035

Figure 18: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Disintegrants, 2020 to 2035

Figure 19: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Colorants, 2020 to 2035

Figure 20: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Lubricants & Glidants, 2020 to 2035

Figure 21: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Preservatives, 2020 to 2035

Figure 22: Global Pharmaceutical Excipients Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 23: Global Pharmaceutical Excipients Market Value Share Analysis, By Region, 2024 and 2035

Figure 24: Global Pharmaceutical Excipients Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 25: North America - Pharmaceutical Excipients Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 26: North America - Pharmaceutical Excipients Market Value Share Analysis, by Country, 2024 and 2035

Figure 27: North America - Pharmaceutical Excipients Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 28: North America Pharmaceutical Excipients Market Value Share Analysis, By Origin, 2024 and 2035

Figure 29: North America Pharmaceutical Excipients Market Attractiveness Analysis, By Origin, 2025 to 2035

Figure 30: North America Pharmaceutical Excipients Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 31: North America Pharmaceutical Excipients Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 32: North America Pharmaceutical Excipients Market Value Share Analysis, By Functionality, 2024 and 2035

Figure 33: North America Pharmaceutical Excipients Market Attractiveness Analysis, By Functionality, 2025 to 2035

Figure 34: Europe - Pharmaceutical Excipients Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 35: Europe - Pharmaceutical Excipients Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 36: Europe - Pharmaceutical Excipients Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 37: Europe Pharmaceutical Excipients Market Value Share Analysis, By Origin, 2024 and 2035

Figure 38: Europe Pharmaceutical Excipients Market Attractiveness Analysis, By Origin, 2025 to 2035

Figure 39: Europe Pharmaceutical Excipients Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 40: Europe Pharmaceutical Excipients Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 41: Europe Pharmaceutical Excipients Market Value Share Analysis, By Functionality, 2024 and 2035

Figure 42: Europe Pharmaceutical Excipients Market Attractiveness Analysis, By Functionality, 2025 to 2035

Figure 43: Asia Pacific - Pharmaceutical Excipients Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: Asia Pacific - Pharmaceutical Excipients Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 45: Asia Pacific - Pharmaceutical Excipients Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 46: Asia Pacific Pharmaceutical Excipients Market Value Share Analysis, By Origin, 2024 and 2035

Figure 47: Asia Pacific Pharmaceutical Excipients Market Attractiveness Analysis, By Origin, 2025 to 2035

Figure 48: Asia Pacific Pharmaceutical Excipients Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 49: Asia Pacific Pharmaceutical Excipients Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 50: Asia Pacific Pharmaceutical Excipients Market Value Share Analysis, By Functionality, 2024 and 2035

Figure 51: Asia Pacific Pharmaceutical Excipients Market Attractiveness Analysis, By Functionality, 2025 to 2035

Figure 52: Latin America - Pharmaceutical Excipients Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 53: Latin America - Pharmaceutical Excipients Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 54: Latin America - Pharmaceutical Excipients Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 55: Latin America Pharmaceutical Excipients Market Value Share Analysis, By Origin, 2024 and 2035

Figure 56: Latin America Pharmaceutical Excipients Market Attractiveness Analysis, By Origin, 2025 to 2035

Figure 57: Latin America Pharmaceutical Excipients Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 58: Latin America Pharmaceutical Excipients Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 59: Latin America Pharmaceutical Excipients Market Value Share Analysis, By Functionality, 2024 and 2035

Figure 60: Latin America Pharmaceutical Excipients Market Attractiveness Analysis, By Functionality, 2025 to 2035

Figure 61: Middle East & Africa - Pharmaceutical Excipients Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Middle East & Africa - Pharmaceutical Excipients Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 63: Middle East & Africa - Pharmaceutical Excipients Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 64: Middle East & Africa Pharmaceutical Excipients Market Value Share Analysis, By Origin, 2024 and 2035

Figure 65: Middle East & Africa Pharmaceutical Excipients Market Attractiveness Analysis, By Origin, 2025 to 2035

Figure 66: Middle East & Africa Pharmaceutical Excipients Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 67: Middle East & Africa Pharmaceutical Excipients Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 68: Middle East & Africa Pharmaceutical Excipients Market Value Share Analysis, By Functionality, 2024 and 2035

Figure 69: Middle East & Africa Pharmaceutical Excipients Market Attractiveness Analysis, By Functionality, 2025 to 2035