Reports

Reports

The manufacturing analytics market is expanding rapidly due to the proliferation of data across supply chains and production lines. Machine data and smart monitoring equipment are installed as more ubiquitous connected sensors.

Enhanced focus on predictive maintenance in order to keep production performance above optimum levels while minimizing downtime is also driving adoption. Additionally, analytics applied in supply chain management simplifies logistics reduce inventory inefficiency and improves demand forecasting, thereby making data-driven decision-making the most significant driving force for manufacturing analytics market growth.

Increasing need for mass customization and customized products that need rapid and efficient manufacturing systems is another significant driving the momentum. Analytics solutions enable manufacturers to address complexity in low-volume production and allow ongoing design modifications without concurrent increases in cost.

Besides, pharmaceutical, automobile, and aviation manufacturing processes involve regulatory compliance issues that induce manufacturers to apply advanced analytics to ascertain traceability and real-time quality assurance. Growing sustainability requirements are also fueling adoption where the businesses apply analytics to curtail waste, improve energy usage, and comply with environmental regulations while ascertaining profitability and elevating environmentally-friendly manufacturing processes.

Current manufacturing trends do point toward a shift to cloud platforms and AI-based solutions. Cloud platforms do offer immediate consumption of data across a manufacturing firm's global locations, reduce capital expenditures on IT infrastructure through pay-as-you-go models, and improve teamwork and collaboration.

Artificial intelligence and machine learning are being increasingly used for anomaly detection, process improvement and predictive suggestion, thereby helping manufacturers to manage and fix issues prior to occurrence. Digital twins are picking up pace since they enable virtual replicas of the physical assets of a manufacturer to be developed so that performance can be simulated, tested, and optimized. Another beneficial feature of edge computing with analytics is to facilitate the process more at the edge than cloud analytics applications at the source or origin, which benefits time-critical industrial applications.

Companies operating in the manufacturing analytics sector have been facing increased burden in R&D to launch sophisticated predictive and prescriptive analytics solutions offering deeper insight into operations. Platform interoperability and effortless connectivity with platforms such as ERP (Enterprise Resource Planning), MES (Manufacturing Execution System), and IoT (Internet of Things) are being widely focused upon.

Manufacturing analytics implies the methodical use of data, statistical models, and sophisticated algorithms for interpreting manufacturing processes, supplying chain activities, and machine effectiveness in manufacturing. This method does collect data from machines, sensors, and enterprise systems and applies both - real-time and historical analysis in order to make informed decisions.

Manufacturing analytics help businesses achieve optimal efficiency, product quality, and downtime. Manufacturing analytics take raw data and translate it into actionable intelligence, which help manufacturers achieve operational excellence and resilience in an ever-changing industrial ecosystem.

One of the primary strengths of manufacturing analytics is its potential for predictive maintenance. Through equipment health monitoring followed by analysis of performance data, it can forecast future machine failures. This lowers unplanned downtime, improves equipment life, and reduces repair expense. Analytics also facilitates enhanced demand forecasting and inventory management, thereby enabling manufacturers to align production with market demand, ultimately resulting in enhanced utilization of resources and reduced wastage.

Manufacturing analytics is also a vital aspect of quality assurance. It allows the determination of whether there are any inefficiencies or deviations that can affect output quality. It facilitates real-time defect detection and conformity testing against rigid industry standards. It also allows companies to determine the cause of commonly recurring issues and implement necessary corrective measures.

For several organizations, continuous quality monitoring through analytics can lead to greater consistency, enhanced brand awareness, better reputation, and lower rework and recall costs.

Sustainability is another critical element of manufacturing analytics. As the focus on sustainability measures increases, manufacturers are using analytics to track energy consumption, material usage, and carbon output. While there are many other elements of sustainability, the companies, using analytics, can see areas of saving energy, reduction of waste, and cleaner production. In addition, some of the most advanced best practices in analytics also enable digital twins and smart factories, where virtual spaces are available to support and maximize real processes.

Finally, manufacturing analytics, such as real-time reporting, enables the firms to balance productivity, profitability, and sustainability and thus gives them greater ability to enable the latest manufacturing operations.

| Attribute | Detail |

|---|---|

| Manufacturing Analytics Market Drivers |

|

One of the principal drivers to the manufacturing analytics market is the quick uptake of Industry 4.0 technologies as it allows for easy unification of digital solutions with conventional manufacturing processes. Industry 4.0 focuses on connectivity, automation, and real-time leverage of data, and this produces vast volumes of information throughout production systems.

Manufacturing analytics is the foundation upon which this data is analyzed, converting it into actionable intelligence that optimizes efficiency, saves costs, and maximizes the overall performance. Analytics is key to the success of Industry 4.0 technologies like IoT, AI, and robotics.

Among the foremost drivers is the fast uptake of smart devices and IoT-enabled smart sensors on the shop floor in factories. These devices provide real-time data streams regarding equipment health, energy usage, and process performance. Factory manufacturing analytics platforms consume and analyze these data streams to allow predictive maintenance, lower downtime hours, and higher productivity. Combined with IoT, analytics equips manufacturers to make informed decisions, with end-to-end visibility and control of intricate processes.

Industry 4.0 is an enabler of automation, thereby facilitating new levels of automation through robotics and data-driven AI systems that are triggered by analytics. Analytics platforms can help companies to monitor the robotics performance, improve workflows, and curtail waste in the allocation of their resources.

Cloud computing and digital twins are examples of Industry 4.0 technologies, thereby creating new opportunities for manufacturers to use analytic capabilities for their businesses. Cloud technology provides real-time visibility by being hosted on the cloud-based platforms, allowing for seamless sharing across facilities worldwide.

Further, digital twins enable firms to model their production process, providing a virtual environment for testing. The merger of cloud-based technologies and analytics has enabled manufacturers to enhance their degree of agility, reduce operational risk, and enhance the cycle of innovation. Cumulatively, the merger of these technologies is poised to enhance analytics as a prime driver of the fulfillment of Industry 4.0's entire value.

The rising requirement for effectiveness in operations is another significant contributor to the expansion of the manufacturing analytics market. This can be ascribed to manufacturers having to progressively enhance productivity without extra expense. Inefficiencies in production, energy consumption, or resource consumption may potentially impact profitability in a competitive world, and manufacturing analytics offers the platform for bottleneck identification, workflow optimization, and machine utilization optimization.

One of the significant contributions made by analytics to operational efficiency is predictive maintenance. For instance, if, upon evaluation, an equipment is predicted to face gear failure, the firm can plan rectify the issue even before it occurs. This minimizes unexpected downtime, reduces repair expenses, and enables constant production. Cost-saving equipment management also has a direct role to contribute to greater operational efficiency.

Manufacturing analytics also enhances inventory and supply chain management. Coupled with analytics' capability to reveal insights on demand patterns, cycles of production, and availability of materials, it can result in enhanced demand forecasting and just-in-time inventory practices. Lean supply chains enhance customer satisfaction and delivery time, as well as reduce the cost of operations.

Analytics enhances energy and resource management, which is another critical field for empowering effective manufacturing practice. Companies can track energy and resource utilization and raw material productivity to assist in containing wasteful consumption. This results in reduced operating costs, as well as ensuring sustainability objectives.

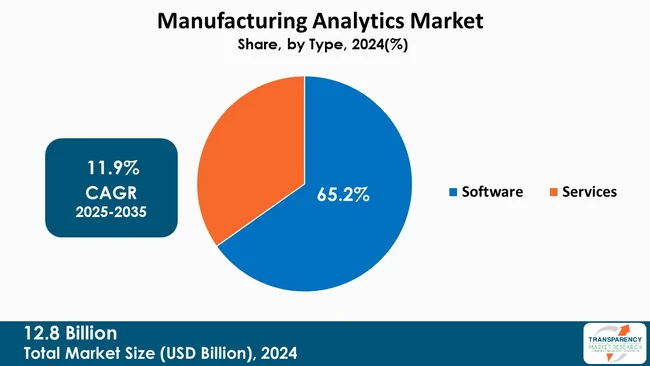

The software segment captures majority of market share in the manufacturing analytics industry since it can deliver the fundamental analysis functionality needed to handle enormous amounts of manufacturing data. The next generation software solutions are used for maintenance prediction, quality control, production optimization, and supply chain transparency and thus they are driving the digitalization of production processes.

Furthermore, the advantages and extensity of the software platforms also sustain compatibility with cloud infrastructures, IoT gadgets and ERP systems. The software solutions improve with the increased use of AI, machine learning, and digital twins, becoming more complex, more sector-specific, and user-friendlier.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest manufacturing analytics market analysis, North America dominated in 2024. This can be attributed to the region’s highly developed technological foundation, mature industrial economy, and high rates of adoption of digital manufacturing technology by firms. This region is known for the many companies that use the internet of things, artificial intelligence and big data technologies to improve the efficiency of the production process and save their operational costs. In addition, the presence of robust legislative measures ensuring both quality and environmental friendliness has a positive influence on the extent of the implementation of IIoT in this region.

Besides, North America heavily invests in R&D and innovation where manufacturing firms partner with technology providers to create innovative analytics platforms. Exposure to skilled experts, combined with high demand for automation and predictive analysis, further solidifies the position of the region as a manufacturing analytics leader.

The manufacturing analytics market players are interested in developing AI- and cloud-based platforms, compatibility with current manufacturing systems, and industry-vertical solutions. They want partnerships, acquisitions, and mergers for building out portfolios, and investments in R&D, security, and usability in analytics tools for more significant adoption and competitiveness.

SAP SE, General Electric Company, IBM, Microsoft, Oracle, PTC, Honeywell International Inc., Plex (Rockwell Automation), Schneider Electric, SAS Institute Inc., QlikTech International AB, Dassault Systèmes, Bosch Global Software Technologies Private Limited, Google LLC, Amazon Web Services, Inc., and CALIBER TECHNOLOGIES are some of the leading players operating in the global market.

Each of these players has been profiled in the manufacturing analytics market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

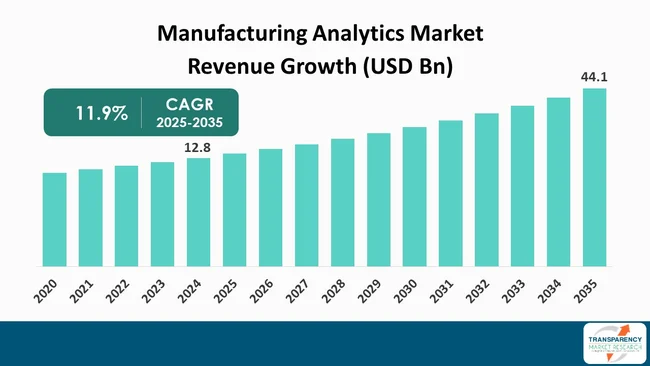

| Size in 2024 | US$ 12.8 Bn |

| Forecast Value in 2035 | US$ 44.1 Bn |

| CAGR | 11.9% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Manufacturing Analytics Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global manufacturing analytics market was valued at US$ 12.8 Bn in 2024

The global manufacturing analytics industry is projected to reach more than US$ 44.1 Bn by the end of 2035

The rapid adoption of Industry 4.0 technologies (IoT, AI, ML), the increasing need for operational efficiency and predictive maintenance to reduce downtime, the paradigm shift towards scalable, cost-effective cloud-based solutions, and improved regulatory compliance are some of the factors driving the expansion of manufacturing analytics market.

The CAGR is anticipated to be 11.9% from 2025 to 2035

SAP SE, General Electric Company, IBM, Microsoft, Oracle, PTC, Honeywell International Inc., Plex (Rockwell Automation), Schneider Electric, SAS Institute Inc., QlikTech International AB, Dassault Systèmes, Bosch Global Software Technologies Private Limited, Google LLC, Amazon Web Services, Inc., and CALIBER TECHNOLOGIES

Table 01: Global Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 02: Global Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 03: Global Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 04: Global Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 05: Global Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 06: Global Manufacturing Analytics Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Manufacturing Analytics Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 08: North America Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 09: North America Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 10: North America Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 11: North America Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: North America Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 13: U.S. Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 14: U.S. Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 15: U.S. Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 16: U.S. Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 17: U.S. Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 18: Canada Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 19: Canada Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 20: Canada Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 21: Canada Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 22: Canada Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 23: Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 24: Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 25: Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 26: Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 27: Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 28: Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 29: UK Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 30: UK Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 31: UK Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 32: UK Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 33: UK Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 34: Germany Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 35: Germany Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 36: Germany Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 37: Germany Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 38: Germany Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 39: France Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 40: France Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 41: France Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 42: France Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 43: France Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 44: Italy Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 45: Italy Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 46: Italy Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 47: Italy Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 48: Italy Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 49: Spain Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 50: Spain Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 51: Spain Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 52: Spain Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 53: Spain Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 54: The Netherlands Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 55: The Netherlands Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 56: The Netherlands Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 57: The Netherlands Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 58: The Netherlands Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 59: Rest of Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 60: Rest of Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 61: Rest of Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 62: Rest of Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 63: Rest of Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 64: Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 65: Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 66: Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 67: Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 68: Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 69: Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 70: China Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 71: China Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 72: China Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 73: China Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 74: China Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 75: India Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 76: India Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 77: India Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 78: India Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 79: India Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 80: Japan Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 81: Japan Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 82: Japan Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 83: Japan Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 84: Japan Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 85: Australia Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 86: Australia Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 87: Australia Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 88: Australia Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 89: Australia Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 90: South Korea Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 91: South Korea Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 92: South Korea Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 93: South Korea Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 94: South Korea Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 95: ASEAN Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 96: ASEAN Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 97: ASEAN Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 98: ASEAN Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 99: ASEAN Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 100: Rest of Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 101: Rest of Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 102: Rest of Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 103: Rest of Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 104: Rest of Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 105: Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 106: Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 107: Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 108: Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 109: Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 110: Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 111: Brazil Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 112: Brazil Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 113: Brazil Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 114: Brazil Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 115: Brazil Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 116: Argentina Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 117: Argentina Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 118: Argentina Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 119: Argentina Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 120: Argentina Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 121: Mexico Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 122: Mexico Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 123: Mexico Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 124: Mexico Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 125: Mexico Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 126: Rest of Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 127: Rest of Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 128: Rest of Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 129: Rest of Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 130: Rest of Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 131: Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 132: Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 133: Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 134: Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 135: Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 136: Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 137: GCC Countries Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 138: GCC Countries Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 139: GCC Countries Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 140: GCC Countries Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 141: GCC Countries Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 142: South Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 143: South Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 144: South Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 145: South Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 146: South Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 147: Rest of Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 148: Rest of Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 149: Rest of Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 150: Rest of Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 151: Rest of Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Figure 01: Global Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 02: Global Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 03: Global Manufacturing Analytics Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 04: Global Manufacturing Analytics Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 05: Global Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 06: Global Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 07: Global Manufacturing Analytics Market Revenue (US$ Bn), by Cloud-based, 2020 to 2035

Figure 08: Global Manufacturing Analytics Market Revenue (US$ Bn), by On-premise, 2020 to 2035

Figure 09: Global Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 10: Global Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 11: Global Manufacturing Analytics Market Revenue (US$ Bn), by Inventory Management, 2020 to 2035

Figure 12: Global Manufacturing Analytics Market Revenue (US$ Bn), by Supply Chain Optimization, 2020 to 2035

Figure 13: Global Manufacturing Analytics Market Revenue (US$ Bn), by Predictive Maintenance, 2020 to 2035

Figure 14: Global Manufacturing Analytics Market Revenue (US$ Bn), by Energy Management, 2020 to 2035

Figure 15: Global Manufacturing Analytics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 16: Global Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 17: Global Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 18: Global Manufacturing Analytics Market Revenue (US$ Bn), by Electronics, 2020 to 2035

Figure 19: Global Manufacturing Analytics Market Revenue (US$ Bn), by Oil & Gas, 2020 to 2035

Figure 20: Global Manufacturing Analytics Market Revenue (US$ Bn), by Automotive, 2020 to 2035

Figure 21: Global Manufacturing Analytics Market Revenue (US$ Bn), by Pharmaceutical, 2020 to 2035

Figure 22: Global Manufacturing Analytics Market Revenue (US$ Bn), by Aerospace and Defense, 2020 to 2035

Figure 23: Global Manufacturing Analytics Market Revenue (US$ Bn), by Food & Beverage, 2020 to 2035

Figure 24: Global Manufacturing Analytics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 25: Global Manufacturing Analytics Market Value Share Analysis, By Region, 2024 and 2035

Figure 26: Global Manufacturing Analytics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 27: North America Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: North America Manufacturing Analytics Market Value Share Analysis, by Country, 2024 and 2035

Figure 29: North America Manufacturing Analytics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 30: North America Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 31: North America Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 32: North America Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 33: North America Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 34: North America Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 35 North America Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 36: North America Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 37: North America Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 38: U.S. Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: U.S. Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 40: U.S. Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 41: U.S. Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 42: U.S. Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 43: U.S. Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 44: U.S. Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 45: U.S. Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 46: U.S. Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 47: Canada Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Canada Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 49: Canada Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 50: Canada Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 51: Canada Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 52: Canada Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 53: Canada Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 54: Canada Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 55: Canada Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 56: Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Europe Manufacturing Analytics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 58: Europe Manufacturing Analytics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 59: Europe Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 60: Europe Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 61: Europe Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 62: Europe Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 63: Europe Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 64: Europe Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 65: Europe Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 66: Europe Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 67: UK Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: UK Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 69: UK Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 70: UK Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 71: UK Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 72: UK Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 73: UK Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 74: UK Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 75: UK Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 76: Germany Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 77: Germany Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 78: Germany Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 79: Germany Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 80: Germany Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 81: Germany Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 82: Germany Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 83: Germany Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 84: Germany Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 85: France Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 86: France Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 87: France Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 88: France Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 89: France Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 90: France Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 91: France Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 92: France Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 93: France Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 94: Italy Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 95: Italy Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 96: Italy Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 97: Italy Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 98: Italy Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 99: Italy Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 100: Italy Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 101: Italy Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 102: Italy Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 103: Spain Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 104: Spain Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 105: Spain Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 106: Spain Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 107: Spain Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 108: Spain Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 109: Spain Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 110: Spain Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 111: Spain Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 112: The Netherlands Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 113: The Netherlands Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 114: The Netherlands Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 115: The Netherlands Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 116: The Netherlands Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 117: The Netherlands Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 118: The Netherlands Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 119: The Netherlands Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 120: The Netherlands Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 121: Rest of Europe Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 122: Rest of Europe Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 123: Rest of Europe Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 124: Rest of Europe Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 125: Rest of Europe Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 126: Rest of Europe Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 127: Rest of Europe Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 128: Rest of Europe Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 129: Rest of Europe Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 130: Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 131: Asia Pacific Manufacturing Analytics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 132: Asia Pacific Manufacturing Analytics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 133: Asia Pacific Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 134: Asia Pacific Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 135: Asia Pacific Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 136: Asia Pacific Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 137: Asia Pacific Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 138: Asia Pacific Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 139: Asia Pacific Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 140: Asia Pacific Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 141: China Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 142: China Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 143: China Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 144: China Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 145: China Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 146: China Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 147: China Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 148: China Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 149: China Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 150: India Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 151: India Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 152: India Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 153: India Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 154: India Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 155: India Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 156: India Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 157: India Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 158: India Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 159: Japan Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 160: Japan Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 161: Japan Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 162: Japan Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 163: Japan Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 164: Japan Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 165: Japan Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 166: Japan Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 167: Japan Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 168: Australia Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 169: Australia Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 170: Australia Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 171: Australia Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 172: Australia Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 173: Australia Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 174: Australia Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 175: Australia Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 176: Australia Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 177: South Korea Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 178: South Korea Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 179: South Korea Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 180: South Korea Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 181: South Korea Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 182: South Korea Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 183: South Korea Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 184: South Korea Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 185: South Korea Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 186: ASEAN Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 187: ASEAN Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 188: ASEAN Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 189: ASEAN Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 190: ASEAN Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 191: ASEAN Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 192: ASEAN Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 193: ASEAN Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 194: ASEAN Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 195: Rest of Asia Pacific Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 196: Rest of Asia Pacific Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 197: Rest of Asia Pacific Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 198: Rest of Asia Pacific Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 199: Rest of Asia Pacific Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 200: Rest of Asia Pacific Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 201: Rest of Asia Pacific Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 202: Rest of Asia Pacific Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 203: Rest of Asia Pacific Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 204: Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 205: Latin America Manufacturing Analytics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 206: Latin America Manufacturing Analytics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 207: Latin America Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 208: Latin America Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 209: Latin America Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 210: Latin America Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 211: Latin America Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 212: Latin America Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 213: Latin America Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 214: Latin America Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 215: Brazil Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 216: Brazil Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 217: Brazil Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 218: Brazil Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 219: Brazil Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 220: Brazil Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 221: Brazil Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 222: Brazil Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 223: Brazil Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 224: Argentina Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 225: Argentina Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 226: Argentina Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 227: Argentina Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 228: Argentina Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 229: Argentina Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 230: Argentina Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 231: Argentina Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 232: Argentina Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 233: Mexico Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 234: Mexico Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 235: Mexico Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 236: Mexico Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 237: Mexico Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 238: Mexico Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 239: Mexico Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 240: Mexico Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 241: Mexico Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 242: Rest of Latin America Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 243: Rest of Latin America Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 244: Rest of Latin America Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 245: Rest of Latin America Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 246: Rest of Latin America Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 247: Rest of Latin America Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 248: Rest of Latin America Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 249: Rest of Latin America Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 250: Rest of Latin America Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 251: Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 252: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 253: Middle East & Africa Manufacturing Analytics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 254: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 255: Middle East & Africa Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 256: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 257: Middle East & Africa Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 258: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 259: Middle East & Africa Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 260: Middle East & Africa Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 261: Middle East & Africa Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 262: GCC Countries Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 263: GCC Countries Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 264: GCC Countries Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 265: GCC Countries Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 266: GCC Countries Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 267: GCC Countries Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 268: GCC Countries Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 269: GCC Countries Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 270: GCC Countries Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 271: South Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 272: South Africa Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 273: South Africa Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 274: South Africa Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 275: South Africa Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 276: South Africa Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 277: South Africa Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 278: South Africa Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 279: South Africa Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 280: Rest of Middle East & Africa Manufacturing Analytics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 281: Rest of Middle East & Africa Manufacturing Analytics Market Value Share Analysis, By Type, 2024 and 2035

Figure 282: Rest of Middle East & Africa Manufacturing Analytics Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 283: Rest of Middle East & Africa Manufacturing Analytics Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 284: Rest of Middle East & Africa Manufacturing Analytics Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 285: Rest of Middle East & Africa Manufacturing Analytics Market Value Share Analysis, By Application, 2024 and 2035

Figure 286: Rest of Middle East & Africa Manufacturing Analytics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 287: Rest of Middle East & Africa Manufacturing Analytics Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 288: Rest of Middle East & Africa Manufacturing Analytics Market Attractiveness Analysis, By End-use Industry, 2025 to 2035