Reports

Reports

Recent advancements in stem cell research have raised the awareness about cellular development and differentiation. The present scenario is such that advancements with stem-cell-derived organoids are aiming to be as close to the structures and functions of real organs as possible, and provide the most unique models for studying human biology and disease.

In addition, growing demand for personalized medicine has led to greater emphasis on patient-specific modeling of organoids, where drug action against a particular genotype can be screened, and organoids do have immense potential in tissue engineering with the possibility of designing individualized tissues and organs to be transplanted to mitigate donor organ scarcity.

Technological innovations such as microfluidics and 3D bioprinting are facilitating the enhancement of the organoid function toward increasingly sophisticated experimentation and analysis. Organoid market, therefore, is not only growing on the basis of application but also changing as a result of persistent pressure for increasingly precise and reliable research tools.

One of the most significant trends is the growing use of organoids in drug discovery and development. Organoid models are increasingly utilized by pharmaceuticals for preclinical research due to the fact that the systems more accurately represent human tissue than two-dimensional cell cultures. The change allows for more accurate predictions to be made about the efficacy and toxicity of drugs while providing much reduced probabilities of failure in final-stage clinical trials.

The market is also benefiting from increased funding and investment from both - public and private sectors. With growing awareness of the prospect for applications of organoids, growing venture capital and grants are being poured into research and development activities in the area. Also, collaborative research between academic institutions, biotech companies, and pharmaceutical companies is creating a fertile ground for innovation.

Organoids are miniaturized, three-dimensional structures derived from stem cells that replicate the functional and architectural characteristics of real organs. Organoids are self-organizing structures that have the same complexity as human tissue and organs, and can serve as a platform for making paradigm-changing advancements in biomedical science. Organoids are useful mainly as they expand from two-dimensional cell culture, which is a more representative physiology, allowing scientist to study interaction of cells and development of tissues and disease in a more realistic manner.

The applications of organoids are vast and varied. Organoids provide a platform for the testing of new drug’s effect and toxicity in drug development, thereby facilitating more representative models of the human response. Organoids generated from tumor tissue are employed to explore the dynamics of tumors, identify possible therapeutic targets, and also determine personalized treatment in the field of cancer research.

Besides, organoids play a vital role in regenerative medicine as they can provide information on tissue development and potential organ replacement or repair methods.

There are several types of organoids categorized on the basis of the organ systems they represent. Intestinal organoids, for example, are used for investigation of gastrointestinal disease and nutrient uptake, while liver organoids enable hepatic disease research and drug metabolism. Brain organoids help with investigation of neurological disease and brain development. Kidney, lung, and pancreatic organoids are the ones whose purposes of investigation as well as expanding the knowledge of human biology are distinct. With continued growth in research, organoids will play increasingly important roles in advancing medicine and improving patient outcomes.

| Attribute | Detail |

|---|---|

| Organoids Market Drivers |

|

Advances in stem cell research are a key driver to the organoids market, dramatically increasing the functionality and utility of these novel biological models. Stem cells can differentiate into many different cell types, a key property to creating organoids with structure and function very close to that of real human organs.

Improvements in the methodology of stem cell isolation, culture, and differentiation have enabled the derivation of organoids from adult and pluripotent stem cells more reproducibly and efficiently. The implementation of these improvements has made it possible to derive organoids that are physiologically similar to some tissues, yielding precious information about human disease and biology.

Significant progress has been made in stem cell research over the last 10 years, most notably with the emergence of induced pluripotent stem cells (iPSCs) that are adult cells re-programmed to a state more like embryonic stem cells. This technology not only avoids the ethical problems related to embryonic stem cells; but could also be used to create patient-specific organoids. By separating organoids from a patient's iPSCs, scientists are able to investigate disease mechanisms in conditions closely replicating the patient's own individual genetic environment. This is a key consideration for personalized medicine as it opens up the possibility of personalized therapeutic strategies based on individual drug and treatment response.

In addition, new gene editing tools such as CRISPR-Cas9 have allowed for precise modification of stem cells to create defined gene-altered organoids. This is of huge significance in disease modeling of genetic disease, tumorigenesis research, and determining the effects of therapeutic candidates. By creating organoids with deletion or mutation specific to disease, scientists can gain more insights into the mechanistic underpinnings of many diseases and reveal new therapeutic approaches.

In addition, advancements in more sophisticated culture methods including 3D bioprinting and organ-on-a-chip systems have enhanced organoid development and function. Methods enable various varieties of cell types and extracellular matrix components to be combined in trying to create more sophisticated, more biologically relevant organoid morphologies. All these advancements enhance not only the biological significance of organoids but also their use in drug discovery and development, toxicity screening, and regenerative medicine.

Growing need for personalized medicine is the key growth driver to the organoids market, a new healthcare industry trend toward individualized treatment protocols from the patient's tailored profile. Personalized medicine is centered on maximizing the therapeutic effect by considering the patient's tailored genetic, environmental, and lifestyle factors that influence patient responsiveness to therapy. Organoids spearhead this process as state-of-the-art devices that facilitate the development of tailored treatment protocols.

Organoids derived from the cells of a patient provide a unique platform to investigate disease pathophysiology and drug response in a configuration closely approaching true human physiology. By producing organoids of a patient's tumor cells, researchers can trace the tumor's response to various chemotherapeutic agents or targeted therapies in real time. This may facilitate the identification of the best therapy for the patient and improve the clinical outcome with fewer side-effects.

Further, organoids are not just used in precision medicine for cancer. Organoids are also utilized in cardiology, infectious disease, and neurology, where patient-derived organoids can be utilized to explore how a particular genetic mutation or disease state affects drug response. This ability does not only allow to learn more about different conditions but also assist in developing therapies specifically tailored to meet the unique needs of an individual patient.

The clinical application of organoid technology is also enabled by genomics and bioinformatics advances that enable the handling of the patient's data to be utilized in the decision for treatment. With healthcare systems also moving toward personalized medicine models, there would be growing demand for organoids as tools for research and therapy.

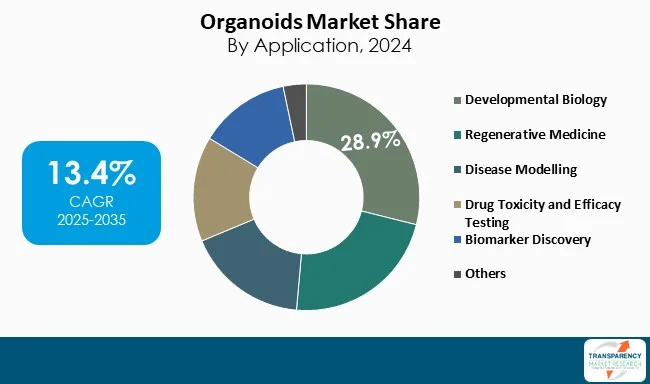

Developmental biology segment captures the majority share in the global organoids market. This is due to the fact that organoids have provided unprecedented information about organ developmental processes, and it is now possible to experiment on cell differentiation and tissue formation in a controlled setting. This is a crucial ability in interpreting congenital malformations and developmental disorders, which are continuously being found to be more complex in nature. Further, the ability to model organogenesis with organoids provides an avenue for the study of intricate signaling pathways and cellular interactions that propel development.

In addition, the increasing focus on regenerative medicine provides impetus to developmental biology. Organoids obtained from stem cells can be used as models for tissue regeneration and repair, thereby making it easier to develop therapeutic approaches toward the restoration of injured organs.

| Attribute | Detail |

|---|---|

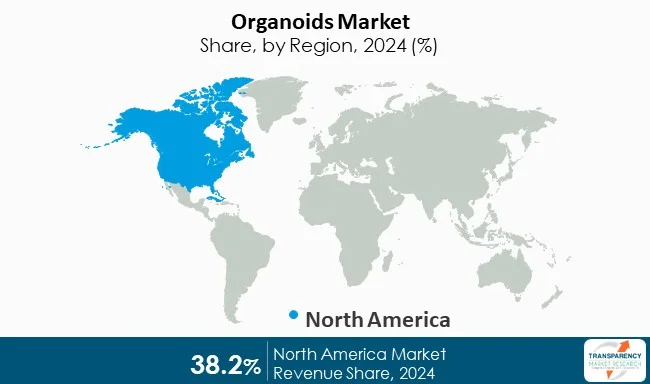

| Leading Region | North America |

As per the latest organoids market analysis, North America dominated in the market in 2024 due to strong research infrastructure owned by the region, high level of funding, and robust focus on innovation in biotechnology. The region is home to top research institutes and universities of the U.S. and Canada, which provide a rich ecosystem for organoids-oriented R&D.

In addition, North America is backed up by huge government and private investments in biotechnology and life sciences research. The national governmental organizations, such as the National Institutes of Health (NIH), provide grants and funding programs directly to aid stem cell studies and regenerative medicine, which are crucial to organoid development.

High acceptability and awareness of sophisticated medical technologies such as organoids also propel North America. Organoid models are increasingly being applied by healthcare practitioners and pharmaceutical firms within the region for drug development as well as targeted medicine, leveraging their potential to enhance therapeutic efficacy.

Several companies engaged in the organoids market are planning to create customized organoid models of different organs to enable drug discovery and disease modeling. Companies are also pursuing grants and investments to fund novel organoid studies, and incorporating cutting-edge technologies such as 3D bioprinting and microfluidics in a bid to enhance organoid complexity and functionality.

Danaher Corporation, Merck KGaA, 3Dnamics Inc., ATCC, STEMCELL Technologies, CelVivo ApS, Emulate, Inc., Newcells Biotech, ACROBiosystems, Corning Incorporated, Pandorum Technologies Pvt. Ltd., MIMETAS B.V., Organovo Holdings Inc., Crown Bioscience and OrganoTherapeutics SARL are some of the leading players operating in the global organoids market.

Each of these players has been profiled in the organoids market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

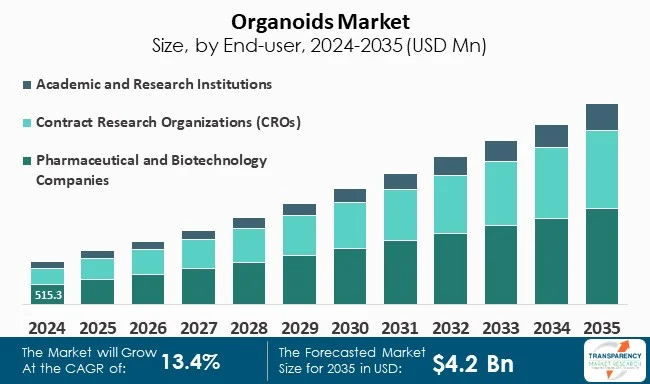

| Size in 2024 | US$ 1.1 Bn |

| Forecast Value in 2035 | US$ 4.2 Bn |

| CAGR | 13.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Biotechnology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global Organoids market was valued at US$ 1.1 Bn in 2024.

The global Organoids industry is projected to reach more than US$ 4.2 Bn by the end of 2035.

Ongoing advancements in stem cell research, rising demand for personalized medicine, and growing focus on regenerative medicine are the factors driving the expansion of Organoids market.

The CAGR is anticipated to be 13.4% from 2025 to 2035.

Danaher Corporation, Merck KGaA, 3Dnamics Inc., ATCC, STEMCELL Technologies, CelVivo ApS, Emulate, Inc., Newcells Biotech, ACROBiosystems, Corning Incorporated, Pandorum Technologies Pvt. Ltd., MIMETAS B.V., Organovo Holdings Inc., Crown Bioscience and OrganoTherapeutics SARL.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Organoids Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Organoids Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Healthcare Expenditure across Key Regions / Countries

5.2. Recent Advancements in Organoid Technology

5.3. Pricing Trends for Organoids

5.4. Regulatory Scenario across Key Regions / Countries

5.5. PORTER’s Five Forces Analysis

5.6. PESTEL Analysis

5.7. Value Chain Analysis

5.8. Key Purchase Metrics for End-users

5.9. Go-to-Market Strategy for New Market Entrants

5.10. Key Industry Events (Partnerships, Collaborations, Product approvals, mergers & acquisitions)

5.11. Benchmarking of Key Products Offered by the Leading Competitors

6. Global Organoids Market Analysis and Forecasts, By Type of Organoid

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Type of Organoid, 2020 to 2035

6.3.1. Stomach Organoids

6.3.2. Intestinal Organoids

6.3.3. Liver Organoids

6.3.4. Lung Organoids

6.3.5. Brain Organoids

6.3.6. Kidney Organoids

6.3.7. Colorectal Organoids

6.3.8. Breast Organoids

6.3.9. Prostate Organoids

6.3.10. Skin Organoids

6.3.11. Retina Organoids

6.3.12. Others

6.4. Market Attractiveness By Type of Organoid

7. Global Organoids Market Analysis and Forecasts, By Source

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Source, 2020 to 2035

7.3.1. Pluripotent Stem Cells (PSCs)

7.3.1.1. Embryonic Stem Cells (ESCs)

7.3.1.2. Induced Pluripotent Stem Cells (iPSCs)

7.3.2. Adult Stem Cells (ASCs)

7.3.3. Patient-derived Organoids

7.4. Market Attractiveness By Source

8. Global Organoids Market Analysis and Forecasts, By Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Application, 2020 to 2035

8.3.1. Developmental Biology

8.3.2. Regenerative Medicine

8.3.3. Disease Modelling

8.3.4. Drug Toxicity and Efficacy Testing

8.3.5. Biomarker Discovery

8.3.6. Others

8.4. Market Attractiveness By Application

9. Global Organoids Market Analysis and Forecasts, By Usability

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By Usability, 2020 to 2035

9.3.1. Ready-to-Use Organoids

9.3.2. Customizable Organoids

9.4. Market Attractiveness By Usability

10. Global Organoids Market Analysis and Forecasts, By Storage Conditions

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast By Storage Conditions, 2020 to 2035

10.3.1. Shelf-stable Organoids

10.3.2. Cryopreserved Organoids

10.4. Market Attractiveness By Storage Conditions

11. Global Organoids Market Analysis and Forecasts, By End-user

11.1. Introduction & Definition

11.2. Key Findings / Developments

11.3. Market Value Forecast By End-user, 2020 to 2035

11.3.1. Pharmaceutical and Biotechnology Companies

11.3.2. Contract Research Organizations (CROs)

11.3.3. Academic and Research Institutions

11.4. Market Attractiveness By End-user

12. Global Organoids Market Analysis and Forecasts, By Region

12.1. Key Findings

12.2. Market Value Forecast By Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Latin America

12.2.5. Middle East & Africa

12.3. Market Attractiveness By Region

13. North America Organoids Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Type of Organoid, 2020 to 2035

13.2.1. Stomach Organoids

13.2.2. Intestinal Organoids

13.2.3. Liver Organoids

13.2.4. Lung Organoids

13.2.5. Brain Organoids

13.2.6. Kidney Organoids

13.2.7. Colorectal Organoids

13.2.8. Breast Organoids

13.2.9. Prostate Organoids

13.2.10. Skin Organoids

13.2.11. Retina Organoids

13.2.12. Others

13.3. Market Value Forecast By Source, 2020 to 2035

13.3.1. Pluripotent Stem Cells (PSCs)

13.3.1.1. Embryonic Stem Cells (ESCs)

13.3.1.2. Induced Pluripotent Stem Cells (iPSCs)

13.3.2. Adult Stem Cells (ASCs)

13.3.3. Patient-derived Organoids

13.4. Market Value Forecast By Application, 2020 to 2035

13.4.1. Developmental Biology

13.4.2. Regenerative Medicine

13.4.3. Disease Modelling

13.4.4. Drug Toxicity and Efficacy Testing

13.4.5. Biomarker Discovery

13.4.6. Others

13.5. Market Value Forecast By Usability, 2020 to 2035

13.5.1. Ready-to-Use Organoids

13.5.2. Customizable Organoids

13.6. Market Value Forecast By Storage Conditions, 2020 to 2035

13.6.1. Shelf-stable Organoids

13.6.2. Cryopreserved Organoids

13.7. Market Value Forecast By End-user, 2020 to 2035

13.7.1. Pharmaceutical and Biotechnology Companies

13.7.2. Contract Research Organizations (CROs)

13.7.3. Academic and Research Institutions

13.8. Market Value Forecast By Country , 2020 to 2035

13.8.1. U.S.

13.8.2. Canada

13.9. Market Attractiveness Analysis

13.9.1. By Type of Organoid

13.9.2. By Source

13.9.3. By Application

13.9.4. By Usability

13.9.5. By Storage Conditions

13.9.6. By End-user

13.9.7. By Country

14. Europe Organoids Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Type of Organoid, 2020 to 2035

14.2.1. Stomach Organoids

14.2.2. Intestinal Organoids

14.2.3. Liver Organoids

14.2.4. Lung Organoids

14.2.5. Brain Organoids

14.2.6. Kidney Organoids

14.2.7. Colorectal Organoids

14.2.8. Breast Organoids

14.2.9. Prostate Organoids

14.2.10. Skin Organoids

14.2.11. Retina Organoids

14.2.12. Others

14.3. Market Value Forecast By Source, 2020 to 2035

14.3.1. Pluripotent Stem Cells (PSCs)

14.3.1.1. Embryonic Stem Cells (ESCs)

14.3.1.2. Induced Pluripotent Stem Cells (iPSCs)

14.3.2. Adult Stem Cells (ASCs)

14.3.3. Patient-derived Organoids

14.4. Market Value Forecast By Application, 2020 to 2035

14.4.1. Developmental Biology

14.4.2. Regenerative Medicine

14.4.3. Disease Modelling

14.4.4. Drug Toxicity and Efficacy Testing

14.4.5. Biomarker Discovery

14.4.6. Others

14.5. Market Value Forecast By Usability, 2020 to 2035

14.5.1. Ready-to-Use Organoids

14.5.2. Customizable Organoids

14.6. Market Value Forecast By Storage Conditions, 2020 to 2035

14.6.1. Shelf-stable Organoids

14.6.2. Cryopreserved Organoids

14.7. Market Value Forecast By End-user, 2020 to 2035

14.7.1. Pharmaceutical and Biotechnology Companies

14.7.2. Contract Research Organizations (CROs)

14.7.3. Academic and Research Institutions

14.8. Market Value Forecast By Country / Sub-region , 2020 to 2035

14.8.1. Germany

14.8.2. UK

14.8.3. France

14.8.4. Italy

14.8.5. Spain

14.8.6. Switzerland

14.8.7. The Netherlands

14.8.8. Rest of Europe

14.9. Market Attractiveness Analysis

14.9.1. By Type of Organoid

14.9.2. By Source

14.9.3. By Application

14.9.4. By Usability

14.9.5. By Storage Conditions

14.9.6. By End-user

14.9.7. By Country / Sub-region

15. Asia Pacific Organoids Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast By Type of Organoid, 2020 to 2035

15.2.1. Stomach Organoids

15.2.2. Intestinal Organoids

15.2.3. Liver Organoids

15.2.4. Lung Organoids

15.2.5. Brain Organoids

15.2.6. Kidney Organoids

15.2.7. Colorectal Organoids

15.2.8. Breast Organoids

15.2.9. Prostate Organoids

15.2.10. Skin Organoids

15.2.11. Retina Organoids

15.2.12. Others

15.3. Market Value Forecast By Source, 2020 to 2035

15.3.1. Pluripotent Stem Cells (PSCs)

15.3.1.1. Embryonic Stem Cells (ESCs)

15.3.1.2. Induced Pluripotent Stem Cells (iPSCs)

15.3.2. Adult Stem Cells (ASCs)

15.3.3. Patient-derived Organoids

15.4. Market Value Forecast By Application, 2020 to 2035

15.4.1. Developmental Biology

15.4.2. Regenerative Medicine

15.4.3. Disease Modelling

15.4.4. Drug Toxicity and Efficacy Testing

15.4.5. Biomarker Discovery

15.4.6. Others

15.5. Market Value Forecast By Usability, 2020 to 2035

15.5.1. Ready-to-Use Organoids

15.5.2. Customizable Organoids

15.6. Market Value Forecast By Storage Conditions, 2020 to 2035

15.6.1. Shelf-stable Organoids

15.6.2. Cryopreserved Organoids

15.7. Market Value Forecast By End-user, 2020 to 2035

15.7.1. Pharmaceutical and Biotechnology Companies

15.7.2. Contract Research Organizations (CROs)

15.7.3. Academic and Research Institutions

15.8. Market Value Forecast By Country / Sub-region , 2020 to 2035

15.8.1. China

15.8.2. India

15.8.3. Japan

15.8.4. South Korea

15.8.5. Australia & New Zealand

15.8.6. Rest of Asia Pacific

15.9. Market Attractiveness Analysis

15.9.1. By Type of Organoid

15.9.2. By Source

15.9.3. By Application

15.9.4. By Usability

15.9.5. By Storage Conditions

15.9.6. By End-user

15.9.7. By Country / Sub-region

16. Latin America Organoids Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast By Type of Organoid, 2020 to 2035

16.2.1. Stomach Organoids

16.2.2. Intestinal Organoids

16.2.3. Liver Organoids

16.2.4. Lung Organoids

16.2.5. Brain Organoids

16.2.6. Kidney Organoids

16.2.7. Colorectal Organoids

16.2.8. Breast Organoids

16.2.9. Prostate Organoids

16.2.10. Skin Organoids

16.2.11. Retina Organoids

16.2.12. Others

16.3. Market Value Forecast By Source, 2020 to 2035

16.3.1. Pluripotent Stem Cells (PSCs)

16.3.1.1. Embryonic Stem Cells (ESCs)

16.3.1.2. Induced Pluripotent Stem Cells (iPSCs)

16.3.2. Adult Stem Cells (ASCs)

16.3.3. Patient-derived Organoids

16.4. Market Value Forecast By Application, 2020 to 2035

16.4.1. Developmental Biology

16.4.2. Regenerative Medicine

16.4.3. Disease Modelling

16.4.4. Drug Toxicity and Efficacy Testing

16.4.5. Biomarker Discovery

16.4.6. Others

16.5. Market Value Forecast By Usability, 2020 to 2035

16.5.1. Ready-to-Use Organoids

16.5.2. Customizable Organoids

16.6. Market Value Forecast By Storage Conditions, 2020 to 2035

16.6.1. Shelf-stable Organoids

16.6.2. Cryopreserved Organoids

16.7. Market Value Forecast By End-user, 2020 to 2035

16.7.1. Pharmaceutical and Biotechnology Companies

16.7.2. Contract Research Organizations (CROs)

16.7.3. Academic and Research Institutions

16.8. Market Value Forecast By Country / Sub-region , 2020 to 2035

16.8.1. Brazil

16.8.2. Mexico

16.8.3. Argentina

16.8.4. Rest of Latin America

16.9. Market Attractiveness Analysis

16.9.1. By Type of Organoid

16.9.2. By Source

16.9.3. By Application

16.9.4. By Usability

16.9.5. By Storage Conditions

16.9.6. By End-user

16.9.7. By Country / Sub-region

17. Middle East & Africa Organoids Market Analysis and Forecast

17.1. Introduction

17.1.1. Key Findings

17.2. Market Value Forecast By Type of Organoid, 2020 to 2035

17.2.1. Stomach Organoids

17.2.2. Intestinal Organoids

17.2.3. Liver Organoids

17.2.4. Lung Organoids

17.2.5. Brain Organoids

17.2.6. Kidney Organoids

17.2.7. Colorectal Organoids

17.2.8. Breast Organoids

17.2.9. Prostate Organoids

17.2.10. Skin Organoids

17.2.11. Retina Organoids

17.2.12. Others

17.3. Market Value Forecast By Source, 2020 to 2035

17.3.1. Pluripotent Stem Cells (PSCs)

17.3.1.1. Embryonic Stem Cells (ESCs)

17.3.1.2. Induced Pluripotent Stem Cells (iPSCs)

17.3.2. Adult Stem Cells (ASCs)

17.3.3. Patient-derived Organoids

17.4. Market Value Forecast By Application, 2020 to 2035

17.4.1. Developmental Biology

17.4.2. Regenerative Medicine

17.4.3. Disease Modelling

17.4.4. Drug Toxicity and Efficacy Testing

17.4.5. Biomarker Discovery

17.4.6. Others

17.5. Market Value Forecast By Usability, 2020 to 2035

17.5.1. Ready-to-Use Organoids

17.5.2. Customizable Organoids

17.6. Market Value Forecast By Storage Conditions, 2020 to 2035

17.6.1. Shelf-stable Organoids

17.6.2. Cryopreserved Organoids

17.7. Market Value Forecast By End-user, 2020 to 2035

17.7.1. Pharmaceutical and Biotechnology Companies

17.7.2. Contract Research Organizations (CROs)

17.7.3. Academic and Research Institutions

17.8. Market Value Forecast By Country / Sub-region , 2020 to 2035

17.8.1. GCC Countries

17.8.2. South Africa

17.8.3. Rest of Middle East & Africa

17.9. Market Attractiveness Analysis

17.9.1. By Type of Organoid

17.9.2. By Source

17.9.3. By Application

17.9.4. By Usability

17.9.5. By Storage Conditions

17.9.6. By End-user

17.9.7. By Country / Sub-region

18. Competition Landscape

18.1. Market Player – Competition Matrix (By Tier and Size of companies)

18.2. Market Share Analysis By Company (2024)

18.3. Company Profiles

18.3.1. Danaher Corporation

18.3.1.1. Company Overview

18.3.1.2. Financial Overview

18.3.1.3. Product Portfolio

18.3.1.4. Business Strategies

18.3.1.5. Recent Developments

18.3.2. Merck KGaA

18.3.2.1. Company Overview

18.3.2.2. Financial Overview

18.3.2.3. Product Portfolio

18.3.2.4. Business Strategies

18.3.2.5. Recent Developments

18.3.3. 3Dnamics Inc.

18.3.3.1. Company Overview

18.3.3.2. Financial Overview

18.3.3.3. Product Portfolio

18.3.3.4. Business Strategies

18.3.3.5. Recent Developments

18.3.4. ATCC

18.3.4.1. Company Overview

18.3.4.2. Financial Overview

18.3.4.3. Product Portfolio

18.3.4.4. Business Strategies

18.3.4.5. Recent Developments

18.3.5. STEMCELL Technologies

18.3.5.1. Company Overview

18.3.5.2. Financial Overview

18.3.5.3. Product Portfolio

18.3.5.4. Business Strategies

18.3.5.5. Recent Developments

18.3.6. CelVivo ApS

18.3.6.1. Company Overview

18.3.6.2. Financial Overview

18.3.6.3. Product Portfolio

18.3.6.4. Business Strategies

18.3.6.5. Recent Developments

18.3.7. Emulate, Inc.

18.3.7.1. Company Overview

18.3.7.2. Financial Overview

18.3.7.3. Product Portfolio

18.3.7.4. Business Strategies

18.3.7.5. Recent Developments

18.3.8. Newcells Biotech

18.3.8.1. Company Overview

18.3.8.2. Financial Overview

18.3.8.3. Product Portfolio

18.3.8.4. Business Strategies

18.3.8.5. Recent Developments

18.3.9. ACROBiosystems

18.3.9.1. Company Overview

18.3.9.2. Financial Overview

18.3.9.3. Product Portfolio

18.3.9.4. Business Strategies

18.3.9.5. Recent Developments

18.3.10. Corning Incorporated

18.3.10.1. Company Overview

18.3.10.2. Financial Overview

18.3.10.3. Product Portfolio

18.3.10.4. Business Strategies

18.3.10.5. Recent Developments

18.3.11. Pandorum Technologies Pvt. Ltd.

18.3.11.1. Company Overview

18.3.11.2. Financial Overview

18.3.11.3. Product Portfolio

18.3.11.4. Business Strategies

18.3.11.5. Recent Developments

18.3.12. MIMETAS B.V.

18.3.12.1. Company Overview

18.3.12.2. Financial Overview

18.3.12.3. Product Portfolio

18.3.12.4. Business Strategies

18.3.12.5. Recent Developments

18.3.13. Organovo Holdings Inc.

18.3.13.1. Company Overview

18.3.13.2. Financial Overview

18.3.13.3. Product Portfolio

18.3.13.4. Business Strategies

18.3.13.5. Recent Developments

18.3.14. Crown Bioscience

18.3.14.1. Company Overview

18.3.14.2. Financial Overview

18.3.14.3. Product Portfolio

18.3.14.4. Business Strategies

18.3.14.5. Recent Developments

18.3.15. OrganoTherapeutics SARL

18.3.15.1. Company Overview

18.3.15.2. Financial Overview

18.3.15.3. Product Portfolio

18.3.15.4. Business Strategies

18.3.15.5. Recent Developments

List of Tables

Table 01: Global Organoids Market Value (US$ Bn) Forecast, By Type of Organoid, 2020 to 2035

Table 02: Global Organoids Market Value (US$ Bn) Forecast, By Source, 2020 to 2035

Table 03: Global Organoids Market Value (US$ Bn) Forecast, By Pluripotent Stem Cells (PSCs), 2020 to 2035

Table 04: Global Organoids Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 05: Global Organoids Market Value (US$ Bn) Forecast, By Usability, 2020 to 2035

Table 06: Global Organoids Market Value (US$ Bn) Forecast, By Storage Conditions, 2020 to 2035

Table 07: Global Organoids Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 08: Global Organoids Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 09: North America Organoids Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 10: North America Organoids Market Value (US$ Bn) Forecast, By Type of Organoid, 2020 to 2035

Table 11: North America Organoids Market Value (US$ Bn) Forecast, By Source, 2020 to 2035

Table 12: North America Organoids Market Value (US$ Bn) Forecast, By Pluripotent Stem Cells (PSCs), 2020 to 2035

Table 13: North America Organoids Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 14: North America Organoids Market Value (US$ Bn) Forecast, By Usability, 2020 to 2035

Table 15: North America Organoids Market Value (US$ Bn) Forecast, By Storage Conditions, 2020 to 2035

Table 16: North America Organoids Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 17: Europe Organoids Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 18: Europe Organoids Market Value (US$ Bn) Forecast, By Type of Organoid, 2020 to 2035

Table 19: Europe Organoids Market Value (US$ Bn) Forecast, By Source, 2020 to 2035

Table 20: Europe Organoids Market Value (US$ Bn) Forecast, By Pluripotent Stem Cells (PSCs), 2020 to 2035

Table 21: Europe Organoids Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 22: Europe Organoids Market Value (US$ Bn) Forecast, By Usability, 2020 to 2035

Table 23: Europe Organoids Market Value (US$ Bn) Forecast, By Storage Conditions, 2020 to 2035

Table 24: Europe Organoids Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Asia Pacific Organoids Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 26: Asia Pacific Organoids Market Value (US$ Bn) Forecast, By Type of Organoid, 2020 to 2035

Table 27: Asia Pacific Organoids Market Value (US$ Bn) Forecast, By Source, 2020 to 2035

Table 28: Asia Pacific Organoids Market Value (US$ Bn) Forecast, By Pluripotent Stem Cells (PSCs), 2020 to 2035

Table 29: Asia Pacific Organoids Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Asia Pacific Organoids Market Value (US$ Bn) Forecast, By Usability, 2020 to 2035

Table 31: Asia Pacific Organoids Market Value (US$ Bn) Forecast, By Storage Conditions, 2020 to 2035

Table 32: Asia Pacific Organoids Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 33: Latin America Organoids Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 34: Asia Pacific Organoids Market Value (US$ Bn) Forecast, By Type of Organoid, 2020 to 2035

Table 35: Latin America Organoids Market Value (US$ Bn) Forecast, By Source, 2020 to 2035

Table 36: Latin America Organoids Market Value (US$ Bn) Forecast, By Pluripotent Stem Cells (PSCs), 2020 to 2035

Table 37: Latin America Organoids Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 38: Latin America Organoids Market Value (US$ Bn) Forecast, By Usability, 2020 to 2035

Table 39: Latin America Organoids Market Value (US$ Bn) Forecast, By Storage Conditions, 2020 to 2035

Table 40: Latin America Organoids Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 41: Middle East & Africa Organoids Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 42: Middle East & Africa Organoids Market Value (US$ Bn) Forecast, By Type of Organoid, 2020 to 2035

Table 43: Middle East & Africa Organoids Market Value (US$ Bn) Forecast, By Source, 2020 to 2035

Table 44: Middle East & Africa Organoids Market Value (US$ Bn) Forecast, By Pluripotent Stem Cells (PSCs), 2020 to 2035

Table 45: Middle East & Africa Organoids Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 46: Middle East & Africa Organoids Market Value (US$ Bn) Forecast, By Usability, 2020 to 2035

Table 47: Middle East & Africa Organoids Market Value (US$ Bn) Forecast, By Storage Conditions, 2020 to 2035

Table 48: Middle East & Africa Organoids Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Organoids Market Value Share Analysis, By Type of Organoid, 2024 and 2035

Figure 02: Global Organoids Market Attractiveness Analysis, By Type of Organoid, 2025 to 2035

Figure 03: Global Organoids Market Revenue (US$ Bn), by Stomach Organoids, 2020 to 2035

Figure 04: Global Organoids Market Revenue (US$ Bn), by Intestinal Organoids, 2020 to 2035

Figure 05: Global Organoids Market Revenue (US$ Bn), by Liver Organoids, 2020 to 2035

Figure 06: Global Organoids Market Revenue (US$ Bn), by Lung Organoids, 2020 to 2035

Figure 07: Global Organoids Market Revenue (US$ Bn), by Brain Organoids, 2020 to 2035

Figure 08: Global Organoids Market Revenue (US$ Bn), by Kidney Organoids, 2020 to 2035

Figure 09: Global Organoids Market Revenue (US$ Bn), by Colorectal Organoids, 2020 to 2035

Figure 10: Global Organoids Market Revenue (US$ Bn), by Breast Organoids, 2020 to 2035

Figure 11: Global Organoids Market Revenue (US$ Bn), by Prostate Organoids, 2020 to 2035

Figure 12: Global Organoids Market Revenue (US$ Bn), by Skin Organoids, 2020 to 2035

Figure 13: Global Organoids Market Revenue (US$ Bn), by Retina Organoids, 2020 to 2035

Figure 14: Global Organoids Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 15: Global Organoids Market Value Share Analysis, By Source, 2024 and 2035

Figure 16: Global Organoids Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 17: Global Organoids Market Revenue (US$ Bn), by Pluripotent Stem Cells (PSCs), 2020 to 2035

Figure 18: Global Organoids Market Revenue (US$ Bn), by Adult Stem Cells (ASCs), 2020 to 2035

Figure 19: Global Organoids Market Revenue (US$ Bn), by Patient-derived Organoids, 2020 to 2035

Figure 20: Global Organoids Market Value Share Analysis, By Application, 2024 and 2035

Figure 21: Global Organoids Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 22: Global Organoids Market Revenue (US$ Bn), by Developmental Biology, 2020 to 2035

Figure 23: Global Organoids Market Revenue (US$ Bn), by Regenerative Medicine, 2020 to 2035

Figure 24: Global Organoids Market Revenue (US$ Bn), by Disease Modelling, 2020 to 2035

Figure 25: Global Organoids Market Revenue (US$ Bn), by Drug Toxicity and Efficacy Testing, 2020 to 2035

Figure 26: Global Organoids Market Revenue (US$ Bn), by Biomarker Discovery, 2020 to 2035

Figure 27: Global Organoids Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 28: Global Organoids Market Value Share Analysis, By Usability, 2024 and 2035

Figure 29: Global Organoids Market Attractiveness Analysis, By Usability, 2025 to 2035

Figure 30: Global Organoids Market Revenue (US$ Bn), by Ready-to-Use Organoids, 2020 to 2035

Figure 31: Global Organoids Market Revenue (US$ Bn), by Customizable Organoids, 2020 to 2035

Figure 32: Global Organoids Market Value Share Analysis, By Storage Conditions, 2024 and 2035

Figure 33: Global Organoids Market Attractiveness Analysis, By Storage Conditions, 2025 to 2035

Figure 34: Global Organoids Market Revenue (US$ Bn), by Shelf-stable Organoids, 2020 to 2035

Figure 35: Global Organoids Market Revenue (US$ Bn), by Cryopreserved Organoids, 2020 to 2035

Figure 36: Global Organoids Market Value Share Analysis, By End-user, 2024 and 2035

Figure 37: Global Organoids Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 38: Global Organoids Market Revenue (US$ Bn), by Pharmaceutical and Biotechnology Companies, 2020 to 2035

Figure 39: Global Organoids Market Revenue (US$ Bn), by Contract Research Organizations (CROs), 2020 to 2035

Figure 40: Global Organoids Market Revenue (US$ Bn), by Academic and Research Institutions, 2020 to 2035

Figure 41: Global Organoids Market Value Share Analysis, By Region, 2024 and 2035

Figure 42: Global Organoids Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 43: North America Organoids Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: North America Organoids Market Value Share Analysis, by Country, 2024 and 2035

Figure 45: North America Organoids Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 46: North America Organoids Market Value Share Analysis, By Type of Organoid, 2024 and 2035

Figure 47: North America Organoids Market Attractiveness Analysis, By Type of Organoid, 2025 to 2035

Figure 48: North America Organoids Market Value Share Analysis, By Source, 2024 and 2035

Figure 49: North America Organoids Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 50: North America Organoids Market Value Share Analysis, By Application, 2024 and 2035

Figure 51: North America Organoids Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 52: North America Organoids Market Value Share Analysis, By Usability, 2024 and 2035

Figure 53: North America Organoids Market Attractiveness Analysis, By Usability, 2025 to 2035

Figure 54: North America Organoids Market Value Share Analysis, By Storage Conditions, 2024 and 2035

Figure 55: North America Organoids Market Attractiveness Analysis, By Storage Conditions, 2025 to 2035

Figure 56: North America Organoids Market Value Share Analysis, By End-user, 2024 and 2035

Figure 57: North America Organoids Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 58: Europe Organoids Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Europe Organoids Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 60: Europe Organoids Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 61: Europe Organoids Market Value Share Analysis, By Type of Organoid, 2024 and 2035

Figure 62: Europe Organoids Market Attractiveness Analysis, By Type of Organoid, 2025 to 2035

Figure 63: Europe Organoids Market Value Share Analysis, By Source, 2024 and 2035

Figure 64: Europe Organoids Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 65: Europe Organoids Market Value Share Analysis, By Application, 2024 and 2035

Figure 66: Europe Organoids Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 67: Europe Organoids Market Value Share Analysis, By Usability, 2024 and 2035

Figure 68: Europe Organoids Market Attractiveness Analysis, By Usability, 2025 to 2035

Figure 69: Europe Organoids Market Value Share Analysis, By Storage Conditions, 2024 and 2035

Figure 70: Europe Organoids Market Attractiveness Analysis, By Storage Conditions, 2025 to 2035

Figure 71: Europe Organoids Market Value Share Analysis, By End-user, 2024 and 2035

Figure 72: Europe Organoids Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 73: Asia Pacific Organoids Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 74: Asia Pacific Organoids Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 75: Asia Pacific Organoids Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 76: Asia Pacific Organoids Market Value Share Analysis, By Type of Organoid, 2024 and 2035

Figure 77: Asia Pacific Organoids Market Attractiveness Analysis, By Type of Organoid, 2025 to 2035

Figure 78: Asia Pacific Organoids Market Value Share Analysis, By Source, 2024 and 2035

Figure 79: Asia Pacific Organoids Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 80: Asia Pacific Organoids Market Value Share Analysis, By Application, 2024 and 2035

Figure 81: Asia Pacific Organoids Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 82: Asia Pacific Organoids Market Value Share Analysis, By Usability, 2024 and 2035

Figure 83: Asia Pacific Organoids Market Attractiveness Analysis, By Usability, 2025 to 2035

Figure 84: Asia Pacific Organoids Market Value Share Analysis, By Storage Conditions, 2024 and 2035

Figure 85: Asia Pacific Organoids Market Attractiveness Analysis, By Storage Conditions, 2025 to 2035

Figure 86: Asia Pacific Organoids Market Value Share Analysis, By End-user, 2024 and 2035

Figure 87: Asia Pacific Organoids Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 88: Latin America Organoids Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 89: Latin America Organoids Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 90: Latin America Organoids Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 91: Latin America Organoids Market Value Share Analysis, By Type of Organoid, 2024 and 2035

Figure 92: Latin America Organoids Market Attractiveness Analysis, By Type of Organoid, 2025 to 2035

Figure 93: Latin America Organoids Market Value Share Analysis, By Source, 2024 and 2035

Figure 94: Latin America Organoids Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 95: Latin America Organoids Market Value Share Analysis, By Application, 2024 and 2035

Figure 96: Latin America Organoids Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 97: Latin America Organoids Market Value Share Analysis, By Usability, 2024 and 2035

Figure 98: Latin America Organoids Market Attractiveness Analysis, By Usability, 2025 to 2035

Figure 99: Latin America Organoids Market Value Share Analysis, By Storage Conditions, 2024 and 2035

Figure 100: Latin America Organoids Market Attractiveness Analysis, By Storage Conditions, 2025 to 2035

Figure 101: Latin America Organoids Market Value Share Analysis, By End-user, 2024 and 2035

Figure 102: Latin America Organoids Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 103: Middle East & Africa Organoids Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 104: Middle East & Africa Organoids Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 105: Middle East & Africa Organoids Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 106: Middle East & Africa Organoids Market Value Share Analysis, By Type of Organoid, 2024 and 2035

Figure 107: Middle East & Africa Organoids Market Attractiveness Analysis, By Type of Organoid, 2025 to 2035

Figure 108: Middle East & Africa Organoids Market Value Share Analysis, By Source, 2024 and 2035

Figure 109: Middle East & Africa Organoids Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 110: Middle East & Africa Organoids Market Value Share Analysis, By Application, 2024 and 2035

Figure 111: Middle East & Africa Organoids Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 112: Middle East & Africa Organoids Market Value Share Analysis, By Usability, 2024 and 2035

Figure 113: Middle East & Africa Organoids Market Attractiveness Analysis, By Usability, 2025 to 2035

Figure 114: Middle East & Africa Organoids Market Value Share Analysis, By Storage Conditions, 2024 and 2035

Figure 115: Middle East & Africa Organoids Market Attractiveness Analysis, By Storage Conditions, 2025 to 2035

Figure 116: Middle East & Africa Organoids Market Value Share Analysis, By End-user, 2024 and 2035

Figure 117: Middle East & Africa Organoids Market Attractiveness Analysis, By End-user, 2025 to 2035