Reports

Reports

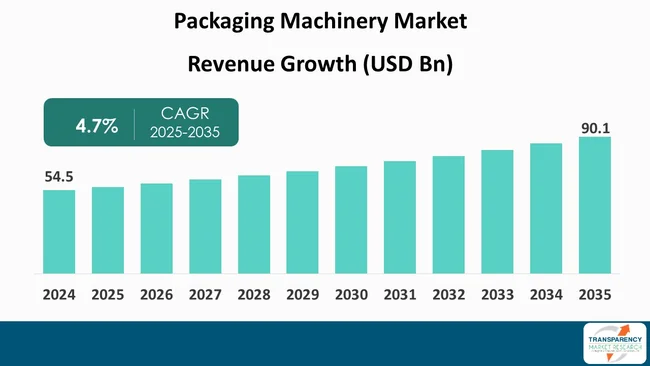

The global packaging machinery market size was valued at US$ 54.5 Bn in 2024 and is projected to reach US$ 90.1 Bn by 2035, expanding at a CAGR of 4.7% from 2025 to 2035. The market growth is driven by rising manufacturer shifts toward automated packaging systems featuring advanced intelligent technologies, coupled with expanding food-processing sectors that boost production efficiency, equipment innovation, and collaborative machine product integration globally.

The packaging machinery market is growing owing to the rising demand for energy efficiency, automation, and sustainability. Advancements in robotics, AI, and machine learning are driving greater precision and speed at lower cost in packaging. An increase in consumer demand for packaged food in the food, pharmaceutical, and e-Commerce industries is also driving expansion of the market. Industry dynamics are being transformed by trends such as sustainable packaging and increased automation.

Another significant trend is the introduction of intelligent packaging solutions that can track product integrity and provide extended shelf life. These innovations are enhancing the efficiency of production and are also leading to reduction in waste, along with an improvement in the quality of products. With the industry's demand for faster production and lower cost, packaging machinery manufacturers are paying more attention to automation and AI-based technology.

Packaging machinery is used to pack products, which includes food and beverages, pharmaceuticals, personal care, chemicals, and consumer goods. The role of the packaging machinery is to automate filling, sealing, labeling, and packing over wrappers and to significantly increase production speed. This equipment enhances production, lowers labor expenses, and provides the presentation of quality products.

Different types of packaging machinery consist of form-fill-seal (FFS) machines, filling machines, labeling machines, shrink-wrapping machines, and cartoning machines. These units are built to handle different product formats such as liquid, powder, solid, and paste. The range of packaging machinery includes semi-automatic to fully automated systems that can be used for different production volumes.

Such systems make it possible to increase output while keeping the packaging of products in accordance with safety regulations. Moreover, due to technological innovations, the industry is modifying with machines that provide high flexibility, speed, and can be easily integrated with smart systems for monitoring and data analysis.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Driven by the need to lower operating costs, difficulty of labor shortages persisting, and the increased need for rapid turnover for modern distribution channels, manufacturers and brand owners are turning to more automation solutions. Automation systems practically limit regular manual handling, which contributes toward reducing contamination and work-related injury, while also providing stable production speeds. In addition, plants are deploying connected sensors and software to enable predictive maintenance, so that machinery-related problems can be fixed before causing output disruptions.

However, many processors concentrate on form-fill-seal lines that can manage several pack formats with little human intervention. Equipment suppliers have observed rising interest in retrofitting, as producers look for ways to update the older assets with robotic pick-and-place units, vision systems or in-line weighing. This route helps retain existing capital equipment while adding flexibility and accuracy.

Packaging machinery manufacturers have highlighted a higher use of automation solutions in e-Commerce and fulfillment centers. For instance, Ranpak reported an expansion of its protective packaging systems, and that revenue has been derived from electronic platforms and systems, which continue to grow as retailers and logistics providers adopt automated void-fill and box-filling solutions. The development shows that automated packaging is increasingly used to enhance the utilization of cartons, speed up packing jobs, and reduce the waste of transport materials, which are the authentic rather than promotional concerns in whole industries.

Investments in robotics and AI within packaging operations have moved beyond pilot projects and are treated as core capital expenditure. Vendors of industrial robots and system integrators are building systems with longer reach, higher payloads, and faster repeatable cycle times. These systems increasingly combine vision, force feedback, and certified safety functions so that delicate, irregular, and flexible packs can be gripped and oriented without damaging films or seals.

Machine learning models are being deployed for anomaly detection on seal integrity and fill accuracy, as well as for adaptive line balancing, where conveyors and wrapping heads adjust speed automatically to maintain target throughput. Digital-twin models are also used to commission cells more quickly by validating motion paths and collision risks before physical installation.

For instance, Siemens has presented a packaging line controlled by standard PLC hardware with an AI layer that has adjusted wrapping parameters and determined box orientation in real time. The demonstration has reported a 33% increase in wrapped boxes per minute without replacing mechanical components, illustrating that software optimization can raise output on existing machines.

ABB and the other robotics manufacturers have also announced product extensions focused on integrated robotic packaging cells, indicating that suppliers are technically and commercially prepared to scale these solutions for converters and processors seeking higher throughput on mixed-product lines.

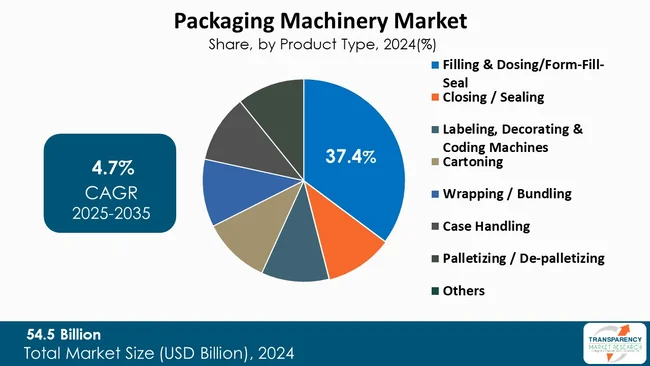

In 2024, filling and dosing/form-fill-seal (FFS) systems represented the dominant product type, holding 29.9% of the global packaging machinery market. Their position was linked to the broad functional range of FFS technology, as both - vertical and horizontal configurations can create a pack from roll stock, meter the product, and complete sealing within one continuous line. This structure supports diverse formats including snacks, powdered ingredients, liquids, unit doses, and several pharmaceutical presentations.

Filling and dosing modules such as piston, volumetric and net-weight fillers, along with auger systems for powders are typically integrated with an FFS head or with pre-formed container fillers. Through this arrangement, producers manage a wide spectrum of viscosities and particulates while maintaining dosing accuracy. These systems also accommodate high-speed changeovers, supported by in-line inspection tools such as checkweighers, metal detection, and vision units for seal and print control. The combination of rapid format change and traceable quality checks has made them suitable for operations where throughput and compliance are equally important.

Large food processors that have moved to monoblock FFS and dosing platforms reported smaller line footprints and fewer labour hours per ton of packed output. They have also noted reduced lead time when introducing new SKUs as compared to running separate forming, filling and secondary packaging stations. Suppliers, including well-established OEMs such as Syntegon and Krones, have presented similar results from horizontal and vertical FFS portfolios. Continued growth of single-serve packs and strict retail presentation requirements have reinforced demand for flexible FFS and dosing equipment, their sustaining their leading market share.

| Attribute | Detail |

|---|---|

| Leading Region |

|

In the global packaging-machinery industry, Asia-Pacific held 37.4% of the market share. The region has maintained this lead as several structural advantages have continued to reinforce one another. Manufacturing and processing activities continue to be concentrated in China, India, Japan and the economies of Southeast Asia, thereby creating a large installed base of food, beverages, and pharmaceutical producers that regularly invest in modernized or new packing lines. As demand for packaged goods increases, domestic processors need form-fill-seal, dependable filling, cartoning and end-of-line automation, which support consistent orders for machinery suppliers.

China functions as the core of this system. Provincial clusters such as Guangdong have specialized in packaging-equipment output.

India continues to implement trade and industrial facilitation measures designed for strengthening food processing and related production. These measures have encouraged producers to invest in local machinery rather than rely on external sourcing.

Coesia S.p.A., GEA Group Aktiengesellschaft, Herma GmbH, Industria Macchine Automatiche SpA, Ishida Co. Ltd., Marchesini Group S.p.A., Muller Load Containment Solutions, OPTIMA Packaging Group GmbH, PFM Group, Premier Tech Chronos Ltd., ProMach, Inc., Robert Bosch GmbH, Tetra Pak International S.A., Videojet Technologies, Inc., and Omori Machinery Co. Ltd. are some of the leading manufacturers operating in the global packaging machinery market.

Each of these companies has been profiled in the packaging machinery market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 54.5 Bn |

| Market Forecast Value in 2035 | US$ 90.1 Bn |

| Growth Rate (CAGR 2025 to 2035) | 4.7% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentations | By Product Type

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global packaging machinery market was valued at US$ 54.5 Bn in 2024

The global packaging machinery industry is projected to reach at US$ 90.1 Bn by the end of 2035

Rising demand for automated packaging solutions and investment in robotics & AI-powered packaging systems are some of the factors driving the expansion of packaging machinery market.

The CAGR is anticipated to be 4.7% from 2025 to 2035

Coesia S.p.A., GEA Group Aktiengesellschaft, Herma GmbH, Industria Macchine Automatiche SpA, Ishida Co. Ltd., Marchesini Group S.p.A., Muller Load Containment Solutions, OPTIMA Packaging Group GmbH, PFM Group, Premier Tech Chronos Ltd., ProMach, Inc., Robert Bosch GmbH, Tetra Pak International S.A., Videojet Technologies, Inc., Omori Machinery Co. Ltd., and others

Table 01: Global Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 02: Global Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 03: Global Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 04: Global Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 05: Global Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 06: Global Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 07: Global Packaging Machinery Market Value (US$ Bn) Projection, By Region 2020 to 2035

Table 08: Global Packaging Machinery Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Table 09: North America Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 10: North America Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 11: North America Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 12: North America Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 13: North America Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 14: North America Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 15: North America Packaging Machinery Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 16: North America Packaging Machinery Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 17: U.S. Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 18: U.S. Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 19: U.S. Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 20: U.S. Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 21: U.S. Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 22: U.S. Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 23: Canada Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 24: Canada Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 25: Canada Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 26: Canada Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 27: Canada Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 28: Canada Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 29: Europe Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 30: Europe Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 31: Europe Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 32: Europe Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 33: Europe Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 34: Europe Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 35: Europe Packaging Machinery Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 36: Europe Packaging Machinery Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 37: U.K. Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 38: U.K. Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 39: U.K. Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 40: U.K. Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 41: U.K. Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 42: U.K. Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 43: Germany Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 44: Germany Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 45: Germany Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 46: Germany Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 47: Germany Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 48: Germany Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 49: France Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 50: France Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 51: France Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 52: France Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 53: France Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 54: France Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 55: Italy Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 56: Italy Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 57: Italy Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 58: Italy Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 59: Italy Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 60: Italy Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 61: Spain Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 62: Spain Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 63: Spain Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 64: Spain Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 65: Spain Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 66: Spain Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 67: The Netherlands Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 68: The Netherlands Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 69: The Netherlands Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 70: The Netherlands Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 71: The Netherlands Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 72: The Netherlands Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 73: Asia Pacific Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 74: Asia Pacific Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 75: Asia Pacific Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 76: Asia Pacific Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 77: Asia Pacific Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 78: Asia Pacific Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 79: Asia Pacific Packaging Machinery Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 80: Asia Pacific Packaging Machinery Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 81: China Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 82: China Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 83: China Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 84: China Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 85: China Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 86: China Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 87: India Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 88: India Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 89: India Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 90: India Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 91: India Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 92: India Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 93: Japan Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 94: Japan Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 95: Japan Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 96: Japan Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 97: Japan Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 98: Japan Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 99: Australia Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 100: Australia Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 101: Australia Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 102: Australia Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 103: Australia Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 104: Australia Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 105: South Korea Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 106: South Korea Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 107: South Korea Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 108: South Korea Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 109: South Korea Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 110: South Korea Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 111: ASEAN Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 112: ASEAN Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 113: ASEAN Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 114: ASEAN Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 115: ASEAN Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 116: ASEAN Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 117: Middle East & Africa Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 118: Middle East & Africa Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 119: Middle East & Africa Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 120: Middle East & Africa Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 121: Middle East & Africa Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 122: Middle East & Africa Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 123: Middle East & Africa Packaging Machinery Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 124: Middle East & Africa Packaging Machinery Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 125: GCC Countries Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 126: GCC Countries Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 127: GCC Countries Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 128: GCC Countries Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 129: GCC Countries Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 130: GCC Countries Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 131: South Africa Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 132: South Africa Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 133: South Africa Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 134: South Africa Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 135: South Africa Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 136: South Africa Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 137: Latin America Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 138: Latin America Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 139: Latin America Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 140: Latin America Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 141: Latin America Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 142: Latin America Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 143: Latin America Packaging Machinery Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 144: Latin America Packaging Machinery Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 145: Brazil Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 146: Brazil Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 147: Brazil Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 148: Brazil Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 149: Brazil Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 150: Brazil Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 151: Mexico Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 152: Mexico Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 153: Mexico Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 154: Mexico Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 155: Mexico Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 156: Mexico Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Table 157: Argentina Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 158: Argentina Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 159: Argentina Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Table 160: Argentina Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Table 161: Argentina Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Table 162: Argentina Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 01: Global Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 02: Global Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 03: Global Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 04: Global Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 05: Global Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 06: Global Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 07: Global Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 08: Global Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 09: Global Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 10: Global Packaging Machinery Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 11: Global Packaging Machinery Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 12: Global Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 13: North America Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 14: North America Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 15: North America Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 16: North America Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 17: North America Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 18: North America Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 19: North America Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 20: North America Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 21: North America Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 22: North America Packaging Machinery Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 23: North America Packaging Machinery Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 24: North America Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 25: U.S. Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 26: U.S. Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 27: U.S. Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 28: U.S. Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 29: U.S. Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 30: U.S. Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 31: U.S. Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 32: U.S. Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 33: U.S. Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 34: Canada Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 35: Canada Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 36: Canada Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 37: Canada Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 38: Canada Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 39: Canada Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 40: Canada Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 41: Canada Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 42: Canada Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 43: Europe Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 44: Europe Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 45: Europe Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 46: Europe Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 47: Europe Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 48: Europe Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 49: Europe Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 50: Europe Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 51: Europe Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 52: Europe Packaging Machinery Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 53: Europe Packaging Machinery Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 54: Europe Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 55: U.K. Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 56: U.K. Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 57: U.K. Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 58: U.K. Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 59: U.K. Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 60: U.K. Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 61: U.K. Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 62: U.K. Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 63: U.K. Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 64: Germany Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 65: Germany Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 66: Germany Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 67: Germany Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 68: Germany Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 69: Germany Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 70: Germany Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 71: Germany Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 72: Germany Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 73: France Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 74: France Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 75: France Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 76: France Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 77: France Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 78: France Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 79: France Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 80: France Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 81: France Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 82: Italy Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 83: Italy Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 84: Italy Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 85: Italy Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 86: Italy Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 87: Italy Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 88: Italy Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 89: Italy Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 90: Italy Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 91: Spain Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 92: Spain Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 93: Spain Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 94: Spain Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 95: Spain Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 96: Spain Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 97: Spain Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 98: Spain Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 99: Spain Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 100: The Netherlands Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 101: The Netherlands Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 102: The Netherlands Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 103: The Netherlands Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 104: The Netherlands Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 105: The Netherlands Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 106: The Netherlands Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 107: The Netherlands Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 108: The Netherlands Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 109: Asia Pacific Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 110: Asia Pacific Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 111: Asia Pacific Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 112: Asia Pacific Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 113: Asia Pacific Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 114: Asia Pacific Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 115: Asia Pacific Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 116: Asia Pacific Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 117: Asia Pacific Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 118: Asia Pacific Packaging Machinery Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 119: Asia Pacific Packaging Machinery Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 120: Asia Pacific Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 121: China Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 122: China Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 123: China Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 124: China Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 125: China Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 126: China Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 127: China Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 128: China Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 129: China Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 130: India Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 131: India Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 132: India Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 133: India Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 134: India Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 135: India Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 136: India Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 137: India Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 138: India Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 139: Japan Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 140: Japan Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 141: Japan Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 142: Japan Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 143: Japan Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 144: Japan Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 145: Japan Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 146: Japan Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 147: Japan Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 148: Australia Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 149: Australia Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 150: Australia Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 151: Australia Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 152: Australia Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 153: Australia Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 154: Australia Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 155: Australia Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 156: Australia Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 157: South Korea Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 158: South Korea Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 159: South Korea Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 160: South Korea Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 161: South Korea Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 162: South Korea Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 163: South Korea Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 164: South Korea Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 165: South Korea Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 166: ASEAN Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 167: ASEAN Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 168: ASEAN Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 169: ASEAN Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 170: ASEAN Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 171: ASEAN Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 172: ASEAN Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 173: ASEAN Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 174: ASEAN Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 175: Middle East & Africa Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 176: Middle East & Africa Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 177: Middle East & Africa Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 178: Middle East & Africa Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 179: Middle East & Africa Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 180: Middle East & Africa Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 181: Middle East & Africa Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 182: Middle East & Africa Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 183: Middle East & Africa Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 184: Middle East & Africa Packaging Machinery Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 185: Middle East & Africa Packaging Machinery Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 186: Middle East & Africa Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 187: GCC Countries Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 188: GCC Countries Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 189: GCC Countries Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 190: GCC Countries Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 191: GCC Countries Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 192: GCC Countries Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 193: GCC Countries Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 194: GCC Countries Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 195: GCC Countries Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 196: South Africa Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 197: South Africa Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 198: South Africa Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 199: South Africa Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 200: South Africa Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 201: South Africa Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 202: South Africa Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 203: South Africa Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 204: South Africa Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 205: Latin America Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 206: Latin America Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 207: Latin America Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 208: Latin America Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 209: Latin America Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 210: Latin America Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 211: Latin America Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 212: Latin America Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 213: Latin America Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 214: Latin America Packaging Machinery Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 215: Latin America Packaging Machinery Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 216: Latin America Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 217: Brazil Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 218: Brazil Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 219: Brazil Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 220: Brazil Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 221: Brazil Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 222: Brazil Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 223: Brazil Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 224: Brazil Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 225: Brazil Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 226: Mexico Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 227: Mexico Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 228: Mexico Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 229: Mexico Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 230: Mexico Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 231: Mexico Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 232: Mexico Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 233: Mexico Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 234: Mexico Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035

Figure 235: Argentina Packaging Machinery Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 236: Argentina Packaging Machinery Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 237: Argentina Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 238: Argentina Packaging Machinery Market Value (US$ Bn) Projection, By Packaging Technology 2020 to 2035

Figure 239: Argentina Packaging Machinery Market Volume (Thousand Units) Projection, By Packaging Technology 2020 to 2035

Figure 240: Argentina Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By Packaging Technology 2025 to 2035

Figure 241: Argentina Packaging Machinery Market Value (US$ Bn) Projection, By End-use Industry 2020 to 2035

Figure 242: Argentina Packaging Machinery Market Volume (Thousand Units) Projection, By End-use Industry 2020 to 2035

Figure 243: Argentina Packaging Machinery Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2025 to 2035