Reports

Reports

Orthobiologics market is expected to grow enormously due to an increased demand for new therapies in sports medicine and orthopedic use. Orthobiologics like biologic tissue applied to improve acceleration of bone and soft tissue healing are gaining prominence as they can be used to improve the patient outcome and healing time. As the population ages globally and the prevalence rate of musculoskeletal diseases steadily increases, a safe and easy curing of the diseases without the detriments of conventional surgical procedures is more in need.

.webp)

Regenerative medicine procedures like platelet-rich plasma (PRP) therapy and stem cell therapy are driving this growth. Both the procedures take advantage of the healing potential of the body itself, providing patients less invasive therapies that fit the trend in medicine today away from the one-size-fits-all model and toward patient-specific and individualized medicine. Furthermore, increased research and development spending is fueling new product launches and introducing more products to the market.

Demand is also fueled by rising levels of awareness among both - patients and healthcare professionals of the benefits of biologic-based therapy. As more clinic data becomes available to support the effectiveness of orthobiologics, there is every chance that the market will expand, presenting the opportunity for manufacturers and healthcare professionals to deliver innovative solutions for musculoskeletal well-being.

Orthobiologics is a clinical specialty of regenerative medicine with the application of biologic agents to facilitate acceleration of healing of musculoskeletal tissues like cartilage and bone. Orthobiologics is a new medical specialty that utilizes the body's natural healing potential by applying products such as stem cells, platelet-rich plasma (PRP), and growth factors in tissue repair and regeneration. Orthobiologics are increasingly utilized in orthopedic surgery, sports medicine, and rehabilitation with fewer invasive methods than conventional surgery.

Orthobiologics market is progressing rapidly with rising sports injuries and degenerative diseases and supported by an expanding aging population for effective musculoskeletal disorder management. Increasing awareness about these therapies is leading to more medical practitioners incorporating orthobiologics in practice.

| Attribute | Detail |

|---|---|

| Orthobiologics Market Drivers |

|

Rising prevalence of orthopedic conditions is one of the key drivers to the market, reflecting rising demand for alternative treatments. As a result of demographic aging and rising leisure culture, incidences like osteoarthritis, fractures, and sports injuries rise. The trend of the overall case is robust in developed markets like North America and Europe, which also possess an aging population.

Patients are also seeking effective, least invasive treatments to heal and cure pain, leading medical practitioners to orthobiologic therapy. The treatment, in which biological tissue is used to stimulate tissue regeneration, offers promising solutions to surgery, with most patients enjoying quicker recovery periods and improved outcomes.

Increased knowledge regarding the benefit that regenerative medicine has on the patient as well as clinician also led them to request orthobiologics as a method of treatment. Greater expenditures on research and development activities only lead to greater innovation, with more products and applications being brought to the market for orthobiologics. With healthcare systems targeting more implementation of patient-focused care and proper pain management, demand for orthobiologics will only grow, propelling the growth of the market as well as new therapeutic avenues for orthopedic disease.

Stem cell and regenerative medicine are the key drivers to the growth of orthobiologics, and have been the driving force for being at the center of musculoskeletal disease treatment modalities. Stem cells possess the capacity to differentiate into numerous types of cells and are thus suitable to be utilized in the management of musculoskeletal disease such as osteoarthritis, tendon damage, and fracture.

The combination of orthobiologics and stem cell therapies has provided new channels for minimally invasive care to improve the healing without contributing to the utilization of invasive procedure. The innovative methods of delivering and harvesting the stem cells, e.g., adipose-derived stem cells and bone marrow aspirate, have also become therapeutic option.

In addition, new investment and funding fuel the expansion of effective orthobiologic therapies. As more clinical evidence of effectiveness exists, professionals will work harder to make them part of routine practice.

Viscosupplementation devices lead the market in orthobiologics by their target treatment of osteoarthritis, that is, of the knee joint. The devices, most commonly made of hyaluronic acid, replace the natural viscosity and elasticity of synovial fluid, lubricating and cushioning in the joint space. Since osteoarthritis is increasingly common, there is a need for less invasive but effective treatment, and viscosupplementation is therefore the treatment of choice for pain relief and mobility enhancement among most patients.

Furthermore, the minimally invasive procedure of viscosupplementation is also more palatable to patients and physicians since it is less complication-susceptible and leads to quicker recovery than traditional surgery. With growing care for joint health and early intervention, viscosupplementation is also set to continue its market dominance in the field of orthobiologics with its therapeutic alternatives for osteoarthritis treatment and enhanced quality of life for patients.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America leads the orthobiologics market due to the integration of sophisticated healthcare infrastructure, prevalence of orthopedic disorders, and research and development cost. It boasts some of the finest medical and research facilities on the globe, which has resulted in record-breaking advancements in orthobiologics and regenerative medicine. The influence of demographic aging also contributes to raising the incidence of conditions such as osteoarthritis, sports trauma, and fractures that need successful management.

Also, greater knowledge of the importance of orthobiologic treatments by physicians and patients has contributed to greater use of new treatments. North America has a pro-regulatory environment for developing and bringing new biologic drugs to market, and quick entry into the market for new treatments. Overall, North America's strong healthcare innovation culture is a force to be reckoned with in the field of orthobiologics that reacts to growing calls for effective musculoskeletal wellness solutions.

Key players in the global market are investing in innovation, technological advancements, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and gain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

Alphatec Spine Inc., Arthrex, Bioventus LLC, Exactech Inc., Global Medical Inc., Integra Lifesciences, Medtronic, MTF Biologics, RTI Surgical, Sano Orthopedics, Sanofi, Seikagaku Corporation and others are some of the leading key players.

Each of these players has been profiled in the Market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

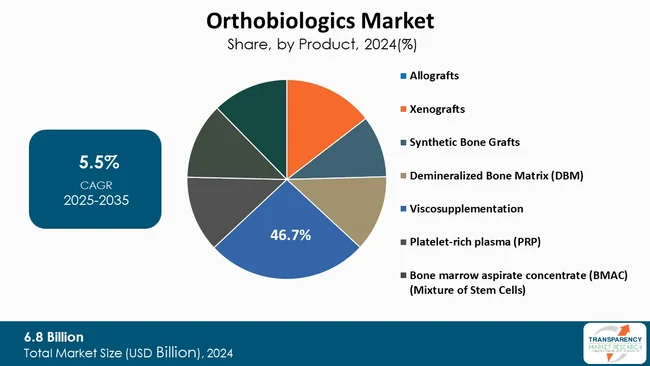

| Size in 2024 | US$ 6.8 Bn |

| Forecast Value in 2035 | US$ 12.2 Bn |

| CAGR | 5.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Orthobiologics Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 6.8 Bn in 2024.

It is projected to cross US$ 12.2 Bn by the end of 2035.

Growing prevalence of orthopedic disorders and advancements in stem cell and regenerative medicine.

It is anticipated to grow at a CAGR of 5.5% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Alphatec Spine Inc., Arthrex, Bioventus LLC, Exactech Inc., Global Medical Inc., Integra Lifesciences, Medtronic, MTF Biologics, RTI Surgical, Sano Orthopedics, Sanofi, Seikagaku Corporation and Others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Orthobiologics Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Orthobiologics Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Key Market Trends

5.2. Regulatory Scenario across Key Regions/Countries

5.3. Current role in Orthopedic Surgery and Traumatology

5.4. Regenerative Orthobiologic Therapy

5.5. PESTEL Analysis

5.6. PORTER's Analysis

5.7. Strategies of Top Five Players Operating in the Market

5.8. Number of Surgical Procedures

6. Global Orthobiologics Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2020 to 2035

6.3.1. Allografts

6.3.2. Xenografts

6.3.3. Synthetic Bone Grafts

6.3.3.1. Hydroxyapatite

6.3.3.2. β-tricalcium phosphate (β-TCP)

6.3.3.3. BiPhasic

6.3.3.4. Bioactive glass

6.3.3.5. Others

6.3.4. Demineralized Bone Matrix (DBM)

6.3.5. Viscosupplementation

6.3.6. Platelet-rich plasma (PRP)

6.3.7. Bone marrow aspirate concentrate (BMAC) (Mixture of Stem Cells)

6.3.8. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Orthobiologics Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2020 to 2035

7.3.1. Spinal Fusion

7.3.2. Trauma Repair

7.3.3. Reconstructive Surgeries

7.3.4. Fractures

7.3.5. Osteoarthritis

7.3.6. Maxillofacial and Dental Applications

7.3.7. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Orthobiologics Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2020 to 2035

8.3.1. Hospitals

8.3.2. Orthopedic Clinics

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Orthobiologics Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2020 to 2035

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Orthobiologics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2020 to 2035

10.2.1. Allografts

10.2.2. Xenografts

10.2.3. Synthetic Bone Grafts

10.2.3.1. Hydroxyapatite

10.2.3.2. β-tricalcium phosphate (β-TCP)

10.2.3.3. BiPhasic

10.2.3.4. Bioactive glass

10.2.3.5. Others

10.2.4. Demineralized Bone Matrix (DBM)

10.2.5. Viscosupplementation

10.2.6. Platelet-rich plasma (PRP)

10.2.7. Bone marrow aspirate concentrate (BMAC) (Mixture of Stem Cells)

10.2.8. Others

10.3. Market Value Forecast, by Application, 2020 to 2035

10.3.1. Spinal Fusion

10.3.2. Trauma Repair

10.3.3. Reconstructive Surgeries

10.3.4. Fractures

10.3.5. Osteoarthritis

10.3.6. Maxillofacial and Dental Applications

10.3.7. Others

10.4. Market Value Forecast, by End-user, 2020 to 2035

10.4.1. Hospitals

10.4.2. Orthopedic Clinics

10.4.3. Others

10.5. Market Value Forecast, by Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Orthobiologics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2020 to 2035

11.2.1. Allografts

11.2.2. Xenografts

11.2.3. Synthetic Bone Grafts

11.2.3.1. Hydroxyapatite

11.2.3.2. β-tricalcium phosphate (β-TCP)

11.2.3.3. BiPhasic

11.2.3.4. Bioactive glass

11.2.3.5. Others

11.2.4. Demineralized Bone Matrix (DBM)

11.2.5. Viscosupplementation

11.2.6. Platelet-rich plasma (PRP)

11.2.7. Bone marrow aspirate concentrate (BMAC) (Mixture of Stem Cells)

11.2.8. Others

11.3. Market Value Forecast, by Application, 2020 to 2035

11.3.1. Spinal Fusion

11.3.2. Trauma Repair

11.3.3. Reconstructive Surgeries

11.3.4. Fractures

11.3.5. Osteoarthritis

11.3.6. Maxillofacial and Dental Applications

11.3.7. Others

11.4. Market Value Forecast, by End-user, 2020 to 2035

11.4.1. Hospitals

11.4.2. Orthopedic Clinics

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. UK

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Orthobiologics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2020 to 2035

12.2.1. Allografts

12.2.2. Xenografts

12.2.3. Synthetic Bone Grafts

12.2.3.1. Hydroxyapatite

12.2.3.2. β-tricalcium phosphate (β-TCP)

12.2.3.3. BiPhasic

12.2.3.4. Bioactive glass

12.2.3.5. Others

12.2.4. Demineralized Bone Matrix (DBM)

12.2.5. Viscosupplementation

12.2.6. Platelet-rich plasma (PRP)

12.2.7. Bone marrow aspirate concentrate (BMAC) (Mixture of Stem Cells)

12.2.8. Others

12.3. Market Value Forecast, by Application, 2020 to 2035

12.3.1. Spinal Fusion

12.3.2. Trauma Repair

12.3.3. Reconstructive Surgeries

12.3.4. Fractures

12.3.5. Osteoarthritis

12.3.6. Maxillofacial and Dental Applications

12.3.7. Others

12.4. Market Value Forecast, by End-user, 2020 to 2035

12.4.1. Hospitals

12.4.2. Orthopedic Clinics

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. South Korea

12.5.5. Australia & New Zealand

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Orthobiologics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2020 to 2035

13.2.1. Allografts

13.2.2. Xenografts

13.2.3. Synthetic Bone Grafts

13.2.3.1. Hydroxyapatite

13.2.3.2. β-tricalcium phosphate (β-TCP)

13.2.3.3. BiPhasic

13.2.3.4. Bioactive glass

13.2.3.5. Others

13.2.4. Demineralized Bone Matrix (DBM)

13.2.5. Viscosupplementation

13.2.6. Platelet-rich plasma (PRP)

13.2.7. Bone marrow aspirate concentrate (BMAC) (Mixture of Stem Cells)

13.2.8. Others

13.3. Market Value Forecast, by Application, 2020 to 2035

13.3.1. Spinal Fusion

13.3.2. Trauma Repair

13.3.3. Reconstructive Surgeries

13.3.4. Fractures

13.3.5. Osteoarthritis

13.3.6. Maxillofacial and Dental Applications

13.3.7. Others

13.4. Market Value Forecast, by End-user, 2020 to 2035

13.4.1. Hospitals

13.4.2. Orthopedic Clinics

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Orthobiologics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2020 to 2035

14.2.1. Allografts

14.2.2. Xenografts

14.2.3. Synthetic Bone Grafts

14.2.3.1. Hydroxyapatite

14.2.3.2. β-tricalcium phosphate (β-TCP)

14.2.3.3. BiPhasic

14.2.3.4. Bioactive glass

14.2.3.5. Others

14.2.4. Demineralized Bone Matrix (DBM)

14.2.5. Viscosupplementation

14.2.6. Platelet-rich plasma (PRP)

14.2.7. Bone marrow aspirate concentrate (BMAC) (Mixture of Stem Cells)

14.2.8. Others

14.3. Market Value Forecast, by Application, 2020 to 2035

14.3.1. Spinal Fusion

14.3.2. Trauma Repair

14.3.3. Reconstructive Surgeries

14.3.4. Fractures

14.3.5. Osteoarthritis

14.3.6. Maxillofacial and Dental Applications

14.3.7. Others

14.4. Market Value Forecast, by End-user, 2020 to 2035

14.4.1. Hospitals

14.4.2. Orthopedic Clinics

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2024)

15.3. Company Profiles

15.3.1. Alphatec Spine Inc.

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Arthrex

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Bioventus LLC

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Exactech Inc.

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Global Medical Inc.

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Integra Lifesciences

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Medtronic

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. MTF Biologics

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. RTI Surgical

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Sano Orthopedics

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Sanofi

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. Seikagaku Corporation

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

List of Tables

Table 01: Global Orthobiologics Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 02: Global Orthobiologics Market Value (US$ Bn) Forecast, By Synthetic Bone Grafts, 2020 to 2035

Table 03: Global Orthobiologics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Orthobiologics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Orthobiologics Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Orthobiologics Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 07: North America Orthobiologics Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 08: North America Orthobiologics Market Value (US$ Bn) Forecast, By Synthetic Bone Grafts, 2020 to 2035

Table 09: North America Orthobiologics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 10: North America Orthobiologics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe Orthobiologics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 12: Europe Orthobiologics Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 13: Europe Orthobiologics Market Value (US$ Bn) Forecast, By Synthetic Bone Grafts, 2020 to 2035

Table 14: Europe Orthobiologics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: Europe Orthobiologics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific - Orthobiologics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 17: Asia Pacific Orthobiologics Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 18: Asia Pacific Orthobiologics Market Value (US$ Bn) Forecast, By Synthetic Bone Grafts, 2020 to 2035

Table 19: Asia Pacific Orthobiologics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Asia Pacific Orthobiologics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America Orthobiologics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Latin America Orthobiologics Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 23: Latin America Orthobiologics Market Value (US$ Bn) Forecast, By Synthetic Bone Grafts, 2020 to 2035

Table 24: Latin America Orthobiologics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 25: Latin America Orthobiologics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa Orthobiologics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 27: Middle East & Africa Orthobiologics Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 28: Middle East & Africa Orthobiologics Market Value (US$ Bn) Forecast, By Synthetic Bone Grafts, 2020 to 2035

Table 29: Middle East & Africa Orthobiologics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Middle East & Africa Orthobiologics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Orthobiologics Market Value Share Analysis, By Product, 2024 and 2035

Figure 02: Global Orthobiologics Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 03: Global Orthobiologics Market Revenue (US$ Bn), by Allografts, 2020 to 2035

Figure 04: Global Orthobiologics Market Revenue (US$ Bn), by Xenografts, 2020 to 2035

Figure 05: Global Orthobiologics Market Revenue (US$ Bn), by Synthetic Bone Grafts, 2020 to 2035

Figure 06: Global Orthobiologics Market Revenue (US$ Bn), by Demineralized Bone Matrix (DBM), 2020 to 2035

Figure 07: Global Orthobiologics Market Revenue (US$ Bn), by Viscosupplementation, 2020 to 2035

Figure 08: Global Orthobiologics Market Revenue (US$ Bn), by Platelet-rich plasma (PRP), 2020 to 2035

Figure 09: Global Orthobiologics Market Revenue (US$ Bn), by Bone marrow aspirate concentrate (BMAC) (Mixture of Stem Cells), 2020 to 2035

Figure 10: Global Orthobiologics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 11: Global Orthobiologics Market Value Share Analysis, By Application, 2024 and 2035

Figure 12: Global Orthobiologics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 13: Global Orthobiologics Market Revenue (US$ Bn), by Spinal Fusion, 2020 to 2035

Figure 14: Global Orthobiologics Market Revenue (US$ Bn), by Trauma Repair, 2020 to 2035

Figure 15: Global Orthobiologics Market Revenue (US$ Bn), by Reconstructive Surgeries, 2020 to 2035

Figure 16: Global Orthobiologics Market Revenue (US$ Bn), by Fractures, 2020 to 2035

Figure 17: Global Orthobiologics Market Revenue (US$ Bn), by Osteoarthritis, 2020 to 2035

Figure 18: Global Orthobiologics Market Revenue (US$ Bn), by Maxillofacial and Dental Applications, 2020 to 2035

Figure 19: Global Orthobiologics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Orthobiologics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 21: Global Orthobiologics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 22: Global Orthobiologics Market Revenue (US$ Bn), by Hospital, 2020 to 2035

Figure 23: Global Orthobiologics Market Revenue (US$ Bn), by Orthopedic Clinics, 2020 to 2035

Figure 24: Global Orthobiologics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 25: Global Orthobiologics Market Value Share Analysis, By Region, 2024 and 2035

Figure 26: Global Orthobiologics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 27: North America Orthobiologics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: North America Orthobiologics Market Value Share Analysis, by Country, 2024 and 2035

Figure 29: North America Orthobiologics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 30: North America Orthobiologics Market Value Share Analysis, By Product, 2024 and 2035

Figure 31: North America Orthobiologics Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 32: North America Orthobiologics Market Value Share Analysis, By Application, 2024 and 2035

Figure 33: North America Orthobiologics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 34: North America Orthobiologics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 35: North America Orthobiologics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 36: Europe Orthobiologics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: Europe Orthobiologics Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 38: Europe Orthobiologics Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 39: Europe Orthobiologics Market Value Share Analysis, By Product, 2024 and 2035

Figure 40: Europe Orthobiologics Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 41: Europe Orthobiologics Market Value Share Analysis, By Application, 2024 and 2035

Figure 42: Europe Orthobiologics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 43: Europe Orthobiologics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 44: Europe Orthobiologics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 45: Asia Pacific Orthobiologics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: Asia Pacific Orthobiologics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 47: Asia Pacific Orthobiologics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 48: Asia Pacific Orthobiologics Market Value Share Analysis, By Product, 2024 and 2035

Figure 49: Asia Pacific Orthobiologics Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 50: Asia Pacific Orthobiologics Market Value Share Analysis, By Application, 2024 and 2035

Figure 51: Asia Pacific Orthobiologics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 52: Asia Pacific Orthobiologics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 53: Asia Pacific Orthobiologics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 54: Latin America Orthobiologics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 55: Latin America Orthobiologics Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 56: Latin America Orthobiologics Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 57: Latin America Orthobiologics Market Value Share Analysis, By Product, 2024 and 2035

Figure 58: Latin America Orthobiologics Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 59: Latin America Orthobiologics Market Value Share Analysis, By Application, 2024 and 2035

Figure 60: Latin America Orthobiologics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 61: Latin America Orthobiologics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 62: Latin America Orthobiologics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 63: Middle East & Africa Orthobiologics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 64: Middle East & Africa Orthobiologics Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 65: Middle East & Africa Orthobiologics Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 66: Middle East & Africa Orthobiologics Market Value Share Analysis, By Product, 2024 and 2035

Figure 67: Middle East & Africa Orthobiologics Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 68: Middle East & Africa Orthobiologics Market Value Share Analysis, By Application, 2024 and 2035

Figure 69: Middle East & Africa Orthobiologics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 70: Middle East & Africa Orthobiologics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 71: Middle East & Africa Orthobiologics Market Attractiveness Analysis, By End-user, 2025 to 2035