Reports

Reports

Analysts’ Viewpoint on Orthopedic Fracture Repairing Implants for Osteoporosis Market Scenario

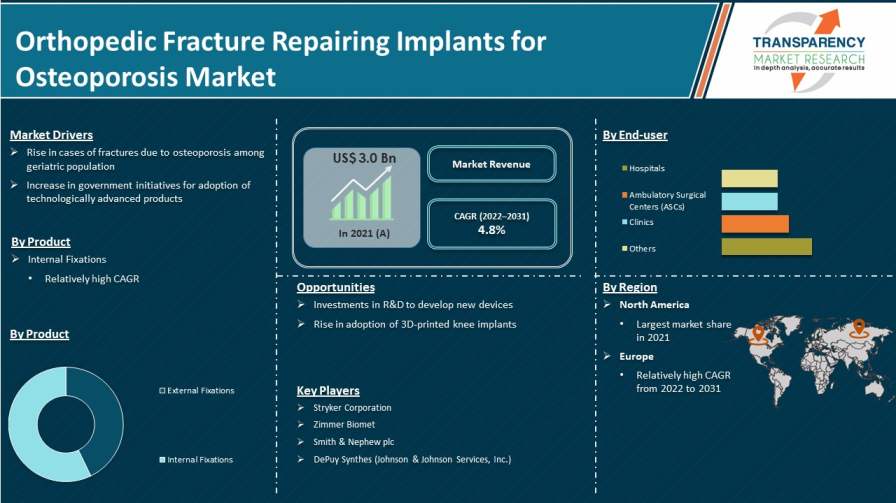

The global orthopedic fracture repairing implants for osteoporosis market has contracted during the COVID-19 pandemic due to limited surgeries carried out in hospitals. Delay in surgeries due to restrictions imposed to combat the pandemic, such as lockdowns, has also adversely affected the market. Several manufacturing sites had also ceased production due to lack of raw materials and adequate workforce. However, the market is expected to grow during the forecast period with rise in number of osteoporosis surgeries. Serious bone injuries have been reported recently among professional as well as amateur sportspersons. Similarly, surge in road accidents and bone disorders has led to an increase in demand for osteoporosis treatment. The global orthopedic fracture repairing implants for osteoporosis market trends suggest that leading companies are focused on improving the available surgical implants and procedures to provide better treatment and a faster healing time for patients.

Orthopedic implants are devices that can be put or placed into the body through surgical procedures. Implants are designed such that they can provide and restore functions of the damaged part of the body. Recent trends suggest that bisphosphonates and biodegradable implants are gaining traction in the market. Increase in demand for biodegradable implants can be ascribed to their ability to provide necessary mechanical function for tissue reconstruction. Bisphosphonates help prevent or slow down the progression of osteoporosis. They can also be used in the treatment of some types of cancer that cause bone damage.

Osteoporosis is a health problem caused due to low bone mass and microarchitectural deterioration of the bone structure. It leads to bone fragility and increases the chances of bone fracture. Hence, orthopedic fracture repairing implants are used to provide support to bones during osteoporosis treatment.

Increase in incidence rate of injuries related to accidents, sports, and adventure; and surge in the global geriatric population are expected to propel the orthopedic fracture repairing implants for osteoporosis market size. Growth in government initiatives for the adoption of technologically advanced products is also anticipated to boost the market.

Large population in developing countries such as China, India, and Brazil suffers from several orthopedic disorders, injuries, and trauma that require advanced orthopedic products such as casting tapes, fiberglass, polyester, and metal splints. Therefore, companies domiciled in these countries are focused on development and launch of technologically-advanced casting and splinting products to attract new customers. Government initiatives in terms of reimbursement and increase in awareness about proper treatment compliance are estimated to drive the adoption of these new products. For instance, the Centers for Medicare & Medicaid Services (CMS) finalized the Comprehensive Care for Joint Replacement (CJR) model. As per the model, hospitals are accountable for the quality of care they deliver in order to benefit from the Medicare Fee-For-Service program for knee replacements. CJR’s objective is to provide financial incentives to hospitals to work with surgeons, home health agencies, skilled nursing facilities, and other providers to ensure that recipients get the coordinated care they require.

Osteoporosis is characterized by increase in bone fragility and subsequent accumulated fracture risks. The disease is common in older individuals due to decreased Bone Mineral Density (BMD) as people age. According to the World Health Organization (WHO), the elderly population is likely to reach 12 billion by 2025. Aging is associated with chronic diseases, disabilities, and cognitive decline. As the population ages, the number of osteoporotic fractures also increases substantially. Older adults with a trauma fracture are likely to have low BMD, increased bone turnover, and/or poor bone quality. Bone loss and high risk of additional fractures are observed in this population; hence, they are recommended osteoporosis treatment regardless of their BMD.

In terms of product, the internal fixations segment dominated the global orthopedic fracture repairing implants for osteoporosis market with more than 62% share in 2021. The trend is expected to continue during the forecast period. The segment is driven by the increase in demand for internal fixations as they enable fast recovery of patients to facilitate shorter hospital stays. Internal fixations also decrease the incidence of improper healing and healing in the incorrect position of damaged bones.

Based on end-user, the global orthopedic fracture repairing implants for osteoporosis market has been divided into hospitals, ambulatory surgical centers (ASCs), clinics, and others. The hospitals segment held major share of around 40% in 2021. The trend is likely to continue during the forecast period. Growth of the segment can be ascribed to the increase in orthopedic fractures and surge in preference for hospitals for treatment and recovery. Hospitals are preferred due to the availability of advanced surgical treatments and the subsequent possibility of faster recovery.

North America accounted for the largest share of around 42% of the global market in 2021. Early adoption of innovative surgical products and implants can be ascribed to the region’s prominent share of the global market in 2021. Europe held around 23% share of the global market in 2021. The market in the region is likely to grow at a faster rate during the forecast period due to the rise in cases of fragility fracture.

Asia Pacific constituted a larger share of the global market in 2021 than Latin America and Middle East & Africa. However, the market in Latin America is anticipated to grow at a faster rate than that in Middle East & Africa.

The global orthopedic fracture repairing implants for osteoporosis market report concludes with the company profiles section, which includes key information about major players in the market. Leading players operating in the market are Stryker, Zimmer Biomet, Smith & Nephew plc, DePuy Synthes (Johnson & Johnson Services, Inc.), and Medicalplastic s.r.l. The companies are focused on adopting various organic and inorganic strategies to strengthen their global orthopedic fracture repairing implants for osteoporosis market share.

Each of these players has been profiled in the orthopedic fracture repairing implants for osteoporosis market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 3.0 Bn |

|

Market Forecast Value in 2031 |

More than US$ 4.8 Bn |

|

Growth Rate (CAGR) for 2022–2031 |

4.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global orthopedic fracture repairing implants for osteoporosis market was valued at US$ 3.0 Bn in 2021

The global orthopedic fracture repairing implants for osteoporosis market is projected to reach more than US$ 4.8 Bn by 2031

The global orthopedic fracture repairing implants for osteoporosis market is anticipated to grow at a CAGR of 4.8% from 2022 to 2031

The internal fixations segment held over 62% share of the global orthopedic fracture repairing implants for osteoporosis market in 2021

North America is expected to account for major share of the global orthopedic fracture repairing implants for osteoporosis market during the forecast period

Stryker Corporation, Zimmer Biomet, Smith & Nephew plc, DePuy Synthes (Johnson & Johnson Services, Inc.), and Medicalplastic s.r.l.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Disease Prevalence & Incidence Rate globally with key countries

5.2. Technological Advancements

5.3. Key Industry Events (mergers, acquisitions, partnerships, collaborations,etc.)

5.4. COVID-19 Pandemic Impact on Industry (Value Chain and Short / Mid / Long Term Impact)

6. Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. External Fixations

6.3.1.1. Ilizarov apparatus

6.3.1.2. Taylor Spatial Frame

6.3.1.3. Others

6.3.2. Internal Fixations

6.3.2.1. Intramedullary (IM) Nails

6.3.2.2. Bone Screws

6.3.2.3. Biological Bone Graft Substitutes

6.3.2.4. Synthetic Bone Graft Substitutes

6.3.2.5. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals

7.3.2. Ambulatory Surgical Centers

7.3.3. Clinics

7.3.4. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Country/Region

9. North America Orthopedic Fracture Repairing Implants for Osteoporosis Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017–2031

9.2.1. External Fixations

9.2.1.1. Ilizarov apparatus

9.2.1.2. Taylor Spatial Frame

9.2.1.3. Others

9.2.2. Internal Fixations

9.2.2.1. Intramedullary (IM) Nails

9.2.2.2. Bone Screws

9.2.2.3. Biological Bone Graft Substitutes

9.2.2.4. Synthetic Bone Graft Substitutes

9.2.2.5. Others

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Clinics

9.3.4. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. External Fixations

10.2.1.1. Ilizarov apparatus

10.2.1.2. Taylor Spatial Frame

10.2.1.3. Others

10.2.2. Internal Fixations

10.2.2.1. Intramedullary (IM) Nails

10.2.2.2. Bone Screws

10.2.2.3. Biological Bone Graft Substitutes

10.2.2.4. Synthetic Bone Graft Substitutes

10.2.2.5. Others

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Ambulatory Surgical Centers

10.3.3. Clinics

10.3.4. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. External Fixations

11.2.1.1. Ilizarov apparatus

11.2.1.2. Taylor Spatial Frame

11.2.1.3. Others

11.2.2. Internal Fixations

11.2.2.1. Intramedullary (IM) Nails

11.2.2.2. Bone Screws

11.2.2.3. Biological Bone Graft Substitutes

11.2.2.4. Synthetic Bone Graft Substitutes

11.2.2.5. Others

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals

11.3.2. Ambulatory Surgical Centers

11.3.3. Clinics

11.3.4. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. External Fixations

12.2.1.1. Ilizarov apparatus

12.2.1.2. Taylor Spatial Frame

12.2.1.3. Others

12.2.2. Internal Fixations

12.2.2.1. Intramedullary (IM) Nails

12.2.2.2. Bone Screws

12.2.2.3. Biological Bone Graft Substitutes

12.2.2.4. Synthetic Bone Graft Substitutes

12.2.2.5. Others

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals

12.3.2. Ambulatory Surgical Centers

12.3.3. Clinics

12.3.4. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. External Fixations

13.2.1.1. Ilizarov apparatus

13.2.1.2. Taylor Spatial Frame

13.2.1.3. Others

13.2.2. Internal Fixations

13.2.2.1. Intramedullary (IM) Nails

13.2.2.2. Bone Screws

13.2.2.3. Biological Bone Graft Substitutes

13.2.2.4. Synthetic Bone Graft Substitutes

13.2.2.5. Others

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals

13.3.2. Ambulatory Surgical Centers

13.3.3. Clinics

13.3.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. Stryker

14.3.1.1. Company Description

14.3.1.2. Business Overview

14.3.1.3. Financial Overview

14.3.1.4. Strategic Overview

14.3.1.5. SWOT Analysis

14.3.2. Zimmer Biomet

14.3.2.1. Company Description

14.3.2.2. Business Overview

14.3.2.3. Financial Overview

14.3.2.4. Strategic Overview

14.3.2.5. SWOT Analysis

14.3.3. Smith & Nephew plc

14.3.3.1. Company Description

14.3.3.2. Business Overview

14.3.3.3. Financial Overview

14.3.3.4. Strategic Overview

14.3.3.5. SWOT Analysis

14.3.4. DePuy Synthes (Johnson & Johnson Services, Inc.)

14.3.4.1. Company Description

14.3.4.2. Business Overview

14.3.4.3. Financial Overview

14.3.4.4. Strategic Overview

14.3.4.5. SWOT Analysis

14.3.5. Medicalplastic s.r.l.

14.3.5.1. Company Description

14.3.5.2. Business Overview

14.3.5.3. Financial Overview

14.3.5.4. Strategic Overview

14.3.5.5. SWOT Analysis

List of Tables

Table 01: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by External Fixation, 2017–2031

Table 03: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Internal Fixation, 2017–2031

Table 04: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, End-user, 2017?2031

Table 05: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 08: North America Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by External Fixation, 2017–2031

Table 09: North America Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Internal Fixation, 2017–2031

Table 10: North America Orthopedic Fracture Repairing Implants for Osteoporosis Market (US$ Mn) Forecast, End-user, 2017–2031

Table 11: Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 13: Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by External Fixation 2017–2031

Table 14: Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Internal Fixation 2017–2031

Table 15: Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market (US$ Mn) Forecast, End-user, 2017–2031

Table 16: Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 18: Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by External Fixation 2017–2031

Table 19: Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Internal Fixation 2017–2031

Table 20: Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market (US$ Mn) Forecast, End-user, 2017–2031

Table 21: Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by External Fixation 2017–2031

Table 24: Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Internal Fixation, 2017–2031

Table 25: Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market (US$ Mn) Forecast, End-user, 2017–2031

Table 26: Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 28: Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by External Fixation 2017–2031

Table 29: Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, by Internal Fixation 2017–2031

Table 30: Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market (US$ Mn) Forecast, End-user, 2017–2031

List of Figures

Figure 01: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market, by Product, 2021 and 2031

Figure 02: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by Product, 2022–2031

Figure 03: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market (US$ Mn), by External Fixation, 2017–2031

Figure 04: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market (US$ Mn), by Internal Fixation, 2017–2031

Figure 05: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market, End-user, 2021 and 2031

Figure 06: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, End-user, 2022–2031

Figure 07: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market (US$ Mn), by Hospitals, 2017–2031

Figure 08: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 09: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market (US$ Mn), by Clinics, 2017–2031

Figure 10: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market (US$ Mn), by Others, 2017–2031

Figure 11: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Value Share Analysis, by Region, 2021 and 2031

Figure 12: Global Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by Region, 2022–2031

Figure 13: North America Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, 2017–2031

Figure 14: North America Orthopedic Fracture Repairing Implants for Osteoporosis Market Value Share Analysis, by Country, 2021 and 2031

Figure 15: North America Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by Country, 2022–2031

Figure 16: North America Orthopedic Fracture Repairing Implants for Osteoporosis Market, by Product, 2021 and 2031

Figure 17: North America Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by Product, 2022–2031

Figure 18: North America Orthopedic Fracture Repairing Implants for Osteoporosis Market, by End-user, 2021 and 2031

Figure 19: North America Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by End-user, 2022–2031

Figure 20: Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, 2017–2031

Figure 21: Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 22: Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 23: Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market, by Product, 2021 and 2031

Figure 24: Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by Product, 2022–2031

Figure 25: Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market, End-user, 2021 and 2031

Figure 26: Europe Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, End-user, 2022–2031

Figure 27: Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, 2017–2031

Figure 28: Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 29: Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 30: Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market, by Product, 2021 and 2031

Figure 31: Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by Product, 2022–2031

Figure 32: Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market, End-user, 2021 and 2031

Figure 33: Asia Pacific Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, End-user, 2022–2031

Figure 34: Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, 2017–2031

Figure 35: Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 36: Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 37: Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market, by Product, 2021 and 2031

Figure 38: Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by Product, 2022–2031

Figure 39: Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market, End-user, 2021 and 2031

Figure 40: Latin America Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, End-user, 2022–2031

Figure 41: Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market Value (US$ Mn) Forecast, 2017–2031

Figure 42: Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 43: Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 44: Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market, by Product, 2021 and 2031

Figure 45: Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, by Product, 2022–2031

Figure 46: Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market, End-user, 2021 and 2031

Figure 47: Middle East & Africa Orthopedic Fracture Repairing Implants for Osteoporosis Market Attractiveness Analysis, End-user, 2022–2031