Reports

Reports

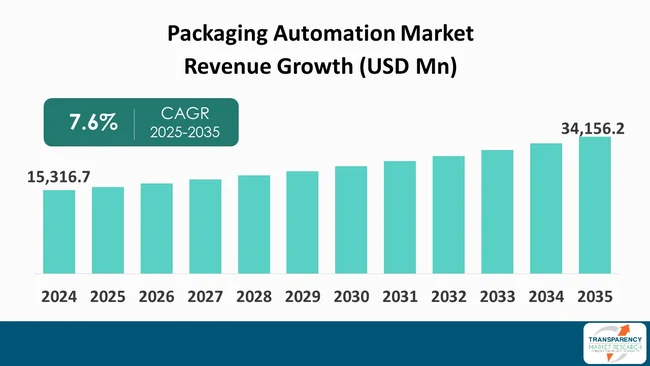

The global packaging automation market size was valued at US$ 15,316.7 million in 2024 and is projected to reach US$ 34,156.2 million by 2035, expanding at a CAGR of 7.6% from 2025 to 2035. The market growth is driven by the rising demand for operational efficiency, and expansion of e-commerce and logistics.

The packaging automation market is witnessing rapid growth as industries continue deploying new technologies for optimizing their operations and improving productivity. Increased operational efficiency and the significant growth of e-commerce and logistics are the reasons behind embracing solutions to increase throughput, minimize human error, and achieve consistency across packaging lines.

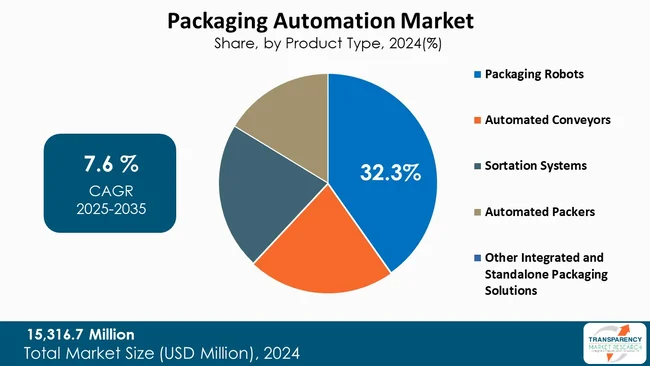

As several manufacturers deploy packaging robots, this segment has emerged as the dominant segment due to speed, flexibility, and the ability to perform multiple continuous functions including case packing, quality inspection, wrapping, and picking in one device. In terms of market growth, the Asia-Pacific region is leading the packaging automation market, driven by the manufacturing base and others that provide goods and services to industrial and retail markets, the growing industrial output, and government incentives that promote smart manufacturing and associated automation adoption. Altogether, the evolution of the Packaging Automation industry is already heading to the smart, scalable, and flexible delivery and packaging systems in accordance to Industry 4.0 to streamline and optimize the performance of operations, reduce expenses, and address the needs of a rapidly-changing global economy.

The packaging automation market is the combination of both robotics, high-tech machinery, control systems, and software for automating the packaging process used in the packaging of various industries, including pharmaceuticals, food & beverages, e-Commerce, consumer goods, and logistics. It entails automation of operations such as sealing, filling, palletizing, labeling, wrapping, and coding for increasing the accuracy and efficiency, as well as productivity with the least human intervention.

The automation systems that are intended to package products are built to automate operations that are fast yet precise enough to minimize waste and meet the standards of safety and quality. They are both the semi- and fully automated and are applicable to different production volumes and working requirements. The need to have greener packaging, reduction of labor costs, and maximization of throughput in the operations are the prevailing factors of market expansion.

Furthermore, the integration of smart technologies like Internet of Things (IoT), Artificial Intelligence (AI), and machine vision is transforming conventional packaging lines into adaptive, intelligent systems capable of predictive maintenance and real-time monitoring. As industries shift toward data-driven and digitalized manufacturing environments, packaging automation is turning out to be a key enabler of Industry 4.0, supporting quicker production cycles, personalization, and improved supply chain visibility.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The global manufacturing value-added (MVA) per capita was US$ 1,936 (2024, constant prices) in 2024 according to the United Nations Industrial Development Organization (UNIDO), which is 17.4% higher than in 2015. This growth means that every person is currently making more contributions to the manufacturing output and this is indicative of increased productivity, modernization, and effectiveness of operations in all the industries.

In addition, UNIDO mentions that the global manufacturing proportion of GDP was approximately 16.5% in 2023, which highlights the stability and robustness of industrial output in the changing market environment. Moreover, worldwide manufacturing output increased by 1.0% quarter-on-quarter in Q2 2024 as compared to 1.1% in industrializing economies in the same quarter.

These statistics demonstrate the fact that global growth in production is average, but the industries are focusing on efficiency, accuracy, and sustainability to be competitive. Automation has become the focus in terms of increasing efficiency and reliability as business works to improve their profitability and operational efficiency.

This emphasis in the packaging automation market is reflected in the greater utilization of robotics, modern control systems, machine vision, and AI-driven monitoring technologies that reduce downtime and human error. Therefore, the most significant role is played by the global focus on the efficiency of operations allowing companies to optimize their performance, cut expenses, and cater to the continually increasing global demand in the most efficient way.

The growth of e-commerce and logistics is one of the driving forces behind the global packaging automation market since the growing online retailing demand necessitates more efficient and faster, as well as reliable, packaging and fulfillment processes. The International Telecommunication Union (ITU) estimates that by 2024 some 5.5 billion individuals globally, or about 68 % of the total population, had access to the Internet, or 53 % in 2019. This high increase in digital connectivity has led to a massive increase in the online consumer base of e-commerce and this has seen an increase in the levels of online orders in various sectors including food and beverage, consumer goods, electronics and pharmaceuticals.

Furthermore, the growing number of consumers shopping online is putting a growing strain on the companies to ensure that they are fast and efficient in picking, wrapping and loading packages and automation in packaging lines has not yet been thought of in business circles as a crucial necessity. Its packaging solutions must be effective enough to accommodate a wide range of products, reduce human errors caused by the human hands, reduce material wastage and ensure the products are provided on time to meet the customer requirements. At the same time, the pressure of the automated systems is also supported by the globalization of the supply chains and the increased number of complexity of the logistics networks.

Automated packaging and materials handling solutions not only help process more orders but also allow for increased efficiency in warehouse space utilization, clear palletizing and labeling, and smoother integration with digital order management platforms. Increasing Internet penetration, logistics networks, and online purchases are driving companies to implement the latest packaging automation equipment. Customer demands, the need to be competitive in this dynamic environment of global e-commerce and logistics, the need to improve operations, have become paramount to the industry and one of the primary drivers of market growth.

Packaging robots holds the largest share of 34.5% as they are fast and highly flexible. They can incorporate functions such as case packing, quality inspection, wrapping and picking to eliminate the need for manual labour and reduce errors.

In the food & beverages and pharmaceuticals sectors, consumer goods and e‑Commerce sectors, more number of product manufacturers are using packaging robots to increase output and quality consistency. Developments of robots’ technology such as AI/machine vision, advanced sensors, and cobot features enable the robot to work around humans without threatening safety.

Packaging robots provide greater flexibility, easier reconfiguration and can accommodate a wider variety of package sizes and types than automated conveyors, sortation systems, automatic packers, and likewise. They also maximize the use of floor space, minimize downtime, and offer data for predictive maintenance and process improvement. With the rise in e-commerce demand, logistical complexities and the need for fulfillment personalization for today’s consumers, robotics for packaging is still a paramount need as businesses search for operation efficiencies. Their speed, flexible capability, and accuracy justify them as the product of choice in today's packaging environments, providing high performance while meeting the needs of Industry 4.0.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia-Pacific region is dominating with a market share of 32.8%. It is witnessing steady manufacturing activities, industrial outputs, and increasing adoption of automation, which has turned the region into a hub for packaging automation.

China’s Ministry of Industry and Information Technology reported in 2024 that China’s total value-added industrial output was around US$ 5.65 trillion (about ¥40.5 trillion) making it the world's largest manufacturing economy. Manufacturing accounted for about 24.86% of China’s GDP in the same period, reflecting the region’s strong industrial base.

The abundance of production and its variety in countries like China, India, Japan, and South Korea drive a significant demand for automated materials handling solutions such as packaging robots, conveyors robotics systems etc., which can guarantee efficacy, uniformity and shorter delivery period.

Furthermore, government programs in the Asia-Pacific region that endorse Industry 4.0 and smart manufacturing drive the demand for automation in packaging, as manufacturers look to boost productivity, minimize labor reliance, and improve supply chain effectiveness. With growing manufacturing scales and increased operational complexities, the Asia-Pacific becomes the promising packaging automation market for players in the region.

Packaging automation manufacturers are advancing their technologies with AI-driven quality inspection, precision filling and sealing, and smart conveyor integration, enabling faster production, reduced waste, and consistent packaging for both large-scale manufacturing operations and commercial production environments

ABB Ltd., Barry-Wehmiller Inc., Coesia SpA, Honeywell International Inc., IMA S.p.A., Krones AG, Mitsubishi Electric Corporation, Multivac Group, ProMach, Inc., Rockwell Automation, Schneider Electric SE, Siemens AG, Syntegon Technology GmbH, Tetra Pak International S.A., and ULMA Packaging and others are some of the leading companies operating in the global packaging automation market.

Each of these companies has been profiled in the packaging automation market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 15,316.7 Mn |

| Market Forecast Value in 2035 | US$ 34,156.2 Mn |

| Growth Rate (CAGR 2025 to 2035) | 7.6% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value and Thousand Units for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentations |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global packaging automation market was valued at US$ 15,361.7 Mn in 2024

The global packaging automation industry is projected to reach at US$ 34,156.2 Mn by the end of 2035

Rising demand for operational efficiency, and expansion of e-commerce & logistics are some of the factors driving the expansion of packaging automation market.

The CAGR is anticipated to be 7.6% from 2025 to 2035

ABB Ltd., Barry-Wehmiller Inc., Coesia SpA, Honeywell International Inc., IMA S.p.A., Krones AG, Mitsubishi Electric Corporation, Multivac Group, ProMach Inc., Rockwell Automation, Schneider Electric SE, Siemens AG, Syntegon Technology GmbH, Tetra Pak International S.A., and ULMA Packaging and others.

Table 01: Global Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 02: Global Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 03: Global Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 04: Global Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 05: Global Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 06: Global Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 07: Global Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 08: Global Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 09: Global Packaging Automation Market Value (US$ Mn) Projection, By Region 2020 to 2035

Table 10: Global Packaging Automation Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Table 11: North America Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 12: North America Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 13: North America Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 14: North America Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 15: North America Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 16: North America Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 17: North America Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 18: North America Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 19: North America Packaging Automation Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 20: North America Packaging Automation Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 21: U.S. Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 22: U.S. Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 23: U.S. Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 24: U.S. Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 25: U.S. Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 26: U.S. Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 27: U.S. Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 28: U.S. Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 29: Canada Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 30: Canada Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 31: Canada Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 32: Canada Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 33: Canada Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 34: Canada Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 35: Canada Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 36: Canada Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 37: Europe Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 38: Europe Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 39: Europe Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 40: Europe Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 41: Europe Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 42: Europe Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 43: Europe Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 44: Europe Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 45: Europe Packaging Automation Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 46: Europe Packaging Automation Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 47: U.K. Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 48: U.K. Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 49: U.K. Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 50: U.K. Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 51: U.K. Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 52: U.K. Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 53: U.K. Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 54: U.K. Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 55: Germany Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 56: Germany Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 57: Germany Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 58: Germany Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 59: Germany Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 60: Germany Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 61: Germany Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 62: Germany Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 63: France Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 64: France Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 65: France Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 66: France Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 67: France Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 68: France Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 69: France Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 70: France Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 71: Italy Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 72: Italy Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 73: Italy Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 74: Italy Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 75: Italy Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 76: Italy Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 77: Italy Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 78: Italy Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 79: Spain Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 80: Spain Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 81: Spain Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 82: Spain Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 83: Spain Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 84: Spain Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 85: Spain Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 86: Spain Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 87: The Netherlands Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 88: The Netherlands Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 89: The Netherlands Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 90: The Netherlands Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 91: The Netherlands Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 92: The Netherlands Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 93: The Netherlands Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 94: The Netherlands Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 95: Asia Pacific Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 96: Asia Pacific Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 97: Asia Pacific Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 98: Asia Pacific Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 99: Asia Pacific Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 100: Asia Pacific Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 101: Asia Pacific Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 102: Asia Pacific Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 103: Asia Pacific Packaging Automation Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 104: Asia Pacific Packaging Automation Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 105: China Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 106: China Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 107: China Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 108: China Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 109: China Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 110: China Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 111: China Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 112: China Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 113: India Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 114: India Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 115: India Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 116: India Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 117: India Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 118: India Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 119: India Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 120: India Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 121: Japan Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 122: Japan Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 123: Japan Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 124: Japan Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 125: Japan Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 126: Japan Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 127: Japan Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 128: Japan Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 129: Australia Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 130: Australia Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 131: Australia Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 132: Australia Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 133: Australia Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 134: Australia Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 135: Australia Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 136: Australia Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 137: South Korea Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 138: South Korea Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 139: South Korea Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 140: South Korea Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 141: South Korea Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 142: South Korea Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 143: South Korea Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 144: South Korea Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 145: ASEAN Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 146: ASEAN Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 147: ASEAN Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 148: ASEAN Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 149: ASEAN Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 150: ASEAN Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 151: ASEAN Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 152: ASEAN Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 153: Middle East & Africa Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 154: Middle East & Africa Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 155: Middle East & Africa Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 156: Middle East & Africa Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 157: Middle East & Africa Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 158: Middle East & Africa Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 159: Middle East & Africa Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 160: Middle East & Africa Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 161: Middle East & Africa Packaging Automation Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 162: Middle East & Africa Packaging Automation Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 163: GCC Countries Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 164: GCC Countries Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 165: GCC Countries Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 166: GCC Countries Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 167: GCC Countries Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 168: GCC Countries Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 169: GCC Countries Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 170: GCC Countries Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 171: South Africa Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 172: South Africa Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 173: South Africa Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 174: South Africa Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 175: South Africa Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 176: South Africa Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 177: South Africa Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 178: South Africa Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 179: Latin America Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 180: Latin America Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 181: Latin America Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 182: Latin America Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 183: Latin America Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 184: Latin America Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 185: Latin America Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 186: Latin America Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 187: Latin America Packaging Automation Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 188: Latin America Packaging Automation Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 189: Brazil Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 190: Brazil Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 191: Brazil Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 192: Brazil Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 193: Brazil Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 194: Brazil Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 195: Brazil Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 196: Brazil Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 197: Mexico Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 198: Mexico Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 199: Mexico Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 200: Mexico Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 201: Mexico Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 202: Mexico Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 203: Mexico Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 204: Mexico Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 205: Argentina Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 206: Argentina Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 207: Argentina Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Table 208: Argentina Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Table 209: Argentina Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Table 210: Argentina Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Table 211: Argentina Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 212: Argentina Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 01: Global Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 02: Global Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 03: Global Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 04: Global Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 05: Global Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 06: Global Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 07: Global Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 08: Global Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 09: Global Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 10: Global Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 11: Global Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 12: Global Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 13: Global Packaging Automation Market Value (US$ Mn) Projection, By Region 2020 to 2035

Figure 14: Global Packaging Automation Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 15: Global Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Region 2025 to 2035

Figure 16: North America Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 17: North America Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 18: North America Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 19: North America Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 20: North America Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 21: North America Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 22: North America Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 23: North America Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 24: North America Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 25: North America Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 26: North America Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 27: North America Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 28: North America Packaging Automation Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 29: North America Packaging Automation Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 30: North America Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 31: U.S. Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 32: U.S. Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 33: U.S. Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 34: U.S. Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 35: U.S. Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 36: U.S. Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 37: U.S. Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 38: U.S. Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 39: U.S. Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 40: U.S. Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 41: U.S. Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 42: U.S. Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 43: Canada Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 44: Canada Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 45: Canada Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 46: Canada Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 47: Canada Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 48: Canada Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 49: Canada Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 50: Canada Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 51: Canada Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 52: Canada Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 53: Canada Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 54: Canada Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 55: Europe Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 56: Europe Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 57: Europe Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 58: Europe Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 59: Europe Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 60: Europe Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 61: Europe Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 62: Europe Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 63: Europe Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 64: Europe Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 65: Europe Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 66: Europe Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 67: Europe Packaging Automation Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 68: Europe Packaging Automation Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 69: Europe Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 70: U.K. Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 71: U.K. Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 72: U.K. Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 73: U.K. Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 74: U.K. Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 75: U.K. Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 76: U.K. Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 77: U.K. Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 78: U.K. Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 79: U.K. Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 80: U.K. Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 81: U.K. Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 82: Germany Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 83: Germany Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 84: Germany Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 85: Germany Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 86: Germany Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 87: Germany Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 88: Germany Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 89: Germany Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 90: Germany Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 91: Germany Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 92: Germany Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 93: Germany Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 94: France Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 95: France Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 96: France Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 97: France Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 98: France Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 99: France Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 100: France Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 101: France Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 102: France Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 103: France Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 104: France Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 105: France Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 106: Italy Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 107: Italy Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 108: Italy Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 109: Italy Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 110: Italy Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 111: Italy Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 112: Italy Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 113: Italy Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 114: Italy Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 115: Italy Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 116: Italy Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 117: Italy Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 118: Spain Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 119: Spain Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 120: Spain Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 121: Spain Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 122: Spain Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 123: Spain Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 124: Spain Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 125: Spain Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 126: Spain Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 127: Spain Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 128: Spain Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 129: Spain Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 130: The Netherlands Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 131: The Netherlands Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 132: The Netherlands Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 133: The Netherlands Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 134: The Netherlands Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 135: The Netherlands Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 136: The Netherlands Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 137: The Netherlands Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 138: The Netherlands Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 139: The Netherlands Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 140: The Netherlands Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 141: The Netherlands Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 142: Asia Pacific Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 143: Asia Pacific Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 144: Asia Pacific Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 145: Asia Pacific Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 146: Asia Pacific Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 147: Asia Pacific Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 148: Asia Pacific Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 149: Asia Pacific Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 150: Asia Pacific Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 151: Asia Pacific Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 152: Asia Pacific Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 153: Asia Pacific Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 154: Asia Pacific Packaging Automation Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 155: Asia Pacific Packaging Automation Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 156: Asia Pacific Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 157: China Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 158: China Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 159: China Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 160: China Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 161: China Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 162: China Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 163: China Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 164: China Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 165: China Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 166: China Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 167: China Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 168: China Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 169: India Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 170: India Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 171: India Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 172: India Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 173: India Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 174: India Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 175: India Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 176: India Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 177: India Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 178: India Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 179: India Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 180: India Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 181: Japan Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 182: Japan Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 183: Japan Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 184: Japan Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 185: Japan Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 186: Japan Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 187: Japan Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 188: Japan Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 189: Japan Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 190: Japan Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 191: Japan Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 192: Japan Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 193: Australia Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 194: Australia Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 195: Australia Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 196: Australia Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 197: Australia Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 198: Australia Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 199: Australia Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 200: Australia Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 201: Australia Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 202: Australia Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 203: Australia Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 204: Australia Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 205: South Korea Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 206: South Korea Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 207: South Korea Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 208: South Korea Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 209: South Korea Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 210: South Korea Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 211: South Korea Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 212: South Korea Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 213: South Korea Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 214: South Korea Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 215: South Korea Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 216: South Korea Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 217: ASEAN Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 218: ASEAN Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 219: ASEAN Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 220: ASEAN Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 221: ASEAN Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 222: ASEAN Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 223: ASEAN Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 224: ASEAN Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 225: ASEAN Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 226: ASEAN Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 227: ASEAN Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 228: ASEAN Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 229: Middle East & Africa Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 230: Middle East & Africa Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 231: Middle East & Africa Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 232: Middle East & Africa Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 233: Middle East & Africa Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 234: Middle East & Africa Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 235: Middle East & Africa Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 236: Middle East & Africa Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 237: Middle East & Africa Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 238: Middle East & Africa Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 239: Middle East & Africa Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 240: Middle East & Africa Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 241: Middle East & Africa Packaging Automation Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 242: Middle East & Africa Packaging Automation Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 243: Middle East & Africa Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 244: GCC Countries Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 245: GCC Countries Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 246: GCC Countries Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 247: GCC Countries Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 248: GCC Countries Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 249: GCC Countries Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 250: GCC Countries Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 251: GCC Countries Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 252: GCC Countries Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 253: GCC Countries Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 254: GCC Countries Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 255: GCC Countries Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 256: South Africa Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 257: South Africa Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 258: South Africa Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 259: South Africa Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 260: South Africa Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 261: South Africa Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 262: South Africa Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 263: South Africa Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 264: South Africa Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 265: South Africa Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 266: South Africa Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 267: South Africa Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 268: Latin America Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 269: Latin America Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 270: Latin America Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 271: Latin America Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 272: Latin America Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 273: Latin America Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 274: Latin America Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 275: Latin America Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 276: Latin America Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 277: Latin America Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 278: Latin America Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 279: Latin America Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 280: Latin America Packaging Automation Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 281: Latin America Packaging Automation Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 282: Latin America Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 283: Brazil Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 284: Brazil Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 285: Brazil Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 286: Brazil Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 287: Brazil Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 288: Brazil Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 289: Brazil Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 290: Brazil Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 291: Brazil Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 292: Brazil Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 293: Brazil Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 294: Brazil Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 295: Mexico Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 296: Mexico Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 297: Mexico Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 298: Mexico Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 299: Mexico Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 300: Mexico Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 301: Mexico Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 302: Mexico Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 303: Mexico Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 304: Mexico Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 305: Mexico Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 306: Mexico Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 307: Argentina Packaging Automation Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 308: Argentina Packaging Automation Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 309: Argentina Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 310: Argentina Packaging Automation Market Value (US$ Mn) Projection, By Function 2020 to 2035

Figure 311: Argentina Packaging Automation Market Volume (Thousand Units) Projection, By Function 2020 to 2035

Figure 312: Argentina Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Function 2025 to 2035

Figure 313: Argentina Packaging Automation Market Value (US$ Mn) Projection, By Automation 2020 to 2035

Figure 314: Argentina Packaging Automation Market Volume (Thousand Units) Projection, By Automation 2020 to 2035

Figure 315: Argentina Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By Automation 2025 to 2035

Figure 316: Argentina Packaging Automation Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 317: Argentina Packaging Automation Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 318: Argentina Packaging Automation Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035