Reports

Reports

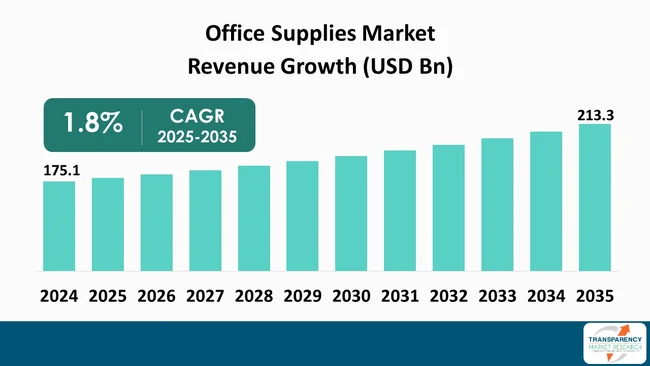

The global office supplies market size was valued at USD 175.1 billion in 2024 and is projected to reach USD 213.3 billion by 2035, expanding at a CAGR of 1.8% from 2025 to 2035. The market growth is driven by hybrid & remote work model expansion, and growth of the corporate sector in emerging economies.

The global office supplies market is characterized as a developing but still strong sector that has been influenced by the changing dynamics of the workplace and the evolving procurement practices. The pandemic-induced acceptance of hybrid working has resulted in varied demand, which now incorporates both - traditional and home-office sales channels.

Organizations are still weighing the pros and cons of making all purchasing decisions centralized or reimbursing employees, resulting in demand that is both - stable and fragmented. On the top of that, the use of sustainability as a criterion for procurement and transition to recyclable materials have emerged as key forces that not only influence the strategies of manufacturers but also the criteria for corporate purchasing.

From a trade point of view, the global supply chains are pointing still to Asia as the leading region in the production of office supplies. Based on the data from the World Integrated Trade Solution (WITS), a World Bank-affiliated database, the export value of plastics for office or school supplies from China was US$ 1.892 Bn in 2023, which was equivalent to 327,364,000 kilograms exported to world markets. This indicates that China is the main player in producing and exporting stationery and plastic-based office products, showing through the amounts the extent of supply-side capacity and dependency on raw materials in the global market.

The global office supplies market comprises a wide range of products that are necessary for maintaining productivity, organization, and communication in workplaces of various kinds such as corporate, educational, and home-office. The traditional supplies that form the core of daily administrative operations include stationery, writing instruments, filing and storage materials, and binding and fastening supplies.

Apart from the consumables, the office supplies market includes copying and printing machines, presentation tools, identification and time-tracking systems, laptops and PCs, as well as specialized devices such as shredders and laminators. Furthermore, the office supply industry also embraces furniture and fixtures that comprise desks, ergonomic chairs, and modular storage units, which are specially designed for providing more comfort and productivity in both - hybrid and conventional work settings.

Cleaning equipment, pantry supplies, and break room are among the complementary categories that are gaining traction as organizations prioritize employee well-being, hygiene, and workplace experience. Market evolution is showing digital transformation, sustainability, and workspace optimization. The ongoing trend of hybrid and remote work is such that it is gradually increasing the demand for flexible, multifunctional, and eco-friendly office solutions, which, in turn, is shaping the global procurement trends, thus driving product diversification and innovation across the office supplies ecosystem.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The transition to hybrid and remote work models has been a significant factor in the changing dynamics of the global office supplies market. Employees' organizations adapt to the flexibility workers demand and thus product demand spreads to the home office and co-working spaces. This results in a continuous demand for items such as portable office furniture, home-office lightings, personal printers, noise-cancelling solutions, and upgraded digital peripherals.

At the same time, companies changing their physical office layouts to allow for less on-site presence are purchasing shared resources, hot-desking equipment, and modular stationery solutions for managing reduced usage and optimizing cost per square foot.

In a survey comprising U.S. employees with "remote-capable" roles, approximately 51% of them are now working hybrid, around 28% are working remotely, and just about 21% are working full-time on-site. This change in numbers signifies a long-term structural shift: hybrid work has become the most common form of remote-capable work, with a continued stability since the year 2022.

The upcoming period indicates a demand driver that points to a specific area of office supplies growth, which is flexibility with users and their workspaces. Manufacturers making small, multifunctional, and user-friendly products will be supported. Purchasing methods will also be required to shift by placing heavier emphasis on distributed supply contracts and flexibility.

The corporate sector in emerging markets is growing at an unprecedented pace, which is a major cause of increasing demand in different segments of the office supplies market. With technology, manufacturing, education, and financial as well as services sectors at the forefront, the whole lot of their supplies starting from furniture and fixtures to desktop accessories and computing equipment is going to be massive. Emerging markets are not only expanding their business numbers but also bringing in the major changes in their infrastructure, digital, and administrative systems, which, in turn, lead to higher consumption of stationery, printing/copying equipment, identification/time-tracking devices, and presentation tools.

One of the indicators pointing in this direction is the education sector in India: the higher education market was expected to be worth US$ 225 Bn by the end of FY 25, nearly double the FY20 figure. Besides, the number of colleges is projected to grow sharply from 42,343 in FY20 to 52,538 in FY25. This growth is hailed as a reflection of not just increasing pupil numbers but also expanding administration and operations; hence, a larger influx of office supplies, covering institutions (desks, PCs, printing, paper, filing/storage) and their corporate suppliers (cleaning, pantry, office furniture) coming in.

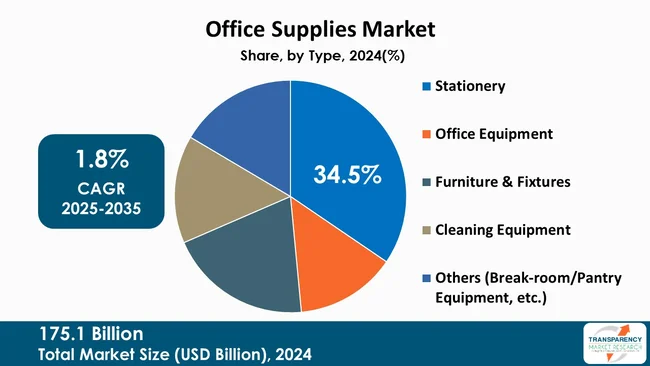

The stationery segment is at the forefront of the global market, comprising 34.5% of the total share. The office supplies market is made up of items like pens, notebooks, files, and folders that are used so often that their demand keeps coming back. Stationery has managed to keep its position despite the digital tools being popular since it offers practicality, low prices, and an increasing number of paper products that are sustainable and recyclable. Company’s and school choices for eco-friendly stationery nowadays are directed toward supporting environmental goals and gaining cost efficiency over a long period.

The other significant segments, which consist of office equipment, furniture and fixtures, and paper products, are also experiencing gradual yet continuous growth. The increase in the number of people working from home and hybrid arrangements has led to more demand for high-quality ergonomic chairs, printers that occupy less space, and filing systems that can hold too much data that is usually kept in an office cabinet. These changes indicate that the market is weighing the old supplies against the new tools the way that it is showing a marriage of functionality, innovation, and workplace changes.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The global office supplies market is mainly dominated by the Asia Pacific with a 42.5% of the market share. China, India, Japan, and South Korea's rapid industrialization, strong educational sector growth, and their expanding corporate infrastructure are the main reasons for this. In addition to this, an increasing number of small and medium-sized enterprises (SMEs) and start-ups has resulted in a consistent demand for stationery, office equipment, and furniture.

In addition, Asia Pacific is the home of a large global production area for stationery, paper products, and inexpensive office equipment, thus it enhances its export potential. The local manufacturers have the advantage of low costs for raw materials, good and fast communication, and large domestic markets. The rise and acceptance of hybrid and remote working models will make the region’s flexibility and cost advantages continue to hold its leadership position and the power to influence global supply changes even more.

3M, ACCO Brands, BIC, BROTHER, Canon, Dell Inc., Epson, Faber-Castell, Fellowes Brands, HP, KOKUYO CO., LTD, Lenovo, MillerKnoll, Inc., Newell Brands, Zebra Technologies Corp and others are some of the leading manufacturers operating in the global office supplies market.

Each of these companies has been profiled in the Office Supplies market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 175.1 Bn |

| Market Forecast Value in 2035 | US$ 213.3 Bn |

| Growth Rate (CAGR 2025 to 2035) | 1.8% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global office supplies market was valued at US$ 175.1 Bn in 2024

The global office supplies industry is projected to reach at US$ 213.3 Bn by the end of 2035

Hybrid & remote work model expansion and growth of the corporate sector in emerging economies, are some of the driving factors for this market

The CAGR is anticipated to be 1.8% from 2025 to 2035

3M, ACCO Brands, BIC, BROTHER, Canon, Dell Inc., Epson, Faber-Castell, Fellowes Brands, HP, KOKUYO CO., LTD, Lenovo, MillerKnoll, Inc., Newell Brands, Zebra Technologies Corp and others

Table 01: Global Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 02: Global Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 03: Global Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 04: Global Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 05: Global Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 06: Global Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 07: Global Office Supplies Market Value (US$ Bn) Projection, By Region 2020 to 2035

Table 08: Global Office Supplies Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Table 09: North America Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 10: North America Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 11: North America Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 12: North America Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 13: North America Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 14: North America Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 15: North America Office Supplies Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 16: North America Office Supplies Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 17: U.S. Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 18: U.S. Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 19: U.S. Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 20: U.S. Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 21: U.S. Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 22: U.S. Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 23: Canada Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 24: Canada Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 25: Canada Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 26: Canada Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 27: Canada Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 28: Canada Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 29: Europe Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 30: Europe Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 31: Europe Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 32: Europe Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 33: Europe Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 34: Europe Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 35: Europe Office Supplies Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 36: Europe Office Supplies Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 37: U.K. Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 38: U.K. Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 39: U.K. Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 40: U.K. Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 41: U.K. Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 42: U.K. Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 43: Germany Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 44: Germany Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 45: Germany Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 46: Germany Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 47: Germany Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 48: Germany Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 49: France Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 50: France Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 51: France Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 52: France Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 53: France Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 54: France Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 55: Italy Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 56: Italy Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 57: Italy Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 58: Italy Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 59: Italy Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 60: Italy Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 61: Spain Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 62: Spain Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 63: Spain Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 64: Spain Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 65: Spain Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 66: Spain Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 67: The Netherlands Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 68: The Netherlands Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 69: The Netherlands Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 70: The Netherlands Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 71: The Netherlands Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 72: The Netherlands Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 73: Asia Pacific Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 74: Asia Pacific Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 75: Asia Pacific Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 76: Asia Pacific Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 77: Asia Pacific Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 78: Asia Pacific Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 79: Asia Pacific Office Supplies Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 80: Asia Pacific Office Supplies Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 81: China Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 82: China Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 83: China Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 84: China Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 85: China Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 86: China Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 87: India Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 88: India Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 89: India Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 90: India Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 91: India Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 92: India Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 93: Japan Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 94: Japan Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 95: Japan Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 96: Japan Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 97: Japan Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 98: Japan Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 99: Australia Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 100: Australia Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 101: Australia Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 102: Australia Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 103: Australia Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 104: Australia Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 105: South Korea Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 106: South Korea Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 107: South Korea Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 108: South Korea Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 109: South Korea Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 110: South Korea Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 111: ASEAN Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 112: ASEAN Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 113: ASEAN Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 114: ASEAN Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 115: ASEAN Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 116: ASEAN Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 117: Middle East & Africa Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 118: Middle East & Africa Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 119: Middle East & Africa Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 120: Middle East & Africa Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 121: Middle East & Africa Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 122: Middle East & Africa Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 123: Middle East & Africa Office Supplies Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 124: Middle East & Africa Office Supplies Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 125: GCC Countries Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 126: GCC Countries Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 127: GCC Countries Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 128: GCC Countries Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 129: GCC Countries Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 130: GCC Countries Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 131: South Africa Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 132: South Africa Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 133: South Africa Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 134: South Africa Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 135: South Africa Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 136: South Africa Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 137: Latin America Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 138: Latin America Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 139: Latin America Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 140: Latin America Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 141: Latin America Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 142: Latin America Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 143: Latin America Office Supplies Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 144: Latin America Office Supplies Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 145: Brazil Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 146: Brazil Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 147: Brazil Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 148: Brazil Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 149: Brazil Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 150: Brazil Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 151: Mexico Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 152: Mexico Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 153: Mexico Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 154: Mexico Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 155: Mexico Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 156: Mexico Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 157: Argentina Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 158: Argentina Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 159: Argentina Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Table 160: Argentina Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Table 161: Argentina Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 162: Argentina Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 01: Global Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 02: Global Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 03: Global Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 04: Global Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 05: Global Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 06: Global Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 07: Global Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 08: Global Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 09: Global Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 10: Global Office Supplies Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 11: Global Office Supplies Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 12: Global Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 13: North America Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 14: North America Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 15: North America Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 16: North America Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 17: North America Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 18: North America Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 19: North America Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 20: North America Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 21: North America Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 22: North America Office Supplies Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 23: North America Office Supplies Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 24: North America Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 25: U.S. Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 26: U.S. Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 27: U.S. Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 28: U.S. Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 29: U.S. Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 30: U.S. Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 31: U.S. Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 32: U.S. Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 33: U.S. Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 34: Canada Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 35: Canada Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 36: Canada Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 37: Canada Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 38: Canada Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 39: Canada Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 40: Canada Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 41: Canada Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 42: Canada Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 43: Europe Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 44: Europe Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 45: Europe Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 46: Europe Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 47: Europe Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 48: Europe Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 49: Europe Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 50: Europe Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 51: Europe Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 52: Europe Office Supplies Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 53: Europe Office Supplies Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 54: Europe Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 55: U.K. Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 56: U.K. Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 57: U.K. Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 58: U.K. Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 59: U.K. Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 60: U.K. Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 61: U.K. Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 62: U.K. Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 63: U.K. Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 64: Germany Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 65: Germany Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 66: Germany Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 67: Germany Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 68: Germany Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 69: Germany Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 70: Germany Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 71: Germany Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 72: Germany Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 73: France Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 74: France Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 75: France Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 76: France Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 77: France Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 78: France Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 79: France Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 80: France Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 81: France Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Italy Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 83: Italy Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 84: Italy Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 85: Italy Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 86: Italy Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 87: Italy Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 88: Italy Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 89: Italy Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 90: Italy Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 91: Spain Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 92: Spain Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 93: Spain Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 94: Spain Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 95: Spain Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 96: Spain Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 97: Spain Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 98: Spain Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 99: Spain Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 100: The Netherlands Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 101: The Netherlands Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 102: The Netherlands Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 103: The Netherlands Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 104: The Netherlands Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 105: The Netherlands Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 106: The Netherlands Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 107: The Netherlands Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 108: The Netherlands Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 109: Asia Pacific Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 110: Asia Pacific Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 111: Asia Pacific Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 112: Asia Pacific Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 113: Asia Pacific Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 114: Asia Pacific Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 115: Asia Pacific Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 116: Asia Pacific Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 117: Asia Pacific Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 118: Asia Pacific Office Supplies Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 119: Asia Pacific Office Supplies Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 120: Asia Pacific Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 121: China Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 122: China Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 123: China Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 124: China Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 125: China Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 126: China Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 127: China Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 128: China Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 129: China Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 130: India Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 131: India Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 132: India Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 133: India Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 134: India Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 135: India Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 136: India Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 137: India Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 138: India Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 139: Japan Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 140: Japan Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 141: Japan Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 142: Japan Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 143: Japan Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 144: Japan Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 145: Japan Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 146: Japan Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 147: Japan Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 148: Australia Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 149: Australia Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 150: Australia Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 151: Australia Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 152: Australia Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 153: Australia Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 154: Australia Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 155: Australia Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 156: Australia Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 157: South Korea Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 158: South Korea Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 159: South Korea Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 160: South Korea Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 161: South Korea Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 162: South Korea Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 163: South Korea Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 164: South Korea Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 165: South Korea Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 166: ASEAN Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 167: ASEAN Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 168: ASEAN Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 169: ASEAN Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 170: ASEAN Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 171: ASEAN Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 172: ASEAN Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 173: ASEAN Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 174: ASEAN Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 175: Middle East & Africa Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 176: Middle East & Africa Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 177: Middle East & Africa Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 178: Middle East & Africa Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 179: Middle East & Africa Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 180: Middle East & Africa Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 181: Middle East & Africa Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 182: Middle East & Africa Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 183: Middle East & Africa Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 184: Middle East & Africa Office Supplies Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 185: Middle East & Africa Office Supplies Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 186: Middle East & Africa Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 187: GCC Countries Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 188: GCC Countries Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 189: GCC Countries Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 190: GCC Countries Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 191: GCC Countries Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 192: GCC Countries Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 193: GCC Countries Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 194: GCC Countries Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 195: GCC Countries Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 196: South Africa Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 197: South Africa Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 198: South Africa Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 199: South Africa Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 200: South Africa Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 201: South Africa Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 202: South Africa Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 203: South Africa Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 204: South Africa Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 205: Latin America Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 206: Latin America Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 207: Latin America Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 208: Latin America Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 209: Latin America Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 210: Latin America Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 211: Latin America Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 212: Latin America Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 213: Latin America Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 214: Latin America Office Supplies Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 215: Latin America Office Supplies Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 216: Latin America Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 217: Brazil Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 218: Brazil Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 219: Brazil Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 220: Brazil Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 221: Brazil Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 222: Brazil Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 223: Brazil Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 224: Brazil Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 225: Brazil Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 226: Mexico Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 227: Mexico Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 228: Mexico Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 229: Mexico Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 230: Mexico Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 231: Mexico Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 232: Mexico Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 233: Mexico Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 234: Mexico Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 235: Argentina Office Supplies Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 236: Argentina Office Supplies Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 237: Argentina Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 238: Argentina Office Supplies Market Value (US$ Bn) Projection, By End-user 2020 to 2035

Figure 239: Argentina Office Supplies Market Volume (Thousand Units) Projection, By End-user 2020 to 2035

Figure 240: Argentina Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By End-user 2025 to 2035

Figure 241: Argentina Office Supplies Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 242: Argentina Office Supplies Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 243: Argentina Office Supplies Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035