Reports

Reports

Analysts’ Viewpoint

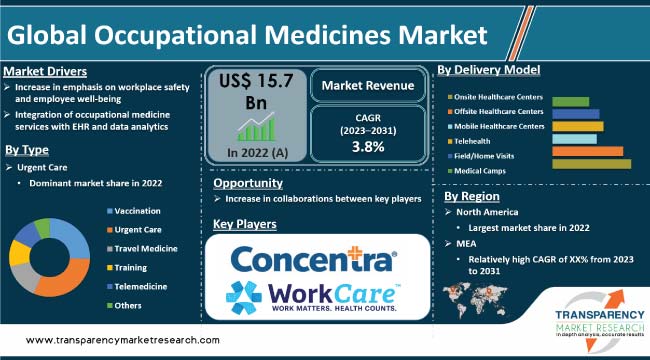

Increase in emphasis on workplace safety and employee well-being is driving the global occupational medicines market. Occupational medicine focuses on the health and well-being of employees in the workplace, contributing to improved health outcomes, increased productivity, and cost savings for both employers and employees. Rise in awareness among the working population about the importance of occupational health is another major factor propelling market expansion. Furthermore, integration of occupational medicine services with EHR and data analytics is expected to bolster the global occupational medicines industry size during the forecast period.

Awareness campaigns by governments, non-governmental organizations (NGOs), and international bodies to promote occupational health and safety offer lucrative opportunities to market players. Companies are focusing on providing comprehensive occupational healthcare solutions in order to increase occupational medicines market presence.

The field of occupational medicine, previously known as industrial medicine, is dedicated to safeguarding the health of working populations, preventing & treating occupational diseases, and addressing accidental injuries that occur in the workplace.

Historically, occupational medicine was primarily concerned with treating injuries and diseases that affected production workers while on the job. However, it has evolved over time to encompass employees in various settings, such as factories, offices, and educational institutions, reflecting a broader reach of its medical services.

The Industrial Revolution brought about a surge in the number of people exposed to potential workplace hazards, resulting in increased traumatic injuries and diseases caused by exposure to dust, gases, and harmful substances. Initially, occupational medicine focused on treating these work-related injuries and illnesses, but it soon became evident that prevention was more cost-effective than treatment.

Preventive measures, including protective devices, engineering controls, proper ventilation, and containment processes, were introduced to reduce occupational disease. These efforts led to a decline in the prevalence of occupational diseases, but the ever-evolving nature of industrial processes and materials continued to introduce new hazards, necessitating ongoing vigilance and adaptation.

Emphasis on occupational health not only improved the well-being of workers, but also had positive business implications. Effective occupational medicine programs led to improved labor-management relations, reduced absenteeism, decreased turnover, and increased productivity. In several cases, the savings generated from reduced workers' compensation insurance premiums offset the costs of these medical programs.

Increase in emphasis on workplace safety and employee well-being has become a defining priority for organizations across industries in the past few years. This increased awareness is driving employers to make substantial investments in occupational health services, with a dual focus on physical and mental health, to foster a secure and healthy work environment.

In 2021, the U.S. witnessed a significant number of workplace safety incidents. The country recorded 2.61 million nonfatal incidents, encompassing a range of issues such as slips, trips, falls, illnesses, and other nonfatal injuries.

Worker illnesses have also shown a positive trajectory, with a noteworthy decrease from 10.9 incidents per 100 workers in 1970 to 2.7 per 100 in 2020. This reduction can be attributed to improved safety protocols, better workplace conditions, and advancements in occupational health services. The decline in worker illnesses is a testament to the efficacy of these measures in protecting the physical health of employees.

These statistics indicate an evolving landscape of workplace safety in the U.S. There is evidence of progress, especially in reducing nonfatal incidents and worker illnesses; however, rise in fatal workplace safety incidents in 2021 serves as a reminder that safety efforts must remain a top priority.

Employers' investments in occupational health services play a pivotal role in addressing these challenges, not only by addressing physical health concerns, but also by recognizing the importance of mental health in ensuring a holistic approach to employee well-being.

These factors are anticipated to drive the global occupational medicines market demand in the next few years.

Integration of occupational medicine services with Electronic Health Records (EHR) and data analytics signifies a significant advancement in the realm of workplace health and safety. This technological convergence provides a holistic approach to managing employee well-being, enabling organizations to offer personalized and effective care while gleaning valuable insights into workforce health trends.

EHR, serving as the digital cornerstone of contemporary healthcare, plays a pivotal role in this integration. By harmonizing occupational medicine services with EHR systems, employers gain access to a centralized repository of employee health data.

This repository encompasses medical histories, immunization records, screenings, and previous occupational health assessments. This information offers a comprehensive view of an individual's health, facilitating well-informed decisions concerning employee well-being.

EHR integration also streamlines the management of occupational health services. It empowers healthcare providers to efficiently document and track workplace-related injuries and illnesses, ensuring not only regulatory compliance, but also expeditious and accurate diagnosis and treatment.

Data analytics assumes a central role in extracting actionable insights from this abundance of health data. Through the utilization of data analytics tools, organizations can discern trends and patterns in workforce health. This newfound knowledge equips them to enact precisely targeted interventions to preempt workplace-related health issues.

Thus, integration with EHR and data analytics is projected to propel the global occupational medicines industry growth in the near future.

In terms of type, the urgent care segment accounted for significant global occupational medicines market share in 2022. Urgent care services are crucial in addressing immediate health concerns of employees. These ensure swift and effective responses to workplace injuries and health issues. Urgent care services play a vital role in safeguarding employee well-being and productivity.

Surge in product introductions and substantial employer investments are likely to bolster the segment in the next few years.

For instance, Amazon unveiled an employee health and safety initiative in May 2021, backed by a substantial investment exceeding US$ 300 Mn. This initiative's primary objectives are to proactively mitigate workplace injuries and offer comprehensive wellness services to its workforce.

Based on delivery model, the onsite healthcare centers segment dominated the global occupational medicines market in 2022. Onsite healthcare centers offer immediate and convenient access to medical care for employees at their workplace, ensuring quick response to workplace injuries, wellness programs, and health assessments. Employers find this model effective in enhancing employee health and reducing absenteeism.

In October 2022, Cohezio and DOKTR formed a strategic partnership to launch a pioneering teleconsultation service tailored for occupational health. This pilot project received the endorsement and support of the FPS Employment, Labor, and Social Dialog, the regulatory authority overseeing the SEPPT.

In terms of industry, the construction & real estate segment is projected to grow at a rapid pace during the forecast period. This is ascribed to the industry's unique demand for occupational health and safety services.

Construction and real estate entail a range of physical and potentially hazardous work, making the need for injury care, pre-employment physicals, drug testing, and other occupational health services crucial.

The sector's focus on worker well-being and safety, coupled with regulations and employer initiatives, has accelerated the adoption of occupational medicine services. As a result, the construction and real estate segment is witnessing rapid expansion to cater to these specialized needs.

Based on application, the chronic respiratory diseases segment held significant share of the global occupational medicines industry in 2022. This is attributed to rise in prevalence of work-related respiratory ailments, which result from exposure to hazardous substances, including dust, fumes, and gases, in various occupational settings.

Industries such as drug and antibiotics manufacturing are particularly susceptible to respiratory health issues, with a notable incidence of work-related asthma among employees. Research, such as the November 2022 article in Frontiers, highlights the elevated health risks faced by workers involved in processes, such as powder-coating, emphasizing the heightened exposure to submicron particles and the associated respiratory concerns.

Expansion of the drug development and manufacturing sector is increasing the risk of occupational respiratory diseases, which is fueling the growth of the segment.

Substantial increase in cases of employer-reported respiratory illnesses in the U.S. in 2020, reaching 428,700, reflects the pressing need for effective occupational medicine services. As a result, the work-related respiratory diseases segment is poised for sustained growth in the foreseeable future, driven by the rising incidence of these conditions across the world.

As per occupational medicines market analysis, North America is expected to account for significant share during the forecast period. This can be ascribed to surge in research & development activities, substantial investment in the sector, and new product launches.

Government agencies have also been conducting awareness programs, which is likely to bolster the occupational medicines market growth in the region. According to the 2022 Occupational Disease report in Connecticut, musculoskeletal disorders, such as Carpal Tunnel Syndrome and tendonitis, accounted for a substantial portion of workers' compensation and physician reports.

Respiratory diseases and poisoning, including conditions such as asthma and poisoning from substances such as carbon monoxide and lead, also contributed significantly to the reported cases. This surge in occupational diseases in the region is expected to drive demand for occupational medicine services.

North America hosts a series of awareness programs emphasizing the significance of occupational health. For instance, the Safety and Health Week is celebrated across workplaces in North America from May 1 to 7, 2022. This event serves as a platform to raise awareness about injury and illness prevention in the workplace, home, and community.

As per occupational medicines market research, the industry in Asia Pacific driven by expanding workforce, stringent government regulations, and growing awareness about workplace health and safety.

Rapid economic growth, particularly in emerging economies, has resulted in higher demand for occupational medicine services to ensure the well-being of employees. Government authorities in several countries in Asia Pacific have been enforcing stricter workplace health and safety standards, propelling the need for compliance and occupational health services.

With a diverse range of industrial sectors, including manufacturing and construction, occupational medicine addresses specific health challenges. Surge in awareness and education about occupational health further contribute to the global occupational medicines market development in the region.

The global industry is fragmented, with the presence of a large number of players. Companies in the occupational medicines market are focusing on collaboration with established players in the industry.

Concentra, Inc., WorkCare, Inc., Occucare International, Workwell Occupational Medicine, LLC. HealthWorks Medical, LLC, WebPT, MED-1 Occupational Health Services, and Nova Medical Center are the prominent players in the occupational medicines market.

Each of these players has been profiled in the occupational medicines market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 15.7 Bn |

| Forecast Value in 2031 | More than US$ 22.5 Bn |

| Growth Rate (CAGR) | 3.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 15.7 Bn in 2022

It is projected to reach more than US$ 22.5 Bn by 2031

It is anticipated to grow at a CAGR of 3.8% from 2023 to 2031

Increase in emphasis on workplace safety & employee well-being and integration of occupational medicine services with EHR and data analytics

North America is expected to account for largest share during the forecast period.

Concentra, Inc., WorkCare, Inc., Occucare International, Workwell Occupational Medicine, LLC., HealthWorks Medical, LLC, WebPT, MED-1 Occupational Health Services, and Nova Medical Center.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Occupational Medicines Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Occupational Medicines Market Analysis and Forecasts, 2023–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Regulatory Scenario by Region/globally

5.2. Key Mergers & Acquisitions

5.3. COVID Impact Analysis

5.4. Top 3 players operating in the market space

5.5. Healthcare Industry Overview

6. Global Occupational Medicines Market Analysis and Forecasts, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2023–2031

6.3.1. Vaccination

6.3.2. Urgent Care+A34

6.3.3. Travel Medicine

6.3.4. Training

6.3.5. Telemedicine

6.3.6. Others

6.4. Market Attractiveness Analysis, by Type

7. Global Occupational Medicines Market Analysis and Forecasts, by Delivery Model

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Delivery Model, 2023–2031

7.3.1. Onsite Healthcare Centers

7.3.2. Offsite Healthcare Centers

7.3.3. Mobile Healthcare Centers

7.3.4. Telehealth

7.3.5. Field/Home Visits

7.3.6. Medical Camps

7.4. Market Attractiveness Analysis, by Delivery Model

8. Global Occupational Medicines Market Analysis and Forecasts, by Industry

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Industry, 2023–2031

8.3.1. Agriculture & Forestry

8.3.2. Construction & Real Estate

8.3.3. Manufacturing

8.3.4. Petroleum & Mining

8.3.5. Transportation

8.3.6. Other

8.4. Market Attractiveness Analysis, by Industry

9. Global Occupational Medicines Market Analysis and Forecasts, by Application

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Application, 2023–2031

9.3.1. Occupational Cancer

9.3.2. Chemical Poisoning

9.3.3. Chronic Respiratory Diseases

9.3.4. Musculoskeletal Disorders

9.3.5. Non-induced Hearing Loss & Vibration

9.3.6. Psychological Disorders

9.3.7. Skin Disorders

9.3.8. Others

9.4. Market Attractiveness Analysis, by Application

10. Global Occupational Medicines Market Analysis and Forecasts, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Occupational Medicines Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2023–2031

11.2.1. Vaccination

11.2.2. Urgent Care

11.2.3. Travel Medicine

11.2.4. Training

11.2.5. Telemedicine

11.2.6. Others

11.3. Market Value Forecast, by Delivery Model, 2023–2031

11.3.1. Onsite Healthcare Centers

11.3.2. Offsite Healthcare Centers

11.3.3. Mobile Healthcare Centers

11.3.4. Telehealth

11.3.5. Field/Home Visits

11.3.6. Medical Camps

11.4. Market Value Forecast, by Industry, 2023–2031

11.4.1. Agriculture & Forestry

11.4.2. Construction & Real Estate

11.4.3. Manufacturing

11.4.4. Petroleum & Mining

11.4.5. Transportation

11.4.6. Other

11.5. Market Value Forecast, by Application, 2023–2031

11.5.1. Occupational Cancer

11.5.2. Chemical Poisoning

11.5.3. Chronic Respiratory Diseases

11.5.4. Musculoskeletal Disorders

11.5.5. Non-induced Hearing Loss & Vibration

11.5.6. Psychological Disorders

11.5.7. Skin Disorders

11.5.8. Others

11.6. Market Value Forecast, by Country, 2023–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Delivery Model

11.7.3. By Industry

11.7.4. By Application

11.7.5. By Country

12. Europe Occupational Medicines Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2023–2031

12.2.1. Vaccination

12.2.2. Urgent Care

12.2.3. Travel Medicine

12.2.4. Training

12.2.5. Telemedicine

12.2.6. Others

12.3. Market Value Forecast, by Delivery Model, 2023–2031

12.3.1. Onsite Healthcare Centers

12.3.2. Offsite Healthcare Centers

12.3.3. Mobile Healthcare Centers

12.3.4. Telehealth

12.3.5. Field/Home Visits

12.3.6. Medical Camps

12.4. Market Value Forecast, by Industry, 2023–2031

12.4.1. Agriculture & Forestry

12.4.2. Construction & Real Estate

12.4.3. Manufacturing

12.4.4. Petroleum & Mining

12.4.5. Transportation

12.4.6. Other

12.5. Market Value Forecast, by Application, 2023–2031

12.5.1. Occupational Cancer

12.5.2. Chemical Poisoning

12.5.3. Chronic Respiratory Diseases

12.5.4. Musculoskeletal Disorders

12.5.5. Non-induced Hearing Loss & Vibration

12.5.6. Psychological Disorders

12.5.7. Skin Disorders

12.5.8. Others

12.6. Market Value Forecast, by Country/Sub-region, 2023–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Delivery Model

12.7.3. By Industry

12.7.4. By Application

12.7.5. By Country/Sub-region

13. Asia Pacific Occupational Medicines Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2023–2031

13.2.1. Vaccination

13.2.2. Urgent Care

13.2.3. Travel Medicine

13.2.4. Training

13.2.5. Telemedicine

13.2.6. Others

13.3. Market Value Forecast, by Delivery Model, 2023–2031

13.3.1. Onsite Healthcare Centers

13.3.2. Offsite Healthcare Centers

13.3.3. Mobile Healthcare Centers

13.3.4. Telehealth

13.3.5. Field/Home Visits

13.3.6. Medical Camps

13.4. Market Value Forecast, by Industry, 2023–2031

13.4.1. Agriculture & Forestry

13.4.2. Construction & Real Estate

13.4.3. Manufacturing

13.4.4. Petroleum & Mining

13.4.5. Transportation

13.4.6. Other

13.5. Market Value Forecast, by Application, 2023–2031

13.5.1. Occupational Cancer

13.5.2. Chemical Poisoning

13.5.3. Chronic Respiratory Diseases

13.5.4. Musculoskeletal Disorders

13.5.5. Non-induced Hearing Loss & Vibration

13.5.6. Psychological Disorders

13.5.7. Skin Disorders

13.5.8. Others

13.6. Market Value Forecast, by Country/Sub-region, 2023–2031

13.6.1. China

13.6.2. India

13.6.3. Japan

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Delivery Model

13.7.3. By Industry

13.7.4. By Application

13.7.5. By Country/Sub-region

14. Latin America Occupational Medicines Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2023–2031

14.2.1. Vaccination

14.2.2. Urgent Care

14.2.3. Travel Medicine

14.2.4. Training

14.2.5. Telemedicine

14.2.6. Others

14.3. Market Value Forecast, by Delivery Model, 2023–2031

14.3.1. Onsite Healthcare Centers

14.3.2. Offsite Healthcare Centers

14.3.3. Mobile Healthcare Centers

14.3.4. Telehealth

14.3.5. Field/Home Visits

14.3.6. Medical Camps

14.4. Market Value Forecast, by Industry, 2023–2031

14.4.1. Agriculture & Forestry

14.4.2. Construction & Real Estate

14.4.3. Manufacturing

14.4.4. Petroleum & Mining

14.4.5. Transportation

14.4.6. Other

14.5. Market Value Forecast, by Application, 2023–2031

14.5.1. Occupational Cancer

14.5.2. Chemical Poisoning

14.5.3. Chronic Respiratory Diseases

14.5.4. Musculoskeletal Disorders

14.5.5. Non-induced Hearing Loss & Vibration

14.5.6. Psychological Disorders

14.5.7. Skin Disorders

14.5.8. Others

14.6. Market Value Forecast, by Country/Sub-region, 2023–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Type

14.7.2. By Delivery Model

14.7.3. By Industry

14.7.4. By Application

14.7.5. By Country/Sub-region

15. Middle East & Africa Occupational Medicines Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Type, 2023–2031

15.2.1. Vaccination

15.2.2. Urgent Care

15.2.3. Travel Medicine

15.2.4. Training

15.2.5. Telemedicine

15.2.6. Others

15.3. Market Value Forecast, by Delivery Model, 2023–2031

15.3.1. Onsite Healthcare Centers

15.3.2. Offsite Healthcare Centers

15.3.3. Mobile Healthcare Centers

15.3.4. Telehealth

15.3.5. Field/Home Visits

15.3.6. Medical Camps

15.4. Market Value Forecast, by Industry, 2023–2031

15.4.1. Agriculture & Forestry

15.4.2. Construction & Real Estate

15.4.3. Manufacturing

15.4.4. Petroleum & Mining

15.4.5. Transportation

15.4.6. Other

15.5. Market Value Forecast, by Application, 2023–2031

15.5.1. Occupational Cancer

15.5.2. Chemical Poisoning

15.5.3. Chronic Respiratory Diseases

15.5.4. Musculoskeletal Disorders

15.5.5. Non-induced Hearing Loss & Vibration

15.5.6. Psychological Disorders

15.5.7. Skin Disorders

15.5.8. Others

15.6. Market Value Forecast, by Country/Sub-region, 2023–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Type

15.7.2. By Delivery Model

15.7.3. By Industry

15.7.4. By Application

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis By Company (2021)

16.3. Company Profiles

16.3.1. Concentra, Inc.

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. Strategic Overview

16.3.1.5. SWOT Analysis

16.3.2. WorkCare, Inc.

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. Strategic Overview

16.3.2.5. SWOT Analysis

16.3.3. Occucare International

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. Strategic Overview

16.3.3.5. SWOT Analysis

16.3.4. Workwell Occupational Medicine, LLC.

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. Strategic Overview

16.3.4.5. SWOT Analysis

16.3.5. HealthWorks Medical, LLC

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. Strategic Overview

16.3.5.5. SWOT Analysis

16.3.6. WebPT

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. Strategic Overview

16.3.6.5. SWOT Analysis

16.3.7. Nova Medical Center

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. Strategic Overview

16.3.7.5. SWOT Analysis

16.3.8. MED-1 Occupational Health Services

16.3.8.1. Company Overview

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. Strategic Overview

16.3.8.5. SWOT Analysis

List of Tables

Table 1 : Global Occupational Medicines Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 2 : Global Occupational Medicines Market Value (US$ Mn) Forecast, by Delivery Model, 2023–2031

Table 3 : Global Occupational Medicines Market Value (US$ Mn) Forecast, by Industry, 2023–2031

Table 4 : Global Occupational Medicines Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 5 : Global Occupational Medicines Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 6 : North America Occupational Medicines Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 7 : North America Occupational Medicines Market Value (US$ Mn) Forecast, by Delivery Model, 2023–2031

Table 8 : North America Occupational Medicines Market Value (US$ Mn) Forecast, by Industry, 2023–2031

Table 9 : North America Occupational Medicines Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 10: North America Occupational Medicines Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 11: Europe Occupational Medicines Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 12: Europe Occupational Medicines Market Value (US$ Mn) Forecast, by Delivery Model, 2023–2031

Table 13: Europe Occupational Medicines Market Value (US$ Mn) Forecast, by Industry, 2023–2031

Table 14: Europe Occupational Medicines Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 15: Europe Occupational Medicines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 16: Asia Pacific Occupational Medicines Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 17: Asia Pacific Occupational Medicines Market Value (US$ Mn) Forecast, by Delivery Model, 2023–2031

Table 18: Asia Pacific Occupational Medicines Market Value (US$ Mn) Forecast, by Industry, 2023–2031

Table 19: Asia Pacific Occupational Medicines Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 20: Asia Pacific Occupational Medicines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 21: Latin America Occupational Medicines Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 22: Latin America Occupational Medicines Market Value (US$ Mn) Forecast, by Delivery Model, 2023–2031

Table 23: Latin America Occupational Medicines Market Value (US$ Mn) Forecast, by Industry, 2023–2031

Table 24: Latin America Occupational Medicines Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 25: Latin America Occupational Medicines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 26: Middle East & Africa Occupational Medicines Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 27: Middle East & Africa Occupational Medicines Market Value (US$ Mn) Forecast, by Delivery Model, 2023–2031

Table 28: Middle East & Africa Occupational Medicines Market Value (US$ Mn) Forecast, by Industry, 2023–2031

Table 29: Middle East & Africa Occupational Medicines Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 30: Middle East & Africa Occupational Medicines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 31: Latin America Occupational Medicines Market Value (US$ Mn) Forecast, by Distribution Channel, 2023–2031

Table 32: Middle East & Africa Occupational Medicines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 33: Middle East & Africa Occupational Medicines Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 34:Middle East & Africa Occupational Medicines Market Value (US$ Mn) Forecast, by Distribution Channel, 2023–2031

List of Figures

Figure 01: Global Occupational Medicines Market Value (US$ Mn) Forecast, 2023–2031

Figure 02: Global Occupational Medicines Market Value Share, by Type, 2022

Figure 03: Global Occupational Medicines Market Value Share, by Delivery Model, 2022

Figure 04: Global Occupational Medicines Market Value Share, by Industry, 2022

Figure 05: Global Occupational Medicines Market Value Share, by Application, 2022

Figure 06: Global Occupational Medicines Market Value Share Analysis, by Type, 2022 and 2031

Figure 07: Global Occupational Medicines Market Revenue (US$ Mn), by Vaccination 2023–2031

Figure 08: Global Occupational Medicines Market Revenue (US$ Mn), by Urgent Care 2023–2031

Figure 09: Global Occupational Medicines Market Revenue (US$ Mn), by Travel Medicine 2023–2031

Figure 10: Global Occupational Medicines Market Revenue (US$ Mn), by Training 2023–2031

Figure 11: Global Occupational Medicines Market Revenue (US$ Mn), by Telemedicine 2023–2031

Figure 12: Global Occupational Medicines Market Revenue (US$ Mn), by Others 2023–2031

Figure 13: Global Occupational Medicines Market Attractiveness Analysis, by Delivery Model 2023–2031

Figure 14: Global Occupational Medicines Market Value Share Analysis, by Delivery Model 2022 and 2031

Figure 15: Global Occupational Medicines Market Revenue (US$ Mn), by Onsite Healthcare Centers 2023–2031

Figure 16: Global Occupational Medicines Market Revenue (US$ Mn), by Offsite Healthcare Centers 2023–2031

Figure 17: Global Occupational Medicines Market Revenue (US$ Mn), by Mobile Healthcare Centers 2023–2031

Figure 18: Global Occupational Medicines Market Revenue (US$ Mn), by Telehealth 2023–2031

Figure 19: Global Occupational Medicines Market Revenue (US$ Mn), by Field/Home Visits 2023–2031

Figure 20: Global Occupational Medicines Market Revenue (US$ Mn), by Medical Camps 2023–2031

Figure 21: Global Occupational Medicines Market Attractiveness Analysis, by Industry 2023–2031

Figure 22: Global Occupational Medicines Market Value Share Analysis, by Industry 2022 and 2031

Figure 23: Global Occupational Medicines Market Revenue (US$ Mn), by Agriculture & Forestry 2023–2031

Figure 24: Global Occupational Medicines Market Revenue (US$ Mn), by Construction & Real Estate 2023–2031

Figure 25: Global Occupational Medicines Market Revenue (US$ Mn), by Manufacturing 2023–2032

Figure 26: Global Occupational Medicines Market Revenue (US$ Mn), by Petroleum & Mining 2023–2033

Figure 27: Global Occupational Medicines Market Revenue (US$ Mn), by Transportation 2023–2034

Figure 28: Global Occupational Medicines Market Revenue (US$ Mn), by Other 2023–2035

Figure 29: Global Occupational Medicines Market Attractiveness Analysis, by Application 2023–2031

Figure 30: Global Occupational Medicines Market Value Share Analysis, by Application 2022 and 2031

Figure 31: Global Occupational Medicines Market Revenue (US$ Mn), by Occupational Cancer 2023–2031

Figure 32: Global Occupational Medicines Market Revenue (US$ Mn), by Chemical Poisoning 2023–2032

Figure 33: Global Occupational Medicines Market Revenue (US$ Mn), by Chronic Respiratory Diseases 2023–2033

Figure 34: Global Occupational Medicines Market Revenue (US$ Mn), by Musculoskeletal Disorders 2023–2031

Figure 35: Global Occupational Medicines Market Revenue (US$ Mn), by Non-induced Hearing Loss & Vibration 2023–2031

Figure 36: Global Occupational Medicines Market Revenue (US$ Mn), by Psychological Disorders 2023–2032

Figure 37: Global Occupational Medicines Market Revenue (US$ Mn), by Skin Disorders 2023–2033

Figure 38: Global Occupational Medicines Market Value Share Analysis, by Region 2022 and 2031

Figure 39: Global Occupational Medicines Market Attractiveness Analysis, by Region 2023–2031

Figure 40: North America Occupational Medicines Market Value (US$ Mn) Forecast 2023–2031

Figure 41: North America Occupational Medicines Market Value Share Analysis, by Country 2022 and 2031

Figure 42: North America Occupational Medicines Market Attractiveness Analysis, by Country 2023–2031

Figure 43: North America Occupational Medicines Market Value Share Analysis, by Type 2022 and 2031

Figure 44: North America Occupational Medicines Market Attractiveness Analysis, by Type 2023–2031

Figure 45: North America Occupational Medicines Market Value Share Analysis, by Delivery Model 2022 and 2031

Figure 46: North America Occupational Medicines Market Attractiveness Analysis, by Delivery Model 2023–2031

Figure 47: North America Occupational Medicines Market Value Share Analysis, by Industry 2022 and 2031

Figure 48: North America Occupational Medicines Market Attractiveness Analysis, by Industry 2023–2031

Figure 49: North America Occupational Medicines Market Value Share Analysis, by Application 2022 and 2031

Figure 50: North America Occupational Medicines Market Attractiveness Analysis, by Application 2023–2031

Figure 51: Europe Occupational Medicines Market Value (US$ Mn) Forecast 2023–2031

Figure 52: Europe Occupational Medicines Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 53: Europe Occupational Medicines Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 54: Europe Occupational Medicines Market Value Share Analysis, by Type 2022 and 2031

Figure 55: Europe Occupational Medicines Market Attractiveness Analysis, by Type 2023–2031

Figure 56: Europe Occupational Medicines Market Value Share Analysis, by Delivery Model 2022 and 2031

Figure 57: Europe Occupational Medicines Market Attractiveness Analysis, by Delivery Model 2023–2031

Figure 58: Europe Occupational Medicines Market Value Share Analysis, by Industry 2022 and 2031

Figure 59: Europe Occupational Medicines Market Attractiveness Analysis, by Industry 2023–2031

Figure 60: Europe Occupational Medicines Market Value Share Analysis, by Application 2023 and 2031

Figure 61: Europe Occupational Medicines Market Attractiveness Analysis, by Application 2023–2032

Figure 62: Asia Pacific Occupational Medicines Market Value (US$ Mn) Forecast 2023–2031

Figure 63: Asia Pacific Occupational Medicines Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 64: Asia Pacific Occupational Medicines Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 65: Asia Pacific Occupational Medicines Market Value Share Analysis, by Type 2022 and 2031

Figure 66: Asia Pacific Occupational Medicines Market Attractiveness Analysis, by Type 2023–2031

Figure 67: Asia Pacific Occupational Medicines Market Value Share Analysis, by Delivery Model 2022 and 2031

Figure 68: Asia Pacific Occupational Medicines Market Attractiveness Analysis, by Delivery Model 2023–2031

Figure 69: Asia Pacific Occupational Medicines Market Value Share Analysis, by Industry 2022 and 2031

Figure 70: Asia Pacific Occupational Medicines Market Attractiveness Analysis, by Industry 2023–2031

Figure 71: Asia Pacific Occupational Medicines Market Value (US$ Mn) Forecast, by Application 2023 and 2031

Figure 72: Asia Pacific Occupational Medicines Market Value Share Analysis, by Application 2023–2032

Figure 73: Latin America Occupational Medicines Market Value (US$ Mn) Forecast 2023–2031

Figure 74: Latin America Occupational Medicines Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 75: Latin America Occupational Medicines Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 76: Latin America Occupational Medicines Market Value Share Analysis, by Type 2022 and 2031

Figure 77: Latin America Occupational Medicines Market Attractiveness Analysis, by Type 2023–2031

Figure 78: Latin America Occupational Medicines Market Value Share Analysis, by Delivery Model 2022 and 2031

Figure 79: Latin America Occupational Medicines Market Attractiveness Analysis, by Delivery Model 2023–2031

Figure 80: Latin America Occupational Medicines Market Value Share Analysis, by Industry 2022 and 2031

Figure 81: Latin America Occupational Medicines Market Attractiveness Analysis, by Industry 2023–2031

Figure 82: Latin America Occupational Medicines Market Attractiveness Analysis, by Application 2023 and 2031

Figure 83: Latin America Occupational Medicines Market Value Share Analysis, by Application 2023–2032

Figure 84: Middle East & Africa Occupational Medicines Market Value (US$ Mn) 2023–2031

Figure 85: Middle East & Africa Occupational Medicines Market Value Share Analysis, by Country 2022 and 2031

Figure 86: Middle East & Africa Occupational Medicines Market Attractiveness , by Country 2023–2031

Figure 87: Middle East & Africa Occupational Medicines Market Value Share Analysis, by Type 2022 and 2031

Figure 88: Middle East & Africa Occupational Medicines Market Attractiveness , by Type 2023–2031

Figure 89: Middle East & Africa Occupational Medicines Market Value Share Analysis, by Delivery Model 2022 and 2031

Figure 90: Middle East & Africa Occupational Medicines Market Attractiveness , by Delivery Model 2023–2031

Figure 91: Middle East & Africa Occupational Medicines Market Value Share Analysis, by Industry 2022 and 2031

Figure 92: Middle East & Africa Occupational Medicines Market Attractiveness, by Industry 2023–2031

Figure 93: Middle East & Africa Occupational Medicines Market Attractiveness , by Application 2023–2032

Figure 94: Middle East & Africa Occupational Medicines Market Value Share Analysis, by Application 2023 and 2031