Reports

Reports

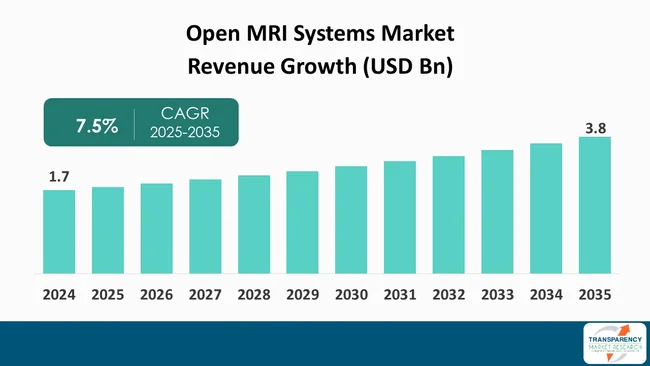

The global open MRI systems market size was valued at US$ 1.7 Bn in 2024 and is projected to reach US$ 3.8 Bn by 2035, expanding at a CAGR of 7.5% from 2025 to 2035. The global open MRI systems Industry is projected to expand at a strong compound annual growth rate (CAGR 7.5%) over the forecast period, leading by the factors such as increasing cases of the disease, the variety of the therapy available to patients and the improvements in the healthcare sector.

The global open MRI systems market is expected to maintain the trend of gradual growth over the forecast period. This growth is majorly attributed to the rising requirement of patient-friendly imaging procedures and progressive changes in diagnostic technology. A significant factor in the increased use of open MRI systems is their better patient comfort, lessening of claustrophobia, and improved access for pediatric and bariatric patients.

Additionally, continuous innovation in magnet design and imaging quality are closing the performance difference between open and closed MRI systems, thus making them more preferred to medical facilities. Nevertheless, the somewhat expensive costs for installation and maintaining the device as well as the lack of high-field open MRI models could limit the growth of the market to some degree.

Besides, the increasing incidence of chronic diseases such as cancer and neurological disorders is pushing the requirement of advanced imaging modalities, thus leading to an increase in market demand. The strategic partnerships between manufacturers and healthcare institutions are also helping the technological innovations and the expansion of product portfolios.

The global open MRI systems market is a major subset of the medical imaging industry, which basically deals with state-of-the-art magnetic resonance imaging (MRI) technologies aimed at improvement of patient comfort and the precision of diagnosis. Open MRI devices, in contrast to the conventional closed MRI systems, have a bigger and more user-friendly design that reduces the anxiety of the patients and makes it possible for the ones who suffer from claustrophobia or have some kind of physical limitation for being safely treated.

Such types of systems are majorly seen in hospitals, diagnostic centers, and laboratories to provide detailed images of soft tissues, organs, and the inside body structures. As the demand for non-invasive diagnostic methods rises and the technology keeps on improving, open MRI systems are being accepted by most patients and doctors as their preferred choice.

In addition, the expansion of medical facilities across the globe, the increasing incidences of diseases, and the growing investments in advanced imaging technologies globally are some of the major factors that have propelled the market to grow further.

For instance, the U.S. Food and Drug Administration (FDA) has established new regulations (referred to as "Medical Device Radiological Health Regulations, 2023") that require MRI machines, which include open MRI systems, to undergo a series of tests relating to safety, image quality, electromagnetic compatibility, and labeling prior to receiving a market approval.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing global prevalence of chronic diseases is among the major attributes to the surge in the demand for advanced diagnostic imaging technologies like open MRI systems. With increased aging population, the requirement for non-invasive and precise diagnostic instruments to identify as well as follow the progression of cardiovascular, neurological, and musculoskeletal disorders is becoming higher.

As per the World Health Organization, cardiovascular diseases accounted for most NCD deaths, or at least 19 million deaths in 2021, followed by cancers (10 million), chronic respiratory diseases (4 million), and diabetes (over 2 million including kidney disease deaths caused by diabetes).

Moreover, the rising occurrence of chronic diseases like cancer, diabetes, and arthritis is compelling the medical professionals to use MRI technology for the first time detection and treatment that is effective by the planning.

According to U.S. Control of Disease Control and Prevention, more than 843,000 Americans die of heart disease or stroke every year—that's more than 1 in 4 deaths. These diseases take an economic toll, as well, costing its health care system US$ 233.3 Bn per year and causing loss of US$ 184.6 Bn in productivity on the job. Costs from cardiovascular diseases are projected to hit roughly US$ 2 Tn by 2050.

Open MRI systems are gaining popularity as a result of them being more cost-effective and having more advantages in operations than what it was traditionally thought to be. Hence, they have become a feasible and attractive option for providers seeking to resolve the diagnostic needs of patients in an efficient and cost-saving way.

Open systems usually have less costly installation, maintenance, and operational activities in comparison with conventional closed MRI units. Thus the money saved can be used for the other healthcare initiatives. For instance, at the 78th World Health Assembly, the WHO Member States agreed to a resolution to enhance medical imaging capacity globally. The resolution points out that diagnostic imaging (including MRI) is "a cost-effective method when employed in an appropriate manner," and recommends that steps be taken to lessen the differences in access to imaging services.

Moreover, their small and space-saving layouts make it possible for them to be more easily merged into outpatient centers, diagnostic clinics, and smaller healthcare establishments, thereby leading to the availability of advanced imaging services to the localities of both cities and villages. The adoption of open MRI systems in various medical facilities worldwide is being propelled by this triple of factors comprising price, flexibility, and patient comfort.

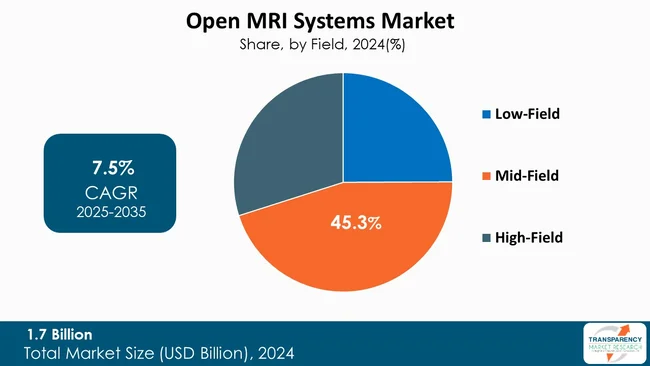

Mid-Field remains the key segment for open MRI systems with largest market share of 45.3%. In terms of image quality and patient comfort, it provides the most effective combination-thus, it can offer a diagnostic capability that is significantly better than that of low-field units, while at the same time it does not have the problems of size, cost, and claustrophobia that are associated with high-field scanners. As a result, it is preferred by outpatient clinics, orthopedic and neurology practices, as well as hospitals that are looking for versatile and cost-effective imaging solutions.

The main field strength with the highest share in the open MRI market is thus supported even more by its reliable performance and lower operating complexity. A steady flow of upgrades from outdated low-field systems is sustaining the mid-field trend in the open MRI market.

Their excellent balance between throughput, maintenance requirements, and patient accessibility makes mid-field systems very attractive to demand. The wide range of examinations that can be done in these units without the need for the infrastructure of high-field ones is what clinics most appreciate about them. On top of that, ongoing technological advancements in coil design and image reconstruction are gradually making the mid-field even more dominant.

| Attribute | Detail |

|---|---|

| Leading Region |

|

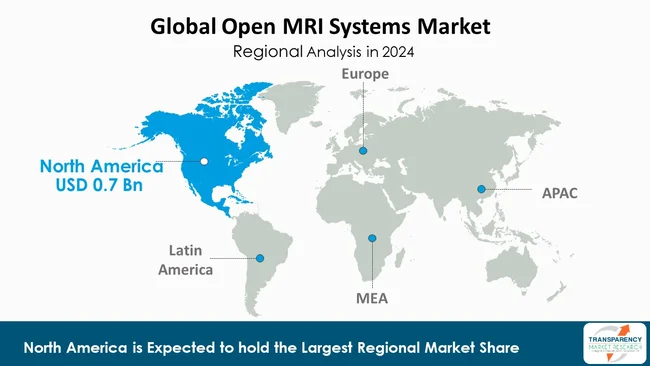

North America holds the dominant position on the global open MRI systems market with market share of 41.2%. This region is acknowledged for its well-established healthcare infrastructure, rapid adoption of innovative medical technologies, and increased demand for patient-friendly diagnostic solutions. Besides, the availability of a great many top MRI manufacturers in the region along with the large investments in research and development has led to the quick turnover of high-performance open MRI systems to the market.

The growing occurrence of chronic and age-related diseases, attractive payment policies, and the increased focus on early diagnosis have been the major factors impelling the market expansion in the U.S. and Canada. Moreover, the region remains at the forefront of the worldwide market due to a series of ongoing innovations such as AI-integrated imaging and high-field open MRI configurations. For instance, the Advanced Research Projects Agency for Health (ARPA-H), a part of the U.S. Department of Health & Human Services (HHS), started its "INDEX" (ImagiNg Data EXchange) initiative that is meant to build a nationwide infrastructure for medical imaging data (like MRI, CT, etc.) to not only speed up AI/ML-driven diagnostic development but also enable providers to handle more images for quicker diagnosis.

GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems, Hitachi Healthcare, Hologic Inc., Bruker Corporation, Esaote SPA, Fujifilm Holdings Corporation, Shimadzu Corporation, Aurora Imaging Technologies, Inc., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Neusoft Medical Systems Co., Ltd., Toshiba Medical Systems Corporation and others are some of the leading manufacturers operating in the global Open MRI Systems market.

Each of these companies has been profiled in the open MRI Systems industry report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.7 Bn |

| Forecast Value in 2035 | More than US$ 3.8 Bn |

| CAGR | 7.5 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Field

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global open MRI systems market was valued at US$ 1.7 Bn in 2024

The global open MRI systems industry is projected to reach more than US$ 3.8 Bn by the end of 2035

Increasing prevalence of chronic and age-related diseases & cost-efficiency and accessibility are some of the factors driving the expansion of open MRI systems market.

The CAGR is anticipated to be 7.5% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems, Hitachi Healthcare, Hologic Inc., Bruker Corporation, Esaote SPA, Fujifilm Holdings Corporation, Shimadzu Corporation, Aurora Imaging Technologies, Inc., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Neusoft Medical Systems Co., Ltd., Toshiba Medical Systems Corporation and other prominent players.

Table 01: Global Open MRI Systems Market Value (US$ Bn) Forecast, by Field, 2020 to 2035

Table 02: Global Open MRI Systems Market Value (US$ Bn) Forecast, By Age Group, 2020 to 2035

Table 03: Global Open MRI Systems Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Open MRI Systems Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Open MRI Systems Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Open MRI Systems Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America Open MRI Systems Market Value (US$ Bn) Forecast, by Field, 2020 to 2035

Table 08: North America Open MRI Systems Market Value (US$ Bn) Forecast, by Age Group, 2020 to 2035

Table 09: North America Open MRI Systems Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 10: North America Open MRI Systems Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 11: Europe Open MRI Systems Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 12: Europe Open MRI Systems Market Value (US$ Bn) Forecast, by Field, 2020 to 2035

Table 13: Europe Open MRI Systems Market Value (US$ Bn) Forecast, by Age Group, 2020 to 2035

Table 14: Europe Open MRI Systems Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 15: Europe Open MRI Systems Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 16: Asia Pacific Open MRI Systems Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 17: Asia Pacific Open MRI Systems Market Value (US$ Bn) Forecast, by Field, 2020 to 2035

Table 18: Asia Pacific Open MRI Systems Market Value (US$ Bn) Forecast, by Age Group, 2020 to 2035

Table 19: Asia Pacific Open MRI Systems Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 20: Asia Pacific Open MRI Systems Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 21: Latin America Open MRI Systems Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Latin America Open MRI Systems Market Value (US$ Bn) Forecast, by Field, 2020 to 2035

Table 23: Latin America Open MRI Systems Market Value (US$ Bn) Forecast, by Age Group, 2020 to 2035

Table 24: Latin America Open MRI Systems Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 25: Latin America Open MRI Systems Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 26: Middle East and Africa Open MRI Systems Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 27: Middle East and Africa Open MRI Systems Market Value (US$ Bn) Forecast, by Field, 2020 to 2035

Table 28: Middle East and Africa Open MRI Systems Market Value (US$ Bn) Forecast, by Age Group, 2020 to 2035

Table 29: Middle East and Africa Open MRI Systems Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 30: Middle East and Africa Open MRI Systems Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Open MRI Systems Market Value Share Analysis, by Field, 2024 and 2035

Figure 02: Global Open MRI Systems Market Attractiveness Analysis, by Field, 2025 to 2035

Figure 03: Global Open MRI Systems Market Revenue (US$ Bn), by Low-Field, 2020 to 2035

Figure 04: Global Open MRI Systems Market Revenue (US$ Bn), by Mid-Field, 2020 to 2035

Figure 05: Global Open MRI Systems Market Revenue (US$ Bn), by High-Field, 2020 to 2035

Figure 06: Global Open MRI Systems Market Value Share Analysis, by Age Group, 2024 and 2035

Figure 07: Global Open MRI Systems Market Attractiveness Analysis, by Age Group, 2025 to 2035

Figure 08: Global Open MRI Systems Market Revenue (US$ Bn), by Pediatric, 2020 to 2035

Figure 09: Global Open MRI Systems Market Revenue (US$ Bn), by Geriatric, 2020 to 2035

Figure 10: Global Open MRI Systems Market Value Share Analysis, by Application, 2024 and 2035

Figure 11: Global Open MRI Systems Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 12: Global Open MRI Systems Market Revenue (US$ Bn), by Neurology, 2020 to 2035

Figure 13: Global Open MRI Systems Market Revenue (US$ Bn), by Gastroenterology, 2020 to 2035

Figure 14: Global Open MRI Systems Market Revenue (US$ Bn), by Cardiology, 2020 to 2035

Figure 15: Global Open MRI Systems Market Revenue (US$ Bn), by Oncology, 2020 to 2035

Figure 16: Global Open MRI Systems Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 17: Global Open MRI Systems Market Value Share Analysis, by End-user, 2024 and 2035

Figure 18: Global Open MRI Systems Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 19: Global Open MRI Systems Market Revenue (US$ Bn), by Hospitals, 2025 to 2035

Figure 20: Global Open MRI Systems Market Revenue (US$ Bn), by Imaging Centers, 2020 to 2035

Figure 21: Global Open MRI Systems Market Revenue (US$ Bn), by Ambulatory Surgical Centers, 2020 to 2035

Figure 22: Global Open MRI Systems Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 23: Global Open MRI Systems Market Value Share Analysis, By Region, 2024 and 2035

Figure 24: Global Open MRI Systems Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 25: North America Open MRI Systems Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 26: North America Open MRI Systems Market Value Share Analysis, by Country, 2024 and 2035

Figure 27: North America Open MRI Systems Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 28: North America Open MRI Systems Market Value Share Analysis, by Field, 2024 and 2035

Figure 29: North America Open MRI Systems Market Attractiveness Analysis, by Field, 2025 to 2035

Figure 30: North America Open MRI Systems Value Share Analysis, by Age Group, 2025 to 2035

Figure 31: North America Open MRI Systems Market Attractiveness Analysis, by Age Group, 2025 to 2035

Figure 32: North America Open MRI Systems Market Value Share Analysis, by Application, 2025 to 2035

Figure 33: North America Open MRI Systems Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 34: North America Open MRI Systems Market Value Share Analysis, by End-user, 2024 and 2035

Figure 35: North America Open MRI Systems Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 36: Europe Open MRI Systems Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: Europe Open MRI Systems Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 38: Europe Open MRI Systems Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 39: Europe Open MRI Systems Market Value Share Analysis, by Field, 2024 and 2035

Figure 40: Europe Open MRI Systems Market Attractiveness Analysis, by Field, 2025 to 2035

Figure 41: Europe Open MRI Systems Market Value Share Analysis, by Age Group, 2024 and 2035

Figure 42: Europe Open MRI Systems Market Attractiveness Analysis, by Age Group, 2025 to 2035

Figure 43: Europe Open MRI Systems Market Value Share Analysis, By Application, 2024 and 2035

Figure 44: Europe Open MRI Systems Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 45: Europe Open MRI Systems Market Value Share Analysis, by End-user, 2024 and 2035

Figure 46: Europe Open MRI Systems Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 47: Asia Pacific Open MRI Systems Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Asia Pacific Open MRI Systems Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 49: Asia Pacific Open MRI Systems Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 50: Asia Pacific Open MRI Systems Market Value Share Analysis, by Field, 2024 and 2035

Figure 51: Asia Pacific Open MRI Systems Market Attractiveness Analysis, by Field, 2025 to 2035

Figure 52: Asia Pacific Open MRI Systems Market Value Share Analysis, by Age Group, 2024 and 2035

Figure 53: Asia Pacific Open MRI Systems Market Attractiveness Analysis, by Age Group, 2025 to 2035

Figure 54: Asia Pacific Open MRI Systems Market Value Share Analysis, By Application, 2024 and 2035

Figure 55: Asia Pacific Open MRI Systems Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 56: Asia Pacific Open MRI Systems Market Value Share Analysis, by End-user, 2024 and 2035

Figure 57: Asia Pacific Open MRI Systems Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 58: Latin America Open MRI Systems Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Latin America Open MRI Systems Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 60: Latin America Open MRI Systems Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 61: Latin America Open MRI Systems Market Value Share Analysis, by Field, 2024 and 2035

Figure 62: Latin America Open MRI Systems Market Attractiveness Analysis, by Field, 2025 to 2035

Figure 63: Latin America Open MRI Systems Market Value Share Analysis, by Age Group, 2024 and 2035

Figure 64: Latin America Open MRI Systems Market Attractiveness Analysis, by Age Group, 2025 to 2035

Figure 65: Latin America Open MRI Systems Market Value Share Analysis, By Application, 2024 and 2035

Figure 66: Latin America Open MRI Systems Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 67: Latin America Open MRI Systems Market Value Share Analysis, by End-user, 2024 and 2035

Figure 68: Latin America Open MRI Systems Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 69: Middle East and Africa Open MRI Systems Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 70: Middle East and Africa Open MRI Systems Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 71: Middle East and Africa Open MRI Systems Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 72: Middle East and Africa Open MRI Systems Market Value Share Analysis, by Field, 2024 and 2035

Figure 73: Middle East and Africa Open MRI Systems Market Attractiveness Analysis, by Field, 2025 to 2035

Figure 74: Middle East and Africa Open MRI Systems Market Value Share Analysis, by Age Group, 2024 and 2035

Figure 75: Middle East and Africa Open MRI Systems Market Attractiveness Analysis, by Age Group, 2025 to 2035

Figure 76: Middle East and Africa Open MRI Systems Market Value Share Analysis, by Application, 2024 and 2035

Figure 77: Middle East and Africa Open MRI Systems Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 78: Middle East and Africa Open MRI Systems Market Value Share Analysis, by End-user, 2024 and 2035

Figure 79: Middle East and Africa Open MRI Systems Market Attractiveness Analysis, by End-user, 2025 to 2035