Reports

Reports

The stem cell market is witnessing a strong growth fueled by increase in production of regenerative medicine, growing research and development spending, and expanding clinical uses. Experts predict the market to grow significantly in the next ten years with North America leading the pack on account of a strong R&D spending, ample clinical trial opportunities, and favorable regulations, and Asia-Pacific slowly transforming into the fastest emerging region on account of rising healthcare spending and an enormous patient pool.

Growing number of product launches by the major players in the market is further expected to drive the overall stem cell market. For instance, in July 2024, Bioserve India, announced the launch of its advanced stem cell products in India. These new products from REPROCELL aims to support innovation in scientific research and drug development, supporting advancements in regenerative medicine and therapeutic discovery in Indian Market.

The increasing rate of chronic diseases, including neurodegenerative disorders and cancer, with increased need for new treatments like stem cell-based therapy, are the driving forces. In technological developments (including adult stem cells), induced pluripotent stem cells, and embryonic stem cells, new therapeutic applications and possibility of feasibility of developing customized medicine are being unveiled.

The increasing level of stem cell therapy clinical trials and approvals, along with enormous private and government investments, also fuel market growth. Apart from this, stem cell banking and increasing awareness, especially among the developing countries, also fuel growth.

The market is also assisted by trends such as the growth of regenerative medicine, precision and personalized medicine, and growing commercialization and collaboration between biotech companies and research institutions. There are challenges such as ethical issues-particularly in the case of embryonic stem cells-technical barriers to economies of scale in production, and competition from alternative treatments.

| Attribute | Detail |

|---|---|

| Stem Cells Market Drivers |

|

Government initiatives and financing instruments exert a determining role in the marketplace. Facilitating regulatory frameworks as well as funds provided by the government in support from state entities work as an agent in implementing a research-friendly and development-promoting environment in the case of stem cell therapeutics.

The need for newer and better therapies for the treatment of autoimmune, neurological, and cardiovascular diseases has resulted in an overall increase in research activities and the availability of funding for cell-based research.

In December 2022, Alpha Stem Cell Clinic received USD 8 million, a five-year grant from the California Institute of Regenerative Medicine (CIRM) for the study of the use of self-renewing cells to treat human disease.

Furthermore, in November 2019, the Australian government released a 10-year roadmap for stem cell research in Australia-The Stem Cell Therapies Mission. The initiative would provide USD 102 Million (AUD 150 Million) under the Medical Research Future Fund (MRFF) to support stem cell research to deliver new therapies.

The government infusion of funds not only hastens the rate of clinical trials but also makes easier the passage of the result of research into effective therapeutic practice. Thus, the stem cell therapy market is getting a positive ripple effect as more investments leading to expanded capabilities, enhanced infrastructure, and ultimately contributing to the overall growth and maturation of the industry.

Induced pluripotent stem cells (iPSCs) are reprogrammed adult stem cells to an embryonic stem cell-like state. iPSCs behave just like embryonic stem cells (ESCs), capable of being differentiated into specialized cells of the tissue based on gene expression; therefore, iPSCs are a good substitute for ESCs.

As ESCs are obtained from embryos at an early stage of life, they are linked with socio-ethical concerns and law pertaining to contraception, abortion, and in-vitro fertilization. The utilization of iPSCs is free from the handling of human embryos and therefore avoids socio-ethical concerns. iPSCs can be applied to a range of applications, such as the creation of regenerative medicine and drug discovery (e.g., modeling diseases and cytotoxicity assays), thereby decreasing the cost of clinical trials as a whole.

The application of iPSCs in cell therapy means that pluripotent cells with a compatible genetic map of the patient are generated. Thus, with such benefits, the application of iPSCs in cell therapy research is on the rise and can be helpful to the overall development of the market.

Based on cell type, the stem cells market is categorized into Embryonic Stem Cells (ESCs), Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells, Induced Pluripotent Stem Cells (iPSCs), and Others.

Mesenchymal Stem Cells (MSCs) lead the cell type market segment of the stem cell industry as they possess specific immunomodulatory and regenerative properties that make them highly effective in treating a wide range of chronic and degenerative diseases like diabetes, autoimmune disease, cardiovascular and neurological diseases.

Since they can regenerate injured tissues as well as modulate inflammatory responses, MSCs are the best choice in cell-based therapies and regenerative medicine. The growth in the market is also driven by growing clinical trials, improvement in genetic engineering technology, personal medicine strategies, and technology uptake such as AI and 3D bioprinting.

MSCs are also available from many tissue sources including bone marrow, adipose tissue, and umbilical cord, thereby becoming increasingly available and usable. In spite of restraints such as elevated therapy expense and regulatory complexity, rising demand for advanced therapies and research collaborations uphold MSCs in the leadership position.

North America dominates this segment based on robust R&D as well as regulation back-up, whereas Asia Pacific experiences rapid growth based on increasing healthcare spending. In total, MSCs' adaptability, widespread therapy application, and technology advances form the pillars of their leadership position in the stem cell market.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is a global leader in the stem cell market for some compelling reasons. There is an established healthcare infrastructure in the region, massive investments in R&D, and high research and manufacturing density facilities. Favorable government policies and reimbursement policies also facilitate innovation and adoption of stem cell treatments.

Besides, the major public and private funds are provided to stem cell research, driving production technology, storage, and clinical application. The United States is particularly dominant in terms of the number of ongoing clinical trials and drug approvals, accelerating new treatment accessibility to market. High public consciousness of the therapeutic value of stem cells coupled with rising cases of chronic ailments such as diabetes and cancer stimulate demand for regenerative and personalized medicine across the region.

Leading companies are partnering with hospitals, specialty clinics, and research institutes to expand inorganically. PromoCell, AcceGen, Bio-Techne, Cellular Engineering Technologies, Inc., Merck KGaA, Lonza, Miltenyi Biotec, STEMCELL Technologies., StemBioSys, Inc., CORESTEMCHEMON Inc., HARMICELL Co., Ltd., and BlueRock Therapeutics LP, are the prominent stem cells market players.

Each of these players has been have been profiled in the stem cells market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

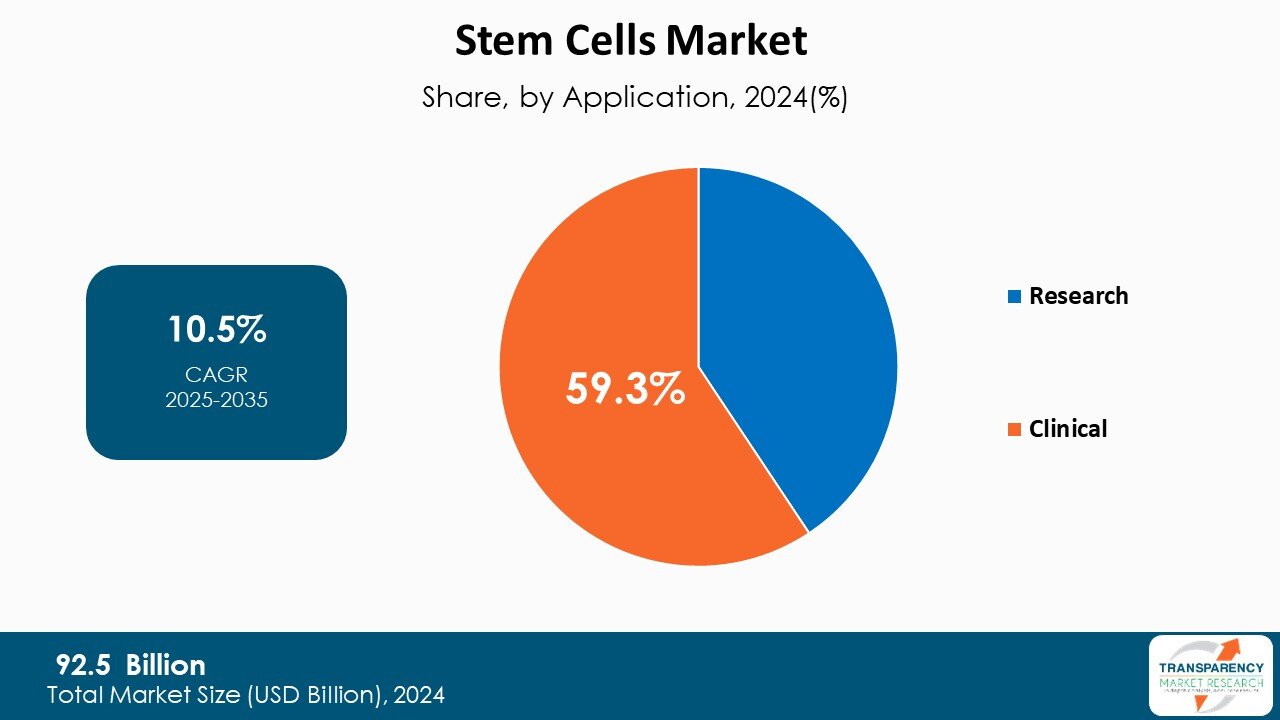

| Size in 2024 | US$ 92.5 Bn |

| Forecast Value in 2035 | More than US$ 280.2 Bn |

| CAGR | 10.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global stem cells market was valued at US$ 92.5 Bn in 2024.

Stem cells business is projected to cross US$ 280.2 Bn by the end of 2035.

Increased funding for stem cell research and The emergence of iPSCs as an alternative to ESCs.

The CAGR is anticipated to be 10.5% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

PromoCell, AcceGen, Bio-Techne, Cellular Engineering Technologies, Inc., Merck KGaA, Lonza, Miltenyi Biotec, STEMCELL Technologies., StemBioSys, Inc., CORESTEMCHEMON Inc., HARMICELL Co., Ltd., and BlueRock Therapeutics LP are the prominent stem cells market players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Stem Cells Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Stem Cells Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Key Industry Events (Partnerships, Collaborations, Mergers, Acquisitions, etc.)

5.2. Overview on Stem Cells

5.3. Pipeline Analysis

5.4. PORTER’s Five Forces Analysis

5.5. PESTLE Analysis

5.6. Regulatory Scenario by Key Countries/Regions

5.7. Value Chain Analysis

5.8. Pricing Trends

5.9. Benchmarking of the Products Offered by the Leading Competitors

5.10. Go-to-Market Strategy for New Market Entrants

6. Global Stem Cells Market Analysis and Forecasts, By Cell Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Cell Type, 2020 to 2035

6.3.1. Embryonic Stem Cells (ESCs)

6.3.2. Mesenchymal Stem Cells (MSCs)

6.3.3. Hematopoietic Stem Cells

6.3.4. Induced Pluripotent Stem Cells (iPSCs)

6.3.5. Others

6.4. Market Attractiveness By Cell Type

7. Global Stem Cells Market Analysis and Forecasts, By Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Application, 2020 to 2035

7.3.1. Research

7.3.2. Clinical

7.4. Market Attractiveness By Application

8. Global Stem Cells Market Analysis and Forecasts, By Indication

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Indication, 2020 to 2035

8.3.1. Musculoskeletal Disorders

8.3.2. Cardiovascular Disorders

8.3.3. Oncology

8.3.4. Inflammatory & Autoimmune Diseases

8.3.5. Neurological Disorders

8.3.6. Others

8.4. Market Attractiveness By Indication

9. Global Stem Cells Market Analysis and Forecasts, By End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By End-user, 2020 to 2035

9.3.1. Hospitals

9.3.2. Pharmaceutical & Biotechnology Companies

9.3.3. Others

9.4. Market Attractiveness By End-user

10. Global Stem Cells Market Analysis and Forecasts, By Region

10.1. Key Findings

10.2. Market Value Forecast By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Region

11. North America Stem Cells Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Cell Type, 2020 to 2035

11.2.1. Embryonic Stem Cells (ESCs)

11.2.2. Mesenchymal Stem Cells (MSCs)

11.2.3. Hematopoietic Stem Cells

11.2.4. Induced Pluripotent Stem Cells (iPSCs)

11.2.5. Others

11.3. Market Value Forecast By Application, 2020 to 2035

11.3.1. Research

11.3.2. Clinical

11.4. Market Value Forecast By Indication, 2020 to 2035

11.4.1. Musculoskeletal Disorders

11.4.2. Cardiovascular Disorders

11.4.3. Oncology

11.4.4. Inflammatory & Autoimmune Diseases

11.4.5. Neurological Disorders

11.4.6. Others

11.5. Market Value Forecast By End-user, 2020 to 2035

11.5.1. Hospitals

11.5.2. Pharmaceutical & Biotechnology Companies

11.5.3. Others

11.6. Market Value Forecast By Country, 2020 to 2035

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Cell Type

11.7.2. By Application

11.7.3. By Indication

11.7.4. By End-user

11.7.5. By Country

12. Europe Stem Cells Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Cell Type, 2020 to 2035

12.2.1. Embryonic Stem Cells (ESCs)

12.2.2. Mesenchymal Stem Cells (MSCs)

12.2.3. Hematopoietic Stem Cells

12.2.4. Induced Pluripotent Stem Cells (iPSCs)

12.2.5. Others

12.3. Market Value Forecast By Application, 2020 to 2035

12.3.1. Research

12.3.2. Clinical

12.4. Market Value Forecast By Indication, 2020 to 2035

12.4.1. Musculoskeletal Disorders

12.4.2. Cardiovascular Disorders

12.4.3. Oncology

12.4.4. Inflammatory & Autoimmune Diseases

12.4.5. Neurological Disorders

12.4.6. Others

12.5. Market Value Forecast By End-user, 2020 to 2035

12.5.1. Hospitals

12.5.2. Pharmaceutical & Biotechnology Companies

12.5.3. Others

12.6. Market Value Forecast By Country/Sub-region, 2020 to 2035

12.6.1. Germany

12.6.2. UK

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Cell Type

12.7.2. By Application

12.7.3. By Indication

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Stem Cells Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Cell Type, 2020 to 2035

13.2.1. Embryonic Stem Cells (ESCs)

13.2.2. Mesenchymal Stem Cells (MSCs)

13.2.3. Hematopoietic Stem Cells

13.2.4. Induced Pluripotent Stem Cells (iPSCs)

13.2.5. Others

13.3. Market Value Forecast By Application, 2020 to 2035

13.3.1. Research

13.3.2. Clinical

13.4. Market Value Forecast By Indication, 2020 to 2035

13.4.1. Musculoskeletal Disorders

13.4.2. Cardiovascular Disorders

13.4.3. Oncology

13.4.4. Inflammatory & Autoimmune Diseases

13.4.5. Neurological Disorders

13.4.6. Others

13.5. Market Value Forecast By End-user, 2020 to 2035

13.5.1. Hospitals

13.5.2. Pharmaceutical & Biotechnology Companies

13.5.3. Others

13.6. Market Value Forecast By Country/Sub-region, 2020 to 2035

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Cell Type

13.7.2. By Application

13.7.3. By Indication

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Stem Cells Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Cell Type, 2020 to 2035

14.2.1. Embryonic Stem Cells (ESCs)

14.2.2. Mesenchymal Stem Cells (MSCs)

14.2.3. Hematopoietic Stem Cells

14.2.4. Induced Pluripotent Stem Cells (iPSCs)

14.2.5. Others

14.3. Market Value Forecast By Application, 2020 to 2035

14.3.1. Research

14.3.2. Clinical

14.4. Market Value Forecast By Indication, 2020 to 2035

14.4.1. Musculoskeletal Disorders

14.4.2. Cardiovascular Disorders

14.4.3. Oncology

14.4.4. Inflammatory & Autoimmune Diseases

14.4.5. Neurological Disorders

14.4.6. Others

14.5. Market Value Forecast By End-user, 2020 to 2035

14.5.1. Hospitals

14.5.2. Pharmaceutical & Biotechnology Companies

14.5.3. Others

14.6. Market Value Forecast By Country/Sub-region, 2020 to 2035

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Cell Type

14.7.2. By Application

14.7.3. By Indication

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Stem Cells Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast By Cell Type, 2020 to 2035

15.2.1. Embryonic Stem Cells (ESCs)

15.2.2. Mesenchymal Stem Cells (MSCs)

15.2.3. Hematopoietic Stem Cells

15.2.4. Induced Pluripotent Stem Cells (iPSCs)

15.2.5. Others

15.3. Market Value Forecast By Application, 2020 to 2035

15.3.1. Research

15.3.2. Clinical

15.4. Market Value Forecast By Indication, 2020 to 2035

15.4.1. Musculoskeletal Disorders

15.4.2. Cardiovascular Disorders

15.4.3. Oncology

15.4.4. Inflammatory & Autoimmune Diseases

15.4.5. Neurological Disorders

15.4.6. Others

15.5. Market Value Forecast By End-user, 2020 to 2035

15.5.1. Hospitals

15.5.2. Pharmaceutical & Biotechnology Companies

15.5.3. Others

15.6. Market Value Forecast By Country/Sub-region, 2020 to 2035

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Cell Type

15.7.2. By Application

15.7.3. By Indication

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis By Company (2024)

16.3. Company Profiles

16.3.1. PromoCell

16.3.1.1. Company Overview

16.3.1.2. Financial Overview

16.3.1.3. Financial Overview

16.3.1.4. Business Strategies

16.3.1.5. Recent Developments

16.3.2. AcceGen

16.3.2.1. Company Overview

16.3.2.2. Financial Overview

16.3.2.3. Financial Overview

16.3.2.4. Business Strategies

16.3.2.5. Recent Developments

16.3.3. Bio-Techne

16.3.3.1. Company Overview

16.3.3.2. Financial Overview

16.3.3.3. Financial Overview

16.3.3.4. Business Strategies

16.3.3.5. Recent Developments

16.3.4. Cellular Engineering Technologies, Inc.

16.3.4.1. Company Overview

16.3.4.2. Financial Overview

16.3.4.3. Financial Overview

16.3.4.4. Business Strategies

16.3.4.5. Recent Developments

16.3.5. Merck KGaA

16.3.5.1. Company Overview

16.3.5.2. Financial Overview

16.3.5.3. Financial Overview

16.3.5.4. Business Strategies

16.3.5.5. Recent Developments

16.3.6. Lonza

16.3.6.1. Company Overview

16.3.6.2. Financial Overview

16.3.6.3. Financial Overview

16.3.6.4. Business Strategies

16.3.6.5. Recent Developments

16.3.7. Miltenyi Biotec

16.3.7.1. Company Overview

16.3.7.2. Financial Overview

16.3.7.3. Financial Overview

16.3.7.4. Business Strategies

16.3.7.5. Recent Developments

16.3.8. STEMCELL Technologies.

16.3.8.1. Company Overview

16.3.8.2. Financial Overview

16.3.8.3. Financial Overview

16.3.8.4. Business Strategies

16.3.8.5. Recent Developments

16.3.9. StemBioSys, Inc.

16.3.9.1. Company Overview

16.3.9.2. Financial Overview

16.3.9.3. Financial Overview

16.3.9.4. Business Strategies

16.3.9.5. Recent Developments

16.3.10. CORESTEMCHEMON Inc.

16.3.10.1. Company Overview

16.3.10.2. Financial Overview

16.3.10.3. Financial Overview

16.3.10.4. Business Strategies

16.3.10.5. Recent Developments

16.3.11. PHARMICELL Co., Ltd

16.3.11.1. Company Overview

16.3.11.2. Financial Overview

16.3.11.3. Financial Overview

16.3.11.4. Business Strategies

16.3.11.5. Recent Developments

16.3.12. BlueRock Therapeutics LP

16.3.12.1. Company Overview

16.3.12.2. Financial Overview

16.3.12.3. Financial Overview

16.3.12.4. Business Strategies

16.3.12.5. Recent Developments

List of Tables

Table 01: Global Stem Cells Market Value (US$ Bn) Forecast, By Cell Type, 2020 to 2035

Table 02: Global Stem Cells Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 03: Global Stem Cells Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 04: Global Stem Cells Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Stem Cells Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Stem Cells Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 07: North America Stem Cells Market Value (US$ Bn) Forecast, by Cell Type, 2020 to 2035

Table 08: North America Stem Cells Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 09: North America Stem Cells Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 10: North America Stem Cells Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe Stem Cells Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 12: Europe Stem Cells Market Value (US$ Bn) Forecast, by Cell Type, 2020 to 2035

Table 13: Europe Stem Cells Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 14: Europe Stem Cells Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 15: Europe Stem Cells Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific Stem Cells Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 17: Asia Pacific Stem Cells Market Value (US$ Bn) Forecast, by Cell Type, 2020 to 2035

Table 18: Asia Pacific Stem Cells Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 19: Asia Pacific Stem Cells Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 20: Asia Pacific Stem Cells Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America Stem Cells Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 22: Latin America Stem Cells Market Value (US$ Bn) Forecast, by Cell Type, 2020 to 2035

Table 23: Latin America Stem Cells Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Latin America Stem Cells Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 25: Latin America Stem Cells Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa Stem Cells Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 27: Middle East & Africa Stem Cells Market Value (US$ Bn) Forecast, by Cell Type, 2020 to 2035

Table 28: Middle East & Africa Stem Cells Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 29: Middle East & Africa Stem Cells Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 30: Middle East & Africa Stem Cells Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Stem Cells Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Figure 02: Global Stem Cells Market Value Share Analysis, By Cell Type, 2024 and 2035

Figure 03: Global Stem Cells Market Attractiveness Analysis, By Cell Type, 2020 to 2035

Figure 04: Global Stem Cells Market Revenue (US$ Bn), by Embryonic Stem Cells, 2020 to 2035

Figure 05: Global Stem Cells Market Revenue (US$ Bn), by Mesenchymal Stem Cells, 2020 to 2035

Figure 06: Global Stem Cells Market Revenue (US$ Bn), by Hematopoietic Stem Cells, 2020 to 2035

Figure 07: Global Stem Cells Market Revenue (US$ Bn), by Induced Pluripotent Stem Cells, 2020 to 2035

Figure 08: Global Stem Cells Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 09: Global Stem Cells Market Value Share Analysis, By Application, 2024 and 2035

Figure 10: Global Stem Cells Market Attractiveness Analysis, By Application, 2020 to 2035

Figure 11: Global Stem Cells Market Revenue (US$ Bn), by Research, 2020 to 2035

Figure 12: Global Stem Cells Market Revenue (US$ Bn), by Clinical, 2020 to 2035

Figure 13: Global Stem Cells Market Value Share Analysis, By Indication, 2024 and 2035

Figure 14: Global Stem Cells Market Attractiveness Analysis, By Indication, 2020 to 2035

Figure 15: Global Stem Cells Market Revenue (US$ Bn), by Musculoskeletal Disorders, 2020 to 2035

Figure 16: Global Stem Cells Market Revenue (US$ Bn), by Cardiovascular Disorders, 2020 to 2035

Figure 17: Global Stem Cells Market Revenue (US$ Bn), by Oncology, 2020 to 2035

Figure 18: Global Stem Cells Market Revenue (US$ Bn), by Inflammatory & Autoimmune Diseases, 2020 to 2035

Figure 19: Global Stem Cells Market Revenue (US$ Bn), by Neurological Disorders, 2020 to 2035

Figure 20: Global Stem Cells Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 21: Global Stem Cells Market Value Share Analysis, By End-user, 2024 and 2035

Figure 22: Global Stem Cells Market Attractiveness Analysis, By End-user, 2020 to 2035

Figure 23: Global Stem Cells Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 24: Global Stem Cells Market Revenue (US$ Bn), by Pharmaceutical & Biotechnology Companies, 2020 to 2035

Figure 25: Global Stem Cells Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 26: Global Stem Cells Market Value Share Analysis, By Region, 2024 and 2035

Figure 27: Global Stem Cells Market Attractiveness Analysis, By Region, 2020 to 2035

Figure 28: North America Stem Cells Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 29: North America Stem Cells Market Value Share Analysis, by Country, 2024 and 2035

Figure 30: North America Stem Cells Market Attractiveness Analysis, by Country, 2020 to 2035

Figure 31: North America Stem Cells Market Value Share Analysis, By Cell Type, 2024 and 2035

Figure 32: North America Stem Cells Market Attractiveness Analysis, By Cell Type, 2020 to 2035

Figure 33: North America Stem Cells Market Value Share Analysis, By Application, 2024 and 2035

Figure 34: North America Stem Cells Market Attractiveness Analysis, By Application, 2020 to 2035

Figure 35: North America Stem Cells Market Value Share Analysis, By Indication, 2024 and 2035

Figure 36: North America Stem Cells Market Attractiveness Analysis, By Indication, 2020 to 2035

Figure 37: North America Stem Cells Market Value Share Analysis, By End-user, 2024 and 2035

Figure 38: North America Stem Cells Market Attractiveness Analysis, By End-user, 2020 to 2035

Figure 39: Europe Stem Cells Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 40: Europe Stem Cells Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 41: Europe Stem Cells Market Attractiveness Analysis, by Country/Sub-region, 2020 to 2035

Figure 42: Europe Stem Cells Market Value Share Analysis, By Cell Type, 2024 and 2035

Figure 43: Europe Stem Cells Market Attractiveness Analysis, By Cell Type, 2020 to 2035

Figure 44: Europe Stem Cells Market Value Share Analysis, By Application, 2024 and 2035

Figure 45: Europe Stem Cells Market Attractiveness Analysis, By Application, 2020 to 2035

Figure 46: Europe Stem Cells Market Value Share Analysis, By Indication, 2024 and 2035

Figure 47: Europe Stem Cells Market Attractiveness Analysis, By Indication, 2020 to 2035

Figure 48: Europe Stem Cells Market Value Share Analysis, By End-user, 2024 and 2035

Figure 49: Europe Stem Cells Market Attractiveness Analysis, By End-user, 2020 to 2035

Figure 50: Asia Pacific Stem Cells Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 51: Asia Pacific Stem Cells Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 52: Asia Pacific Stem Cells Market Attractiveness Analysis, by Country/Sub-region, 2020 to 2035

Figure 53: Asia Pacific Stem Cells Market Value Share Analysis, By Cell Type, 2024 and 2035

Figure 54: Asia Pacific Stem Cells Market Attractiveness Analysis, By Cell Type, 2020 to 2035

Figure 55: Asia Pacific Stem Cells Market Value Share Analysis, By Application, 2024 and 2035

Figure 56: Asia Pacific Stem Cells Market Attractiveness Analysis, By Application, 2020 to 2035

Figure 57: Asia Pacific Stem Cells Market Value Share Analysis, By Indication, 2024 and 2035

Figure 58: Asia Pacific Stem Cells Market Attractiveness Analysis, By Indication, 2020 to 2035

Figure 59: Asia Pacific Stem Cells Market Value Share Analysis, By End-user, 2024 and 2035

Figure 60: Asia Pacific Stem Cells Market Attractiveness Analysis, By End-user, 2020 to 2035

Figure 61: Latin America Stem Cells Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Latin America Stem Cells Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 63: Latin America Stem Cells Market Attractiveness Analysis, by Country/Sub-region, 2020 to 2035

Figure 64: Latin America Stem Cells Market Value Share Analysis, By Cell Type, 2024 and 2035

Figure 65: Latin America Stem Cells Market Attractiveness Analysis, By Cell Type, 2020 to 2035

Figure 66: Latin America Stem Cells Market Value Share Analysis, By Application, 2024 and 2035

Figure 67: Latin America Stem Cells Market Attractiveness Analysis, By Application, 2020 to 2035

Figure 68: Latin America Stem Cells Market Value Share Analysis, By Indication, 2024 and 2035

Figure 69: Latin America Stem Cells Market Attractiveness Analysis, By Indication, 2020 to 2035

Figure 70: Latin America Stem Cells Market Value Share Analysis, By End-user, 2024 and 2035

Figure 71: Latin America Stem Cells Market Attractiveness Analysis, By End-user, 2020 to 2035

Figure 72: Middle East & Africa Stem Cells Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 73: Middle East & Africa Stem Cells Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 74: Middle East & Africa Stem Cells Market Attractiveness Analysis, by Country/Sub-region, 2020 to 2035

Figure 75: Middle East & Africa Stem Cells Market Value Share Analysis, By Cell Type, 2024 and 2035

Figure 76: Middle East & Africa Stem Cells Market Attractiveness Analysis, By Cell Type, 2020 to 2035

Figure 77: Middle East & Africa Stem Cells Market Value Share Analysis, By Application, 2024 and 2035

Figure 78: Middle East & Africa Stem Cells Market Attractiveness Analysis, By Application, 2020 to 2035

Figure 79: Middle East & Africa Stem Cells Market Value Share Analysis, By Indication, 2024 and 2035

Figure 80: Middle East & Africa Stem Cells Market Attractiveness Analysis, By Indication, 2020 to 2035

Figure 81: Middle East & Africa Stem Cells Market Value Share Analysis, By End-user, 2024 and 2035

Figure 82: Middle East & Africa Stem Cells Market Attractiveness Analysis, By End-user, 2020 to 2035